Weekly Report | Sep 29, 2024

What is included in this week's edition?

WEEKLY REVIEW: An overview of current market standing, fundamental matters with implications upon the market, and general sentiment regarding the major US indices.

LOOKING AHEAD: Key takeaways to consider as we look forward to the upcoming trading week.

MARKETS: A technical review of the major indices and commodities that represent the overall health of the market.

Market Trader by MyntBit

Stocks are poised to end the week higher as economic data strengthened the case for a soft landing, despite signs of weakening consumer confidence. Personal consumption expenditures (PCE) inflation continued to show signs of easing, while services Purchasing Managers' Index (PMI) data from S&P Global remained expansionary. Additionally, initial jobless claims dropped to a four-month low, and the final print of second-quarter (Q2) gross domestic product (GDP) growth came in at 3%. The housing market remained under pressure, with new and pending home sales still reflecting the challenges posed by elevated home prices and mortgage rates.

Overall Stock Market Heatmap

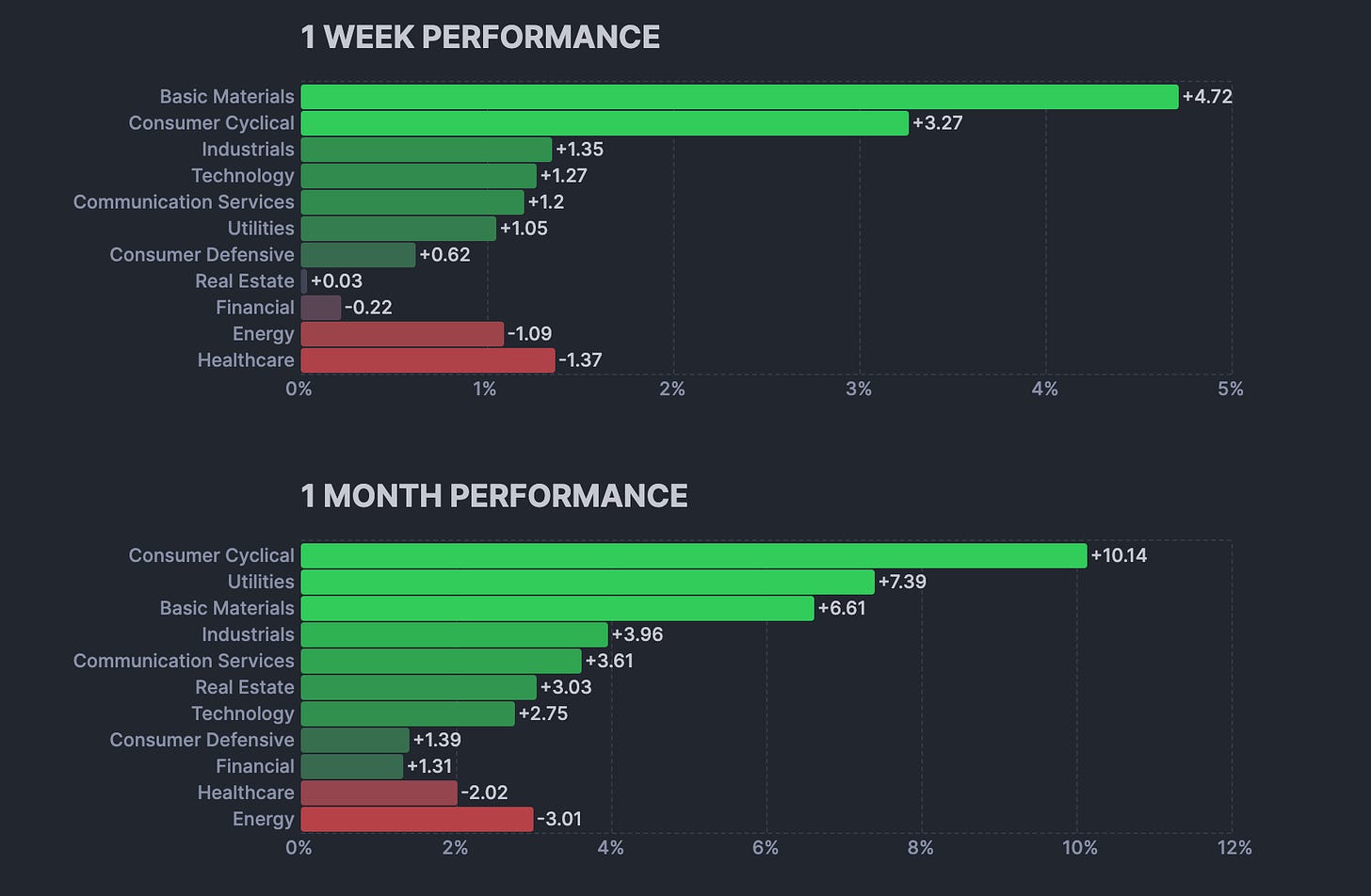

Sector Performance

Looking Ahead to the Upcoming Week

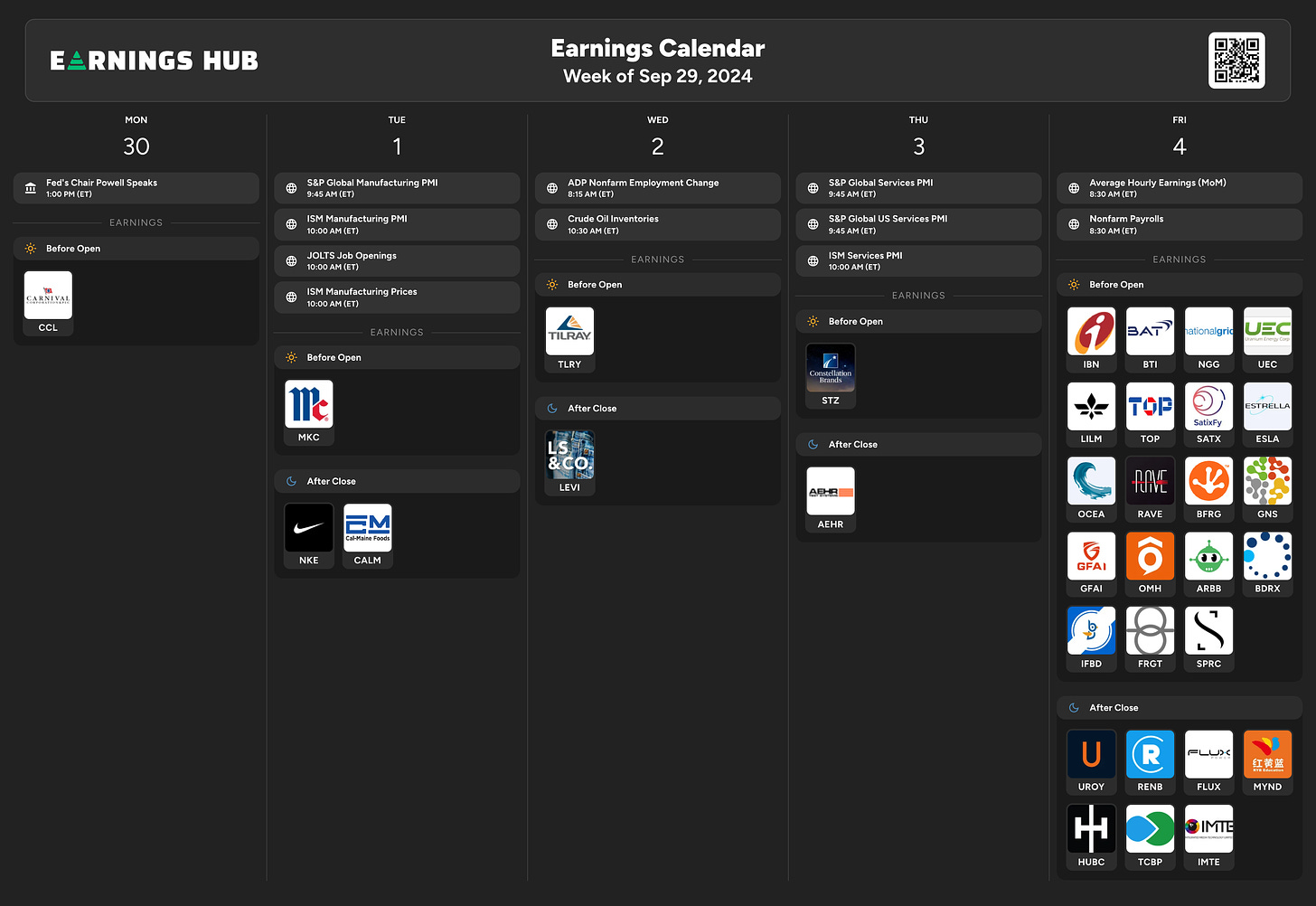

Looking ahead to next week, attention will shift to the September jobs report and several labor market updates. Other key releases will include manufacturing and services PMIs from the Institute for Supply Management (ISM), factory orders, and construction spending.

Economic Events

Earnings Event

Markets

Below are the levels for the upcoming week. Updates will be provided on X (previously Twitter) throughout the week.

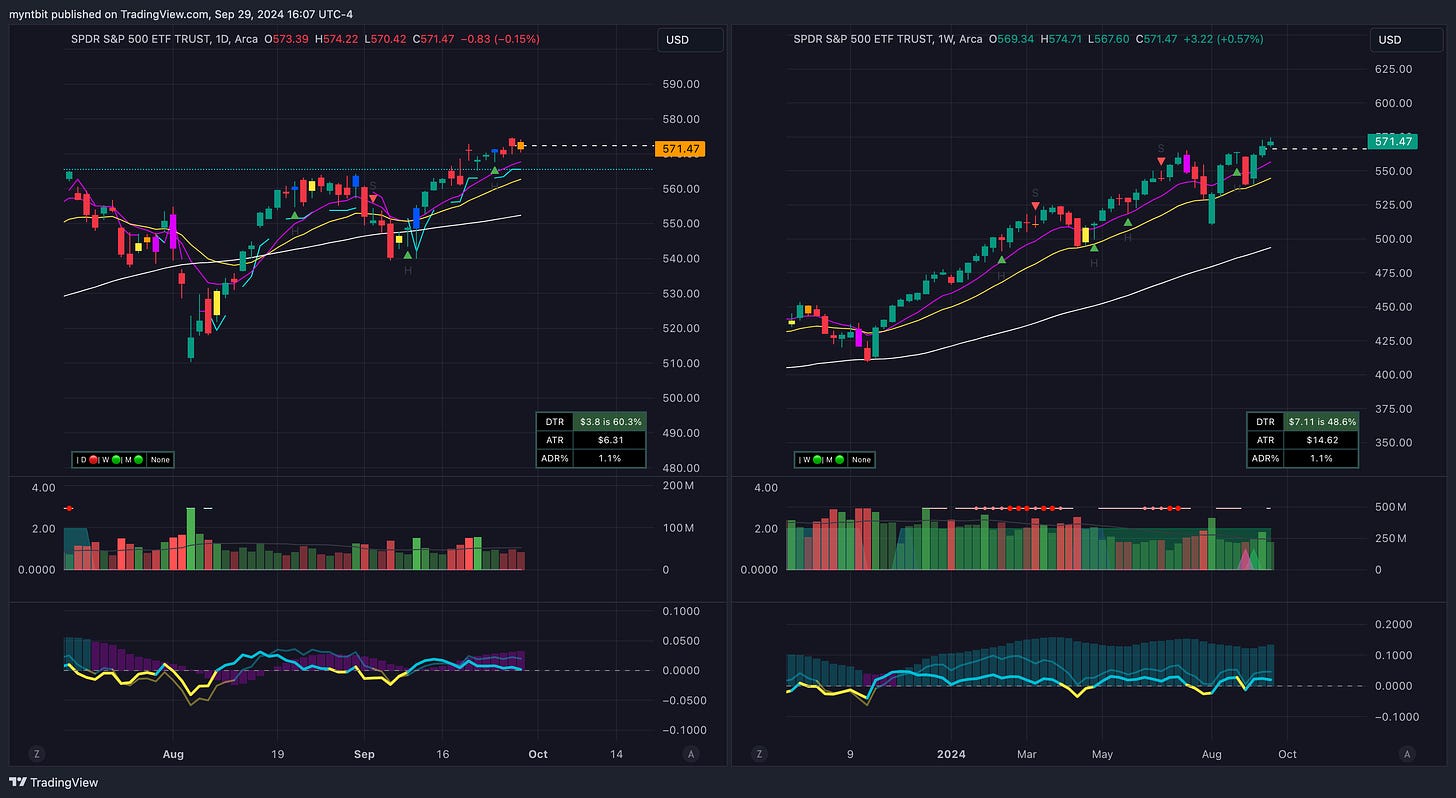

SPY - SPDR S&P 500 ETF Trust

Short-term (Daily): There is potential for a bullish breakout above $575, but volume needs to increase for confirmation. If the price fails to break this level, a pullback to the $565 support level may occur.

Medium-term (Weekly): The trend remains solidly bullish, with higher highs and higher lows. As long as the price stays above $565 on a weekly close, the outlook is positive.

Long-term (Monthly): The long-term uptrend is intact, supported by bullish moving averages. The key to sustaining the trend will be a continued rise in volume and positive price action above resistance.

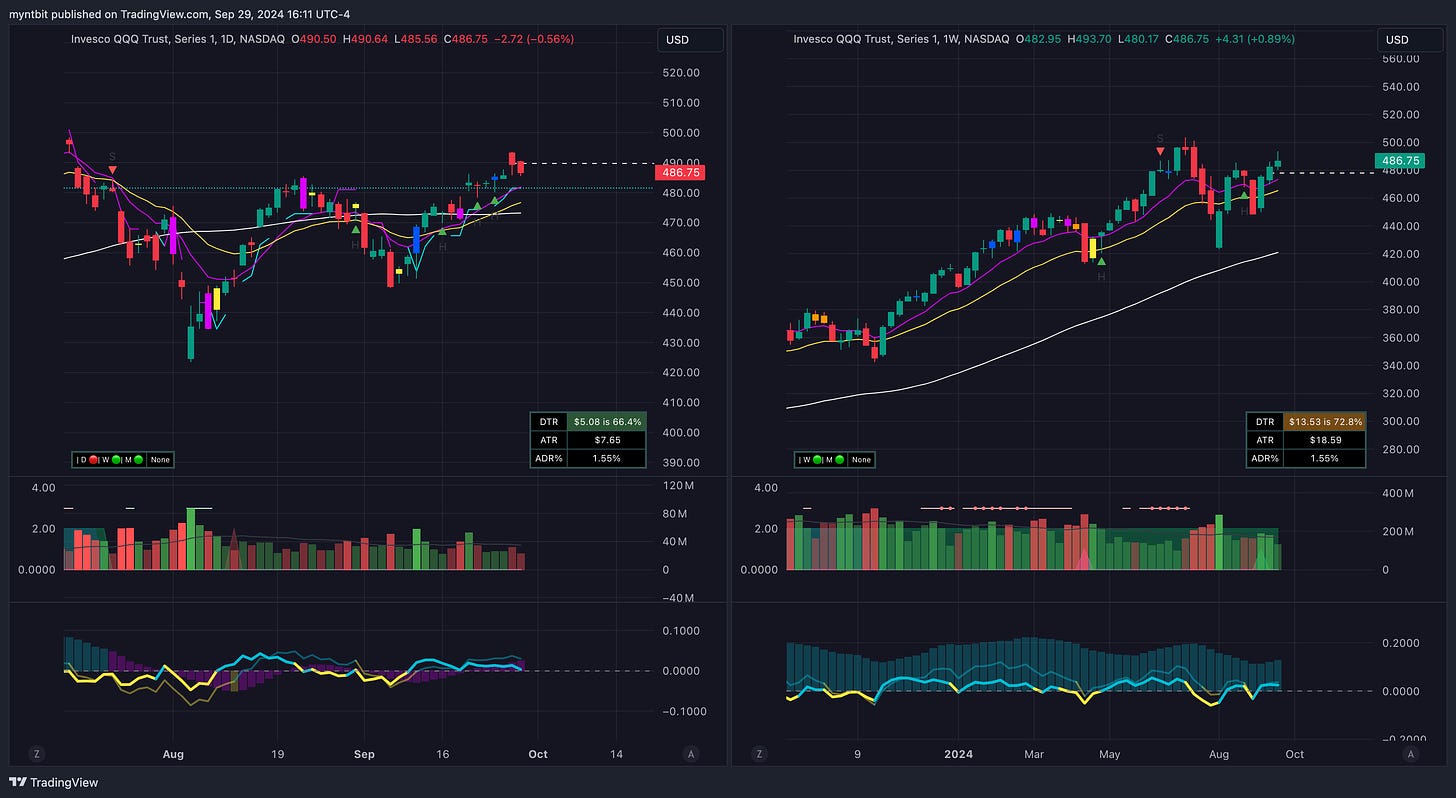

QQQ - Invesco QQQ Trust Series 1

Short-term (Daily): The current pullback may continue towards $480 before a potential bounce. A decisive breakout above $490-$500 on good volume would signal a continuation of the bullish trend.

Medium-term (Weekly): The weekly trend remains strongly bullish as long as the price remains above $480. A sustained move above $500 could trigger further upside.

Long-term (Monthly): The long-term outlook is positive, with higher highs and higher lows in place. Any break below $480 could bring the 50-week moving average into play around $440, which would still be within the context of a bullish trend.

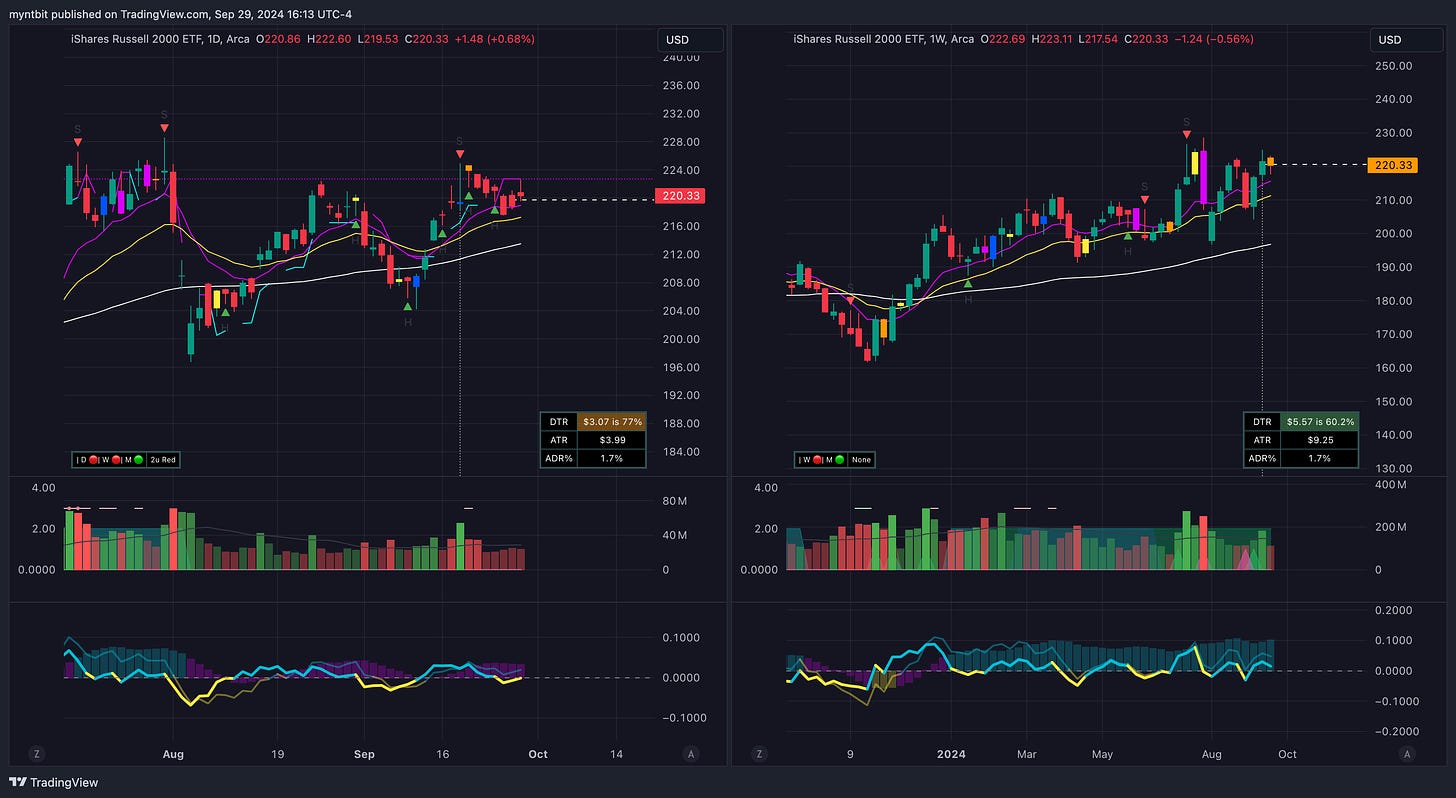

IWM - iShares Russell 2000 ETF

Short-term (Daily): The price is approaching key resistance at $224, and the short-term outlook remains cautiously bullish as long as the price stays above $215. A breakout above $224 would be a strong bullish signal.

Medium-term (Weekly): The medium-term trend is still bullish, with higher lows and higher highs in place. However, the volume is declining slightly, and momentum is flattening, suggesting the uptrend could slow down. A break below $215 on the weekly chart would suggest a deeper correction.

Long-term: The long-term outlook remains bullish as long as the ETF stays above the 200-day moving average, which is currently acting as strong support around $210.

Stock Watchlist for the Upcoming Week

Disclaimer: This newsletter is not trading or investment advice, but for general informational purposes only. This newsletter represents our personal opinions that we share publicly for educational purposes. Futures, stocks, and bonds trading of any kind involves a lot of risks. No guarantee of any profit whatsoever is made. In fact, you may lose everything you have. So be very careful. We guarantee no profit whatsoever, You assume the entire cost and risk of any trading or investing activities you choose to undertake. You are solely responsible for making your own investment decisions. Owners/authors of this newsletter, its representatives, its principals, its moderators, and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission, CFTC, or with any other securities/regulatory authority. Consult with a registered investment advisor, broker-dealer, and/or financial advisor. By reading and using this newsletter or any of my publications, you are agreeing to these terms. Any screenshots used here are courtesy of ForexFactory, EarningsHub, Finviz, ThinkorSwim, and/or Tradingview. We are just end-users with no affiliations with them.