What is included in this week's edition?

WEEKLY REVIEW: An overview of current market standing, fundamental matters with implications upon the market, and general sentiment regarding the major US indices.

LOOKING AHEAD: Key takeaways to consider as we look forward to the upcoming trading week.

MARKETS: A technical review of the major indices and commodities that represent the overall health of the market.

Market Trader by MyntBit | Issue# 26

Stocks rose for the week as the Personal Consumption Expenditure (PCE) inflation for May cooled, matching consensus expectations. This data further supported evidence of disinflation, raising hopes for a rate cut later in 2024. Several data points, including The Conference Board’s Consumer Confidence Index, durable goods orders, and various housing market updates, indicated a gradual economic slowdown. Additionally, the final gross domestic product (GDP) print for the first quarter saw a slight upward revision but still highlighted a notable slowdown compared to the fourth quarter.

Looking ahead to next week, investors will focus on June’s labor market data and the Federal Reserve’s (Fed's) meeting minutes. Other important releases will include the Institute for Supply Management (ISM) Purchasing Managers’ Indexes (PMIs) for manufacturing and services, along with construction spending and factory orders.

Weekly Market Review

The week that just ended had its fair share of positive and negative surprises.

The positive highlights included:

Successful Treasury note auctions for the 2-year, 5-year, and 7-year notes.

Carnival's (CCL) impressive earnings report.

FedEx (FDX) surging post-earnings report.

Amazon.com (AMZN) surpassing a $2 trillion market capitalization.

All 31 large banks passing the Fed's annual stress test.

A Personal Income and Spending report for May that struck the right balance, showing gains in personal income and spending alongside a moderation in the PCE Price indexes.

The negative highlights included:

A lack of broad-based market participation, with the equal-weighted S&P 500 declining 0.8% for the week.

A massive 20% drop in Nike (NKE) after issuing a disappointing FY25 sales outlook.

Rising tensions between Israel and Hezbollah.

Micron (MU) falling nearly 8% after its guidance disappointed investors.

Walgreens Boots Alliance (WBA) missing earnings expectations, cutting its FY24 guidance, and announcing plans to close numerous underperforming stores.

Continuing jobless claims reaching their highest level since November 2021.

New home sales dropping 11.3% month-over-month in May to a seasonally adjusted annual rate of 619,000 units.

Ambiguous Highlights:

The presidential debate, which added a new level of uncertainty to the upcoming election, could be seen as either positive or negative depending on one's perspective.

Market participants reacted to the news as it came but showed little strong conviction outside of individual stock moves. Overall, it was a mixed performance at the index level.

Index Performance:

The market-cap weighted S&P 500 dipped 0.1% for the week.

The Nasdaq Composite increased 0.2%.

The S&P Midcap 400 dropped 0.1%.

The Russell 2000 gained 1.3%.

The price-weighted Dow Jones Industrial Average was down fractionally for the week.

Year-to-Date Performance:

Nasdaq Composite: +18.1%

S&P 500: +14.5%

S&P 400: +5.3%

Dow Jones Industrial Average: +3.8%

Russell 2000: +1.0%

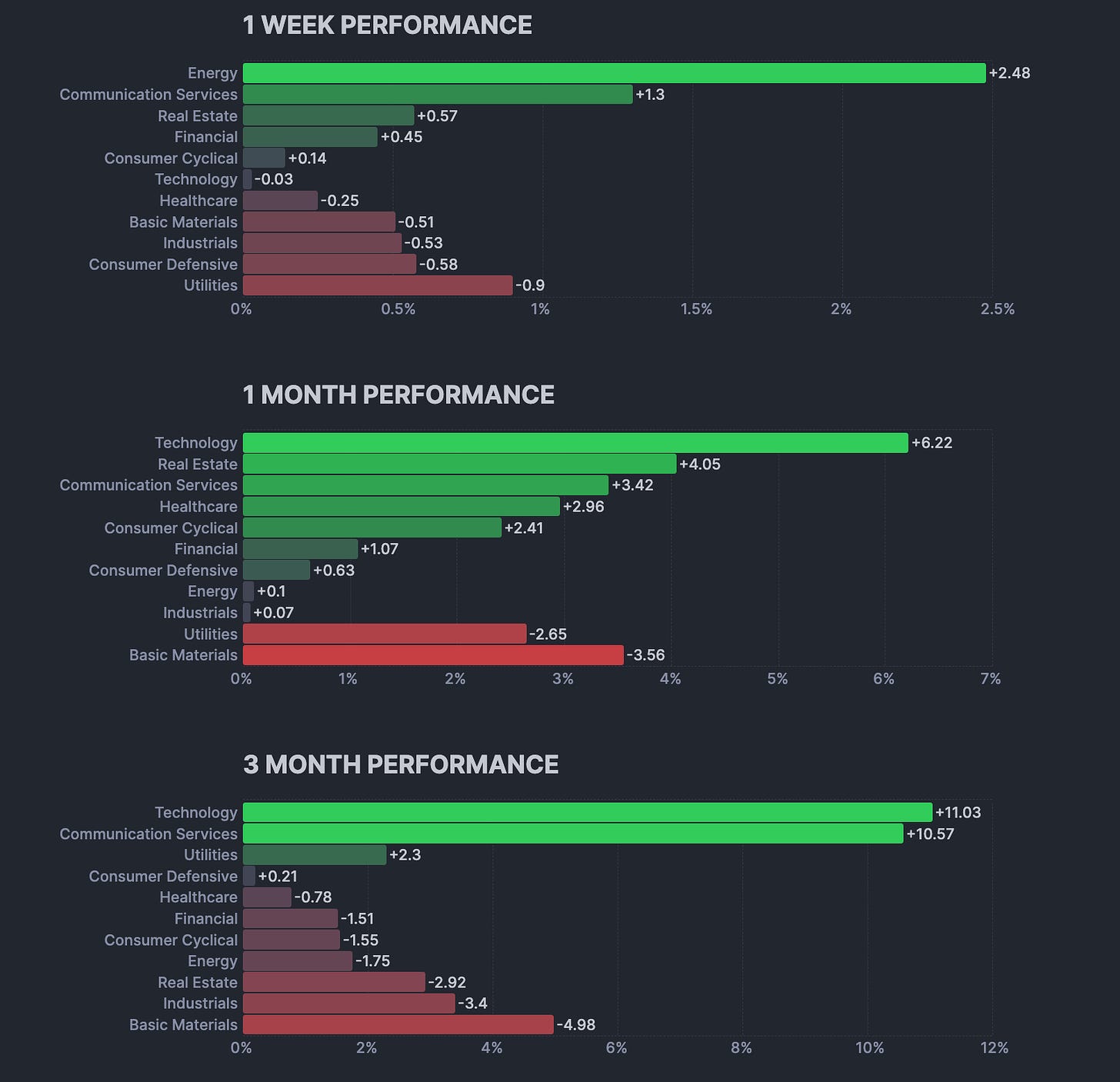

Weekly Performance Heatmap

Overall Stock Market Heatmap & Sector Performance

Looking Ahead to the Upcoming Week

The upcoming holiday-shortened week will be packed with events, starting with the ISM PMIs for June. Manufacturing activity updates are due on Monday, followed by service sector updates on Wednesday, before the focus shifts to Friday’s jobs report for June. Other potential market movers include the Federal Open Market Committee’s June 12 meeting minutes, labor-market data from the ADP survey of private employment, and the May Job Openings and Labor Turnover Survey (JOLTS) midweek. Additionally, factory orders, the trade balance, and construction spending data will be released.

In central bank news, Fed Chair Jerome Powell will speak at the European Central Bank’s Forum on Central Banking in Sintra, Portugal. In China, attention will be on June’s PMIs for the services and manufacturing sectors from Caixin. From Japan, watch for second-quarter business activity updates from Tankan, along with consumer confidence, the leading index, the monetary base, and finalized June PMIs. In South Korea, the Consumer Price Index (CPI), manufacturing PMI, and trade balance will be reported, alongside Australia’s trade balance, retail sales, building approvals, and a measure of inflation.

In Europe, highlights include preliminary June CPIs and finalized PMIs, along with May’s eurozone Producer Price Index, retail sales, and unemployment rate. The U.K.’s general elections and France’s first round of legislative elections will also garner attention. Additionally, updates on U.K. house prices, mortgage approvals, and consumer credit will be released, alongside French industrial production and the trade balance. From Germany, key reports will include industrial production and factory orders data.

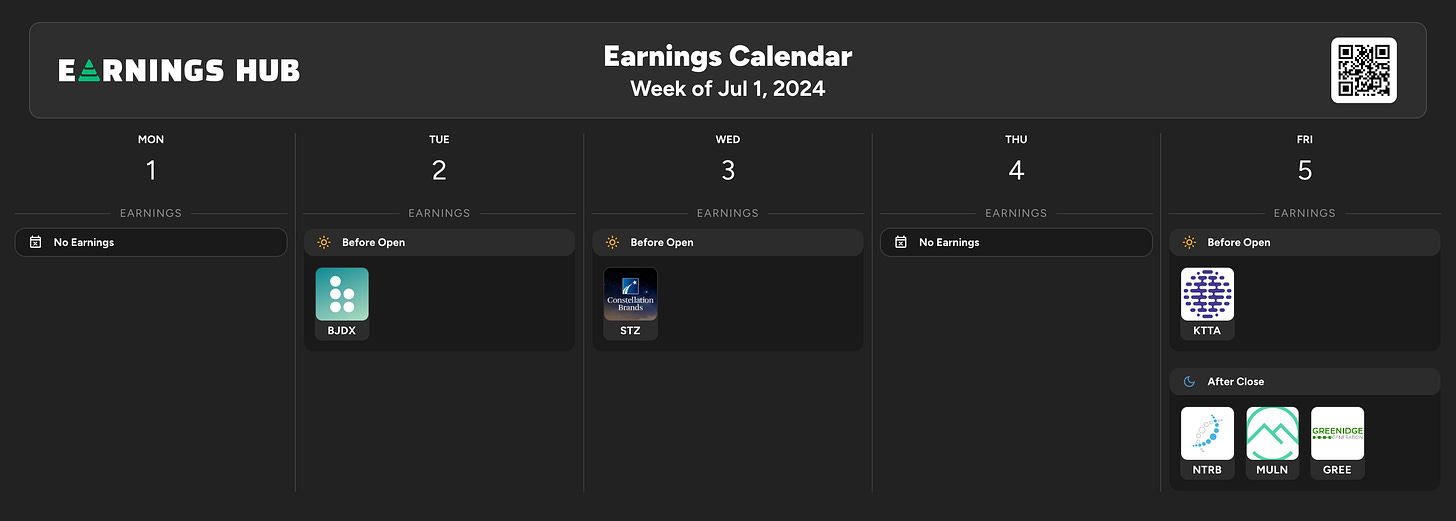

Important Economic & Earnings Event

Markets

Below are the levels for the upcoming week - updates will be provided on X (previously Twitter) throughout the week.

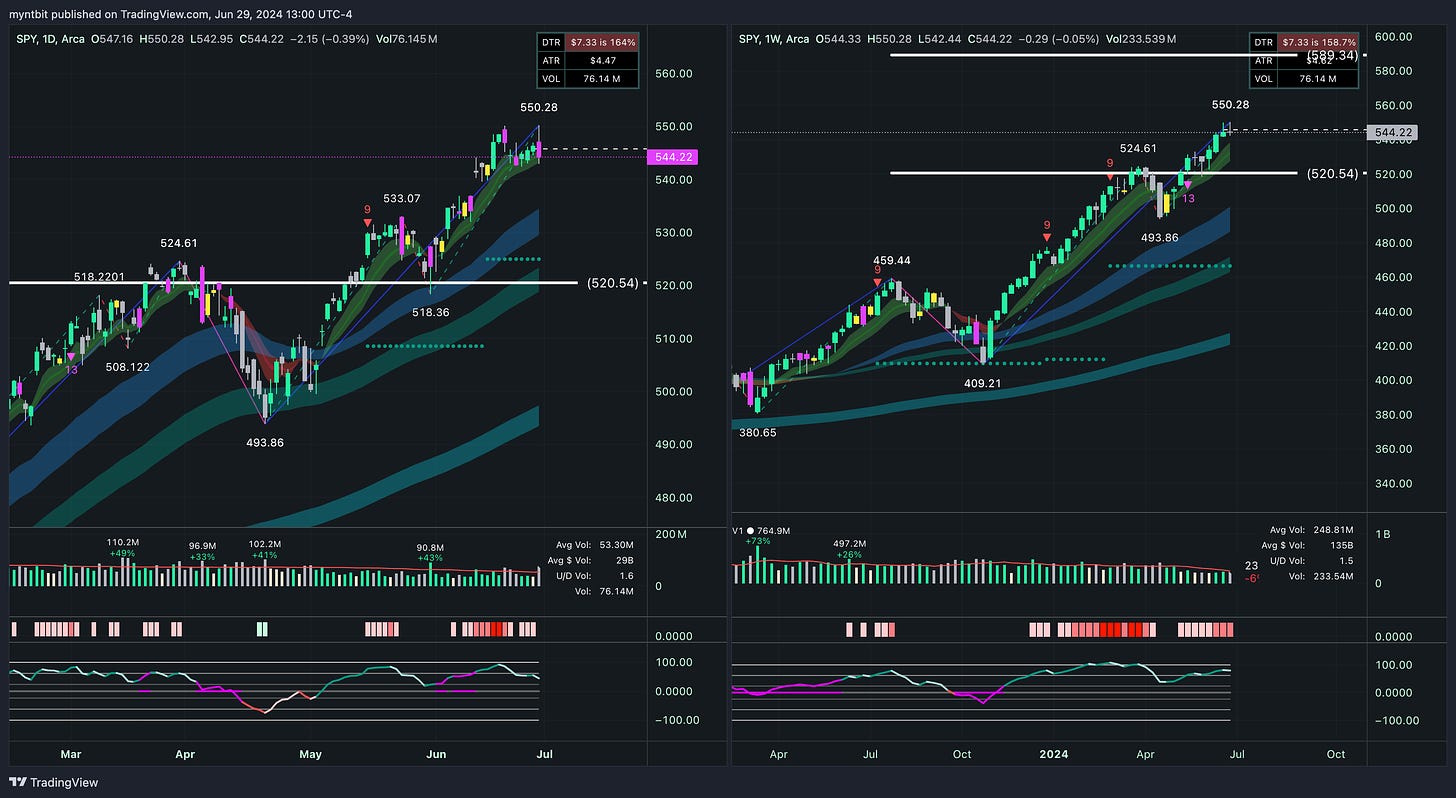

SPY - SPDR S&P 500 ETF Trust

Short Term (1-2 weeks): Neutral to Bullish. The stock might consolidate or test the recent high of 550.28.

Medium Term (1-3 months): Bullish. The trend remains strong, and a break above 550.28 could lead to further gains.

Long Term (3+ months): Bullish if the stock sustains above key support levels and continues to make higher highs and higher lows.

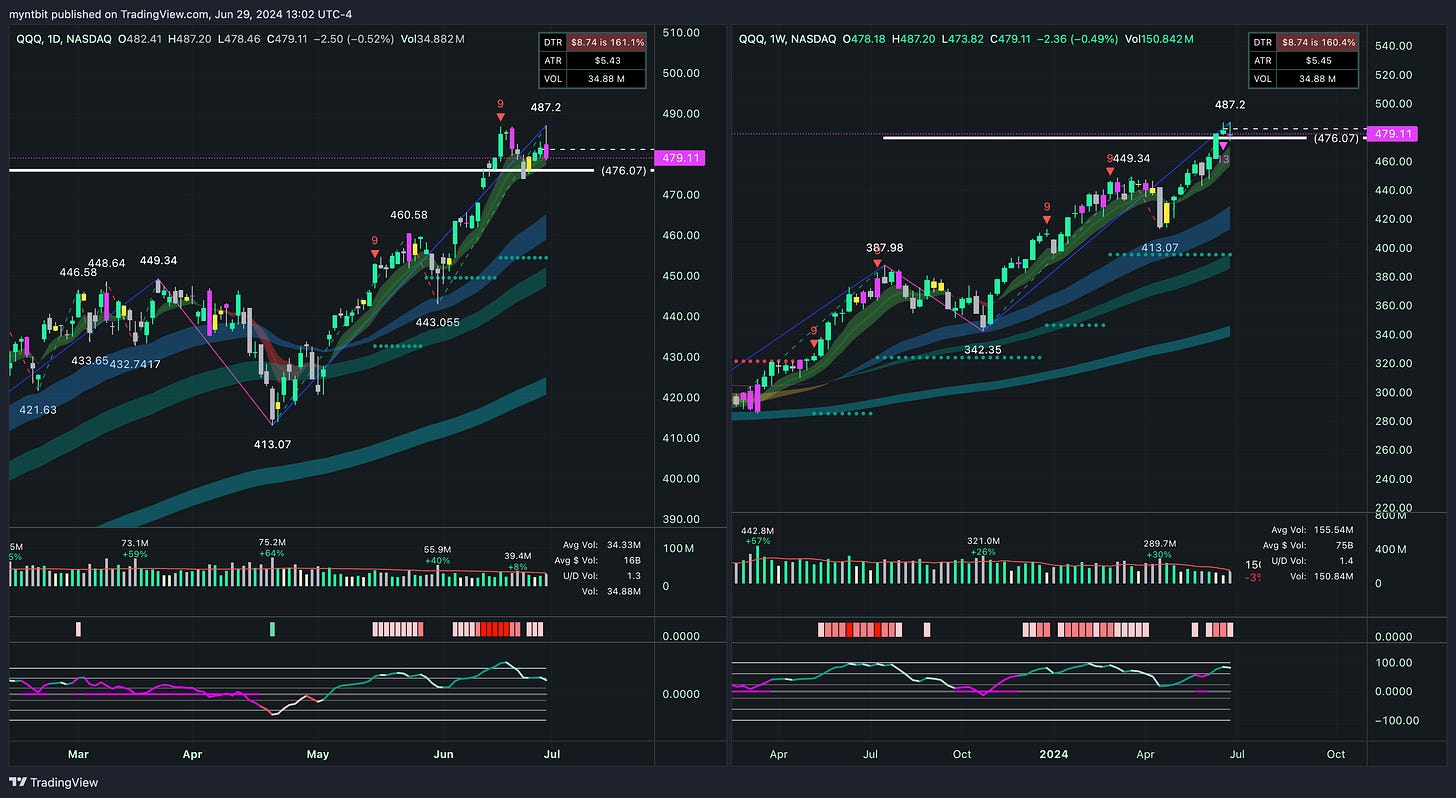

QQQ - Invesco QQQ Trust Series 1

Short Term (1-2 weeks): Neutral to Bullish. The stock might consolidate or test the recent high of 487.2.

Medium Term (1-3 months): Bullish. The trend remains strong, and a break above 487.2 could lead to further gains.

Long Term (3+ months): Bullish if the stock sustains above key support levels and continues to make higher highs and higher lows.

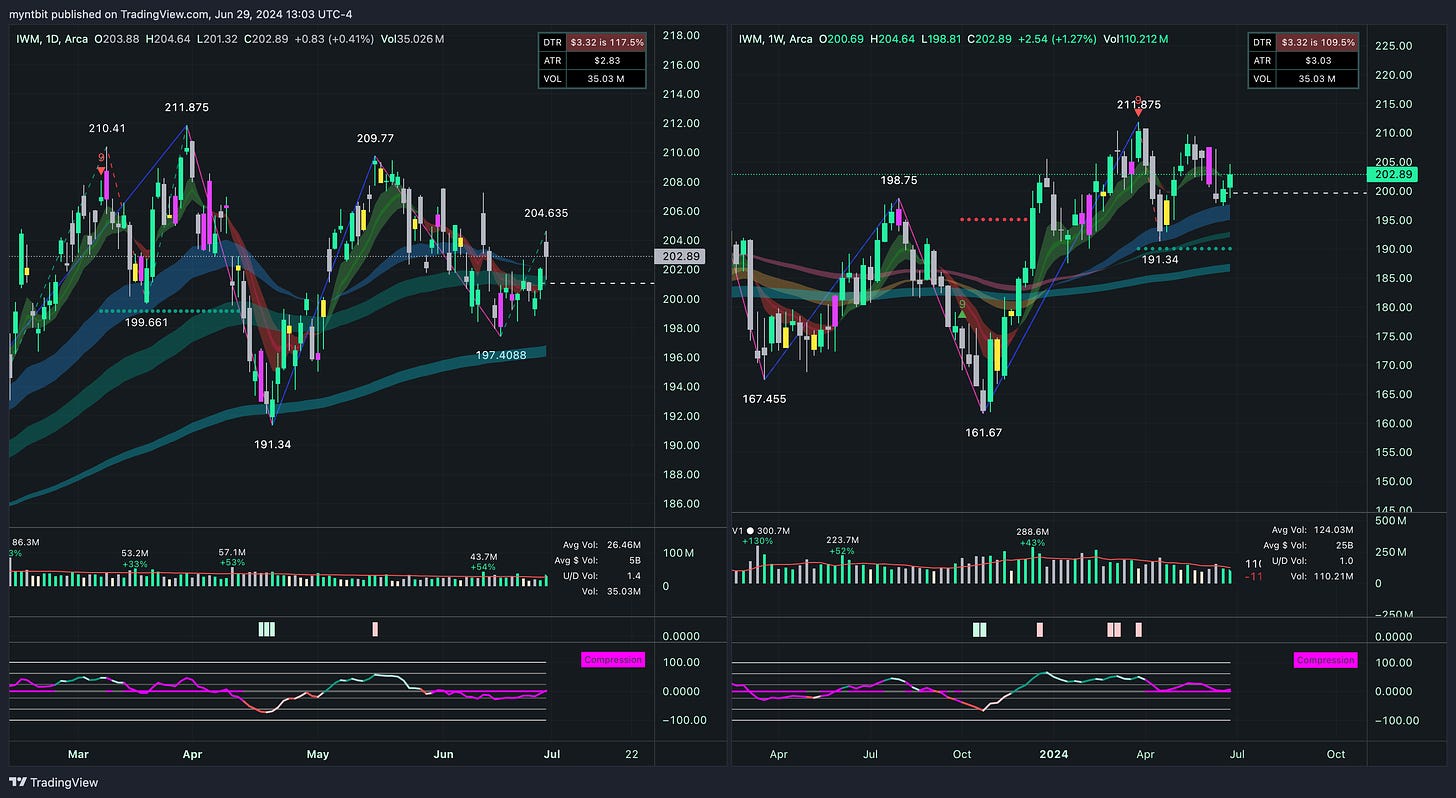

IWM - iShares Russell 2000 ETF

Short Term (1-2 weeks): Neutral to Bullish. The stock might consolidate or test the recent high of 204.635.

Medium Term (1-3 months): Neutral. Continued monitoring is required to see if the stock can sustain above key support levels.

Long Term (3+ months): Bullish if the stock sustains above key support levels and continues to make higher highs and higher lows.

DIA - SPDR Dow Jones Industrial Average ETF Trust

Short Term (1-2 weeks): Neutral to Bullish. The stock might consolidate or test the recent high of 395.59.

Medium Term (1-3 months): Neutral. Continued monitoring is required to see if the stock can sustain above key support levels.

Long Term (3+ months): Bullish if the stock sustains above key support levels and continues to make higher highs and higher lows.

VIX - Volatility S&P 500 Index

Short Term (1-2 weeks): Neutral to Bearish. The VIX might consolidate around current levels or test the support at 11.87.

Medium Term (1-3 months): Neutral. Continued monitoring is required to see if the VIX can sustain above key resistance levels.

Long Term (3+ months): Bearish if the VIX remains below key resistance levels and continues to trend lower.

Last Week's Watchlist

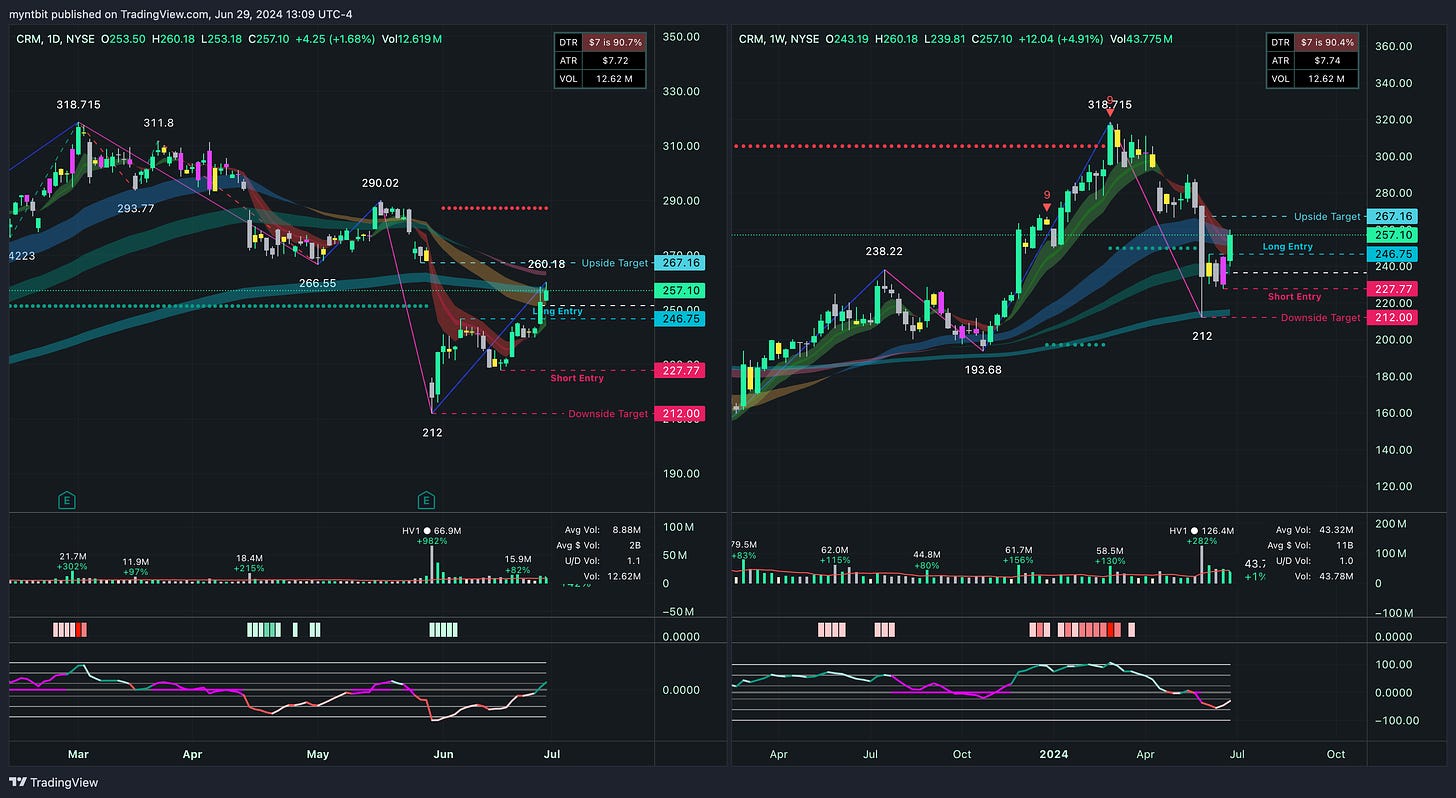

CRM - Salesforce Inc

It broke out on the upside above 250 on its way to fill the gap. Will be removed from the list.

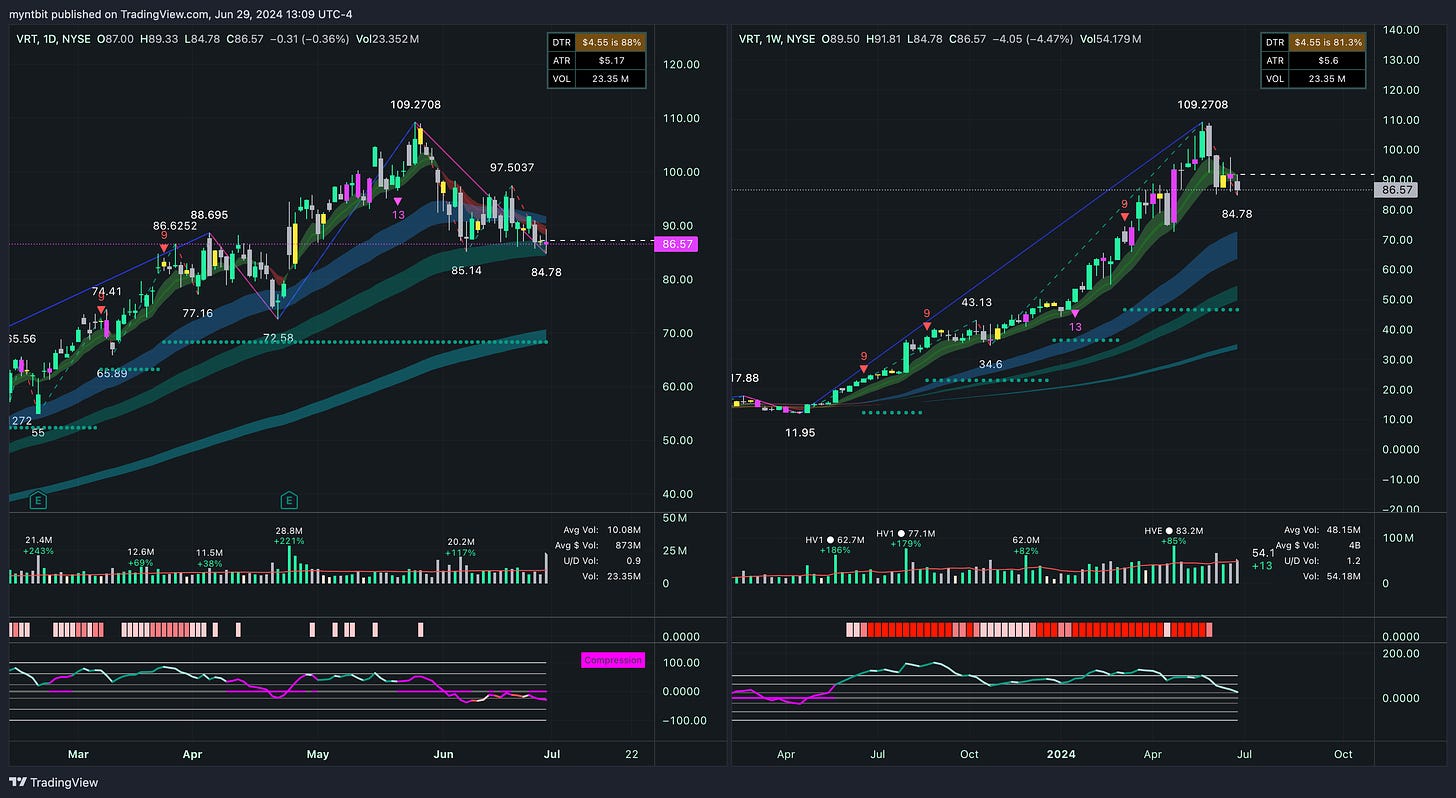

VRT - Vertiv Holdings Co

VRT hit the downside target. Will be removed from the list.

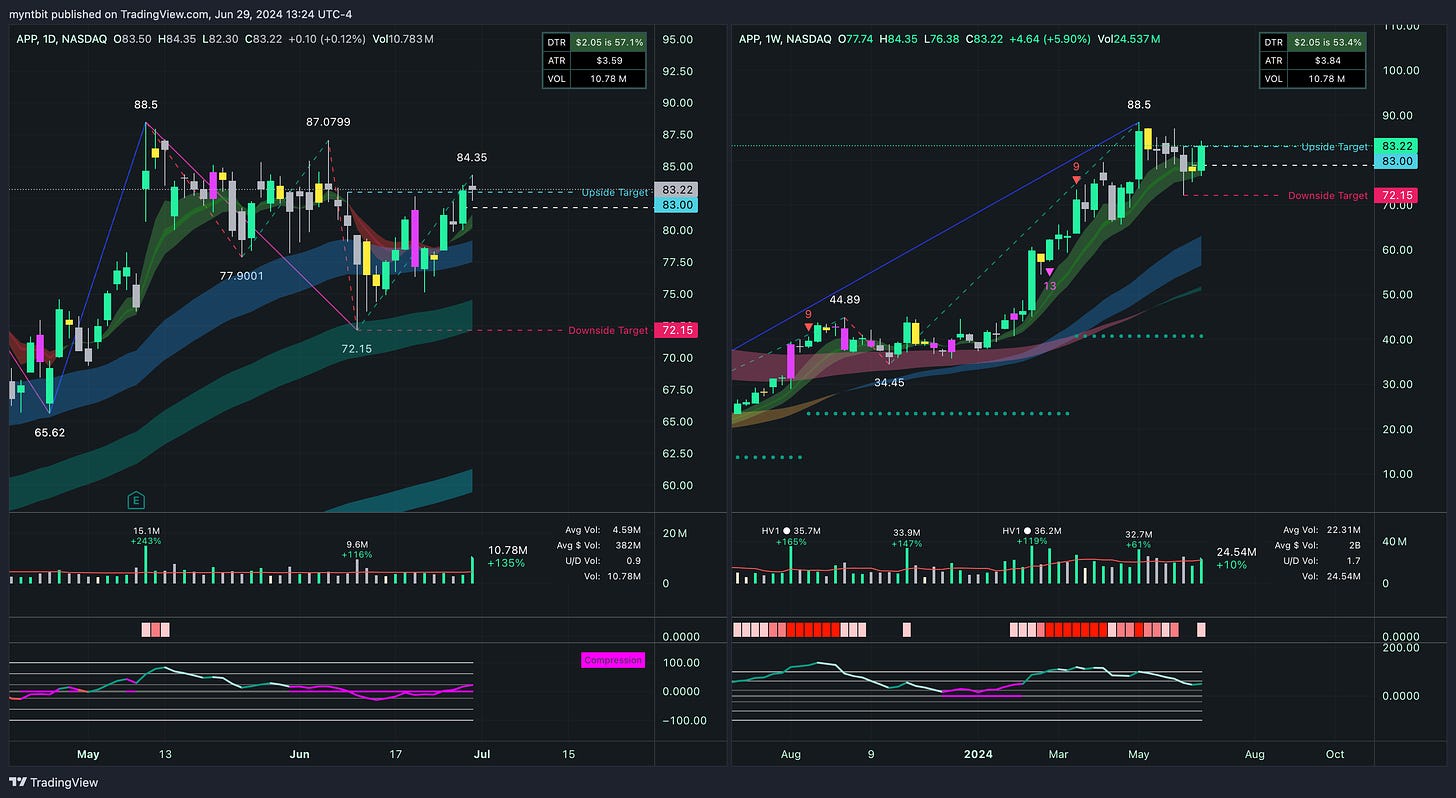

APP - Applovin Corp

APP hit the upside target. Will be removed from the list.

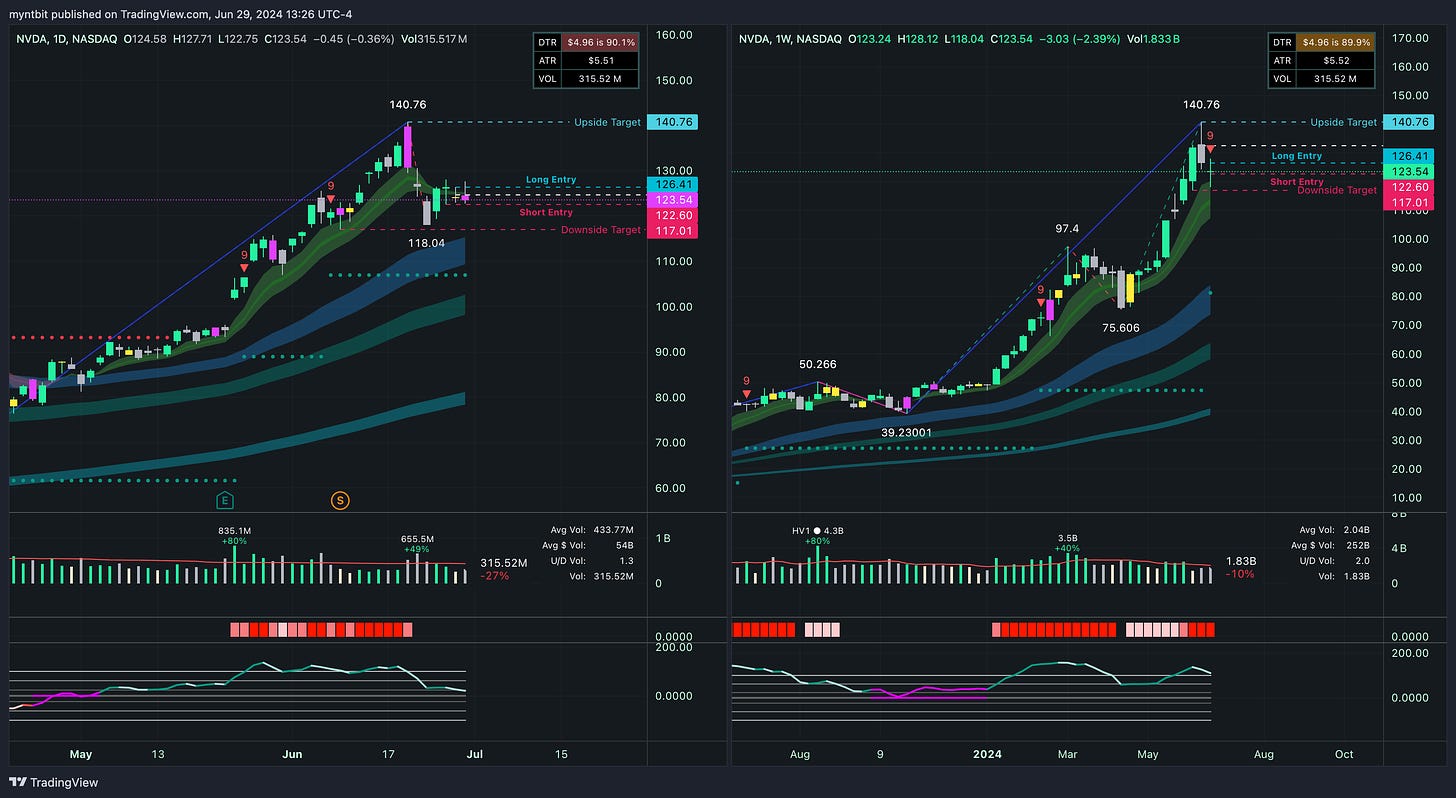

NVDA - Nvidia Corp

NVDA still consolidating. The targets remain the same.

Bull Case: The stock has shown a robust uptrend, with strong volume supporting the price action. The immediate resistance at $140.76 is a critical level to watch. If the stock breaks above this level with strong volume, it could signal a continuation of the bullish trend. The support levels at $126.57 and $117.01 provide potential entry points if the stock pulls back.

Bear Case: The RSI is in overbought territory on both daily and weekly charts, indicating the potential for a pullback. The stock has also shown a bearish MACD crossover on the daily chart, suggesting caution. If the stock fails to hold above the $126.57 support, it could retest lower levels, with the next major support at $117.01.

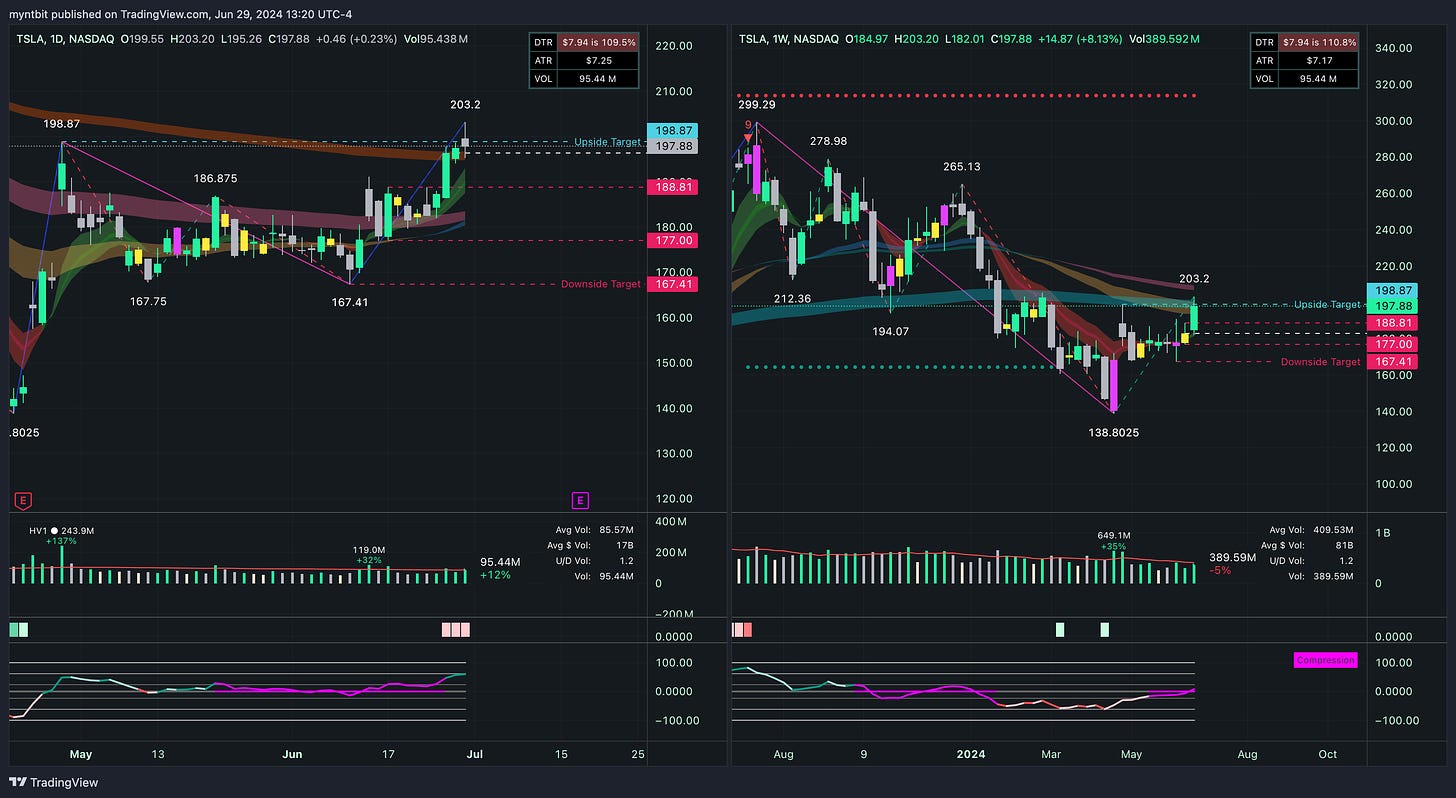

TSLA - Tesla Inc

TSLA hit the upside target. Will be removed from the list.

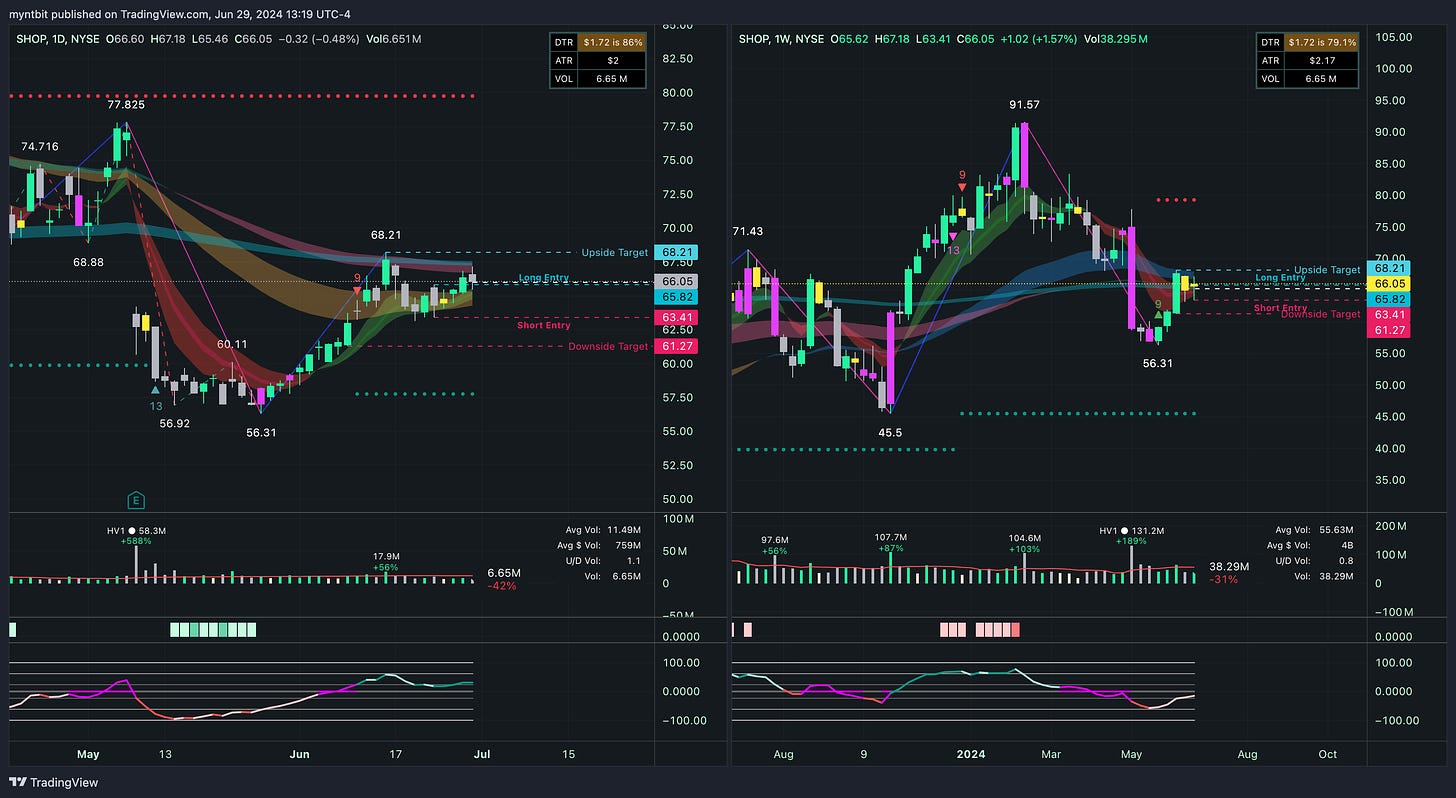

SHOP - Shopify Inc

SHOP still consolidating. The targets remain the same.

Bull Case: The stock is recovering from a significant low and is showing upward momentum. The immediate resistance at $68.21 is a critical level to watch. If the stock can break above this level, it could target higher resistance levels, such as $77.825. The increasing volume during the recovery phase supports the potential for further upside.

Bear Case: The stock is approaching resistance levels, and the Ichimoku cloud on both charts suggests potential resistance. If the stock fails to break above $68.21 and falls below the support at $61.27, it could retest lower levels, including the significant support at $56.31.

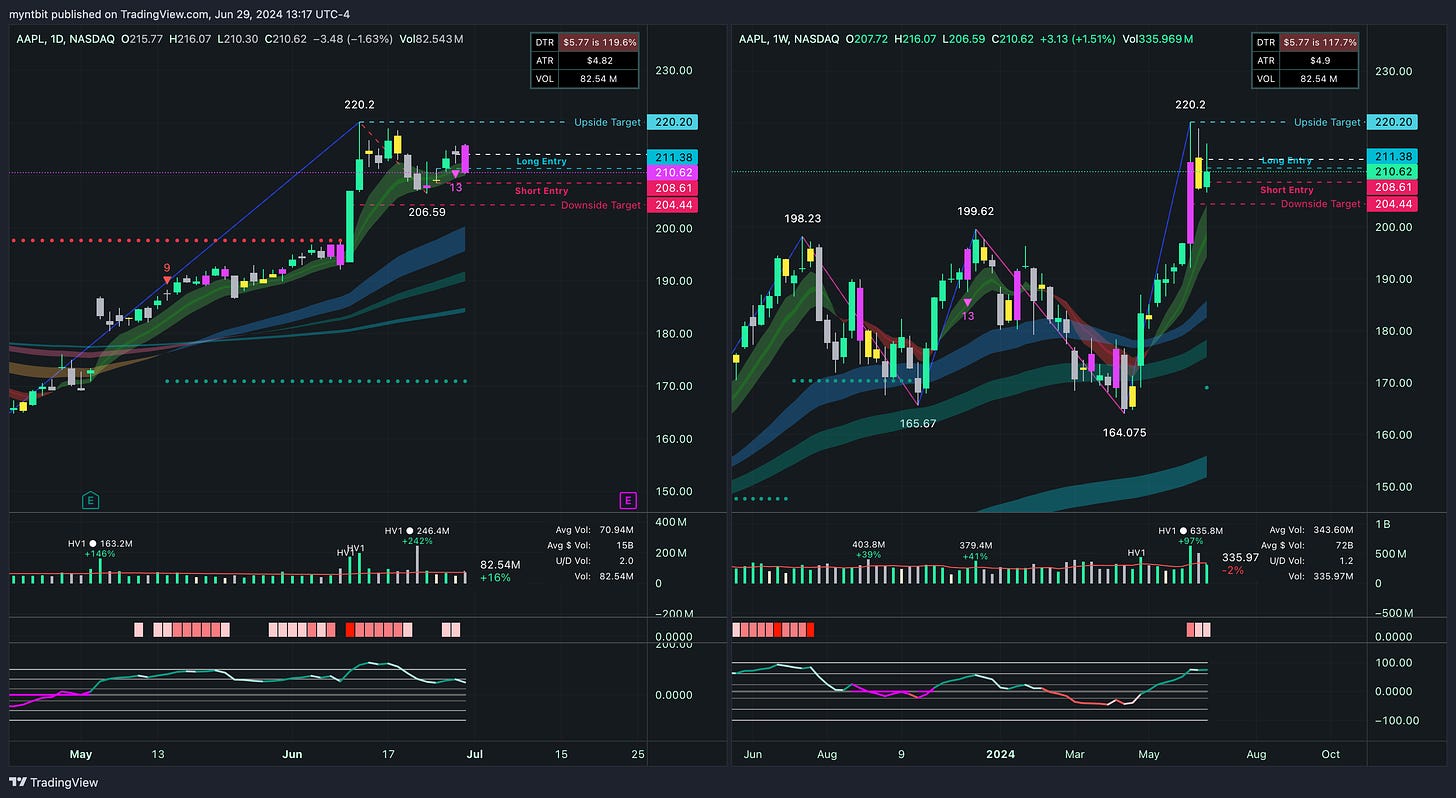

AAPL - Apple Inc

AAPL still consolidating. The targets remain the same.

Bull Case: The stock has shown a strong uptrend and is currently experiencing a minor correction after hitting $220.20. The elevated volume and support from moving averages suggest that there is still bullish interest. If the stock can maintain above $207.49 and break through $220.20, it could continue its upward trajectory toward higher targets.

Bear Case: The stock is experiencing a pullback, and the RSI and MACD indicate potential for further correction. If the stock fails to hold above $207.49, it could test the support level at $199.62 or lower. The increased volume on the recent drop suggests caution as there may be further downside pressure.