Weekly Report | Jul 28, 2024 + CRM, ENPH, ORCL

What is included in this week's edition?

WEEKLY REVIEW: An overview of current market standing, fundamental matters with implications upon the market, and general sentiment regarding the major US indices.

LOOKING AHEAD: Key takeaways to consider as we look forward to the upcoming trading week.

MARKETS: A technical review of the major indices and commodities that represent the overall health of the market.

Market Trader by MyntBit | Issue# 29

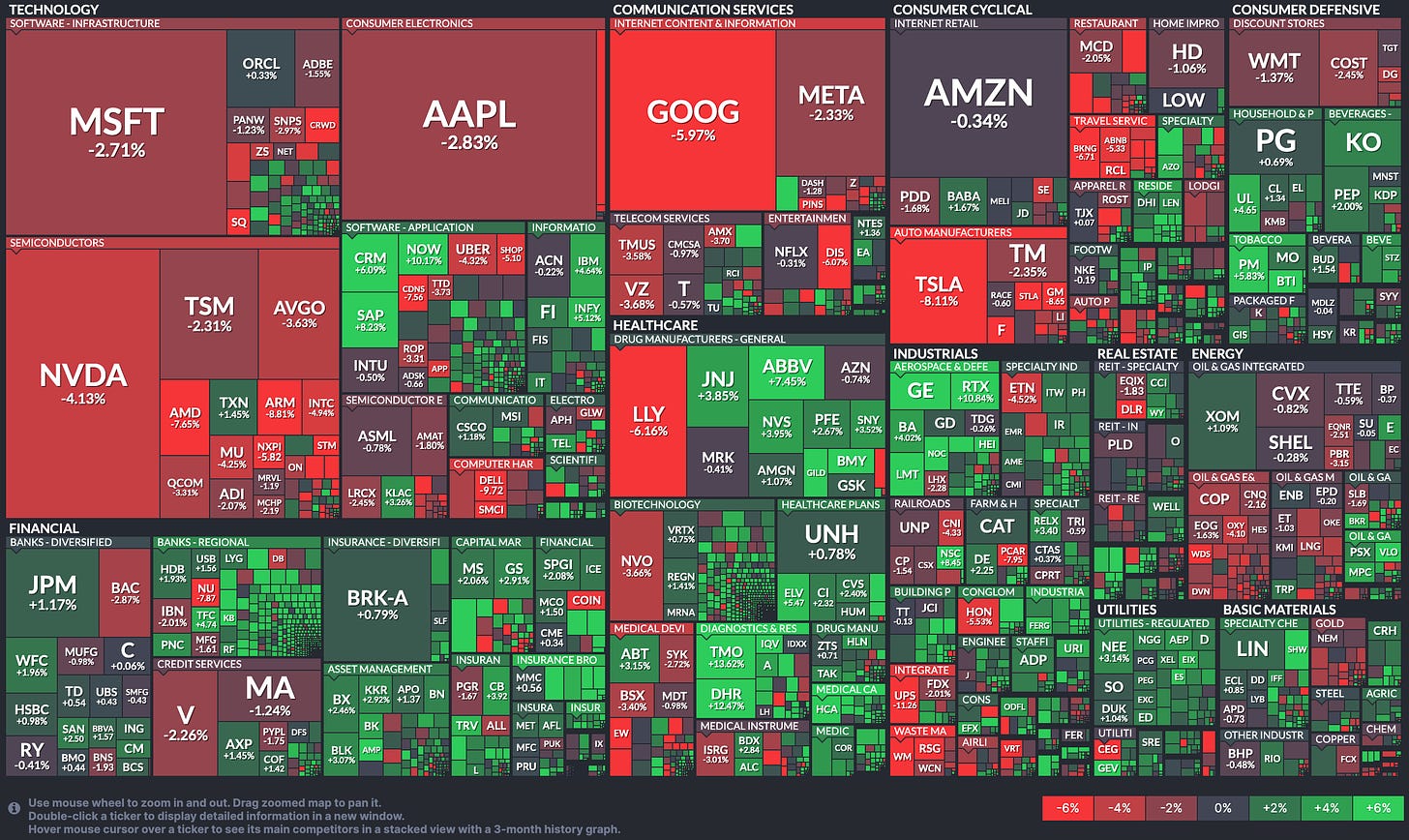

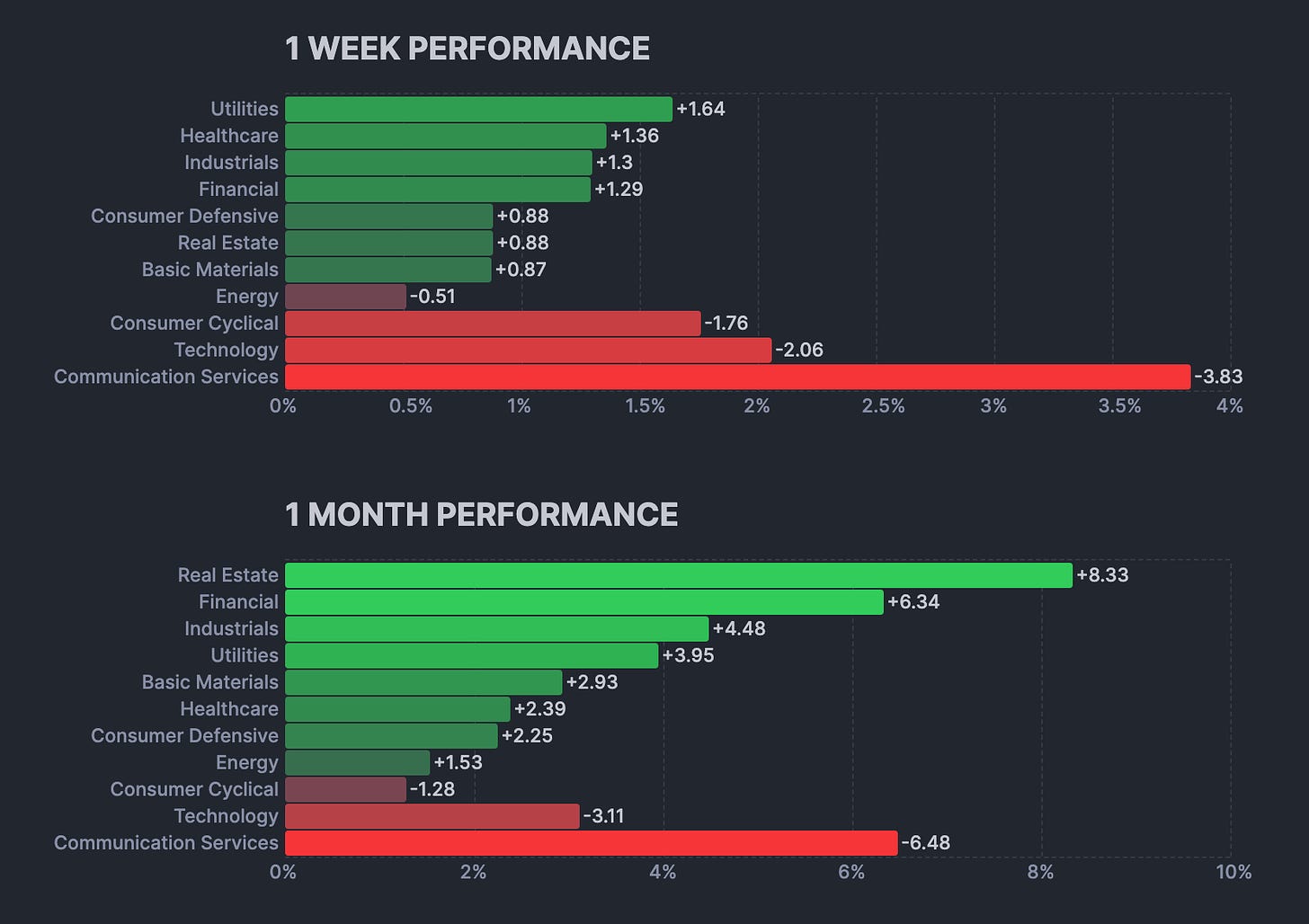

Stocks experienced volatility throughout the week due to earnings season, but an end-of-week upturn was driven by Friday’s personal consumption expenditures (PCE) inflation report. The PCE data indicated ongoing disinflation with mild overall figures, reinforcing expectations for the Federal Reserve (Fed) to cut rates in September. Additionally, the first estimate of second-quarter gross domestic product (GDP) exceeded expectations, showing robust growth and consumer strength.

Other economic indicators presented mixed signals, including consumer sentiment, S&P Global’s preliminary Purchasing Managers’ Indexes (PMIs) for manufacturing and services, durable goods orders, and housing market updates.

Overall Stock Market Heatmap

Sector Performance

Looking Ahead to the Upcoming Week

Looking ahead to next week, investors will focus on the Fed’s policy announcement on Wednesday and July’s jobs report. Additional updates will include the manufacturing PMI from the Institute for Supply Management, consumer confidence, factory orders, and more housing market data.

Economic Events

Earnings Event

Markets

Below are the levels for the upcoming week - updates will be provided on X (previously Twitter) throughout the week.

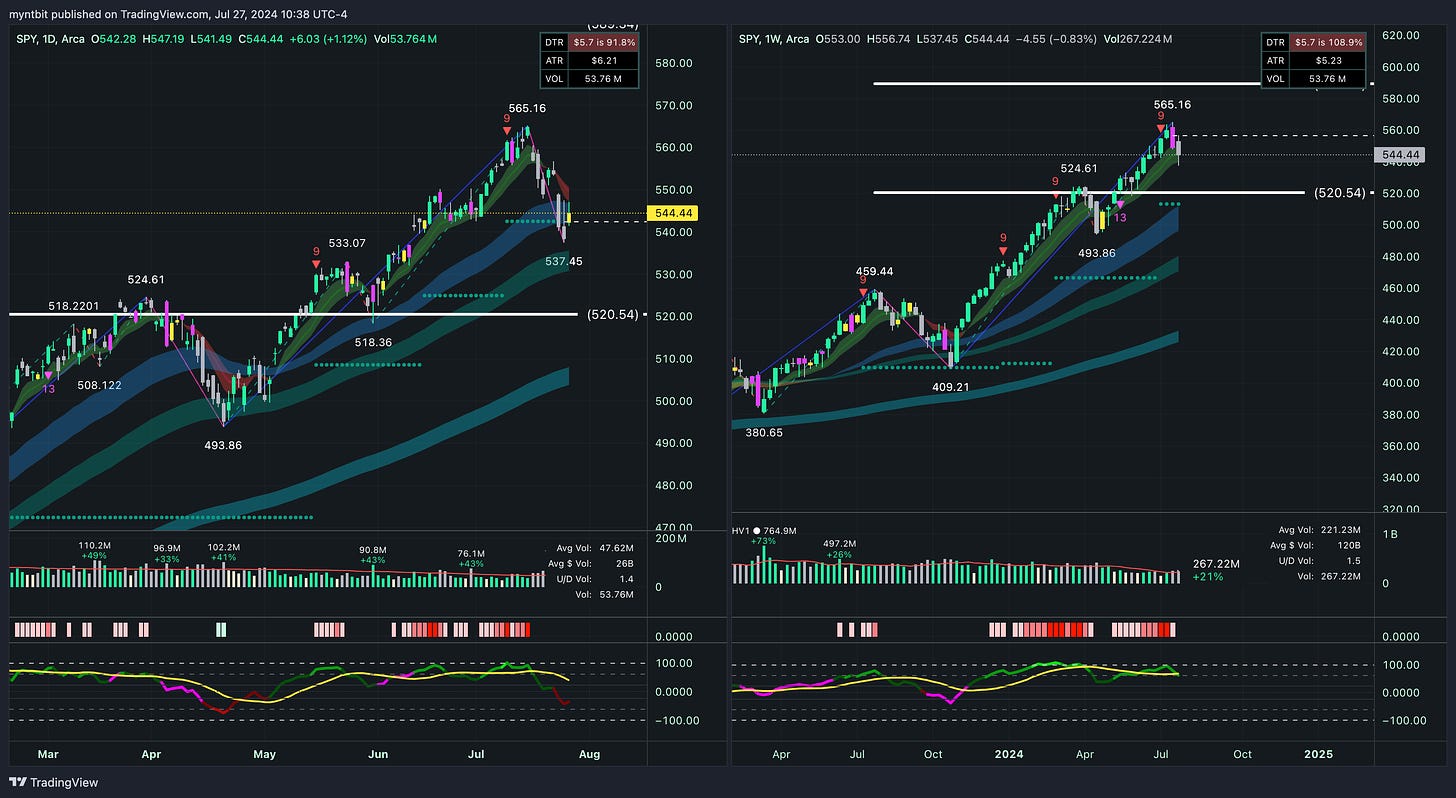

SPY - SPDR S&P 500 ETF Trust

Bullish Case:

A break above 565.16 could push the stock towards new highs. The consistent volume and minor pullback suggest a potential continuation of the uptrend.

Bearish Case:

A failure to hold the 537.45 support level could lead to a decline towards the stronger support level at 520.54.

Trend

Short Term (1-2 weeks): Neutral to Bullish. The stock is holding support levels well and could see a reversal towards 565.16.

Medium Term (1-3 months): Neutral. The stock needs to break above 565.16 to confirm a medium-term uptrend.

Long Term (3+ months): Bullish. The long-term trend remains strong unless the stock breaks significantly below 520.54.

QQQ - Invesco QQQ Trust Series 1

Bullish Case:

A break above 503.52 could push the stock towards new highs. The consistent volume and minor pullback suggest a potential continuation of the uptrend.

Bearish Case:

A failure to hold the 455.63 support level could lead to a decline towards the stronger support level at 443.055.

Trend

Short Term (1-2 weeks): Neutral to Bullish. The stock is holding support levels well and could see a reversal towards 476.07 and potentially 503.52.

Medium Term (1-3 months): Neutral. The stock needs to break above 503.52 to confirm a medium-term uptrend.

Long Term (3+ months): Bullish. The long-term trend remains strong unless the stock breaks significantly below 443.055.

IWM - iShares Russell 2000 ETF

Bullish Case:

A break above 226.64 could push the stock towards new highs. The significant volume increase and strong uptrend suggest a continuation of the bullish trend.

Bearish Case:

A failure to hold the 211.875 support level could lead to a decline towards the stronger support level of 199.661.

Trend

Short Term (1-2 weeks): Bullish. The stock is in a strong uptrend and is likely to test the resistance at 226.64.

Medium Term (1-3 months): Neutral to Bullish. The stock needs to break above 226.64 to confirm a medium-term uptrend.

Long Term (3+ months): Bullish. The long-term trend remains strong unless the stock breaks significantly below 199.661.

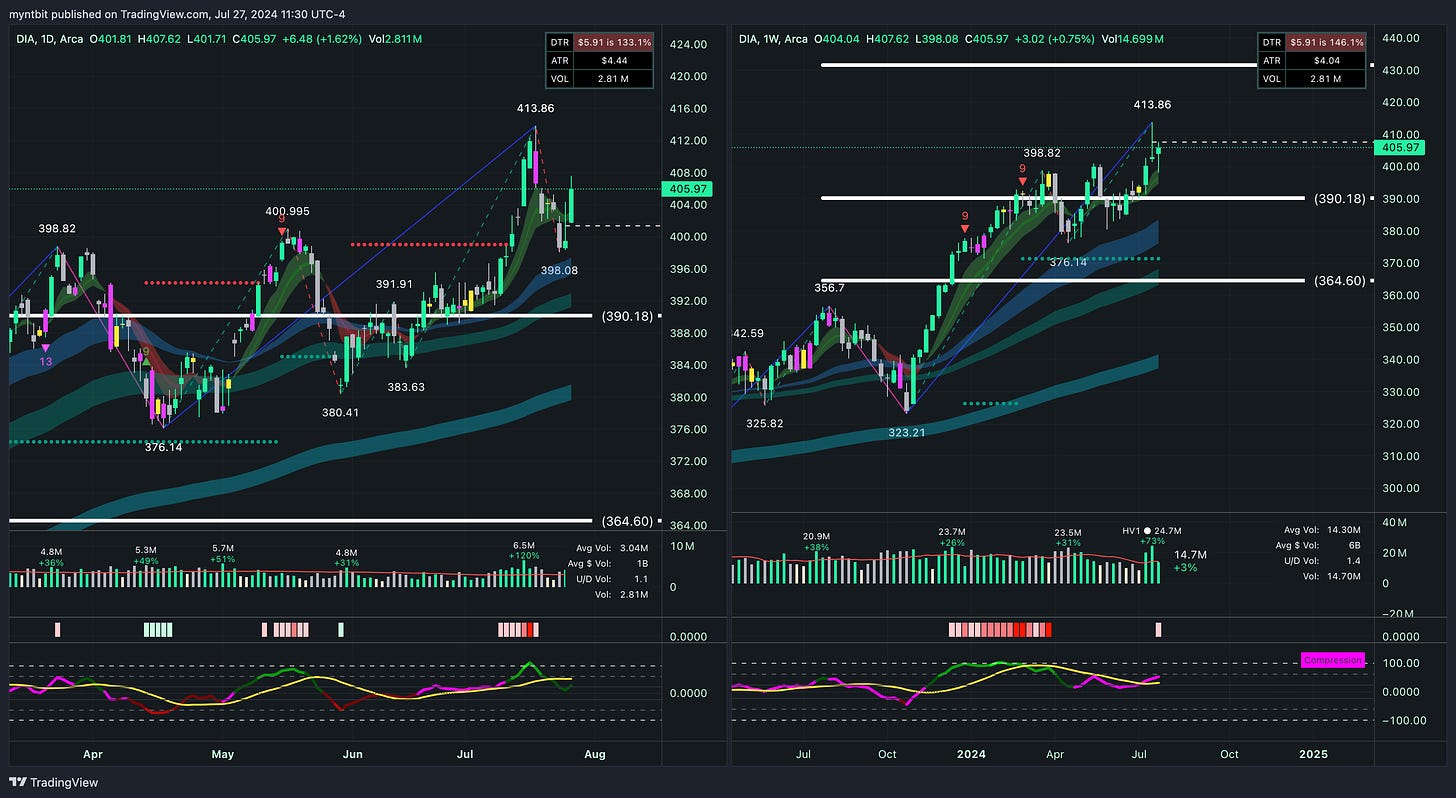

DIA - SPDR Dow Jones Industrial Average ETF Trust

Bullish Case:

A break above 413.86 could push the stock towards new highs. The significant volume increase and strong uptrend suggest a continuation of the bullish trend.

Bearish Case:

A failure to hold the 390.18 support level could lead to a decline towards the stronger support level at 364.60.

Trend

Short Term (1-2 weeks): Bullish. The stock is in a strong uptrend and is likely to test the resistance at 413.86.

Medium Term (1-3 months): Neutral to Bullish. The stock needs to break above 413.86 to confirm a medium-term uptrend.

Long Term (3+ months): Bullish. The long-term trend remains strong unless the stock breaks significantly below 364.60.

VIX - Volatility S&P 500 Index

Bullish Case:

A break above 19.36 could push the index towards new highs. The significant volatility increase suggests a continuation of the bullish trend in the short term.

Bearish Case:

A failure to hold the 15.00 support level could lead to a decline towards the stronger support level at 13.88.

Trend

Short Term (1-2 weeks): Neutral. The index is currently in a pullback phase, and it needs to hold the support at 15.00 for a potential rebound.

Medium Term (1-3 months): Neutral to Bullish. The index needs to break above 19.36 to confirm a medium-term uptrend.

Long Term (3+ months): Neutral. The long-term trend remains uncertain unless the index breaks significantly above or below the key levels.

Last Week's Watchlist

GE - General Electric Co

GE finally broke out and reached out target on the upside, expecting further upside. Will be removed from the watchlist.

CVNA - Carvana Co.

Nothing has changed, as CVNA is still consolidating. The targets remain the same.

Bullish Case:

The price breaking and sustaining above 140.91 could indicate further upside towards 150.84, driven by strong momentum and volume.

Bearish Case:

If the price fails to sustain above 140.91 and breaks below 130.00, it could signal a pullback towards the support at 120.00.

MRNA - Moderna, Inc.

Nothing has changed, as MRNA is still consolidating - Earnings are up this week. The targets remain the same.

Bullish Case:

A break above the 129.39 resistance level could push the stock towards the next target at 137.52. The consolidation phase might be a precursor to a bullish breakout if supported by increased volume.

Bearish Case:

A failure to hold the 114.02 support level could lead to a decline towards the next support at 100.30, indicating a continuation of the downtrend.

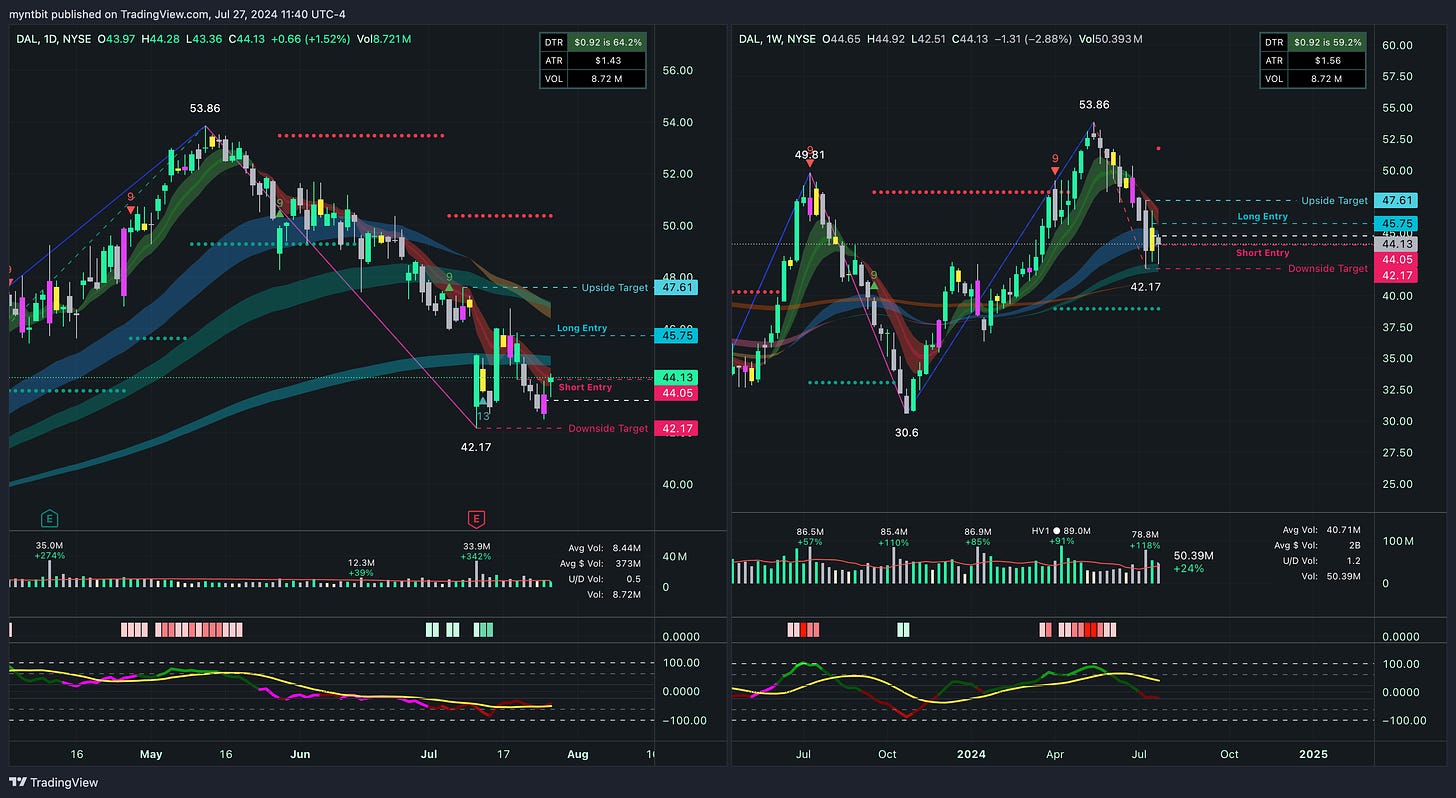

DAL - Delta Air Lines, Inc.

DAL missed the downside target by a few cents. Will be removed from the watchlist.

CHWY - Chewy, Inc.

CHWY is still consolidating. The targets remain the same.

Bullish Case:

A break above the 27.38 resistance level could push the stock towards the next target at 30.63. The decreasing volume during the recent consolidation might indicate that the selling pressure is waning, potentially setting up for a bullish reversal.

Bearish Case:

A failure to hold the 23.84 support level could lead to a decline, continuing the correction phase.

Stock Watchlist for the Upcoming Week

CRM - Salesforce, Inc. (Freebie)

Bullish Case:

A break above 265.81 could push the stock towards the next resistance at 290.02. The significant increase in price suggests a continuation of the bullish trend in the short term.

Bearish Case:

A failure to hold the 245.17 support level could lead to a decline towards the stronger support level at 227.77.

Options Opportunity

Call Option: Consider buying a call option with a strike price around 265, expiring in the next 1-2 months, to capitalize on a potential move towards the resistance level.

Put Option: Alternatively, a put option with a strike price around 245, expiring in 1-2 months, could be considered if the stock fails to hold the current support and declines.