Weekly Report for Oct 27, 2024

What is included in this week's edition?

WEEKLY REVIEW: An overview of current market standing, fundamental matters with implications upon the market, and general sentiment regarding the major US indices.

LOOKING AHEAD: Key takeaways to consider as we look forward to the upcoming trading week.

MARKETS: A technical review of the major indices and commodities that represent the overall health of the market.

Market Trader by MyntBit

Stocks trended mostly lower this week amid limited economic data, a busy earnings season, and elevated uncertainty surrounding the upcoming elections. Notable reports included S&P Global’s PMIs for manufacturing and services, which showed a persistent gap between the sectors but signs of moderating inflation and improved output optimism for the coming year. Housing data highlighted challenges in the resale market, contrasted by an increase in new home sales. The Federal Reserve’s Beige Book reported flat economic activity, easing inflation, and slight employment growth.

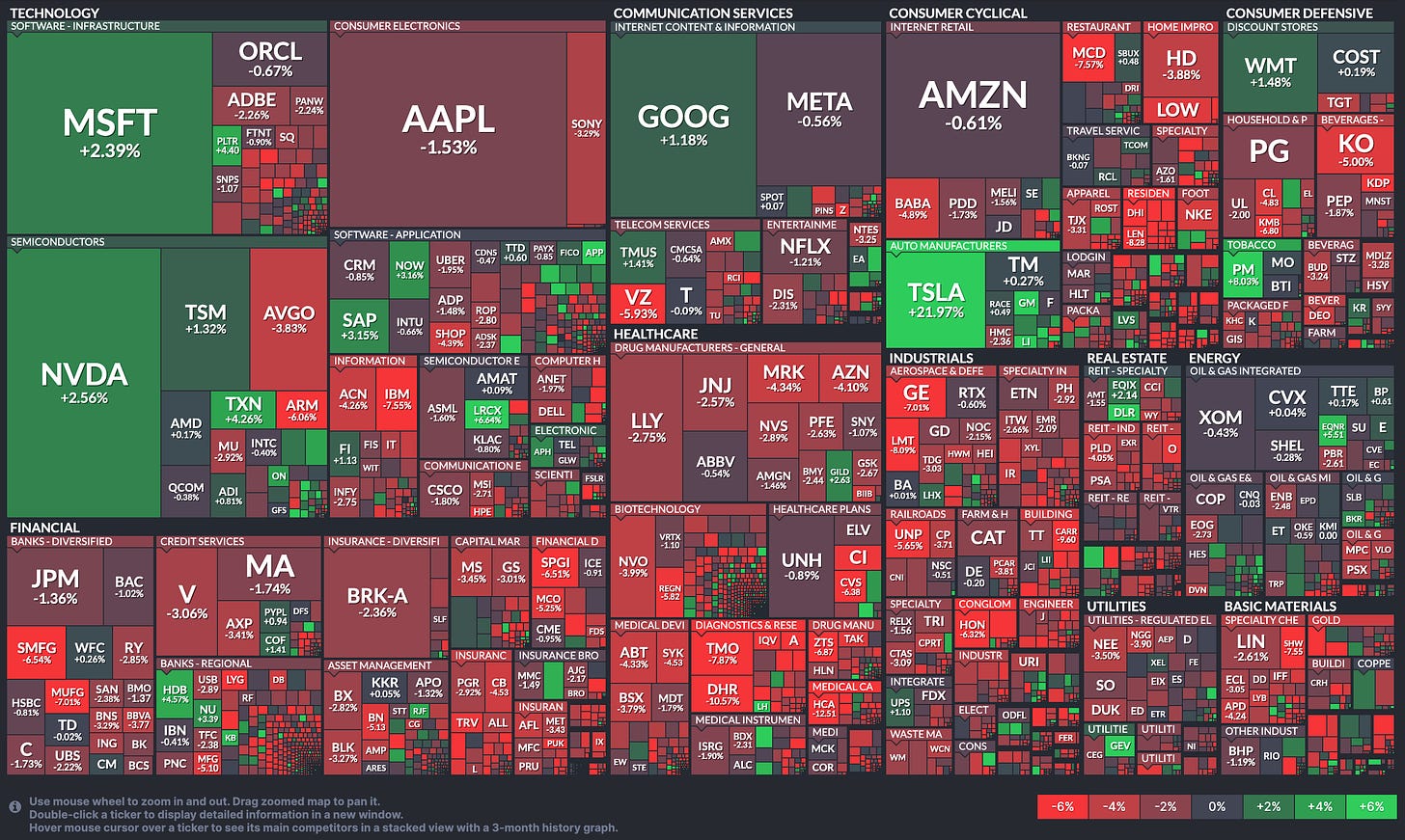

Overall Stock Market Heatmap

Sector Performance

Looking Ahead to the Upcoming Week

Looking ahead, investors will be focused on next week’s releases, including S&P Global’s PMIs for manufacturing and services, leading indicators, new and existing home sales, and the Federal Reserve’s Beige Book.

Economic Events

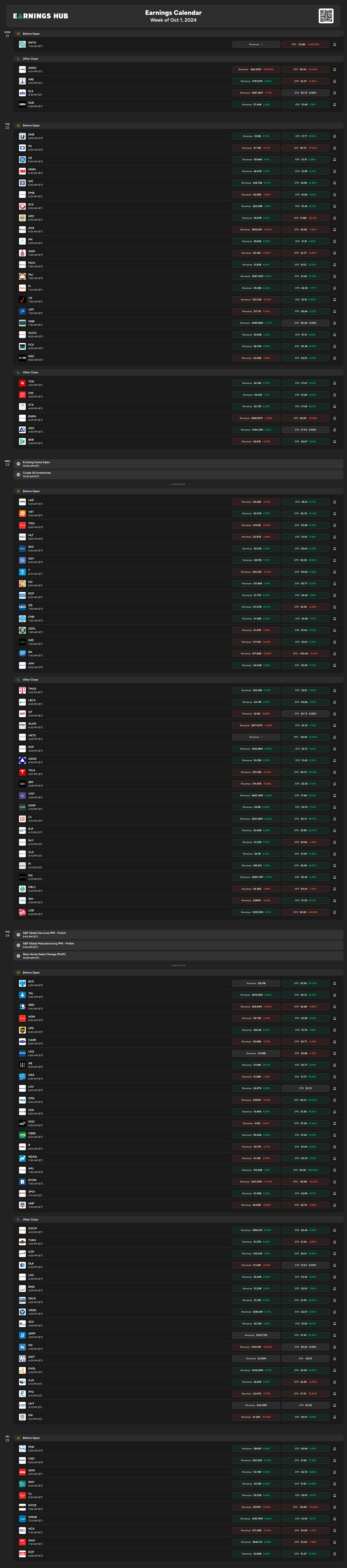

Earnings Event

Markets

Below are the levels for the upcoming week. Updates will be provided on X (@myntbit) throughout the week.

SPY - SPDR S&P 500 ETF Trust

SPY's recent price behavior reflects a cautious market, where investors may be waiting on broader economic indicators, earnings reports, or Fed announcements to provide direction. This indecision is typical as traders weigh macroeconomic risks like inflation, interest rate expectations, and potential impacts on corporate earnings.

Short Term (1 week): SPY is likely to remain in a consolidation phase between $570 and $580 unless a breakout above resistance occurs. Traders should watch for any spike in volume that could indicate a directional move.

Medium Term (1-3 months): A sustained breakout above $580 would support a continued uptrend, with potential upside toward $590 or higher. Conversely, a breakdown below $570 could lead to a pullback, with support around $560 as a possible target.

Long Term (6+ months): The longer-term outlook remains bullish as long as SPY respects its major moving averages and the broader trend stays intact. However, given macroeconomic uncertainties, investors should be mindful of potential volatility spikes due to economic data or geopolitical events.

QQQ - Invesco QQQ Trust Series 1

Short Term (1 week): The immediate focus will be on whether QQQ can break above the $503.52 resistance. A successful breakout would likely lead to further upside toward $510, while failure to break could lead to consolidation or a slight pullback.

Medium Term (1-3 months): A breakout above $503.52 would support continued upside, with the next target in the $515 range. If resistance holds, expect QQQ to consolidate within the $480-$503 range, with the EMA clouds providing intermediate support.

Long Term (6+ months): The long-term trend remains positive as long as QQQ stays above its key EMA support levels. A successful breakout in the near term could lead to new highs in the technology sector, but any macroeconomic headwinds could introduce volatility, especially at these high levels.

IWM - iShares Russell 2000 ETF

Short Term (1 week): IWM is likely to test the lower trendline support around $216-$218. A bounce from this level could lead to a retest of the $224 resistance, while a breakdown would signal short-term bearish momentum.

Medium Term (1-3 months): The outcome of the triangle pattern will set the medium-term trend. A breakout above $224 could lead to a rally toward $230-$235, while a breakdown could take the ETF toward $210 or lower, depending on market sentiment.

Long Term (6+ months): Given that small-cap stocks are often sensitive to broader economic trends, any breakout or breakdown could be influenced by macroeconomic conditions, such as interest rate changes or GDP growth. A sustained uptrend would require a breakout above $224 and continued economic stability, while a downtrend would likely lead to a broader reevaluation of the small-cap sector.

MyntBit’s Top 40 Stocks

Disclaimer: This newsletter is not trading or investment advice, but for general informational purposes only. This newsletter represents our personal opinions that we share publicly for educational purposes. Futures, stocks, and bonds trading of any kind involves a lot of risks. No guarantee of any profit whatsoever is made. In fact, you may lose everything you have. So be very careful. We guarantee no profit whatsoever, You assume the entire cost and risk of any trading or investing activities you choose to undertake. You are solely responsible for making your own investment decisions. Owners/authors of this newsletter, its representatives, its principals, its moderators, and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission, CFTC, or with any other securities/regulatory authority. Consult with a registered investment advisor, broker-dealer, and/or financial advisor. By reading and using this newsletter or any of my publications, you are agreeing to these terms. Any screenshots used here are courtesy of ForexFactory, EarningsHub, Finviz, ThinkorSwim, and/or Tradingview. We are just end-users with no affiliations with them.