Weekly Report for Oct 06, 2024

What is included in this week's edition?

WEEKLY REVIEW: An overview of current market standing, fundamental matters with implications upon the market, and general sentiment regarding the major US indices.

LOOKING AHEAD: Key takeaways to consider as we look forward to the upcoming trading week.

MARKETS: A technical review of the major indices and commodities that represent the overall health of the market.

Market Trader by MyntBit

Stocks experienced some volatility during the week due to geopolitical tensions in the Middle East, but the impact on the market was tempered by Friday’s stronger-than-expected jobs report, which eased concerns about a potential slowdown in the labor market. Nonfarm payrolls exceeded expectations, and the previous two months' figures were revised upward. Meanwhile, the Purchasing Managers' Indexes (PMIs) showed a growing divide between sectors, with manufacturing remaining flat while services continued to strengthen. Additionally, remarks from Federal Reserve officials emphasized the need for patience before considering further rate cuts.

Overall Stock Market Heatmap

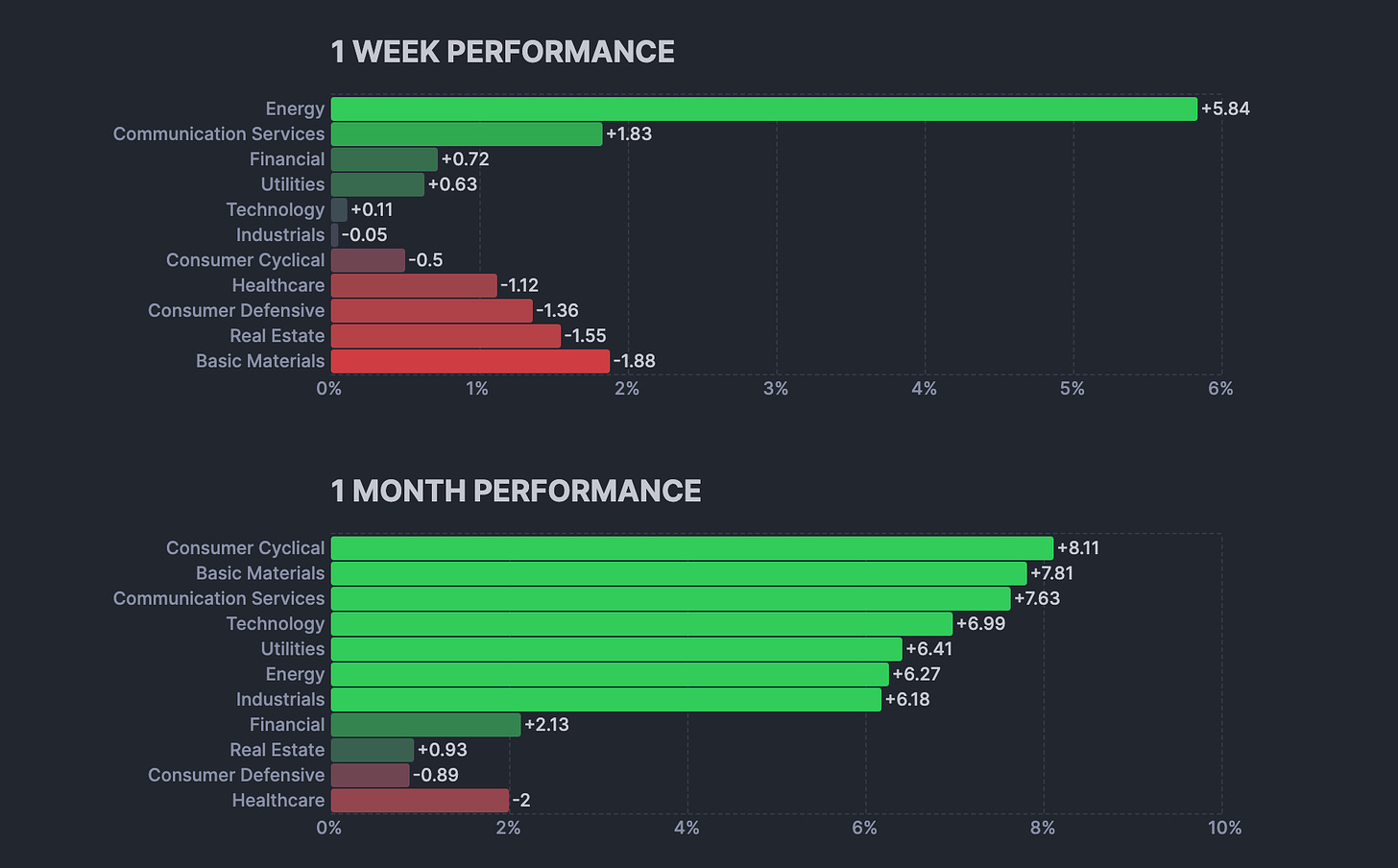

Sector Performance

Looking Ahead to the Upcoming Week

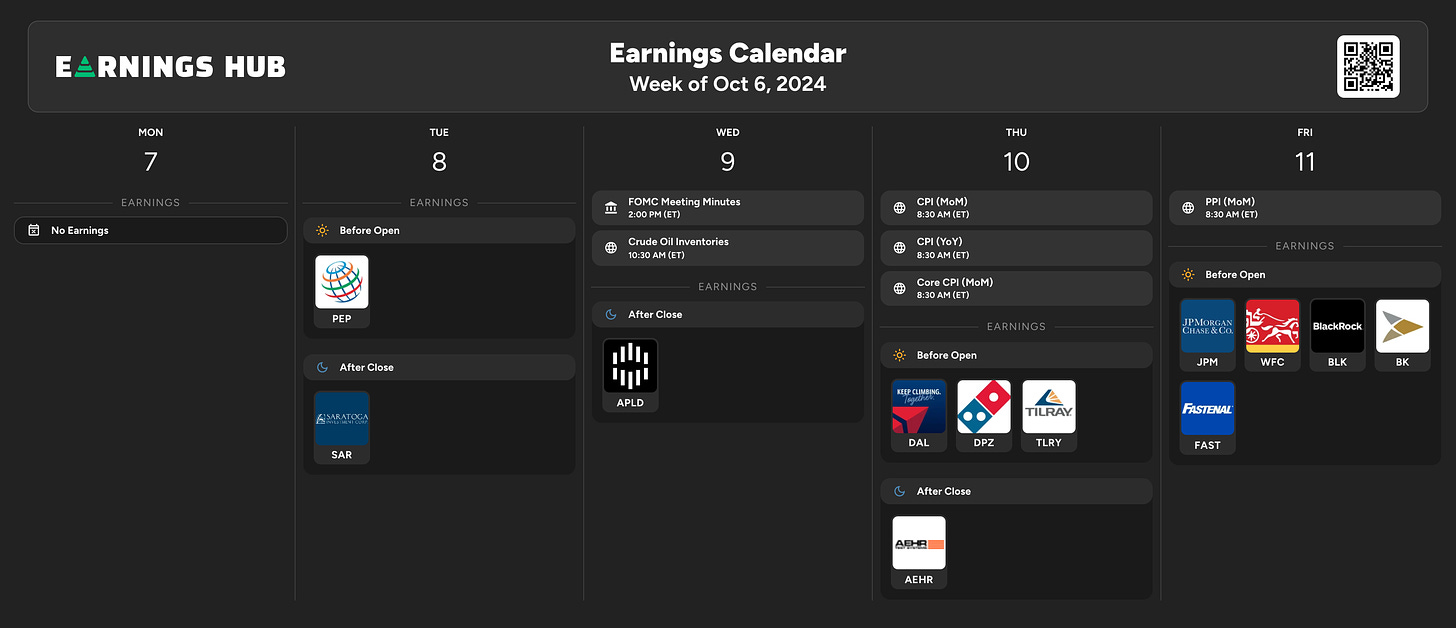

Looking ahead, investors will focus on September's Consumer Price Index (CPI) and Producer Price Index (PPI) inflation data. Other important updates include consumer sentiment, small-business optimism, and the Federal Open Market Committee (FOMC) meeting minutes.

The earnings calendar for the week of October 6, 2024, highlights key reports:

Tuesday: PepsiCo (PEP) reports before market open, and Saratoga Investment Corp (SAR) reports after close.

Wednesday: No major earnings, but the FOMC Meeting Minutes and Crude Oil Inventories will be released.

Thursday: Delta Air Lines (DAL), Domino's (DPZ), and Tilray (TLRY) report before market open, while AEHR Test Systems (AEHR) reports after close. CPI data (MoM, YoY, Core CPI) will be released in the morning.

Friday: Major financial institutions JPMorgan (JPM), Wells Fargo (WFC), BlackRock (BLK), and Bank of New York Mellon (BK), along with Fastenal (FAST), report before market open. PPI data will be released.

This week features a mix of corporate earnings and important economic data releases.

Economic Events

Earnings Event

Markets

Below are the levels for the upcoming week. Updates will be provided on X (previously Twitter) throughout the week.

SPY - SPDR S&P 500 ETF Trust

Short-term (1 week): Bullish. The ETF is approaching a key resistance level at $580.00, and a breakout would confirm further upside. A pullback to $565.00–$560.00 could offer buying opportunities if the uptrend remains intact.

Medium-term (1 month): Bullish. If the ETF breaks above $580.00, it could continue higher, targeting $590.00–$600.00 in the coming weeks. The moving averages provide solid support on pullbacks, keeping the medium-term trend positive.

Long-term (3 months): Cautiously Bullish. As long as the price stays above key support levels, the long-term trend remains upward. However, a failure to break above $580.00 could lead to consolidation or a correction.

QQQ - Invesco QQQ Trust Series 1

Short-term (1 week): Bullish. The ETF is testing a key resistance level at $490.00. A breakout would signal further upside, targeting $500.00. A pullback to $470.00 could offer a buying opportunity if the trend remains intact.

Medium-term (1 month): Bullish. As long as the ETF remains above $470.00, the uptrend is likely to continue, with potential targets toward $500.00 and beyond.

Long-term (3 months): Cautiously Bullish. The ETF is in a strong uptrend, but a failure to break above $490.00 could lead to consolidation or a deeper pullback. However, the long-term outlook remains positive as long as the ETF stays above its major support levels.

IWM - iShares Russell 2000 ETF

Short-term (1 week): Neutral to Bullish. The ETF is testing a key resistance level at $220.00, and a breakout could target $225.00. A pullback to $215.00 could offer a buying opportunity if the uptrend holds.

Medium-term (1 month): Bullish. If the ETF breaks above $225.00, it could continue toward the previous high of $230.00. As long as support levels around $215.00 hold, the uptrend should continue.

Long-term (3 months): Cautiously Bullish. The ETF remains in an uptrend, but the weekly overbought conditions suggest potential for consolidation or a pullback before further gains. Long-term support remains strong near the 200-day moving average.

MyntBit’s Top 40 Stocks

Disclaimer: This newsletter is not trading or investment advice, but for general informational purposes only. This newsletter represents our personal opinions that we share publicly for educational purposes. Futures, stocks, and bonds trading of any kind involves a lot of risks. No guarantee of any profit whatsoever is made. In fact, you may lose everything you have. So be very careful. We guarantee no profit whatsoever, You assume the entire cost and risk of any trading or investing activities you choose to undertake. You are solely responsible for making your own investment decisions. Owners/authors of this newsletter, its representatives, its principals, its moderators, and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission, CFTC, or with any other securities/regulatory authority. Consult with a registered investment advisor, broker-dealer, and/or financial advisor. By reading and using this newsletter or any of my publications, you are agreeing to these terms. Any screenshots used here are courtesy of ForexFactory, EarningsHub, Finviz, ThinkorSwim, and/or Tradingview. We are just end-users with no affiliations with them.