Is the Bear Market over? OPEX Week Coming Up | Weekly Market Update

MyntBit Weekly Report is dedicated to helping traders prepare for the upcoming week.

Recap

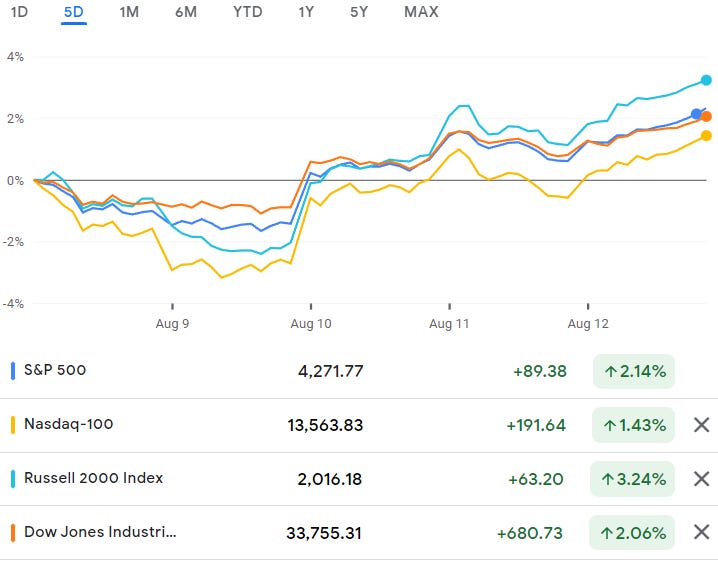

Market Snapshot

Weekly Review

As a result of the Consumer Price Index (CPI), Producer Price Index (PPI), and Import-Export Price Index reports for July, the stock market saw signs of disinflation. They all went the market's way, which is to say they supported the peak inflation narrative.

The gains in all sectors were broad-based and substantive. The S&P 500 scored its fourth straight weekly advance and crossed an important level (4,231) that some will interpret as a signal that the low in June was the low for the bear market.

Notably, the gains for the week were virtually completely achieved across two trading sessions (Wednesday and Friday). The major indices were all showing losses for the week prior to Wednesday, the day the CPI report was announced. The market's slow start of the week was attributed to concerns that it was due for a correction following the strong run off the mid-June lows, some caustic revenue warnings from NVIDIA (NVDA) and Micron (MU), and some nervousness in front of the CPI report.

While the core CPI, which excludes food and energy, increased by a smaller-than-anticipated 0.3%, the overall CPI remained steady month over month. Importantly, the annual pace of core CPI remained constant at 5.9%, defying expectations that it would increase. The annual pace of overall CPI dropped to 8.5% from 9.1%.

Investors relished the idea that inflation may have peaked, that the Fed may be able to moderate the rate hike pace, and that the U.S. economy, which learned last week that 528,000 jobs had been added to nonfarm payrolls in July, may be able to experience a soft landing. This realization led to a significant increase in the major indices.

The Fed's readiness to stop raising interest rates and its intention to switch to a rate-cutting cycle in 2023 were both downplayed by various Fed officials, but stock market participants appeared to ignore the cautions.

Despite these cautions, the general consensus in the stock market was that inflation rates would continue to moderate in the coming months and that Fed officials will ultimately be convinced to soften their hawkish-minded tone as a result.

The fact that the PPI and import-export pricing data moved in the same direction as the CPI data only improved the stock's market mood.

The PPI report on Thursday did, in fact, prevent equities from holding a rally effort, but by Friday morning, that move had been dismissed. On Friday, buyers were back in the game while selling was largely dormant.

The major indices all finished on a high note in a grueling rally attempt on Friday that wasn't matched with a heavy volume. The S&P 500 ended Friday's trading session at 4,280 after briefly approaching 3,600 in mid-June. Some people will view the closing of over 4,231 as a significant technical and psychological level. That price represented a 50% retracement of the losses sustained between the closing level on January 3 (4,796.56) and the closing level on June 16. (3,666.77).

"Since 1950 there has never been a bear market rally that exceeded the 50% retracement and then went on to establish new cycle lows," BTIG technical analyst Jonathan Krinsky told CNBC last week. That doesn't imply that things will get better from here or that the market won't see another significant selloff, but for others, it serves as a sign of discernible downside risk and a reassuring historical pattern.

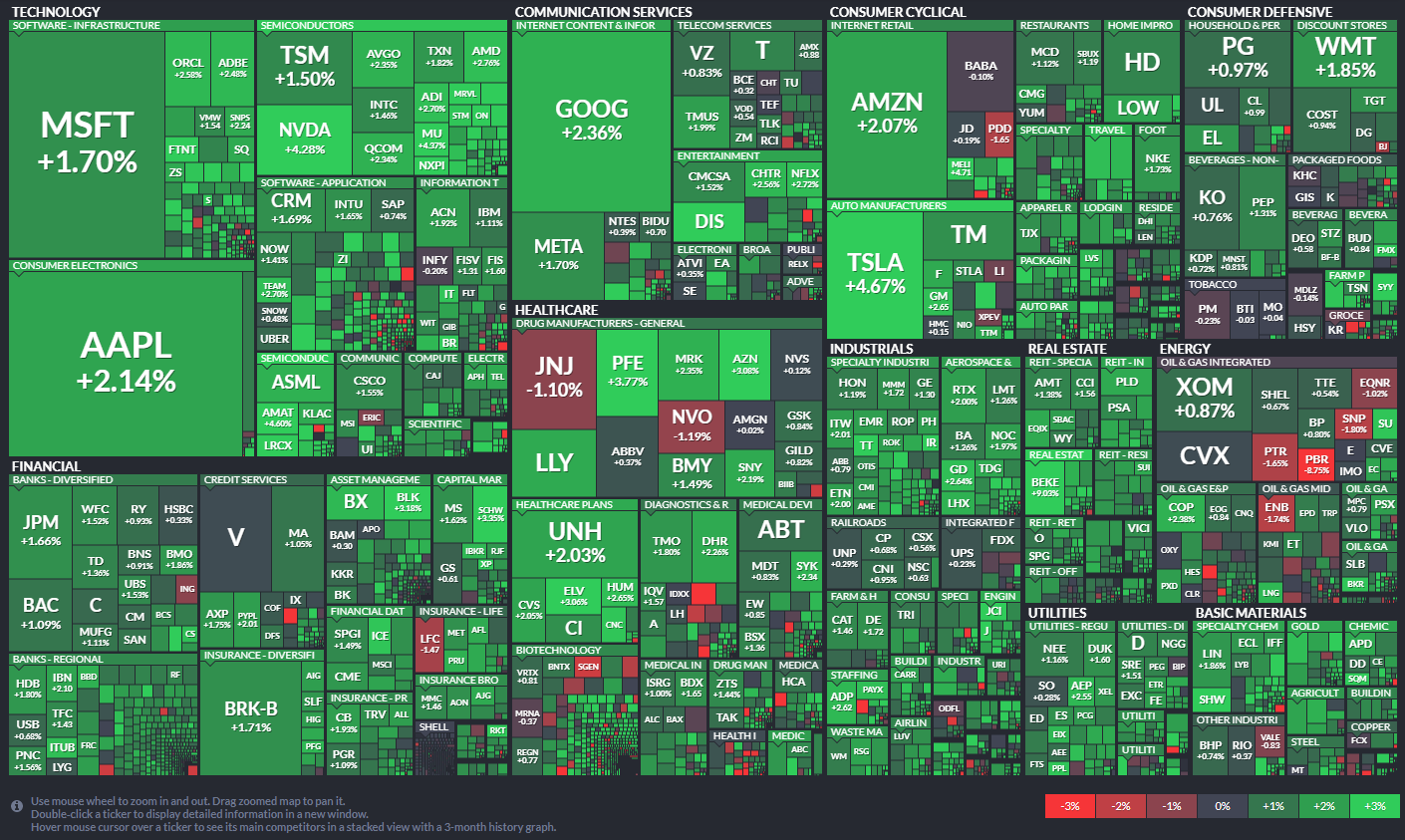

For the week, all 11 S&P 500 sectors closed higher. From 1.2% (consumer staples) to 7.1%, gains were recorded (energy). Cyclical industries had some of the largest increases, while value equities outperformed growth stocks in a move that indicated lowered concerns of a rough landing for the economy. Compared to a 3.0% rise for the Russell 3000 Growth Index, the Russell 3000 Value Index climbed by 3.9%.

Additionally, there was a resurgence of speculative activity this week, which resulted in significant percentage gains for several of the so-called meme stocks as well as the SPAC and profitless tale stocks that were popular last year. Their actions were blatant manifestations of a risk-taking mentality motivated by the expectation that the Fed won't have to raise rates as high as it initially anticipates.

The stock market appeared to be more certain of that point than the Treasury market. The yield on the 2-year note, which is sensitive to changes in the fed funds rate, was almost constant when the CPI report was announced on Wednesday and closed the week up two basis points at 3.25%. The 10-year note yield increased by one basis point to end the week at 2.84%, or around five basis points more than it was before the publication of the CPI report.

Yes, inflation has slowed down, which is a positive development, but the rate is still too high. While PPI is up 9.8% year over year and CPI is up 8.5% year over year, the Fed's inflation target is 2.0%. There is still a great deal of room for inflation improvement, and there must be significant progress in order to persuade the Federal Reserve that inflation is once again in check.

There is no doubt that the stock market won the mental battle this week by seeing what it wanted to see, which was a lower inflation rate in July than it saw in June.

Market Heatmap

Looking Ahead

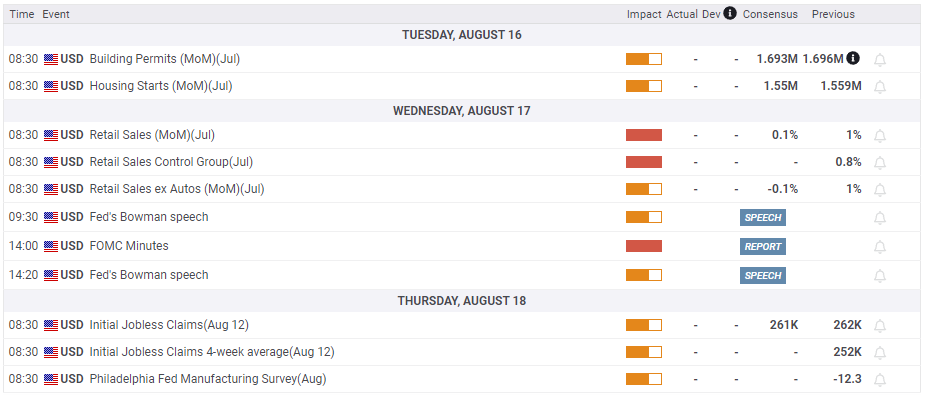

Wall Street will evaluate significant company earnings reports from some of America's biggest retailers the following week. This group's profit totals will be thoroughly examined since they may provide insight into a number of interrelated macroeconomic trends, such as inflation, excess inventories, economic normalization, the labor market, and topics related to consumer bifurcation.

On Tuesday and Wednesday, respectively, major retailers Walmart Inc. and Target Corp. report prior to the opening bell. Results from TJX Cos Inc., Ross Stores Inc., and Bath & Body Works Inc. will also be released during the week. Home improvement businesses Home Depot Inc. and Lowe's Cos Inc. may also draw attention. Additionally, corporate confessions from Cisco Systems Inc., Applied Materials Inc., and Deere & Co. are planned. On the data front, a report on consumer spending headlines the slate.

On Wednesday, it is anticipated that U.S. retail sales gained 0.2% in July, following an unexpected 1% increase the previous month. Investors will also receive home market updates. After falling to its lowest point since May 2020 last month, a measure of homebuilder sentiment is expected to continue to decline in August. Existing home sales, housing starts, and building permits are all anticipated to have continued declining in July. Readings on the leading index of economic indicators, industrial production, initial unemployment claims, and regional Fed measures of business activity will also be provided.

The Federal Open Market Committee (FOMC) will publish the minutes of its July 27 meeting on Wednesday afternoon. The U.S. Treasury Department intends to issue 20-year bonds and 30-year TIPS in the auction space (Treasury Inflation-Protected Securities).

Earnings Calendar

Economic Calendar

Important Update

As you are aware, the Market Trader newsletter by Myntbit was available for free for a limited time only. We hope you have been enjoying it. We wanted to inform you that to be able to maintain the same premium quality, we will need to make adjustments. Starting next week, any new members will be subject to the price for our primary service will be $24.99 and existing members will an additional month to try it out plus a 50 percent off for life when they signup for an annual subscription.

What does the Market Trader Subscription include:

Daily and weekly market recap

Broad market and Commodity Analysis

Technical analysis of weekly watch list

Earnings and Economic Calendar

Options Flow

Premium Discord Access with Real-Time Trading Signals

This week's Market Trader by MyntBit

Market Trader by MyntBit Edition 1

Market Trader by MyntBit Edition 1.pdf

more info...

Market Trader Subscription

Robust weekly technical analysis is delivered straight to your inbox, every week.

Disclaimer: This newsletter is not trading or investment advice, but for general informational purposes only. This newsletter represents our personal opinions which we are sharing publicly for educational purposes. Futures, stocks, bonds trading of any kind involves a lot of risk. No guarantee of any profit whatsoever is made. In fact, you may lose everything you have. So be very careful. We guarantee no profit whatsoever, You assume the entire cost and risk of any trading or investing activities you choose to undertake. You are solely responsible for making your own investment decisions. Owners/authors of this newsletter, its representatives, its principals, its moderators and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission, CFTC or with any other securities/regulatory authority. Consult with a registered investment advisor, broker-dealer, and/or financial advisor. Reading and using this newsletter or any of my publications, you are agreeing to these terms. Any screenshots used here are the courtesy of Briefing.com, FXstreet, Google Finance, Unusual Whale, Refinitiv, and/or Tradingview. We are just an end-user with no affiliations with them.