Wall Street on Edge | CPI, FOMC, and Bank Earnings in Focus – Week of April 7

Dive into the market analysis for the upcoming week of April 07, 2025 and the week’s key economic data. Stay ahead with expert insights and forecasts.

Market Report

This week, U.S. equity markets experienced a sharp decline fueled by rising trade tensions and growing concerns about a potential recession. The sell-off was sparked by President Donald Trump's announcement of new “Liberation Day” tariffs on imports, leading to the worst single-day market drop since early 2020.

The tariffs range from 10% to as high as 54%, depending on retaliatory tariffs and other nonmonetary measures from trading partners. These developments have reignited fears of stagflation—a mix of sluggish economic growth and sustained inflation—as global trade faces major disruptions.

In response, China imposed retaliatory tariffs of 34% on all U.S. imports.

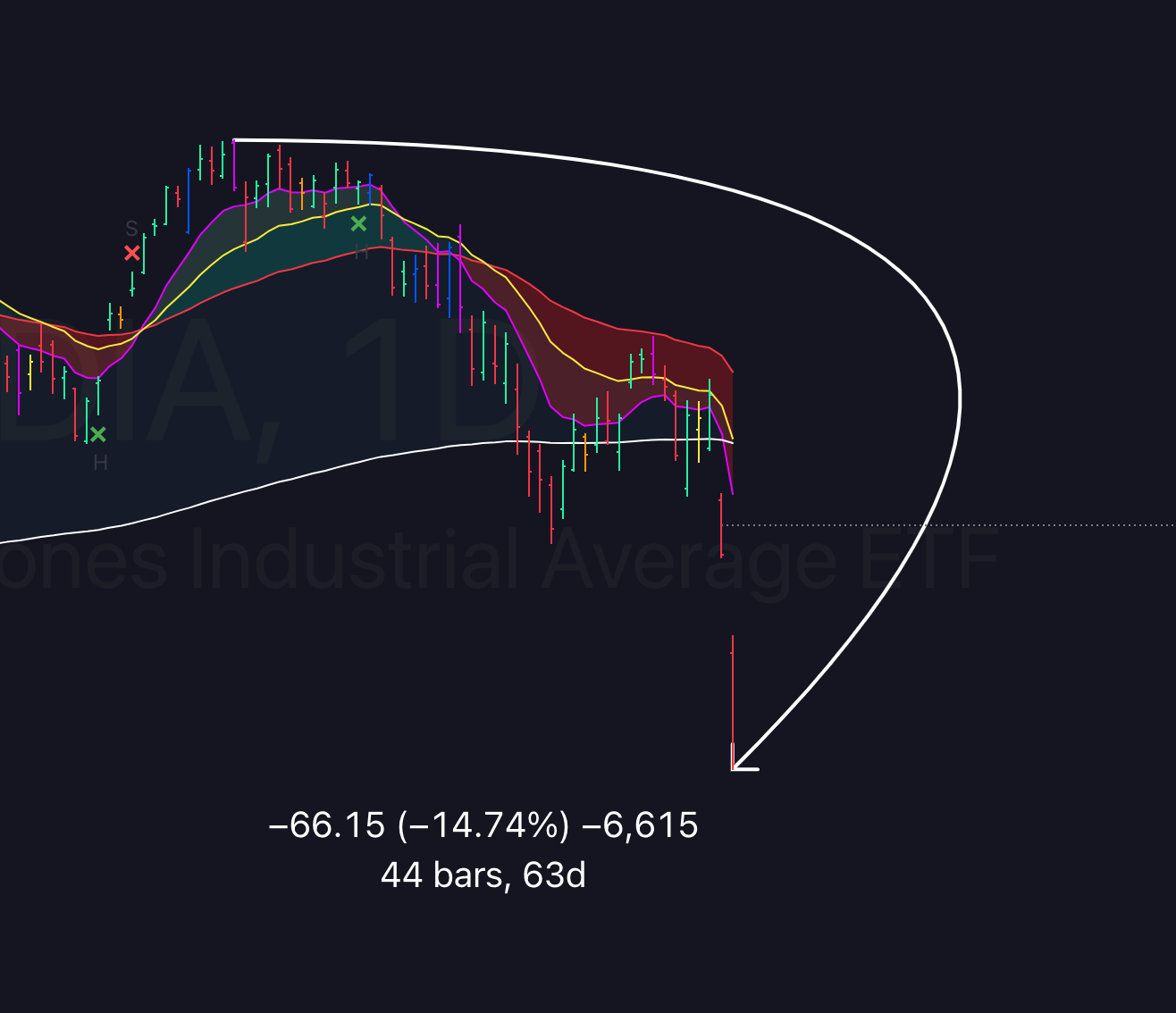

The Dow Jones Industrial Average plunged over 3,200 points this week (-7.9%), slipping into correction territory (a 10% decline from recent highs).

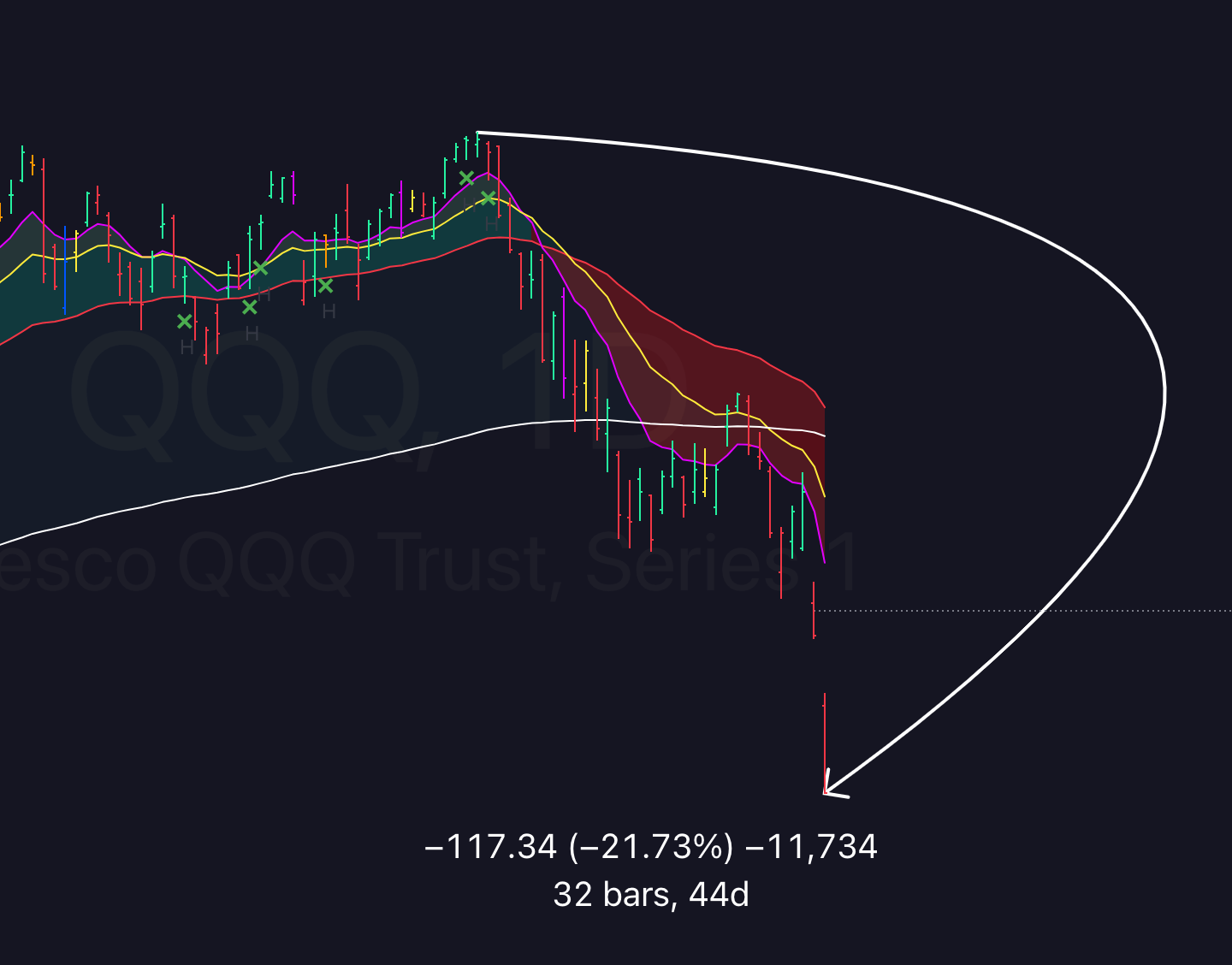

The Nasdaq Composite fell 10.0%, officially entering a bear market (a 20% decline from its peak),

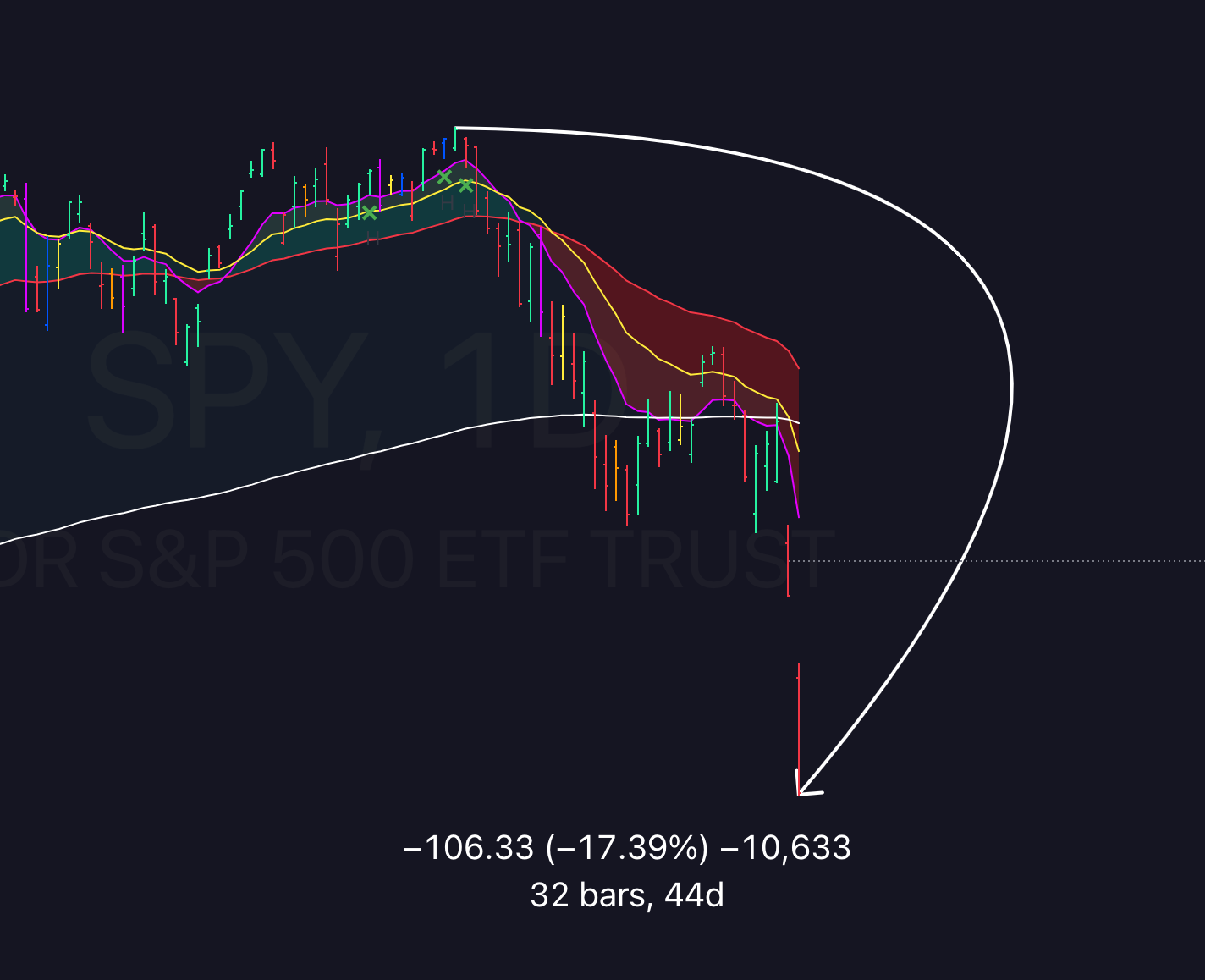

while the S&P 500 dropped 9.1% since last Friday.

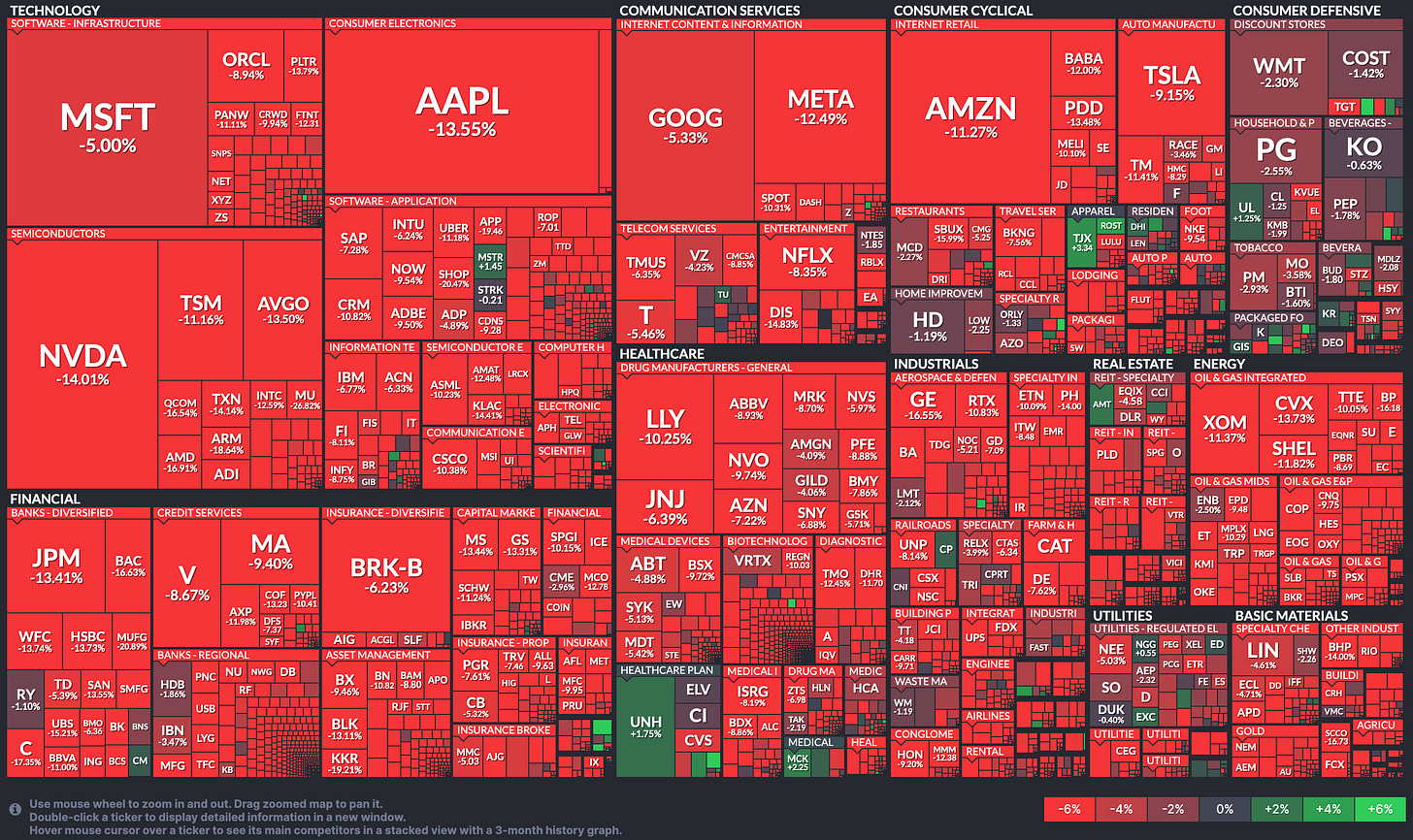

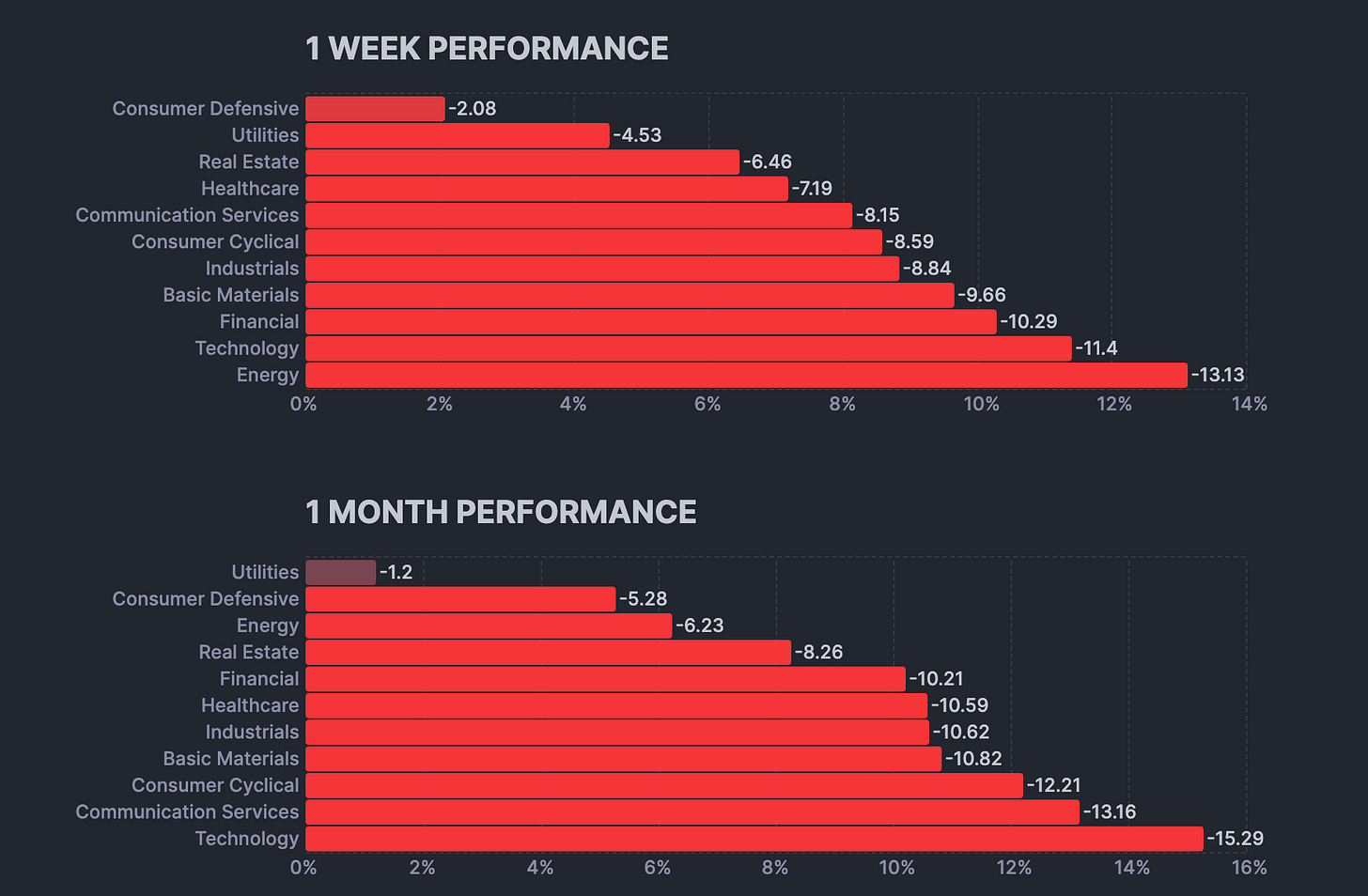

Technology stocks bore the brunt of the downturn, with major players like Apple (AAPL), NVIDIA (NVDA), and Meta Platforms (META) seeing double-digit losses.

The S&P 500's information technology sector was among the hardest hit, falling 11.4%. The energy (-15.0%) and financial (-11.4%) sectors were also among the biggest laggards.

Broader slowdown fears were evident in falling oil prices—now at $62.02 per barrel (-$7.32, -10.6%)—and declining market yields. The 10-year Treasury yield dropped 27 basis points to 3.99%, while the 2-year yield fell 24 basis points to 3.67%.

Meanwhile, the CBOE Volatility Index (VIX), often called the “fear gauge,” surged past 45.0, reflecting heightened investor anxiety and expectations of continued market turbulence.

Weekly Market Heatmap

Weekly Sector Performance

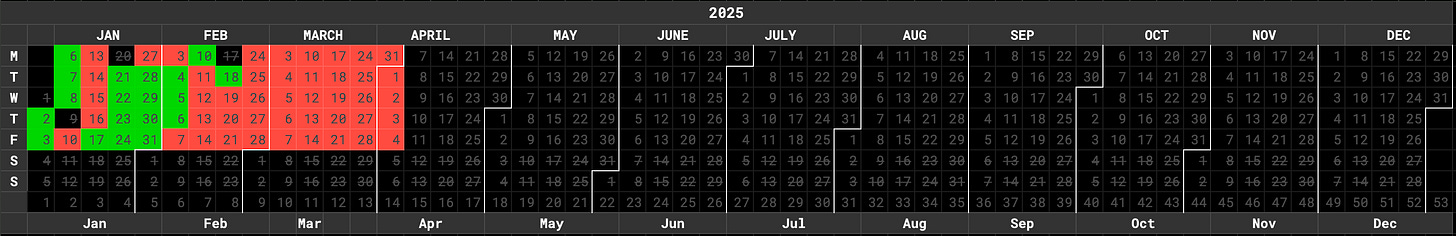

Market Health

Based on our Market Internals, the market continues to be in a Sell Mode.

Sell Mode is when a weak market repeatedly fails to break out due to insufficient buying strength based on several internals.

The internal market damage is more severe than the headline indexes suggest.

Momentum has flipped sharply bearish.

The broad-based weakness, breakdown in leadership, and extreme downside breadth mirror major risk-off events like Q1 2020 or early 2022.

Broader Market Analysis

All four major U.S. equity ETFs—SPY (S&P 500), QQQ (Nasdaq 100), IWM (Russell 2000), and MDY (S&P MidCap 400)—are experiencing sharp breakdowns with elevated volume, indicating broad-based distribution across market caps. Each ETF has decisively lost key moving averages, with SPY down -5.85%, QQQ -6.21%, IWM -4.46%, and MDY -4.87% on the day, all closing below prior support levels and deep within declining trend channels. The rapid spike in relative volume highlights panic selling and a potential shift in market sentiment. These charts suggest a coordinated risk-off environment with no immediate signs of stabilization, as even growth-heavy QQQ and small-cap IWM reflect deepening weakness, while mid-caps are now confirming the broader downtrend.

Looking Ahead to the Upcoming Week

The upcoming week is loaded with market-moving catalysts, both on the macro and micro fronts:

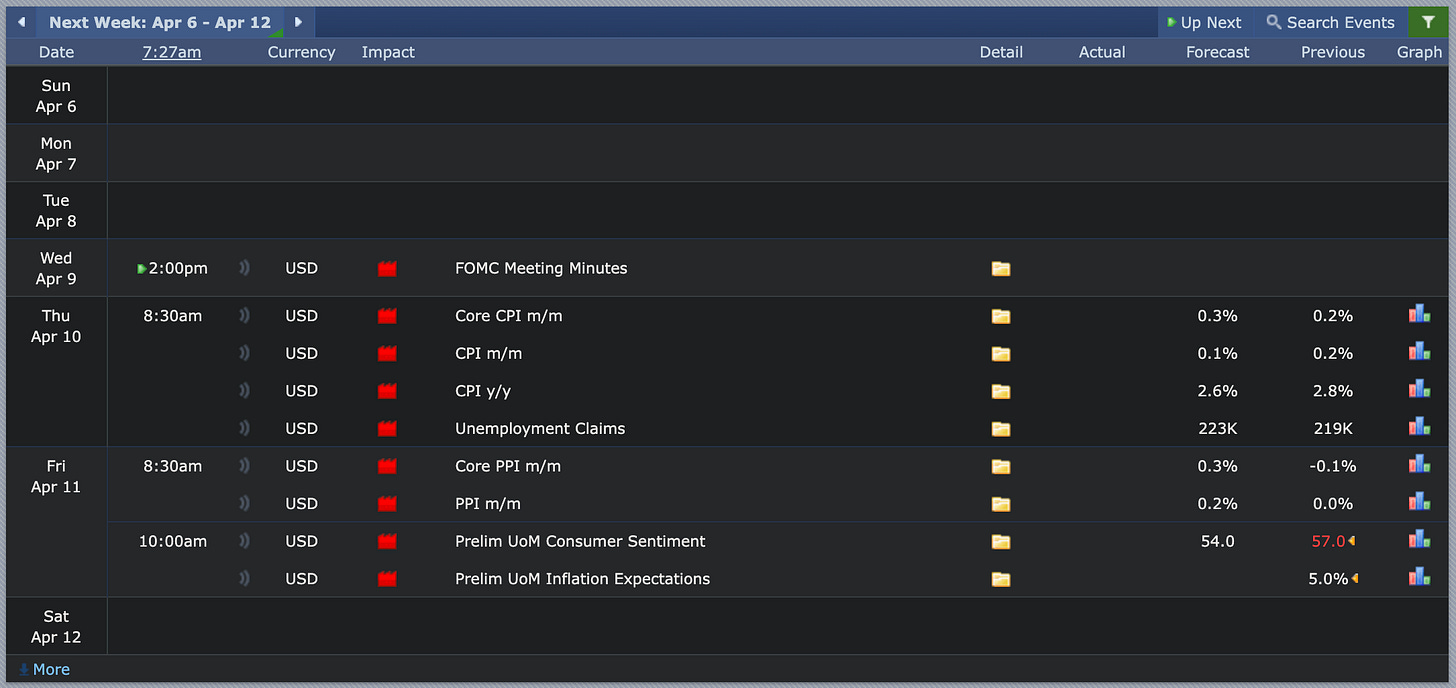

Key Economic Events to Watch:

Wednesday, April 9:

2:00pm ET – FOMC Meeting Minutes

Markets will look for hints on the Fed’s rate path, balance sheet policy, and inflation outlook.Thursday, April 10:

8:30am ET – CPI Inflation Data (Core m/m, CPI m/m, CPI y/y)

A hotter-than-expected print could reignite rate hike fears, while a cool read may bring relief.

Also: Weekly Unemployment ClaimsFriday, April 11:

8:30am ET – PPI Inflation Data (Core & headline)

10:00am ET – University of Michigan Consumer Sentiment & Inflation Expectations

📌 Inflation + jobs data in quick succession = volatility spike potential.

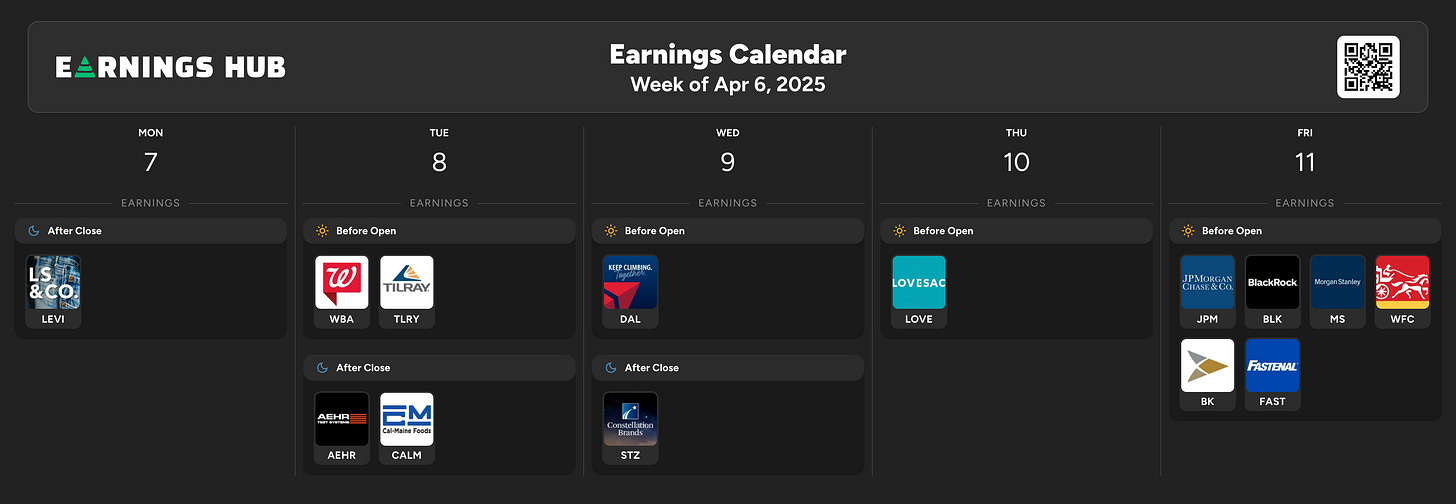

Earnings Highlights:

Monday: Levi Strauss (LEVI)

Tuesday: Walgreens (WBA), Tilray (TLRY) before open; AEHR & Cal-Maine (CALM) after close

Wednesday: Delta Air Lines (DAL) before open, Constellation Brands (STZ) after close

Thursday: Lovesac (LOVE)

Friday (Big Banks):

JPMorgan (JPM), BlackRock (BLK), Morgan Stanley (MS), Wells Fargo (WFC), BNY Mellon (BK), and Fastenal (FAST)

📌 Bank earnings on Friday will set the tone for Q1 reporting season. Watch for guidance on credit risk, deposit flows, and consumer health.

What to Do in this Market Environment (Bearish-Negative Outlook)?

Given:

Sharp technical breakdowns across SPY, QQQ, IWM, MDY

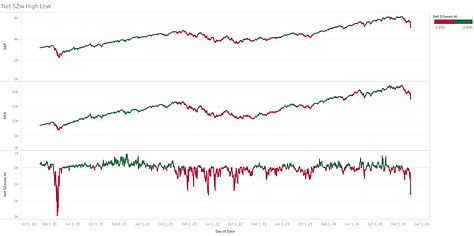

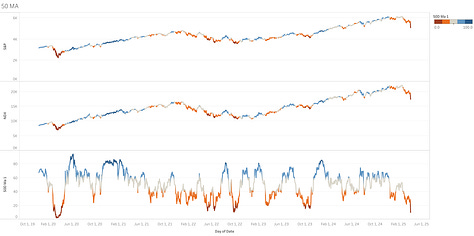

Plunging breadth & momentum (confirmed by 52w HL, 25%+ Q, and 50 MA indicators)

Upcoming high-stakes economic data

Surge in volume = institutional selling

Outlook: Bearish-Negative

Strategy Suggestions:

❌ Avoid initiating new long positions until clarity post-CPI/FOMC

✅ Raise cash or hedge with inverse ETFs (e.g., SQQQ, SPXU) or put options

📉 Watch for failed rallies as shorting opportunities

📊 If CPI surprises to the downside, be ready for a short-term bounce, but treat it as a chance to reposition rather than a trend reversal.

Follow us on Twitter/X

(Link Below) 👇

Disclaimer: This newsletter is not trading or investment advice, but for general informational purposes only. This newsletter represents our personal opinions that we share publicly for educational purposes. Futures, stocks, and bonds trading of any kind involves a lot of risks. No guarantee of any profit whatsoever is made. In fact, you may lose everything you have. So be very careful. We guarantee no profit whatsoever, You assume the entire cost and risk of any trading or investing activities you choose to undertake. You are solely responsible for making your own investment decisions. Owners/authors of this newsletter, its representatives, its principals, its moderators, and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission, CFTC, or with any other securities/regulatory authority. Consult with a registered investment advisor, broker-dealer, and/or financial advisor. By reading and using this newsletter or any of my publications, you are agreeing to these terms. Any screenshots used here are courtesy of ForexFactory, EarningsHub, Finviz, ThinkorSwim, and/or Tradingview. We are just end-users with no affiliations with them.