Weekly Market Report (January 20, 2025) - Insights and Forecasts

Dive into the market analysis for January 20, 2025, covering SPY, QQQ, IWM, and the week’s key economic data. Stay ahead with expert insights and forecasts.

Weekly Market Report for January 20, 2025

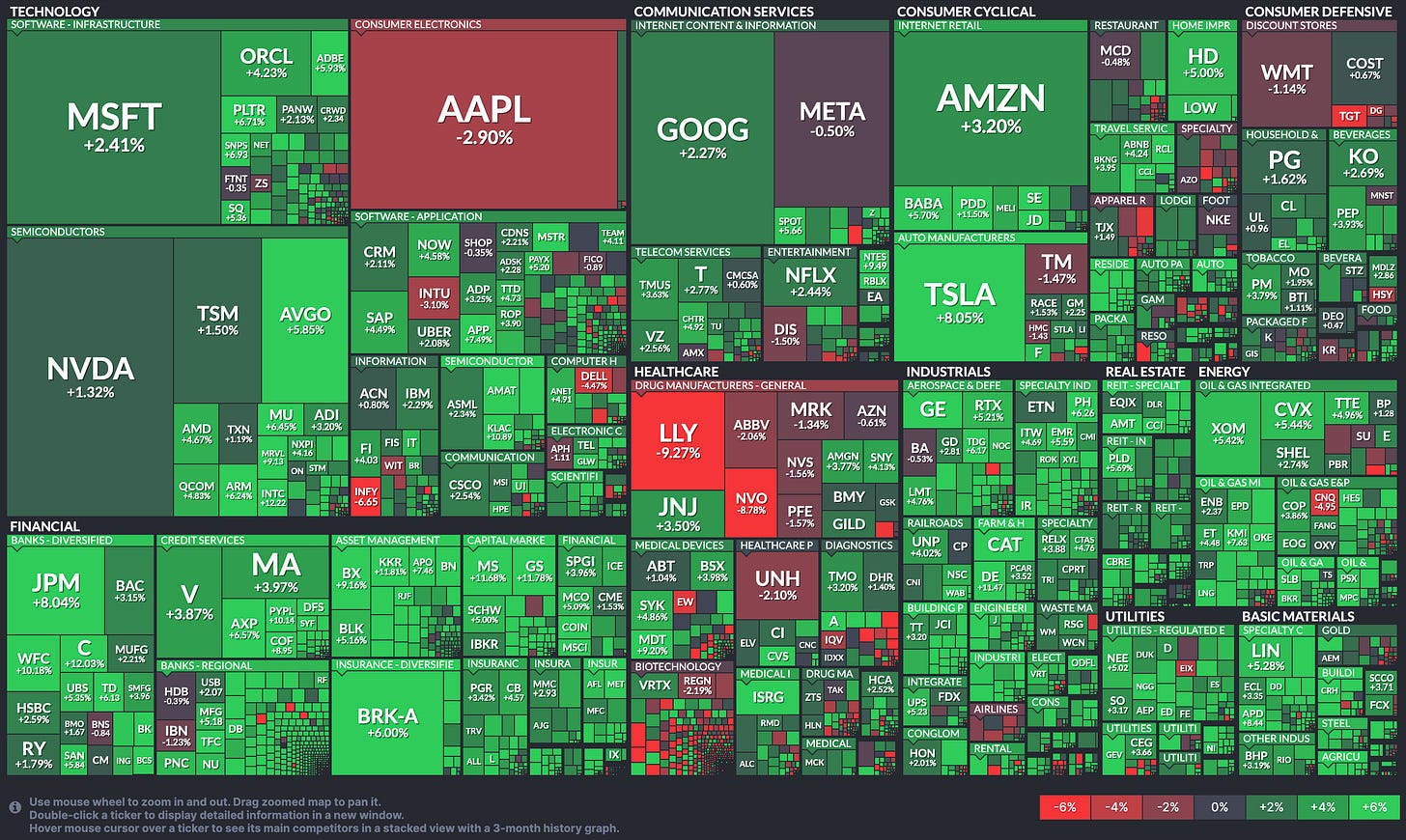

The stock market had a strong week, marking the best performance for the S&P 500 since the election, just ahead of Donald J. Trump's inauguration as the 47th President of the United States. However, the market’s rally was driven more by optimism around inflation trends and strong earnings reports from major financial institutions than by politics. That said, political developments played a role, including relief over a ceasefire agreement between Israel and Hamas and speculation about the incoming administration’s plans for deregulation and tax cuts.

Treasury Secretary nominee Scott Bessent reinforced the need for fiscal discipline during his confirmation hearing, while the Congressional Budget Office (CBO) projected a $1.9 trillion budget deficit for fiscal 2025. Despite this, markets focused on positive inflation data, as both CPI and PPI reports were better than expected, easing concerns about rising prices. Treasury yields fell sharply in response, with the 2-year yield dropping 13 basis points to 4.27% and the 10-year yield falling 17 basis points to 4.61%, fueling a stock rally.

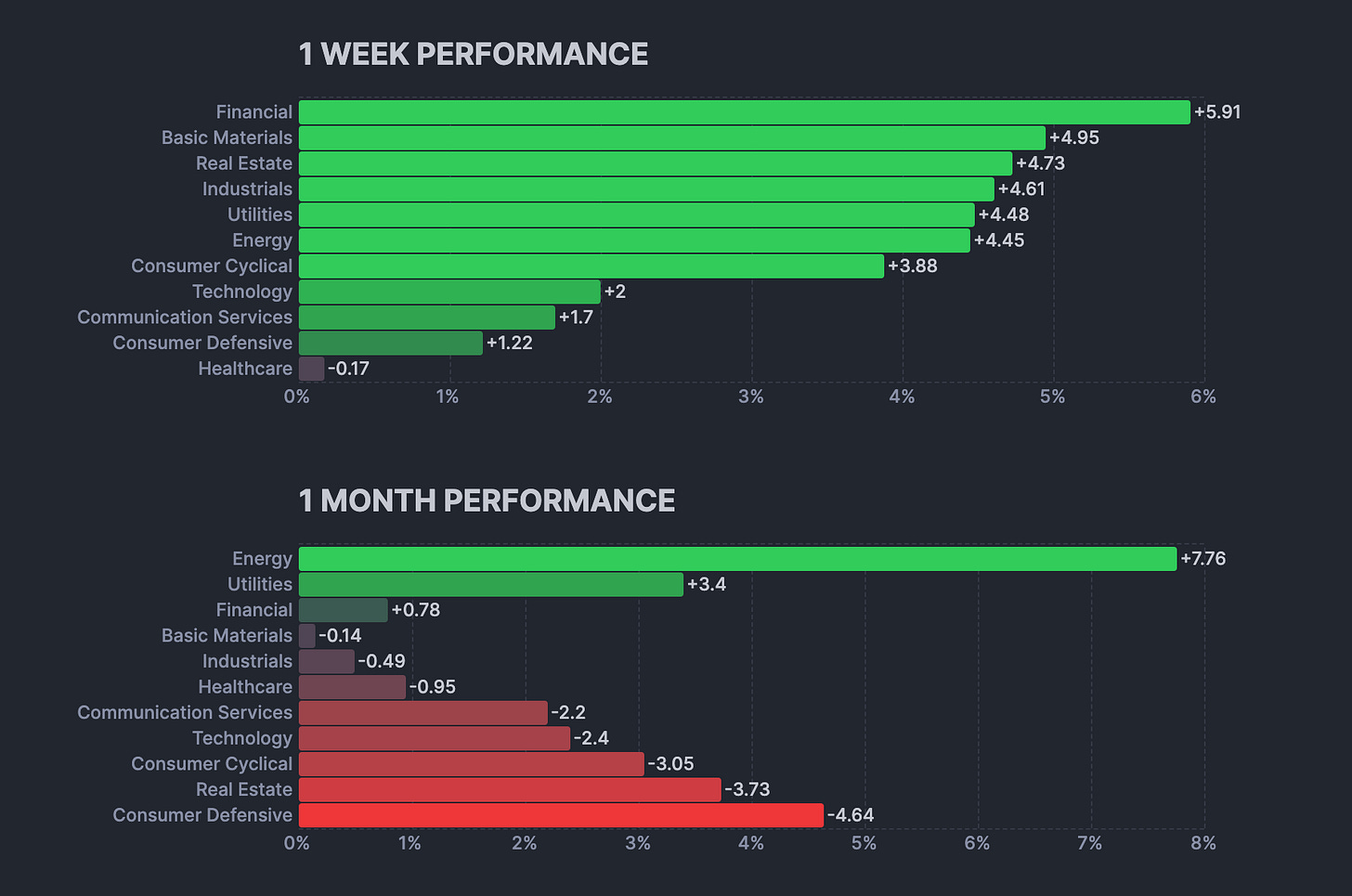

The Dow, Nasdaq, and S&P 500 recorded their biggest daily gains on Wednesday, boosted by stronger-than-expected earnings from JPMorgan Chase (JPM), Goldman Sachs (GS), BlackRock (BLK), Wells Fargo (WFC), and Citigroup (C). The financial sector surged 6.1%, matching gains in energy, while materials rose 6.0%, and industrials climbed 4.8%. The rally was cyclically driven, with value stocks outperforming growth stocks, small caps leading over large caps, and the equal-weighted S&P 500 (+3.9%) outpacing the market-cap-weighted S&P 500 (+2.9%), which reclaimed its 50-day moving average by Friday.

Weekly Market Heatmap

Weekly Sector Performance

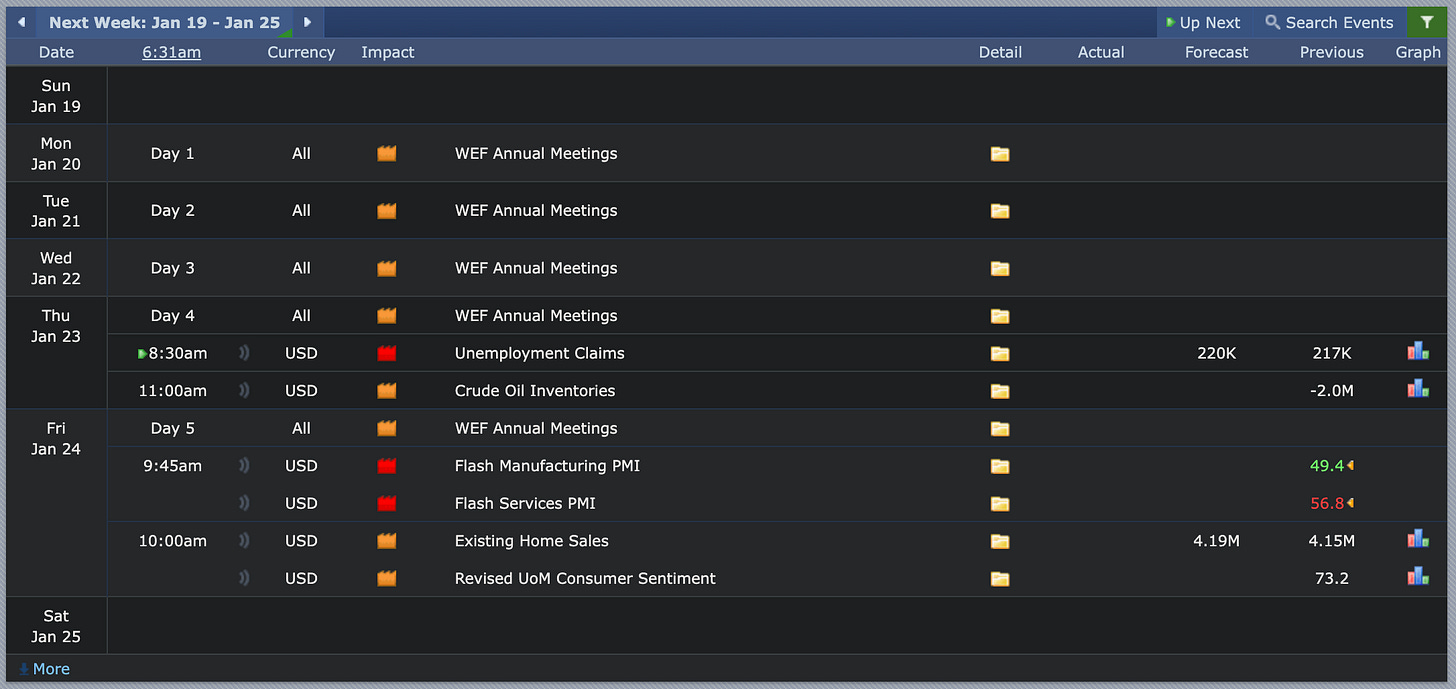

Looking Ahead to the Upcoming Week

Next week, market attention will be focused on S&P Global’s Flash Manufacturing and Services PMIs, providing an early look at economic activity in January. Other key reports include regional business surveys from the Philadelphia and Kansas City Federal Reserve districts, which may offer insight into business sentiment and economic conditions. Additionally, the Existing Home Sales report for December will gauge the health of the housing market, while the University of Michigan’s final January Consumer Sentiment and Inflation Expectations will shed light on consumer confidence and inflation outlooks. Investors will also monitor weekly unemployment claims and crude oil inventories, both of which can impact market sentiment. With the WEF Annual Meetings taking place throughout the week, potential policy discussions and economic outlooks could also influence market movements.

Economic Events

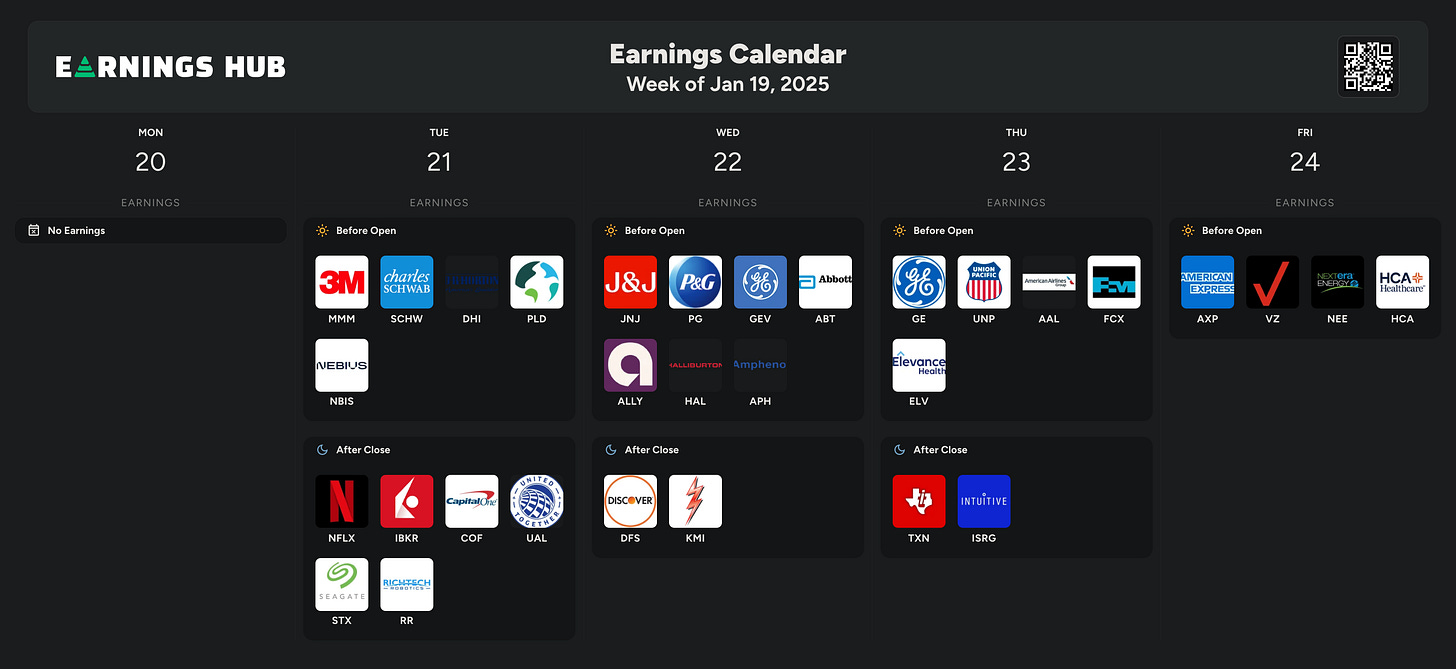

Earnings Event

Next week’s earnings calendar features key reports across multiple sectors, with major financials, tech, industrials, and healthcare companies set to release their results. Tuesday kicks off with earnings from 3M (MMM), Charles Schwab (SCHW), and D.R. Horton (DHI) before the open, followed by Netflix (NFLX), Capital One (COF), and Seagate (STX) after the close. Wednesday highlights reports from Johnson & Johnson (JNJ), Procter & Gamble (PG), GE Vernova (GEV), and Abbott (ABT) before the open, with Discover (DFS) and Kinder Morgan (KMI) reporting after the close.

Thursday brings earnings from General Electric (GE), Union Pacific (UNP), American Airlines (AAL), and Freeport-McMoRan (FCX) in the morning, while Texas Instruments (TXN) and Intuitive Surgical (ISRG) will report after market close. The week wraps up on Friday with reports from American Express (AXP), Verizon (VZ), NextEra Energy (NEE), and HCA Healthcare (HCA) before the open. Investors will closely watch these reports for insights into corporate performance and economic trends.

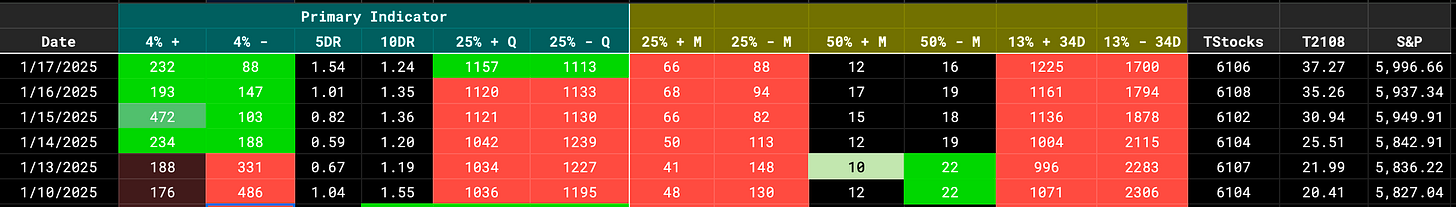

Market Health

The market has entered a bullish phase, with improving breadth.

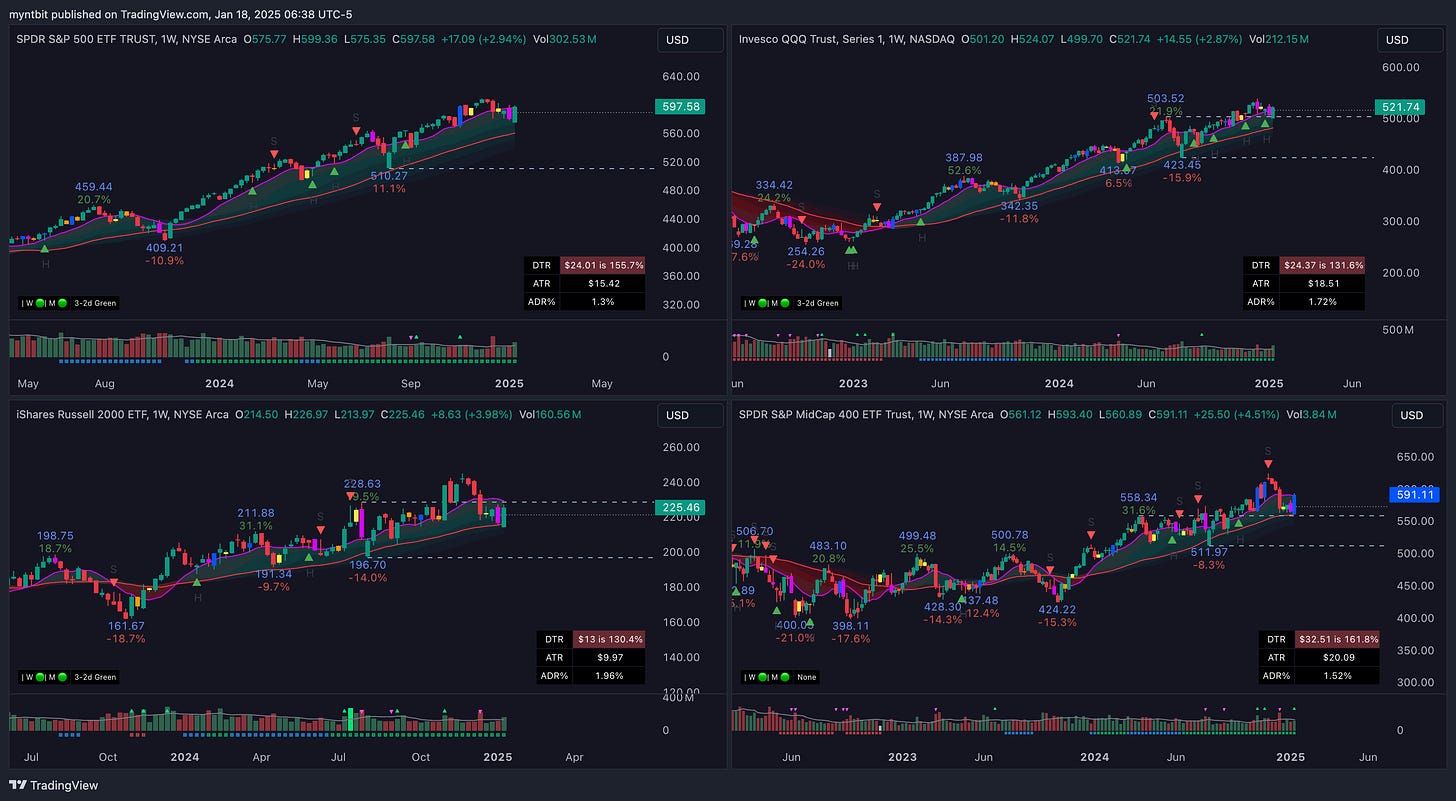

Broader Market - SPY, QQQ, IWM, MDY

The major indices had a strong recovery this week, with SPY (+2.94%), QQQ (+2.87%), IWM (+3.98%), and MDY (+4.51%) all posting solid gains. SPY and QQQ bounced off key support levels, regaining bullish momentum after recent pullbacks, while IWM and MDY showed relative strength, signaling renewed interest in small and mid-cap stocks. Volume levels were healthy, confirming strong buying interest across all indices. If this momentum continues, a retest of recent highs could be in play, but caution remains as markets approach resistance zones.

Watch List

RDDT, AVGO, APP, OKLO

VRT, VST, TSLA, MSTR

Disclaimer: This newsletter is not trading or investment advice, but for general informational purposes only. This newsletter represents our personal opinions that we share publicly for educational purposes. Futures, stocks, and bonds trading of any kind involves a lot of risks. No guarantee of any profit whatsoever is made. In fact, you may lose everything you have. So be very careful. We guarantee no profit whatsoever, You assume the entire cost and risk of any trading or investing activities you choose to undertake. You are solely responsible for making your own investment decisions. Owners/authors of this newsletter, its representatives, its principals, its moderators, and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission, CFTC, or with any other securities/regulatory authority. Consult with a registered investment advisor, broker-dealer, and/or financial advisor. By reading and using this newsletter or any of my publications, you are agreeing to these terms. Any screenshots used here are courtesy of ForexFactory, EarningsHub, Finviz, ThinkorSwim, and/or Tradingview. We are just end-users with no affiliations with them.