Weekly Market Report (January 13, 2025) - Insights and Forecasts

Dive into the market analysis for January 13, 2025, covering SPY, QQQ, IWM, and the week’s key economic data. Stay ahead with expert insights and forecasts.

Weekly Market Report for January 13, 2025

The stock market finished the week with losses, as rising interest rates caused concerns about inflation staying high and the Federal Reserve keeping rates higher for longer. The 10-year Treasury yield increased to 4.78%, and the 2-year yield rose to 4.40%, reacting to economic data released during the week.

Key reports included the ISM Services PMI for December, which showed stronger activity and a big rise in prices, hitting the highest level since January 2024. The JOLTS report revealed more job openings than expected, while the ADP Employment report showed fewer new jobs than predicted. Weekly jobless claims dropped to 201,000, lower than expected. The December jobs report showed 256,000 new jobs and a lower unemployment rate of 4.1%. Additionally, a consumer survey showed rising inflation expectations for the next year and the long term.

The Federal Reserve’s meeting minutes confirmed that policymakers are cautious about lowering rates and want more evidence of inflation heading toward their 2% goal or clear signs of a weakening job market.

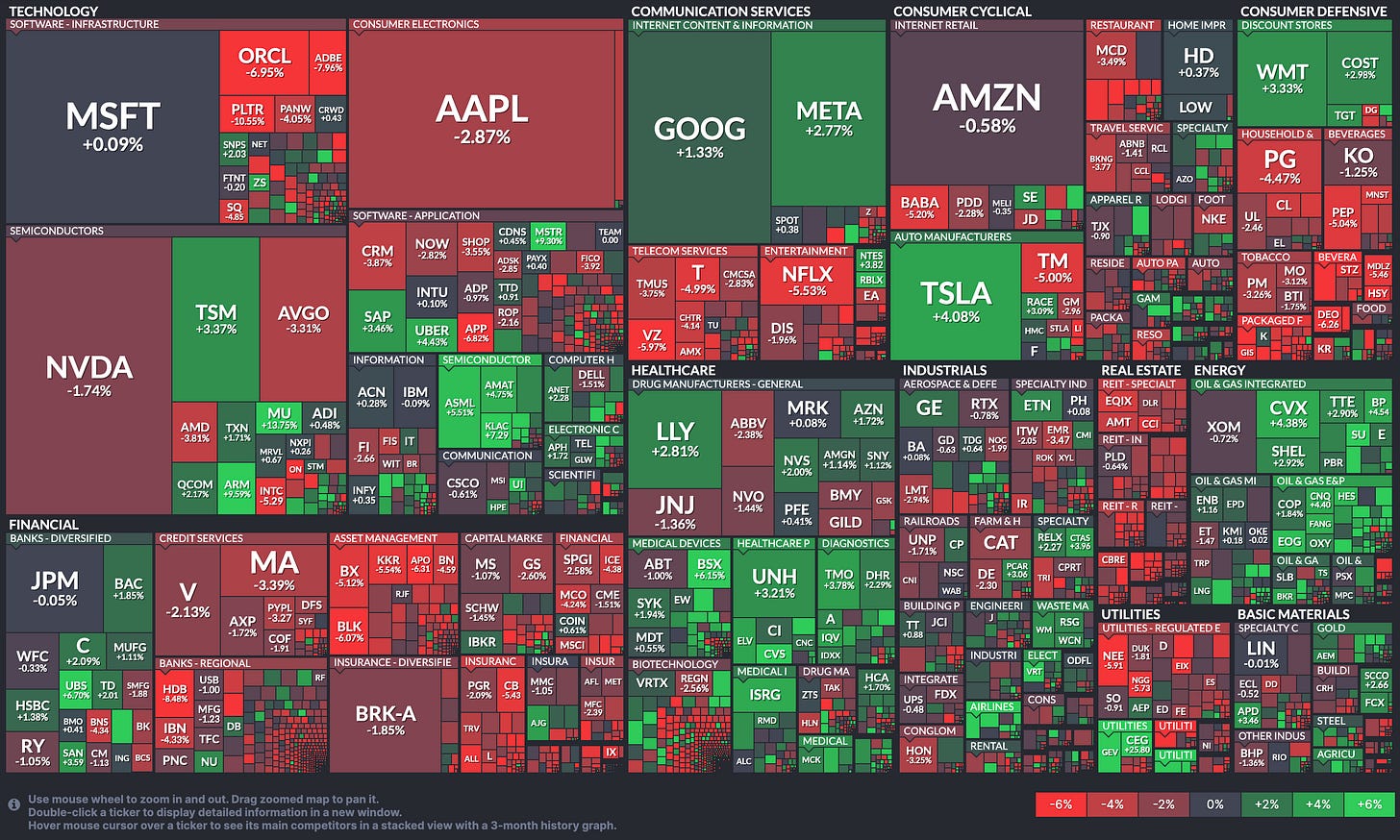

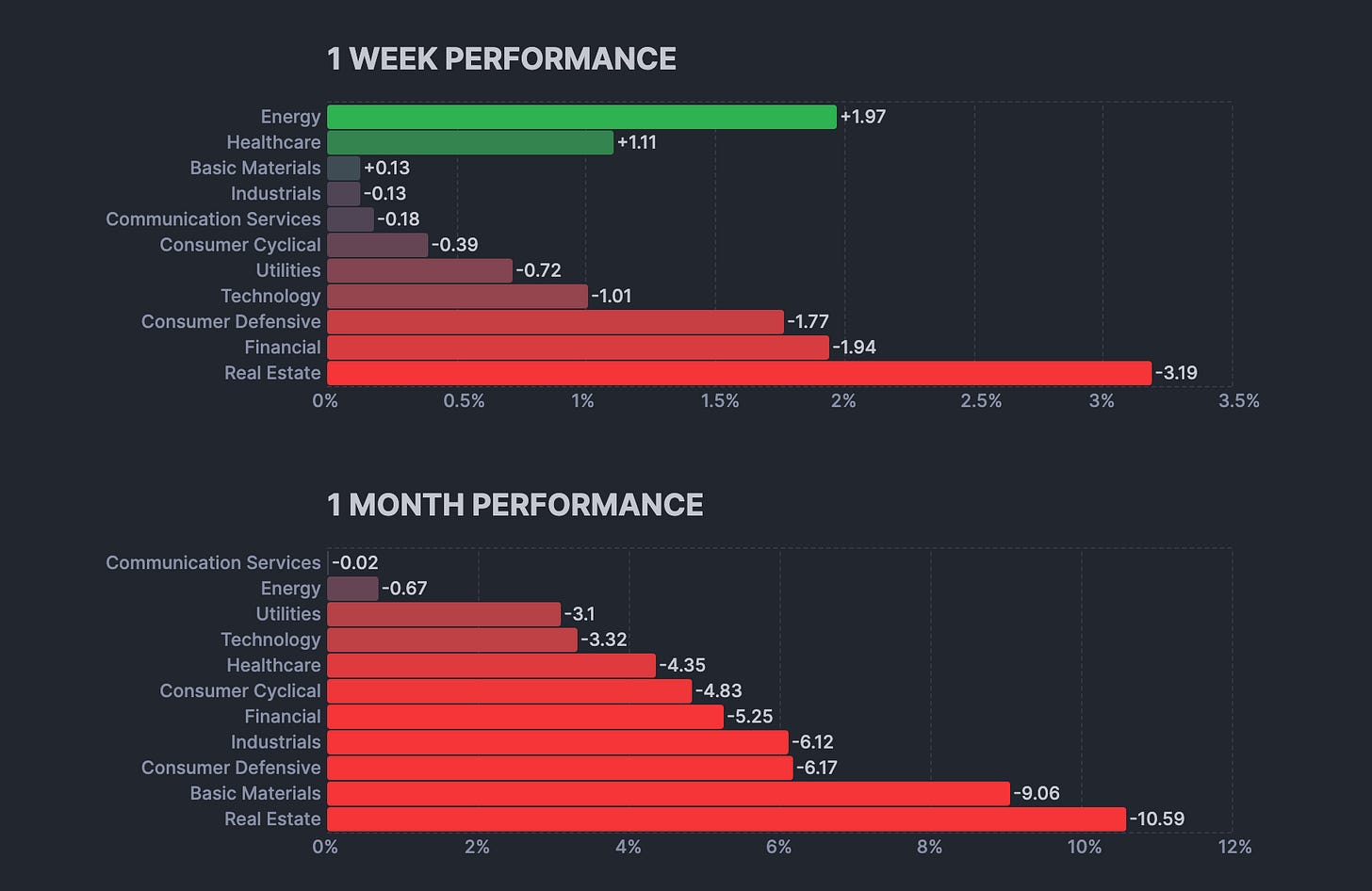

Most stocks fell, with the S&P 500 losing 1.9%, the Nasdaq down 2.3%, and the Dow dropping 1.9%. The S&P 500 briefly moved above its 50-day average but ended below it. Only three sectors gained—health care (+0.5%), energy (+0.9%), and materials (+0.1%)—while real estate fell the most, dropping 4.1%.

Only three sectors in the S&P 500 ended the week higher: energy (+3.2%), real estate (+0.6%), and health care (+0.01%). On the downside, materials (-2.1%), consumer discretionary (-1.5%), and consumer staples (-1.4%) posted the biggest losses.

Weekly Market Heatmap

Weekly Sector Performance

Looking Ahead to the Upcoming Week

Next week brings a series of critical economic updates that will provide insights into inflation, consumer behavior, and the broader economy. Key reports include the Producer Price Index (PPI) and Consumer Price Index (CPI) data on Tuesday and Wednesday, offering a closer look at inflation trends. Wednesday also features the Empire State Manufacturing Index and Crude Oil Inventories, highlighting industrial and energy sector dynamics. On Thursday, Retail Sales and Unemployment Claims will give clues about consumer spending and labor market conditions, while the Philadelphia Fed Manufacturing Index will assess regional business activity. Finally, Building Permits data on Friday will shed light on the housing market's momentum. Markets are likely to react strongly to any surprises in inflation and consumer activity figures.

Economic Events

Earnings Event

Next week’s earnings calendar is packed with key reports from major sectors, kicking off earnings season with a focus on financials, healthcare, and industrials. On Wednesday, big names like JPMorgan Chase (JPM), Goldman Sachs (GS), BlackRock (BLK), and Citigroup (C) will report before the market opens, giving insight into the health of the banking sector and financial markets. Thursday features earnings from healthcare giant UnitedHealth (UNH) and financial institutions Bank of America (BAC) and Morgan Stanley (MS). Rounding out the week, Friday brings updates from industrial players like Schlumberger (SLB) and Fastenal (FAST), alongside financial company Truist Financial (TFC). These reports will provide critical clues about corporate performance amid a challenging economic environment and set the tone for the broader market.

Market Health

The sharp turn from green to red highlights growing caution among investors, potentially fueled by concerns over upcoming economic data or profit-taking after earlier gains. This shift suggests that sentiment has turned more defensive heading into next week.

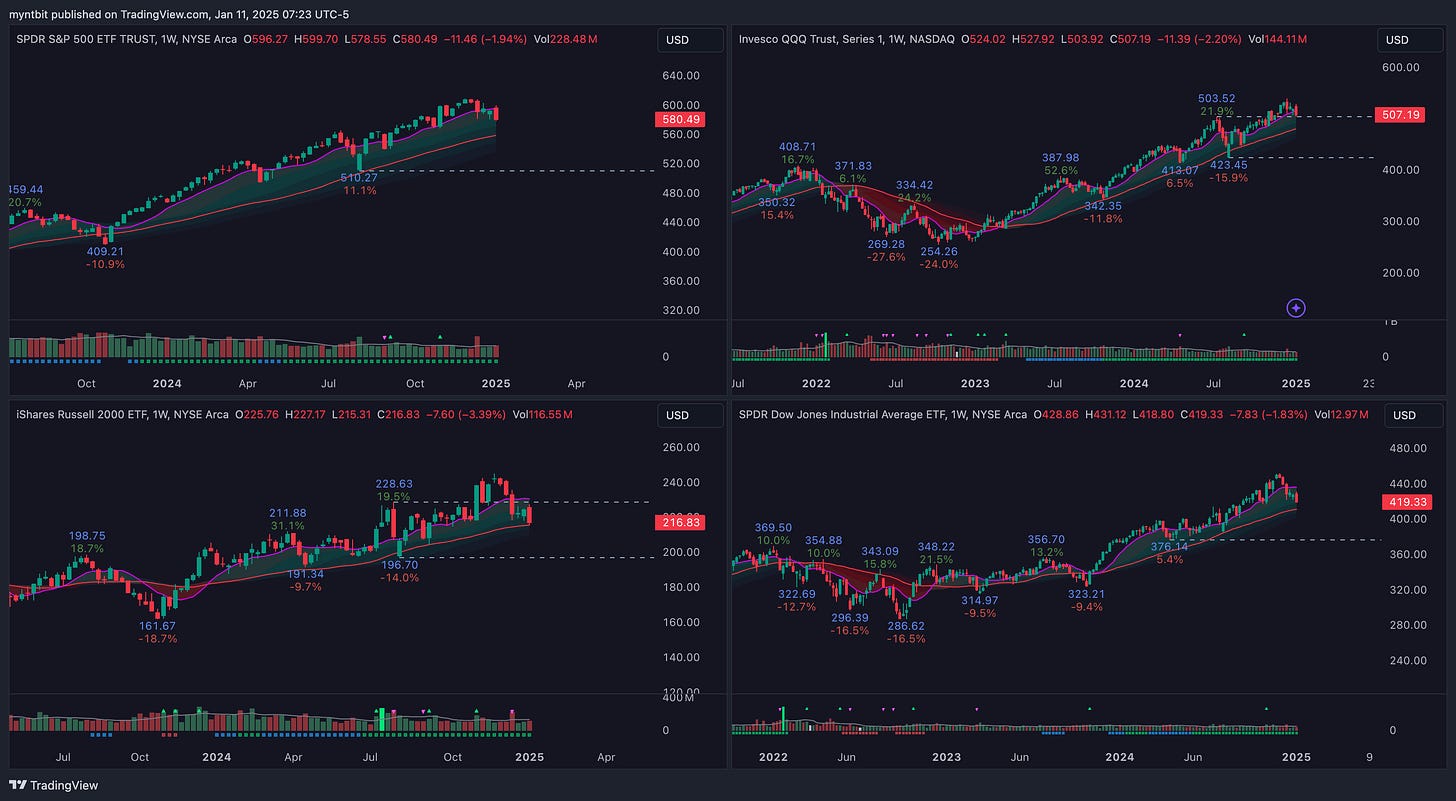

Broader Market - SPY, QQQ, IWM, DIA

The weekly charts for SPY, QQQ, IWM, and DIA all show notable pullbacks after previously strong uptrends. SPY dropped 1.94%, closing below key support near $590, indicating potential weakness if it cannot regain its 10-week moving average. QQQ fell 2.20%, retreating from recent highs and testing support near $507, reflecting pressure on growth and tech stocks. IWM saw the steepest decline, down 3.39%, as small caps broke below $220, suggesting a shift in sentiment away from riskier assets. DIA also declined 1.83%, nearing $420, with its trend showing a potential breakdown if support levels fail. Overall, the indices show signs of near-term weakness, with further downside likely if key support levels aren't defended.

Watch List

HOOD, GRPN, SMTC, GME

RIOT, AVGO, BROS, CRDO

Disclaimer: This newsletter is not trading or investment advice, but for general informational purposes only. This newsletter represents our personal opinions that we share publicly for educational purposes. Futures, stocks, and bonds trading of any kind involves a lot of risks. No guarantee of any profit whatsoever is made. In fact, you may lose everything you have. So be very careful. We guarantee no profit whatsoever, You assume the entire cost and risk of any trading or investing activities you choose to undertake. You are solely responsible for making your own investment decisions. Owners/authors of this newsletter, its representatives, its principals, its moderators, and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission, CFTC, or with any other securities/regulatory authority. Consult with a registered investment advisor, broker-dealer, and/or financial advisor. By reading and using this newsletter or any of my publications, you are agreeing to these terms. Any screenshots used here are courtesy of ForexFactory, EarningsHub, Finviz, ThinkorSwim, and/or Tradingview. We are just end-users with no affiliations with them.