Weekly Market Report (January 05, 2025) - Insights and Forecasts

Dive into the market analysis for January 05, 2025, covering SPY, QQQ, IWM, and the week’s key economic data. Stay ahead with expert insights and forecasts.

Weekly Market Report for January 05, 2025

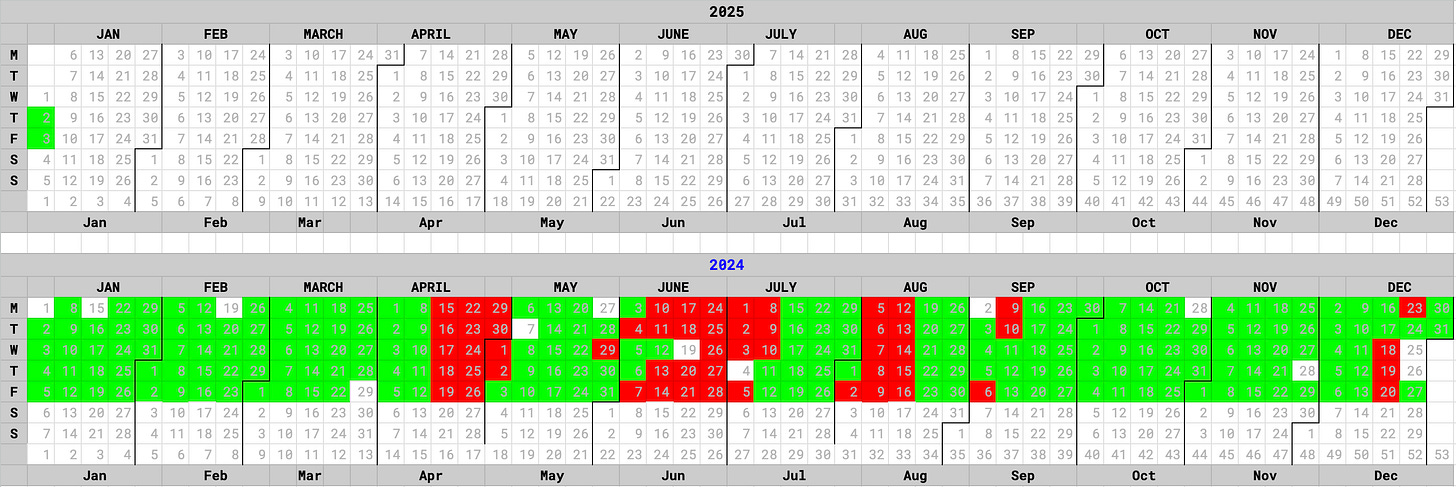

The stock market had a mixed week, wrapping up both the final trading days of 2024 and the Santa Claus Rally period. After strong yearly gains, the major indices lost momentum as the year ended, but some recovery was seen in the final sessions.

Smaller stocks outshined larger ones, with the Russell 2000 rising 1.1% this week. In contrast, the S&P 500 and Nasdaq Composite each fell 0.5%. For the year, however, the S&P 500 surged 23.3%, and the Nasdaq Composite gained an impressive 28.6%.

This week's performance left the S&P 500 down for the Santa Claus Rally period, which historically delivers an average 1.3% gain since 1950, according to The Stock Trader's Almanac. While some years without a Santa Claus Rally have led to market downturns, last year was an exception, as the S&P 500 gained 23.3% in 2024 despite Santa’s absence.

The S&P 500 also slipped below its 50-day moving average, which shifted from support to resistance on Monday.

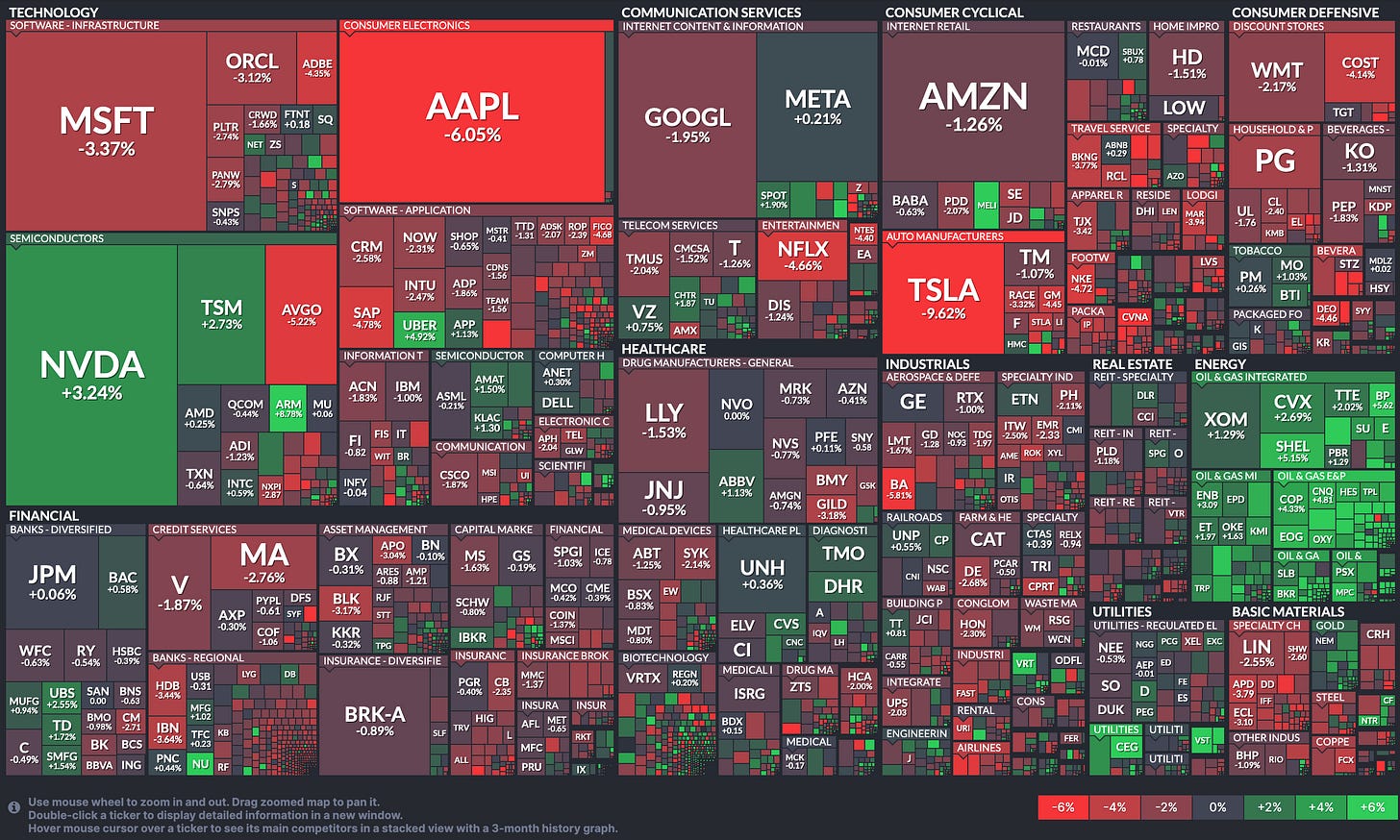

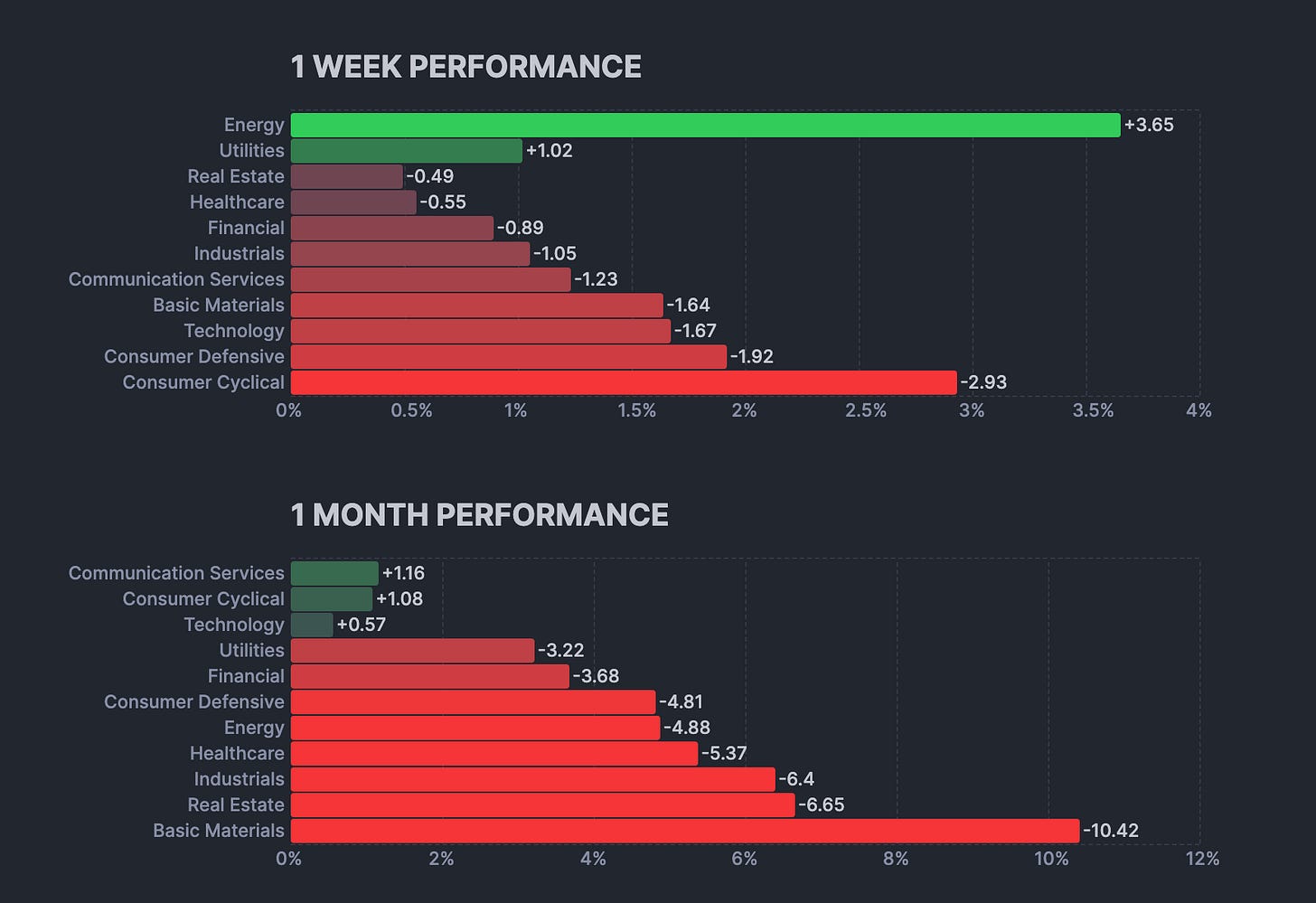

Only three sectors in the S&P 500 ended the week higher: energy (+3.2%), real estate (+0.6%), and health care (+0.01%). On the downside, materials (-2.1%), consumer discretionary (-1.5%), and consumer staples (-1.4%) posted the biggest losses.

Weekly Market Heatmap

Weekly Sector Performance

Looking Ahead to the Upcoming Week

The upcoming week features several key economic events that could influence market sentiment. Highlights include the ISM Services PMI and JOLTS Job Openings on Tuesday, offering insights into economic activity and labor market conditions. Wednesday brings the ADP Non-Farm Employment Change, unemployment claims, and FOMC meeting minutes, providing a deeper look into employment trends and Federal Reserve policy discussions. On Friday, the focus will be on the Non-Farm Payrolls report, unemployment rate, and average hourly earnings, alongside the preliminary University of Michigan Consumer Sentiment and inflation expectations, which will shape expectations for future economic growth and inflation dynamics. These reports are likely to set the tone for markets as investors assess economic resilience and policy implications.

Economic Events

Earnings Event

Market Health

Broader Market - SPY, QQQ, IWM, DIA

The SPY, QQQ, IWM, and DIA charts all show medium- to long-term uptrends, supported by upward-sloping 10-week (purple) and 40-week (red) SMAs. However, recent pullbacks across all indices suggest a short-term weakness, with prices testing key support levels near their 10-week SMAs. The SPY and QQQ remain above critical support zones, while IWM and DIA show relative strength in small-cap and industrial stocks.

The market remains bullish

Watch List

AVGO, MRVL, CLS, QBTS

RUM, ANF, CRDO, PRCH

GME, AFRM, NET, TSM

GOOGL, HOOD, AXP, OWL

CLPT, CGNT, POET, PLTR

Disclaimer: This newsletter is not trading or investment advice, but for general informational purposes only. This newsletter represents our personal opinions that we share publicly for educational purposes. Futures, stocks, and bonds trading of any kind involves a lot of risks. No guarantee of any profit whatsoever is made. In fact, you may lose everything you have. So be very careful. We guarantee no profit whatsoever, You assume the entire cost and risk of any trading or investing activities you choose to undertake. You are solely responsible for making your own investment decisions. Owners/authors of this newsletter, its representatives, its principals, its moderators, and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission, CFTC, or with any other securities/regulatory authority. Consult with a registered investment advisor, broker-dealer, and/or financial advisor. By reading and using this newsletter or any of my publications, you are agreeing to these terms. Any screenshots used here are courtesy of ForexFactory, EarningsHub, Finviz, ThinkorSwim, and/or Tradingview. We are just end-users with no affiliations with them.