MyntBit Weekly Report 07.31 | Start of a New Month, a New Week but does the Market Rally Continue?

MyntBit Weekly Report is dedicated to helping traders prepare for the upcoming week.

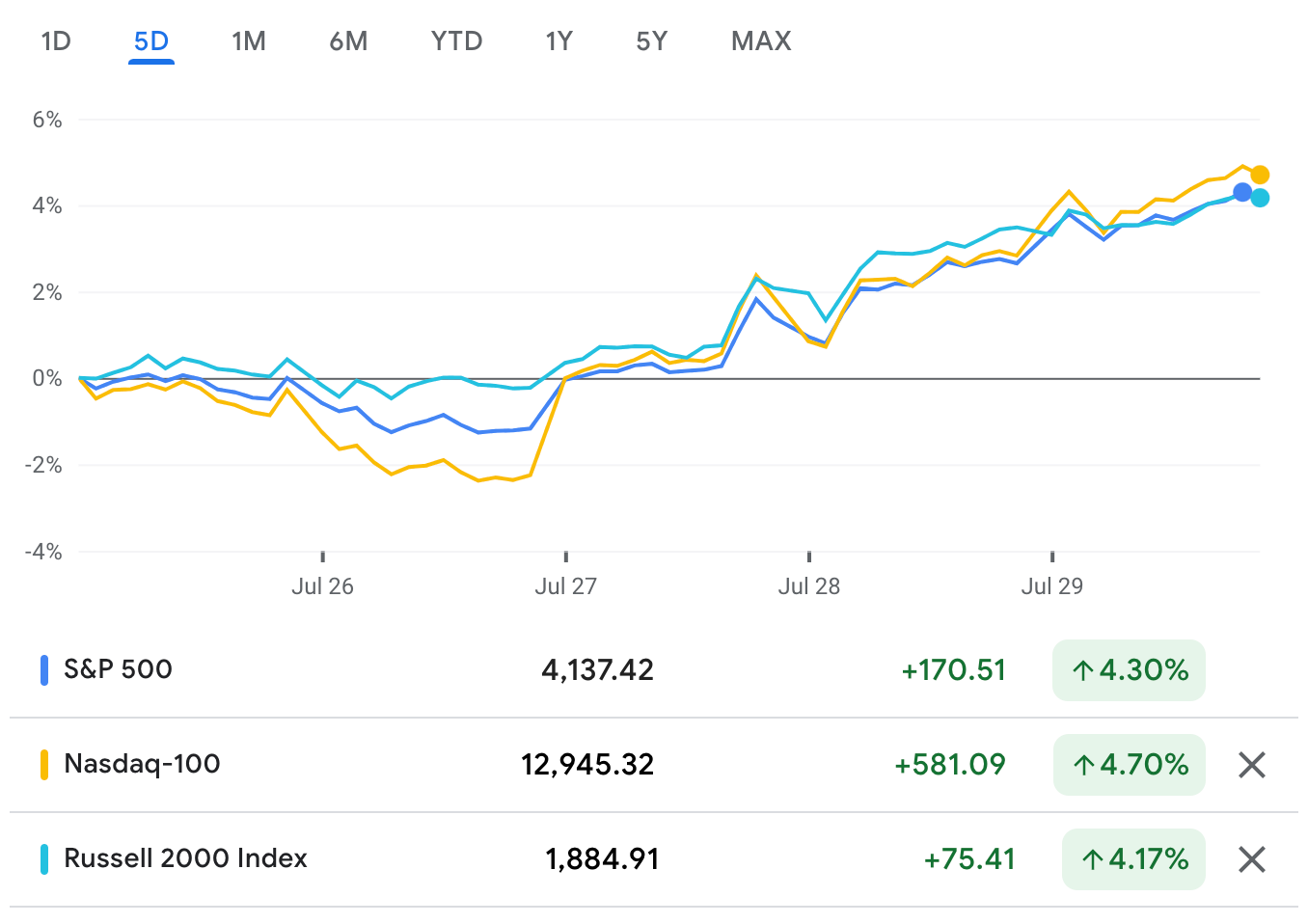

Recap For This Week

Market Snapshot

Weekly Wrap by Breifing.com

Anyone following the market this week has a right to feel exhausted going into the weekend. It was a huge of week of news that was ultimately matched with some big gains for the week that padded some huge gains for the month, which were driven in part by short-covering activity and a bid to add back exposure to equities following the brutal first half of the year.

Briefly, roughly 175 S&P 500 companies reported their results for the June quarter, the FOMC held a policy meeting, the economic calendar featured the Advance Q2 GDP Report, President Biden held a call with President Xi mainly to discuss Taiwan and Russia, Senator Manchin had a stunning reversal of position and reached an agreement with Senator Schumer on the provisions for the Inflation Reduction Act of 2022, and Congress passed a $280 billion bill, which included $52 billion for increasing semiconductor manufacturing capacity, that is designed to fend off competition from China.

Tucked in between was a halting earnings warning from Walmart (WMT) that was pinned on food and fuel inflation detracting from spending in general merchandise categories, a warning from Best Buy (BBY) about a further softening in demand for consumer electronics, a warning from Stanley Black & Decker (SWK) about weakening customer demand, the highest year-over-year reading for the PCE Price Index (6.8%) since 1982, the third straight monthly drop in Consumer Confidence, and a bleak New Home Sales report for June.

The bad news, however, didn't derail the stock market, which locked in on better-than-feared results and/or guidance from Alphabet (GOOG), Microsoft (MSFT), Apple (AAPL), and Amazon.com (AMZN), a marked drop in Treasury yields, and the idea that the weak economic data would compel the Fed to take less aggressive steps with future rate hikes.

The Federal Reserve was central to this week's action. It raised the target range for the fed funds rate on Wednesday by 75 basis points to 2.25-2.50%, as expected. Fed Chair Powell, however, did a commendable job at his press conference of walking the line between needing to be tough still on fighting inflation but conceding that it would likely be appropriate in coming months to slow the pace of rate increases given how frontloaded the rate hikes have been to this point.

He didn't rule out another 75-basis point rate hike at the September meeting. He said the data would dictate that decision. He also said that the Fed wouldn't be offering any clear-cut guidance like it had been doing but would instead let the data dictate policy decisions now on a meeting-by-meeting basis.

There was ample room for interpretation in the wake of his remarks, but the prevailing view of the market was that Mr. Powell opened the door to the Fed taking a step down with its aggressive rate-hike posture. That was enough to launch a post-FOMC rally on Wednesday that was sustained through Friday's close.

Notably, the fed funds futures market is pricing in two rate cuts in the first half of 2023, according to the CME's FedWatch Tool. Mr. Powell didn't say anything that supported such thinking, yet market participants have been seemingly clinging to an expectation that weakening economic data will be the pivot point for the Fed.

The second straight quarter of a contraction in real GDP (-0.9%) contributed to that view; meanwhile, the Treasury market moved in a direction that corroborated that thinking. The 2-yr note yield dropped nine basis points this week to 2.90% and the 10-yr note yield fell 14 basis points to 2.64%, leading to a further inversion of the 2s10s spread that is seen by many as a harbinger of weak growth and/or a recession.

In that vein, it would be remiss not to point out that growth stocks once again led this week's rally effort. The Russell 3000 Growth Index rose 4.9% versus a 3.4% gain for the Russell 3000 Value Index.

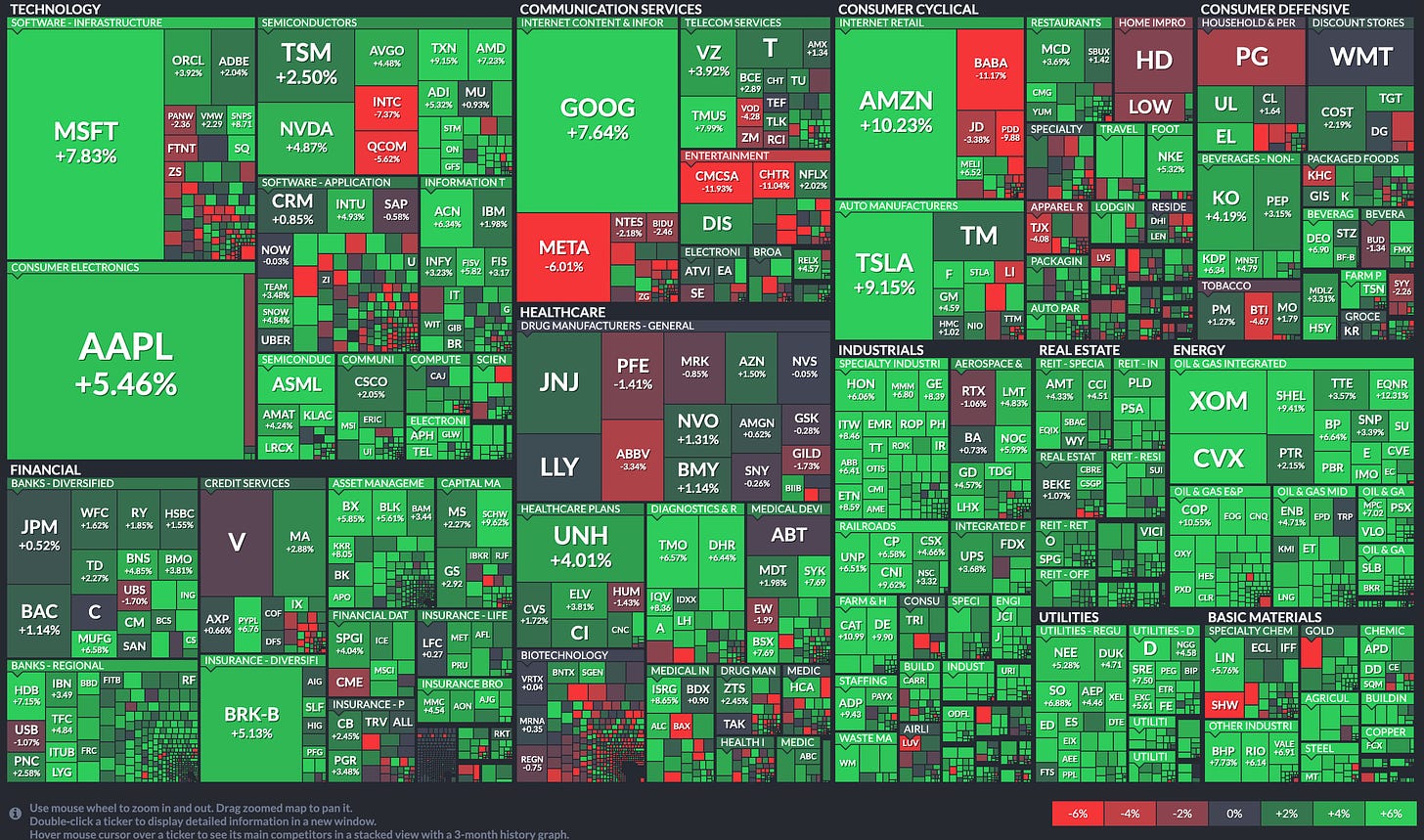

Clearly, though, the otherwise solid 3.4% gain in the Russell 3000 Value Index underscored that there was broad-based buying interest. All 11 S&P 500 sectors gained ground this week with gains ranging from 1.6% (consumer staples) to 10.3% (energy). The latter closed out a huge week on the back of stronger-than-expected earnings results from Chevron (CVX) and Exxon Mobil (XOM).

For the month, every sector advanced. Gains ranged from 3.1% (consumer staples) to 18.9% (consumer discretionary). A surge in Tesla (TSLA) and Amazon.com (AMZN) paved the way to that massive gain for the consumer discretionary sector, which is still down 20.4% for the year.

Altogether the Nasdaq Composite soared 12.4% in July followed by the S&P Midcap 400 (+10.8%), the Russell 2000 (+10.4%), the S&P 500 (+9.1%), and the Dow Jones Industrial Average (+6.7%). The S&P 500, which flirted with 3,600 in mid-June, closed July at 4,130.29.

Market Heatmap

Looking Ahead to Next Week: Aug 1-5

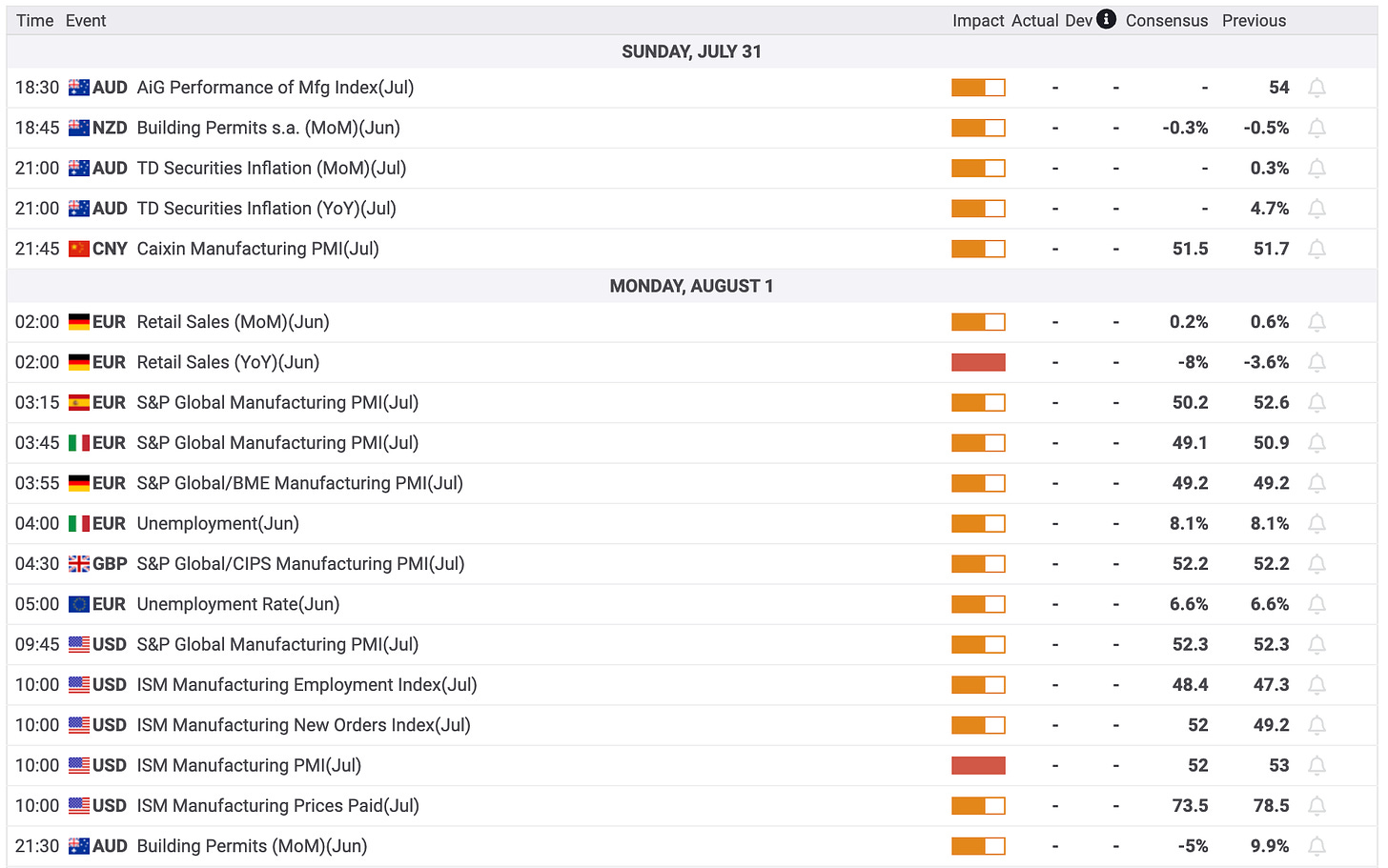

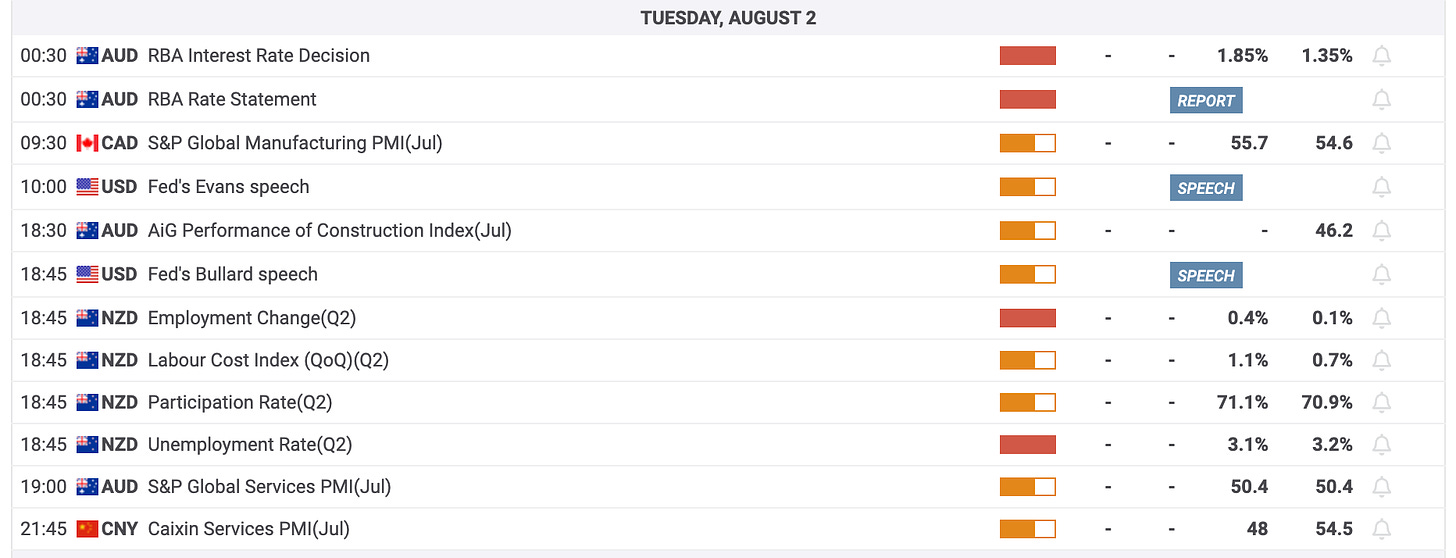

Next week, the Labor Department’s “first Friday” jobs report will take center stage as it could impact the calculus for monetary policy tightening by the Fed. Non-farm payrolls are expected to have increased by 250,000 in July, building on to the prior month’s 372,000 addition. The unemployment rate is forecasted to remain unchanged at 3.6%, while wage inflation likely eased modestly to reflect a 5% year-over-year gain. Also in focus, updates on U.S. business activity from the Institute for Supply Management (ISM) are projected to show growth in both the manufacturing and services sectors slowed in July. However, the purchasing managers’ index (PMI) prints are anticipated to remain in expansionary territory, contradicting a comparable composite reading from S&P Global.

Rounding out the docket, will be reports on construction spending, factory orders, the U.S. trade balance, consumer credit, weekly initial jobless claims, and the Job Openings and Labor Turnover Survey (JOLTS). In central bank news, the Bank of England (BOE) votes on its policy decision Thursday, with a 50-basis point (0.50%) rate hike widely expected. In the U.S., several regional Fed presidents have public appearances scheduled throughout the week.

Meanwhile, Wall Street continues to wade through earnings season, with nearly a third of S&P 500 companies sharing results. Information Technology will be represented by semiconductor manufacturers, including Advanced Micro Devices, while insurance names Aflac Inc. and Allstate Corp. are also due to report. In Health Care, CVS Health Corp., Moderna Inc., and Eli Lilly & Co. may also garner attention. Representing the travel industry will be profit tallies from Marriott International Inc., Expedia Group Inc., and MGM Resorts International. Other notable companies delivering corporate confessions throughout the week include: Caterpillar Inc., Marathon Petroleum Corp., Starbucks Corp., Clorox Co., and Warner Bros Discovery Inc. In other news, OPEC+ (the Organization of the Petroleum Exporting Countries and its allies) holds its monthly production meeting.

Earnings Calendar

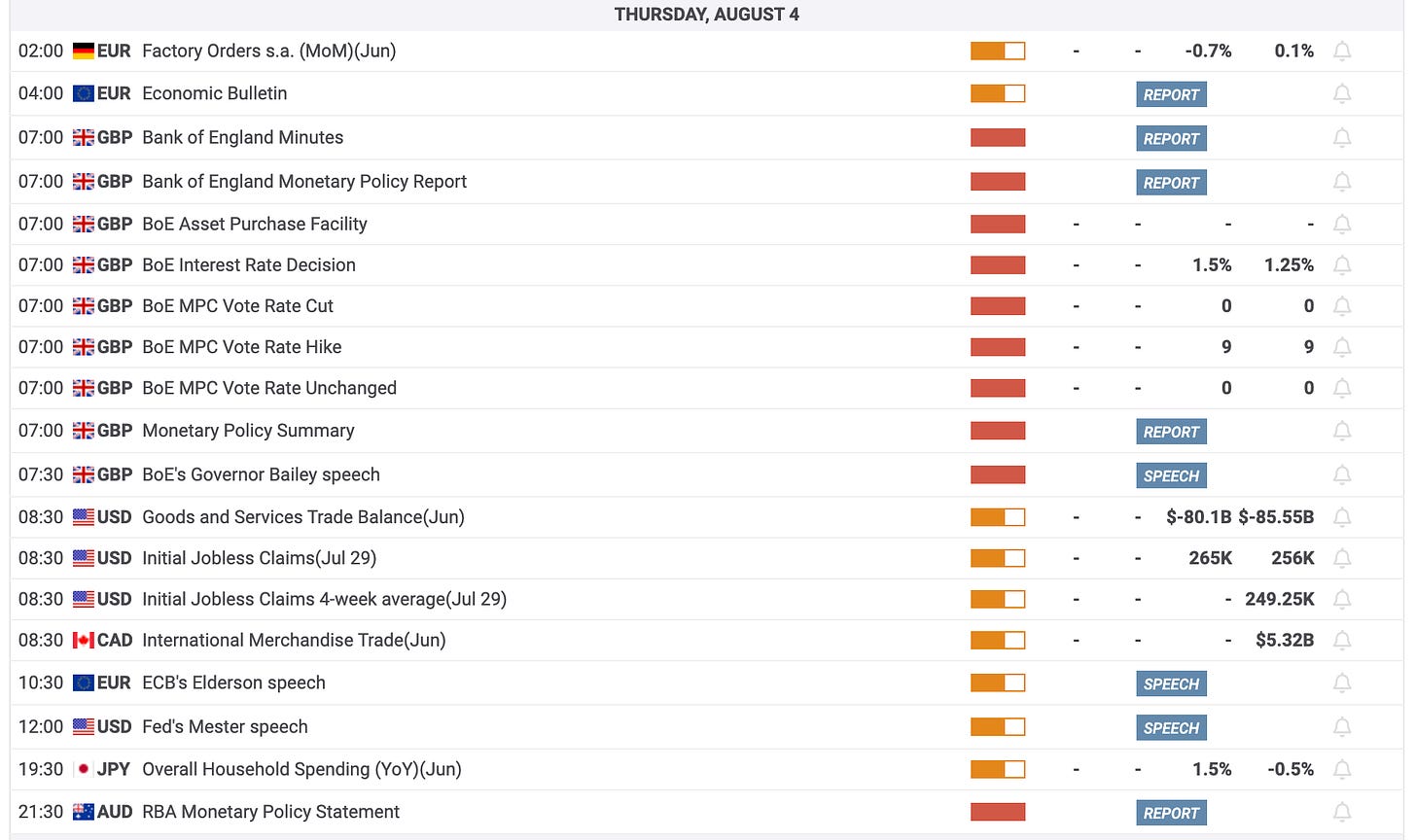

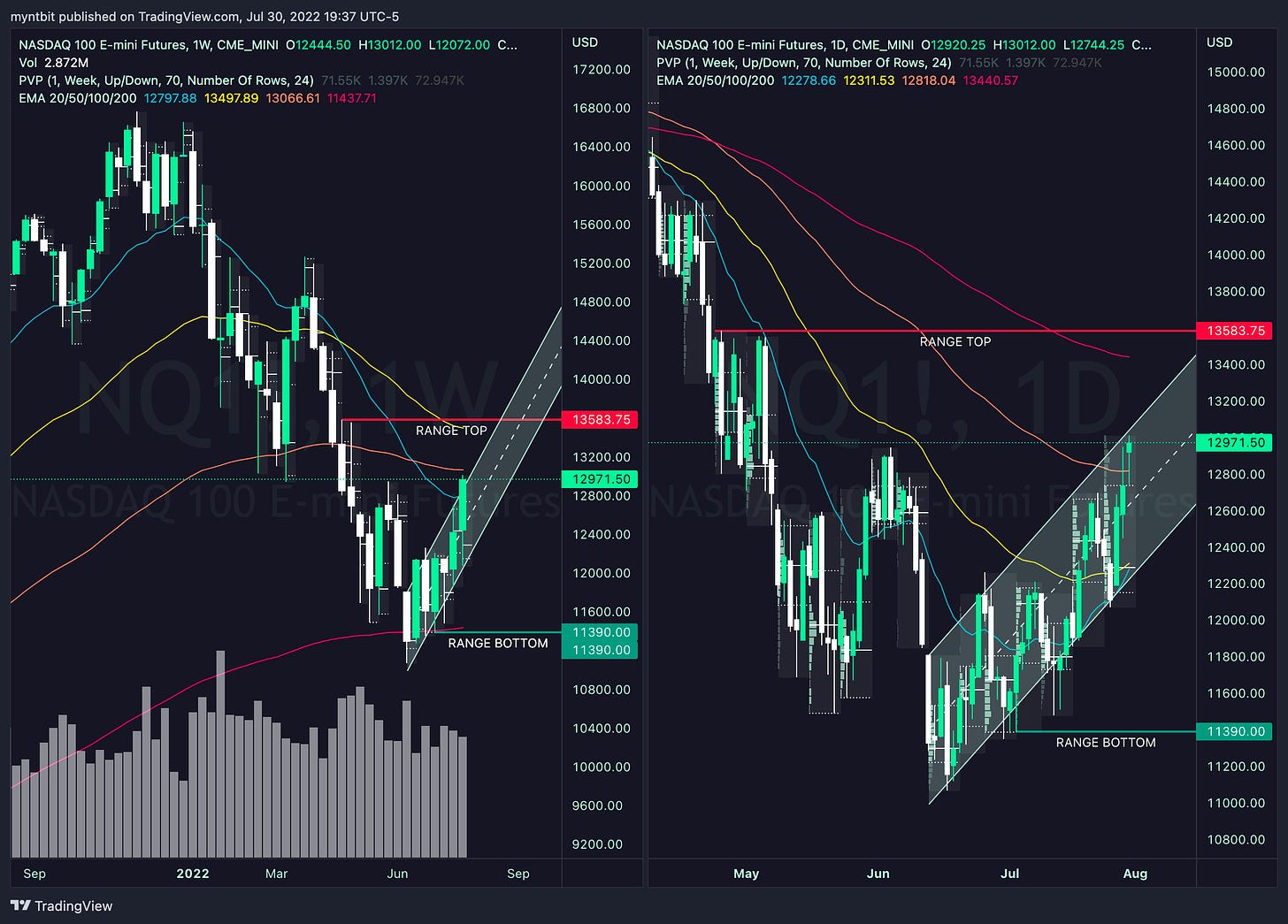

Economic Calendar

Futures Markets

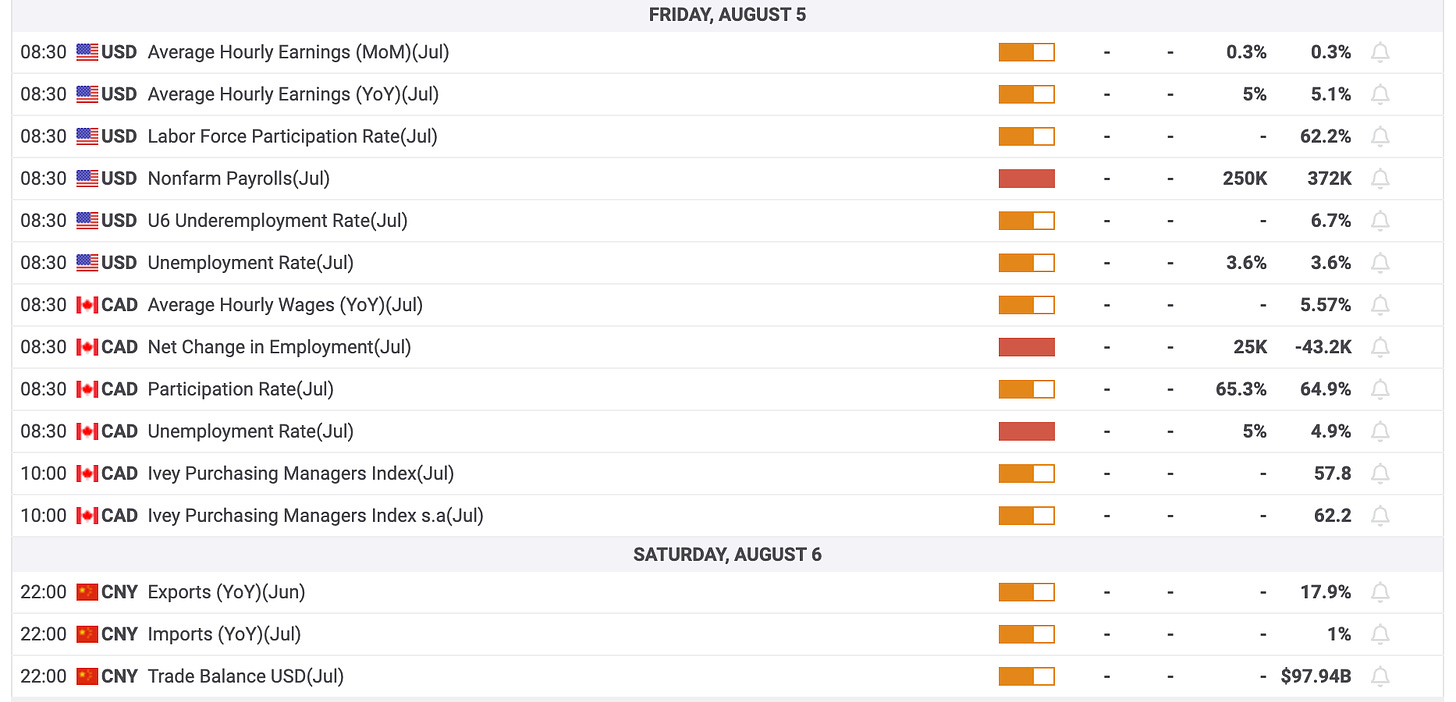

/ES - Emini S&P 500

What a week we had in the markets: 75bps rate hike, Negative GDP = Recession, and Big Earnings! With all the events, ES didn’t stop it started with breaking above our key level at 4000 then we continued higher throughout the week to finish over 4100. On a weekly, ES broke through the declining 100 EMA and now it is knocking on the door at 50 EMA which has been held since April 2022.

Bull Case - 4150 is the new key level. We did manage to test and break 4100 this past week but to see any upside, buyers need to step up and have convection to stay above that point, the next stop would be 4175-4185 where we might find meaningful resistance. Further upside could happen if we pass above 4200 to 4260.

Bear Case - With strong buyers above 4000, the 4150 acted as a strong resistance last week. So, if we remain under 4150, the next level down is 4075 until we find meaningful support again then at 4030. Any further downside might be limited for now.

Weekly POC: 3956 | Range: 3723 - 4300

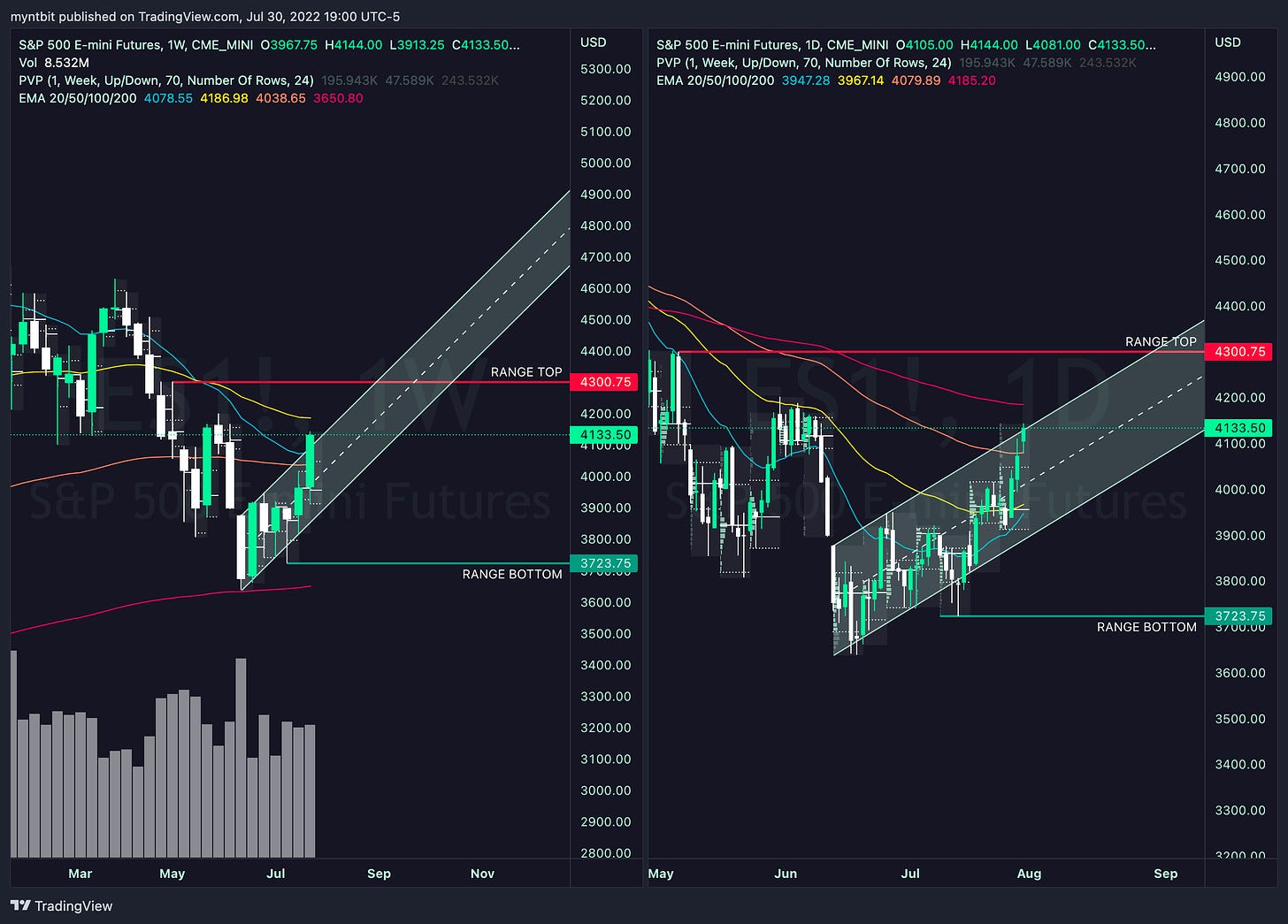

/NQ - Emini Nasdaq 100

NQ started the week strong but towards the end lagged the other indices. On the weekly timeframe, it broke the descending 20 EMA which held since March 2022, but this time around we are oversold we wouldn't be surprised to see further residual follow-through higher before a more meaningful turn potentially takes place.

Bull Case - The Key level on NQ is 13000. If that is broken a trip to 13500 which is set at the new range top.

Bear Case - If we remain under 13000, we could test 12850 before seeing any meaningful support but with further weakness in NQ, could see 12600 broken which would open the door for lows at 12300 getting tested.

Weekly POC: 12290 | Range: 11390 - 13583

Crypto Markets

Crypto has been acting as a leading indicator for the market

#BTC - Bitcoin

Upside Levels - 23900 > 24300 > 24700

Downside Levels - 22800 > 21917 > 21300

Range: 17567 - 26869

#ETH - Ethereum

Upside Levels - 1650 > 1800 > 1912

Downside Levels - 1594 > 1460 > 1348 > 1279

Range: 879 - 1800

Stocks To Watch Next Week

AMD - Advanced Micro Devices, Inc.

AMD reports on Aug 2nd, 2022, and some good news for the chips sectors as the Chip Bill has passed House which helps boost this sector. Also, INTC's bad earnings affected the sector negatively on Thursday but AMD remains strong. The Gap at 94.80 has been filled.

Bull Case - If we OPEN above 95 we might see 101.60 then 105.25.

Bear Case - If we OPEN below 95, we might see 90.67 then 86.61 with a possibility of 84.71.

POC: 86.61

SBUX - Starbucks Corporation

Bull Case - If we OPEN above POC, we might see 85.58, 86.60, and then 87.51.

Bear Case - If we OPEN below POC, we might see 82.87, 81.60 then 80.06.

There is Gap on the downside at 78 that needs to be filled. And there is a gap on the upside at 91 that needs to be filled as well.

POC: 83.99

RIVN - Rivian Automotive Inc

Bull Case - If we OPEN above POC, we might see 37.40, 39.69, and then 41.36.

Bear Case - If we OPEN below POC, we might see 31.85, 30.13, and then 28.04.

There hit major resistance at 34.30. There is a gap to be filled at 26.79.

POC: 33.05

For more stocks...

Disclaimer: This newsletter is not trading or investment advice, but for general informational purposes only. This newsletter represents our personal opinions which we are sharing publicly for educational purposes. Futures, stocks, bonds trading of any kind involves a lot of risk. No guarantee of any profit whatsoever is made. In fact, you may lose everything you have. So be very careful. We guarantee no profit whatsoever, You assume the entire cost and risk of any trading or investing activities you choose to undertake. You are solely responsible for making your own investment decisions. Owners/authors of this newsletter, its representatives, its principals, its moderators and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission, CFTC or with any other securities/regulatory authority. Consult with a registered investment advisor, broker-dealer, and/or financial advisor. Reading and using this newsletter or any of my publications, you are agreeing to these terms. Any screenshots used here are the courtesy of Briefing.com, FXstreet, Google Finance, Unusual Whale, Refinitiv, and/or Tradingview. We are just an end-user with no affiliations with them.