MyntBit Daily Report | 19 July 2022

MyntBit Daily Report is dedicated to provide traders with recap and bring setups to watch for the next trading day.

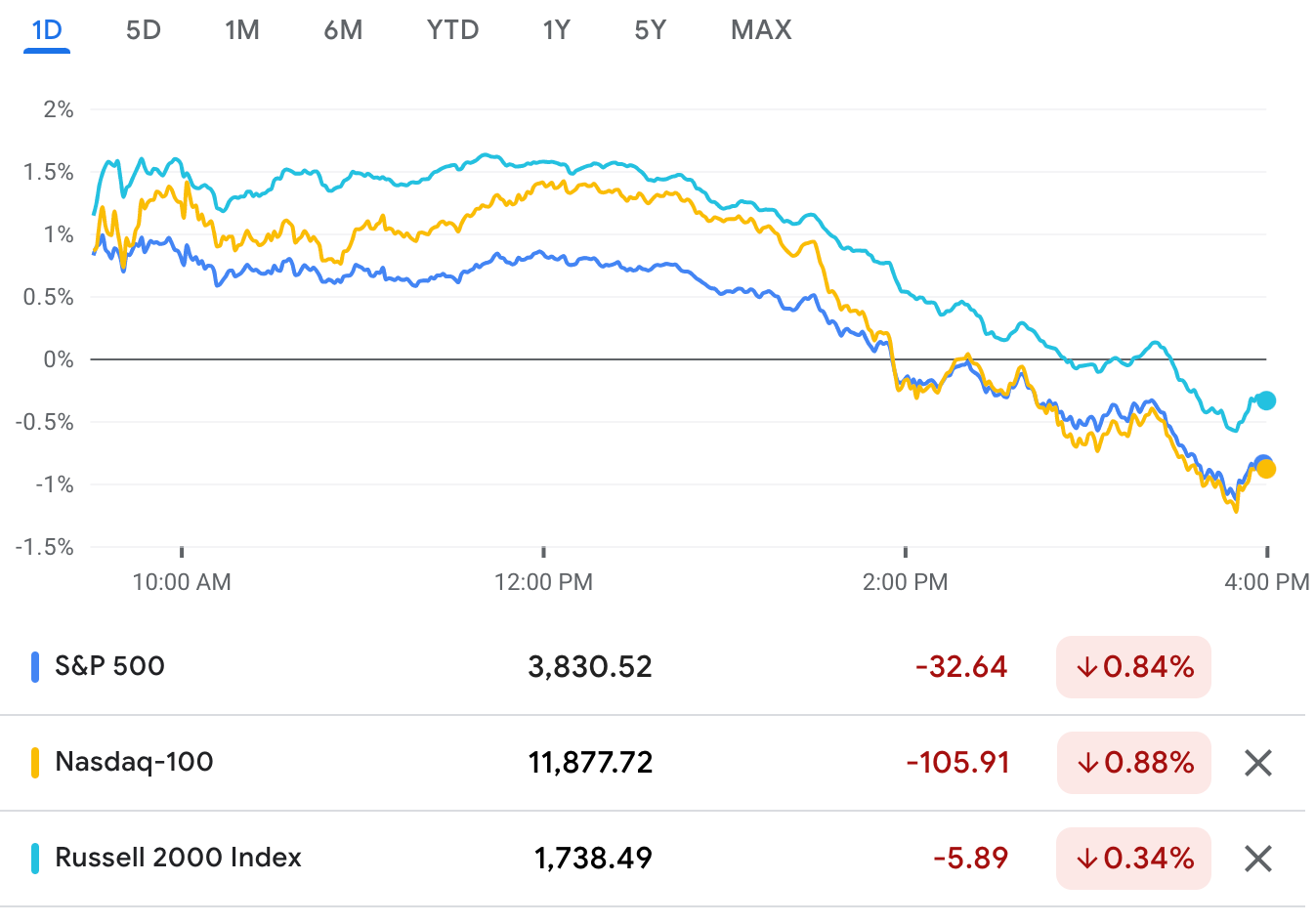

Market Snapshot

RTTNews Market Update

Stocks showed a strong move to the upside in early trading on Monday but saw a substantial downturn over the course of the session. The major averages pulled back well off their early highs and into negative territory.

After surging by more than 350 points early in the session, the Dow fell 215.65 points or 0.7 percent to 31,072.61. The Nasdaq also slumped 92.37 points or 0.8 percent to 11,360.05, while the S&P 500 slid 32.31 points or 0.8 percent to 3,830.85.

The early strength on Wall Street came as traders continued to pick up stocks at relatively reduced levels after the rally seen last Friday halted a recent downward trend.

Positive sentiment was also generated in reaction to upbeat earnings news from Goldman Sachs (GS), with the financial giant jumping by 2.5 percent.

The advance by Goldman Sachs came after the company reported second-quarter results that exceeded analyst estimates on both the top and bottom lines.

Shares of Bank of America (BAC) have also moved modestly higher even though the financial giant reported weaker than expected second-quarter earnings.

Buying interest waned over the course of the session, however, as traders continued to worry about the economic outlook ahead of next week's Federal Reserve meeting.

Traders may also have been reluctant to make significant bets ahead of the release of earnings news from a slew of big-name companies later this week.

In U.S. economic news, the National Association of Home Builders released a report showing a substantial deterioration in U.S homebuilder confidence in the month of July.

The report showed the NAHB/Wells Fargo Housing Market Index plunged to 55 in July from 67 in June. Economists had expected the index to edge down to 66.

The HMI showed its second biggest single-month drop after a 42-point nosedive in April 2020, tumbling to its lowest level since May 2020.

Sector News

Healthcare stocks came under pressure over the course of the session, dragging the Dow Jones U.S. Health Care Index down by 2.2 percent.

Significant weakness also emerged among biotechnology stocks, as reflected by the 2.1 percent slump by the NYSE Arca Biotechnology Index.

Pharmaceutical, utilities and networking stocks also moved notably lower as the day progressed, contributing to the downturn by the broader markets.

On the other hand, energy stocks held on to strong gains amid a sharp increase by the price of crude oil. Crude for August delivery soared $5.01 to $102.60 a barrel amid renewed supply jitters.

Reflecting the strength in the energy sector, the Philadelphia Oil Service Index spiked by 3.6 percent, the NYSE Arca Oil Index surged by 2.4 percent and the NYSE Arca Natural Gas Index jumped by 1.7 percent.

Other Markets

In overseas trading, stock markets across the Asia-Pacific region moved mostly higher on Monday, with the Japanese markets closed for a holiday. China's Shanghai Composite Index surged by 1.6 percent, while Hong Kong's Hang Seng Index spiked by 2.7 percent.

The major European markets also moved to the upside on the day. While the While the German DAX Index climbed by 0.7 percent, the U.K.'s FTSE 100 Index and the French CAC 40 Index both advanced by 0.9 percent.

In the bond market, treasuries climbed off their worst levels of the day but remained in negative territory. As a result, the yield on the benchmark ten-year note, which moves opposite of its price, rose by 3 basis points to 2.960 percent after reaching a high of 3.019 percent.

Looking Ahead

Reaction to the latest earnings news may drive trading on Tuesday, with tech giant IBM Corp. (IBM) among the companies releasing their quarterly results after the close of today's trading.

Halliburton (HAL), Hasbro (HAS), Johnson & Johnson (JNJ) and Lockheed Martin (LMT) are also among the companies due to report their quarterly results before the start of trading on Tuesday.

Market Heatmap

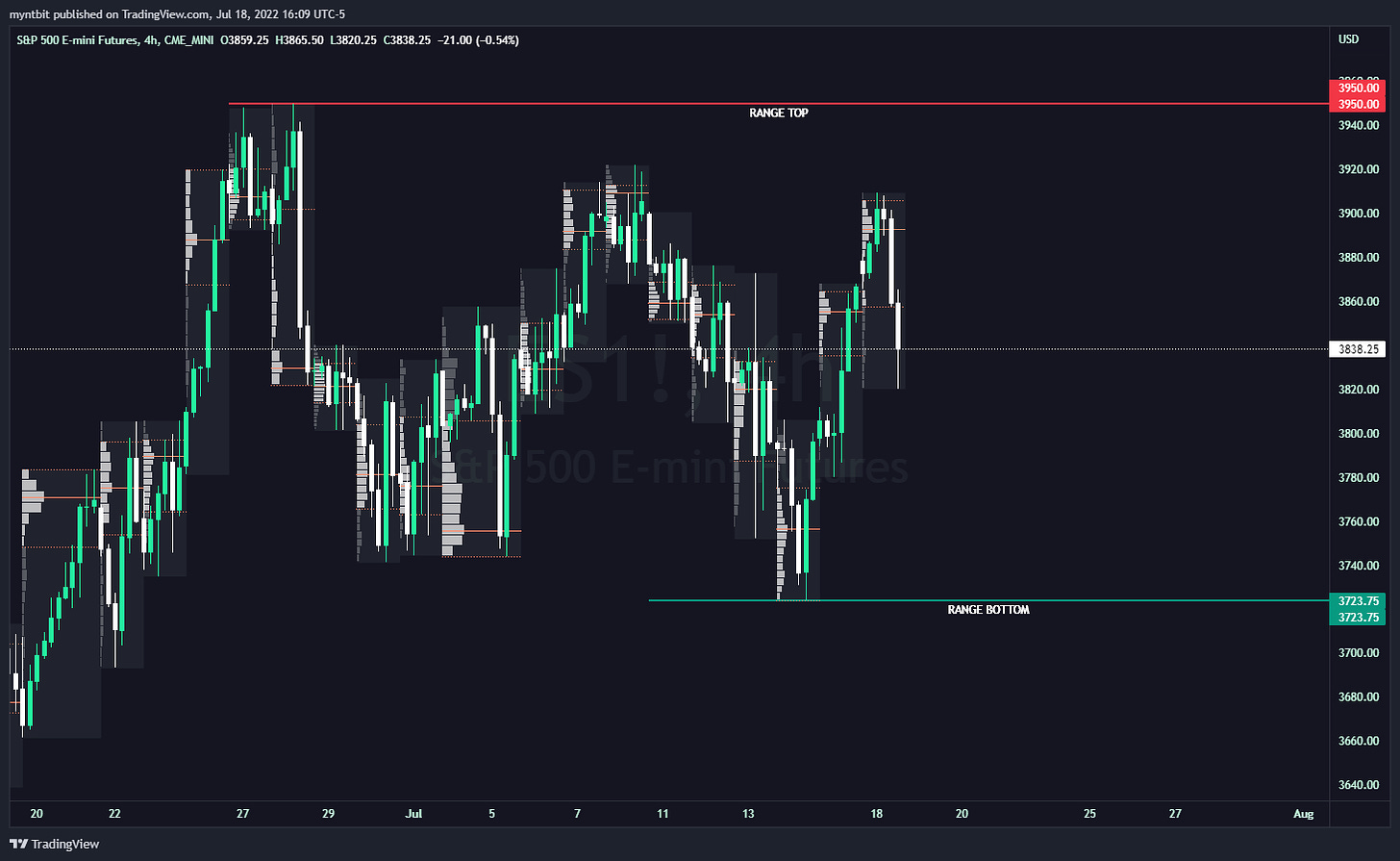

Futures Markets

The weekly perspective for /ES & /NQ has not changed. /ES futures are currently sitting at 3837 (middle of BB). Both futures are still range bound but with the news from AAPL about slower growth and hiring created a ripple effect across the market. Next up, earnings for NFLX and TSLA this week then next week for other mega caps report earnings plus FOMC and GDP release for the second quarter.

/ES - Emini S&P 500

Bullish Scenario

If we open above 3830, we will need to overcome 3853 (VL from today) which has also been a key area. Then the next target would be 3880 might cause us trouble but a 3900 test will be possible.

Bearish Scenario

If we open below 3830 then we will go test 3800 which will open up a likelihood of a test of the recent lows at 3750 and 3720.

POC: 3893 | VAH: 3906 | VAL: 3857 | Range: 3723 - 3950

/NQ - Emini Nasdaq 100

Bullish Scenario

If we open above 11915, we will need to overcome 12000 which has also been a key psychological level. If we have follow through, we can test the 12200 range top.

Bearish Scenario

If we open below 11915, then we will go test 11800 with a move down to 11700 to11600 possible.

POC: 12140 | VAH: 12187 | VAL: 12022 | Range: 11390 - 12211

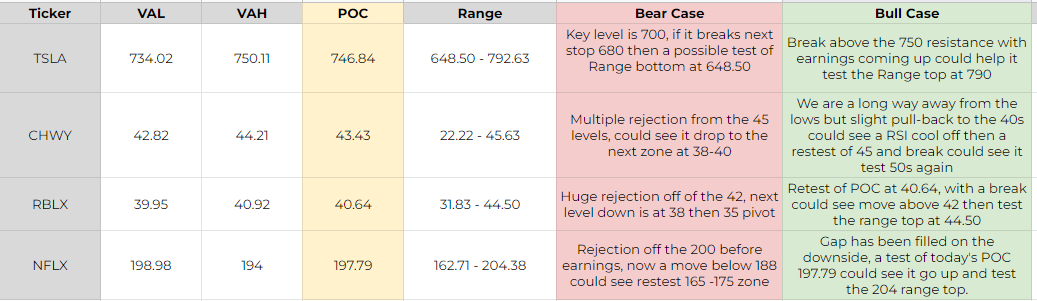

Stocks

TSLA - TESLA, INC.

Earnings July 20th - looks like an inverse H&S on 4 hour

Bull Case - Break above the 750 resistance with earnings coming up could help it test the Range top at 790

Bear Case - Key level is 700, if it breaks next stop 680 then a possible test of Range bottom at 648.50

POC: 746.84 | VAH: 750.11 | VAL: 734.02 | Range: 648.50 - 792.63

More stocks and charts are on Stock Watchlist (Google Doc Link) and MyntBit Discord

Earnings Calendar

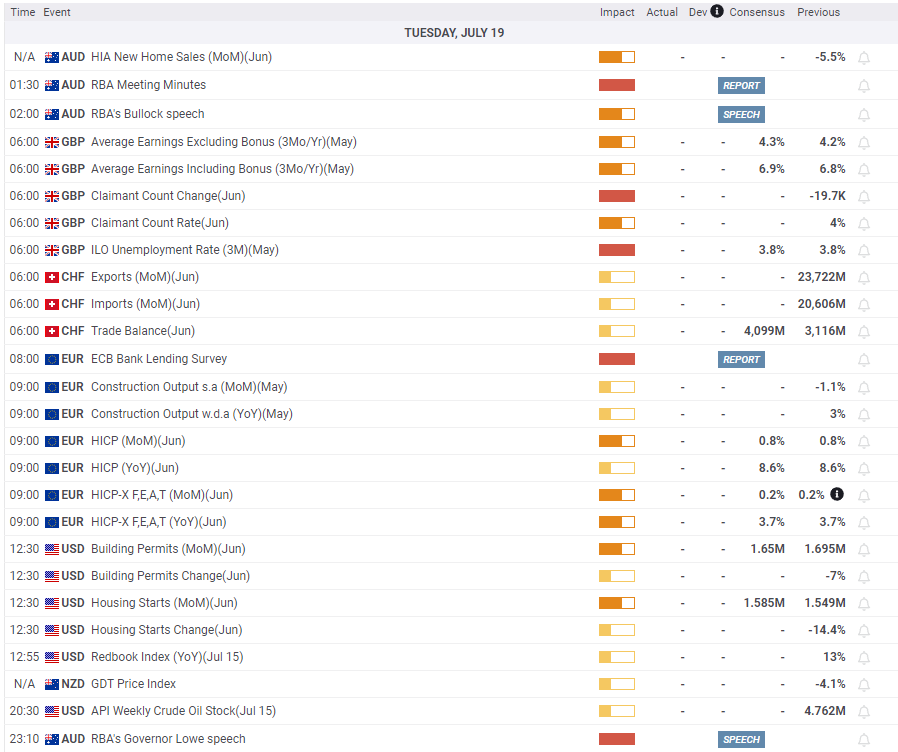

Economic Calendar

Disclaimer: This newsletter is not trading or investment advice, but for general informational purposes only. This newsletter represents our personal opinions which we are sharing publicly for educational purposes. Futures, stocks, bonds trading of any kind involves a lot of risk. No guarantee of any profit whatsoever is made. In fact, you may lose everything you have. So be very careful. We guarantee no profit whatsoever, You assume the entire cost and risk of any trading or investing activities you choose to undertake. You are solely responsible for making your own investment decisions. Owners/authors of this newsletter, its representatives, its principals, its moderators and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission, CFTC or with any other securities/regulatory authority. Consult with a registered investment advisor, broker-dealer, and/or financial advisor. Reading and using this newsletter or any of my publications, you are agreeing to these terms. Any screenshots used here are the courtesy of IBKR, Unusual whales, RTTnews, FXstreet, and/or Tradingview. We are just an end-user with no affiliations with them.