MyntBit Daily Report 07.28 | Recession is here!

MyntBit Daily Report is dedicated to provide traders with recap and bring setups to watch for the next trading day.

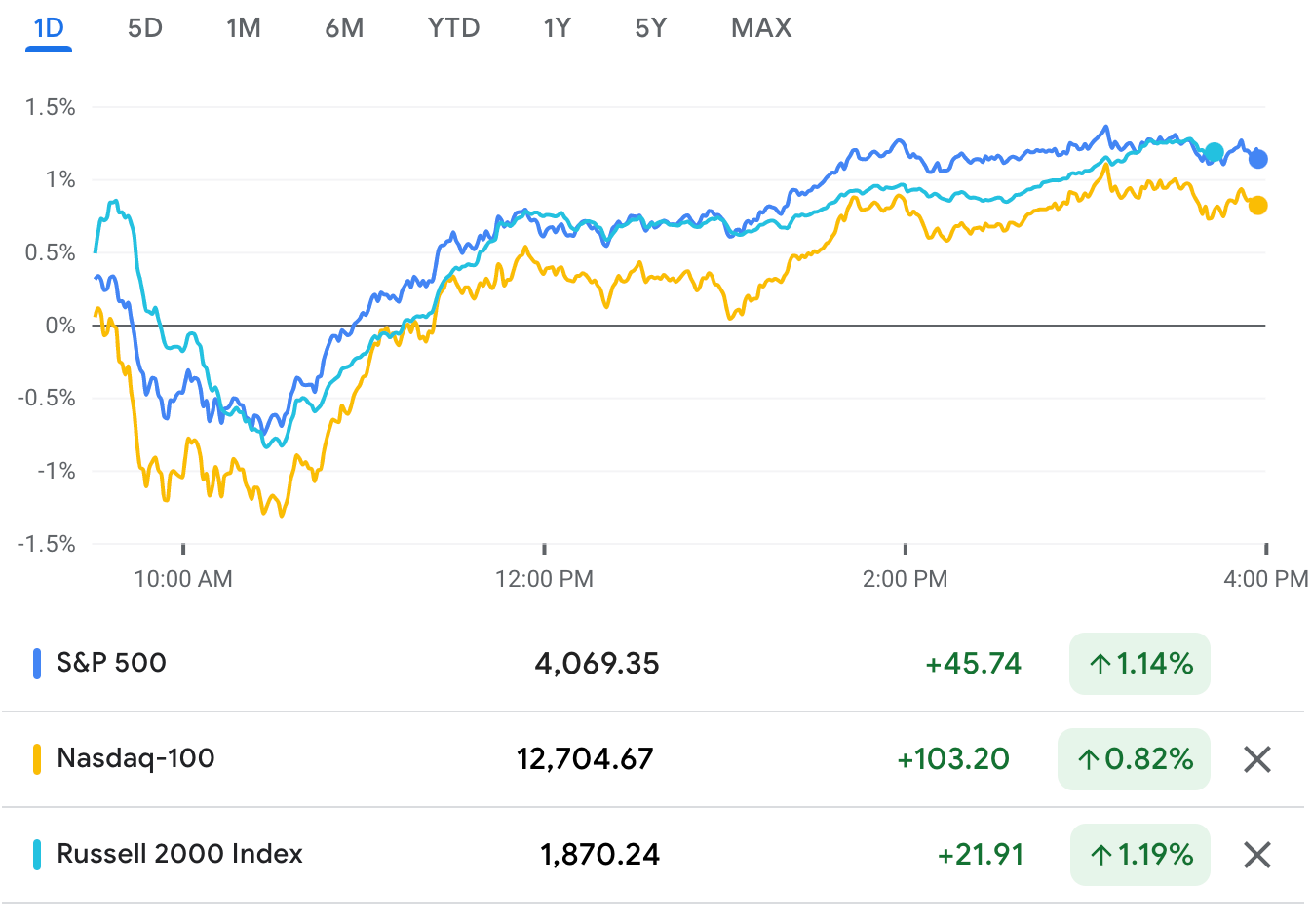

Market Snapshot

RTTNews Market Update

After coming under pressure early in the session, stocks have shown a significant turnaround over the course of the trading day on Thursday. The major averages have climbed well off their early lows and firmly into positive territory.

Currently, the major averages are hovering near their best levels of the day. The Dow is up 236.41 points or 0.7 percent at 32,434.00, the Nasdaq is up 51.46 points or 0.4 percent at 12,083.89 and the S&P 500 is up 30.41 points or 0.8 percent at 4,054.02.

The major averages are extending the rally seen during Wednesday's trading, reaching their best intraday levels in well over a month.

The early weakness on Wall Street came following the release of a Commerce Department report showing a continued contraction in U.S. economic activity in the second quarter of 2022.

The Commerce Department said real gross domestic product decreased by 0.9 percent in the second quarter after slumping by 1.6 percent in the first quarter. Economists had expected GDP to increase by 0.5 percent.

With GDP unexpectedly declining for the second consecutive quarter, the data signals the U.S. economy is in a technical recession.

However, economists cast doubt on whether the economy is actually in a recession, citing other indicators indicating continued growth and persistent strength in the labor market.

The data may have still added to optimism that the Federal Reserve will slow the pace of its interest rate hikes at future meetings, contributing to the turnaround on Wall Street.

Despite the rebound by the broader markets, Meta Platforms (META) continues to post a steep loss after the parent of Facebook and Instagram reported weaker than expected second quarter results, including its first ever year-over-year drop in revenues.

Sector News

Networking stocks are extending the strong upward move seen in the previous session, driving the NYSE Arca Networking Index up by 3.6 percent to its best intraday level in well over two months.

Substantial strength has also emerged among gold stocks, as reflected by the 3.4 percent spike by the NYSE Arca Gold Bugs Index.

The rally by gold stocks comes amid a notable increase by the price of the precious metal, with gold for August delivery jumping $32.60 to $1,751.70 an ounce.

Interest rate-sensitive commercial real estate and utilities stocks are also seeing considerable strength on the day, moving higher along with transportation, chemical and steel stocks.

Meanwhile, oil service stocks have climbed off their worst levels but remain firmly negative amid a modest decrease by the price of crude oil.

Other Markets

In overseas trading, stock markets across the Asia-Pacific region moved mostly higher during trading on Thursday. Japan's Nikkei 225 Index rose by 0.4 percent, while China's Shanghai Composite Index edged up by 0.2 percent.

Most European stocks also moved to the upside over the course of the session. While the U.K.'s FTSE 100 Index closed just below the unchanged line, the German DAX Index advanced by 0.9 percent and the French CAC 40 Index jumped by 1.3 percent.

In the bond market, treasuries have pulled back off their early highs but remain in positive territory. As a result, the yield on the benchmark ten-year note, which moves opposite of its price, is down by 4 basis points at 2.694 percent.

Market Heatmap

Futures Markets

We are in a “Recession,” even though it’s a technical one. The GDP print read came out for the 2Q in the morning and we have two confirmed successive quarters of negative growth:

Q1 GDP -1.4%

Q2 GDP -0.9%

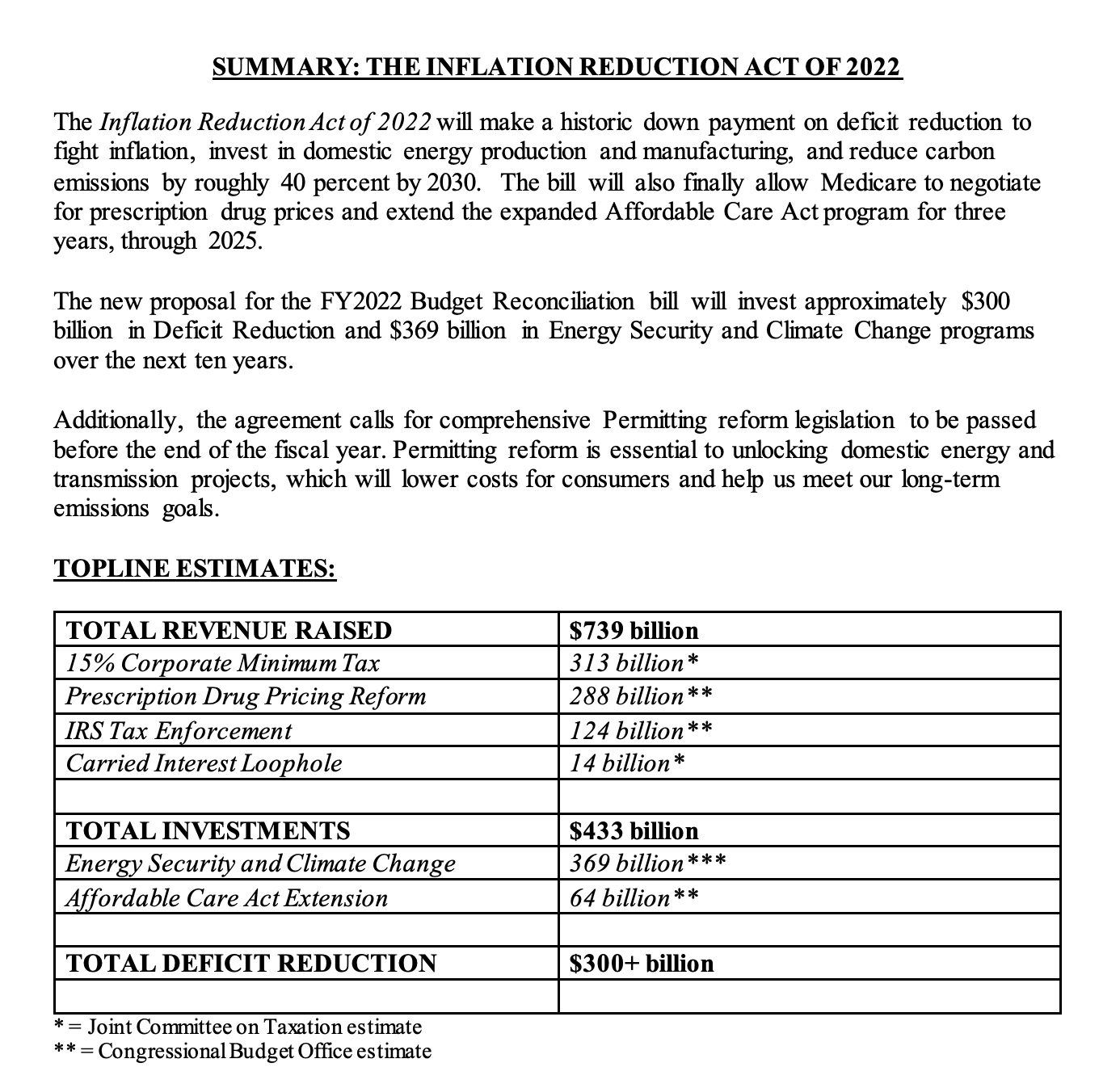

On a similar note, President Biden released his plan for a spending package “The Inflation Reduction Act of 2022” and the Chip bill has passed the House.

Even with negative GDP news, /ES was weak in the morning dipping all the way down to 3990s before rallying to 4080 both of the levels were given in yesterday’s newsletter. Interestingly, /NQ was quite weak compared to the rest of the indices. Also, remember it is the month end so expect volatility tomorrow.

On the earnings front, META -2.39%↓ Q2 earnings and their lowered guidance for Q3 impacted the price action today as it is down over 5 percent. Nothing has changed from our weekly perspective, see below.

Next up, the AAPL 0.33%↑ and AMZN 1.29%↑ earnings after hours which will have impact on the overall market direction moving forward. Keep AAPL and AMZN earnings are today after hours, so if their earnings are like MSFT and GOOGL market will be bullish but if they are like META, then we will be bearish.

/ES - Emini S&P 500

Bullish Scenario

If we OPEN above 4050, the next form of resistance will be around 4075 which was a key area today.

Bearish Scenario

If we OPEN below 4050, if 4030 is the next area that needs to be tested if that gives that could lead us to the 4000 then 3970-80 area where buyers might come in but a break below that is our key level at 3950.

POC: 3960 | Range: 3723 - 4030

/NQ - Emini Nasdaq 100

Bullish Scenario

If we OPEN above 12600, we might see the test of 12700 then a move up to 12900 is possible.

Bearish Scenario

If we OPEN below 12600, we open the possibility of a test of 12500 might with a likely possibility of breaking down to 12300-12100 area before we find any buyers to buy the dip.

POC: 12435 | Range: 11390 - 12726

For the stock watchlist from the weekend and daily updates, please watch the below videos…

Earnings Calendar (Fri. July 29)

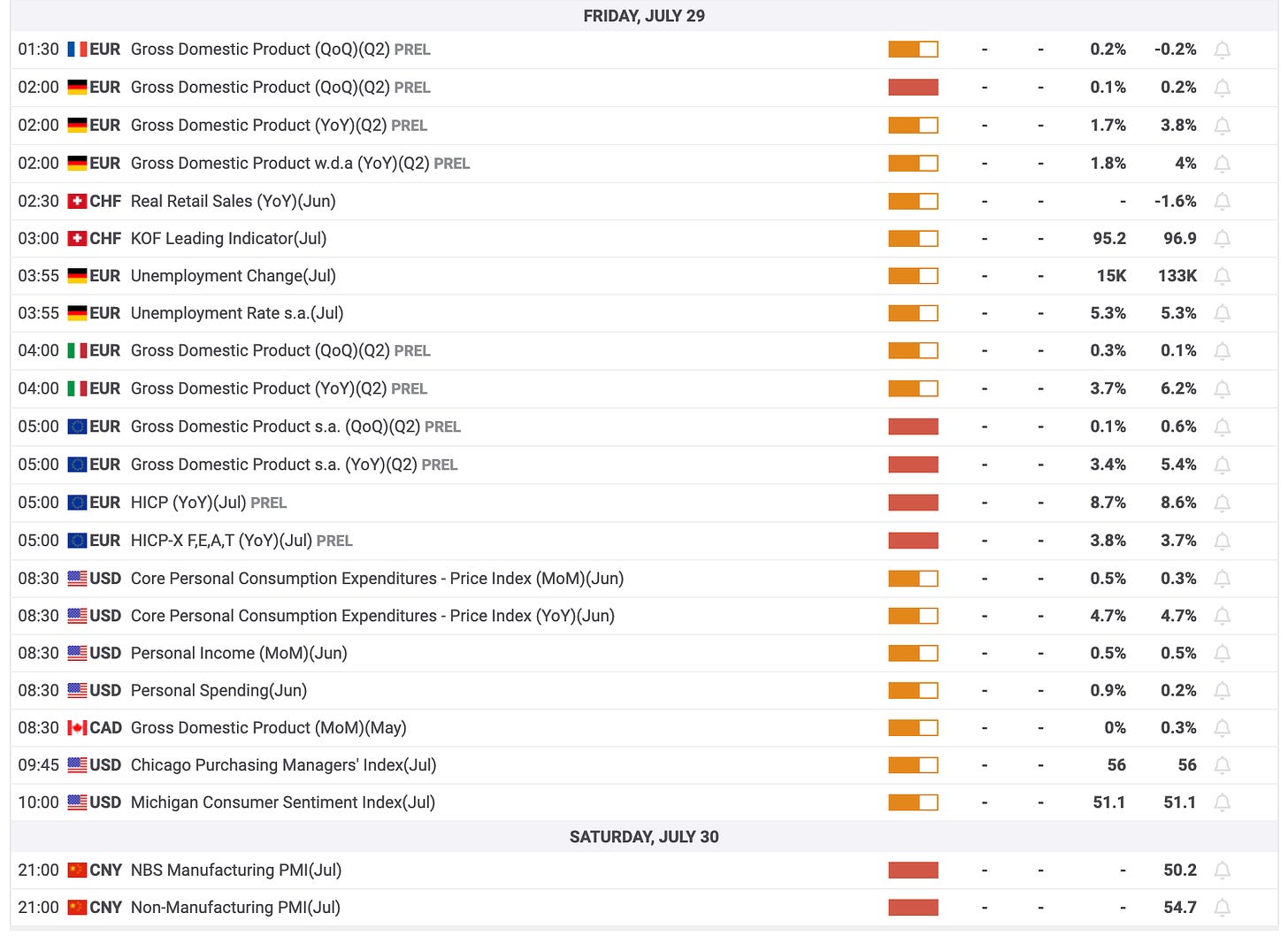

Economic Calendar (Fri. July 29)

Disclaimer: This newsletter is not trading or investment advice, but for general informational purposes only. This newsletter represents our personal opinions which we are sharing publicly for educational purposes. Futures, stocks, bonds trading of any kind involves a lot of risk. No guarantee of any profit whatsoever is made. In fact, you may lose everything you have. So be very careful. We guarantee no profit whatsoever, You assume the entire cost and risk of any trading or investing activities you choose to undertake. You are solely responsible for making your own investment decisions. Owners/authors of this newsletter, its representatives, its principals, its moderators and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission, CFTC or with any other securities/regulatory authority. Consult with a registered investment advisor, broker-dealer, and/or financial advisor. Reading and using this newsletter or any of my publications, you are agreeing to these terms. Any screenshots used here are the courtesy of IBKR, Unusual whales, RTTnews, FXstreet, and/or Tradingview. We are just an end-user with no affiliations with them.