MyntBit Daily Report 07.27 | Stock Market Rallied after another 75 Basis Point Rate Hike!

MyntBit Daily Report is dedicated to provide traders with recap and bring setups to watch for the next trading day.

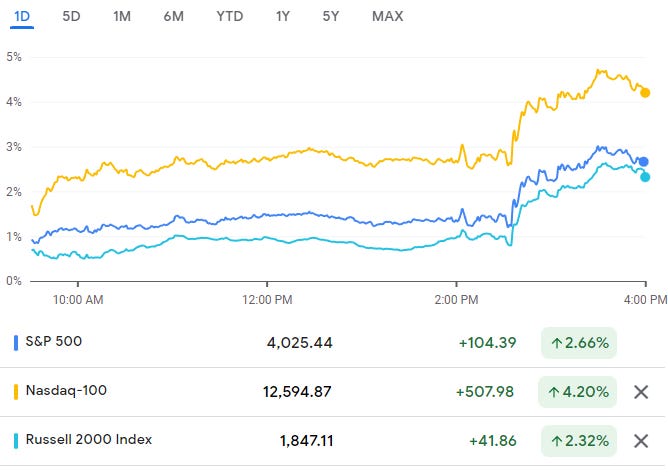

Market Snapshot

RTTNews Market Update

Following the sell-off seen during Tuesday's session, stocks showed a substantial move back to the upside during trading on Wednesday. The major averages more than offset Tuesday's losses, with the Dow and the S&P 500 reaching their best closing levels in well over a month.

The major averages pulled back off their intraday highs going into the close but held on strong gains. While the Nasdaq spiked 469.85 points or 4.1 percent to 12,032.42, the S&P 500 surged 102.56 points or 2.6 percent to 4,023.61 and the Dow jumped 436.05 points or 1.4 percent at 32,197.59.

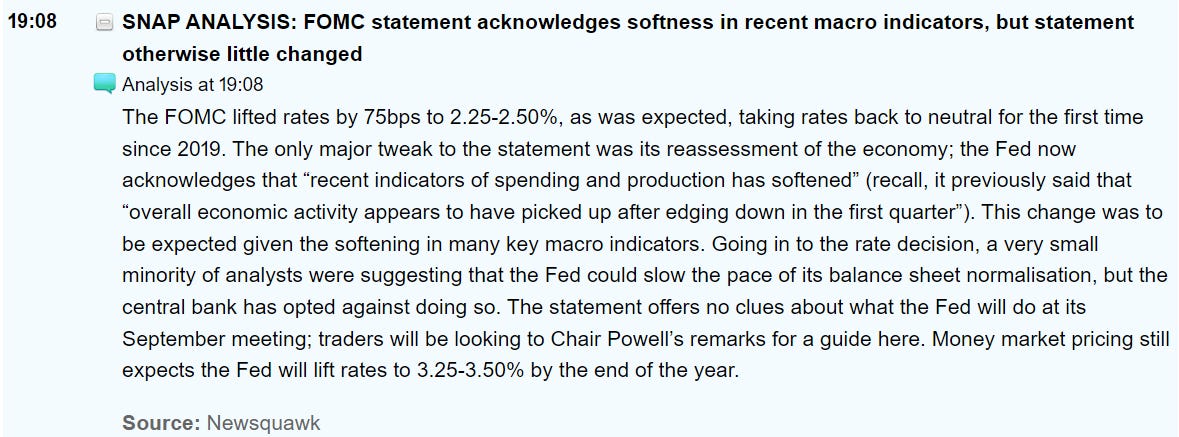

Stocks showed a significant rebound in early trading and accelerated to the upside following the Federal Reserve's monetary policy decision and Fed Chair Jerome Powell's post-meeting press conference.

While the Fed announced another 75 basis point interest rate, as widely expected, comments from Powell hinted at a slowdown in the pace of rate hikes at future meetings.

"As the stance of monetary policy tightens further, it likely will become appropriate to slow the pace of increases while we assess how our cumulative policy adjustments are affecting the economy and inflation," Powell said.

The Fed's next monetary policy meeting is scheduled for September 20-21, with CME Group's FedWatch tool currently indicating a 59.2 percent chance of a 50 basis point rate hike and a 36.7 percent chance of another 75 basis points rate hike.

"With rates now close to the Fed's estimate of neutral, the economy clearly showing signs of a slowdown in the face of rising rates and inflation set to fall in July, we suspect the Fed will shift back to smaller hikes from here, with a 50bp hike in September the most likely option," said Michael Pearce, Senior U.S. Economist at Capital Economics.

The early rally on Wall Street partly reflected strong gains by Google parent Alphabet (GOOGL) and software giant Microsoft (MSFT).

Shares of Alphabet soared by 7.7 percent after ending Monday's trading at its lowest closing level in well over a year.

The rebound by Alphabet came as the company reported second quarter results that missed analyst estimates but were not as bad as some investors had feared.

Shares of Microsoft also surged by 6.7 percent after the company reported weaker than expected fiscal fourth quarter results but provided upbeat guidance.

Meanwhile, traders largely shrugged off separate reports showing an unexpected jump in durable goods orders and a much bigger than expected pullback in pending home sales.

Sector News

Semiconductor stocks turned in some of the market's best performances on the day, resulting in a 4.8 percent spike by the Philadelphia Semiconductor Index.

Substantial strength also emerged among airline stocks, with the NYSE Arca Airline Index soaring by 4.3 percent on the day.

Oil service stocks also saw considerable strength, driving the Philadelphia Oil Service Index up by 4 percent. The strength in the sector came as the price of crude oil for September delivery jumped $2.28 to $97.26 a barrel.

Retail, networking steel and financial stocks also showed notable moves to the upside, while tobacco stocks were among the few groups to buck the uptrend.

Other Markets

In overseas trading, stock markets across the Asia-Pacific region turned in another mixed performance during trading on Wednesday. Japan's Nikkei 225 Index edged up by 0.2 percent, while Hong Kong's Hang Seng Index slumped by 1.1 percent.

Meanwhile, the major European markets all moved to the upside on the day. While the French CAC 40 Index advanced by 0.8 percent, the U.K.'s FTSE 100 Index climbed by 0.6 percent and the German DAX Index rose by 0.5 percent.

In the bond market, treasuries moved higher following the Fed announcement and Powell's comments. Subsequently, the yield on the benchmark ten-year note, which moves opposite of its price, slid 5.3 basis points to a three-month closing low of 2.734 percent.

Looking Ahead

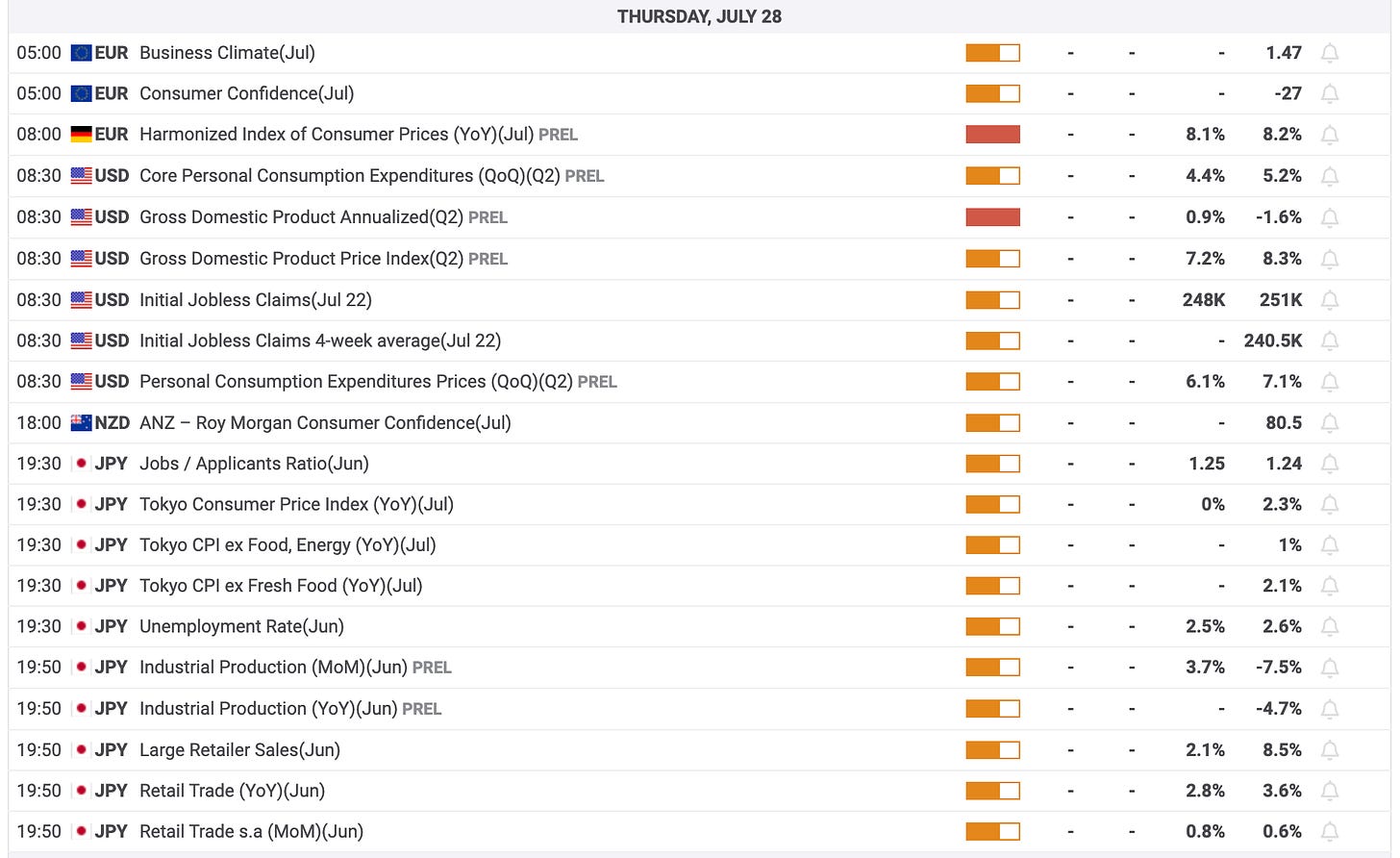

A preliminary reading on second quarter GDP is likely to attract attention on Thursday along with the weekly jobless claims data.

Earnings news is also likely to remain in focus, with Ford (F), Meta Platforms (META), and Qualcomm (QCOM) among the companies releasing their quarterly results after the close of today's trading.

Comcast (CMSA), Hershey Foods (HSY), Honeywell (HON), Mastercard (MA), Merck (MRK) and Pfizer (PFE) are also among the companies due to report their results before the start of trading on Thursday.

Market Heatmap

Futures Markets

What a week it has been so far, with FOMC finally done and dusted we are left with more questions than answers. From the FOMC meeting, we got another 75 bps hike as expected but there is no clear path forward to fight inflation plus our leaders refusing to believe that we are in a recession…

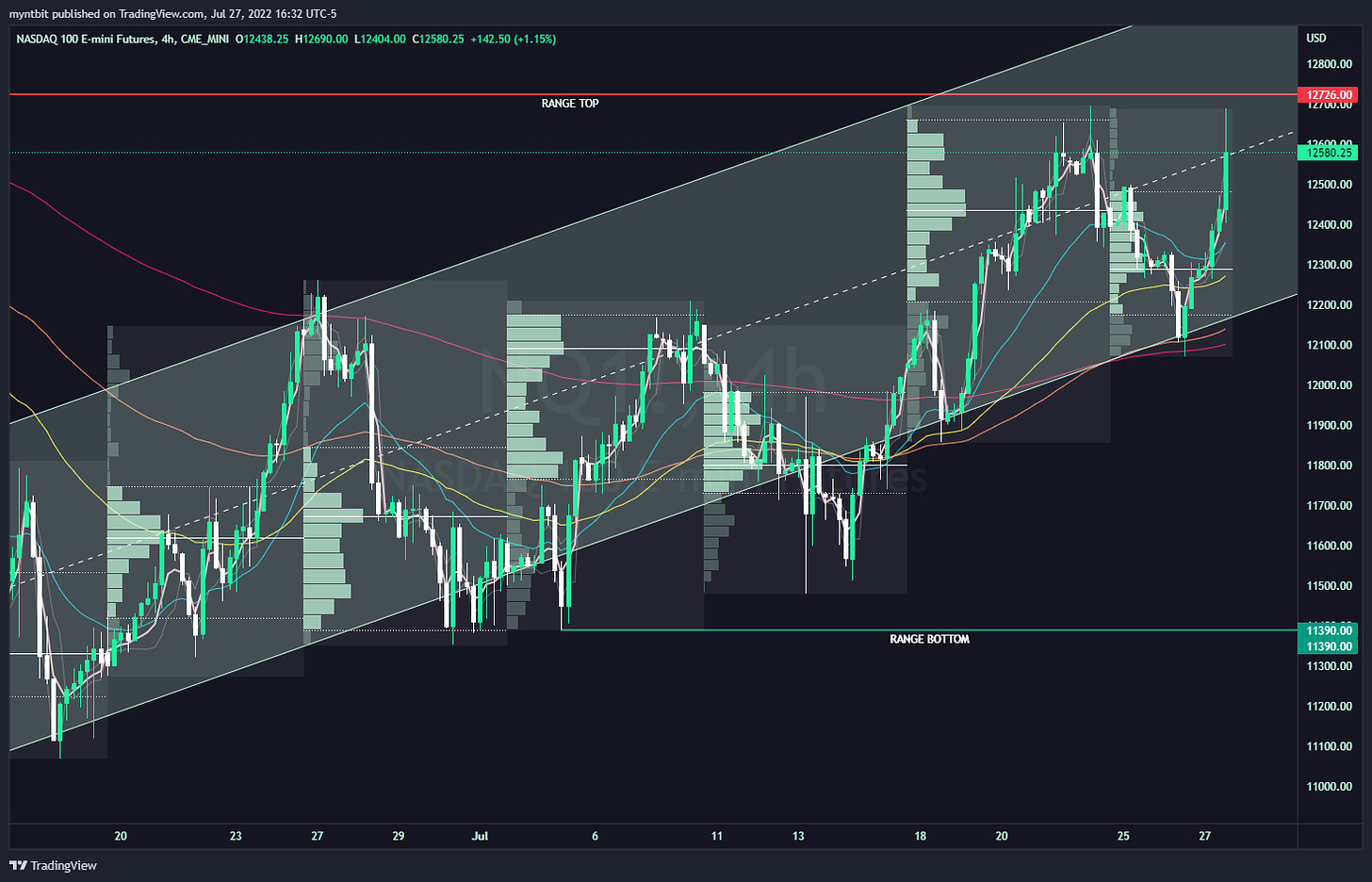

Even with so much uncertainty, the market rallied with /ES topping our range top of 4030 before finishing under it. /NQ again was the strongest of all the indices due to all major tech rallying after the FOMC meeting. Something to note, /NQ does have a double top on a 4-hour time frame.

On the earnings front, META 0.00%↑ followed GOOGL 0.00%↑ and MSFT 0.00%↑ with horrible Q2 earnings plus they lowered their guidance for Q3 but this time around the market didn’t like those results so now we are currently sitting 3 percent down at the time of writing this post. Nothing has changed from our weekly perspective, see below.

Next up, the US GDP reading at 8.30 am EST followed by AAPL 0.00%↑ and AMZN 0.00%↑ earnings after hours.

/ES - Emini S&P 500

Bullish Scenario

If we OPEN above 4030, we need to overcome 4050 levels again these levels have not been tested in a while but the next form of resistance will be around 4075. But further upside might be limited.

Bearish Scenario

If we OPEN below 4030, if 4000 gives that could lead us to the 3970-80 area where buyers might come in but a break below that is our key level at 3950.

Keep in mind we have the GDP reading tomorrow pre-market, so we might have gaps before the open.

POC: 3959 | Range: 3723 - 4030

/NQ - Emini Nasdaq 100

Bullish Scenario

If we OPEN above 12500, we might see the test of 12600 before any sort of resistance then target would be the range top at 12700.

Bearish Scenario

If we OPEN below 12500, we open the possibility of a test of 12300 might with a likely possibility of breaking down to 12000-11800 area before we find any buyers to buy the dip.

POC: 12290 | Range: 11390 - 12726

For the stock watchlist from the weekend and daily updates, please watch the below videos…

Earnings Calendar (Thurs. July 28)

Economic Calendar (Thurs. July 28)

Disclaimer: This newsletter is not trading or investment advice, but for general informational purposes only. This newsletter represents our personal opinions which we are sharing publicly for educational purposes. Futures, stocks, bonds trading of any kind involves a lot of risk. No guarantee of any profit whatsoever is made. In fact, you may lose everything you have. So be very careful. We guarantee no profit whatsoever, You assume the entire cost and risk of any trading or investing activities you choose to undertake. You are solely responsible for making your own investment decisions. Owners/authors of this newsletter, its representatives, its principals, its moderators and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission, CFTC or with any other securities/regulatory authority. Consult with a registered investment advisor, broker-dealer, and/or financial advisor. Reading and using this newsletter or any of my publications, you are agreeing to these terms. Any screenshots used here are the courtesy of IBKR, Unusual whales, RTTnews, FXstreet, and/or Tradingview. We are just an end-user with no affiliations with them.