MyntBit Daily Report 07.26 | Stocks weary ahead of FOMC

MyntBit Daily Report is dedicated to provide traders with recap and bring setups to watch for the next trading day.

Market Snapshot

RTTNews Market Update

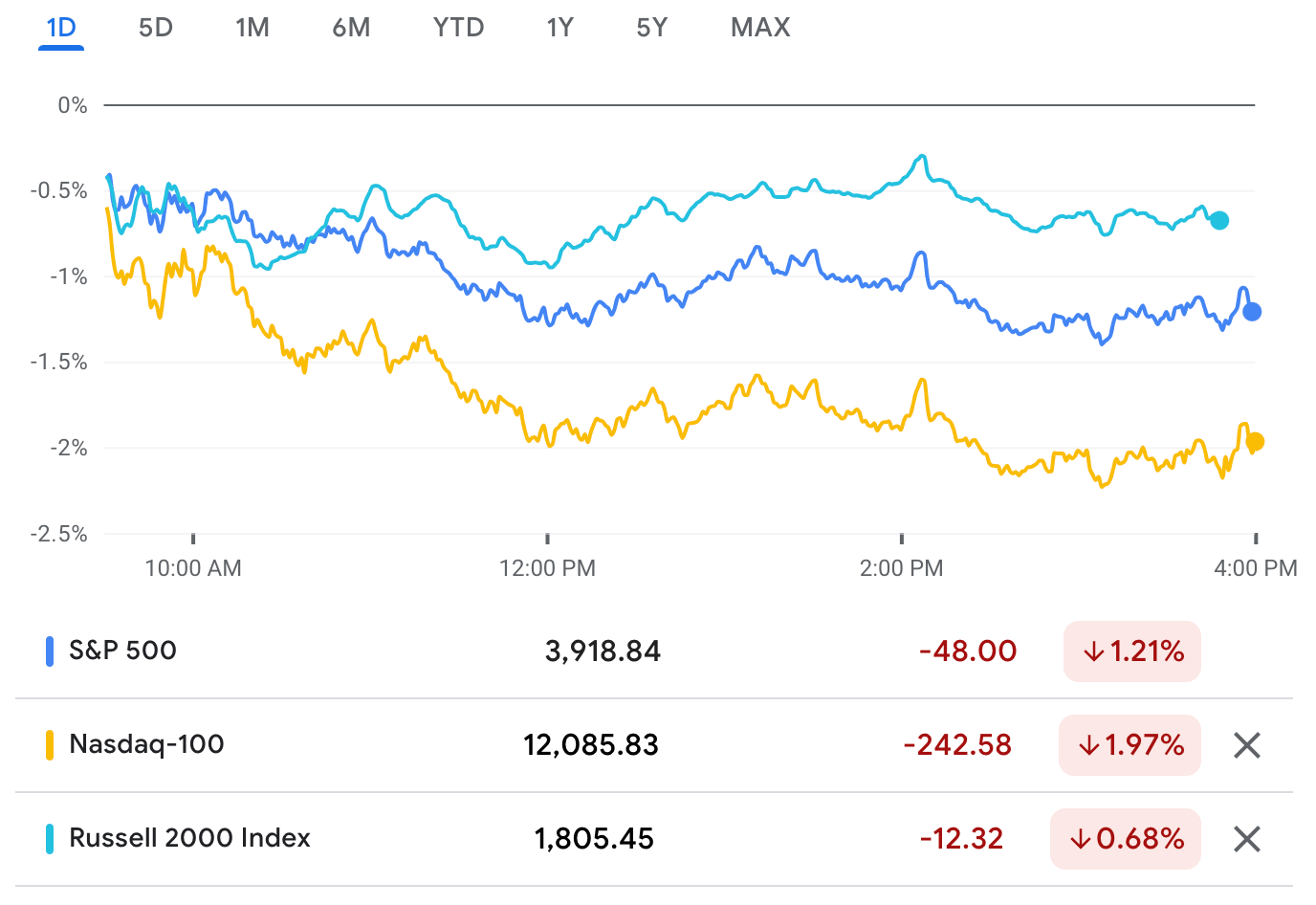

Following the mixed performance seen during Monday's session, stocks moved sharply lower over the course of the trading day on Tuesday. The major averages all showed notable moves to the downside, with the tech-heavy Nasdaq showing a particularly steep drop.

The major averages climbed off their worst levels going into the close but remained firmly negative. While the Nasdaq tumbled 220.09 points or 1.9 percent to 11,562.57, the S&P 500 slumped 45.79 points or 1.2 percent to 3,921.05 and the Dow slid 228.50 points or 0.7 percent to 31,761.54.

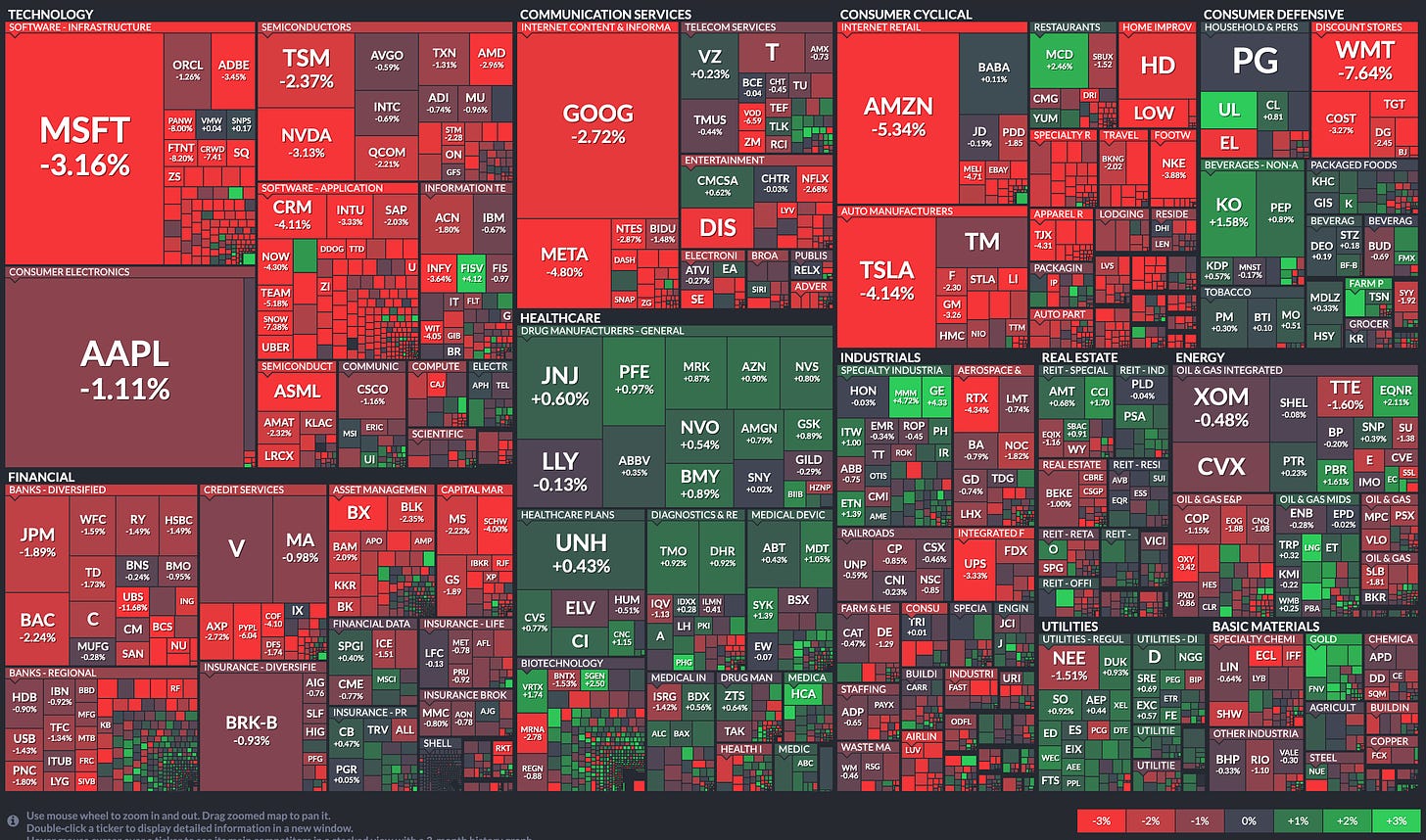

A steep drop by shares of Walmart (WMT) weighed on the markets, with the retail giant plunging by 7.6 percent to its lowest closing level in almost a month.

Walmart came under pressure after lowering its guidance for the second quarter and full year primarily due to pricing actions aimed to improve inventory levels.

Auto giant General Motors (GM) also moved to the downside after reporting second quarter earnings that missed analyst estimates.

Meanwhile, a strong gain by 3M (MMM) limited the downside for the Dow, with the conglomerate jumping by 4.9 percent after reporting better than expected second quarter results and announcing plans to spin off its health care business.

Shares of General Electric (GE) also surged after the conglomerate reported second quarter results that exceeded expectations on both the top and bottom lines.

The weakness on Wall Street also came as traders looked ahead to the Federal Reserve's monetary policy announcement on Wednesday.

The Fed is widely expected to announce another 75 basis point rate hike as part of its efforts to combat elevated inflation.

In U.S. economic news, the Commerce Department released a report showing new home sales pullback by more than expected in the month of June.

The report said new home sales plunged by 8.1 percent to an annual rate of 590,000 in June after jumping by 6.3 percent to a revised rate of 642,000 in May.

Economists had expected new home sales to tumble by 5.2 percent to an annual rate of 660,000 from the 696,000 originally reported for the previous month.

With the bigger than expected decrease, new home sales slumped to their lowest annual rate since hitting 582,000 in April 2020.

A separate report released by the Conference Board showed consumer confidence in the U.S. deteriorated by more than expected in the month of July.

The Conference Board said its consumer confidence index slid to 95.7 in July from a downwardly revised 98.4 in June. Economists had expected the index to drop to 96.8 from the 98.7 originally reported for the previous month.

Sector News

Retail stocks moved sharply lower following the warning from Walmart, dragging the Dow Jones U.S. Retail Index down by 4 percent.

The index continued to give background after ending last Thursday's trading at its best closing level in well over two months.

Significant weakness was also visible among airline stocks, as reflected by the 2.7 percent nosedive by the NYSE Arca Airline Index.

Financial stocks also showed notable moves to the downside on the day, with the KBW Bank Index and the NYSE Arca Broker/Dealer Index slumping by 2.2 percent and 1.7 percent, respectively.

Semiconductor and oil stocks also saw considerable weakness, while gold stocks bucked the downtrend despite a modest decrease by the price of the precious metal.

Other Markets

In overseas trading, stock markets across the Asia-Pacific region turned in a mixed performance during trading on Tuesday. Japan's Nikkei 225 Index edged down by 0.2 percent, while China's Shanghai Composite Index advanced by 0.8 percent.

Meanwhile, European stocks moved mostly lower on the day. While the U.K.'s FTSE 100 Index closed nearly unchanged, the French CAC 40 Index fell by 0.4 percent and the German DAX Index slumped by 0.9 percent.

In the bond market, treasuries gave back ground after an early rally but remained positive. Subsequently, the yield on the benchmark ten-year note, which moves opposite of its price, fell by 3.3 basis points to 2.787 percent after hitting a three-month intraday low of 2.707 percent.

Looking Ahead

Trading on Wednesday is likely to be driven by reaction to the Federal Reserve's monetary policy decision and accompanying statement.

Ahead of the Fed announcement, traders are likely to keep an eye on reports on durable goods orders and pending home sales.

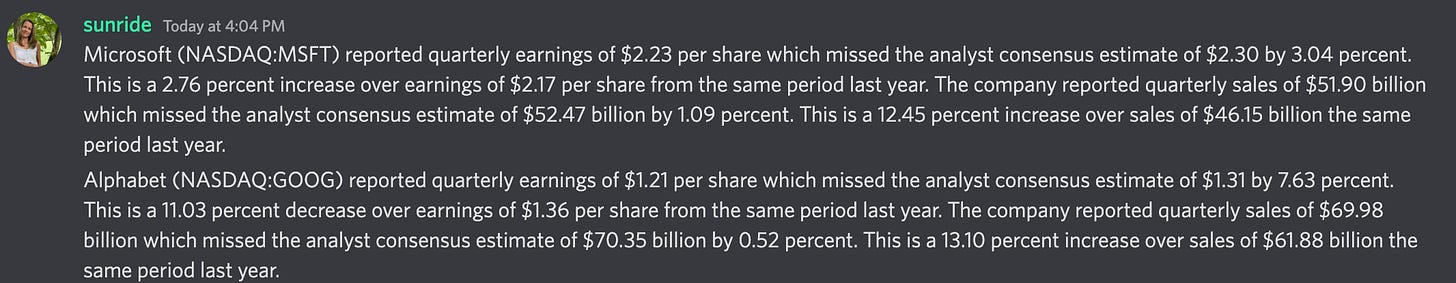

On the earnings front, Alphabet (GOOGL), Microsoft (MSFT), and Visa (V) are among the companies releasing their quarterly results after the close of today's trading.

Boeing (BA), Bristol-Myers Squibb (BMY), Kraft Heinz (KHC), and Spotify (SPOT) are also among the companies due to report their quarterly results before the start of trading on Wednesday.

Market Heatmap

Futures Markets

There were early indicators of about the weakness in today’s price action as suggested in yesterday’s newsletter.

So, today we say weakness across the board especially in tech sectors ahead of the key FOMC decision tomorrow. /ES, did manage to open below yesterday’s level at 3950 and bounced off of the 3910 levels suggested by yesterday’s newsletter. /NQ again was weaker of all the indices due to the following factors: WMT’s revision on their forecast for this quarter and the rest of the year, SHOP cutting their workforce by 10 percent, and major earnings from GOOGL and MSFT looming.

On that note, GOOGL and MSFT earnings results are as follows…

At the time of writing this post, GOOGL is up over 2 percent while MSFT is down over 1.5 percent. But, the market is waiting on FOMC thus the subdue reaction on those earnings. On the FOMC note, there is a 75% likelihood the Fed increase the rate by another 75 basis points with a 25% chance of a 100 basis point move. Nothing has changed from our weekly perspective, see below.

Next up, the FOMC meeting at 2 pm EST followed by FED president Powell speaking at 2.30 pm EST on the monitory policy decision.

/ES - Emini S&P 500

Bullish Scenario

If we OPEN above 3930, we need to overcome 3950 levels again which has been a key support turned resistance but if there is a follow-through the price sees a move towards 4000 where we could see sellers step in.

Bearish Scenario

If we OPEN below 3930, we might see the 3910 range where we found buyers step in to buy the dip.

Keep in mind that FOMC is tomorrow at 2 pm EST. Until the FOMC meeting, we might see this range bond action before a move in either direction.

POC: 3955 | Range: 3723 - 4030

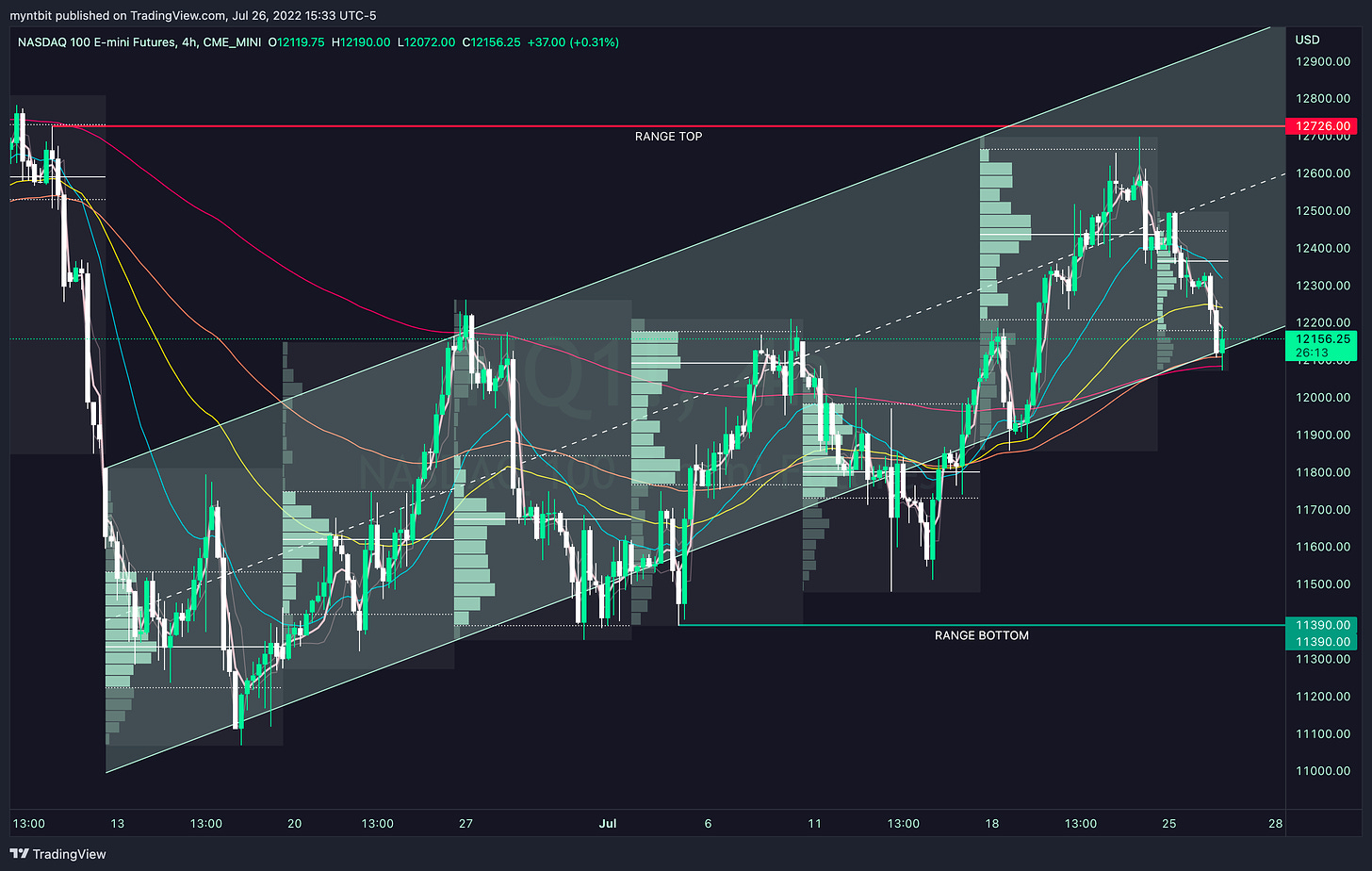

/NQ - Emini Nasdaq 100

Bullish Scenario

If we OPEN above 12200, we might see the test of 12330 before any sort of resistance then the next target up would be 12500.

Bearish Scenario

If we OPEN below 12200, we might see a move down to 12000-11800 area before we find any buyers to buy the dip.

But further upside or downside might be limited until after the FOMC meeting is concluded.

POC: 12364 | Range: 11390 - 12726

Stocks Update

The levels for the stocks on our watchlist are doing pretty well. As the following 8 out of 10 stocks have hit at least our first targets.

ENPH, META, XOM, GOOGL, SNOW, TTD, AMZN, MSFT

For more stock that we covered, watch the below video…

Earnings Calendar (Wed. July 27)

Economic Calendar (Wed. July 27)

Disclaimer: This newsletter is not trading or investment advice, but for general informational purposes only. This newsletter represents our personal opinions which we are sharing publicly for educational purposes. Futures, stocks, bonds trading of any kind involves a lot of risk. No guarantee of any profit whatsoever is made. In fact, you may lose everything you have. So be very careful. We guarantee no profit whatsoever, You assume the entire cost and risk of any trading or investing activities you choose to undertake. You are solely responsible for making your own investment decisions. Owners/authors of this newsletter, its representatives, its principals, its moderators and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission, CFTC or with any other securities/regulatory authority. Consult with a registered investment advisor, broker-dealer, and/or financial advisor. Reading and using this newsletter or any of my publications, you are agreeing to these terms. Any screenshots used here are the courtesy of IBKR, Unusual whales, RTTnews, FXstreet, and/or Tradingview. We are just an end-user with no affiliations with them.