MyntBit Daily Report 07.25 | Stock Market Calm Before The Storm

MyntBit Daily Report is dedicated to provide traders with recap and bring setups to watch for the next trading day.

Market Snapshot

RTTNews Market Update

U.S. stocks ended on a mixed note on Monday after a choppy session as investors largely stayed cautious, looking ahead to some key earnings updates, the GDP data and the Federal Reserve's monetary policy announcement.

The Fed, which is scheduled to announce its interest rate decision on Wednesday, is widely expected to announce another 75-basis points hike. CME Group's FedWatch tool is currently indicating a 77.5 percent chance of a 75 basis point interest rate hike and a 22.5 percent chance of a 100 basis point rate hike.

Investors also look ahead to data on consumer confidence, new home sales, durable goods orders, second quarter GDP and personal income and spending, due during the course of this week.

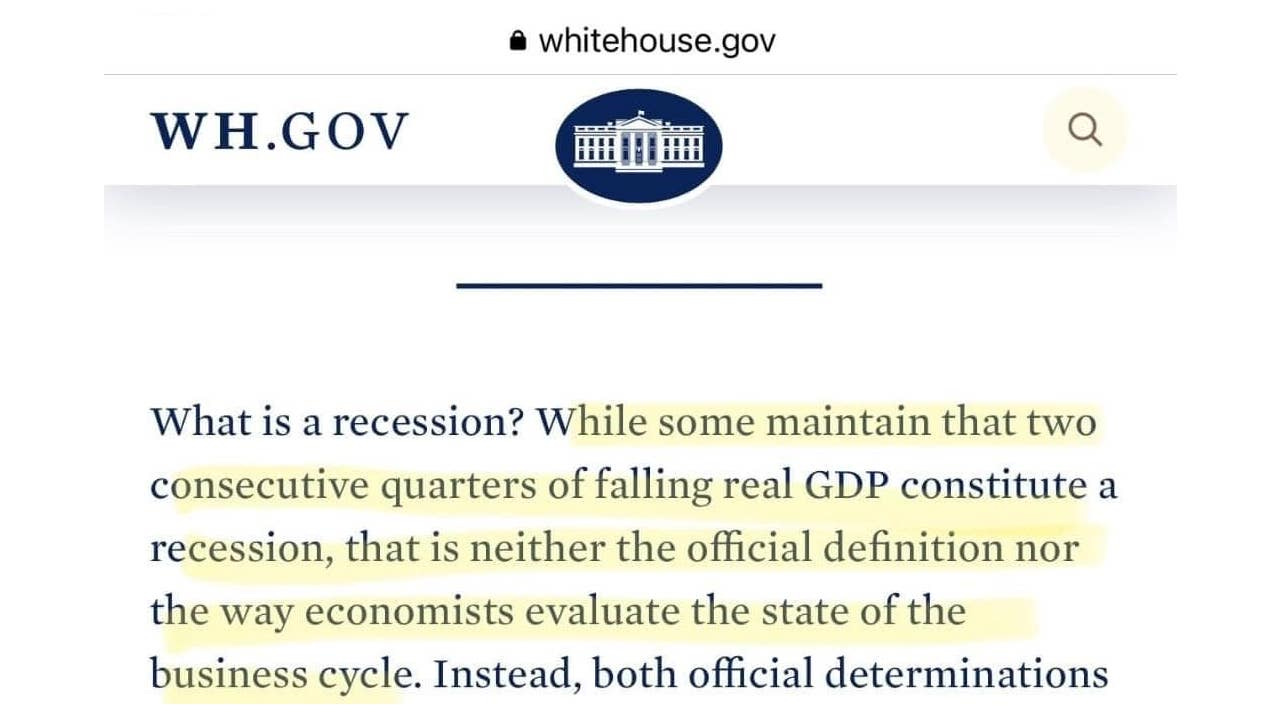

The major averages ended mixed. The Dow ended with a gain of 90.75 points or 0.28 percent at 31,990.04, and the S&P 500 settled with a gain of 5.21 points or 0.13 percent at 3,966.84, while the Nasdaq finished with a loss of 51.45 points or 0.43 percent at 11,782.67.

Technology stocks struggled for direction, continued to be weighed down by weak earnings update from Snap last week.

Shares of Microsoft, Meta Platforms, Apple and Alphabet all closed in negative territory despite coming off the day's lows.

Energy stocks fared well as crude oil prices moved up sharply. Chevron climbed nearly 3%. Marathon Oil, APA, and Diamondback Energy also ended notably higher.

Shares of Newmont Mining Corp plunged nearly 14 percent after quarterly earnings fell short of expectations. The company's earnings came in at $387 million, or $0.49 per share, compared with $650 million, or $0.81 per share, in last year's second quarter.

Travelers Companies, Caterpillar, UnitedHealth, Amgen and Coca-Cola posted strong gains.

Salesforce.com ended lower by nearly 3 percent, and McDonalds drifted down by about 1.4 percent.

Other Markets

In overseas trading, Asian stocks ended broadly lower on Monday as weak business activity data from Europe and the United States coupled with anxiety about China's property market added to worries about a recession.

European stocks turned in a mixed performance with investors looking ahead to corporate earnings updates and the U.S. Federal Reserve's policy announcement, due on Wednesday.

Market Heatmap

Thanks for reading OptionTrader by MyntBit! Subscribe for free to receive new posts and support my work.

Futures Markets

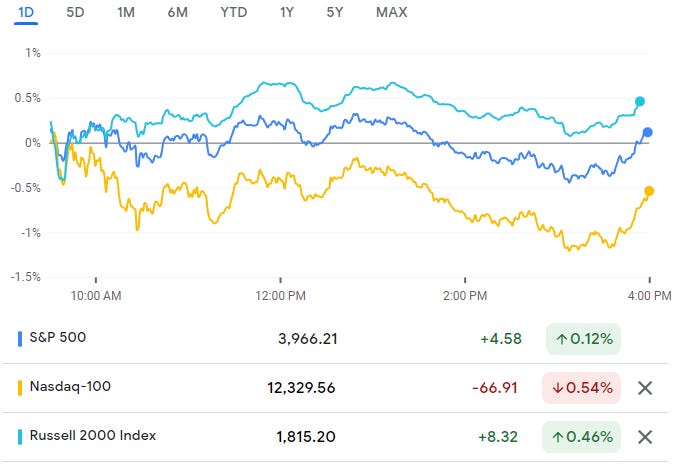

Inside day on /ES, with a lot of choppiness as we await the upcoming data points and earnings. We are expecting uncertainty before the FOMC meeting and earnings. While our leaders discusses the definition of a “recession”.

A couple of other key things to note, /NQ was significantly weaker compared to other indices (is that a warning of what is to come) and WMT revised their forecast for this quarter which caused pain in other sympathy stocks such AMZN, TGT, and COST. Nothing has changed from our weekly perspective, see below.

MyntBit Weekly Report 07.24 | Big Week Coming up!

Next up, again major earnings tomorrow from GOOGL and MSFT while not much on the data front.

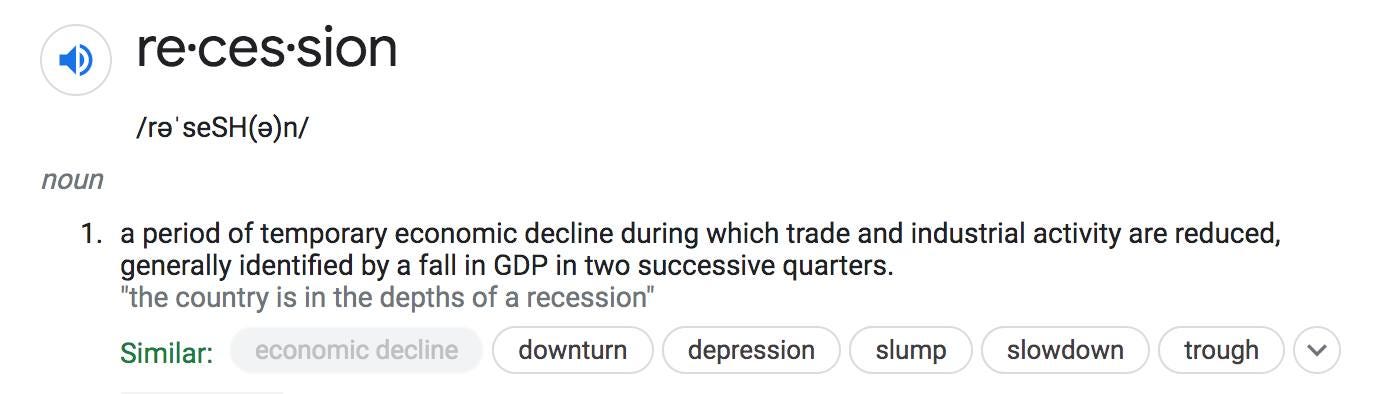

/ES - Emini S&P 500

Bullish Scenario

If we OPEN above 3950, we need to overcome 3980 levels again which has been a key resistance but if there is a follow-through the price sees a move towards 4000 where we could see sellers step in.

Bearish Scenario

If we OPEN below 3950, we might see the 3910 range where we found buyers step in to buy the dip.

Keep in mind that we do have earnings and FOMC coming up.Until the FOMC meeting, we might see this range breaking unless there is a catalyst.

POC: 3959 | Range: 3723 - 4030

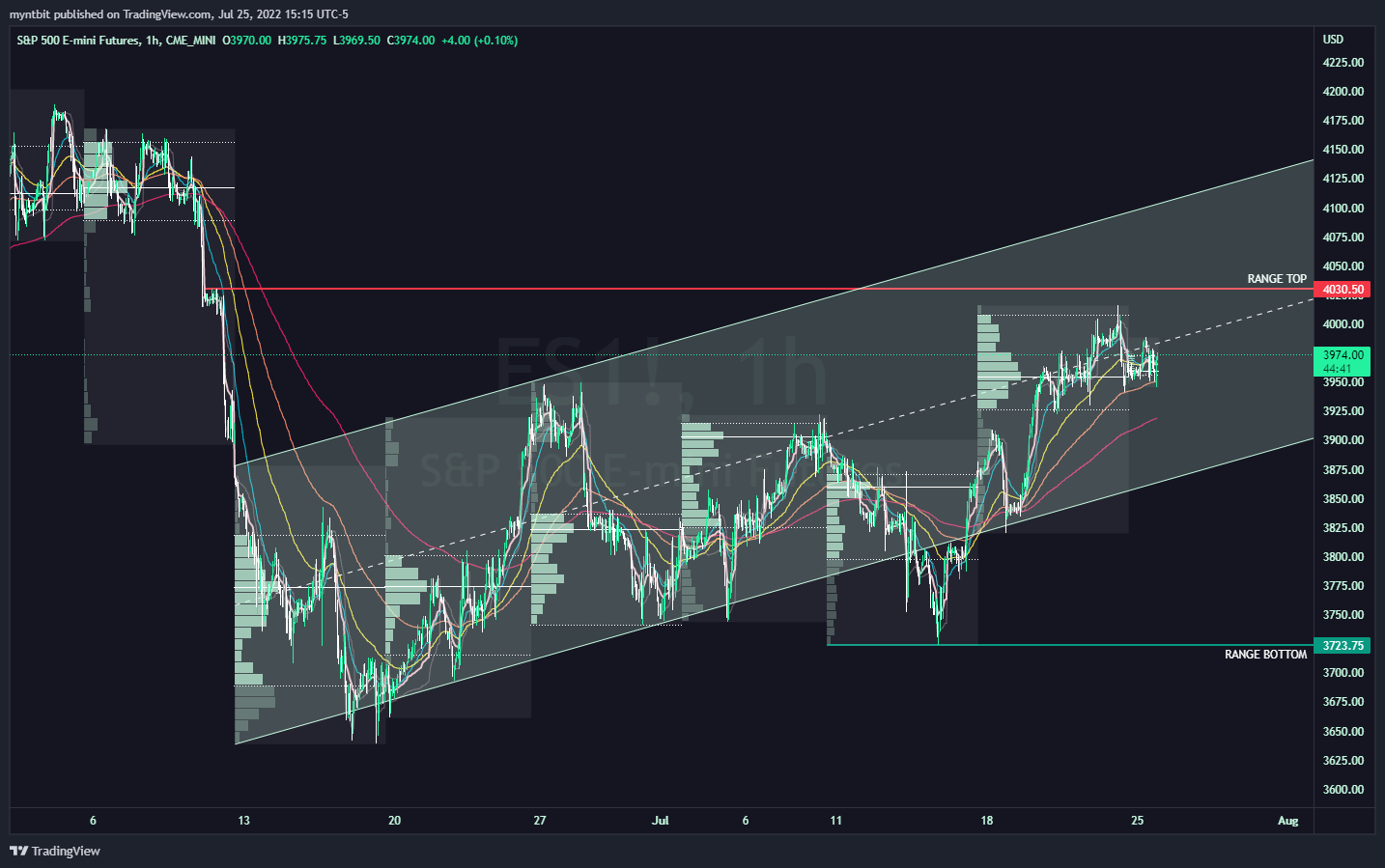

/NQ - Emini Nasdaq 100

Bullish Scenario

If we OPEN above 12400, we might see the test of 12510 before any sort of resistance.

Bearish Scenario

If we OPEN below 12400, we might see a move down to 12300-12100 area before we find any buyers to buy the dip. But further breakdown might be limited until the FOMC meeting.

POC: 12356 | Range: 11390 - 12726

Stocks Update

We did pretty well with the levels as SNOW, XOM and ENPH hit our first targets while the rest are following in their direction. For more stock that we covered, watch the below video…

Earnings Calendar (Tue. July 26)

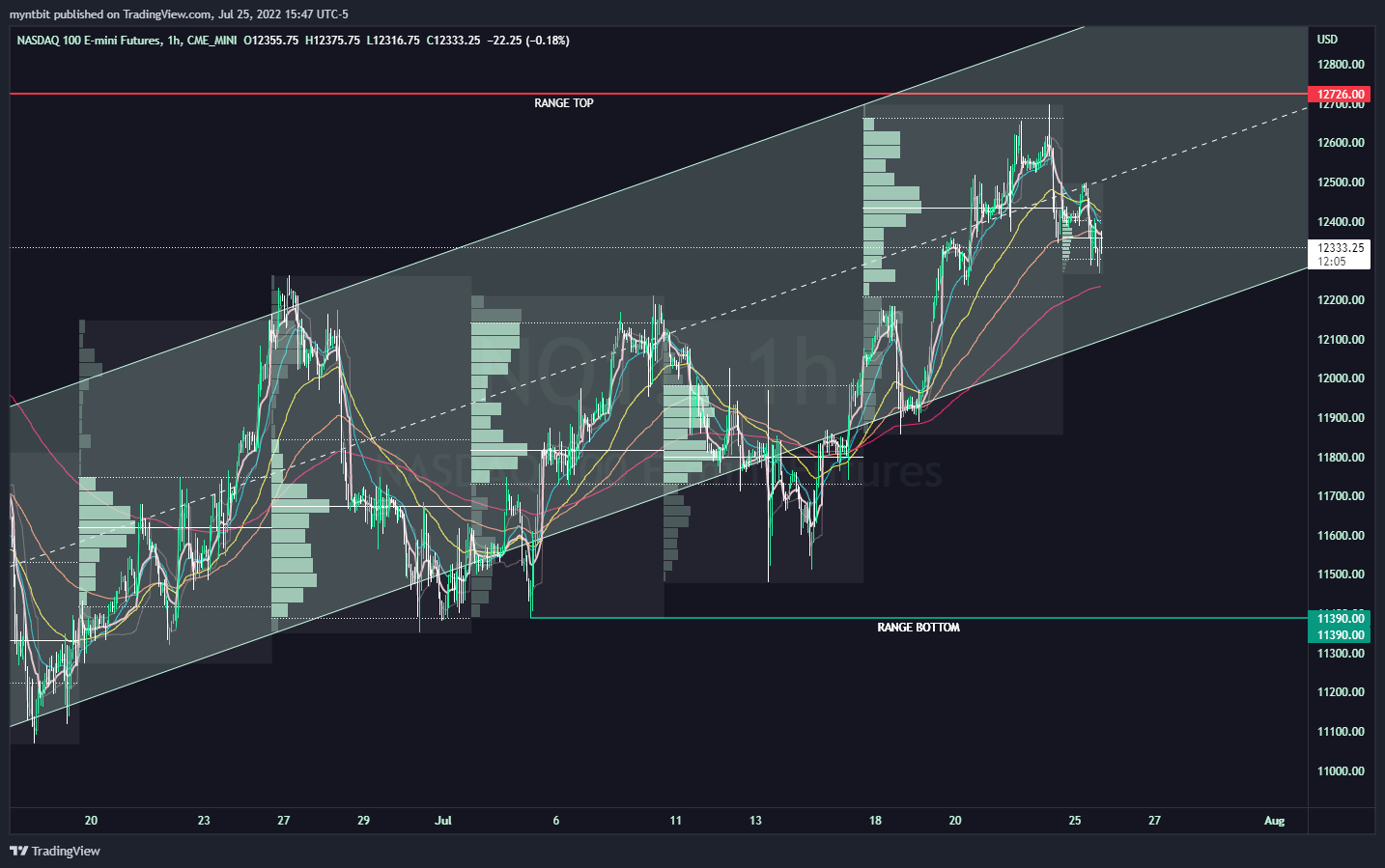

Economic Calendar (Tue. July 26)

Disclaimer: This newsletter is not trading or investment advice, but for general informational purposes only. This newsletter represents our personal opinions which we are sharing publicly for educational purposes. Futures, stocks, bonds trading of any kind involves a lot of risk. No guarantee of any profit whatsoever is made. In fact, you may lose everything you have. So be very careful. We guarantee no profit whatsoever, You assume the entire cost and risk of any trading or investing activities you choose to undertake. You are solely responsible for making your own investment decisions. Owners/authors of this newsletter, its representatives, its principals, its moderators and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission, CFTC or with any other securities/regulatory authority. Consult with a registered investment advisor, broker-dealer, and/or financial advisor. Reading and using this newsletter or any of my publications, you are agreeing to these terms. Any screenshots used here are the courtesy of IBKR, Unusual whales, RTTnews, FXstreet, and/or Tradingview. We are just an end-user with no affiliations with them.