Market Trader Report V2#37

MyntBit's Market Trader Report brings potential setups for futures & stocks with a time horizon from days to weeks depending on price action. The following research is based on Fundamentals, Technical & Options Analysis.

What is included in this week's edition?

WEEKLY REVIEW: An overview of current market standing, fundamental matters with implications upon the market, and general sentiment regarding the major US indices.

LOOKING AHEAD: Key takeaways to consider as we look forward to the upcoming trading week.

FUTURES MARKETS: ES, NQ, RTY - A technical review of the major indices, futures, and commodities that represent the overall health of the market.

Market Trader by MyntBit

MyntBit PREMIUM

Black Friday Deals - 30% OFF

⚠️ Note - these are only on PREMIUM Subscription. These offers will end on Nov 27 2023 at 12 am EST

Black Friday Deal on Monthly Premium Subscription till the end of the year

Use code: black-friday-monthly

Black Friday Deal on Yearly Premium Subscription for the first year

Use code: black-friday-yearly

Get access to Premium Discord (MT PREMIUM ONLY)

After Signing up, please complete this form with your name (discord username) and email (used for subscription) to get access to the premium channels.

❗ Use the form in the below link. Please allow at least 24 hours to get complete access.

Support

Weekly Market Review

The stock market had another successful week, with the S&P 500 surpassing the 4,500 mark on Friday, following its flirtation with 4,100 in late October. The positive momentum was fueled in part by the observation that there was limited selling activity post a significant market surge. Investors also exhibited a fear of missing out on potential further gains, especially during a seasonally robust period for the market.

While mega-cap stocks contributed to the index's performance, the broader market saw increased buying interest. The market-cap weighted S&P 500 rose by 2.2% for the week, while the Invesco S&P 500 Equal Weight ETF (RSP) surged by 3.4%. Additionally, the Vanguard Mega Cap Growth ETF (MGK) recorded a gain of 2.1%.

The week's gains were largely influenced by the October Consumer Price Index released on Tuesday, supporting the belief that the Federal Reserve has concluded its rate hikes. This sentiment was reinforced by reports such as the October Producer Price Index, October Retail Sales, weekly initial jobless claims, and October Housing Starts, all indicating a scenario of a soft landing for the economy.

As a result, the Fed funds futures market recalibrated, eliminating the likelihood of further rate hikes by the Fed. It now predicts a 61.7% probability of the first-rate cut occurring in May 2024, according to the CME FedWatch Tool.

In response to this data and the perceived Fed stance, Treasury yields experienced a notable decline. The 2-year note yield dropped by 15 basis points to 4.90%, while the 10-year note yield decreased by 19 basis points to 4.44%.

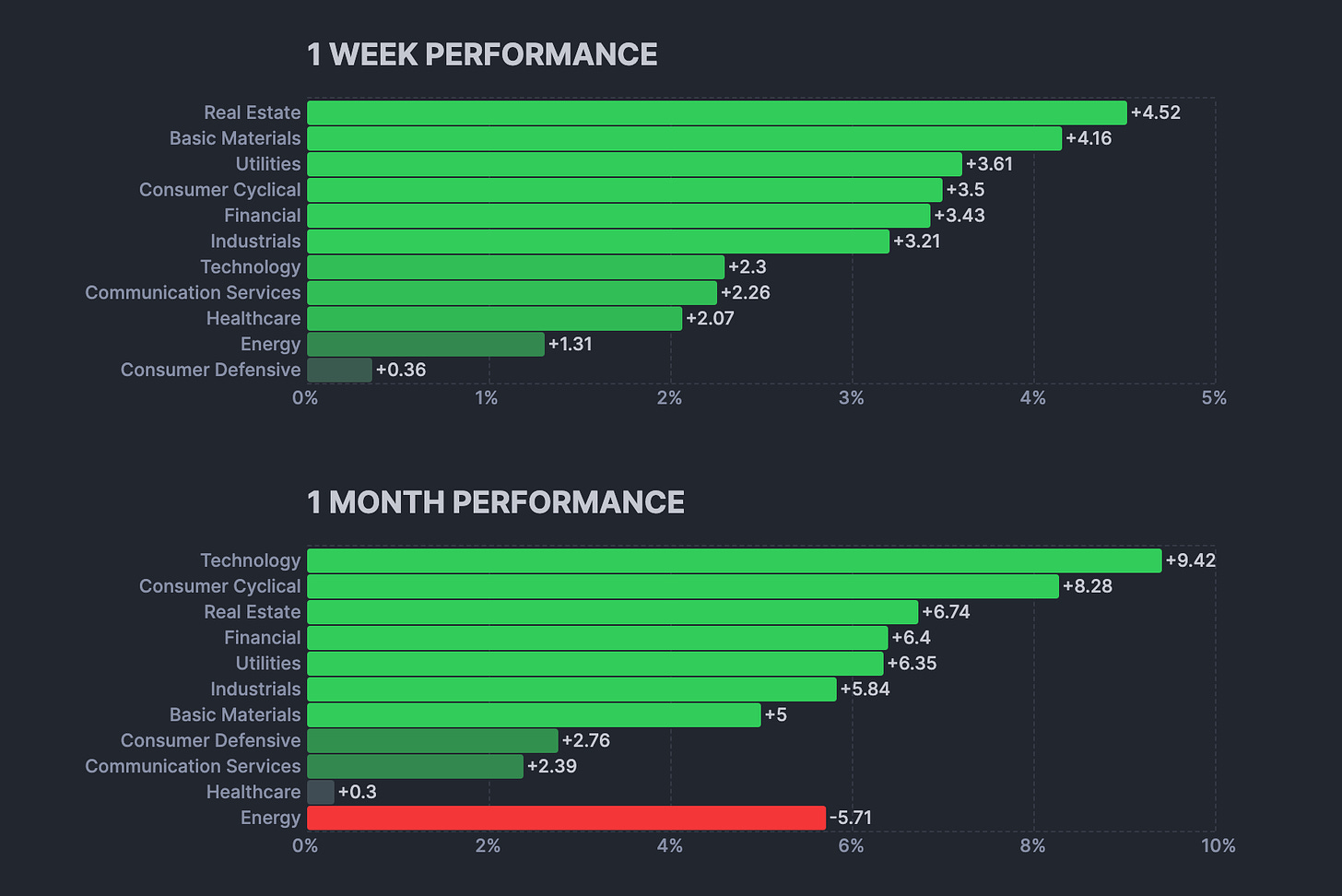

Sectors sensitive to interest rates posted substantial gains, with all 11 sectors trading higher during the week. Notably, the real estate (+4.5%), financials (+3.3%), and utilities (+3.0%) sectors stood out, while consumer staples (+0.6%) and energy (+0.9%) sectors were the only ones with gains less than 1.0%.

Investors were also focused on corporate earnings reports, with Walmart (WMT) and Target (TGT) noting a more cautious consumer sentiment. Despite this, Target saw a significant gain after reporting its results. Standout winners in the earnings season included Gap (GPS), Ross Stores (ROST), and Macy's (M).

Applied Materials (AMAT), a leading chip equipment maker, reported earnings but faced a decline following a Reuters report indicating it is under a Department of Justice (DOJ) criminal probe related to shipments to China's top chipmaker, SMIC.

In other news, Congress passed a continuing resolution to prevent a government shutdown, and Presidents Biden and Xi agreed to resume high-level, direct military talks, along with bilateral cooperation in combating global illicit drug manufacturing and trafficking.

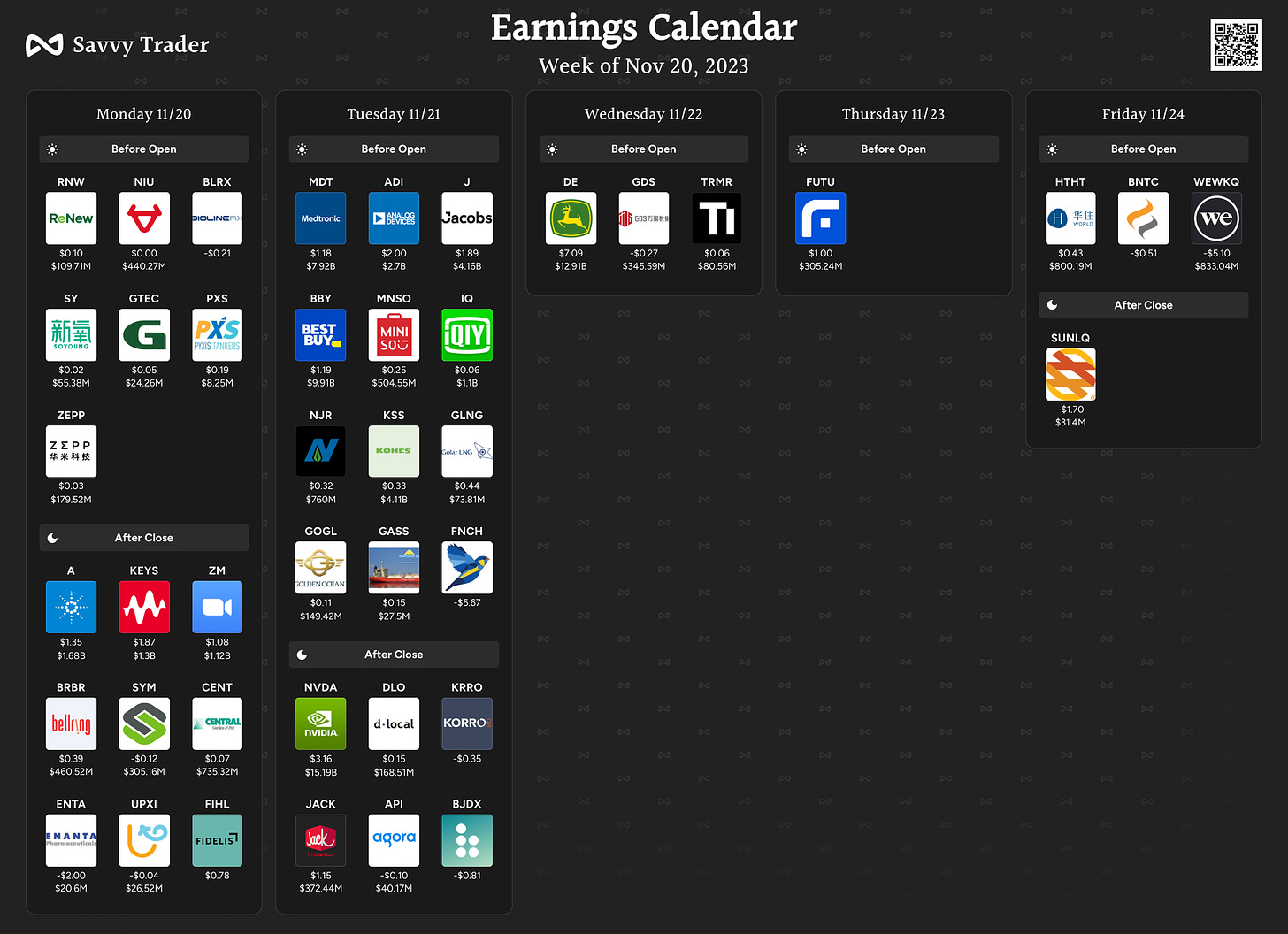

Looking ahead, markets will be closed on Thursday, and Friday's trading will conclude at 1:00 p.m. ET in observance of Thanksgiving.

Weekly Performance Heatmap

Overall Stock Market Heatmap & Sector Performance

Looking Ahead to the Upcoming Week

The upcoming holiday-shortened week will feature several key economic indicators. One notable event is the release of the first look at November Purchasing Managers' Indexes (PMIs) for manufacturing and services by S&P Global on Friday. Investors will also closely monitor the Federal Open Market Committee's (FOMC) meeting minutes from November 1, along with reports on October's durable goods orders and the Conference Board's index of leading economic indicators. Additionally, the docket includes data on October's existing home sales, the Chicago Federal Reserve's National Activity Index, and finalized November consumer sentiment and inflation expectations from the University of Michigan.

In the auction space, the U.S. Treasury Department is set to issue $57 billion in 2-, 10-, and 20-year securities. Turning to Asia, although China has a light data calendar, attention will shift to Japan, where updates on November PMIs, October's national CPI and services PPI, and September's finalized leading index are anticipated. Elsewhere in the region, investors will watch for South Korea's Producer Price Index (PPI) report and Australian releases, including November PMIs and October's Westpac Leading Index.

In Europe, the focus will be on the first reading of November Eurozone PMIs for the manufacturing and services sectors, along with consumer confidence. From Germany, key indicators to watch include Ifo's business climate survey, Producer Price Index (PPI), and finalized third-quarter gross domestic product. The United Kingdom's November PMIs and consumer confidence will also be closely observed. In Vienna, the Organization of the Petroleum Exporting Countries and 11 other non-OPEC members (OPEC+) will meet at the end of the week to discuss production levels.

Key Events/News in Focus

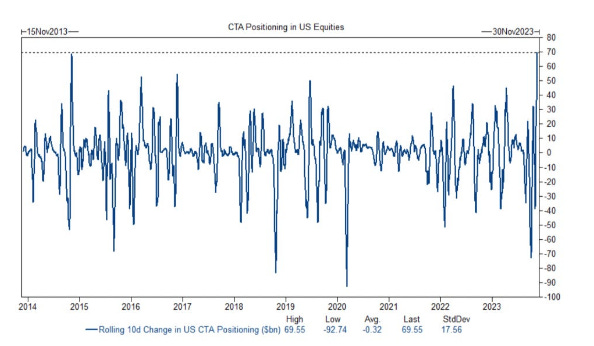

CTAs purchased $70 billion of U.S. Stocks over the last 10 days, the highest amount ever recorded

NVDA earnings.

Mircosoft - OpenAI drama with Sam Altman and others leaving.

These groups have stopped advertising on X, per NYT: Apple, Disney, Paramount, Lionsgate, IBM, Comcast, NBC Universal and The European Commission.

Elon Musk responding with a lawsuit against Media Matters: https://x.com/elonmusk/status/1725771191644758037?s=20

Lastly, Jim Chanos's implosion will send at least some minor shock waves across Wall Street.