Market Trader Report V2#36

MyntBit's Market Trader Report brings potential setups for futures & stocks with a time horizon from days to weeks depending on price action. The following research is based on Fundamentals, Technical & Options Analysis.

What is included in this week's edition?

WEEKLY REVIEW: An overview of current market standing, fundamental matters with implications upon the market, and general sentiment regarding the major US indices.

LOOKING AHEAD: Key takeaways to consider as we look forward to the upcoming trading week.

FUTURES MARKETS: ES, NQ, RTY, VIX - A technical review of the major indices, futures, and commodities that represent the overall health of the market.

Market Trader by MyntBit

Weekly Market Review

The market had a solid performance this week, building on the significant gains from the previous week. Despite a substantial influx of earnings news, attention was primarily directed towards the movements of mega-cap stocks.

The Vanguard Mega Cap Growth ETF (MGK) surged by 3.4% this week, outpacing the 1.3% gain in the market-cap weighted S&P 500, which concluded the week above the 4,400 level. In contrast, the Invesco S&P 500 Equal Weight ETF (RSP) experienced a 0.6% decline.

Despite widespread anticipation of a stock pullback, the broader market demonstrated resilience against selling pressures, with the S&P 500 now boasting a 7.2% increase from its low close on October 27.

However, small and mid-cap stocks deviated from this trend, succumbing to some selling pressure. The Russell 2000 dropped by 3.2%, and the S&P Mid Cap 400 saw a 1.6% decline.

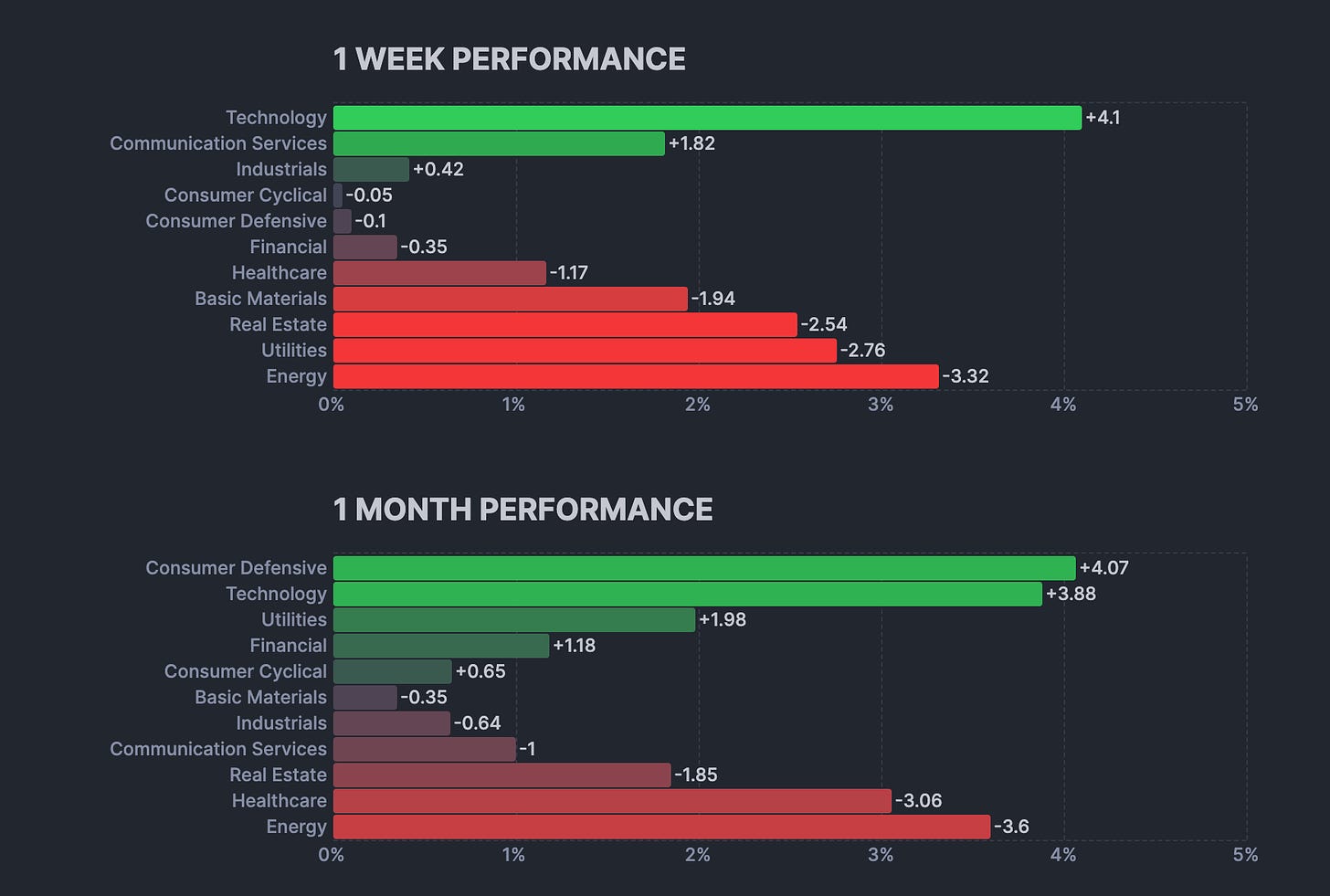

Among the 11 S&P 500 sectors, six recorded gains. Information technology (+4.8%) and communication services (+2.2%) sectors, carrying significant weight, were the top performers, followed by consumer discretionary (+0.9%). Conversely, the energy (-3.8%), utilities (-2.6%), and real estate (-2.1%) sectors experienced the most substantial declines.

The broader market's rebound momentum was tempered by an increase in market rates following Treasury auctions and comments from Fed Chair Powell. The 2-year note yield climbed 19 basis points to 5.05%, and the 10-year note yield rose seven basis points to 4.63%.

While the sales of 3- and 10-year notes on Tuesday and Wednesday were met with satisfactory demand, Thursday's 30-year bond auction faced dismal interest.

Throughout the week, various Fed officials addressed the public, but the market's primary focus was on Fed Chair Powell's IMF panel discussion on Thursday. Powell reiterated his November 1 remarks, emphasizing the Fed's readiness to tighten policy further if deemed appropriate.

Weekly Performance Heatmap

Overall Stock Market Heatmap & Sector Performance

Looking Ahead to the Upcoming Week

The focal point of the upcoming week will be centered around inflation data, commencing with the release of the Consumer Price Index (CPI) on Tuesday, followed by the unveiling of the Producer Price Index (PPI) and import prices later in the week. Market observers will also keep a close eye on updates regarding retail sales and industrial production, in addition to November's regional business surveys from the New York and Philadelphia Fed Districts.

The economic calendar is brimming with activity, featuring a flurry of housing market data encompassing housing starts, building permits, and homebuilder sentiment. Other notable updates include small business optimism, business inventories, and international capital flows.

Investors will closely monitor the Friday deadline for Congress to pass a budget or implement an additional continuing resolution to avert a government shutdown. In the Asian markets, attention will be directed towards major Chinese releases, including October's retail sales, industrial production, and fixed asset investment. From Japan, key indicators include the preliminary read on third-quarter gross domestic product (GDP), along with October's trade balance and September's Tertiary Industry Index and core machine orders. Elsewhere in the region, updates on the South Korean unemployment rate and Australian releases, encompassing labor market data, business, and consumer confidence, will be of significance.

Turning to Europe, the spotlight will be on third-quarter eurozone GDP, the finalized October CPI, and September's foreign trade and industrial production. British economic indicators for October, such as retail sales, CPI, and labor market data, will also command attention. Additionally, Germany's ZEW survey of November business conditions is set to be a noteworthy development.

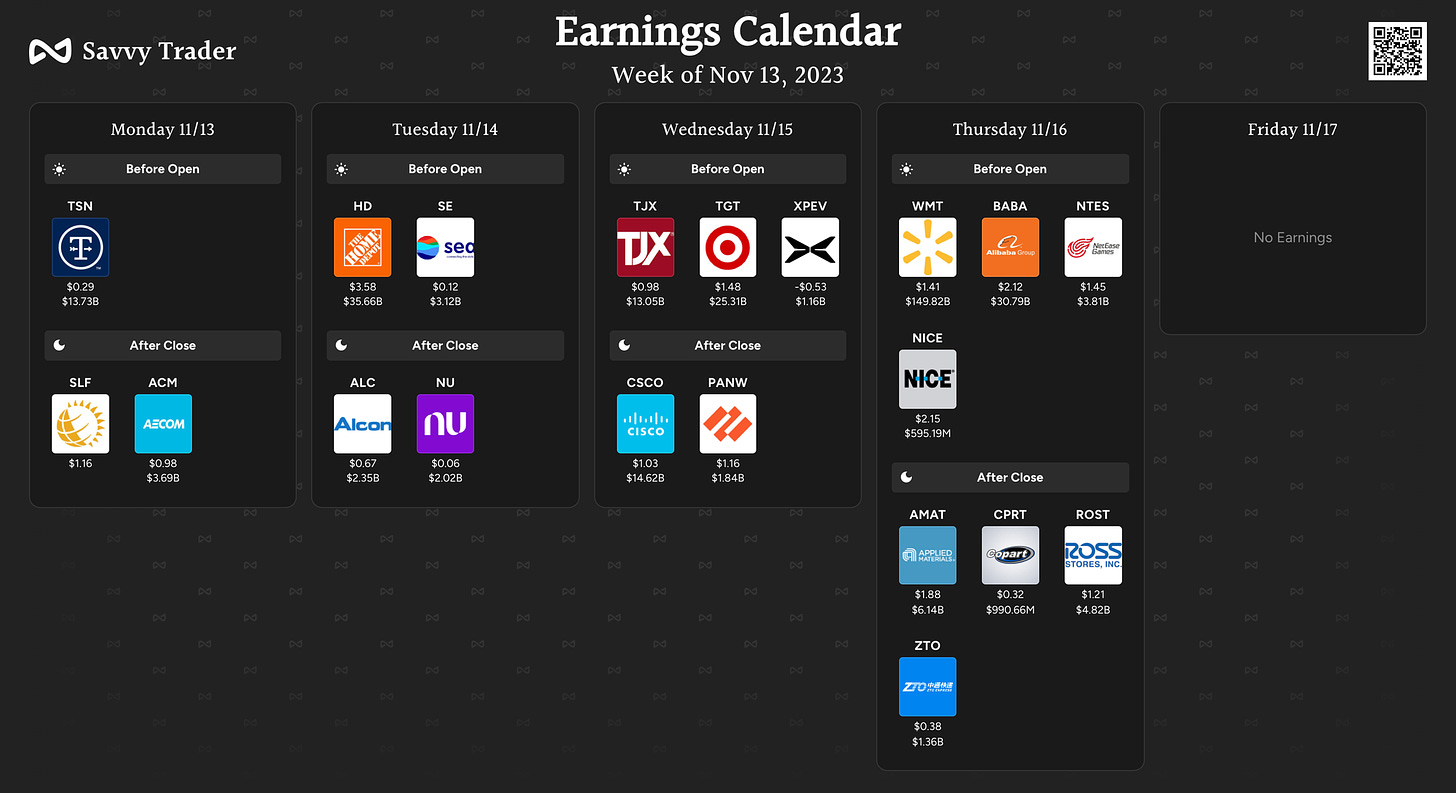

Earnings Calendar