Market Trader Report V2#34

MyntBit's Market Trader Report brings potential setups for futures & stocks with a time horizon from days to weeks depending on price action. The following research is based on Fundamentals, Technical & Options Analysis.

What is included in this week's edition?

WEEKLY REVIEW: An overview of current market standing, fundamental matters with implications upon the market, and general sentiment regarding the major US indices.

LOOKING AHEAD: Key takeaways to consider as we look forward to the upcoming trading week.

FUTURES MARKETS: ES, NQ, RTY - A technical review of the major indices, futures, and commodities that represent the overall health of the market.

SPDR SECTORS & ETFs: SPY, QQQ, IWM - An in-depth review of the SPDR sectors with keynotes on market strength, opportunities, and relative rotation.

Market Trader by MyntBit

Weekly Review

The S&P 500 had a tough week, ending 10.3% lower than its July 31 high.

Both Invesco S&P 500 Equal Weight ETF (RSP) and market-cap weighted S&P 500 fell 2.5%.

Only utilities sector (+1.2%) saw gains; the communication services (-6.3%) and energy (-6.2%) sectors had significant declines.

Alphabet (GOOG) saw a 9.8% decline due to disappointing cloud business growth, while Meta Platforms (META) fell 3.9% after an earnings report.

Positive reactions for Microsoft (MSFT) and Amazon.com (AMZN) after their quarterly results.

Several blue-chip companies had better-than-expected earnings, including Verizon (VZ), Coca-Cola (KO), Dow (DOW), RTX (RTX), General Electric (GE), and 3M (MMM).

Geopolitical tension heightened with US airstrikes in Syria and Israel expanding operations in Gaza.

Economic data included 4.9% real GDP growth in Q3 and ongoing concerns about inflation.

Treasury yields saw declines, with the 2-yr note yield at 5.03% and the 10-yr note yield at 4.85%.

Rep. Mike Johnson (R-LA) was elected Speaker of the House with unanimous Republican support.

Weekly Performance Heatmap

Overall Stock Market Heatmap & Sector Performance

Looking Ahead to the Upcoming Week

Key events and data releases for the upcoming week include:

United States:

Federal Reserve's October 31 - November 1 policy meeting.

October jobs report, private unemployment data, and Job Openings and Labor Turnover Survey (JOLTS).

October PMIs for manufacturing and services from the Institute for Supply Management.

Finalized readings from S&P Global.

August home prices, September construction spending, and factory orders.

October consumer confidence and Chicago PMI.

Measures of labor costs and productivity for the third quarter.

Asia:

Chinese October PMIs for manufacturing and services sectors, including official government release and private data from Caixin.

Bank of Japan's early-week policy meeting.

Updates on Japan's jobless rate, retail sales, consumer confidence, and industrial production.

South Korea's updates on October's Consumer Price Index (CPI), trade balance, and manufacturing PMI.

Australia's releases include building approvals, trade balance, and a measure of inflation.

Europe:

First looks at third-quarter GDP and October's CPI for various European countries.

October's finalized manufacturing PMIs and eurozone consumer confidence.

Bank of England's policy meeting.

British data releases, including house prices and mortgage approvals.

France's industrial production and Producer Price Index.

Germany's unemployment change and trade balance.

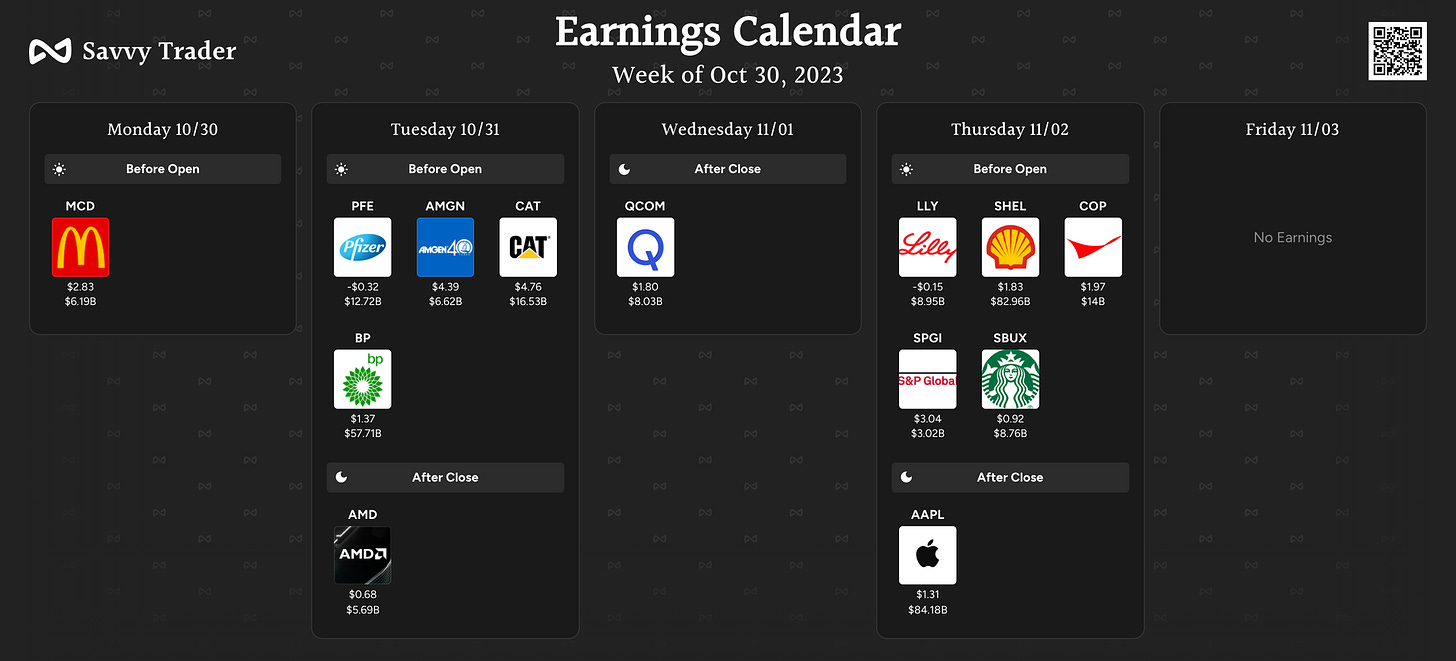

Earnings Calendar