Market Trader Report V2#33

MyntBit's Market Trader Report brings potential setups for futures & stocks with a time horizon from days to weeks depending on price action. The following research is based on Fundamentals, Technical & Options Analysis.

What is included in this week's edition?

WEEKLY REVIEW: An overview of current market standing, fundamental matters with implications upon the market, and general sentiment regarding the major US indices.

LOOKING AHEAD: Key takeaways to consider as we look forward to the upcoming trading week.

FUTURES MARKETS: ES, NQ, RTY - A technical review of the major indices, futures, and commodities that represent the overall health of the market.

SPDR SECTORS & ETFs: SPY, QQQ, IWM - An in-depth review of the SPDR sectors with keynotes on market strength, opportunities, and relative rotation.

Market Trader by MyntBit

Weekly Review

Equities had a widespread decline this week, primarily driven by concerns about interest rates and some risk aversion related to the Israel-Hamas conflict.

Uncertainty regarding a potential ground invasion by Israeli forces into Gaza weighed on market sentiment ahead of the weekend.

Treasury market experienced volatility, with the 10-year note yield reaching 5.00% and the 2-year note yield rising.

Fed Chair Powell's speech indicated the possibility of tighter financial conditions due to rising long-term rates.

Dysfunction in the House of Representatives was notable, with Rep. Jim Jordan losing his Speaker of the House nominee status.

Economic data provided a mixed picture, with strong retail sales and jobless claims but weak existing home sales and a negative Leading Indicators index.

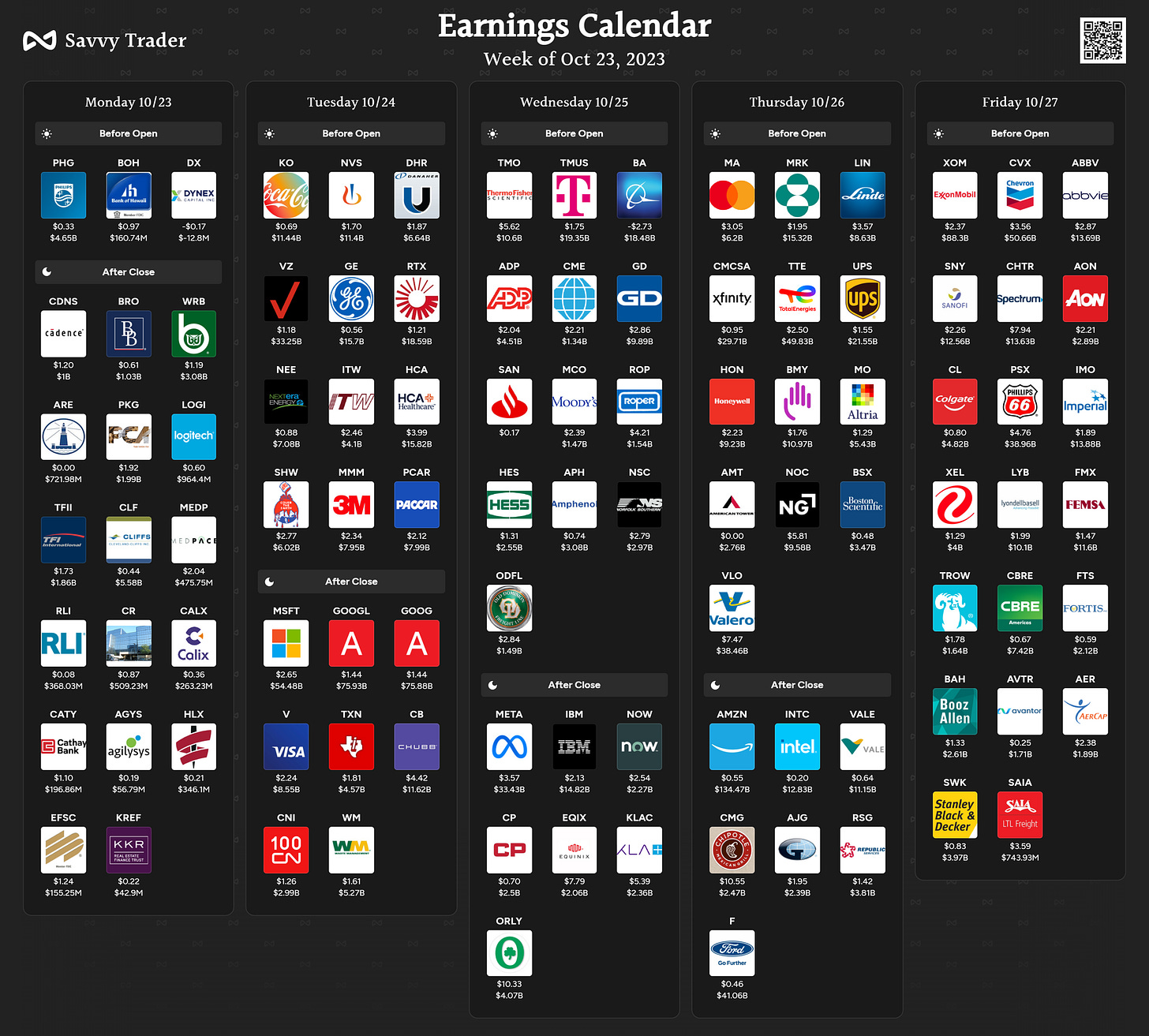

Earnings results were mixed, with notable performers like Netflix, Tesla, Travelers, Procter & Gamble, and American Express.

Market performance for the week:

Vanguard Mega Cap Growth ETF (MGK) fell 3.0%

S&P 500 fell 2.4%

Invesco S&P 500 Equal Weight ETF (RSP) fell 2.3%

S&P 500 closed below its 200-day moving average.

Only consumer staples and energy sectors saw gains, while real estate and consumer discretionary sectors had the largest declines.

Weekly performance of major indices:

Nasdaq Composite: -3.2%

S&P 500: -2.4%

Dow Jones Industrial Average: -1.6%

S&P Midcap 400: -2.0%

Russell 2000: -2.3%

Weekly Performance Heatmap

Overall Stock Market Heatmap & Sector Performance

Looking Ahead to the Upcoming Week

Upcoming Key Data and Events for the Week:

United States:

Personal income and spending for September.

Advance print of third-quarter GDP.

September's Personal Consumption Expenditures (PCE) Deflator.

October purchasing managers' indexes (PMIs) for manufacturing and services from S&P Global.

September's durable goods orders, new and pending home sales, advanced goods trade balance, and wholesale inventories.

Release of economic measures by several regional Fed banks ahead of the next week's policy meeting.

Treasury Department auction of $167 billion in two-, five-, and seven-year securities.

Asia:

China's light data calendar.

Japan's preliminary October Jibun Bank PMIs, Tokyo's Consumer Price Index (CPI), services Producer Price Index (PPI), machine tool orders, and leading index of economic indicators.

Australia's third-quarter inflation and October PMIs.

South Korea's third-quarter GDP.

Europe:

European Central Bank's policy meeting.

Release of consumer confidence data.

First release of October eurozone PMIs for the manufacturing and services sectors.

Germany's Ifo business climate survey, retail sales, and consumer confidence.

France's consumer confidence data.

British labor market data and October house prices.