Market Trader Report V2#32

MyntBit's Market Trader Report brings potential setups for futures & stocks with a time horizon from days to weeks depending on price action. The following research is based on Fundamentals, Technical & Options Analysis.

What is included in this week's edition?

WEEKLY REVIEW: An overview of current market standing, fundamental matters with implications upon the market, and general sentiment regarding the major US indices.

LOOKING AHEAD: Key takeaways to consider as we look forward to the upcoming trading week.

FUTURES MARKETS: ES, NQ, RTY - A technical review of the major indices, futures, and commodities that represent the overall health of the market.

SPDR SECTORS & ETFs: SPY, QQQ, IWM - An in-depth review of the SPDR sectors with keynotes on market strength, opportunities, and relative rotation.

Market Trader by MyntBit

Weekly Review

The week began with news of Israel declaring war on Hamas after a surprise Hamas attack over the weekend.

Concerns about a wider regional conflict weighed on market sentiment.

Reports suggested the Israel-Hamas conflict remained primarily a two-party dispute.

Geopolitical tensions increased when Israel issued an evacuation warning to 1.1 million residents in the northern Gaza Strip, hinting at a possible ground offensive in Gaza.

Iran's foreign minister warned of potential reactions to Israel's continued blockade of Gaza.

Despite these geopolitical uncertainties, the stock market performed reasonably well, aided by lower Treasury yields and technical buying.

Buyer confidence waned as the week progressed.

The 10-year note performed well due to safe-haven flows and expectations of future improvements in inflation rates.

The 2-year note yield fell slightly, while the 10-year note yield decreased noticeably.

Treasury auctions for the 3-year note, 10-year note, and 30-year bond faced weak demand.

Geopolitical tensions prompted a rush of safe-haven flows to offset the prior sell-off.

Federal Reserve officials expressed concern about the impact of rising long-term interest rates on financial conditions.

Oil prices rose due to heightened geopolitical worries.

WTI crude oil futures increased by 6.0% to $87.80 per barrel.

Eight S&P 500 sectors posted gains, with the energy sector leading.

The consumer discretionary sector experienced the largest decline.

Earnings season began with positive results from companies like JPMorgan Chase, Wells Fargo, Citigroup, and UnitedHealth.

In other news, the House of Representatives failed to elect a new Speaker.

Rep. Steve Scalise won the GOP conference vote but withdrew due to insufficient support.

This leadership void raised uncertainty about Congress reaching a budget agreement before the November 17 deadline.

Weekly Performance Heatmap

Overall Stock Market Heatmap & Sector Performance

Looking Ahead to the Upcoming Week

United States:

Investors will closely watch several economic indicators in September, including retail sales, industrial production, and the Conference Board's leading economic indicators.

Housing market data, including existing home sales, housing starts, and building permits for September, will be released.

The National Association of Home Builders will provide the October homebuilder sentiment.

The Federal Reserve will release its Beige Book regional survey.

Regional business surveys from the Philadelphia and New York Fed Districts for October are also expected.

The U.S. Treasury department will conduct auctions for five- and 20-year securities, totaling $35 billion.

Asia:

China's third-quarter Gross Domestic Product (GDP) growth will be a major focus.

Other key releases include September's industrial production, retail sales, and fixed asset investment in China.

Japan will release national CPI and trade balance data for September, along with August's industrial production and Tertiary Industry Index.

The Bank of Korea will have a policy meeting.

Australia will provide labor market data.

Europe:

The finalized eurozone Consumer Price Index (CPI) for September and ZEW expectations for economic growth in October will be of interest.

The UK will release labor market data, September's CPI, retail sales, and October consumer confidence.

France will provide retail sales data for September and manufacturing confidence for October.

Germany's September Producer Price Index and the ZEW survey on October business conditions will also be watched.

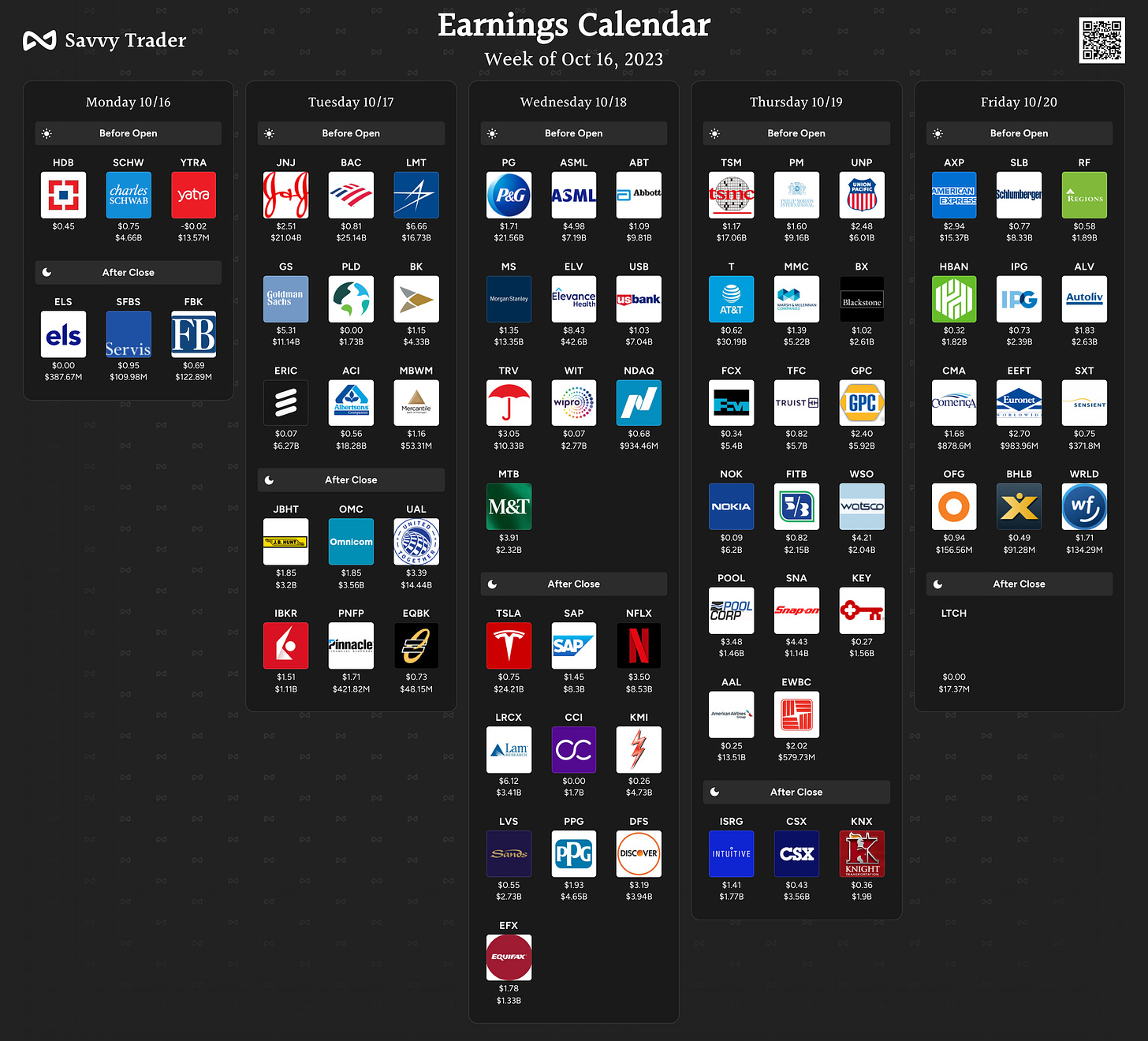

Earnings Calendar

Economical Events