Market Trader Report V2#30

MyntBit's Market Trader Report brings potential setups for futures & stocks with a time horizon from days to weeks depending on price action. The following research is based on Fundamentals, Technical & Options Analysis.

What is included in this week's edition?

WEEKLY REVIEW: An overview of current market standing, fundamental matters with implications upon the market, and general sentiment regarding the major US indices.

LOOKING AHEAD: Key takeaways to consider as we look forward to the upcoming trading week.

FUTURES MARKETS: ES, NQ, RTY - A technical review of the major indices, futures, and commodities that represent the overall health of the market.

SPDR SECTORS & ETFs: SPY, QQQ, IWM - An in-depth review of the SPDR sectors with keynotes on market strength, opportunities, and relative rotation.

Market Trader by MyntBit

Weekly Review

This week, we witnessed significant drops in the primary stock market indicators. The decline was mainly driven by the underperformance of large-cap stocks, which had a more substantial impact on the overall index performance. Notably, there was no coordinated effort to reallocate investments elsewhere, causing many stocks to follow the downward trend.

All 11 sectors of the S&P 500 ended the week in negative territory. The most significant declines were seen in the consumer discretionary sector, which fell by 6.4%, followed by real estate at 5.4%, and materials at 3.7%. In contrast, the health care sector recorded the smallest loss at 1.2%.

The main reason for this market weakness was a notable increase in Treasury yields. During the week, the 2-year note yield rose by eight basis points, reaching 5.12%, while the 10-year note yield increased by 12 basis points, reaching 4.44%. In total, the 10-year note yield has increased by 35 basis points this month. These changes were primarily in response to the Federal Reserve's more hawkish stance announced on Wednesday.

As anticipated, the Federal Open Market Committee (FOMC) unanimously decided to keep the target range for the federal funds rate steady at 5.25-5.50%. While there were minimal changes to the directive itself, the market paid close attention to the Summary of Economic Projections and the dot plot. These projections conveyed two key messages: first, policy rates are expected to remain at higher levels for a more extended period, and second, Fed officials do not foresee rate cuts in 2024 to the extent they had previously projected in June.

The median estimate for the federal funds rate in 2023 remained unchanged at 5.6%, but the median estimate for 2024 increased to 5.1% from 4.6% in June. This suggests a leaning towards one more rate hike in 2023 and a more moderate expectation of a 50-basis-point rate reduction in 2024, compared to the earlier projection of 100 basis points. Additionally, the median estimate for 2025 increased to 3.9% from 3.4% in June, and a median estimate of 2.9% was introduced for 2026. The long-term estimate for the federal funds rate remained at 2.5%, indicating the Fed's commitment to its 2.0% inflation target.

Fed Chair Powell emphasized the need for caution in considering policy moves and hinted that the neutral rate might be higher than the long-run rate of 2.5%, explaining why the economy has shown more resilience than expected.

The market's concern was not that the Fed had adopted a decisively hawkish stance but rather that it had not shifted towards a dovish stance.

Several other Fed officials echoed Chairman Powell's views later in the week, including San Francisco Fed President Daly, Fed Governor Bowman, and Boston Fed President Collins.

In addition to the Federal Reserve, several other central banks made policy announcements this week. The Bank of England voted to keep its bank rate unchanged at 5.25%, the Hong Kong Monetary Authority maintained its key rate at 5.75%, the Swiss National Bank left its key rate at 1.75%, the Bank of Japan made no changes to its policy stance, the Riksbank increased its key rate by 25 basis points to 4.00%, and the Norges Bank increased its key rate by 25 basis points to 4.25%.

In the corporate realm, two noteworthy initial public offerings occurred this week: Instacart (CART) and Klaviyo (KVYO). Both IPOs initially traded above their offering prices but eventually followed the broader market's downward trend by week's end.

Lastly, the UAW (United Auto Workers) extended its strike to encompass all GM (General Motors) and STLA (Stellantis) parts and distribution centers, beginning at noon ET on Friday. This decision followed reports of progress in labor talks with Ford (F) but signaled that more extensive negotiations were needed with Stellantis and General Motors.

Weekly Performance Heatmap

Overall Stock Market Heatmap & Sector Performance

Looking Ahead to the Upcoming Week

The key events to watch for this week will include updates on personal spending and income, as well as the PCE Deflator for August. Additionally, we can expect a third reading on second-quarter Gross Domestic Product (GDP) growth, durable goods orders for August, advance goods trade balance, and wholesale inventories. September will bring reports on consumer confidence and the Chicago PMI. The housing market will also be in focus, with data on new and pending home sales for August, along with two measures of July home prices. Wrapping up the schedule will be the finalized September University of Michigan consumer sentiment, along with various updates on business activity from regional Federal Reserve banks.

In Asia, attention will be on China's September PMIs for both manufacturing and services, reported by the China Federation of Logistics & Purchasing and Caixin. Japan will release Tankan Indexes for the third quarter, September's Tokyo Consumer Price Index (CPI), and the final manufacturing PMI. Additionally, data on August's jobless rate, industrial production, and retail sales will be watched. Updates on Australian retail sales and inflation, as well as South Korea's trade balance, manufacturing PMI, and both manufacturing and non-manufacturing business surveys are also anticipated.

In Europe, the focus will shift to September's preliminary eurozone CPI, finalized consumer confidence figures, and August's money supply. German releases will include September's CPI, unemployment change, and a business sentiment survey. Additionally, data on August's retail sales and prospects for consumer confidence in October will be closely monitored. France will report on September CPI and consumer confidence, along with August's Producer Price Index. From the U.K., we can expect the final reading on second-quarter GDP growth and an update on September home prices.

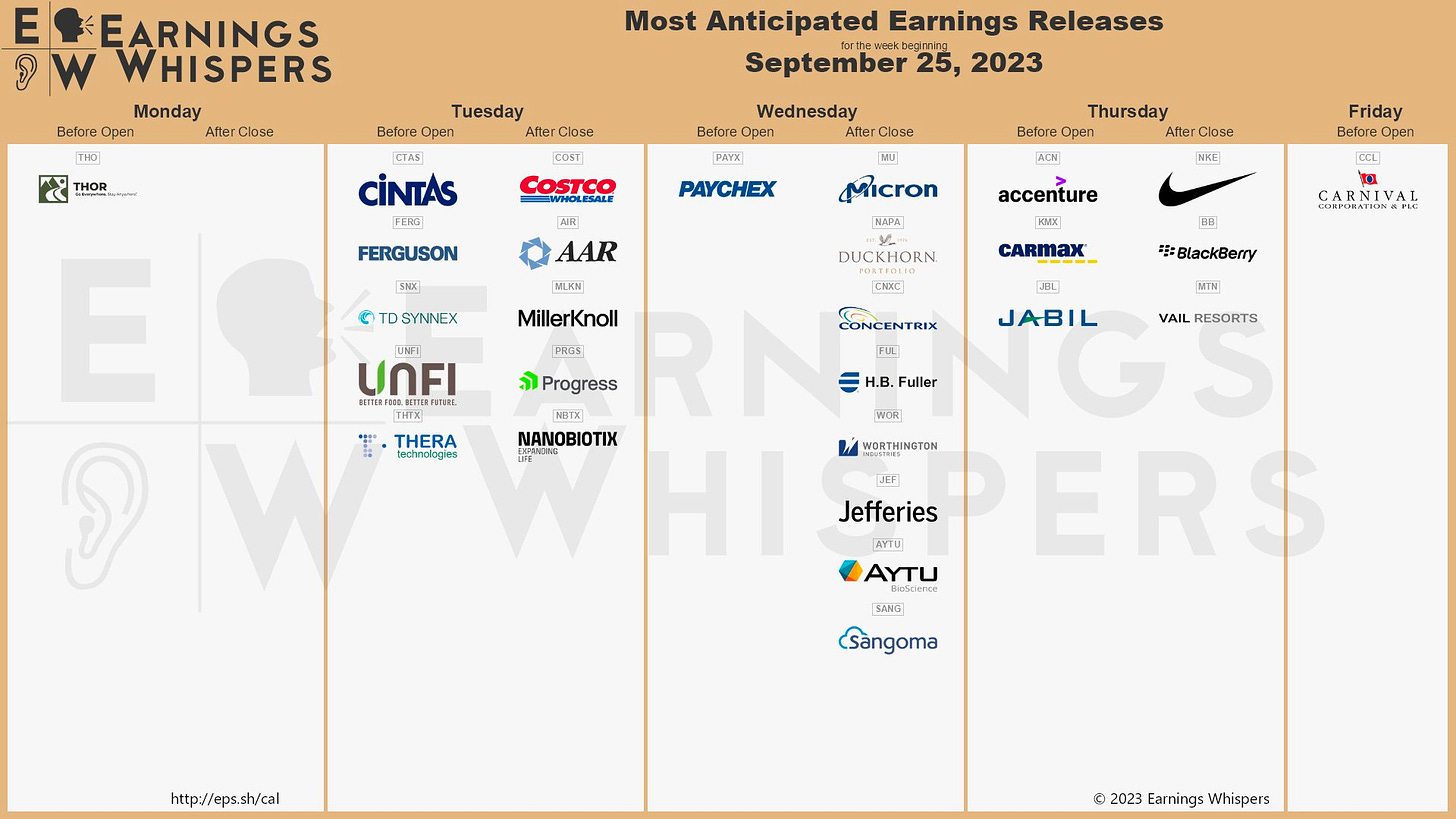

Earnings Calendar & Economical Events