Market Trader Report V2#29

MyntBit's Market Trader Report brings potential setups for futures & stocks with a time horizon from days to weeks depending on price action. The following research is based on Fundamentals, Technical & Options Analysis.

What is included in this week's edition?

WEEKLY REVIEW: An overview of current market standing, fundamental matters with implications upon the market, and general sentiment regarding the major US indices.

LOOKING AHEAD: Key takeaways to consider as we look forward to the upcoming trading week.

FUTURES MARKETS: ES, NQ, RTY - A technical review of the major indices, futures, and commodities that represent the overall health of the market.

SPDR SECTORS & ETFs: SPY, QQQ, IWM - An in-depth review of the SPDR sectors with keynotes on market strength, opportunities, and relative rotation.

Market Trader by MyntBit

Weekly Review

The Dow Jones Industrial Average managed to eke out a modest gain this week, whereas the S&P 500 and Nasdaq experienced slight declines. The beginning of the week remained calm in terms of significant market events and had relatively low participation. In contrast, the latter part of the week witnessed numerous market-moving events, culminating in Friday's quarterly options and futures expiration day. As a result of downward movements, both the S&P 500 and Nasdaq closed below their 50-day moving averages.

Throughout the week, the major stock indices seemed on track for a positive week until they encountered a setback on Friday. Despite closing lower at the index level, eight out of the 11 S&P 500 sectors ended the week with gains. The information technology sector, which carries the most significant weight, saw a decline of 2.2%.

Within the information technology sector, Apple (AAPL) emerged as one of the major underperformers, registering a 1.8% drop during the week. This decline was attributed to ongoing scrutiny in China and the recent product event that unveiled the iPhone 15. Adobe (ADBE) also faced a decline of 5.6% following less-than-impressive fiscal Q4 guidance.

The weakness in semiconductor-related stocks also contributed to the sector's lackluster performance. This weakness was influenced by Arm's (ARM) successful IPO on Thursday and reports indicating delays in chip equipment shipments by Taiwan Semiconductor Manufacturing Co. (TSM). Consequently, the PHLX Semiconductor Index experienced a 2.5% decline.

Netflix (NFLX), despite its status as one of the top performers this year, saw a significant tumble of 10.4% during the week after revealing that its advertising business did not yet have a substantial impact on its overall revenue.

The combined impact of losses in large-cap stocks weighed heavily on index performance. The Vanguard Mega Growth ETF (MGK) saw a decrease of 0.8%, while the market-cap-weighted S&P 500 fell by 0.2%. On the other hand, the Invesco S&P 500 Equal Weight ETF (RSP) experienced a modest decline of 0.1%.

Several corporate developments triggered selling activity, including warnings from Spirit Airlines (SAVE), Frontier Group (ULCC), Delta Air Lines (DAL), and American Airlines (AAL) regarding their Q3 outlooks, partly due to rising fuel costs.

Furthermore, the United Auto Workers initiated targeted strikes at three manufacturing plants, one for each of the Big Three automakers, after failing to reach an agreement on a new contract. Nevertheless, Ford (F), Stellantis (STLA), and General Motors (GM) managed to close the week with gains of 2.5%, 5.6%, and 3.0%, respectively.

Market participants also had to digest a slew of economic releases, with the August Consumer Price Index report being particularly noteworthy. Total CPI rose by a robust 0.6%, in line with expectations, while core CPI (excluding food and energy) increased by 0.3% (compared to the Briefing.com consensus of 0.2%). This resulted in total CPI being up 3.7% year-over-year, surpassing July's 3.2%, and core CPI up 4.3% year-over-year, compared to 4.7% in July.

The key takeaway from this report is that core inflation, which the Federal Reserve closely monitors, showed sustained improvement on a year-over-year basis. However, it remains significantly above the Fed's 2.0% target, indicating persistent inflationary pressures. These pressures are unlikely to prompt the Fed to raise rates further at this point, but they are expected to keep the Fed committed to a "higher for longer" approach.

In response to this week's inflation data, the Treasury market remained relatively stable, providing support to stocks. Yields edged higher, but the movements were not marked by panic. The 2-year note yield increased by seven basis points to reach 5.04% for the week, while the 10-year note yield also rose by seven basis points to 4.33%.

Rising oil prices remained a significant point of focus during the week, with WTI crude oil futures surging by 4.2% to reach $91.00 per barrel.

As a reminder, the Federal Reserve is scheduled to convene next week, with a policy decision announcement set for 2:00 p.m. ET on Wednesday. Market participants do not anticipate a rate hike and are more interested in the updated Summary of Economic Projections and the tone that Federal Reserve Chair Powell will convey during his press conference.

Weekly Performance Heatmap

Overall Stock Market Heatmap & Sector Performance

Looking Ahead to the Upcoming Week

The upcoming week will be highlighted by the Federal Reserve's policy meeting scheduled for September 19-20. Additionally, investors can anticipate the release of September Purchasing Managers' Indexes (PMIs) for both manufacturing and services by S&P Global on Friday. Other noteworthy releases include the Leading Economic Index, a multitude of housing market updates such as existing home sales, housing starts, building permits, and homebuilder sentiment. The economic calendar also includes the second quarter's current account balance, July international capital flows, and September business surveys from the Philadelphia and New York Federal Reserve Districts. In the auction arena, the U.S. Treasury Department will issue $28 billion worth of 10- and 20-year securities.

Looking globally, China's data calendar appears relatively light, with investors focusing on the Bank of Japan's policy meeting later in the week, preliminary September PMIs for manufacturing and services, and economic indicators like August's national CPI, PPI, and trade balance. Updates are also expected on Australia's August Leading Index and September PMIs, as well as South Korea's August Producer Price Index (PPI).

In Europe, the spotlight will be on the initial release of September PMIs for manufacturing and services in the eurozone. The Bank of England is scheduled to meet on Thursday, with preceding data releases including the UK's August inflation figures, followed by August's retail sales. Additionally, the finalized eurozone Consumer Price Index (CPI) for August, September consumer confidence figures for both the eurozone and the UK, August French retail sales, and German Producer Price Index (PPI) are also due.

On Tuesday, the Organisation for Economic Co-operation and Development (OECD) is set to unveil its Interim Economic Outlook, offering insights into the world economy and the economic performance of G20 countries.

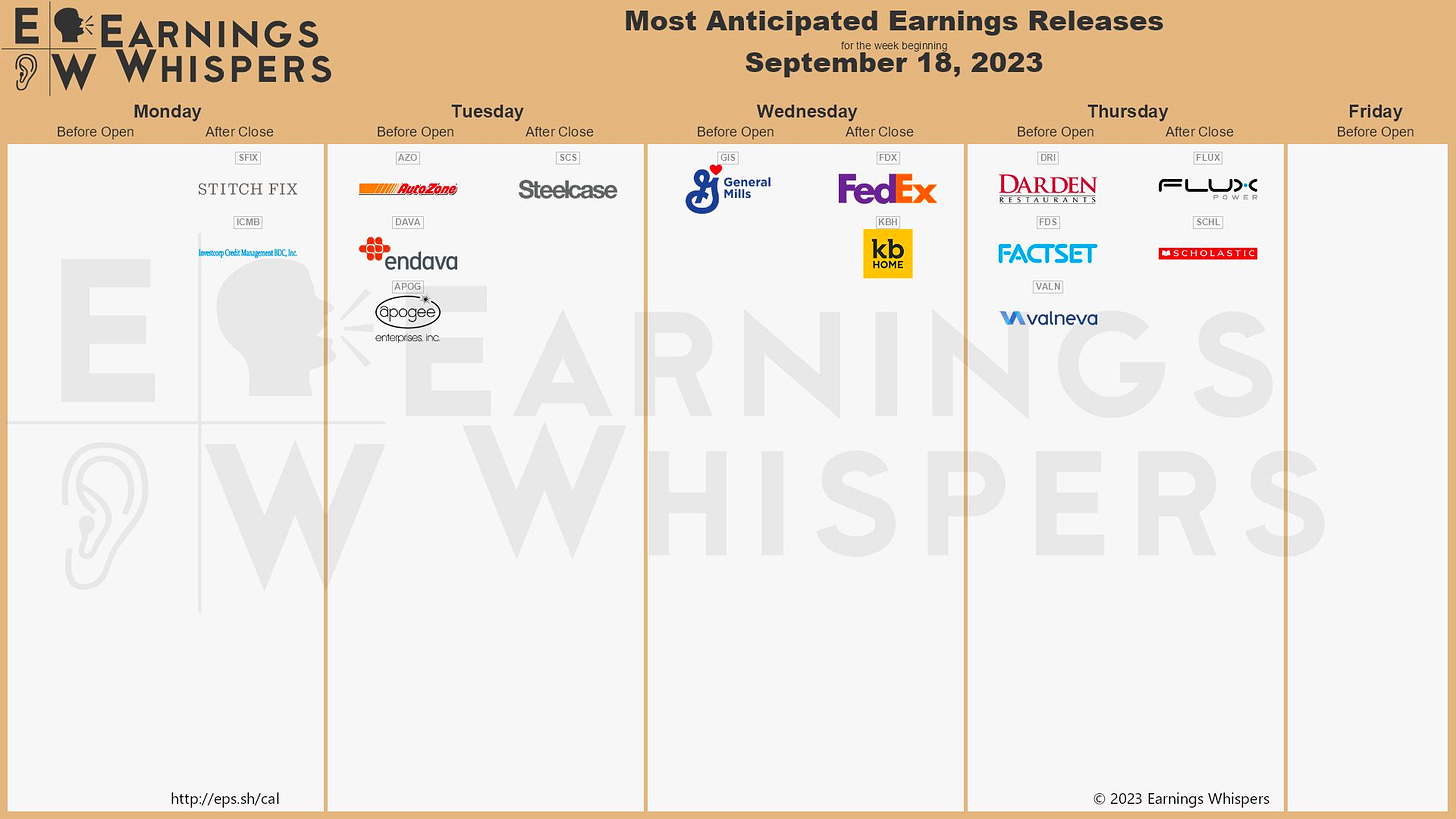

Earnings Calendar & Economical Events