Market Trader Report V2#24

MyntBit's Market Trader Report brings potential setups for futures & stocks with a time horizon from days to weeks depending on price action. The following research is based on Fundamentals, Technical & Options Analysis.

What is included in this week's edition?

WEEKLY REVIEW: An overview of current market standing, fundamental matters with implications upon the market, and general sentiment regarding the major US indices.

LOOKING AHEAD: Key takeaways to consider as we look forward to the upcoming trading week.

FUTURES MARKETS: ES, NQ, RTY - A technical review of the major indices, futures, and commodities that represent the overall health of the market.

SPDR SECTORS & ETFs: SPY, QQQ, IWM - An in-depth review of the SPDR sectors with keynotes on market strength, opportunities, and relative rotation.

Market Trader by MyntBit

Weekly Review

During the past week, the stock market exhibited mixed performance. The Dow Jones Industrial Average saw a slight increase, but the S&P 500, Nasdaq, and Russell 2000 faced losses. The market has entered a consolidation phase in August after a strong run since late March. The S&P 500 closed below 4,500. Trading activity at the NYSE was below average, suggesting reduced participation. Various factors prompted investors to sell, including concerns about global growth due to disappointing trade data and weak yuan loan growth in China, as well as a warning from Chinese property developer Country Garden Holdings about significant anticipated losses. U.S. economic data showed a mixed picture, with CPI figures largely aligning with estimates, but Producer Price Index surpassing expectations. Initial jobless claims remained low. Moody's downgrade of credit ratings for several U.S. banks, along with earnings reports, influenced the market's cautious sentiment. Walt Disney's strong results led to a 3.2% gain, while UPS faced a decline due to a disappointing revenue outlook. The energy and healthcare sectors performed well, whereas the information technology sector experienced a notable decline. Treasury yields continued to rise, adding pressure to equities.

Weekly Performance Heatmap

Overall Stock Market Heatmap & Sector Performance

Looking Ahead to the Upcoming Week

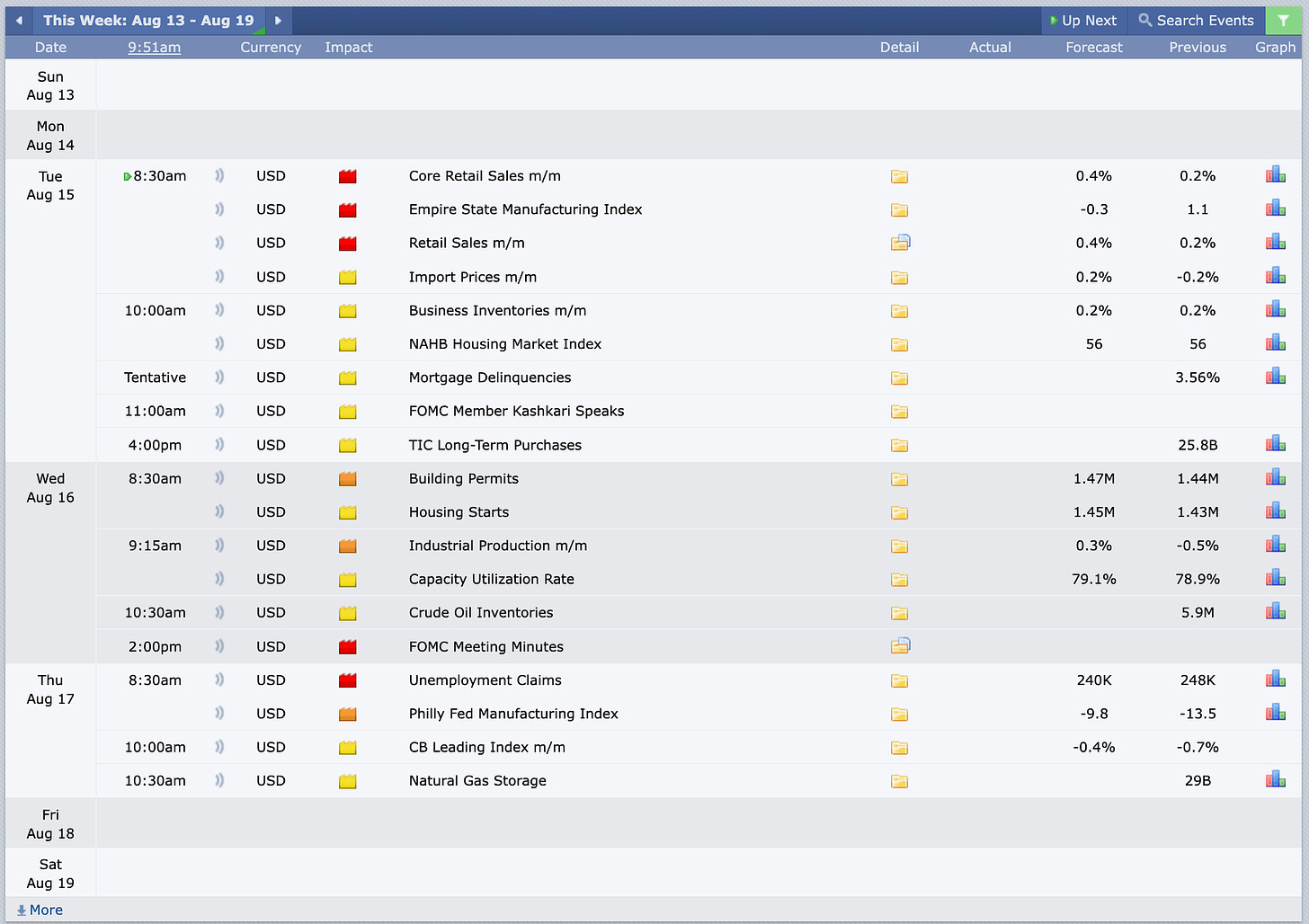

Investors will closely watch several key economic releases in various regions. In the U.S., attention will be on the Federal Open Market Committee's meeting minutes from July 26th, as well as data for retail sales, industrial production, the Conference Board's Leading Index, and import prices for July. Housing market insights will come from June's National Association of Home Builders' Housing Market Index, July's building permits, and housing starts. Additionally, August business surveys from the New York and Philadelphia Federal Reserves will be released. Asian markets will focus on Chinese data, including retail sales, industrial production, and fixed assets investment for July. From Japan, the second quarter GDP, core machine orders, Tertiary Industry Index, industrial production, nationwide CPI, and trade balance for July will be in focus. Australia will release second-quarter wages, July's labor force survey, and the Westpac Leading Index. In Europe, attention will center on second-quarter Eurozone GDP and employment, June's industrial production, finalized July CPI, and the August ZEW economic expectations survey. The UK will provide data on July's CPI, Retail Price Index, retail sales, jobless claims, June's unemployment rate and weekly earnings, and August's consumer confidence. Germany's releases will include surveys on economic growth and the current situation for August, along with July's Wholesale Price Index.

Earnings Calendar & Economical Events