Market Trader Report V2#22 | PEP, ENPH & BABA

MyntBit's Market Trader Report brings potential setups for futures & stocks with a time horizon from days to weeks depending on price action. The following research is based on Fundamentals, Technical & Options Analysis.

What is included in this week's edition?

WEEKLY REVIEW: An overview of current market standing, fundamental matters with implications upon the market, and general sentiment regarding the major US indices.

LOOKING AHEAD: Key takeaways to consider as we look forward to the upcoming trading week.

FUTURES MARKETS: ES, NQ, RTY - A technical review of the major indices, futures, and commodities that represent the overall health of the market.

SPDR SECTORS & ETFs: SPY, QQQ, IWM - An in-depth review of the SPDR sectors with keynotes on market strength, opportunities, and relative rotation.

STOCKS: PEP, ENPH, BABA - Trends, key levels, and trade targets are identified for individual names presenting potential opportunities in the market.

Market Trader by MyntBit

Weekly Review

The stock market started the week slowly due to an extended Fourth of July break. However, market participants later decided to sell off stocks after a strong start to the year. Notably, the Invesco S&P 500 Equal Weight ETF experienced a smaller decline compared to the market-cap weighted S&P 500 due to weakness in mega-cap stocks.

Concerns about geopolitical issues and global growth arose early in the week due to weaker-than-expected Services PMI readings from China and the eurozone. There were also reports of the US seeking to restrict China's access to cloud computing and China announcing restrictions on the export of gallium and germanium.

Later in the week, the increase in market rates became the main driver of selling interest. The yields on the 2-year and 10-year Treasury notes rose, influenced by stronger-than-expected employment data. However, Treasury yields pulled back from their peak levels after the Employment Situation Report revealed less robust payroll gains than estimated.

The employment report showed positive signs with an increase in the average workweek and average hourly earnings, indicating potential growth in spending and the economy. However, concerns about valuations in the stock market emerged due to the possibility of the Federal Reserve taking more aggressive tightening actions. Expectations for future rate hikes have increased.

The Fed funds futures market still maintains a cautious outlook, with low probabilities for additional rate hikes at upcoming FOMC meetings. The release of the June Consumer Price Index report next week could impact these probabilities.

The FOMC Minutes for the June meeting did not bring any surprises or significant market reactions. Rising interest rates are receiving more attention as they create competition for stocks and pose challenges for expansion efforts.

Among the S&P 500 sectors, only real estate recorded a gain, while sectors such as health care, materials, and information technology performed poorly during the week.

Weekly Performance Heatmap

Overall Stock Market Heatmap & Sector Performance

Looking Ahead to Upcoming Week

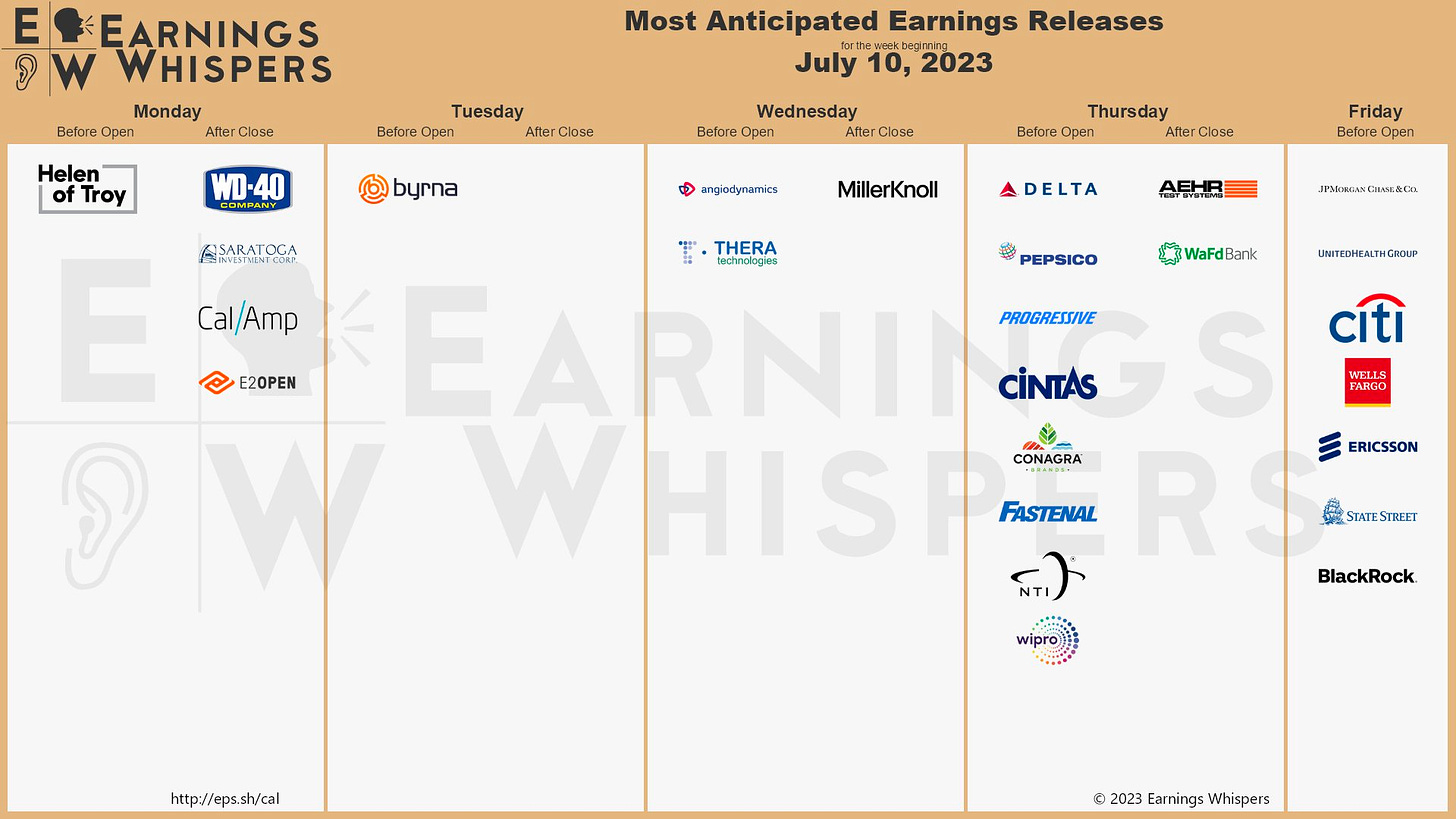

This week's key events include the release of consumer and producer inflation data for June, the Fed's Beige Book regional survey, and preliminary readings of consumer sentiment and inflation expectations. Other notable releases include wholesale inventories, the NFIB Small Business Optimism Index, budget statement, and Import Price Index. The U.S. Treasury Department will also hold auctions for 3-, 10-, and 30-year securities. Asian investors will monitor Chinese inflation, money supply, trade balance, and new yuan loans. Japan will release data on PPI, money stock, machine tool orders, current account balance, core machine orders, and industrial production. South Korea will report the unemployment rate, while Australia will reveal business and consumer confidence for June and July. Germany and France will announce finalized June CPI data, and the Eurozone will release industrial production figures for May. The UK will report on industrial and manufacturing production, trade balance, unemployment rate, and weekly earnings, along with June's jobless claims.

Earnings Calendar & Economical Events

Future & Commodities Markets

Below are the levels for the upcoming week - updates will be provided on Twitter throughout the week.