Market Trader Report V2#19 | JPM, AAL & AMZN

MyntBit's Newsletter brings potential setups with a time horizon from days to weeks depending on price action. The following research is based on Fundamentals & Technical Analysis.

What is included in this week's edition?

WEEKLY REVIEW - An overview of current market standing, fundamental matters with implications upon the market, and general sentiment regarding the major US indices.

LOOKING AHEAD - Key takeaways to consider as we look forward to the upcoming trading week.

FUTURES MARKETS - A technical review of the major indices, futures, and commodities that represent the overall health of the market.

STOCKS - Trends, key levels, and trade targets are identified for individual names presenting potential opportunities in the market.

Market Trader by MyntBit

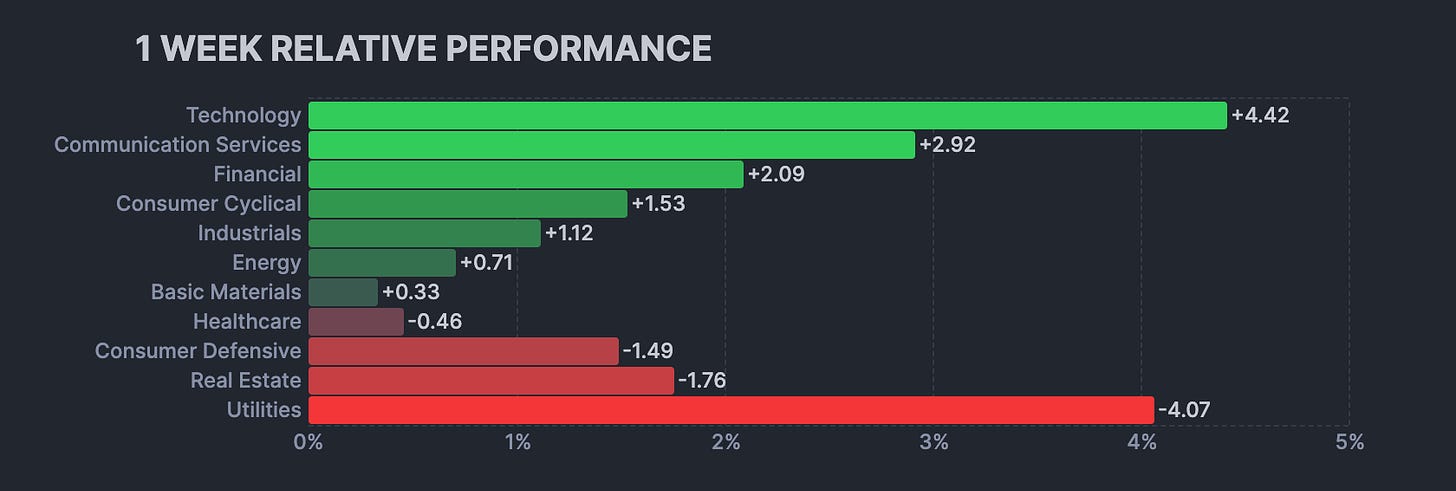

Weekly Review

Major stock indices ended a six-week period of little change with gains this week. The S&P 500 reached new highs but struggled to stay above 4,200. Large-cap stocks outperformed, and more stocks participated in the gains. Optimism about a debt ceiling deal emerged but was later dampened. Some Federal Reserve officials made hawkish comments, suggesting no rate cuts this year. Treasury yields rose as the possibility of a rate hike in June was considered. The bond market reacted to positive news in regional bank stocks. Key retailers reported mixed earnings. Technology, consumer discretionary, communication services, and financials sectors performed well, while utilities and real estate sectors declined.

Weekly Performance Heatmap

Overall Stock Market Heatmap

Sector Performance

Looking Ahead

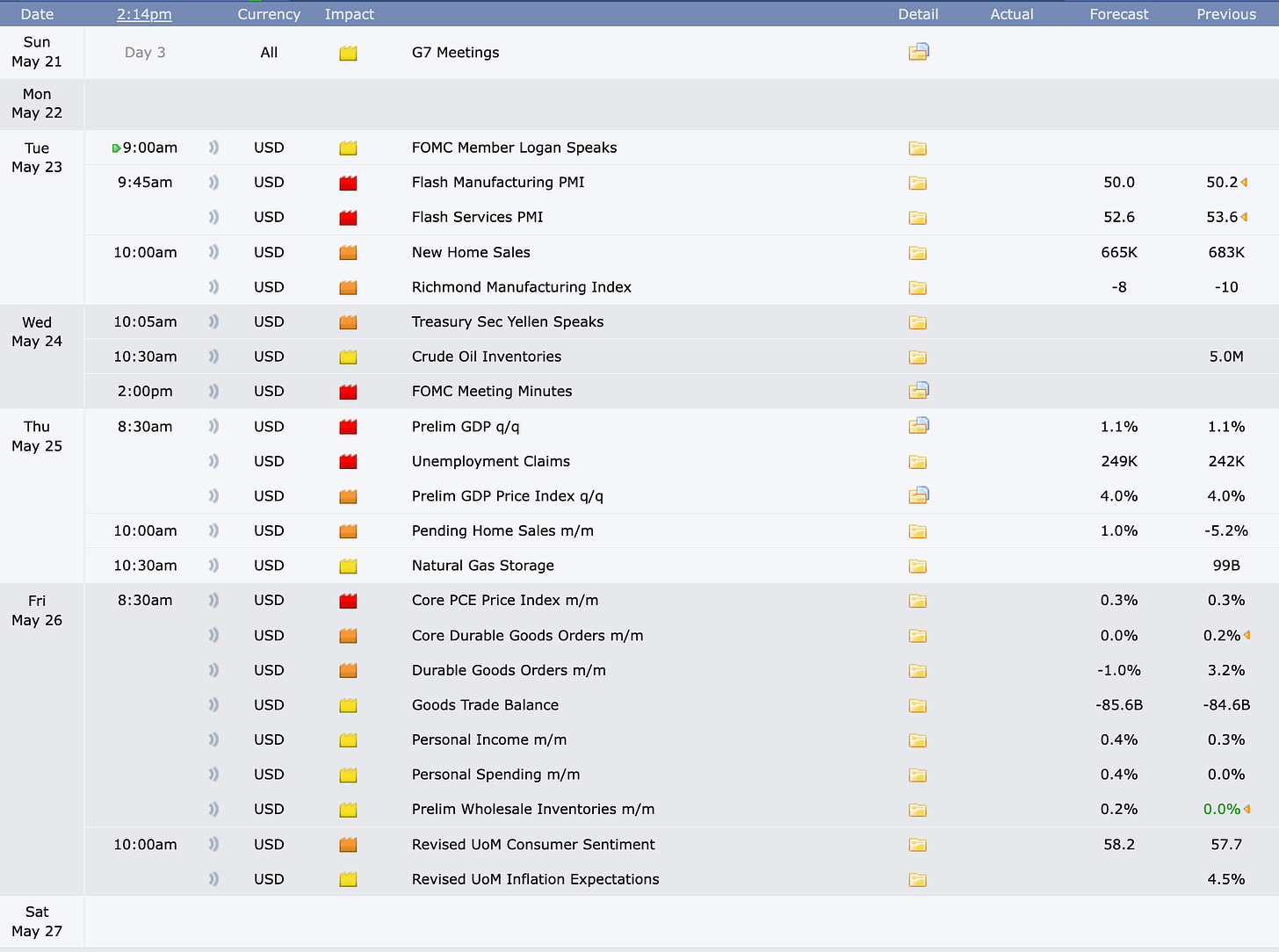

Next week, investors will closely watch April's updates on the Personal Consumption Expenditures (PCE) Deflator, which is the Federal Reserve's preferred measure of inflation. They will be looking for signs that inflation is easing and aligning with the central bank's target of 2%. Additionally, the second reading of the U.S. first-quarter Gross Domestic Product (GDP) will be released. Economic activity updates from S&P Global and regional Fed banks will also be of interest. Internationally, the U.K. and Japan will release their inflation data for April, as well as updates on manufacturing and services sector activity. Several Federal Reserve speakers are scheduled to give speeches, and the minutes from the May 3 Federal Open Market Committee (FOMC) meeting will be released on Wednesday. In terms of auctions, the U.S. Treasury Department will conduct auctions for two-year notes and seven-year notes.

Earnings Calendar

Economical Events

Future & Commodities Markets

Below are the levels for the upcoming week - updates will be provided in the Discord & Twitter throughout the week.

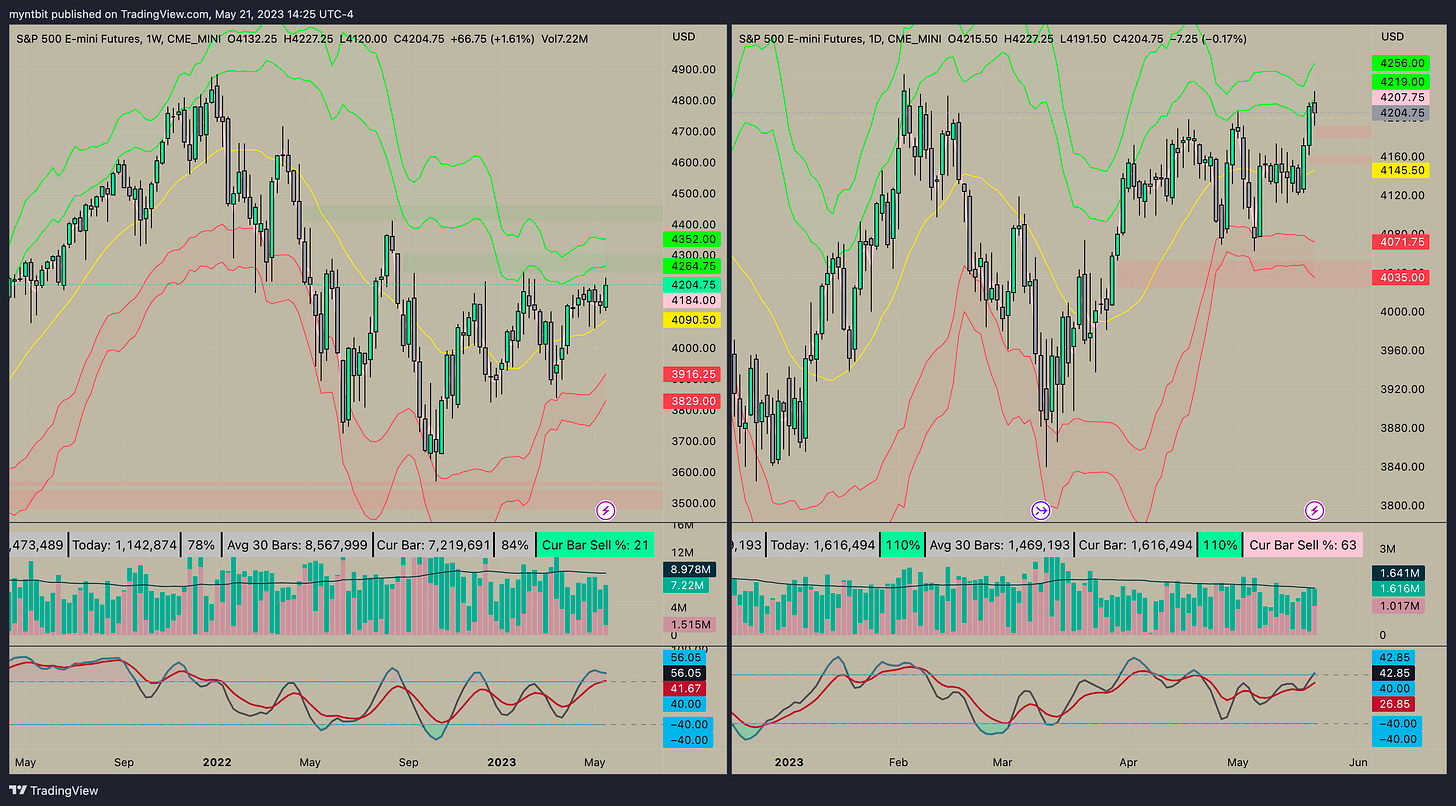

/ES - Emini S&P 500

Upside: Maintaining the 4200 level may encourage an upward move towards 4240. If there is a breakthrough above this level, the target could be set at 4300.

Downside: If the position above 4200 cannot be sustained, there is a chance of revisiting and testing the 4160 level. Failing to hold 4160 as support could lead to a further test of 4110.

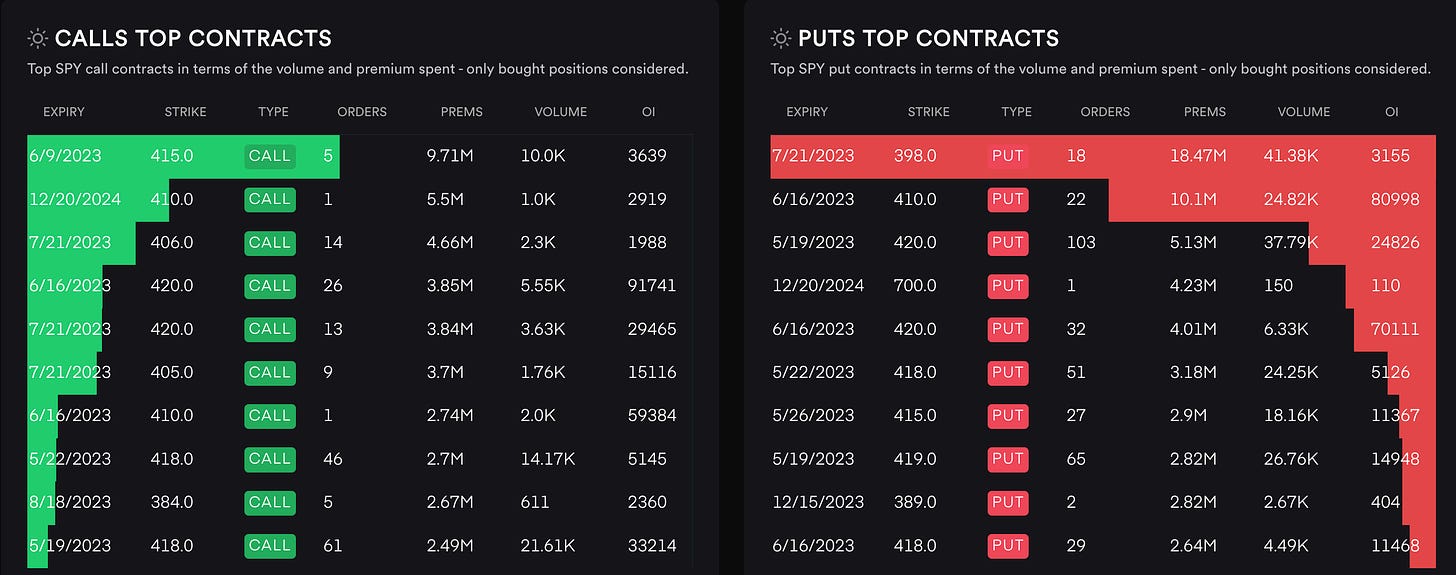

SPY - Calls vs Puts Options

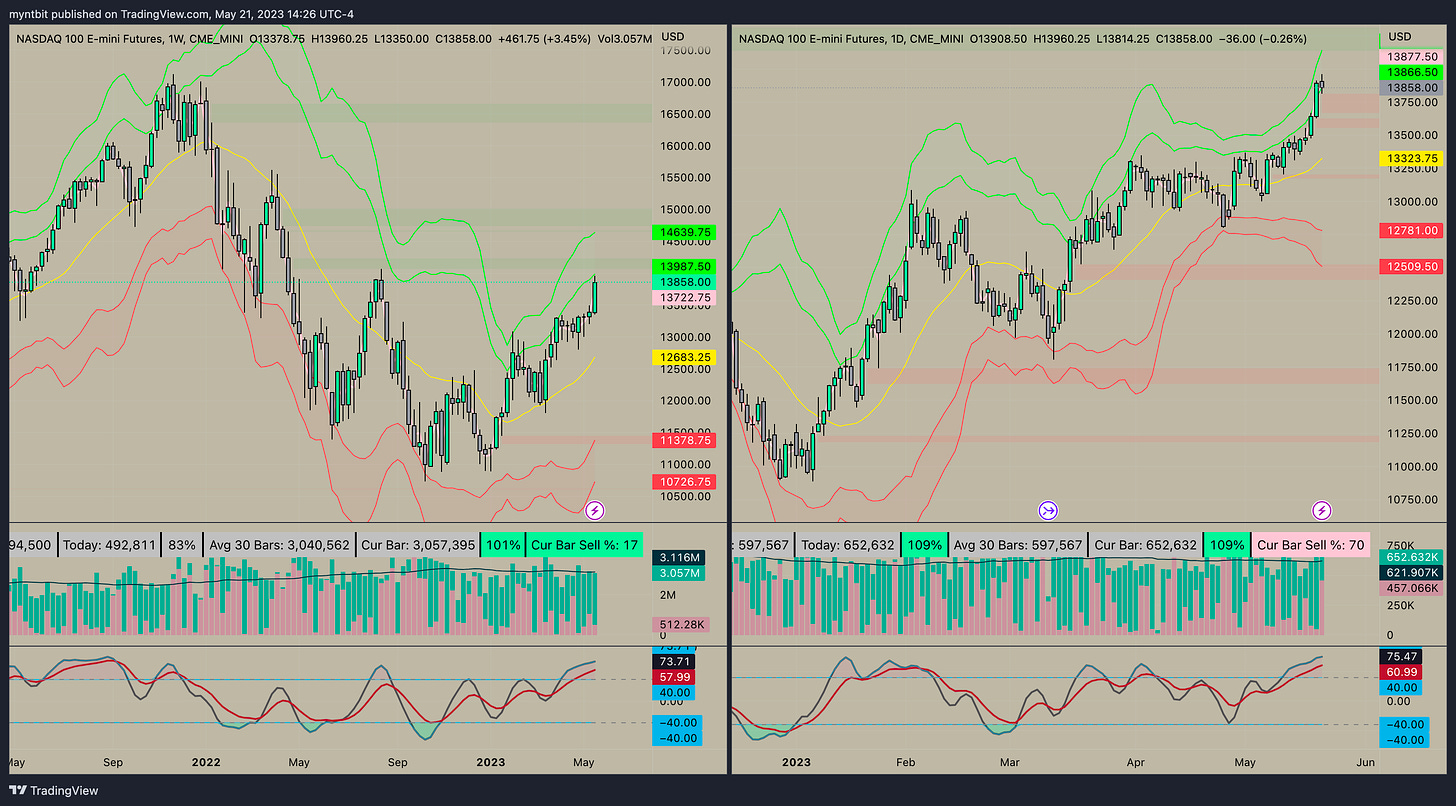

/NQ - Emini Nasdaq 100

Upside: Should we successfully hold a position above the 13800 level, there is potential for a test of 14000. If we manage to break through this level, it could lead to further gains, with the subsequent resistance level set at 14250.

Downside: Failing to sustain above 13800 could result in a downward movement toward the 13650 level. A breakthrough below this level would prompt a test of the important support level at 13500.

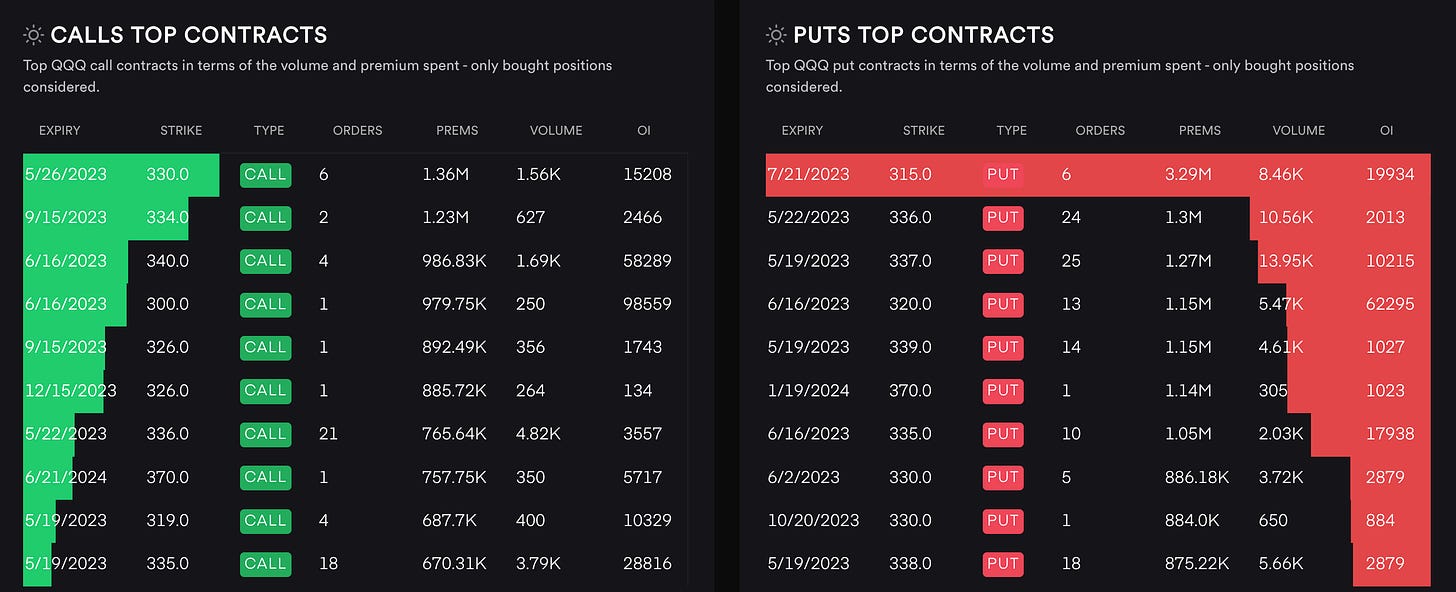

QQQ - Calls vs Puts Options

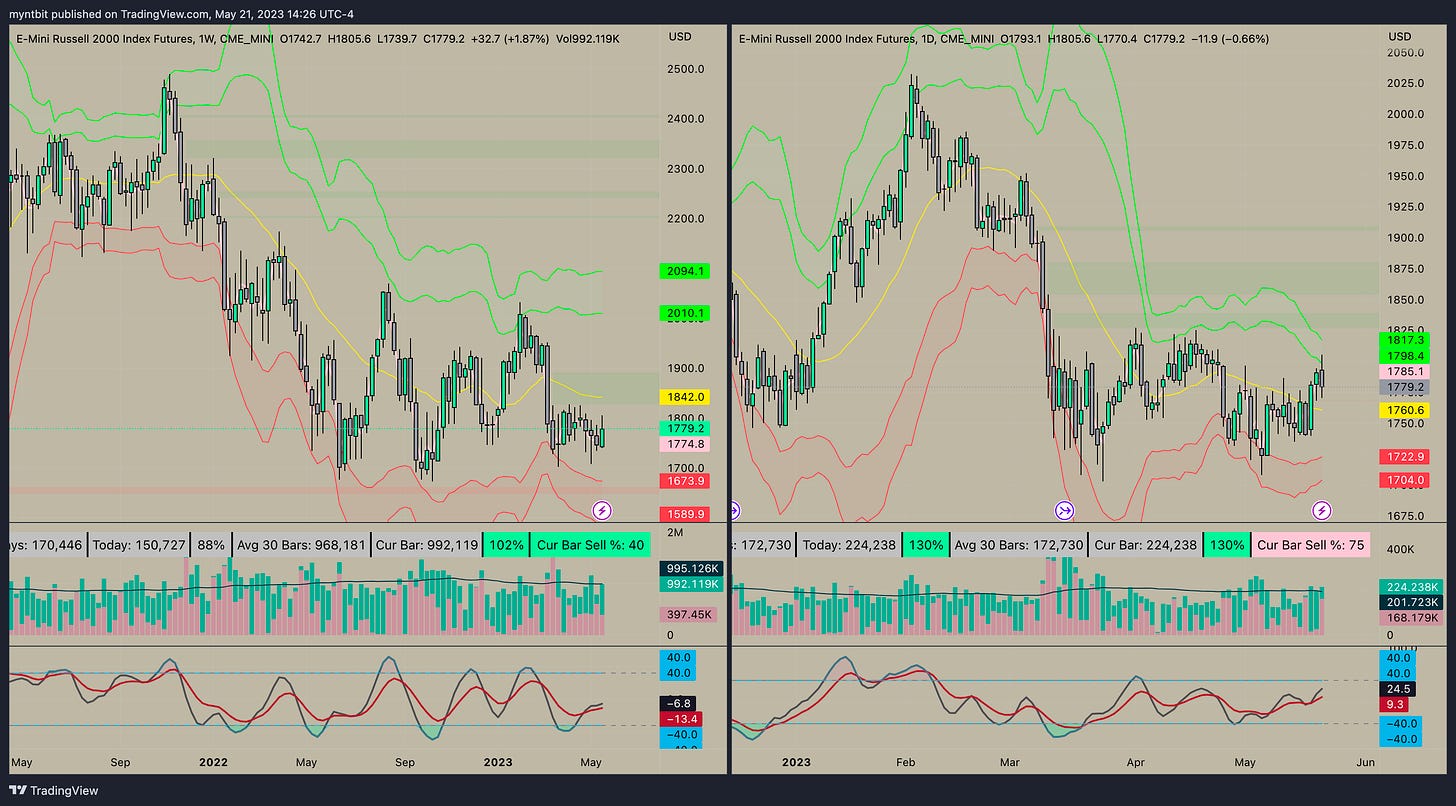

/RTY - Emini Russell 2000

Upside: In case the value remains above 1750, there is a possibility of testing 1780 and 1800.

Downside: However, if the value falls below 1750, it could lead to a decline towards a critical support level at 1730, and another support level at 1700 may be tested.

Small Caps are still range bound - unless something changes the levels above are still valid

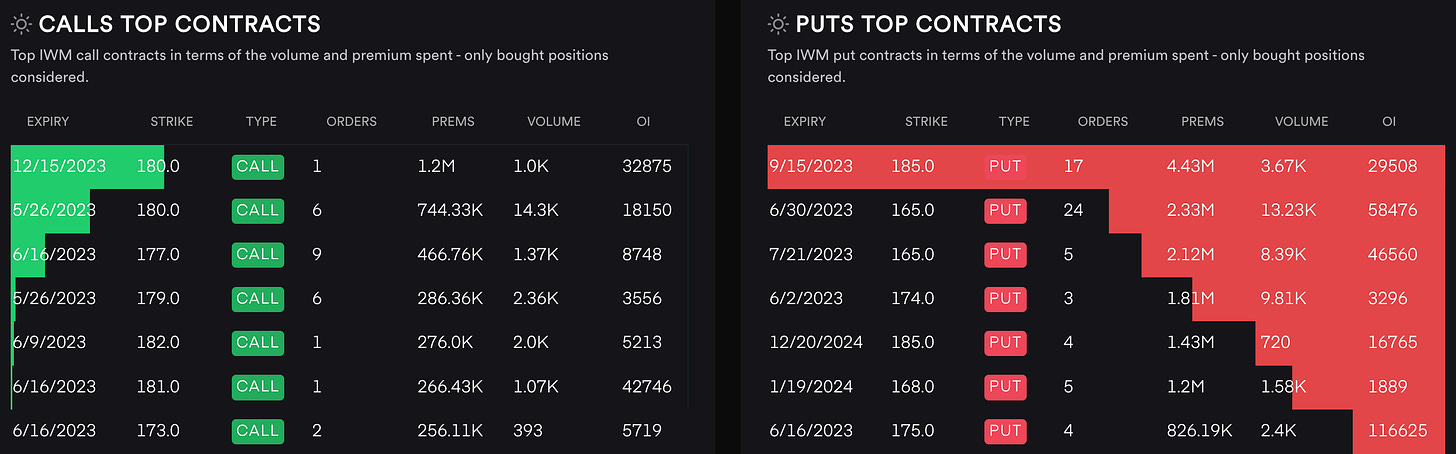

IWM - Calls vs Puts Options

Stocks

JPM - JPMorgan Chase & Co.

Latest News:

- Jamie Dimon turns tide of criticism over JPMorgans big spending plans(Financial Times)

- US Bank Deposits Fall for a Third Week While Lending Stays Little Changed(Bloomberg)

Upside: If the value remains above 140.49, there is a potential for testing levels at 141.39, 142.41, and 143.37.

Downside: Nevertheless, should the value drop below 139.18, it may result in a decline toward 138.13. Additionally, there is a possibility of testing another support level at 137.13.

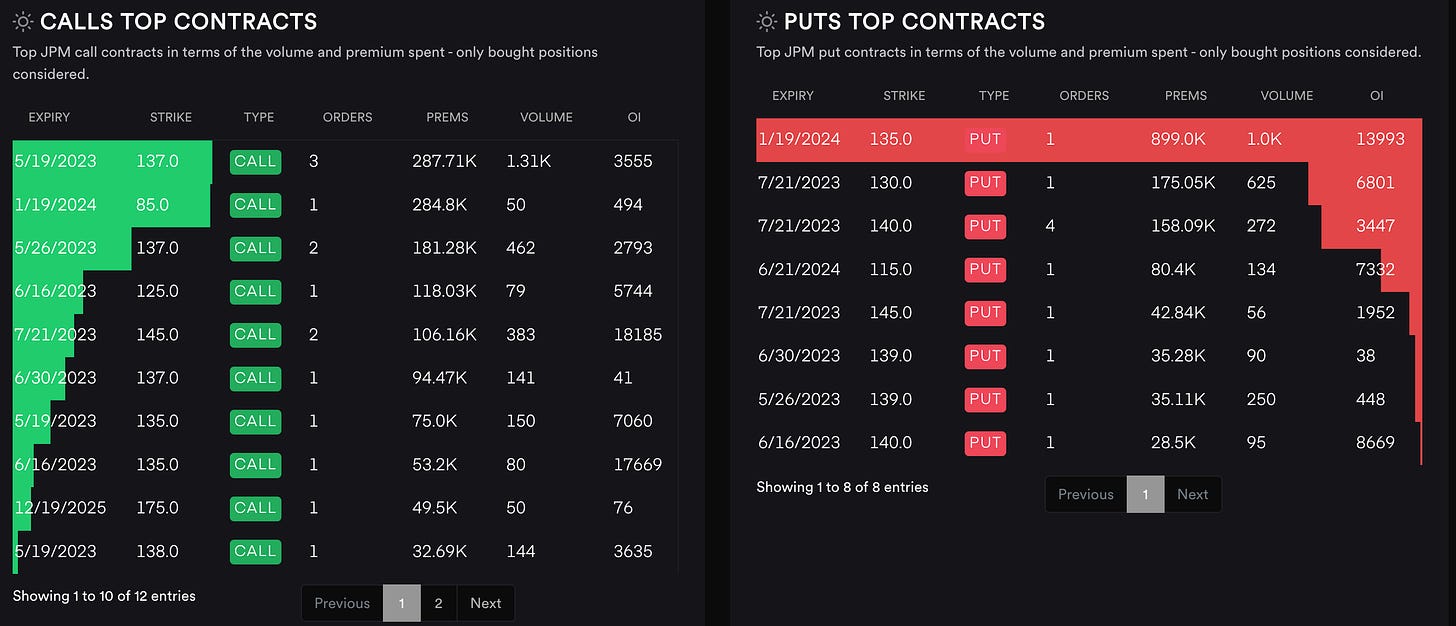

Calls vs Puts Options

AAL - American Airlines Group Inc.

Latest News:

- Judge Rejects Partnership Between American Airlines and JetBlue(The Wall Street Journal)

Upside: Should the value stay above 14.83, there is a possibility of testing levels at 15.06, 15.35, and 15.84.

Downside: If unable to maintain a position above 15.06, there is a potential for a downward movement towards the 14.43 level. Should there be a breakthrough below this level, it would lead to a test of the crucial support level at 13.93.

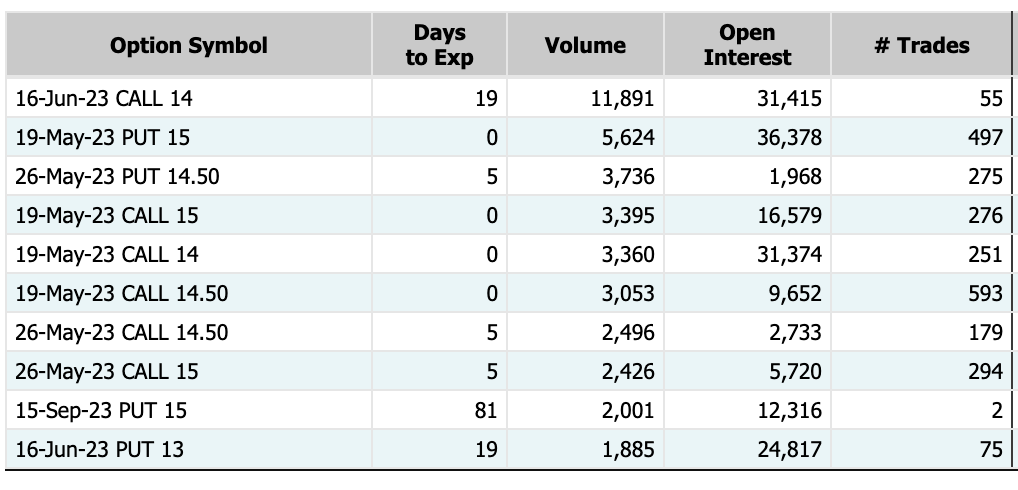

Calls vs Puts Options

AMZN - Amazon.com, Inc.

Latest News:

- Amazon falls behind Walmart in battle for Indias online shoppers(Financial Times)

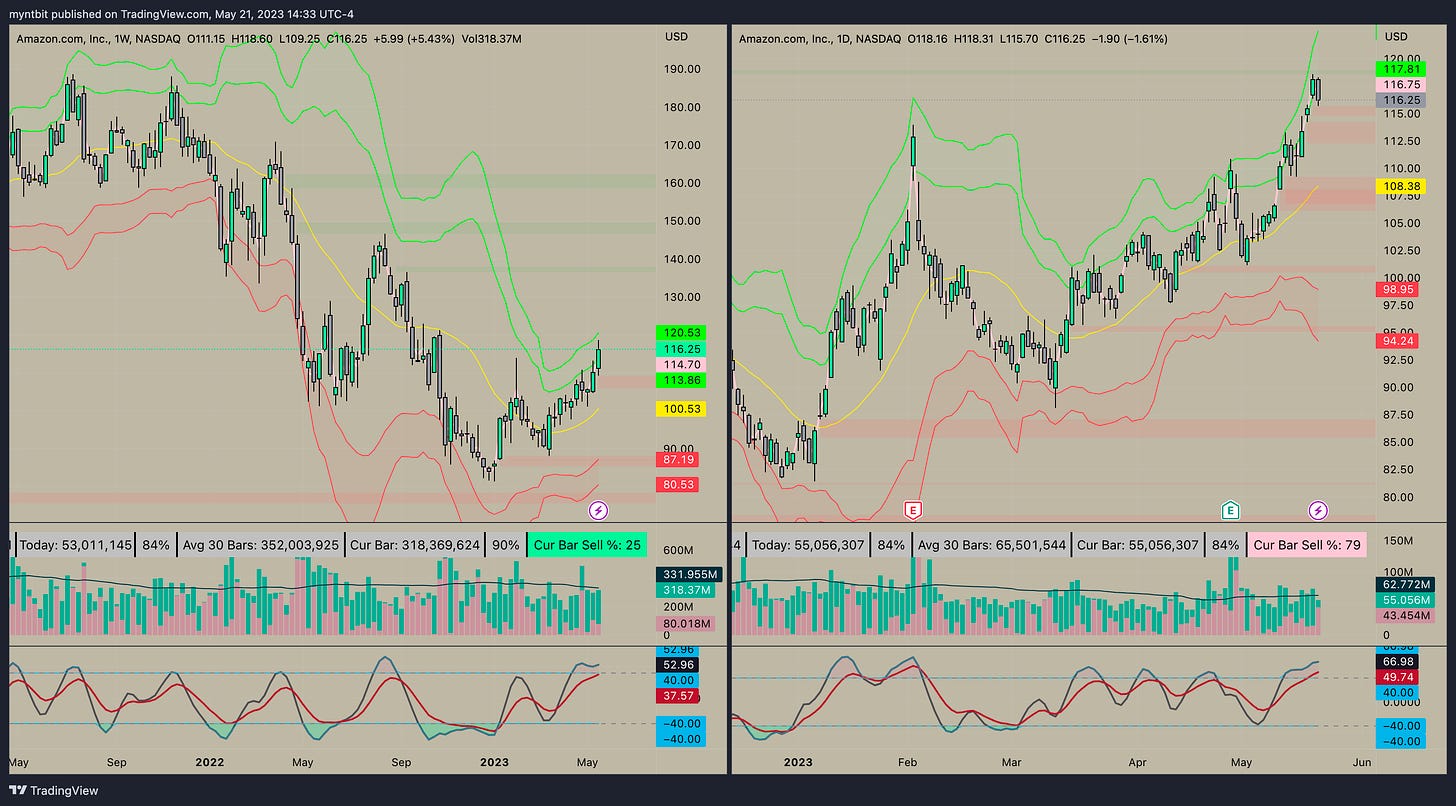

Upside: If we are able to maintain a position above the 117 level, there is a possibility of testing 118.60. A breakthrough above this level may result in additional gains, with the next resistance level at 120.06.

Downside: If the position above 117 cannot be sustained, there is a possibility of a downward movement towards the 115.43 level. A breakthrough below this level would indicate a test of another significant support level at 114.37.

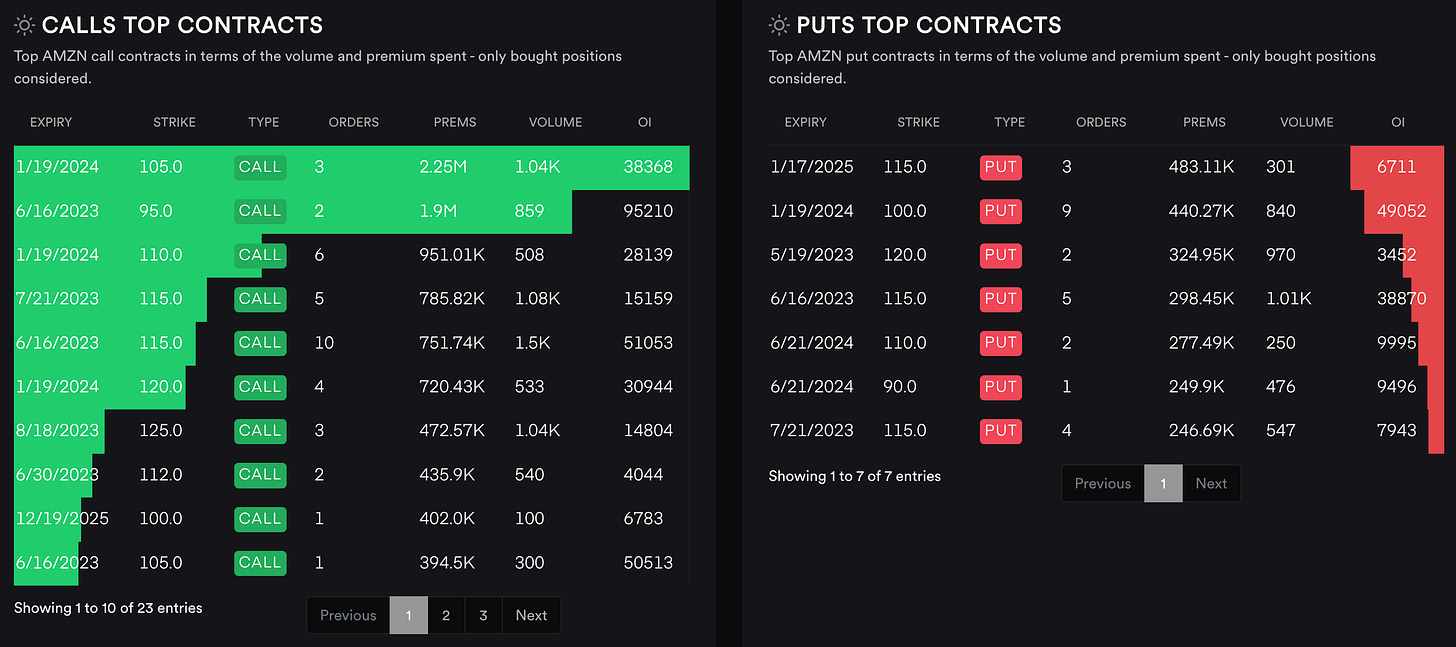

Calls vs Puts Options

👇 Updates for the stocks & futures will be provided in the discord throughout the week (link is below)

Disclaimer: This newsletter is not trading or investment advice, but for general informational purposes only. This newsletter represents our personal opinions that we share publicly for educational purposes. Futures, stocks, and bonds trading of any kind involves a lot of risks. No guarantee of any profit whatsoever is made. In fact, you may lose everything you have. So be very careful. We guarantee no profit whatsoever, You assume the entire cost and risk of any trading or investing activities you choose to undertake. You are solely responsible for making your own investment decisions. Owners/authors of this newsletter, its representatives, its principals, its moderators, and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission, CFTC, or with any other securities/regulatory authority. Consult with a registered investment advisor, broker-dealer, and/or financial advisor. By reading and using this newsletter or any of my publications, you are agreeing to these terms. Any screenshots used here are courtesy of ForexFactory, Earnings Whispers, Finviz, Market Chameleon, Tradytics, and/or Tradingview. We are just end-users with no affiliations with them.