Market Trader Report | May 26, 2024 + Stock Watchlist

What is included in this week's edition?

WEEKLY REVIEW: An overview of current market standing, fundamental matters with implications upon the market, and general sentiment regarding the major US indices.

LOOKING AHEAD: Key takeaways to consider as we look forward to the upcoming trading week.

MARKETS: A technical review of the major indices and commodities that represent the overall health of the market.

Market Trader by MyntBit

Issue# 21

This week, stock performance was mixed as markets responded to a blend of unexpected economic strengths and weaknesses, and the ongoing narrative of sustained higher interest rates. On the stronger side, S&P Global's manufacturing and services purchasing managers' indexes (PMIs) showed significant growth, along with an increase in durable goods orders. Conversely, new and existing home sales fell short of expectations, as high rates continued to suppress activity. Although the final consumer sentiment reading was revised upward, it still hit a five-month low. Additionally, the Federal Open Market Committee’s (FOMC) meeting minutes and comments from Federal Reserve officials emphasized persistent inflation, pushing expectations for rate cuts later into the year. Looking ahead to next week, investors will focus on personal consumption expenditures (PCE) inflation, a second estimate of the first-quarter gross domestic product (GDP), consumer confidence, more housing market data, and wholesale inventories.

Weekly Market Review

The market ended the week with mixed results. The S&P 500 and Nasdaq Composite, which hit a new all-time high, closed with gains, whereas the Russell 2000 and Dow Jones Industrial Average posted significant losses.

Early in the week, price movements were subdued as investors awaited NVIDIA's (NVDA) earnings report, released after Wednesday's close. NVIDIA's shares soared following impressive earnings and outlook, boosting semiconductor and AI-related stocks. However, this did not lift the broader market due to concerns about an impending consolidation.

The PHLX Semiconductor Index (SOX) jumped 4.8% this week, the Vanguard Mega Cap Growth ETF (MGK) gained 1.6%, and the Russell 3000 Growth Index rose 0.9%.

This positive movement benefited the S&P 500 information technology sector, which gained 3.4% for the week. Communication services was the only other sector to close higher, up 0.3%. In contrast, the energy (-3.8%) and real estate (-3.7%) sectors experienced the largest declines.

Investors also reacted to mixed earnings reports from various retailers, including Target (TGT), Lowe's (LOW), TJX (TJX), AutoZone (AZO), and Macy's (M).

Economic data presented a mixed picture as well. The S&P Global U.S. Manufacturing PMI increased to 50.9 from 50.0, and the U.S. Services PMI rose to 54.8 from 51.3. April's New Home Sales Report was weaker than expected, while Durable Orders exceeded expectations. The final reading of the University of Michigan's Consumer Sentiment survey showed a decline in year-ahead inflation expectations to 3.3% from 3.5%.

Yields on government bonds also shifted, with the 10-year note yield rising four basis points and the 2-year note yield increasing by 13 basis points to 4.95%.

Weekly Performance Heatmap

Overall Stock Market Heatmap & Sector Performance

Looking Ahead to the Upcoming Week

The highlight of the holiday-shortened week will be updates on personal spending, personal income, and the PCE deflator, the Fed’s preferred measure of inflation, along with the Fed’s Beige Book survey of regional economic conditions. Other significant reports include the revised first-quarter GDP, consumer confidence, and wholesale inventories. Additionally, updates on the MNI Chicago PMI, the Dallas and Richmond Fed’s manufacturing indexes, pending home sales, and dual measures of home prices will be released.

In the auction space, the U.S. Treasury Department issued $211 billion in two-, five-, and seven-year securities.

Internationally, focus will be on China’s official government release of May’s PMIs for the manufacturing and service sectors, along with industrial profits. From Japan, key data includes industrial production, retail sales, the Tokyo Consumer Price Index (CPI), housing starts, and the jobless rate. In South Korea, trade balance and industrial production figures will be reported, while Australia will release data on retail sales, CPI, building approvals, and the leading index.

In Europe, the main focus will be on preliminary May CPIs, consumer confidence, and the eurozone’s unemployment rate. The U.K. will report house prices and mortgage approvals, while Germany’s retail sales and Ifo Business Climate Index are due. In France, the finalized first-quarter GDP and April’s Producer Price Index will be released.

Important Economical & Earnings Events

Markets

Below are the levels for the upcoming week - updates will be provided on X (previously Twitter) throughout the week.

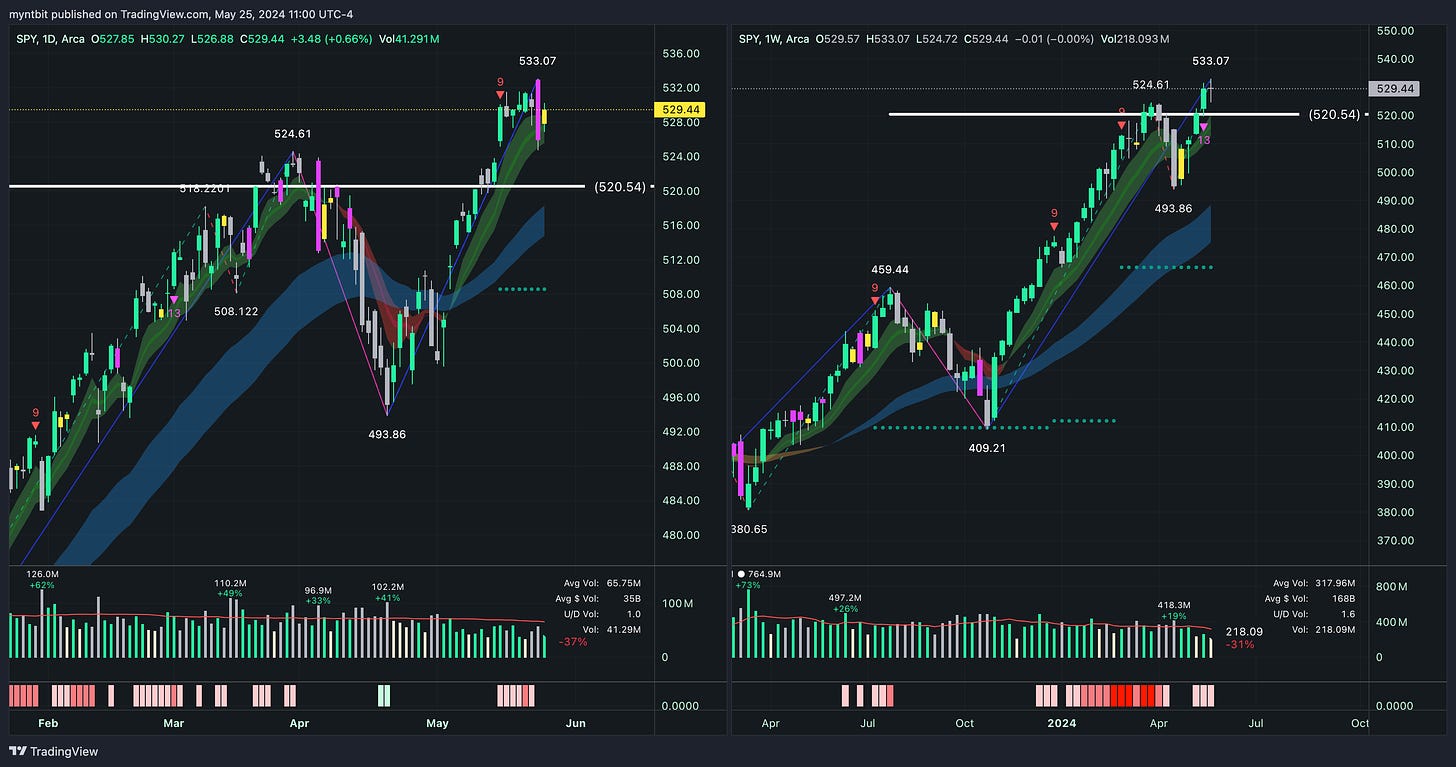

SPY - SPDR S&P 500 ETF Trust

🪷

Support: $525, $520 | Resistance: $530, $535

Given the recent strength and new all-time highs, SPY is likely to continue its upward trend. Based on current momentum and historical data, SPY could reach around $535 in the short term. Nothing has changed from last week's analysis.

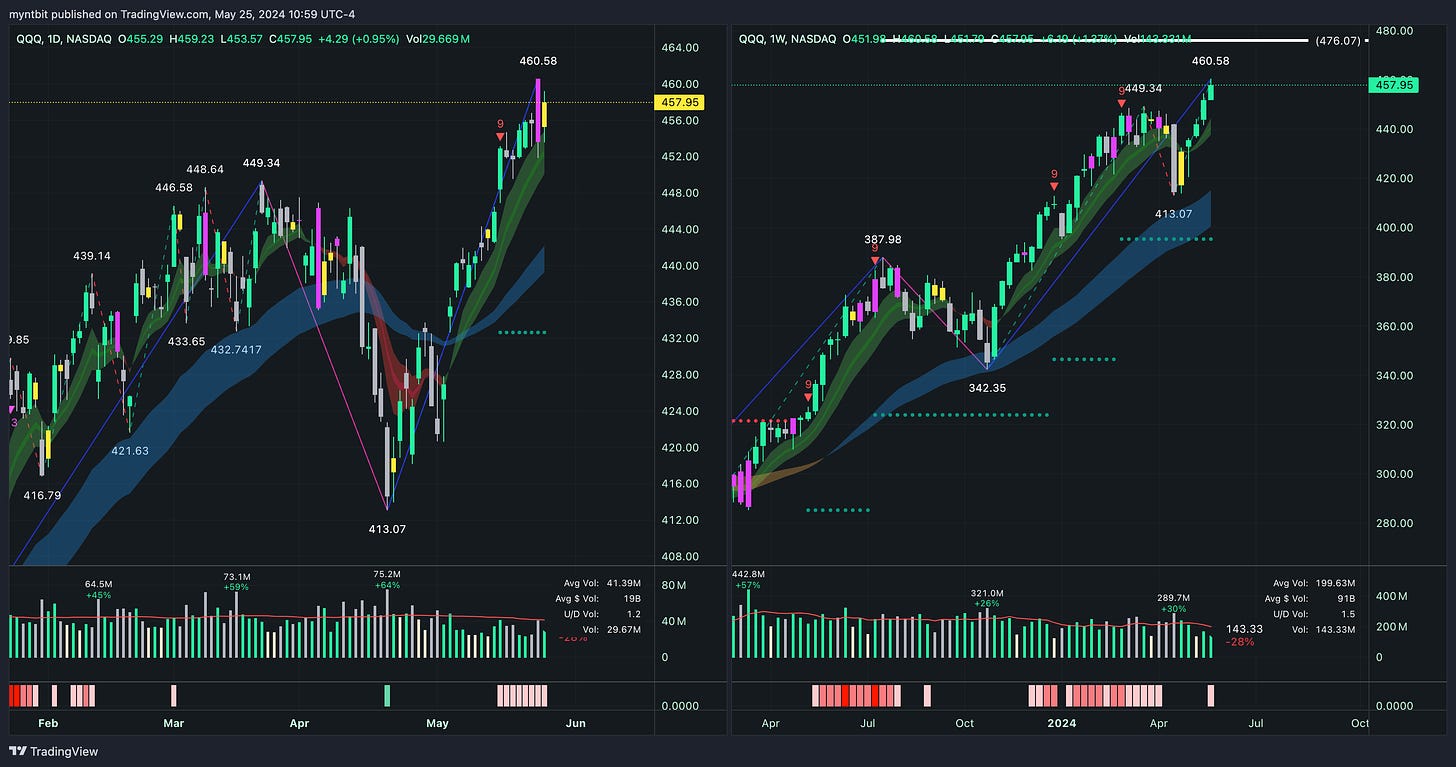

QQQ - Invesco QQQ Trust Series 1

🪷

Support: $450 | Resistance: $460

It was a strong week for QQQ and tech stocks as they broke out and reached a new all-time high. QQQ reached around $460 this past week, so the target of $476 remains valid.

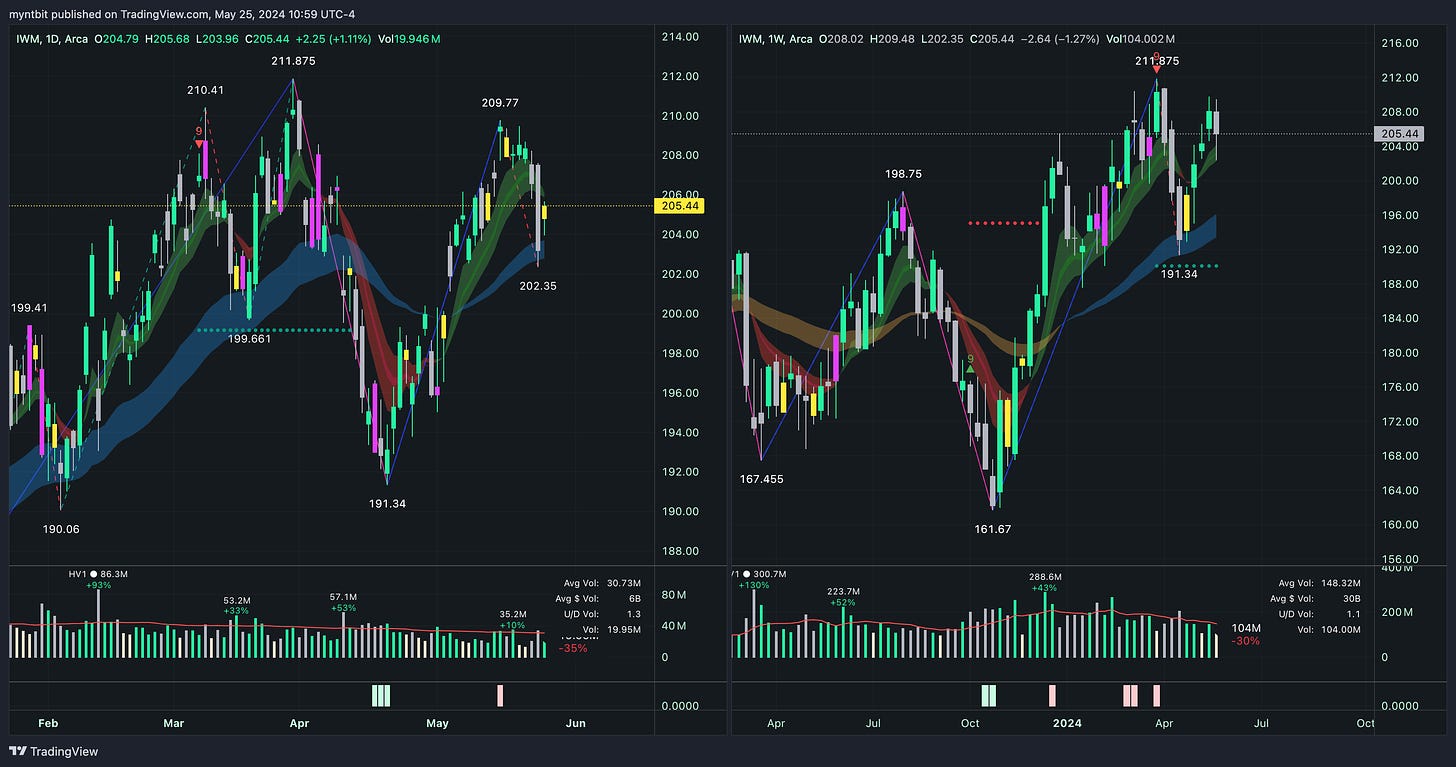

IWM - iShares Russell 2000 ETF

🪷

Support: $200 | Resistance: $210

IWM and small caps remain weak, as they didn't have a great week compared to tech stocks and the broader market. It have not yet reached a new high for the year, continuing to lag due to persistently high interest rates.

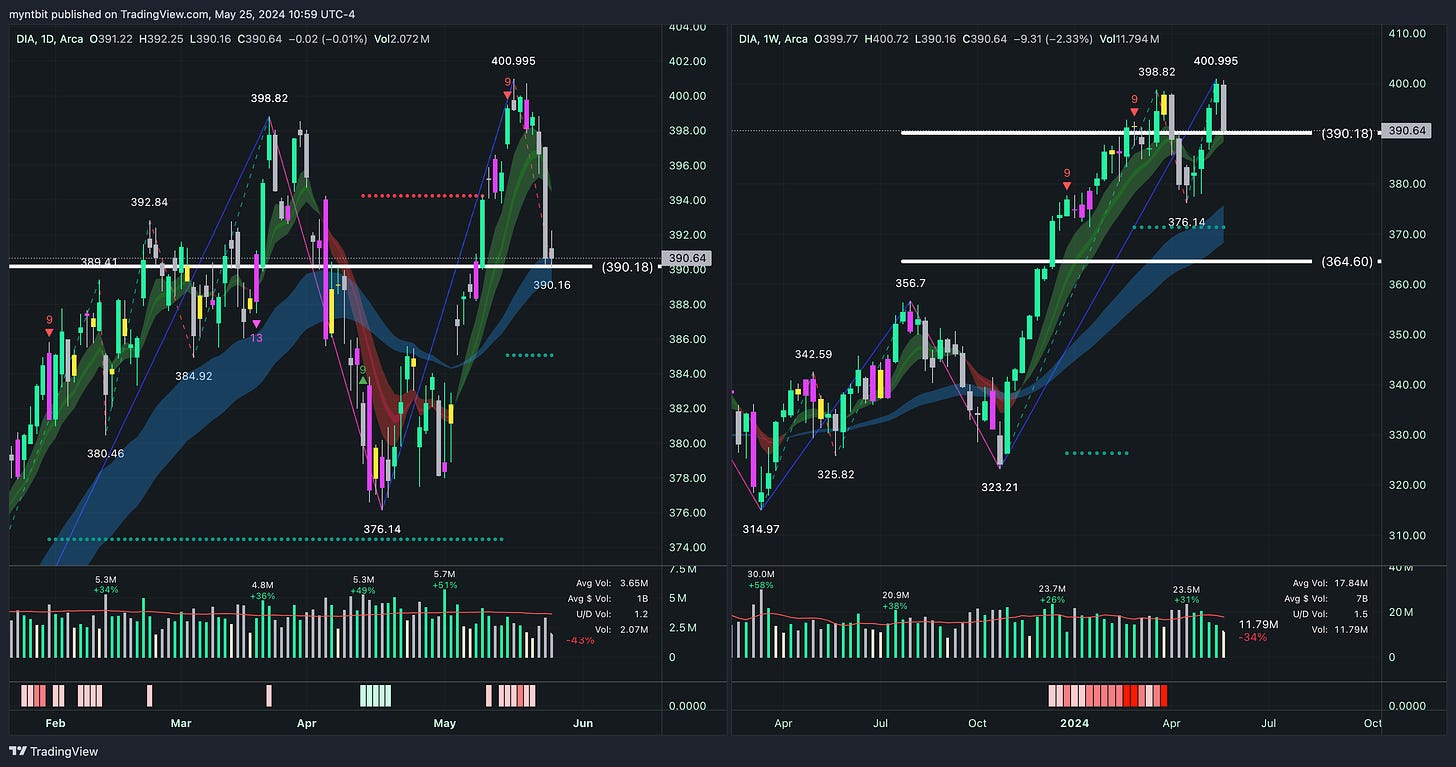

DIA - SPDR Dow Jones Industrial Average ETF Trust

🪷

Support: $395 | Resistance: $400, $405

DIA experienced a sell-off this week, emerging as the weakest among all sectors. This serves as a cautionary signal that warrants additional attention in the days ahead.

VIX - Volatility S&P 500 Index

🪷

Support: $12 | Resistance: $15, $20

The VIX's suppressed levels below $15 and ending the week under $12 highlight a low volatility environment as we approach the typically calm summer months. This suggests that the market is stable and investors are not expecting significant disruptions in the near term. Nothing has changed from last week's analysis.

Last Week's Watchlist

TSLA - Tesla, Inc.

🪷

Support: $169 - $170 | Resistance: $187 & 198

TSLA did reach the first target at $187 but quickly sold off back to our support at $170 but is likely to see continued growth in the near term, potentially aiming for the higher end of its recent trading range around $200.

META - Meta Platforms, Inc.

🪷

Support: $460, $427 | Resistance: $482, $510

META consolidated throughout the week but appears to be poised for a breakout in the upcoming week. It is anticipated that META will continue its upward trajectory in the near term, possibly reaching towards the upper end of its 52-week range, around $531.49.

ARM - Arm Holdings plc.

🪷

Support: $109, $104 | Resistance: $118, $126

ARM broke below, but it faked out with recovery and consolidated throughout the week, coinciding with NVDA earnings. ARM is expected to bounce back from its recent dip and possibly target higher prices in the short to medium term, aiming towards the upper end of its recent range, approximately around $130. However, caution is advised due to the weak close for the week.

Stock Watchlist

BA - Boeing Co.

🪷

Support: $171 & $159 | Resistance: $177 & $188

META - Meta Platforms, Inc.

🪷

Support: $460, $427 | Resistance: $482, $510

JPM - JPMorgan Chase & Co.

🪷

Support: $197 & $193 | Resistance: $201 & $205

Disclaimer: This newsletter is not trading or investment advice, but for general informational purposes only. This newsletter represents our personal opinions that we share publicly for educational purposes. Futures, stocks, and bonds trading of any kind involves a lot of risks. No guarantee of any profit whatsoever is made. In fact, you may lose everything you have. So be very careful. We guarantee no profit whatsoever, You assume the entire cost and risk of any trading or investing activities you choose to undertake. You are solely responsible for making your own investment decisions. Owners/authors of this newsletter, its representatives, its principals, its moderators, and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission, CFTC, or with any other securities/regulatory authority. Consult with a registered investment advisor, broker-dealer, and/or financial advisor. By reading and using this newsletter or any of my publications, you are agreeing to these terms. Any screenshots used here are courtesy of ForexFactory, EarningsWhispers, Finviz, ThinkorSwim, and/or Tradingview. We are just end-users with no affiliations with them.