Market Trader Report | May 05, 2024

What is included in this week's edition?

WEEKLY REVIEW: An overview of current market standing, fundamental matters with implications upon the market, and general sentiment regarding the major US indices.

LOOKING AHEAD: Key takeaways to consider as we look forward to the upcoming trading week.

MARKETS: A technical review of the major indices and commodities that represent the overall health of the market.

Market Trader by MyntBit

Issue# 18

Throughout the week, the stock market experienced fluctuations before ending with mixed results. This came after the Federal Open Market Committee (FOMC) decided to maintain interest rates, as widely expected, followed by labor market data that was less optimistic than anticipated. Nonfarm payrolls experienced their slowest growth in six months, and unemployment edged up slightly. Consequently, Treasury yields declined while stocks rose. Additionally, both manufacturing and services purchasing managers' indexes (PMIs) from the Institute for Supply Management (ISM) unexpectedly contracted. Consumer confidence and housing market data also fell short of expectations, though there were some notable earnings reports that performed well. Looking ahead, the upcoming week will be relatively light on data, featuring the University of Michigan's consumer sentiment index, consumer credit figures, Fedspeak, and the conclusion of earnings season.

Weekly Market Review

This week, the stock market displayed a somewhat mixed performance amidst a flurry of earnings announcements and impactful economic updates. Ultimately, all major indices ended the week with gains. Notably, the Russell 2000 index turned positive for the year, marking a 1.7% increase since the previous Friday.

The performance of mega-cap stocks significantly influenced index movements this week. The Vanguard Mega Cap Growth ETF (MGK) saw a notable 1.3% gain, outperforming the market-cap weighted S&P 500, which rose by 0.6%. Conversely, the equal-weighted S&P 500 experienced a more modest 0.2% increase.

Apple (AAPL) and Amazon.com (AMZN) emerged as standout performers among mega-cap stocks, driven by strong earnings reports and optimistic outlooks. Apple shares surged by 8.3%, while Amazon shares rose by 3.7%.

Market participants also grappled with a mix of economic reports. The Q1 Employment Cost Index revealed a 1.2% rise in compensation costs, surpassing expectations of a 1.0% increase. This report added to concerns about persistent inflation and potential delays in the Fed's rate-cutting timeline.

Fed Chair Powell addressed some of these concerns during his press conference, indicating that it was improbable for the next policy rate adjustment to be a hike. This statement followed the FOMC's decision to maintain the fed funds rate range at 5.25-5.50%, as anticipated, citing a lack of significant progress towards achieving the inflation target in recent months.

The release of the April employment report on Friday received positive market response. The report alleviated worries about an imminent rate hike, yet it did not raise concerns about the health of the labor market. Nonfarm payrolls grew by a smaller-than-expected 175,000, average hourly earnings increased by a smaller-than-expected 0.2%, the unemployment rate rose to a higher-than-expected 3.9%, and the average workweek was slightly shorter than anticipated at 34.3 hours.

In response to the data, Treasury yields decreased over the week, providing support for equities. The 10-year note yield dropped by 17 basis points to 4.50%, while the 2-year note yield declined by 19 basis points to 4.81%.

Among the S&P 500 sectors, only three experienced declines, with utilities (+3.4%) and consumer discretionary (+1.6%) sectors recording the largest gains. The energy sector performed weakest, dropping by 3.4% as oil prices fell below $80.00/bbl, down nearly 7.0% to $78.05/bbl.

Additionally, the S&P 500 and Nasdaq Composite faced technical challenges as they approached their respective 50-day moving averages. The S&P 500 closed just below its 50-day moving average (5,129), while the Nasdaq Composite closed above its 50-day moving average (16,057).

Weekly Performance Heatmap

Overall Stock Market Heatmap & Sector Performance

Looking Ahead to the Upcoming Week

The highlight of a relatively quiet week in terms of economic data will be the University of Michigan's initial release of May's consumer sentiment and inflation expectations, accompanied by the Fed's Senior Loan Officer Opinion Survey for May. Additional updates will include wholesale trade figures, consumer credit data, and the monthly budget statement. The U.S. Treasury Department will auction $125 billion in 3-, 10-, and 30-year securities.

In Asia, investor attention will be on significant releases from China, such as the Consumer Price Index (CPI), Producer Price Index (PPI), trade balance, money supply, Caixin's April PMI for the services sector, and the People's Bank of China's foreign reserves. From Japan, watch for labor cash earnings, the leading index, trade balance figures, and finalized April services PMI. The Reserve Bank of Australia will hold a policy meeting, and economic data from Australia will include retail sales and an inflation measure. Additionally, keep an eye on South Korea's balance of payments and foreign reserves.

In Europe, focus will be on finalized services PMIs, along with retail sales and PPI data from the eurozone. The Bank of England will conduct a policy meeting, coinciding with British data releases including preliminary first-quarter gross domestic product, industrial production figures, and the trade balance. Additionally, Germany's factory orders, industrial production, and trade balance, as well as France's trade balance, will be released.

In other events, Chinese President Xi Jinping will embark on his first visit to Europe since 2019.

Notable Earnings

Important Economical Events

Markets

Below are the levels for the upcoming week - updates will be provided on X (previously Twitter) throughout the week.

SPY - SPDR S&P 500 ETF Trust

🪷

Support: $500 | Resistance: $515, $520

This week, the SPY experienced significant volatility, initially displaying weakness early on before the FOMC announcement served as a catalyst for a rally, propelling the index above last week's high. The focus now shifts to reaching the next target levels at $520 - $525.

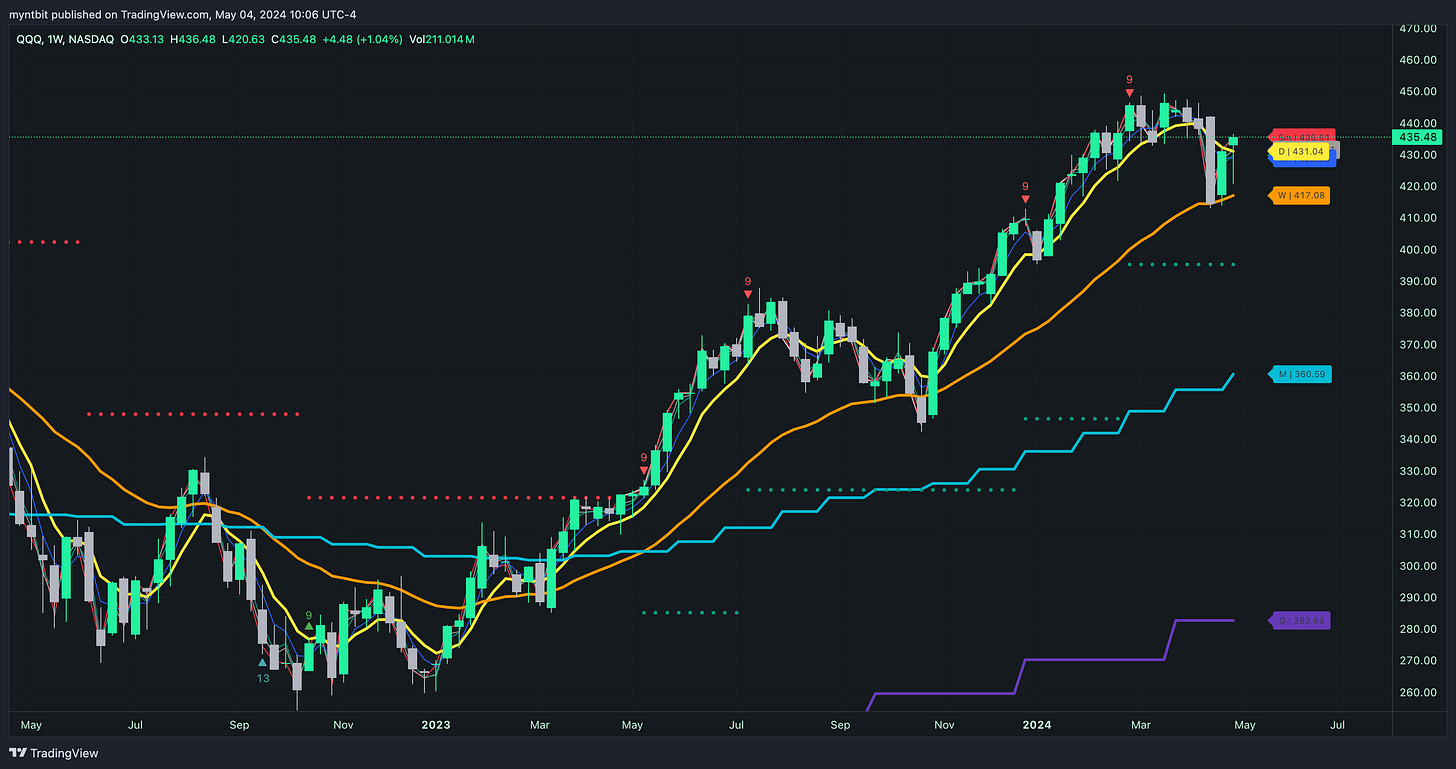

QQQ - Invesco QQQ Trust Series 1

🪷

Support: $415 | Resistance: $440, $450

Once more, the QQQ witnessed weakness earlier in the week, but a turnaround occurred following the release of Apple's earnings and the FOMC meeting, propelling it higher. The focus now shifts to reaching all-time highs as the next target.

IWM - iShares Russell 2000 ETF

🪷

Support: $195 | Resistance: $205, $210

IWM and Small Cap exhibited strength as we saw a close above $200, and the FOMC announcement provided additional momentum to finish the week on a strong note.

DIA - SPDR Dow Jones Industrial Average ETF Trust

🪷

Support: $375 | Resistance: $390, $400

Following the FOMC, the Dow displayed resilience and gained strength, signaling a potential move towards the next target level at 390.

VIX - Volatility S&P 500 Index

🪷

Support: $12 | Resistance: $15, $20

The VIX dropping below $15 indicates a return to the subdued and less volatile market environment observed earlier this year, possibly signaling a resurgence of confidence and trendiness in the market.

Disclaimer: This newsletter is not trading or investment advice, but for general informational purposes only. This newsletter represents our personal opinions that we share publicly for educational purposes. Futures, stocks, and bonds trading of any kind involves a lot of risks. No guarantee of any profit whatsoever is made. In fact, you may lose everything you have. So be very careful. We guarantee no profit whatsoever, You assume the entire cost and risk of any trading or investing activities you choose to undertake. You are solely responsible for making your own investment decisions. Owners/authors of this newsletter, its representatives, its principals, its moderators, and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission, CFTC, or with any other securities/regulatory authority. Consult with a registered investment advisor, broker-dealer, and/or financial advisor. By reading and using this newsletter or any of my publications, you are agreeing to these terms. Any screenshots used here are courtesy of ForexFactory, EarningsHub, Finviz, ThinkorSwim, and/or Tradingview. We are just end-users with no affiliations with them.