Market Trader Report | Mar 31, 2024

What is included in this week's edition?

WEEKLY REVIEW: An overview of current market standing, fundamental matters with implications upon the market, and general sentiment regarding the major US indices.

LOOKING AHEAD: Key takeaways to consider as we look forward to the upcoming trading week.

MARKETS: A technical review of the major indices and commodities that represent the overall health of the market.

Market Trader by MyntBit

Issue# 13

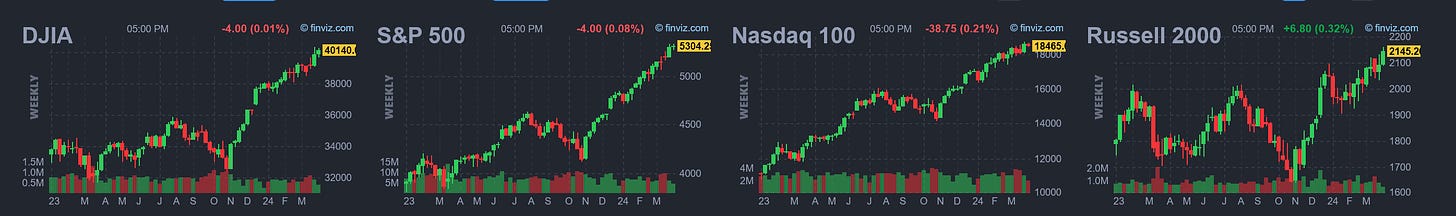

Stocks displayed a mixed performance during a quiet, holiday-shortened week leading up to the release of Friday's personal consumption expenditures (PCE) inflation data. Housing market indicators, such as new and pending home sales, presented a mixed picture, suggesting overall strengthening despite facing challenges. Other key focal points included consumer confidence, the final reading of fourth-quarter gross domestic product (GDP), and durable goods orders. Looking ahead to next week, market reactions will be influenced by the released PCE data, the March jobs report, the Institute for Supply Management's manufacturing and services purchasing managers' indexes (PMIs), and factory orders. Additionally, anticipation is building for the commencement of the first-quarter earnings season, slated to gain momentum in the second week of April. It's worth noting that this report is being published a day earlier due to the holiday on Friday.

Weekly Market Review

The spotlight this week was on housing market data, following last week's robust figures for builder confidence, housing starts, and existing home sales. February's new home sales disappointed slightly at 662K, slipping 0.3% from January's levels. However, this still represented a solid 5.9% increase compared to the same period last year, indicating a continued upward trajectory. The month-over-month decline was likely influenced by higher mortgage rates and an increase in existing homes available for sale. In contrast, pending home sales for February surged 1.6% month-over-month, bouncing back from January's 4.9% drop and surpassing expectations.

Regarding home prices, January's data showed a slowdown in the rate of increase in what remains a pricey market. Both the Federal Housing Finance Agency Home Price Index and the S&P Case-Shiller Home Price Index exhibited modest growth, and undershooting forecasts.

Overall, the housing data suggested an improving market grappling with persistent challenges such as high prices, limited inventory, and elevated mortgage rates. Other significant releases included updates on consumer confidence and the final reading of fourth-quarter GDP. March's Consumer Confidence Survey by the Conference Board remained relatively unchanged from the previous month but fell short of consensus forecasts. Notably, there was a divergence in consumer sentiment regarding current conditions versus future expectations, with concerns over elevated prices and the political climate weighing on outlooks. However, sentiment regarding the current job market improved compared to February.

In a surprise move, the final fourth-quarter real GDP figure was revised upward to 3.4%, attributed to heightened consumer spending, non-residential fixed investment, and reduced private inventory investment. Durable goods orders for February also exceeded expectations, rising 1.4% month-over-month.

Looking ahead, Friday's PCE inflation data will be closely watched, although markets will be closed. Expectations are for mixed but moderate prints, with headline PCE anticipated to increase both month-over-month and year-over-year, while core PCE is expected to see a month-over-month decline while maintaining a steady year-over-year figure. Market reactions to these prints are expected to unfold on Monday.

As of Thursday morning, major stock market indices were mixed for the week but were poised to close the quarter higher. The S&P 500 Index and the Dow were up, while the Nasdaq Composite experienced a slight decline.

Weekly Performance Heatmap

Overall Stock Market Heatmap & Sector Performance

Looking Ahead to the Upcoming Week

The upcoming week will be packed with significant events across various sectors. The focus will primarily be on the Institute for Supply Management's PMIs for March, with updates on manufacturing activity scheduled for Monday and the services sector on Wednesday. Attention will then shift to Friday's release of the March jobs report. Additionally, market-moving data includes labor-market indicators from the ADP survey of private employment and the February Job Openings and Labor Turnover Survey (JOLTS) midweek. Other key releases include factory orders, the trade balance, construction spending, and consumer credit.

In the realm of central banking, Federal Reserve Chair Jerome Powell is set to speak at Stanford's Business, Government, and Society Forum. In China, investors will be closely watching March's PMIs for the services and manufacturing sectors from Caixin. From Japan, expect updates on the Tankan Indexes for the first quarter, finalized March Jibun Bank PMIs, as well as updates on the monetary base and leading economic indicators. South Korea will release its Consumer Price Index (CPI), trade balance data, and manufacturing PMI, while Australia will unveil its trade balance figures, building approvals, and the Melbourne Institute inflation gauge.

In Europe, focus will be on preliminary March Consumer Price Index (CPI) readings, February's eurozone Producer Price Index (PPI), retail sales, consumer expectations, and finalized March PMIs. Additionally, France will provide updates on industrial production, and Germany will report factory orders data. The U.K. is expected to release data on house prices, mortgage approvals, and consumer credit. These events will likely shape market sentiment and drive trading activity throughout the week.

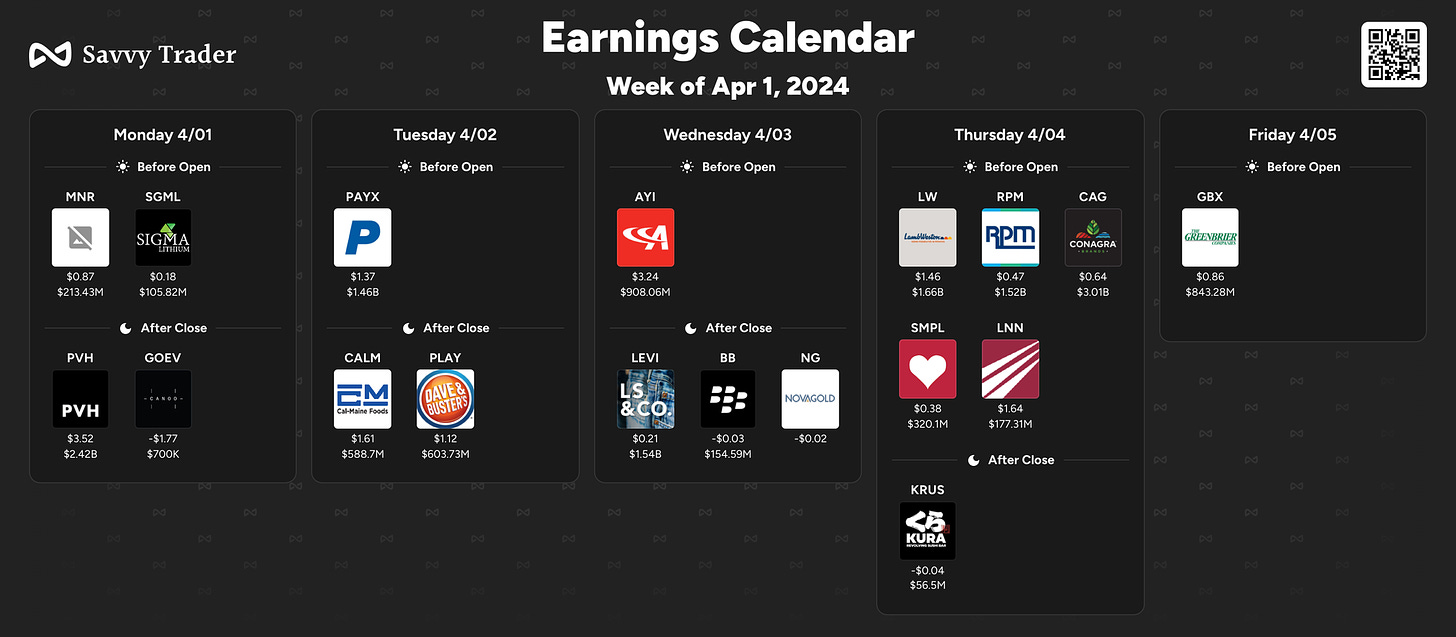

Notable Earnings

Important Economical Events

Markets

Below are the levels for the upcoming week - updates will be provided in Discord and X (previously Twitter) throughout the week.

SPY - SPDR S&P 500 ETF Trust

SPY rallied to an all-time high after FOMC reached our target

🪷

Support: $520, $510 | Resistance: $525

SPY has continued to climb the wall of worry keeping above 10 EMA. Overbought conditions have not resulted in any deterioration. Everything remained the same with the holiday-shortened week.

QQQ - Invesco QQQ Trust Series 1

Tech was chopping for this week

🪷

Support: $440 | Resistance: $450

Nothing changed from last week, as QQQ has been lagging as the tech was getting rotated out of tech into other sectors.

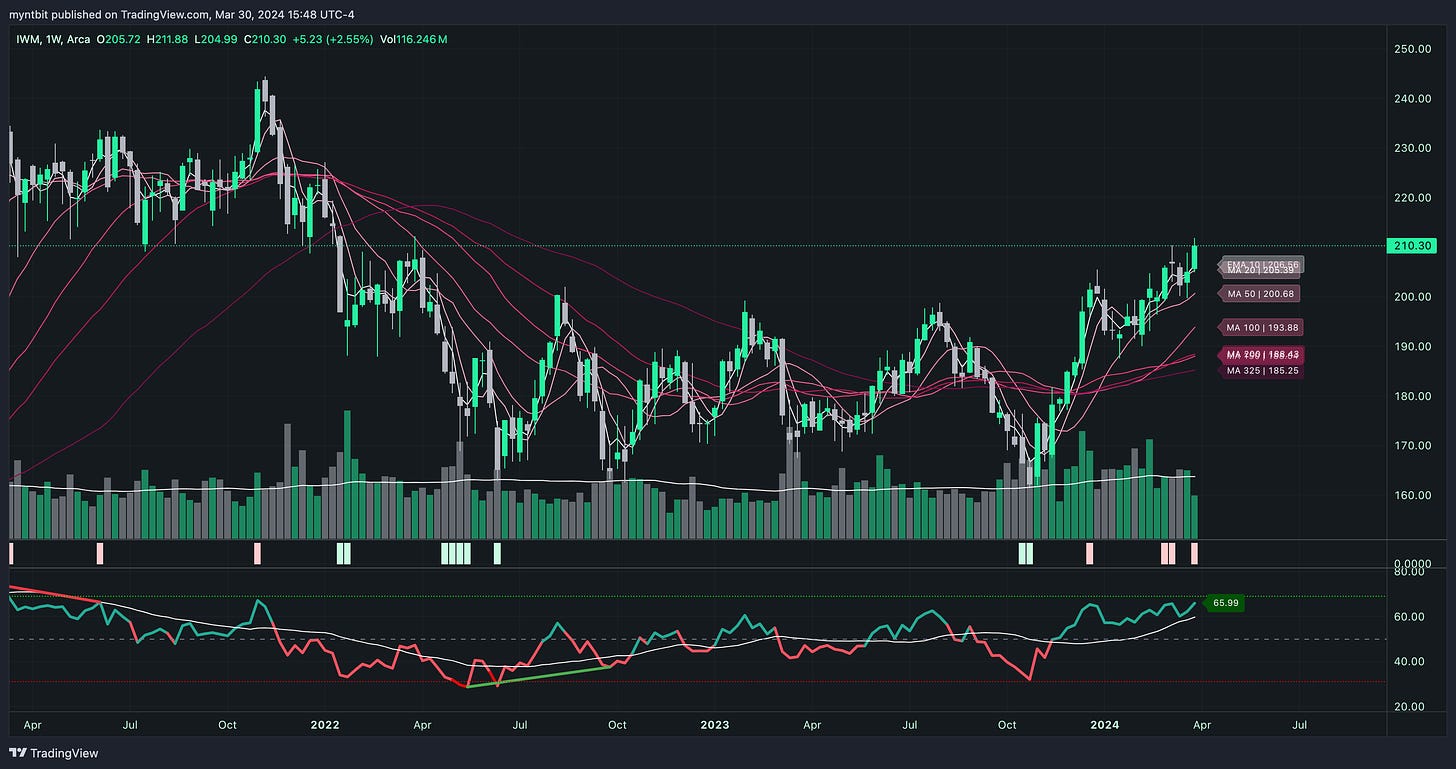

IWM - iShares Russell 2000 ETF

Small Caps showed strength to rally and breakout of the range

🪷

Support: $200 | Resistance: $210, $215

IWM broke out finally, this needs to watch small caps for continuation.

DIA - SPDR Dow Jones Industrial Average ETF Trust

Dow showed strength

🪷

Support: $390 | Resistance: $400

Dow continued showing strength after the breakout.

Disclaimer: This newsletter is not trading or investment advice, but for general informational purposes only. This newsletter represents our personal opinions that we share publicly for educational purposes. Futures, stocks, and bonds trading of any kind involves a lot of risks. No guarantee of any profit whatsoever is made. In fact, you may lose everything you have. So be very careful. We guarantee no profit whatsoever, You assume the entire cost and risk of any trading or investing activities you choose to undertake. You are solely responsible for making your own investment decisions. Owners/authors of this newsletter, its representatives, its principals, its moderators, and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission, CFTC, or with any other securities/regulatory authority. Consult with a registered investment advisor, broker-dealer, and/or financial advisor. By reading and using this newsletter or any of my publications, you are agreeing to these terms. Any screenshots used here are courtesy of ForexFactory, EarningsWishper, Finviz, ThinkorSwim, and/or Tradingview. We are just end-users with no affiliations with them.