Market Trader Report | Mar 24, 2024

What is included in this week's edition?

WEEKLY REVIEW: An overview of current market standing, fundamental matters with implications upon the market, and general sentiment regarding the major US indices.

LOOKING AHEAD: Key takeaways to consider as we look forward to the upcoming trading week.

MARKETS: A technical review of the major indices and commodities that represent the overall health of the market.

Market Trader by MyntBit

Issue# 12

This week saw a strong rally in stocks, notably the S&P 500 Index, set for its best performance of the year, following the Federal Reserve (Fed) meeting. Fed Chair Jerome Powell's post-meeting comments took a dovish stance, suggesting the possibility of three interest rate cuts this year and hinting at a potential slowdown in quantitative tightening. The housing sector garnered attention, with existing home sales data indicating adjustments to higher mortgage rates. Looking ahead, focus will shift to inflation, with personal consumption expenditure (PCE) data scheduled for release next Friday. Other updates to monitor include personal income and spending, the final fourth-quarter GDP report, and further developments in the housing market.

Weekly Market Review

This week, all attention was on the Federal Reserve as the Federal Open Market Committee (FOMC) opted to keep interest rates steady, triggering a rally in markets as investors anticipated a potential shift towards looser monetary policy. Fed Chair Jerome Powell's post-meeting remarks echoed market expectations, emphasizing the possibility of rate cuts later in the year and suggesting a slowdown in the Fed's quantitative tightening program. Economic updates included positive news from the housing market, with February's housing starts and building permits surpassing expectations, indicating ongoing recovery despite high interest rates. Existing home sales also saw a notable increase, suggesting a potential turnaround in the resale market after a period of decline due to rising rates. Other economic indicators, such as preliminary March purchasing managers' index (PMI) data and jobless claims, reflected continued resilience in the economy. By midday Friday, major stock indexes were on track for weekly gains, with the S&P 500, Nasdaq Composite, and Dow Jones Industrial Average all showing positive momentum.

Weekly Performance Heatmap

Overall Stock Market Heatmap & Sector Performance

Looking Ahead to the Upcoming Week

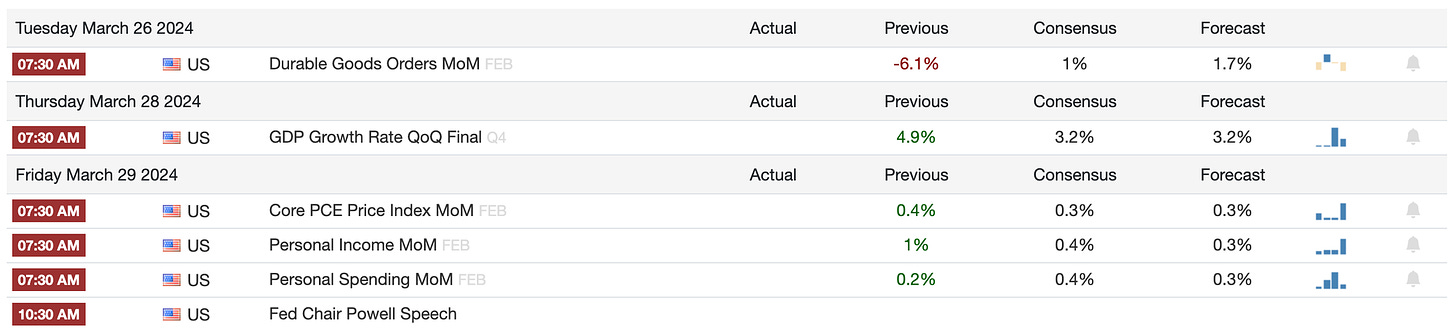

In the upcoming holiday-shortened week, a plethora of economic updates is expected, with February data on personal spending, personal income, and the PCE Deflator, along with durable-goods orders and March consumer confidence. Investors will also be keen on the final look at fourth-quarter GDP and economy-wide corporate profits. Housing market data will also be in focus, including new home sales, pending home sales, and January home prices. The U.S. Treasury will auction $204 billion in two-, five-, and seven-year securities. In China, attention will be on March PMIs for manufacturing and services, preceded by February industrial profit data. From Japan, updates on the Tokyo Consumer Price Index (CPI), labor market, retail sales, industrial production, services Producer Price Index (PPI), and housing starts are expected. South Korea will release industrial production, consumer confidence, and business surveys, while Australia will report CPI, consumer confidence, retail sales, and private sector credit. In Europe, key releases include eurozone March consumer confidence and money supply growth, preliminary March CPI and February PPI from France, and March unemployment claims and February retail sales from Germany. Additionally, the U.K. will finalize fourth-quarter GDP and release house price data.

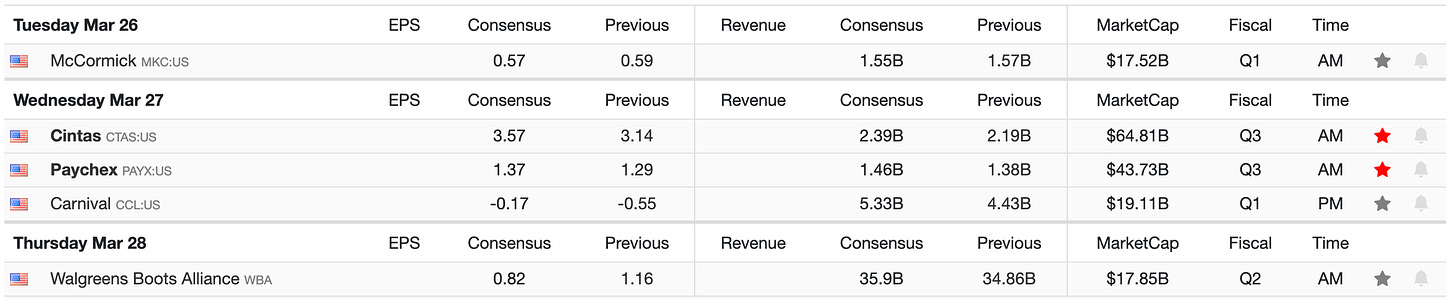

Notable Earnings

Important Economical Events

Markets

Below are the levels for the upcoming week - updates will be provided in Discord and X (previously Twitter) throughout the week.

SPY - SPDR S&P 500 ETF Trust

SPY rallied to an all-time high after FOMC reached our target

🪷

Support: $520, $510 | Resistance: $525

SPY has continued to climb the wall of worry keeping above 10 EMA. Overbought conditions have not resulted in any deterioration.

QQQ - Invesco QQQ Trust Series 1

Tech has been weak of late but it rallied to an all-time high after FOMC

🪷

Support: $440 | Resistance: $450

QQQ has been lagging as the tech was getting rotated out from(take a look at the semiconductor sector) while the other sectors are getting bid but after FOMC, the price rose to an all-time high. Overbought conditions have not resulted in any deterioration.

IWM - iShares Russell 2000 ETF

Small Caps continue to be weak, still awaiting a new yearly high.

🪷

Support: $200 | Resistance: $210

IWM has been weak and consolidating in a range, still awaiting some strength to appear in small caps.

DIA - SPDR Dow Jones Industrial Average ETF Trust

Dow showed more strength than tech suggesting a rotation behind the scenes

🪷

Support: $390 | Resistance: $400

Dow finally broke out from its large base sideways consolidation zone.

Disclaimer: This newsletter is not trading or investment advice, but for general informational purposes only. This newsletter represents our personal opinions that we share publicly for educational purposes. Futures, stocks, and bonds trading of any kind involves a lot of risks. No guarantee of any profit whatsoever is made. In fact, you may lose everything you have. So be very careful. We guarantee no profit whatsoever, You assume the entire cost and risk of any trading or investing activities you choose to undertake. You are solely responsible for making your own investment decisions. Owners/authors of this newsletter, its representatives, its principals, its moderators, and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission, CFTC, or with any other securities/regulatory authority. Consult with a registered investment advisor, broker-dealer, and/or financial advisor. By reading and using this newsletter or any of my publications, you are agreeing to these terms. Any screenshots used here are courtesy of ForexFactory, EarningsWishper, Finviz, ThinkorSwim, and/or Tradingview. We are just end-users with no affiliations with them.