Market Trader Report | Mar 17, 2024

What is included in this week's edition?

WEEKLY REVIEW: An overview of current market standing, fundamental matters with implications upon the market, and general sentiment regarding the major US indices.

LOOKING AHEAD: Key takeaways to consider as we look forward to the upcoming trading week.

MARKETS: A technical review of the major indices and commodities that represent the overall health of the market.

Market Trader by MyntBit

Issue# 11

Weekly Market Review

This week's economic focus was centered on inflation data, which revealed a continued uptick in both headline and core Consumer Price Index (CPI), as well as Producer Price Index (PPI), indicating persistent price pressures in the market. Despite import prices staying in line with expectations, market sentiment leaned towards the Federal Reserve maintaining its current interest rate stance rather than implementing cuts, given the inflationary concerns. Consumer-related indicators presented a mixed picture, with retail sales growth lower than anticipated, unexpected declines in consumer sentiment, and a drop in small business optimism, largely attributed to worries over rising costs and future economic conditions. However, positive signals emerged from the labor market, with real average hourly earnings increasing and fewer initial and continuing jobless claims than expected. Despite these mixed signals, major stock market indices ended the week relatively flat or slightly down, reflecting the prevailing uncertainty among investors amidst the conflicting economic data.

Weekly Performance Heatmap

Overall Stock Market Heatmap & Sector Performance

Looking Ahead to the Upcoming Week

This week's economic agenda is packed with significant events and data releases across various regions. The focus will primarily be on the Federal Reserve's policy decision and Summary of Economic Projections, ahead of the March 22 government funding deadline. Additionally, attention will be on S&P Global's March purchasing managers' indexes (PMIs) for both manufacturing and services sectors, providing insights into economic activity. Other notable releases include the index of leading economic indicators, U.S. international transactions data for the fourth quarter of 2023, and a regional manufacturing survey from the Philadelphia Fed district. The housing market will also be in focus, with data on existing home sales, housing starts, building permits, and homebuilder sentiment. In China, key data on retail sales, industrial production, and fixed asset investment will be scrutinized, alongside loan prime rates from the People's Bank of China. Japan will feature updates on the national CPI, preliminary March Jibun Bank PMIs, trade balance, industrial production, and core machine orders, coinciding with the Bank of Japan's policy meeting. Australia will see the Reserve Bank of Australia's policy meeting, followed by preliminary March PMIs and labor market data, while South Korea will release their PPI. In Europe, attention will be on the first release of March PMIs, consumer confidence, ZEW expectations for economic growth, and the finalized February eurozone CPI. The Bank of England's policy meeting will be a highlight, accompanied by British data releases including CPI, Retail Price Index, consumer confidence, and retail sales. Moreover, Germany's ZEW survey of current conditions, PPI, and Ifo's business climate survey, along with France's manufacturing confidence and retail sales, will be closely watched.

Earnings Calendar

Economical Events

Markets

Below are the levels for the upcoming week - updates will be provided in Discord and X (previously Twitter) throughout the week.

SPY - SPDR S&P 500 ETF Trust

Bullish but looking weak at these levels.

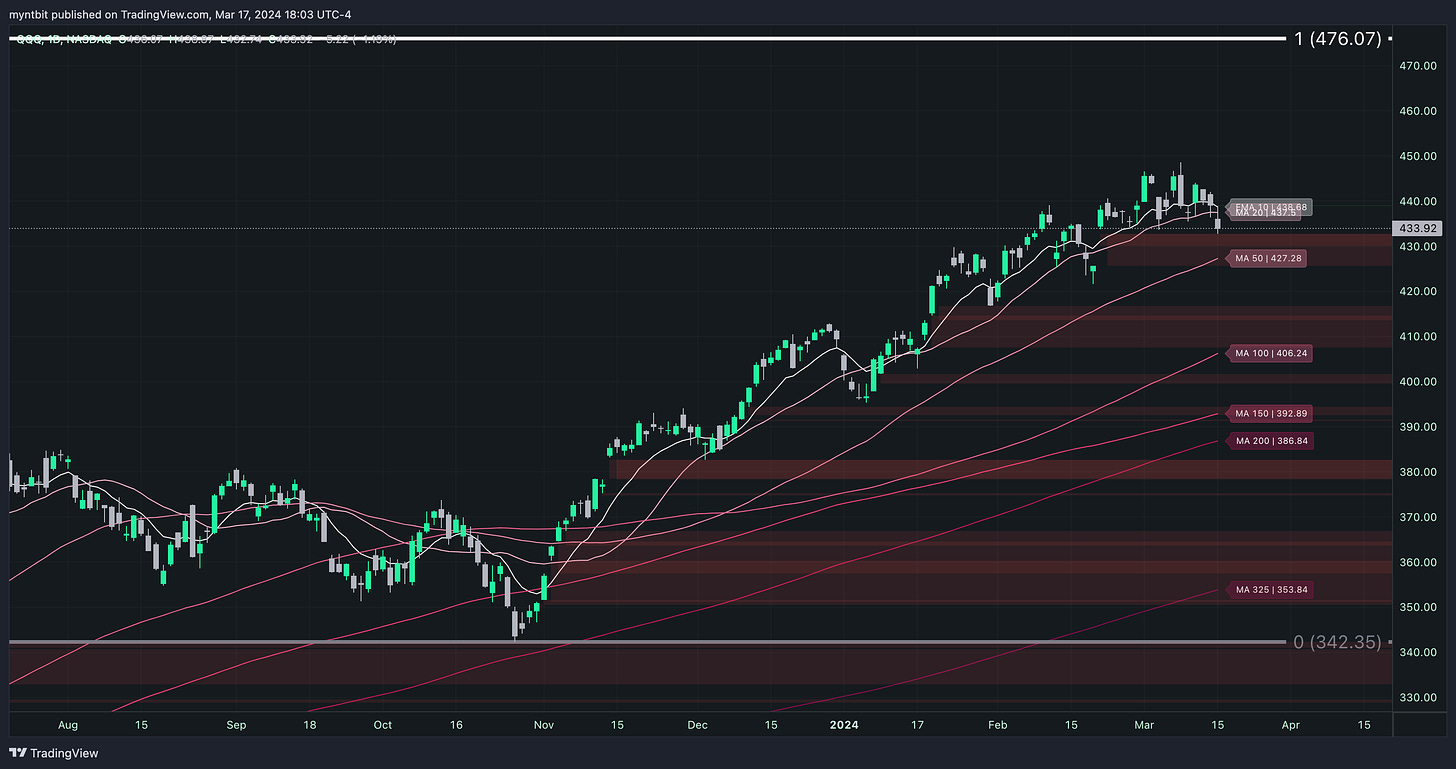

QQQ - Invesco QQQ Trust Series 1

Bullish turning into Sideways, watch for the short-term MA cross.

IWM - iShares Russell 2000 ETF

Sideways, watch for the short-term MA cross and price is under 20 Day MA.

DIA - SPDR Dow Jones Industrial Average ETF Trust

Sideways/Consolidating, watch for the short-term MA cross and price is under 20 Day MA.

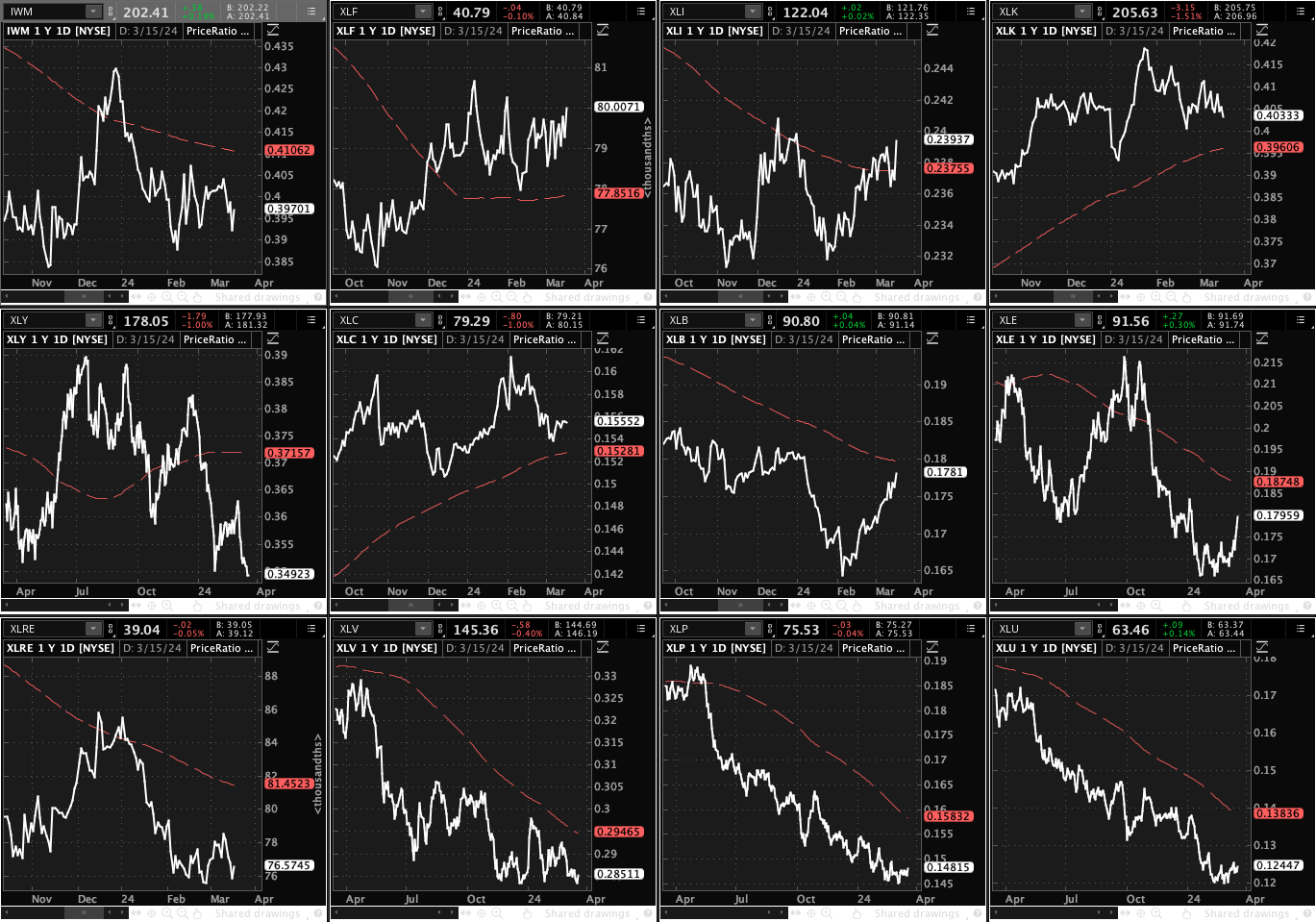

Sector Analysis

Trending up: XLF, XLI, XLB, XLE

Trending down: XLK, XLY

March Watchlist

Our List for March ⛰️🦋$SPY $QQQ #stocks$ARM 🎯 $165$GCT 🎯 $43$NVDA 🎯 $870$GTLB 🎯 $78$NFLX 🎯 $640$DKNG 🎯 $46$NET 🎯 $116$NVO 🎯 $130$PLTR 🎯 $28$META 🎯 $525$DDOG 🎯 $140$COIN 🎯 $240$MRVL 🎯 $84$ABNB 🎯 $170$FTNT 🎯 $80

Again, seasonality is not on our… pic.twitter.com/iWoveppvam— MyntBit (@myntbit) March 2, 2024

Follow us on X/Twitter!

Updates and alerts will be provided on X throughout the week (link is below)

If you want daily support and resistance levels and weekly expected moves check out the below link.

Further Video Analysis...

Thank you for reading MyntBit Newsletter. Please share on X (Previously Twitter)!

Disclaimer: This newsletter is not trading or investment advice, but for general informational purposes only. This newsletter represents our personal opinions that we share publicly for educational purposes. Futures, stocks, and bonds trading of any kind involves a lot of risks. No guarantee of any profit whatsoever is made. In fact, you may lose everything you have. So be very careful. We guarantee no profit whatsoever, You assume the entire cost and risk of any trading or investing activities you choose to undertake. You are solely responsible for making your own investment decisions. Owners/authors of this newsletter, its representatives, its principals, its moderators, and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission, CFTC, or with any other securities/regulatory authority. Consult with a registered investment advisor, broker-dealer, and/or financial advisor. By reading and using this newsletter or any of my publications, you are agreeing to these terms. Any screenshots used here are courtesy of ForexFactory, EarningsWishper, Finviz, ThinkorSwim, and/or Tradingview. We are just end-users with no affiliations with them.