Market Trader Report | Mar 10, 2024

What is included in this week's edition?

WEEKLY REVIEW: An overview of current market standing, fundamental matters with implications upon the market, and general sentiment regarding the major US indices.

LOOKING AHEAD: Key takeaways to consider as we look forward to the upcoming trading week.

MARKETS: A technical review of the major indices and commodities that represent the overall health of the market.

Market Trader by MyntBit

Issue# 10

Weekly Market Review

The focus in markets this week was on labor market data. The February jobs report showed mixed results, indicating a still-resilient labor market. Nonfarm payrolls were strong, but previous months' figures were revised downward. The unemployment rate increased unexpectedly, while average hourly earnings declined slightly. Details in the report showed softening in some areas, like demand for temporary help services. Other economic indicators, like the ISM services PMI and factory orders, showed signs of softening as well. Consumer credit unexpectedly increased in January. Federal Reserve commentary suggested a cautious approach to rate cuts, with some divergence in views among Fed officials. Overall, the markets ended the week mixed, with the S&P 500 slightly up, the Nasdaq down, and the Dow declining.

Weekly Performance Heatmap

Overall Stock Market Heatmap & Sector Performance

Looking Ahead to the Upcoming Week

The upcoming week is packed with important economic data releases and events globally. In the United States, focus will be on inflation data, including Consumer Price Index (CPI) and Producer Price Index (PPI), along with retail sales, industrial production, small business optimism, and consumer sentiment reports. Additionally, there will be releases of the monthly budget statement, business inventories, and a regional business survey from the Fed Bank of New York. The U.S. Treasury department will issue $117 billion in securities across different maturities. U.S. central bank officials will enter a quiet period ahead of the March 20 policy decision.

In China, attention will be on money supply growth, new loans, and the one-year medium-term lending facility rate and volume. Japan will release finalized fourth-quarter gross domestic product (GDP), Producer Price Index (PPI), money stock, Tertiary Industry Index, and machine tool orders. South Korea's unemployment rate and Australia's business confidence will also be monitored.

In Europe, focus will be on the eurozone's industrial production, as well as finalized February CPIs from Germany and France. From the U.K., watch for monthly GDP, employment data, industrial production, visible trade balance, and house prices. Overall, the week ahead is expected to provide crucial insights into the economic health and direction of various major economies worldwide.

Earnings Calendar

Economical Events

Markets

Below are the levels for the upcoming week - updates will be provided in Discord and X (previously Twitter) throughout the week.

SPY - SPDR S&P 500 ETF Trust

Monthly - Up. Nothing has indicated weakness within the S&P 500.

Weekly - Up. DOJI candle, be cautious.

Daily - Sideways. On Friday, that was a bearish engulfing candle, but need follow through.

Note: Based on our system and different criteria

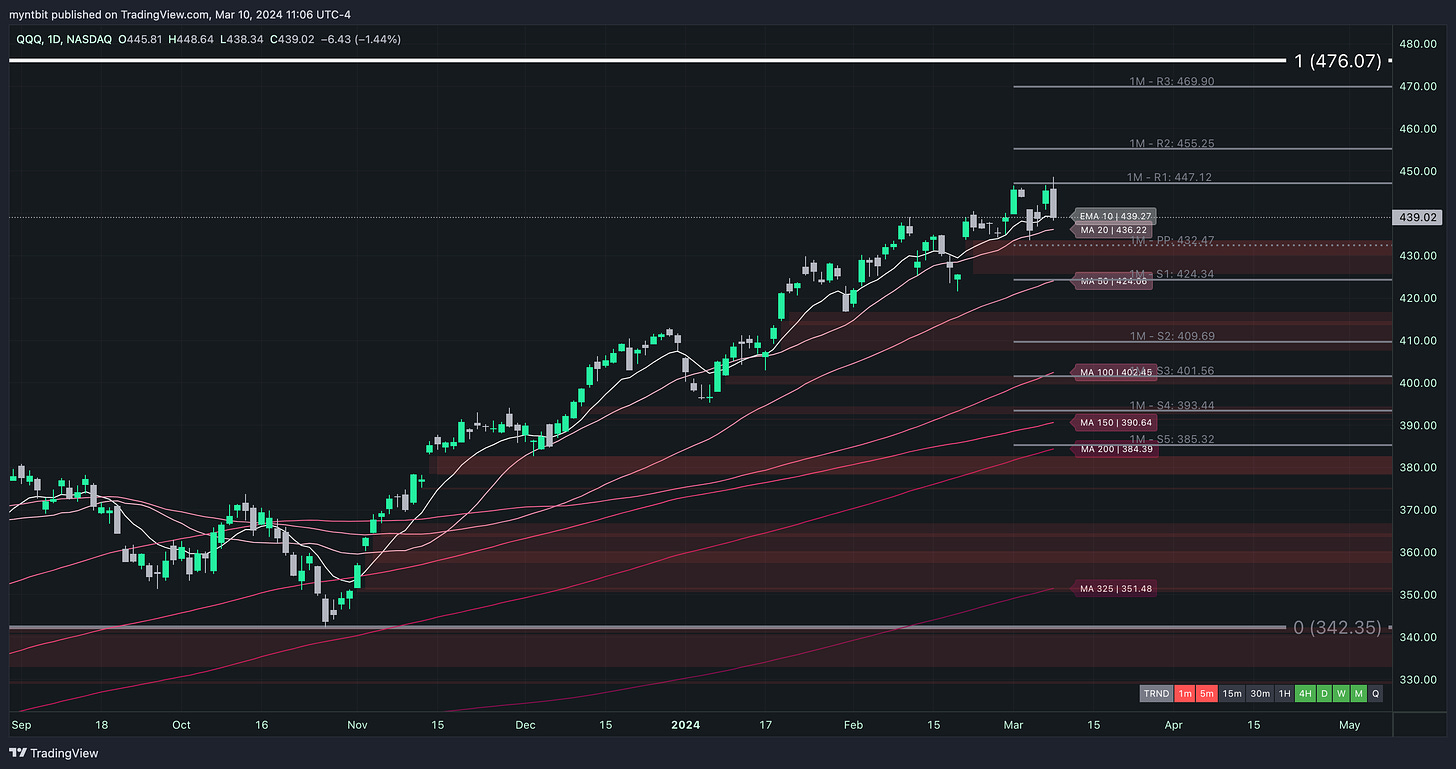

QQQ - Invesco QQQ Trust Series 1

Monthly - Sideways. DOJI candle, need for caution.

Weekly - Sideways. That was a bearish engulfing candle, but need follow through.

Daily - Down. On Friday, that was a bearish engulfing candle, but need follow through.

Note: Based on our system and different criteria

IWM - iShares Russell 2000 ETF

IWM finally broke out but ended with a weekly DOJI, so need week will be important.

Monthly - Up. Still bullish.

Weekly - Sideways. Doji Candle

Daily - Sideways. Bearish engulfing candle.

Note: Based on our system and different criteria

DIA - SPDR Dow Jones Industrial Average ETF Trust

IWM finally broke out but ended with a weekly DOJI, so need week will be important.

Monthly - Sideways. Still inside the bar, consolidating.

Weekly - Down. Follow-through after the DOJI candle the week prior.

Daily - Sideways. The range is getting tighter and volume is drying up, this will break out soon.

Note: Based on our system and different criteria

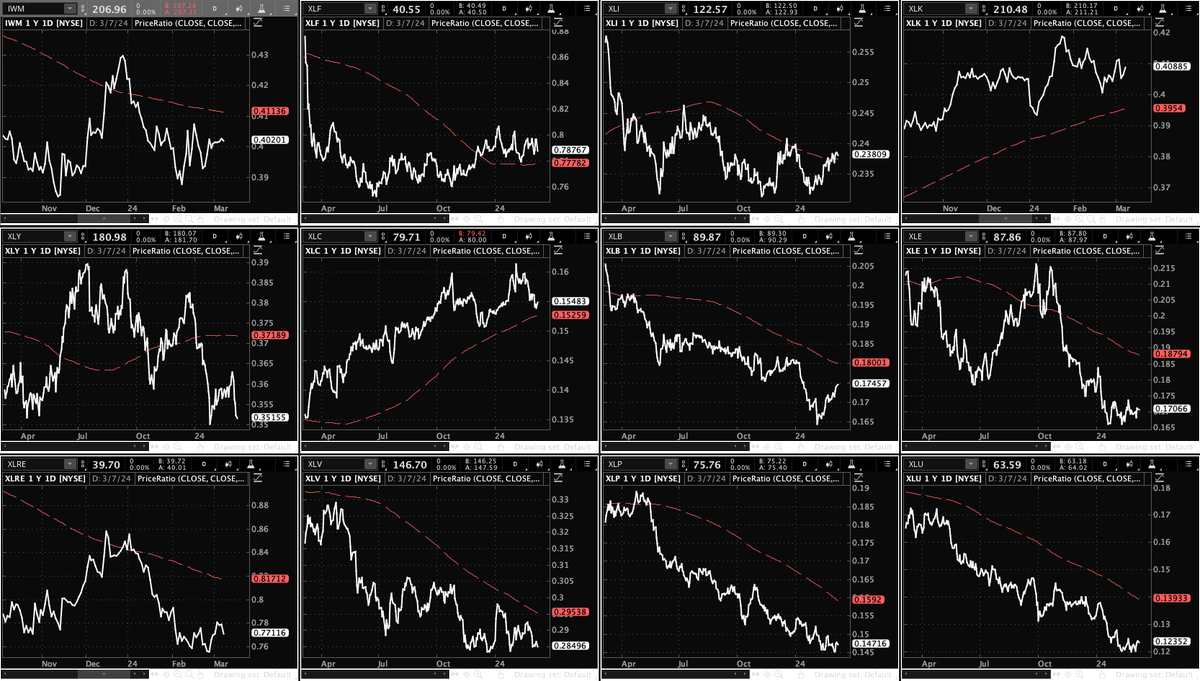

Sector Analysis

$SPY $QQQ $IWM

Sector Analysis - Below is a look at the current state of the sectors

Leading Sectors: $XLC & $XLK

- Communication Services & Technology are the only two sectors currently trending higher.

On Watch: $XLF, $XLI & IWM

- Financial, Industrial & Small Caps are the… pic.twitter.com/JgYsV6Y0ZH— MyntBit (@myntbit) March 8, 2024

March Watchlist

Our List for March ⛰️🦋$SPY $QQQ #stocks$ARM 🎯 $165$GCT 🎯 $43$NVDA 🎯 $870$GTLB 🎯 $78$NFLX 🎯 $640$DKNG 🎯 $46$NET 🎯 $116$NVO 🎯 $130$PLTR 🎯 $28$META 🎯 $525$DDOG 🎯 $140$COIN 🎯 $240$MRVL 🎯 $84$ABNB 🎯 $170$FTNT 🎯 $80

Again, seasonality is not on our… pic.twitter.com/iWoveppvam— MyntBit (@myntbit) March 2, 2024

Follow us on X/Twitter!

Updates and alerts will be provided on X throughout the week (link is below)

If you want daily support and resistance levels and weekly expected moves check out the below link.

Further Video Analysis...

Thank you for reading MyntBit Newsletter. Please share on X (Previously Twitter)!

Disclaimer: This newsletter is not trading or investment advice, but for general informational purposes only. This newsletter represents our personal opinions that we share publicly for educational purposes. Futures, stocks, and bonds trading of any kind involves a lot of risks. No guarantee of any profit whatsoever is made. In fact, you may lose everything you have. So be very careful. We guarantee no profit whatsoever, You assume the entire cost and risk of any trading or investing activities you choose to undertake. You are solely responsible for making your own investment decisions. Owners/authors of this newsletter, its representatives, its principals, its moderators, and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission, CFTC, or with any other securities/regulatory authority. Consult with a registered investment advisor, broker-dealer, and/or financial advisor. By reading and using this newsletter or any of my publications, you are agreeing to these terms. Any screenshots used here are courtesy of ForexFactory, EarningsWishper, Finviz, ThinkorSwim, and/or Tradingview. We are just end-users with no affiliations with them.