What is included in this week's edition?

WEEKLY REVIEW: An overview of current market standing, fundamental matters with implications upon the market, and general sentiment regarding the major US indices.

LOOKING AHEAD: Key takeaways to consider as we look forward to the upcoming trading week.

MARKETS: A technical review of the major indices and commodities that represent the overall health of the market.

Market Trader by MyntBit | Issue# 25

Stocks fluctuated throughout the week as a mixed bag of economic data indicated that the path to disinflation remains uneven. Retail sales, housing market data, and leading economic indicators were softer than expected, highlighting the effects of restrictive monetary policy. On the other hand, some metrics showed unexpected resilience in business activity: S&P Global’s Purchasing Managers’ Indexes (PMIs) for manufacturing and services surpassed consensus expectations, and industrial production experienced a significant rise. Fedspeak emphasized the need for further data to confirm that inflation is moving steadily toward the 2% target before considering any rate cuts.

Looking ahead to next week, the focus will shift back to inflation, with investors closely monitoring the personal consumption expenditure (PCE) inflation data for May. Additionally, updates on the housing market, the third estimate of gross domestic product (GDP), consumer confidence, and durable goods orders will be closely watched.

Weekly Market Review

The major indices posted gains during this holiday-shortened week. The S&P 500 broke past the 5,500 level for the first time, reaching record highs despite light trading volume for most of the week. Both bond and equity markets were closed on Wednesday in observance of Juneteenth. However, Friday's session saw heavy trading volume due to the quadruple witching options expiration.

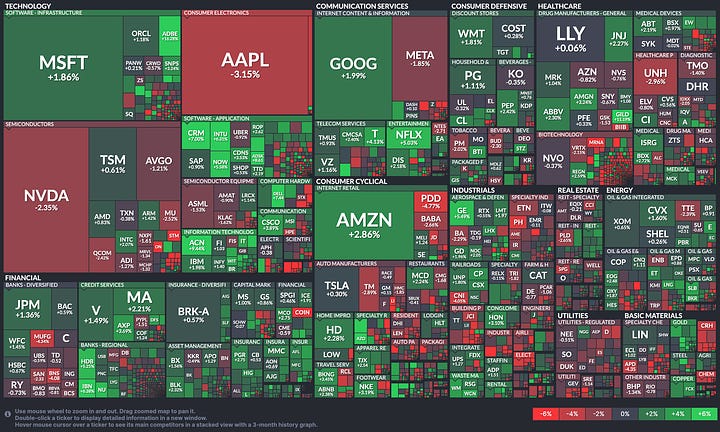

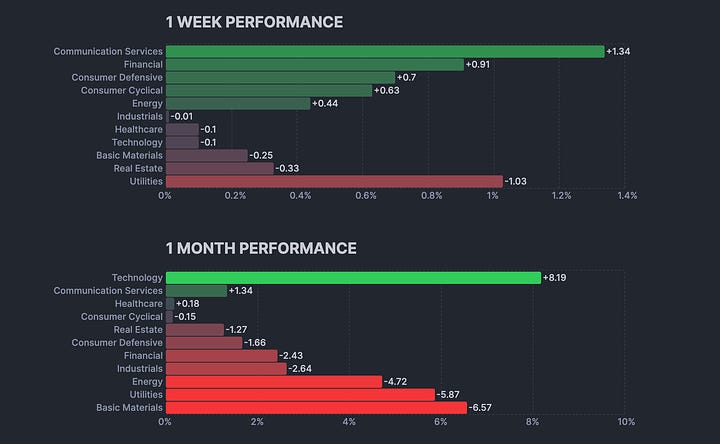

Gains were relatively broad-based throughout the week. The equal-weighted S&P 500 outperformed the market-cap weighted S&P 500, gaining 1.2% compared to the latter's 0.6% increase. Only three sectors in the S&P 500 recorded declines: real estate (-0.3%), information technology (-0.7%), and utilities (-0.8%).

The consumer discretionary sector was the standout performer, rising 2.5%. It was followed by the energy (+1.9%), financials (+1.7%), and industrials (+1.9%) sectors, which also posted strong gains.

Recent weeks have seen mega-cap stocks outperforming, but this week marked a shift towards a broader range of buying activity across different market segments. Some of the top-weighted names actually experienced notable declines, driven by a lingering trend of consolidation. For instance, NVIDIA (NVDA) dropped by 4.0% compared to the previous week, and Apple (AAPL) fell by 2.4%.

Treasury yields moved higher but did not deter stock market buyers. The yield on the 2-year note rose by five basis points for the week, settling at 4.73%, while the 10-year note yield also increased by five basis points, closing at 4.26%.

Weekly Performance Heatmap

Overall Stock Market Heatmap & Sector Performance

Looking Ahead to the Upcoming Week

The week ahead is packed with important data releases, including updates on personal spending, personal income, and the Personal Consumption Expenditures (PCE) index, which is the Federal Reserve's preferred measure of inflation. Additionally, the University of Michigan will release its finalized consumer sentiment report for June. Other potentially market-moving reports include the revised first-quarter GDP, consumer confidence, and durable goods orders.

Also on the agenda are the MNI Chicago PMI, the Chicago Fed’s National Activity Index, and manufacturing indexes from the Dallas and Richmond Federal Reserve districts. A series of housing market updates will be released, covering home prices, as well as new and pending home sales. The U.S. Treasury will also issue $211 billion in two-, five-, and seven-year securities.

In China, the focus will be on the official June Purchasing Managers' Indexes (PMIs) for the manufacturing and service sectors, along with industrial profits. From Japan, key releases will include industrial production, retail sales, the Tokyo Consumer Price Index (CPI), housing starts, the leading economic index, and the unemployment rate.

Elsewhere in the region, South Korea will publish updated business surveys and industrial production data, while Australia will release reports on retail sales, CPI, consumer confidence, and private sector credit.

In Europe, attention will be on consumer confidence reports and the eurozone's money supply. The U.K. will release finalized first-quarter GDP data, while France will report its preliminary June CPI and May Producer Price Index (PPI). Key data from Germany will include retail sales, changes in unemployment, and the Ifo business climate survey.

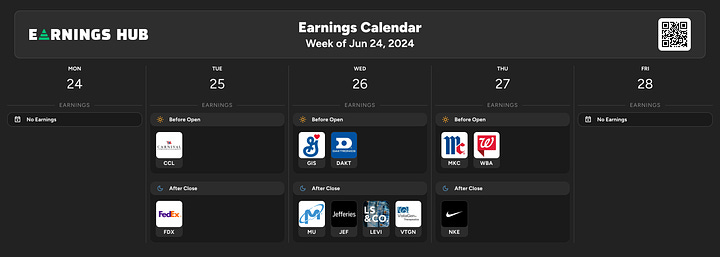

Important Economical & Earnings Event

Markets

Below are the levels for the upcoming week - updates will be provided on X (previously Twitter) throughout the week.

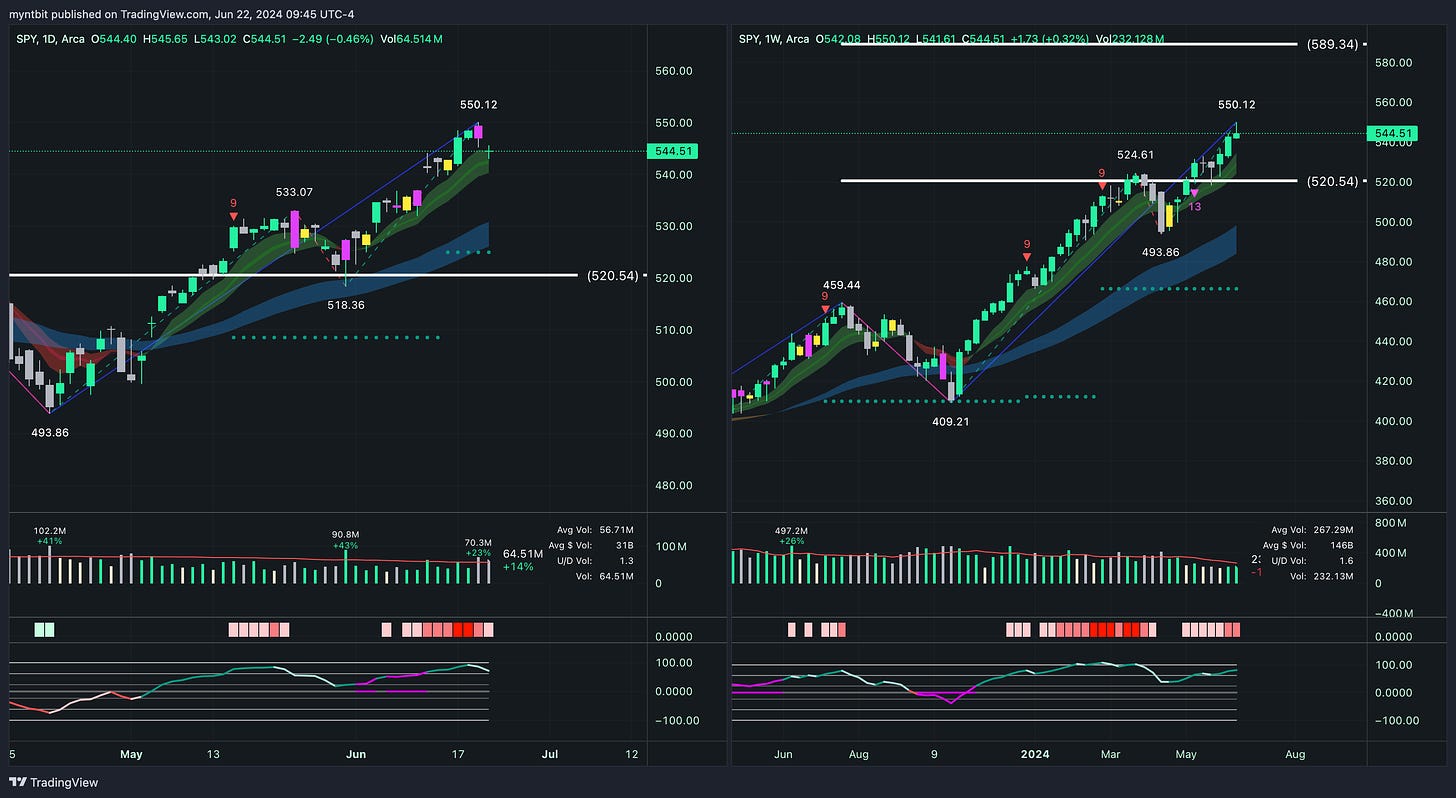

SPY - SPDR S&P 500 ETF Trust

Short-term: Cautiously bullish, watching for a breakout above $544.12 with a target above $545.

Medium-term: Bullish, with the potential for upward continuation if resistance levels are broken.

Long-term: Bullish, contingent on maintaining above key support levels and continuing the upward trend.

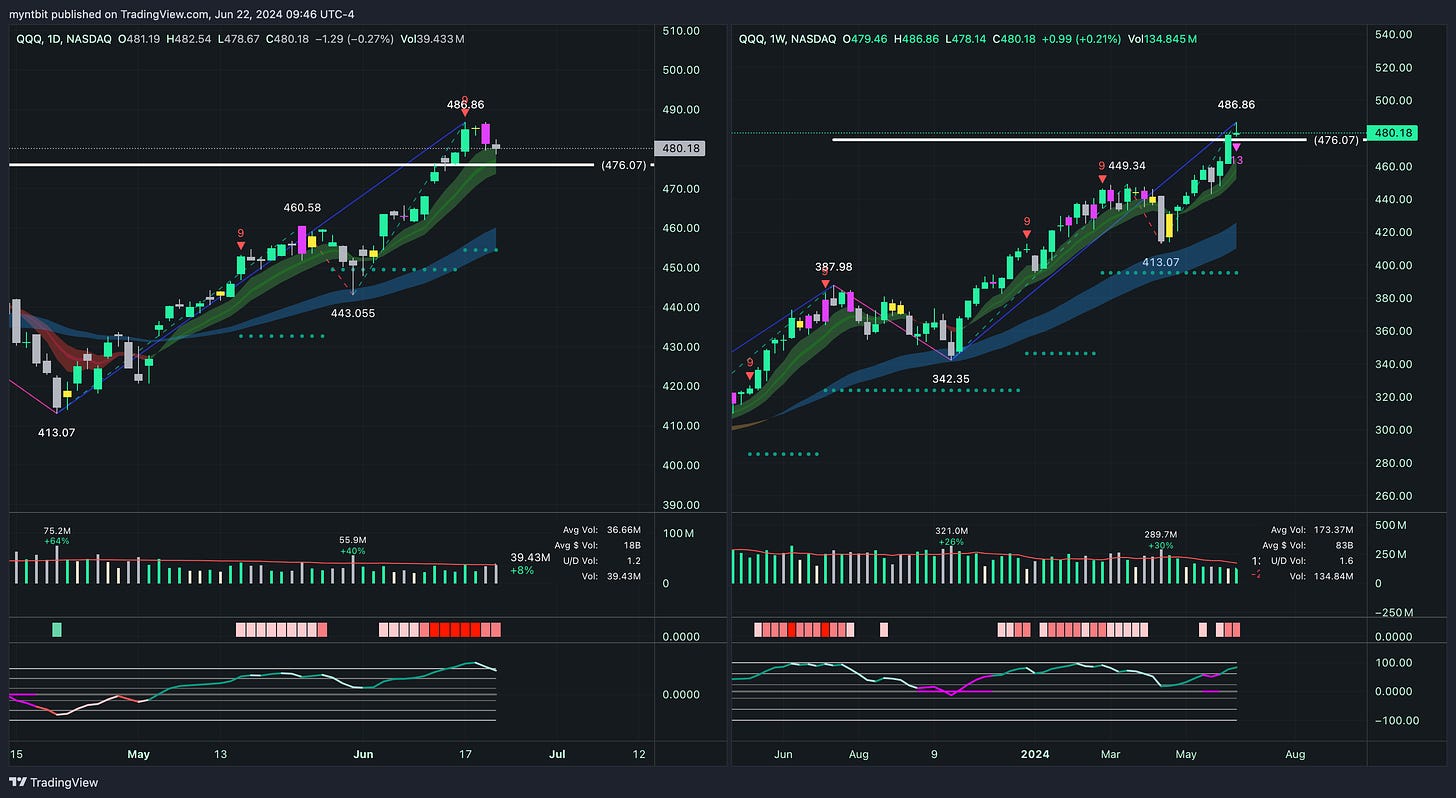

QQQ - Invesco QQQ Trust Series 1

Short-term: Cautiously bullish, watching for a breakout above $479.26 with a target above $480.

Medium-term: Bullish, with the potential for upward continuation if resistance levels are broken.

Long-term: Bullish, contingent on maintaining above key support levels and continuing the upward trend.

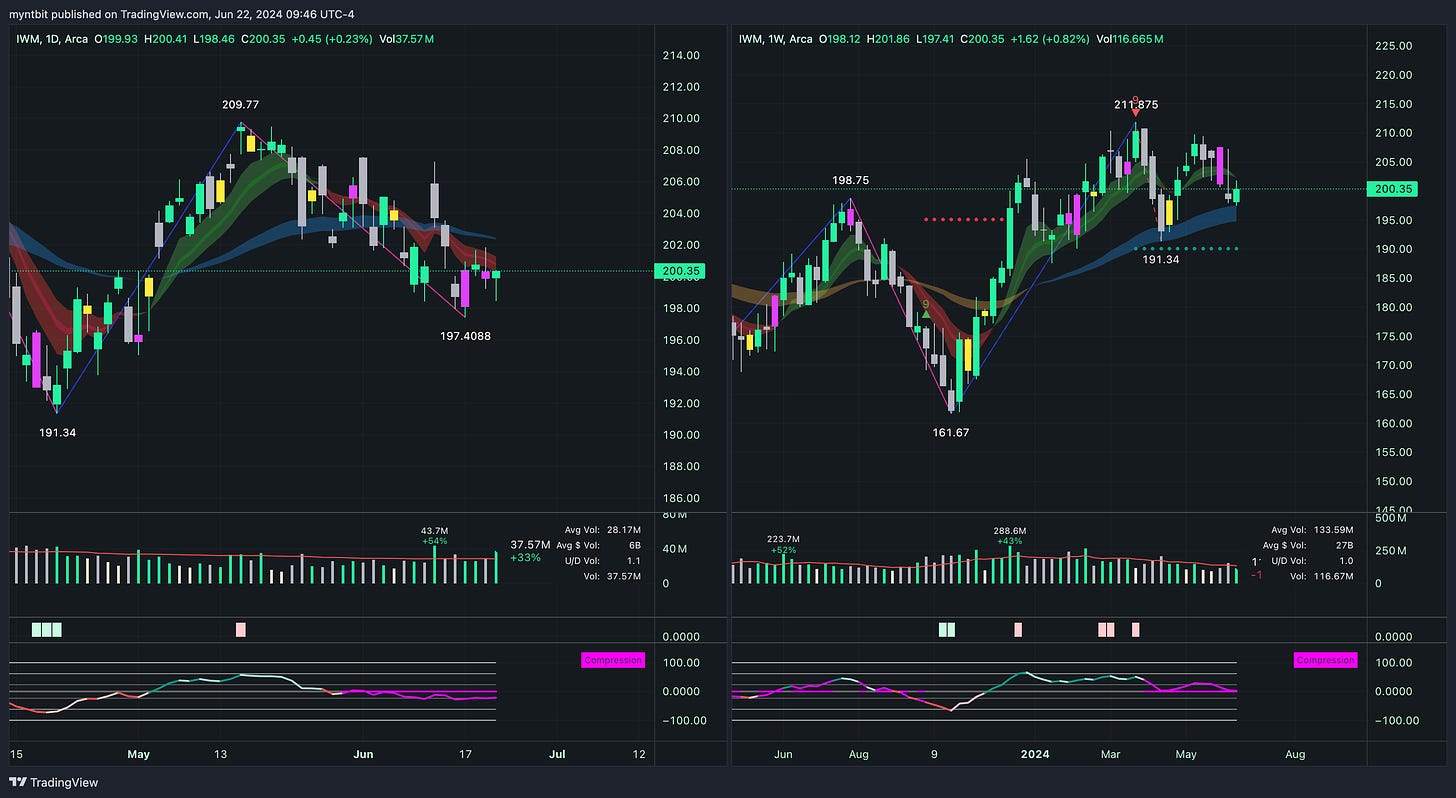

IWM - iShares Russell 2000 ETF

Short-term: Neutral to cautiously bullish, with a focus on maintaining above $197.94 and targeting $209.77.

Medium-term: Bullish, with the potential for upward continuation if resistance levels are broken.

Long-term: Bullish, contingent on maintaining above key support levels and continuing the upward trend.

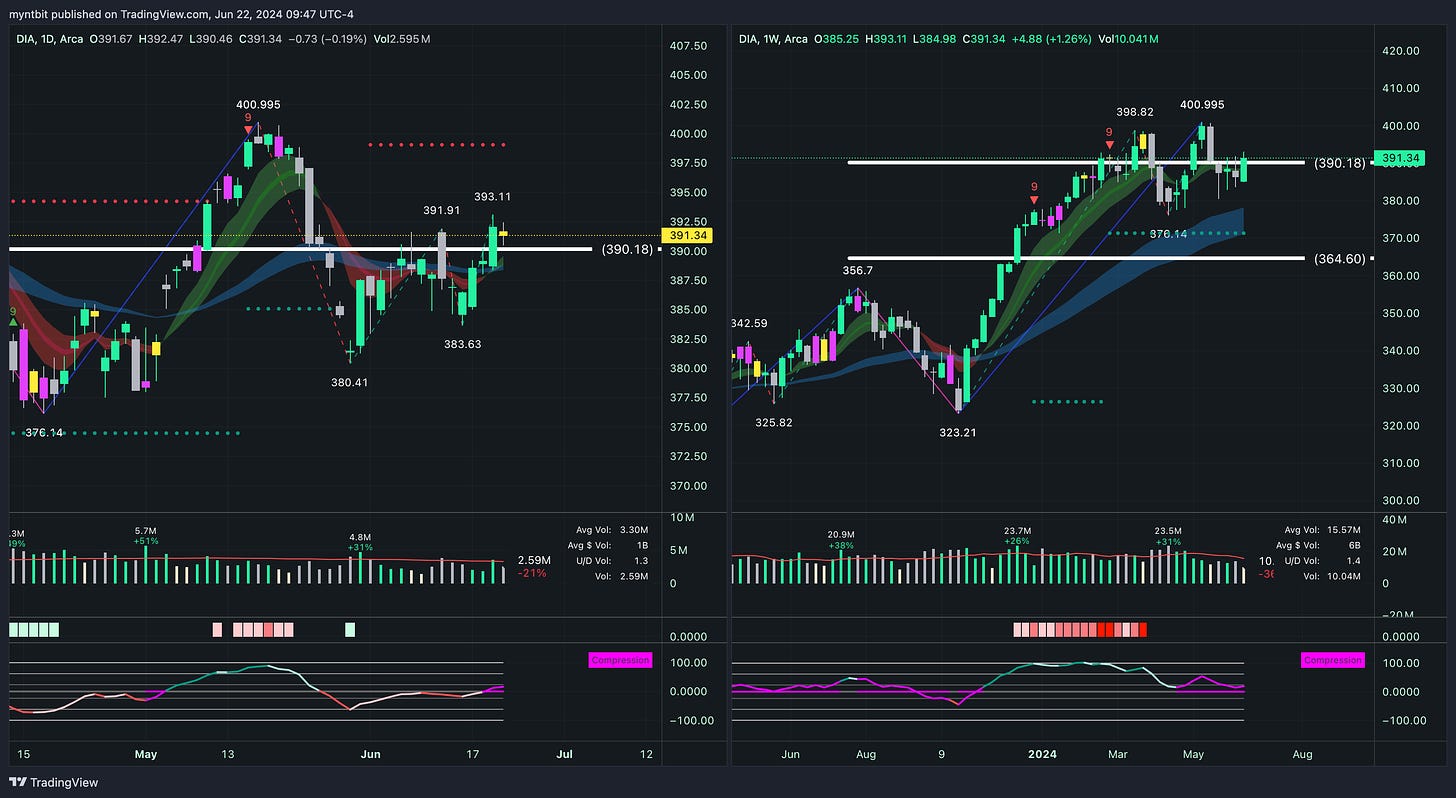

DIA - SPDR Dow Jones Industrial Average ETF Trust

Short-term: Neutral to cautiously bullish, watching for a breakout from the symmetrical triangle and targeting $390.18.

Medium-term: Bullish, with the potential for upward continuation if resistance levels are broken.

Long-term: Bullish, contingent on maintaining above key support levels and continuing the upward trend.

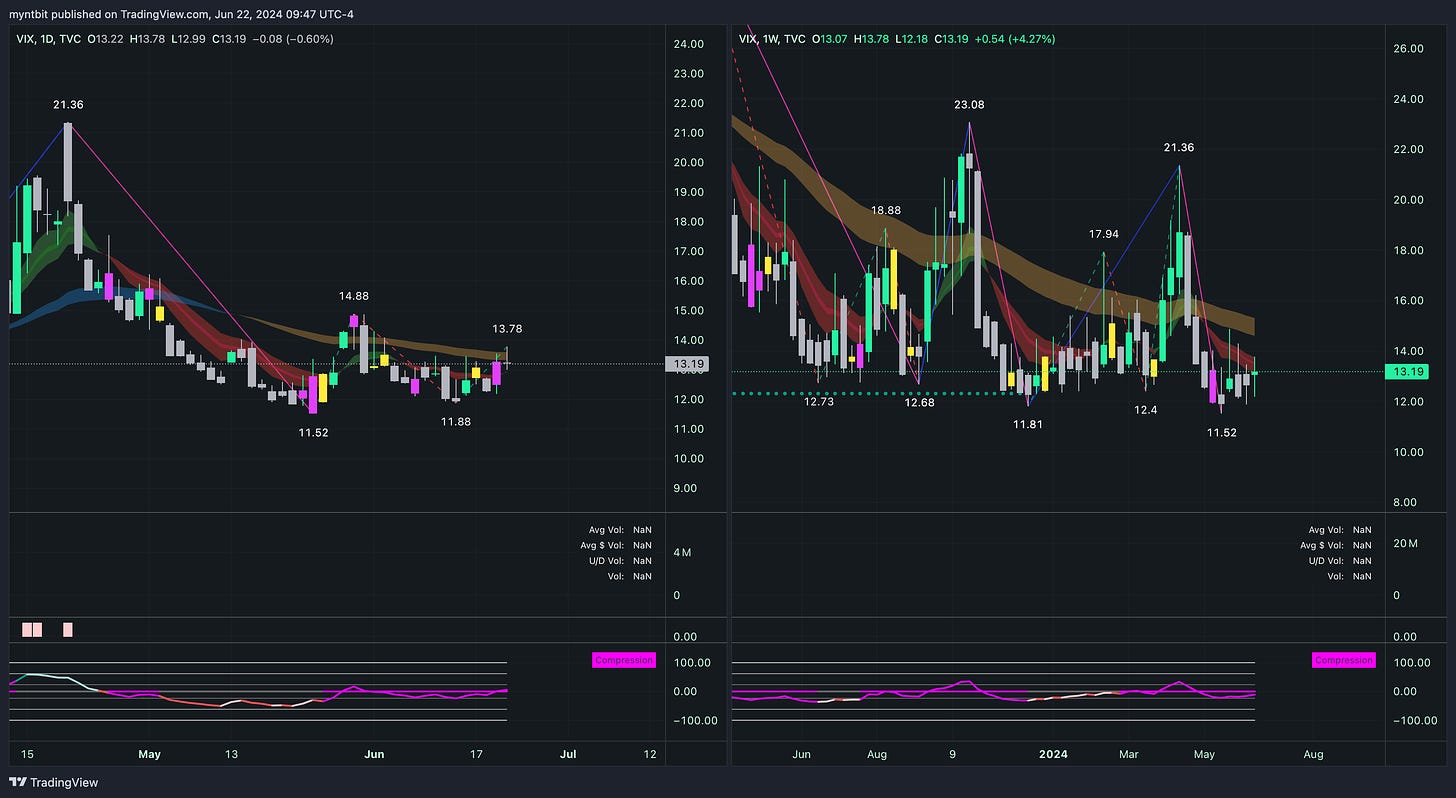

VIX - Volatility S&P 500 Index

Short-term: Neutral to cautiously bullish, with a watch on the support and resistance levels for potential breakout indicators.

Medium-term: Neutral, monitoring for any significant changes that could indicate increased market volatility.

Long-term: Bearish on volatility, unless market conditions change drastically, leading to increased uncertainty.

Last Week's Watchlist

MRNA - Moderna Inc

MRNA finally broke below $131. Will be removed from the list

CRM - Salesforce Inc

As mentioned in last week’s edition, CRM rejected the critical resistance zone around the 240s and pulled back to test the 228 support level. It found support there and rebounded to 245. Now, it's aiming for a breakout above 250 to potentially fill the gap higher.

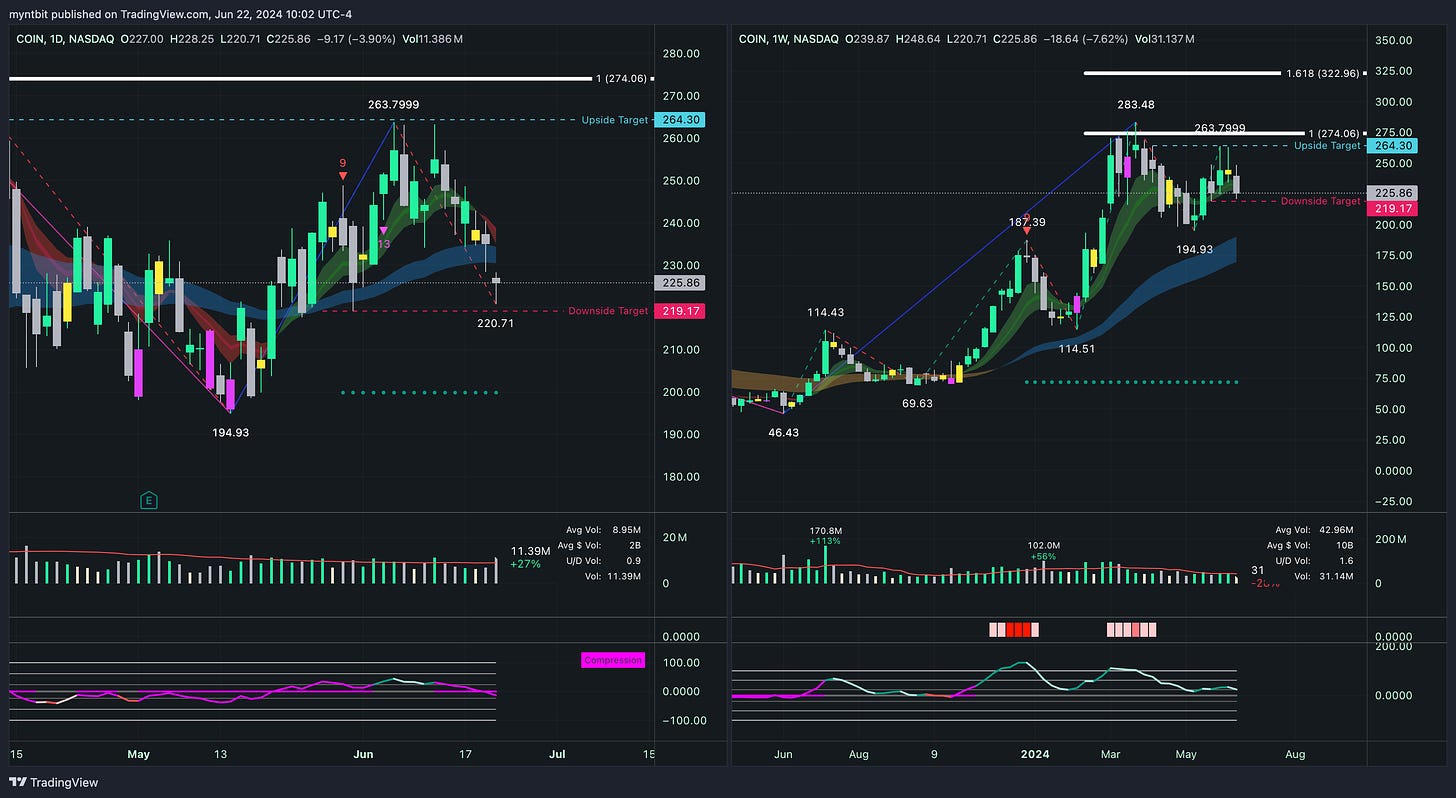

COIN - Coinbase Global Inc

COIN broke to the downside and successfully reached our target. Will be removed from the list

VRT - Vertiv Holdings Co

VRT experienced significant volatility, breaking to the upside before reversing to the downside. Targets remain the same.

Bullish Case: If the stock can hold above the $85.14 support level, it may rally toward the $98.39 resistance level. The RSI nearing oversold conditions supports a potential short-term bounce.

Bearish Case: A break below $85.14 could lead to a decline towards $77.16, continuing the bearish trend indicated by the descending channel.

DELL - Dell Inc.

DELL broke to the upside and successfully hit our target, making it the play of the week! It will now be removed from the list.