Market Trader Report | Jun 09, 2024 + Stock Watchlist

What is included in this week's edition?

WEEKLY REVIEW: An overview of current market standing, fundamental matters with implications upon the market, and general sentiment regarding the major US indices.

LOOKING AHEAD: Key takeaways to consider as we look forward to the upcoming trading week.

MARKETS: A technical review of the major indices and commodities that represent the overall health of the market.

Market Trader by MyntBit

Issue# 23

Stocks ended the week on a positive note, buoyed by overall favorable labor market updates that suggested an improved balance. A robust nonfarm payrolls report contrasted with apparent slowdowns in other areas like manufacturing activity and new orders. Earlier in the week, expectations for a rate cut in September had increased, but these were pushed back following the strong jobs report. Additional data this week underscored continued challenges in the manufacturing sector, with the Institute for Supply Management’s (ISM’s) Purchasing Managers’ Index (PMI) declining for the second consecutive month and falling further into contraction territory. In contrast, the services PMI demonstrated ongoing strength, coming in well above consensus expectations. Looking ahead to next week, the Federal Reserve (Fed) is widely anticipated to maintain the federal funds rate on June 12. Inflation data will also be in focus, with updates on the Consumer Price Index (CPI) and Producer Price Index (PPI). Finally, investors will be monitoring updates on small business optimism and consumer sentiment.

Weekly Market Review

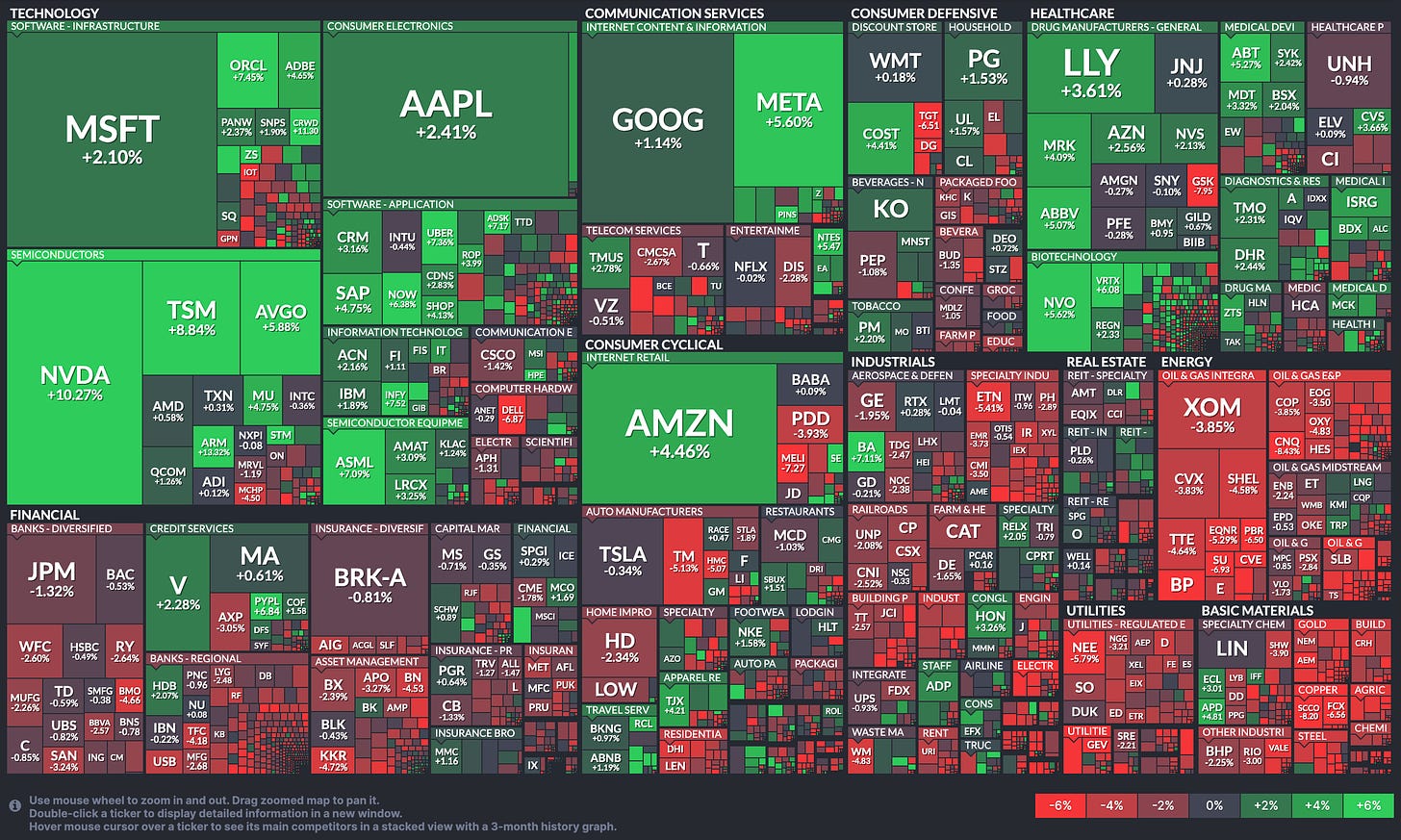

The major indices posted gains this week, primarily driven by the outperformance of mega-cap stocks compared to their smaller counterparts. Despite this, the broader market displayed impressive resilience against selling pressures. While the equal-weighted S&P 500 declined by 0.7%, the market-cap weighted index saw a 1.3% gain. Notably, both the S&P 500 and the Nasdaq Composite achieved new all-time highs this week.

The Vanguard Mega Cap Growth ETF (MGK) surged by 3.3%, and the PHLX Semiconductor Index (SOX) rose by 3.2%. NVIDIA (NVDA) stood out, surpassing a $3 trillion market value on a closing basis for the first time ever this week.

The strength in semiconductor stocks and mega-caps helped lift the S&P 500's information technology (+3.8%), consumer discretionary (+1.5%), and communication services (+1.7%) sectors to solid gains. Conversely, the utilities (-3.9%) and energy (-3.5%) sectors experienced the largest declines.

Economic growth concerns kept the broader market in check, influenced by this week's economic data. The ISM Manufacturing Index for May indicated a faster pace of contraction than anticipated, job openings in April fell compared to March, and the May Employment Situation Report revealed higher than expected earnings growth.

Treasury yields settled lower in response to the data and the European Central Bank's (ECB) first rate cut since September 2019. The 10-year note yield decreased by eight basis points to 4.43%, while the 2-year note yield dropped by two basis points to 4.87%.

Weekly Performance Heatmap

Overall Stock Market Heatmap & Sector Performance

Looking Ahead to the Upcoming Week

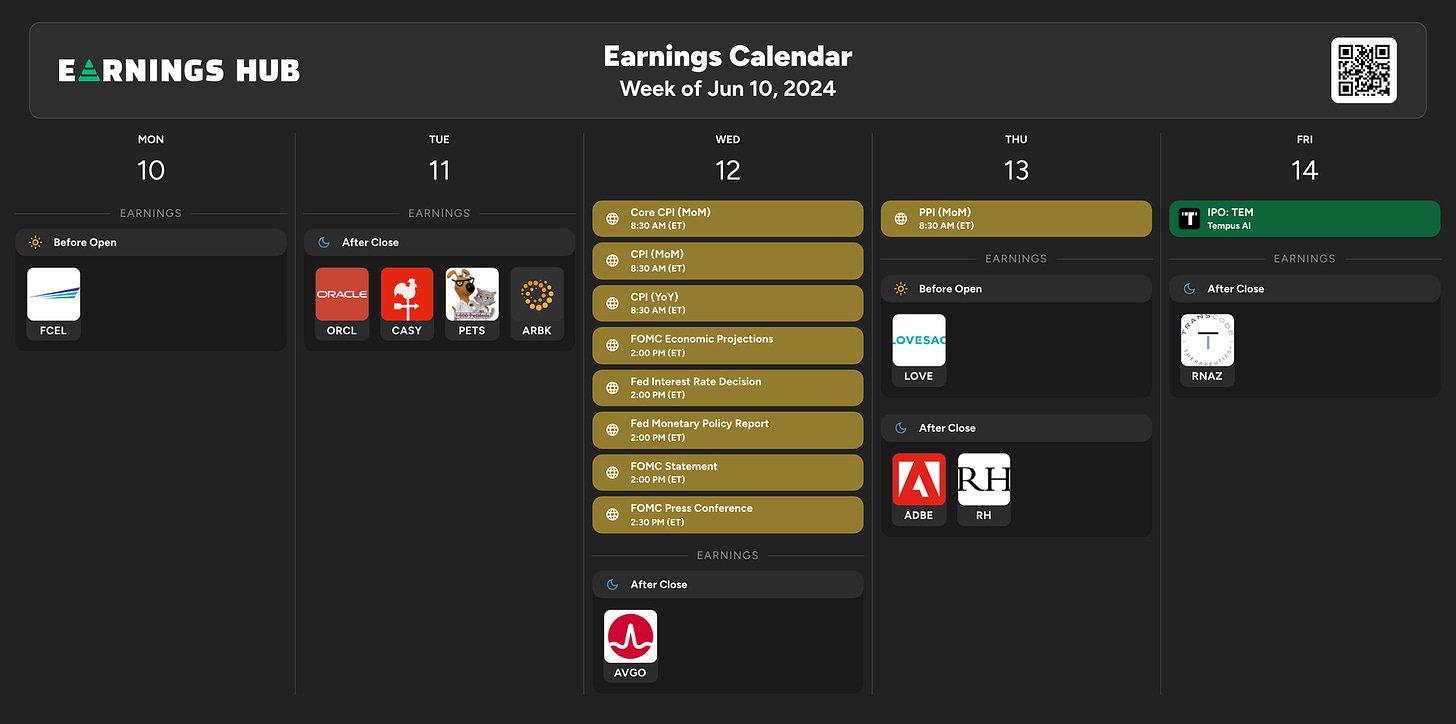

The key event of the week will be the Federal Reserve's meeting on June 11-12. Investors are also keenly watching for inflation data, with the May Consumer Price Index (CPI), Producer Price Index (PPI), and Import Price Index scheduled for release on Tuesday, Wednesday, and Thursday, respectively. Additionally, the agenda includes May's monthly budget statement and small business optimism report, as well as an early look at June's consumer sentiment and inflation expectations from the University of Michigan.

In the auction space, the U.S. Treasury Department is set to issue $119 billion in 3-, 10-, and 30-year securities.

In China, the focus will be on May’s CPI, PPI, and money supply figures. The Bank of Japan will also convene for a policy meeting, with economic updates on the trade balance, machine tool orders, PPI, Tertiary Industry Index, bank lending, capacity utilization, and finalized first-quarter gross domestic product (GDP).

Elsewhere in the region, Australia's May labor market data and business confidence will be released, along with South Korea’s unemployment rate.

In Europe, economic reports will include the eurozone’s April industrial production and trade balance, as well as finalized CPI figures from France and Germany. The U.K. will release labor market data, monthly GDP, industrial production, trade balance, and the Index of Services.

Geopolitically, the results of the European Union parliamentary elections are likely to be in focus, and a G-7 leadership meeting in Italy may also attract attention.

Important Economical & Earnings Events

Markets

Below are the levels for the upcoming week - updates will be provided on X (previously Twitter) throughout the week.

SPY - SPDR S&P 500 ETF Trust

🪷

Support: $525, $520 | Resistance: $535, $540

SPY finally broke out and created a new all-time high.

QQQ - Invesco QQQ Trust Series 1

🪷

Support: $450 | Resistance: $465, $475

QQQ also created a new all-time high, inching closer to our target at $476.

IWM - iShares Russell 2000 ETF

🪷

Support: $200 | Resistance: $210

IWM is still range-bound and looks ugly as it fails to create a new high.

DIA - SPDR Dow Jones Industrial Average ETF Trust

🪷

Support: $385 | Resistance: $400, $405

DIA is weak, as it struggles to get above $390 which is a critical level.

VIX - Volatility S&P 500 Index

🪷

Support: $12 | Resistance: $15, $20

VIX remains suppressed under $15.

Last Week's Watchlist

BA - Boeing Co.

🪷

Support: $171 & $159 | Resistance: $177 & $188

BA finally broke out and reached the upside target.

META - Meta Platforms, Inc.

🪷

Support: $460, $427 | Resistance: $482, $510

META broke out on the upside as it made its way toward our target at $510.

JPM - JPMorgan Chase & Co.

🪷

Support: $197 & $193 | Resistance: $201 & $205

JPM remains rangebound and consolidating as it fakes out on both the upside and downside.

MRNA - Moderna Inc

MRNA recovered after an ugly week and now remains within the range.

GE - General Electric Co

GE is consolidating for a move soon, wait for a breakout & retest. Nothing has changed here.

Stock Watchlist

CRM - Salesforce Inc

CRM has recently tested the support level at 212 and is attempting to recover. The last trading day shows a slight decline of -0.37% closing at $241.85

Short-term: Cautiously bullish, potential for a rebound if support at $212 holds.

Medium-term: Neutral to slightly bearish, with the head and shoulders pattern suggesting potential downside risks.

Long-term: Remains cautiously optimistic, contingent on holding key support levels and reversing current bearish trends.

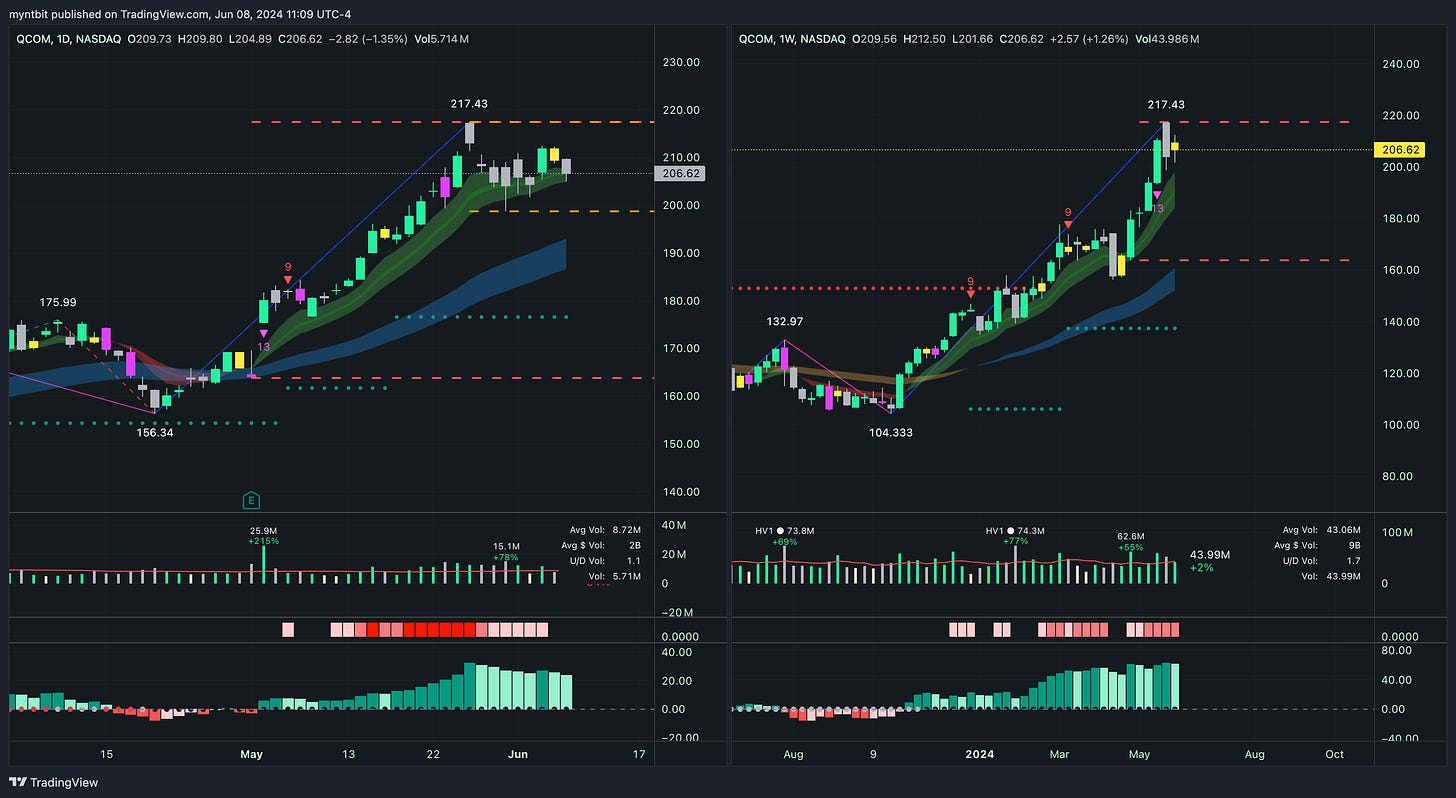

QCOM - Qualcomm Inc

QCOM has recently declined from a peak of $217.43 and is currently trading at $206.62, a drop of -1.35% from the previous day.

Short-term: Bullish, with a watch on the $200 support level and a target of $217.

Medium-term: Bullish, supported by strong upward momentum and robust volume.

Long-term: Bullish, with an expectation for continued gains if current trends persist.

PANW - Palo Alto Networks Inc

PANW recently bounced off the support level at $286.58 and is currently trading at $301.90, reflecting a daily gain of +2.02%.

Short-term: Cautiously bullish, with a focus on maintaining above $300 and targeting $324.

Medium-term: Neutral to slightly bullish, watching for confirmation of a potential double-bottom pattern.

Long-term: Bullish, contingent on holding key support levels and breaking above resistance.

Disclaimer: This newsletter is not trading or investment advice, but for general informational purposes only. This newsletter represents our personal opinions that we share publicly for educational purposes. Futures, stocks, and bonds trading of any kind involves a lot of risks. No guarantee of any profit whatsoever is made. In fact, you may lose everything you have. So be very careful. We guarantee no profit whatsoever, You assume the entire cost and risk of any trading or investing activities you choose to undertake. You are solely responsible for making your own investment decisions. Owners/authors of this newsletter, its representatives, its principals, its moderators, and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission, CFTC, or with any other securities/regulatory authority. Consult with a registered investment advisor, broker-dealer, and/or financial advisor. By reading and using this newsletter or any of my publications, you are agreeing to these terms. Any screenshots used here are courtesy of ForexFactory, EarningsWhispers, Finviz, ThinkorSwim, and/or Tradingview. We are just end-users with no affiliations with them.