Market Trader Report | Jun 02, 2024 + Stock Watchlist

What is included in this week's edition?

WEEKLY REVIEW: An overview of current market standing, fundamental matters with implications upon the market, and general sentiment regarding the major US indices.

LOOKING AHEAD: Key takeaways to consider as we look forward to the upcoming trading week.

MARKETS: A technical review of the major indices and commodities that represent the overall health of the market.

Market Trader by MyntBit

Issue# 22

Over the past week, stocks declined despite personal consumption expenditures (PCE) inflation data meeting expectations. Some investors might have anticipated a lower-than-expected result. Additionally, the first-quarter gross domestic product (GDP) growth was revised downward. Other factors influencing market conditions included continued higher-for-longer messaging from Federal Reserve (Fed) speakers, an unexpected rise in consumer confidence, and a significant drop in pending home sales. The main themes behind these mixed signals are persistently high inflation and tight monetary policy as the economy gradually moves towards the Fed’s 2% inflation target. At the company level, earnings for certain Information Technology companies reflected macroeconomic challenges. In the coming week, investors will be closely monitoring labor-market data, including the May jobs report. Attention will also be on updates for the Institute for Supply Management’s (ISM) Purchasing Managers' Indexes (PMIs) for manufacturing and services, consumer credit, construction spending, and factory orders.

Weekly Market Review

The stock market ended this holiday-shortened week with losses, but closed the month with solid gains. Mega cap stocks significantly influenced index performance throughout the month, particularly NVIDIA (NVDA), which surged 26.9% in May.

The equal-weighted S&P 500 rose 2.8% this month, compared to a 4.8% gain in the market-cap weighted S&P 500. However, the index recorded a 0.5% decline this week.

This week's downside bias was attributed to normal consolidation activity following the substantial gains earlier in the month.

Market participants had to navigate a series of earnings reports this week, including those from retailers like Best Buy (BBY), Foot Locker (FL), Kohl's (KSS), and Dollar General (DG). Notably, Dow component Salesforce (CRM) saw a significant drop, closing 13.9% lower than last Friday after disappointing quarterly results.

In other corporate news, ConocoPhillips (COP) announced it will acquire Marathon Oil (MRO) in an all-stock transaction.

The market also received a mixed set of economic reports, with the highlight being Friday's release of the April Personal Income and Spending report. The key takeaway is that the year-over-year PCE inflation rates remained unchanged, suggesting the Fed may not gain new confidence that inflation is moving sustainably toward its 2% target from this report.

Treasuries had a mixed performance this week in response to the data and some poorly received Treasury auctions. The $69 billion 2-year note, $70 billion 5-year note, and $44 billion 7-year note sales faced weak demand.

The 10-year note yield rose five basis points this week to 4.51%, while the 2-year note yield declined six basis points to 4.89%.

Weekly Performance Heatmap

Overall Stock Market Heatmap & Sector Performance

Looking Ahead to the Upcoming Week

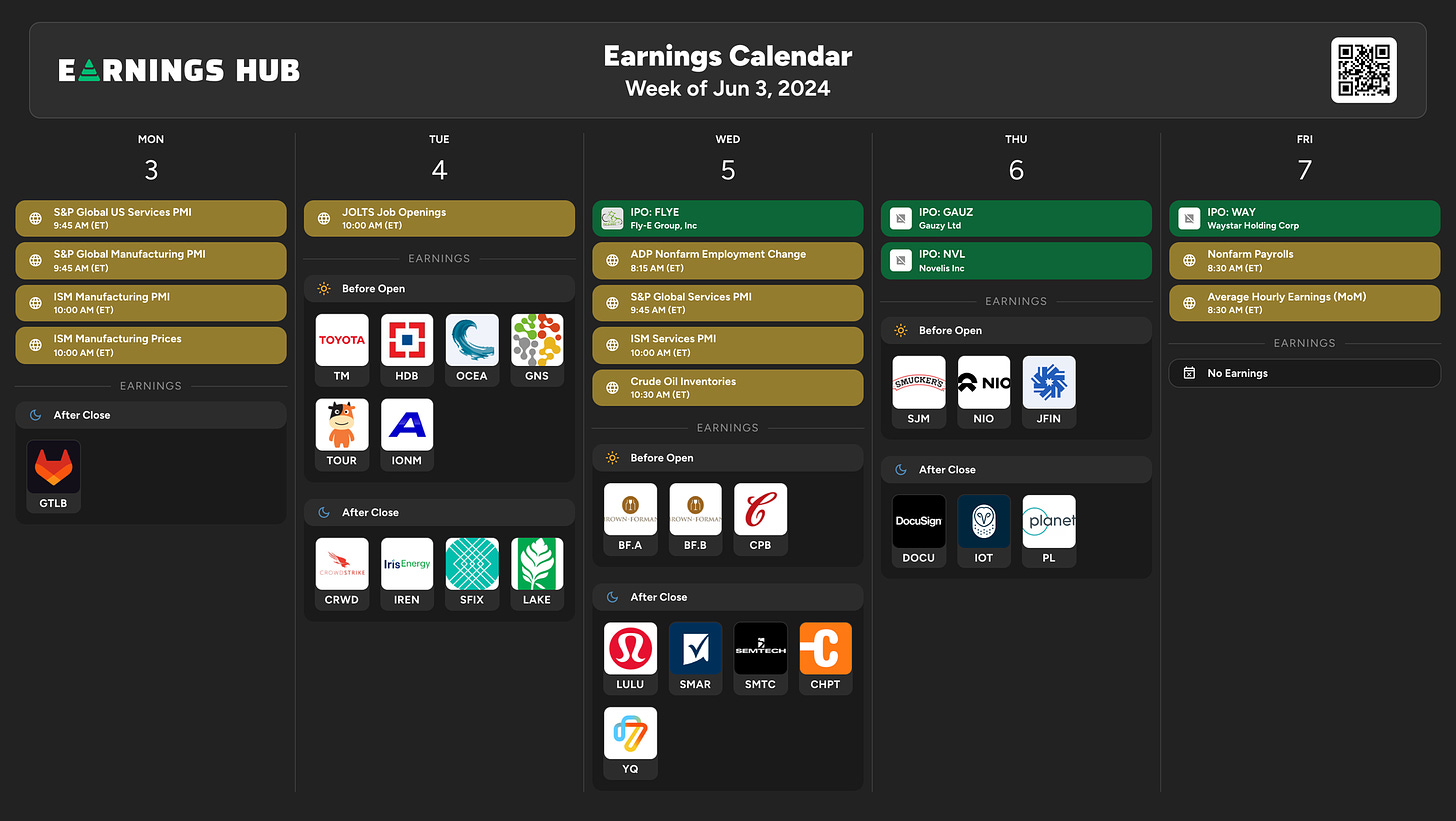

The upcoming week is packed with key events, starting with the ISM’s PMIs for May. Manufacturing activity updates are scheduled for Monday, followed by the service sector data on Wednesday, before the focus shifts to Friday’s May jobs report. Other potential market movers include labor-market data from the ADP survey of private employment and the April Job Openings and Labor Turnover Survey (JOLTS) midweek, along with finalized first-quarter nonfarm productivity and unit labor costs. Additional reports will cover factory orders, the trade balance, construction spending, wholesale inventories, and consumer credit.

In China, the focus will be on May’s PMIs for the services and manufacturing sectors from Caixin, the trade balance, and the People’s Bank of China’s foreign reserves. From Japan, important releases include labor cash earnings, the leading index, capital spending, and finalized May PMIs. Elsewhere in the region, South Korea’s Consumer Price Index (CPI), manufacturing PMI, and preliminary first-quarter GDP will be released, along with Australia’s first-quarter GDP, trade balance, and a measure of inflation.

In Europe, attention will be on Thursday’s European Central Bank policy meeting, finalized PMIs, the eurozone’s Producer Price Index (PPI), retail sales, and finalized first-quarter GDP. Key updates from Germany will include unemployment data, factory orders, and the trade balance, while French releases will cover industrial production and the trade balance.

Important Economical & Earnings Events

Markets

Below are the levels for the upcoming week - updates will be provided on X (previously Twitter) throughout the week.

SPY - SPDR S&P 500 ETF Trust

🪷

Support: $525, $520 | Resistance: $530, $535

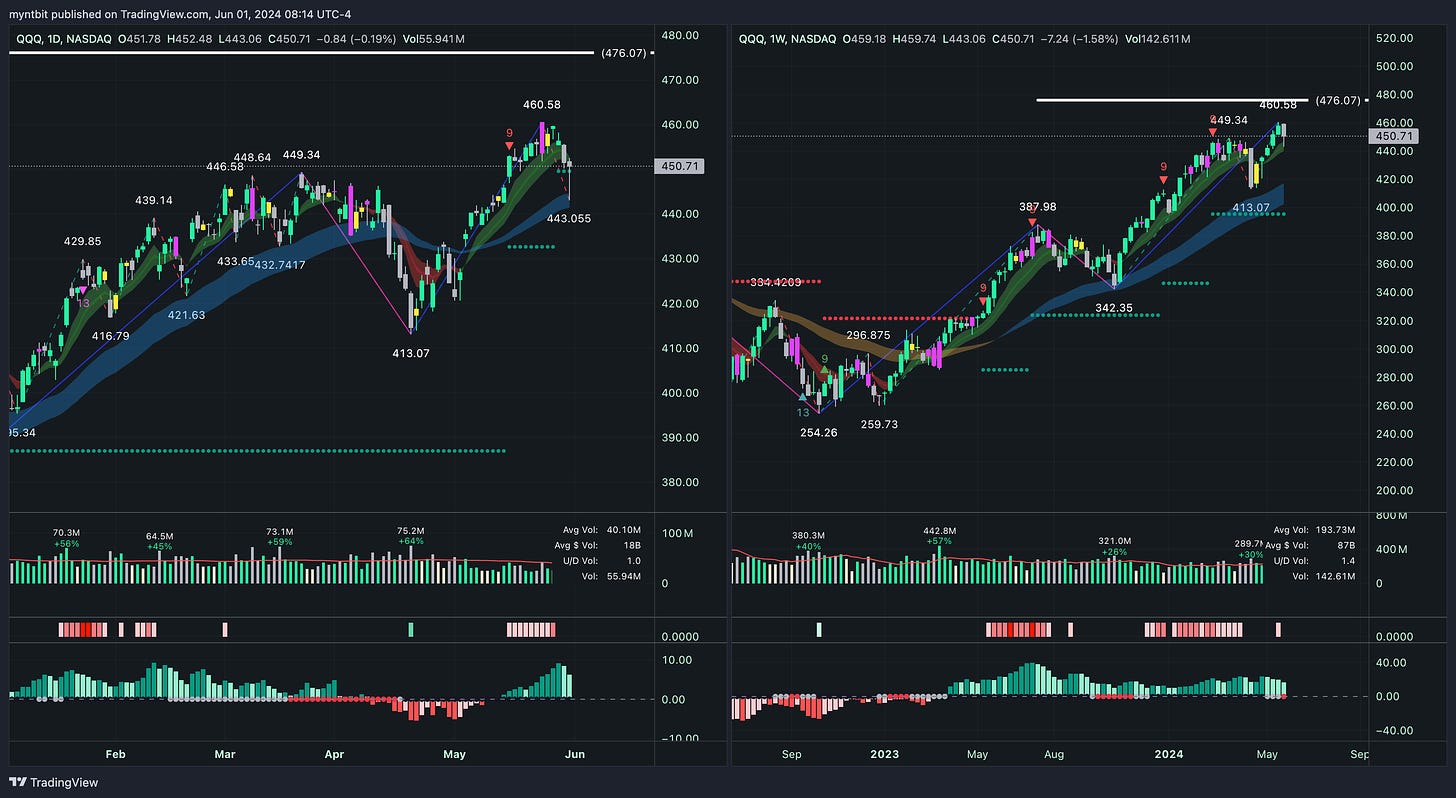

QQQ - Invesco QQQ Trust Series 1

🪷

Support: $450 | Resistance: $460

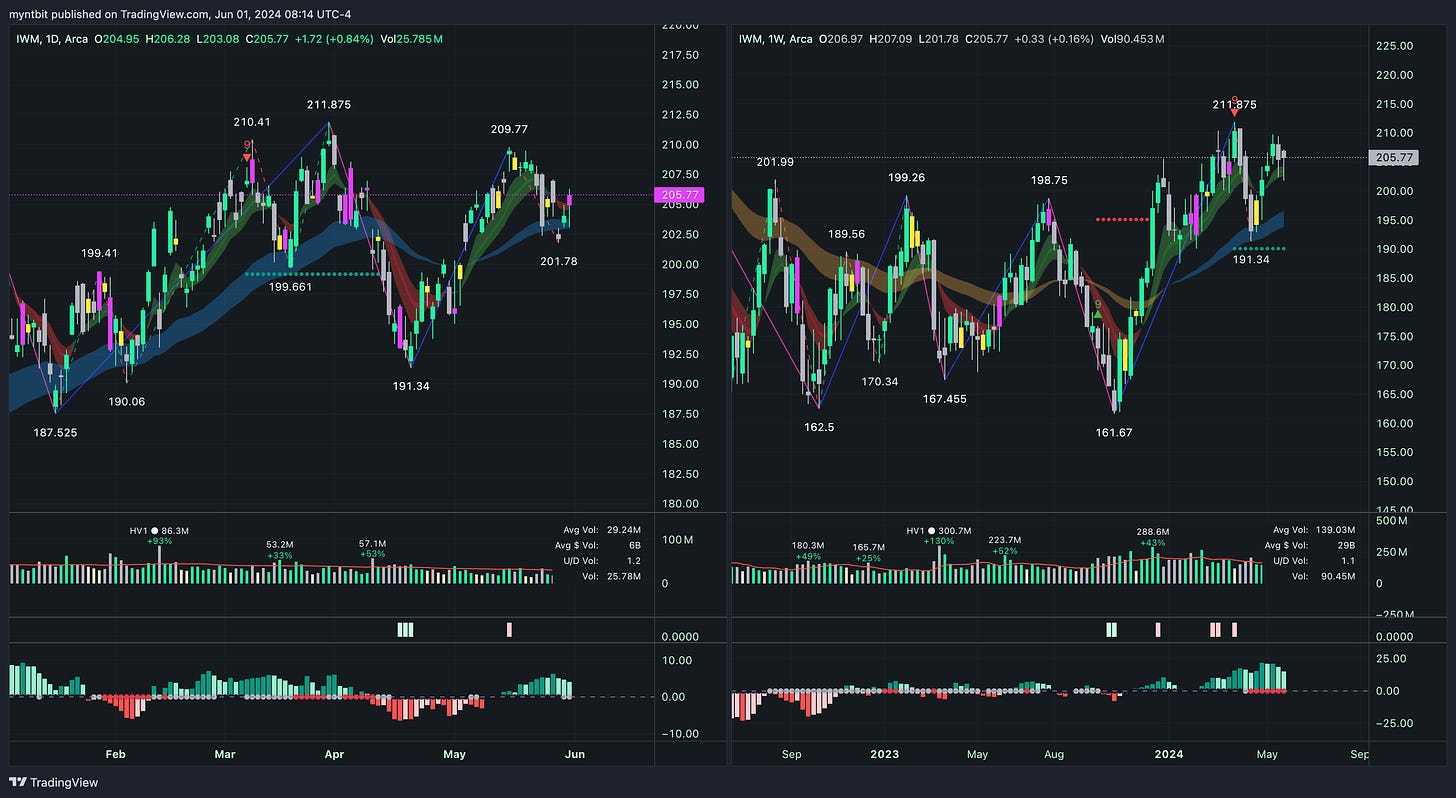

IWM - iShares Russell 2000 ETF

🪷

Support: $200 | Resistance: $210

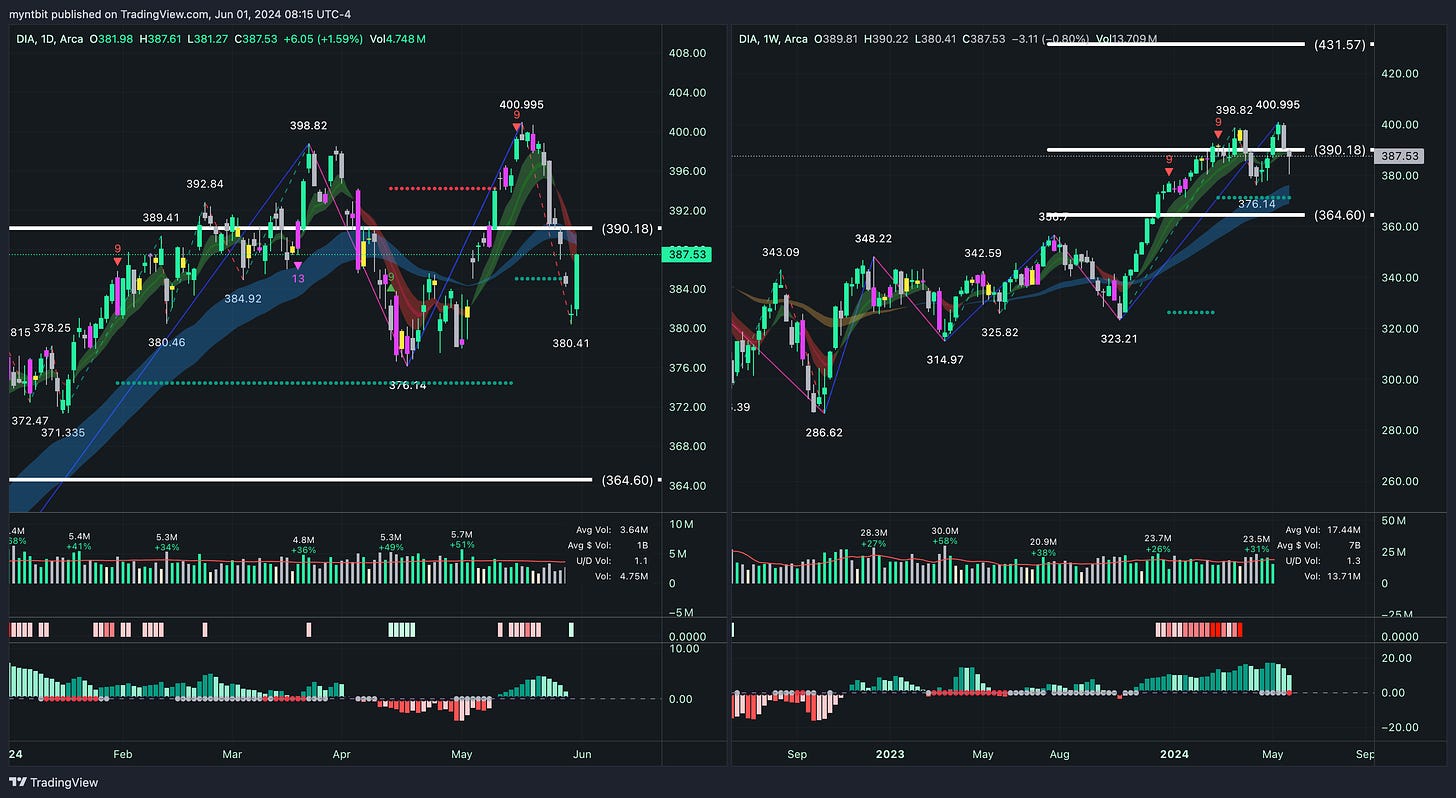

DIA - SPDR Dow Jones Industrial Average ETF Trust

🪷

Support: $395 | Resistance: $400, $405

VIX - Volatility S&P 500 Index

🪷

Support: $12 | Resistance: $15, $20

Last Week's Watchlist

BA - Boeing Co.

🪷

Support: $171 & $159 | Resistance: $177 & $188

BA remained consolidated throughout the week, with no significant changes. It will continue to be on watch for potential movement next week.

META - Meta Platforms, Inc.

🪷

Support: $460, $427 | Resistance: $482, $510

Similarly, META also consolidated.

JPM - JPMorgan Chase & Co.

🪷

Support: $197 & $193 | Resistance: $201 & $205

JPM recovered well after the selloff two weeks ago and is expected to continue moving toward its previous breakdown point.

Stock Watchlist

BA - Boeing Co. & JPM - JPMorgan Chase & Co.

See above.

MRNA - Moderna Inc

Moderna's stock has experienced significant volatility recently, closing the week on a negative note. As of now, the stock is trading around $142.55.

Recent Developments:

RSV Vaccine Approval: Moderna recently received U.S. FDA approval for its respiratory syncytial virus (RSV) vaccine, marking its second marketed product. This approval is crucial as it provides a new revenue stream amidst declining COVID-19 vaccine sales (Stock Analysis) (Finviz).

Bird Flu Vaccine Funding: The U.S. government is nearing a deal to fund a late-stage trial of Moderna's mRNA bird flu vaccine, which could significantly boost the company's future prospects (Stock Analysis).

GE - General Electric Co

GE is consolidating for a move soon, wait for a breakout & retest.

Recent Developments:

Strong Earnings: GE reported robust earnings for Q1 2024, with an EPS of $0.82, surpassing the consensus estimate of $0.65. Revenue for the quarter was $16.1 billion, also beating the expected $15.25 billion, marking an 11.1% year-over-year increase (MarketBeat).

GE Aerospace: The aerospace division has shown strong performance, driven by high demand for jet-engine parts and services. GE Aerospace has also raised its full-year profit forecast, attributing this to strong sales and a solid start to the year (Stock Analysis).

Hiring Surge: GE Aerospace plans to hire 900 engineers in 2024 to support next-generation technology development and current engine programs (Stock Analysis).

Disclaimer: This newsletter is not trading or investment advice, but for general informational purposes only. This newsletter represents our personal opinions that we share publicly for educational purposes. Futures, stocks, and bonds trading of any kind involves a lot of risks. No guarantee of any profit whatsoever is made. In fact, you may lose everything you have. So be very careful. We guarantee no profit whatsoever, You assume the entire cost and risk of any trading or investing activities you choose to undertake. You are solely responsible for making your own investment decisions. Owners/authors of this newsletter, its representatives, its principals, its moderators, and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission, CFTC, or with any other securities/regulatory authority. Consult with a registered investment advisor, broker-dealer, and/or financial advisor. By reading and using this newsletter or any of my publications, you are agreeing to these terms. Any screenshots used here are courtesy of ForexFactory, EarningsWhispers, Finviz, ThinkorSwim, and/or Tradingview. We are just end-users with no affiliations with them.