Market Trader Report | Apr 21, 2024

What is included in this week's edition?

WEEKLY REVIEW: An overview of current market standing, fundamental matters with implications upon the market, and general sentiment regarding the major US indices.

LOOKING AHEAD: Key takeaways to consider as we look forward to the upcoming trading week.

MARKETS: A technical review of the major indices and commodities that represent the overall health of the market.

Market Trader by MyntBit

Issue# 16

This week, the stock market experienced a decline due to a more assertive tone from the Federal Reserve and stronger-than-anticipated retail sales figures. Investors also grappled with geopolitical uncertainties and the commencement of earnings reporting season. Notable data included a drop in the U.S. Leading Economic Index (LEI) following a previously predicted rise in February, ongoing challenges in the housing market attributed to high interest rates, and signs of stabilization in the manufacturing sector. Looking ahead to next week, market attention will be on the initial release of first-quarter gross domestic product (GDP), inflation in personal consumption expenditures (PCE), orders for durable goods, S&P Global's purchasing managers' index (PMI) for both manufacturing and services, as well as new and pending home sales figures. Additionally, investors will closely monitor first-quarter earnings reports and any developments on the geopolitical front.

Weekly Market Review

The week began with March retail sales, showing a 0.7% month-over-month (MOM) increase, surpassing consensus expectations but falling short of February's 0.9%. Control group sales exceeded predictions as well, indicating broader positive trends beyond fuel prices. Various factors were speculated as possible causes, including Easter timing, incoming tax refunds, and rising prices. However, the robust figure raised concerns about its potential impact on GDP.

In contrast, the Leading Economic Index (LEI) for March declined more than anticipated (-0.3% versus -0.1% expected), attributed to negative contributions from the yield spread, new building permits, consumer outlook on business conditions, new orders, and initial jobless claims. Both retail sales and the LEI underscored ongoing uncertainty stemming from the interaction between economic strength and expectations for rate cuts.

The housing market and business-related activities also saw updates. Housing starts and building permits surprised negatively, with the former experiencing a significant 14.7% decline and the latter dropping to 1,458K. Existing home sales for March decreased MOM but exceeded consensus expectations. Meanwhile, the National Association of Home Builders Housing Market Index for April remained steady at 51.0, meeting expectations, reflecting the impact of high rates on affordability and the consequent restraint on new construction.

Business-related updates for March included unchanged industrial production at 0.4%, manufacturing production decreasing to 0.5%, and capacity utilization rising to 78.4%. These figures suggested a stabilization in the factory sector over the past year but indicated susceptibility to disruptions given its dependence on the broader economic landscape.

Investor attention was on Fedspeak, with recent commentary heightening concerns about delayed rate cuts. Federal Reserve Chair Jerome Powell noted a lack of progress towards the 2% inflation goal for the year, emphasizing the need for greater confidence in sustained inflation before easing policy. Other speakers echoed a cautious stance, and the Fed's Beige Book reported a slight expansion in overall economic activity since February.

Numerous stocks took part in this week's downturn, with eight out of the 11 S&P 500 sectors experiencing declines. The information technology (-7.3%), consumer discretionary (-4.5%), and communication services (-3.2%) sectors recorded some of the steepest declines, impacted by weakness in their largest companies. Additionally, the real estate sector, sensitive to interest rate changes, was among the top performers, dropping by 3.6%.

Conversely, the consumer staples (+1.4%), utilities (+1.9%), and financial (+0.8%) sectors were the only ones to see gains.

Here's the weekly performance summary:

S&P 500: -3.1% / +4.1% Year-to-Date (YTD)

S&P Midcap 400: -2.2% / +2.0% YTD

Nasdaq Composite: -5.2% / +1.8% YTD

Dow Jones Industrial Average: No change for the week / +0.8% YTD

Russell 2000: -2.8% / -3.9% YTD

Weekly Performance Heatmap

Overall Stock Market Heatmap & Sector Performance

Looking Ahead to the Upcoming Week

The upcoming week will feature several key events that could impact the markets. On Tuesday, all eyes will be on the first look at S&P Global's April Purchasing Managers' Index (PMI) for both the manufacturing and services sectors. Later in the week, on Friday, market-moving releases include data on personal income and spending, along with the Personal Consumption Expenditure (PCE) deflator, which is closely monitored by the Federal Reserve as a gauge of inflation. Other significant reports to watch include the advance reading of first-quarter Gross Domestic Product (GDP), durable goods orders, wholesale inventories, and the finalized April consumer sentiment from the University of Michigan. Additionally, the Chicago Fed's National Activity Index, as well as data on new and pending home sales, will be on the agenda.

In the auction space, the U.S. Treasury department will issue $169 billion in two-, five-, and seven-year securities. In China, although it's a light data week, focus will be on industrial profits and one- and five-year loan prime rates. The Bank of Japan will hold a policy meeting, preceded by the release of the country's April PMIs, updates on the Consumer Price Index (CPI), and the leading index.

Elsewhere in the region, South Korea's first-quarter GDP, Producer Price Index (PPI), consumer confidence, and manufacturing and non-manufacturing business surveys will be released, along with Australia's CPI, PPI, and preliminary April PMIs.

In Europe, the spotlight will be on the first release of April PMIs, in addition to updates on consumer confidence and the money supply. From Germany, expect updates on retail sales and Ifo's business climate survey, while French manufacturing confidence and the U.K.'s house prices will also be announced.

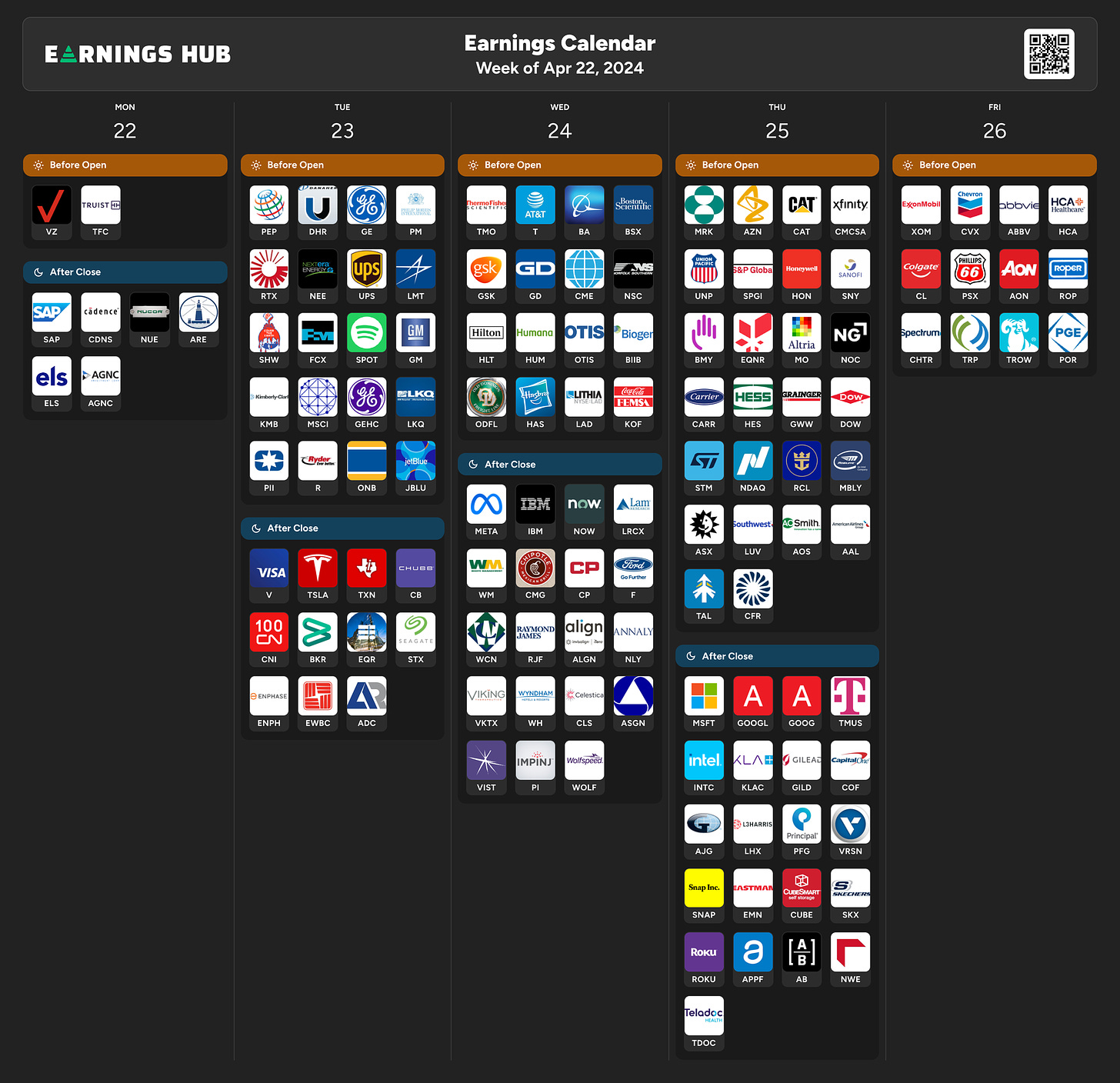

Notable Earnings

Important Economical Events

Markets

Below are the levels for the upcoming week - updates will be provided on X (previously Twitter) throughout the week.

SPY - SPDR S&P 500 ETF Trust

🪷

Support: $485 | Resistance: $500, $520

What an ugly week for the markets! Since we hit our level at $520, we had consolidated now over the past few weeks, SPY has displayed some weakness. We broke below the critical support at $500 and finished the week at the lows at $495.

QQQ - Invesco QQQ Trust Series 1

🪷

Support: $415 | Resistance: $435, $450

It seems that weakness intensified, particularly in the technology sector, with semiconductor stocks bearing the brunt of it, likely influenced by the bleak outlook from $TSM. The QQQ (Invesco QQQ Trust) closed below the $420 mark, which had previously served as support but has now turned into resistance.

IWM - iShares Russell 2000 ETF

🪷

Support: $190 | Resistance: $200

The recent economic data indicating persistent inflation and the Fed's hints at a potential delay in rate cuts have led to struggles for small-cap stocks. The IWM (iShares Russell 2000 ETF) fell below the critical level of $200. However, it's worth noting that the Friday session ended on a strong note, hinting at a possible near-term rebound.

DIA - SPDR Dow Jones Industrial Average ETF Trust

🪷

Support: $375 | Resistance: $380, $400

Similar to small-cap stocks, the DIA (SPDR Dow Jones Industrial Average ETF) also closed the week on a positive note, indicating the possibility of a near-term rebound.

VIX - Volatility S&P 500 Index

🪷

Support: $16 | Resistance: $20

The VIX, often referred to as the fear gauge, surpassed $20 for the first time since last October. It will be interesting to observe whether volatility continues to rise in the upcoming week.

Disclaimer: This newsletter is not trading or investment advice, but for general informational purposes only. This newsletter represents our personal opinions that we share publicly for educational purposes. Futures, stocks, and bonds trading of any kind involves a lot of risks. No guarantee of any profit whatsoever is made. In fact, you may lose everything you have. So be very careful. We guarantee no profit whatsoever, You assume the entire cost and risk of any trading or investing activities you choose to undertake. You are solely responsible for making your own investment decisions. Owners/authors of this newsletter, its representatives, its principals, its moderators, and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission, CFTC, or with any other securities/regulatory authority. Consult with a registered investment advisor, broker-dealer, and/or financial advisor. By reading and using this newsletter or any of my publications, you are agreeing to these terms. Any screenshots used here are courtesy of ForexFactory, EarningsHub, Finviz, ThinkorSwim, and/or Tradingview. We are just end-users with no affiliations with them.