Market Trader Report | Apr 07, 2024

What is included in this week's edition?

WEEKLY REVIEW: An overview of current market standing, fundamental matters with implications upon the market, and general sentiment regarding the major US indices.

LOOKING AHEAD: Key takeaways to consider as we look forward to the upcoming trading week.

MARKETS: A technical review of the major indices and commodities that represent the overall health of the market.

Market Trader by MyntBit

Issue# 14

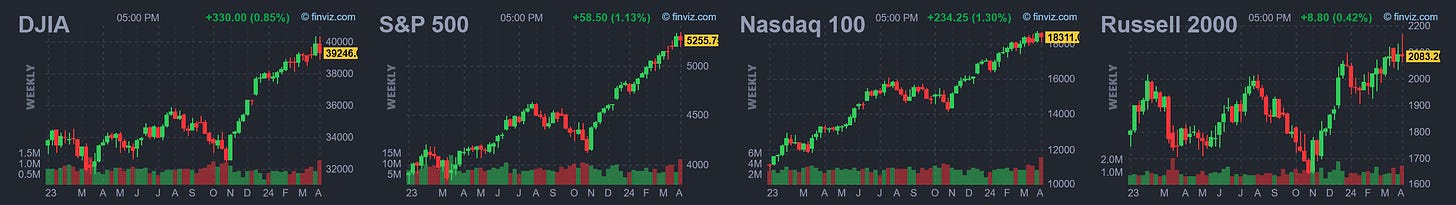

Stocks experienced a decline this week amidst concerns regarding robust economic growth, propelled by inflation data from personal consumption expenditure (PCE), labor market statistics, and updates from the business sector. Although Friday’s jobs report displayed a significant uptick in hiring, other indicators suggested a relative equilibrium. Notably, attention was drawn to the Institute for Supply Management (ISM) purchasing managers’ indexes (PMIs) for manufacturing and services, with the former entering expansionary territory for the first time in 16 months. Additionally, discussions from Federal Reserve officials underscored the necessity for patience. Looking forward to the upcoming week, market observers will be closely monitoring March’s Consumer Price Index (CPI) and Producer Price Index (PPI) inflation figures, as well as gauging consumer sentiment and small business optimism. Furthermore, investors will be attuned to the commencement of the first-quarter earnings season.

Weekly Market Review

This week, all attention was directed towards labor market data. Nonfarm payrolls were pleasantly surprised, showcasing an addition of 303K jobs in March, marking the most significant month-over-month (MOM) increase since May 2023. The bulk of this growth stemmed from sectors such as healthcare, government, and leisure/hospitality, the latter of which has now fully rebounded to its pre-pandemic level. Concurrently, the unemployment rate, as anticipated, aligned with consensus expectations at 3.8%, experiencing a slight MOM decrease, while the average workweek saw a slight MOM increase to 34.4 hours. Despite this positive momentum, wage growth, although remaining elevated compared to pre-pandemic levels, has been gradually slowing since early 2022, with average hourly earnings showing a 4.1% year-over-year (YOY) increase.

Furthermore, the Job Openings and Labor Turnover Survey (JOLTS) reported an increase in job openings to 8.756 million for February, slightly below consensus projections but still indicative of robust demand. The ADP employment report for March echoed this trend, with private employers adding 184K jobs, surpassing consensus expectations. The Federal Reserve (Fed) has frequently emphasized the importance of achieving a balanced labor market as a crucial indicator of economic strength. While this month's reports exhibited a surge in job growth, the implications were tempered by decelerating wage growth and sustained robust demand.

Another significant focus was on the Institute for Supply Management's (ISM) Purchasing Managers' Index (PMIs) for both manufacturing and services. The manufacturing PMI for March pleasantly exceeded expectations, entering expansionary territory at 50.3 for the first time in 16 months, with the report anticipating strength in the second quarter alongside solid demand. Conversely, the services PMI fell lower than anticipated, declining to 51.4. Notably, the Prices Index within the report dropped to its lowest level since March 2020, indicating an increase in prices paid. Additionally, factory orders for February exceeded expectations, rising by 1.4% MOM following a 3.8% decline in January.

Moreover, revisiting February's Personal Consumption Expenditure (PCE) inflation data, released last Friday when markets were closed, revealed figures largely in line with consensus expectations, indicative of a sluggish pace of decline. Both core and headline PCE cooled MOM, with core experiencing a more pronounced slowdown. Year-over-year core PCE decreased by 0.1%, while the headline print increased by 0.1%. Core PCE currently stands at a 2.8% annual rate, exceeding the Fed's target of 2%, further cementing market expectations for an initial rate cut in June and three total cuts in 2024. This cautious outlook was reinforced by numerous statements from Federal Reserve officials, emphasizing patience in light of signs of economic strength.

Weekly Performance Heatmap

Overall Stock Market Heatmap & Sector Performance

Looking Ahead to the Upcoming Week

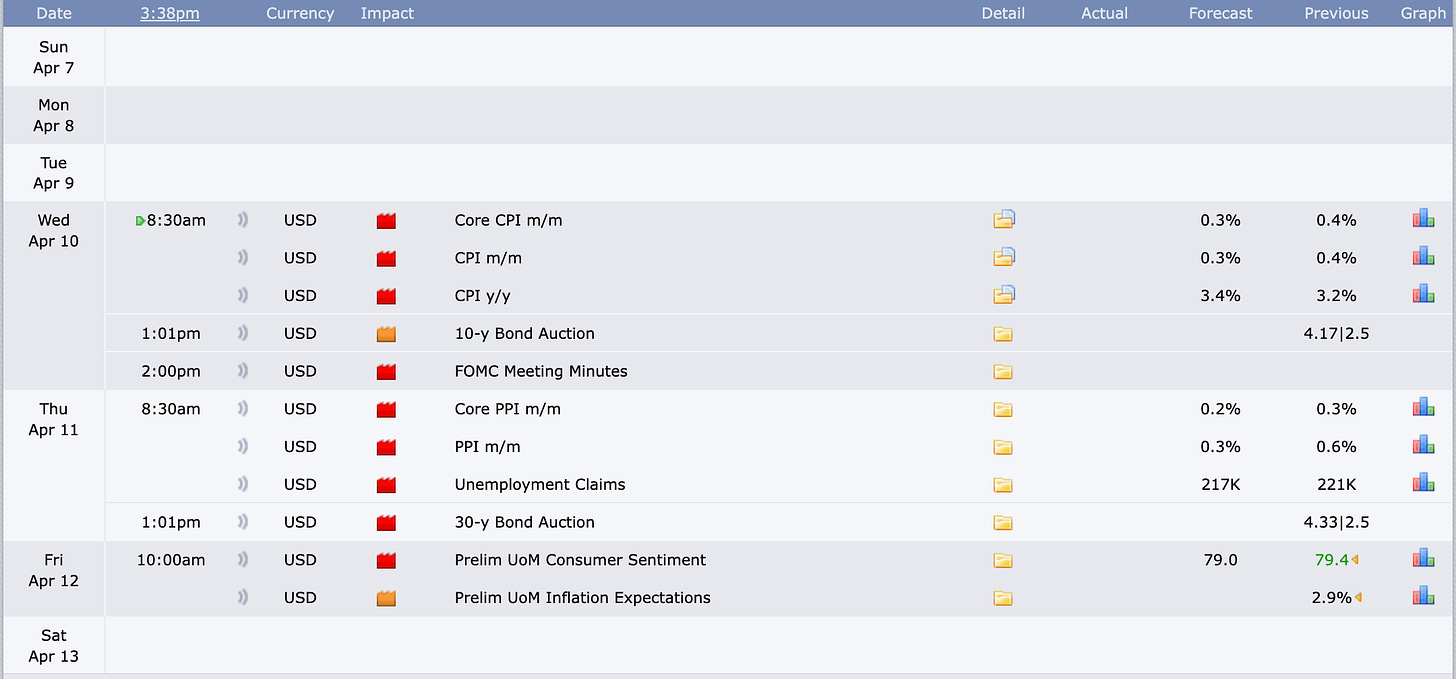

The upcoming week will be highlighted by a plethora of inflation data, including the release of CPI data on Wednesday and PPI data and import prices later in the week. Additionally, market attention will be drawn to the Federal Open Market Committee’s March 20 meeting minutes and a preliminary reading on April consumer sentiment and inflation expectations from the University of Michigan. Other significant releases include the March budget statement, small business optimism for the month, and February wholesale trade figures.

In the auction realm, the U.S. Treasury Department is set to issue $119 billion in 3-, 10-, and 30-year securities. Investors in Asia will closely monitor key Chinese releases, such as the country’s CPI, PPI, trade balance, new loans, and money supply growth. From Japan, updates on labor cash earnings, producer prices, trade data, machine tool orders, money stock, and finalized February industrial production are anticipated. The Bank of Korea’s policy meeting will coincide with the release of the country’s unemployment rate, while readings on Australian consumer and business confidence will also be watched.

In Europe, Thursday’s European Central Bank (ECB) policy meeting and its euro area bank lending survey will be in focus. From the U.K., updates on gross domestic product, industrial production, house prices, and the trade balance are awaited. Meanwhile, Germany’s finalized March CPI and February industrial production data and trade balance, along with France’s finalized March CPI, will round out the region's economic data releases.

Notable Earnings

Important Economical Events

Markets

Below are the levels for the upcoming week - updates will be provided on X (previously Twitter) throughout the week.

SPY - SPDR S&P 500 ETF Trust

🪷

Support: $520, $510 | Resistance: $525

SPY is currently in a range for the last few weeks between 515 to 525. Nothing has changed.

QQQ - Invesco QQQ Trust Series 1

🪷

Support: $440 | Resistance: $450

Tech stocks and the QQQ (Invesco QQQ Trust) have been in a consolidation phase for the past month or so.

IWM - iShares Russell 2000 ETF

🪷

Support: $200 | Resistance: $210, $215

Small caps and the IWM (iShares Russell 2000 ETF) have broken out of their multi-year range, but are currently retesting the breakout level.

DIA - SPDR Dow Jones Industrial Average ETF Trust

🪷

Support: $380 | Resistance: $400

The DOW experienced notable weakness, depicting a challenging week with a concerning outlook. This sector warrants close observation.

MDY - SPDR S&P MidCap 400 ETF

🪷

Support: $530 | Resistance: $560

The mid-cap index has finally broken, reaching a new all-time high (ATH). This could suggest a resurgence of strength within those stocks.

RSP - Invesco S&P 500 Eql Wght ETF

🪷

Support: $165 | Resistance: $170

The S&P 500 equal weight index has finally broken, reaching a new all-time high (ATH). This highlights the disparity between the performance of the S&P 500 and the S&P 500 equal weight index.

VIX - Volatility S&P 500 Index

🪷

Support: $390 | Resistance: $400

Volatility increased notably this week, particularly with a downward swing observed during Thursday and Friday's sessions.

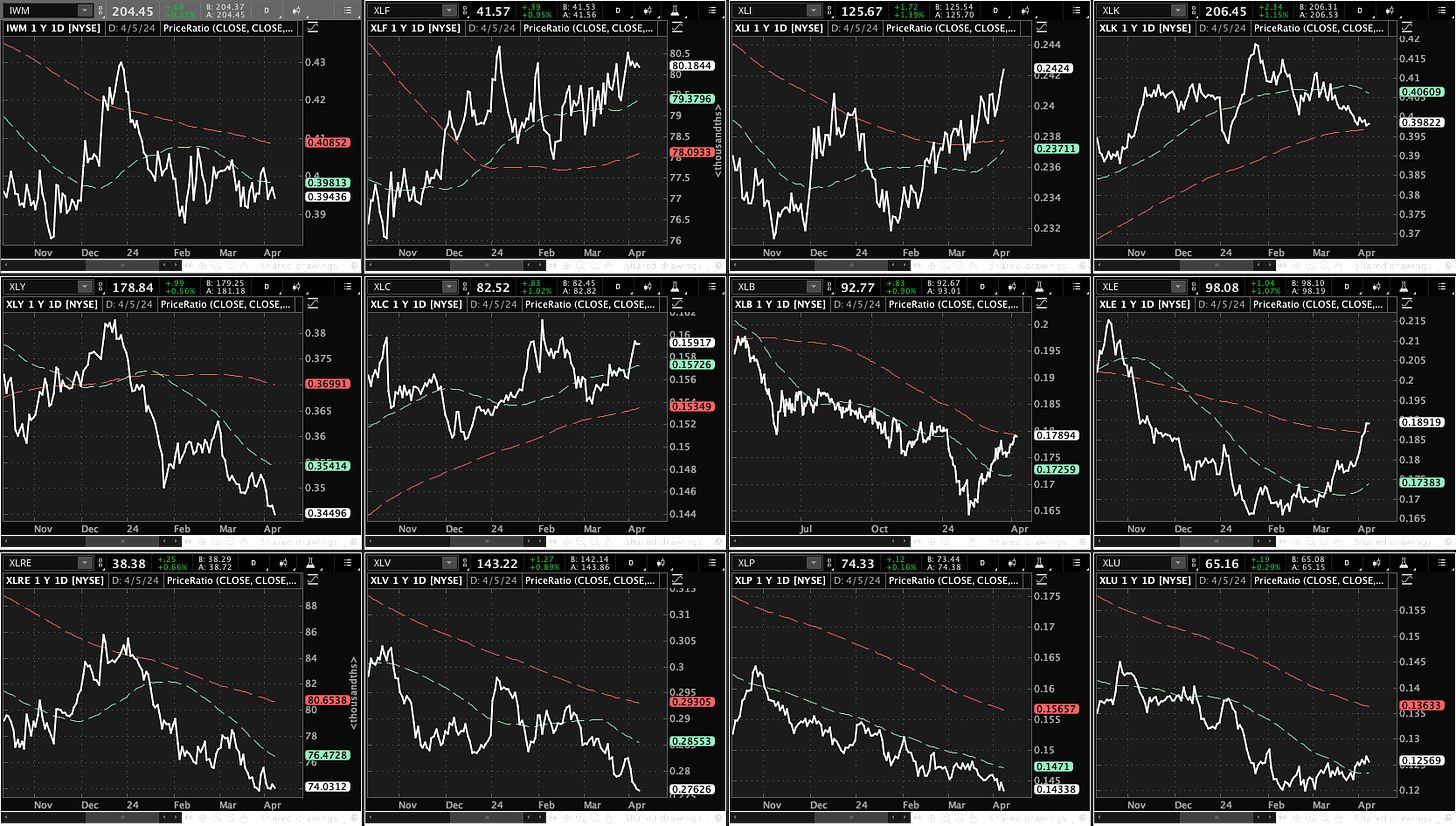

Stock Sectors & Industries

Sectors

Tech, represented by XLK, is experiencing a decline, while sectors such as financials (XLF), industrials (XLI), materials (XLB), and energy (XLE) are leading the market higher. Other sectors are notably lagging.

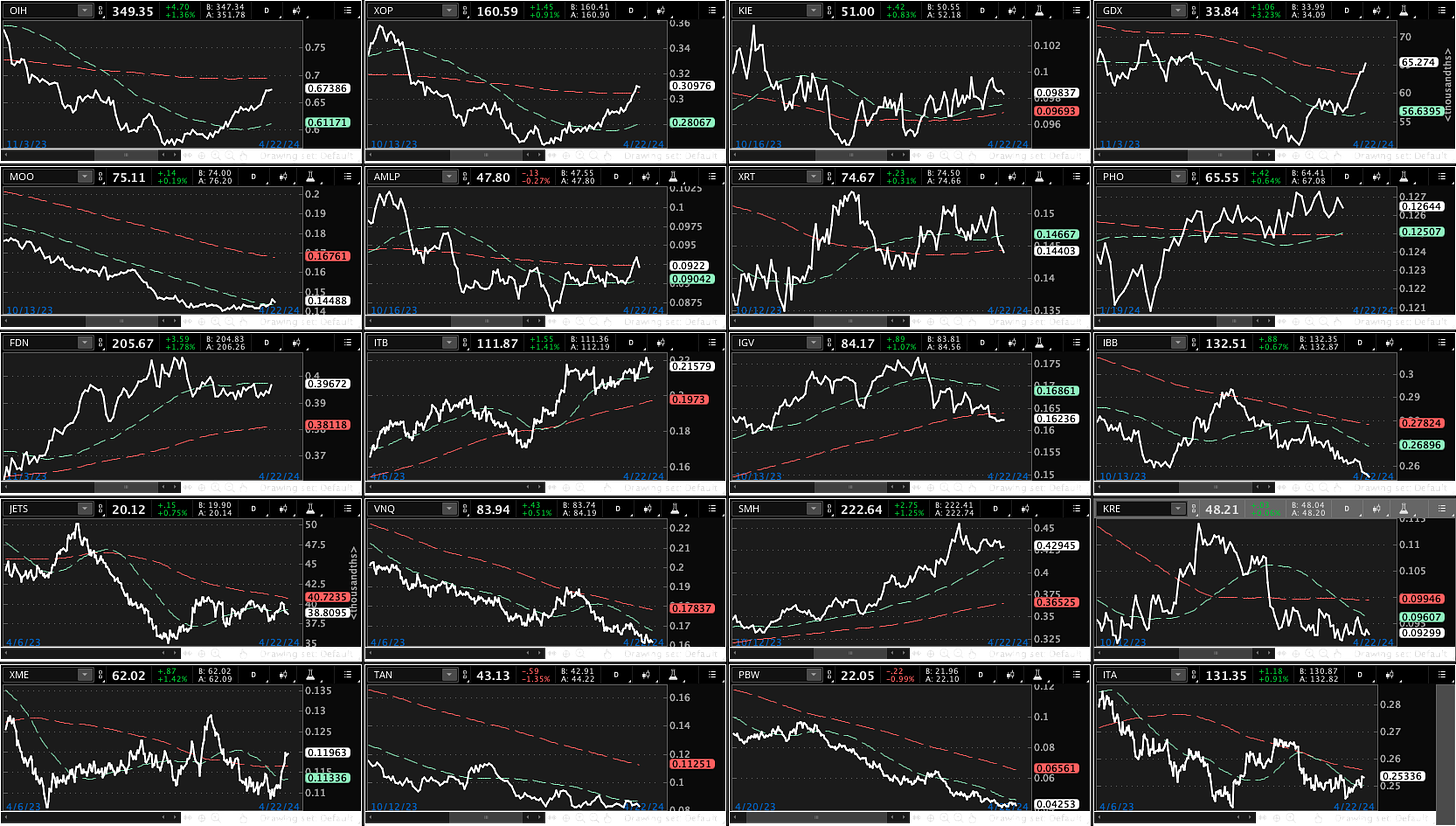

Industries

The OIH (Oil Services ETF), XOP (Oil & Gas Exploration & Production ETF), FDN (Internet Index Fund), ITB (Home Construction ETF), XME (Metals & Mining ETF), and GDX (Gold Miners ETF) sectors are all experiencing upward momentum. Conversely, IGV (Tech-Software Sector ETF), IBB (Biotechnology ETF), SMH (Semiconductor ETF), KIE (Insurance ETF), PHO (Water Resources ETF), XRT (Retail ETF), JETS (Airlines ETF), and TAN (Solar ETF) are all trending downward.

Disclaimer: This newsletter is not trading or investment advice, but for general informational purposes only. This newsletter represents our personal opinions that we share publicly for educational purposes. Futures, stocks, and bonds trading of any kind involves a lot of risks. No guarantee of any profit whatsoever is made. In fact, you may lose everything you have. So be very careful. We guarantee no profit whatsoever, You assume the entire cost and risk of any trading or investing activities you choose to undertake. You are solely responsible for making your own investment decisions. Owners/authors of this newsletter, its representatives, its principals, its moderators, and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission, CFTC, or with any other securities/regulatory authority. Consult with a registered investment advisor, broker-dealer, and/or financial advisor. By reading and using this newsletter or any of my publications, you are agreeing to these terms. Any screenshots used here are courtesy of ForexFactory, SavvyTrader, Finviz, ThinkorSwim, and/or Tradingview. We are just end-users with no affiliations with them.