Market Trader Edition No. 15

Market Trader's goal is to bring you potential swing setups with a time horizon from days to months depending on price action. The stock selection is based on Fundamentals & Technical Analysis.

What is included in this week's edition?

WEEKLY REVIEW - An overview of current market standing, fundamental matters with implications upon the market, and general sentiment regarding the major US indices.

FUTURES & COMMODITIES MARKETS - A technical review of the major indices, futures, and commodities that represent the overall health of the market. Weekly, daily, and four-hour charts for the S&P 500 | NASDAQ | VIX | DXY | CL

SPDR SECTORS & ETFs - An in-depth review of the SPDR sectors with keynotes on market strength, opportunities, and relative rotation. $SPY | $QQQ | $IWM

STOCKS TO WATCH - Trends, key levels, and trade targets are identified for individual names presenting potential opportunities in the market. $GS | $AXON | $AMD

LOOKING AHEAD - Key takeaways to be mindful of as we look forward to the upcoming trading week.

Weekly Review

Positive Shortened Week for the Stock Market. All 11 S&P 500 sectors closed with a gain this week.

China confirmed its first COVID-related deaths in six months and new lockdown measures

Better than expected earnings reports from $BBY, $ANF, $ADI, $DELL

$DIS traded higher after Bob Chapek stepped down as CEO and former CEO Bob Iger is coming back

October Durable Goods Orders, October New Home Sales, and the November University of Michigan Index of Consumer Sentiment were better than expected

Weekly Initial Claims and Preliminary November IHS Markit Manufacturing and Services PMIs, were worse than expected

The FOMC Minutes for the November 1-2 meeting revealed that the Fed is likely to raise rates by 50 bps in December versus a 75 bps rate hike.

Market Heatmap

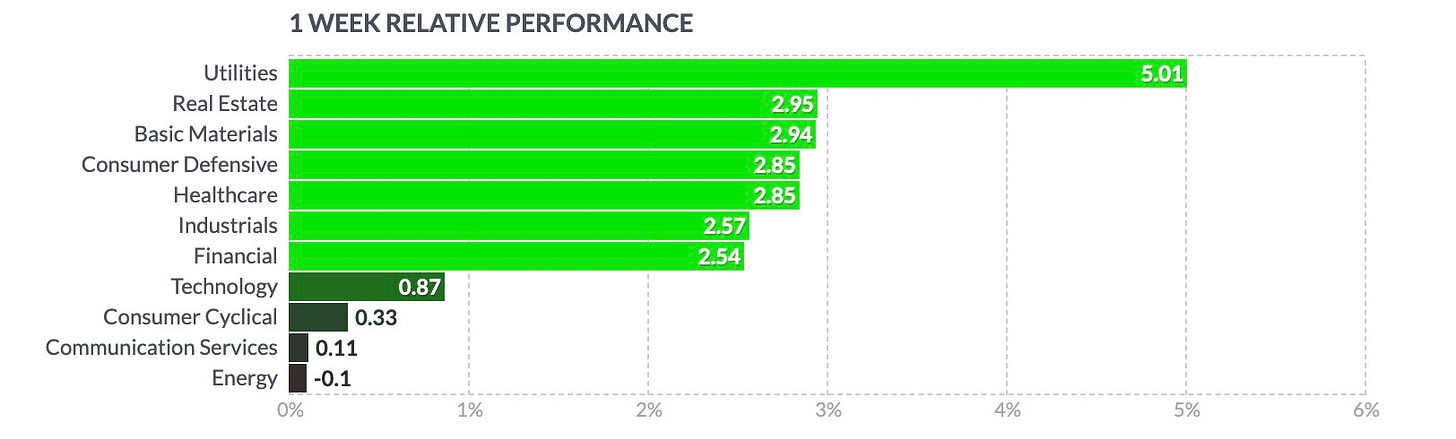

Sector Heatmap

Future & Commodities Markets

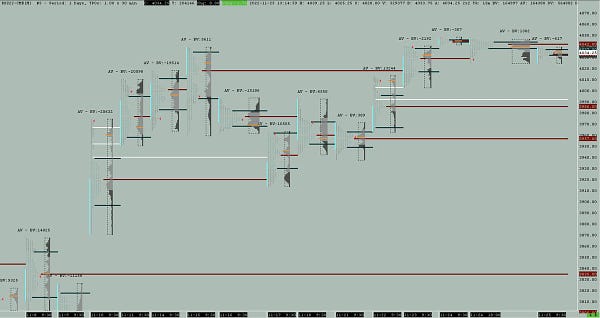

ES - Emini S&P 500

SPDY Sectors & ETFs

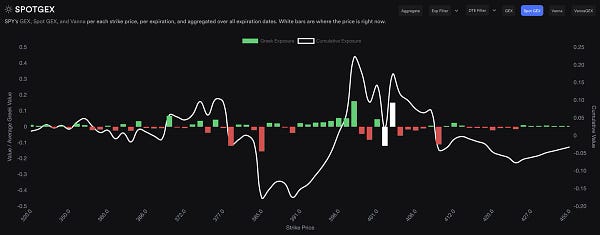

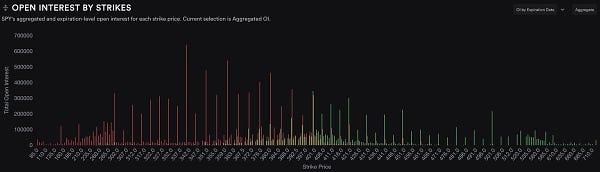

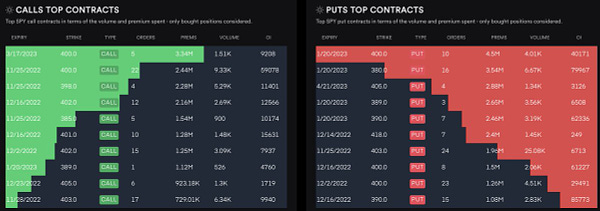

SPY - S&P 500 ETF

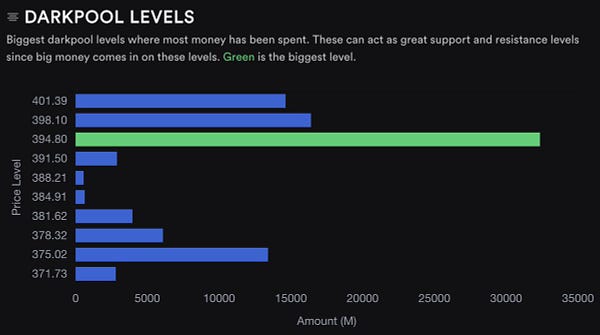

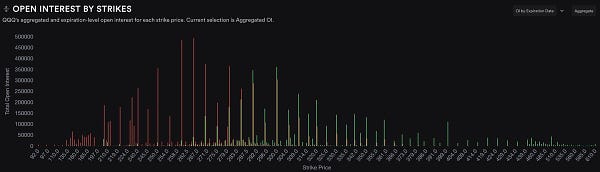

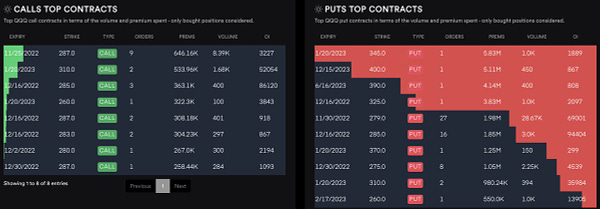

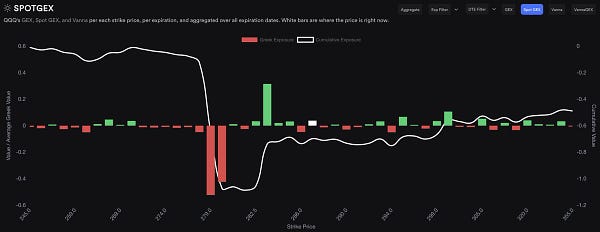

QQQ - Nasdaq 100 ETF

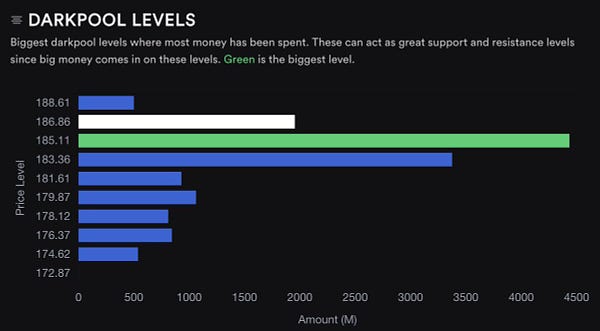

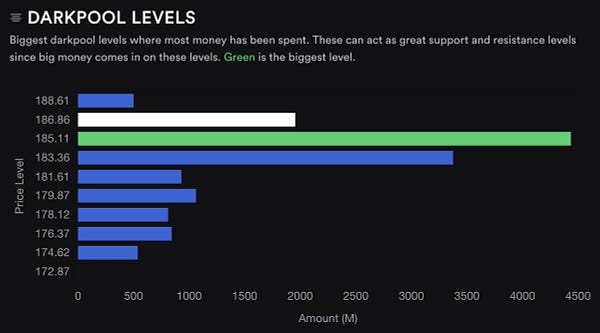

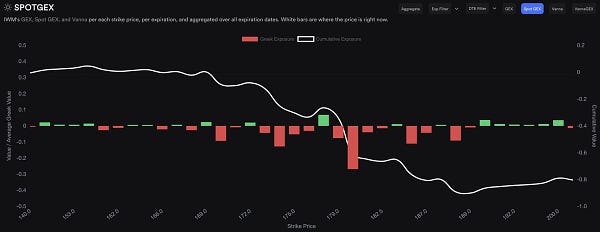

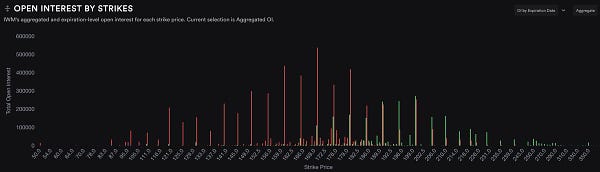

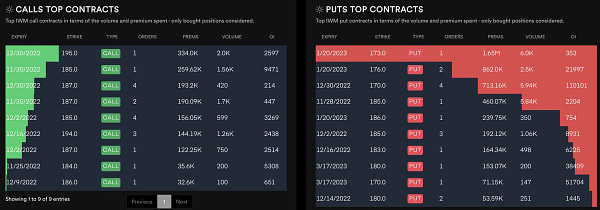

IWM - Russell 2000 ETF

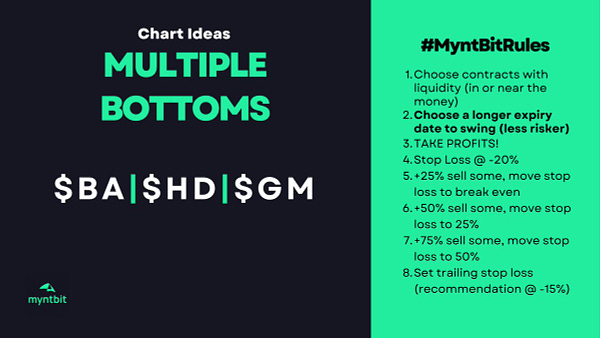

Stocks To Watch

Looking Ahead

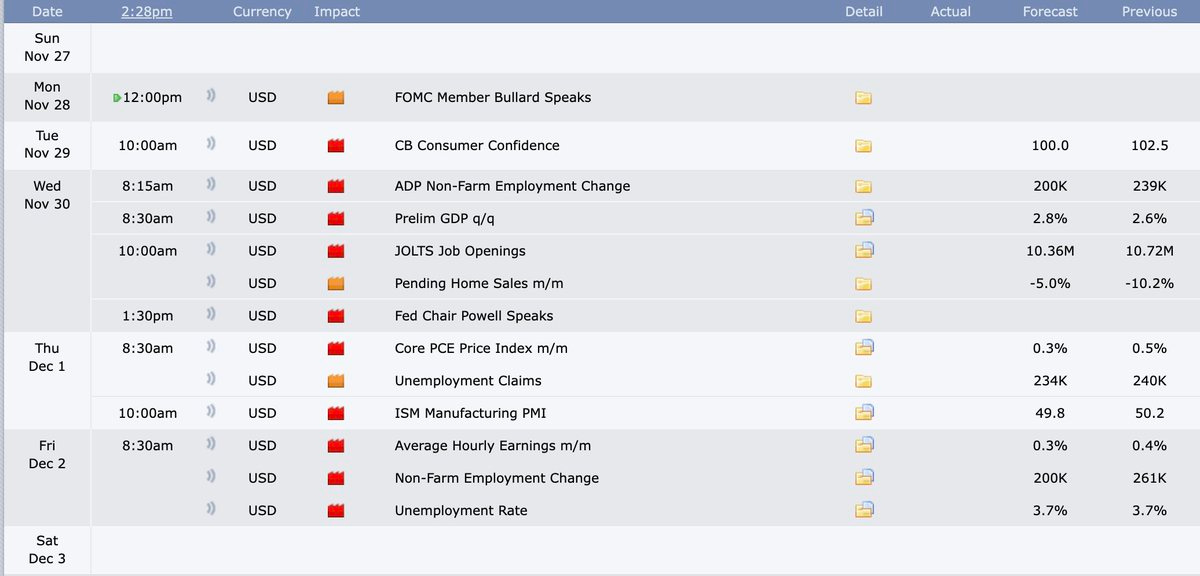

Looking toward November’s “First Friday” jobs report, Personal Consumption Expenditures (PCE) Core, the Institute of Supply Management’s (ISM) Manufacturing index, and the second reading of third-quarter Gross Domestic Product (GDP).

Internationally, the Eurozone is set to release its year-over-year Consumer Price Index (CPI) estimates for November. Meanwhile, China will release November’s manufacturing PMI.

In the central bank sphere, multiple Fed officials are slated to speak throughout the week

Earnings Calendar

Economical Events

Did you enjoy this post?

If you want more detailed levels and a game plan check out our Discord:

Daily Levels for all the stocks

User stock posts if you want a stock charted with levels, let’s talk about it and create a game plan

Live Streams with Q&A

Thank you for reading MyntBit Newsletter. Please share on Twitter!

Disclaimer: This newsletter is not trading or investment advice, but for general informational purposes only. This newsletter represents our personal opinions which we are sharing publicly for educational purposes. Futures, stocks, and bonds trading of any kind involves a lot of risks. No guarantee of any profit whatsoever is made. In fact, you may lose everything you have. So be very careful. We guarantee no profit whatsoever, You assume the entire cost and risk of any trading or investing activities you choose to undertake. You are solely responsible for making your own investment decisions. Owners/authors of this newsletter, its representatives, its principals, its moderators, and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission, CFTC or with any other securities/regulatory authority. Consult with a registered investment advisor, broker-dealer, and/or financial advisor. By reading and using this newsletter or any of my publications, you are agreeing to these terms. Any screenshots used here are the courtesy of Briefing.com, FXstreet, Google Finance, Unusual Whale, Refinitiv, and/or Tradingview. We are just end-users with no affiliations with them.

Thanks for reading MyntBit Newsletter! Subscribe for free to receive new posts and support our work.