The END of the Bear-Market RALLY | Market Trader Edition No. 2

Market Trader's goal is to bring you potential swing setups with a time horizon from days to months depending on price action. The stock selection is based on Fundamentals & Technical Analysis.

Weekly Review

Market Snapshot

Weekly Recap

This week marked the end of the market's four-week winning streak. The explanation is that a pullback was overdue because the market was temporarily overbought on a short-term basis. There was, of course, more to it than that.

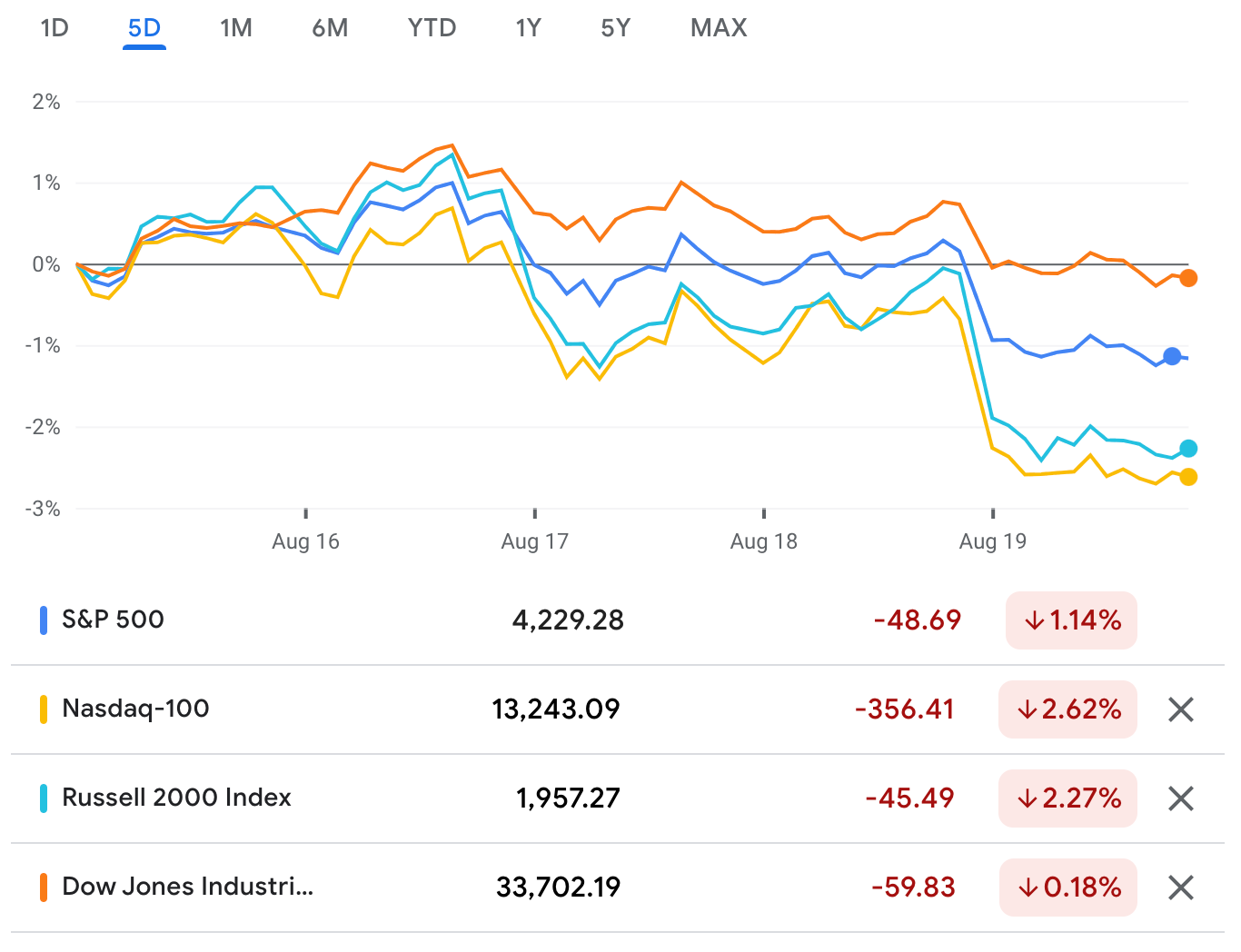

The Russell 2000 fell 2.9% for the week, while the Nasdaq Composite fell 2.6%, the S&P 500 down 1.2%, and the Dow Jones Industrial Average only fell by 0.2%.

The fact that the S&P 500 was up as much as 1.1% for the week on Tuesday at 4,325.28 was overlooked in that losing mixture. That was only a hair short of its 200-day moving average, which offered stiff resistance and served as a roadblock to further buy attempts.

After a strong run that saw the S&P 500 gain 18.9% between its low on June 17 and that Tuesday high was an appropriate stopping point to take some money off the table. This week's news events served as some of the catalysts for that attitude:

Retail sales, industrial production, and fixed asset investment data in China for July were all weaker than expected

The NAHB Housing Market Index decreased for the eighth consecutive month in August, dropping to 49 (a value below 50 is regarded as a sign of negative sentiment)

One of the lowest readings on record for the Empire State Manufacturing Survey for August, at -31.3 from 11.1, was recorded

Housing starts in July were weaker than anticipated

Comparing July to June, total retail sales were flat

July saw a 5.9% month-over-month fall in existing home sales, the sixth consecutive month of declines

Bullard, the president of the St. Louis Fed and a 2022 FOMC voter, declared that he continues to favor a rate increase of 75 basis points at the FOMC meeting in September

Neel Kashkari, president of the Minneapolis Fed and a 2023 FOMC voter, said he is unsure of whether the Fed can reduce inflation without causing a recession

Target (TGT) and Kohl's (KSS) released weaker-than-anticipated earnings results, and Analog Devices (ADI) and Applied Materials (AMAT) provided cautious commentary on recent business activity, reducing some of the positive effects of better-than-anticipated reports from Home Depot (HD), Walmart (WMT), and Cisco (CSCO).

Inflation in the UK reached a 40-year high of 10.1% in July.

The Producer Price Index for Germany increased by 37.2% year over year in July, marking the highest level in more than 70 years

As one can see, a significant economic drag persisted throughout the week, serving as a reminder that the market might have overreached with its eagerness for a turnaround. Similar to this, a 10-year note yield above 3.00% was a sign of underlying inflation anxiety and a fresh obstacle for many growth stocks, which had made significant gains since their June lows.

This week, losses for the Russell 1000, 2000, and 3000 Value Indexes were 1.2%, 2.8%, and 1.3%, respectively, compared to declines for the Russell 1000, 2000, and 3000 Growth Indexes of 1.7%, 3.1%, and 1.8%, respectively. Vanguard Mega-Cap Growth ETF (MGF) lost 2.1% of its value.

The losses for both the Growth and Value Indexes as a whole highlight this week's relatively broad-based decline. To be fair, though, Friday's option expiration day was when the majority of the harm occurred. The S&P 500 has gained less than 0.1% for the week as of Friday.

As a reality check for the speculative excess that had been developing there all week and most definitely since the mid-June lows, there were some repercussions on Friday in the meme stock area. The biggest mover on Friday was Bed Bath & Beyond (BBBY), which fell 40.5% in response to news that Ryan Cohen's RC Ventures had sold all of its shares and a Bloomberg Law article that said the retailer had hired Kirkland & Ellis to help with debt-related issues.

The weakness in the meme stocks spilled into the broader market as a selling catalyst along with the 10-yr note yield's test of 3.00%.

For the week, eight of the 11 S&P 500 sectors finished lower with losses ranging from 0.6% (health care) to 3.3% (communication services). The winning standouts were consumer staples (+1.9%), utilities (+1.0%), and energy (+1.0%).