Daily Report | Jun 28 2024 + Watchlist

What is included in Today’s Daily Report?

Daily Review: In-depth analysis of significant market movements across equities, commodities, forex, and cryptocurrencies over the past 24 hours.

Looking Ahead: Forward-looking insights on key economic data, earnings reports, and geopolitical events likely to influence markets.

Stock Watchlist: Curated selection of stocks with potential for significant price action, including top picks, emerging opportunities, and specific buy and sell targets.

Today's Recap

On Thursday, stocks had a tepid performance as traders anticipated the release of crucial inflation data. The major indices fluctuated throughout the day.

In the end, the major indices closed slightly higher. The Dow rose 36.25 points, or 0.1 percent, to 39,164.06. The Nasdaq climbed 53.53 points, or 0.3 percent, to 17,858.68, while the S&P 500 added 4.97 points, or 0.1 percent, to 5,482.87.

The uncertain trading on Wall Street was due to traders hesitating ahead of Friday's key inflation report. The Commerce Department will release data on personal income and spending for May, including the Federal Reserve's preferred inflation indicators. This report is expected to indicate a modest slowdown in annual consumer price growth, which could influence interest rate projections.

Economically, the Labor Department reported a significant drop in initial jobless claims for the week ending June 22nd, falling to 233,000 from the revised 239,000 of the previous week. Economists had anticipated a decline to 236,000.

Additionally, the Commerce Department showed an unexpected increase in new orders for U.S. manufactured durable goods in May, which edged up by 0.1 percent following a revised 0.2 percent increase in April. Economists had predicted a 0.1 percent decline. Excluding transportation equipment, durable goods orders fell by 0.1 percent after a 0.4 percent rise in April, against expectations of a 0.2 percent increase.

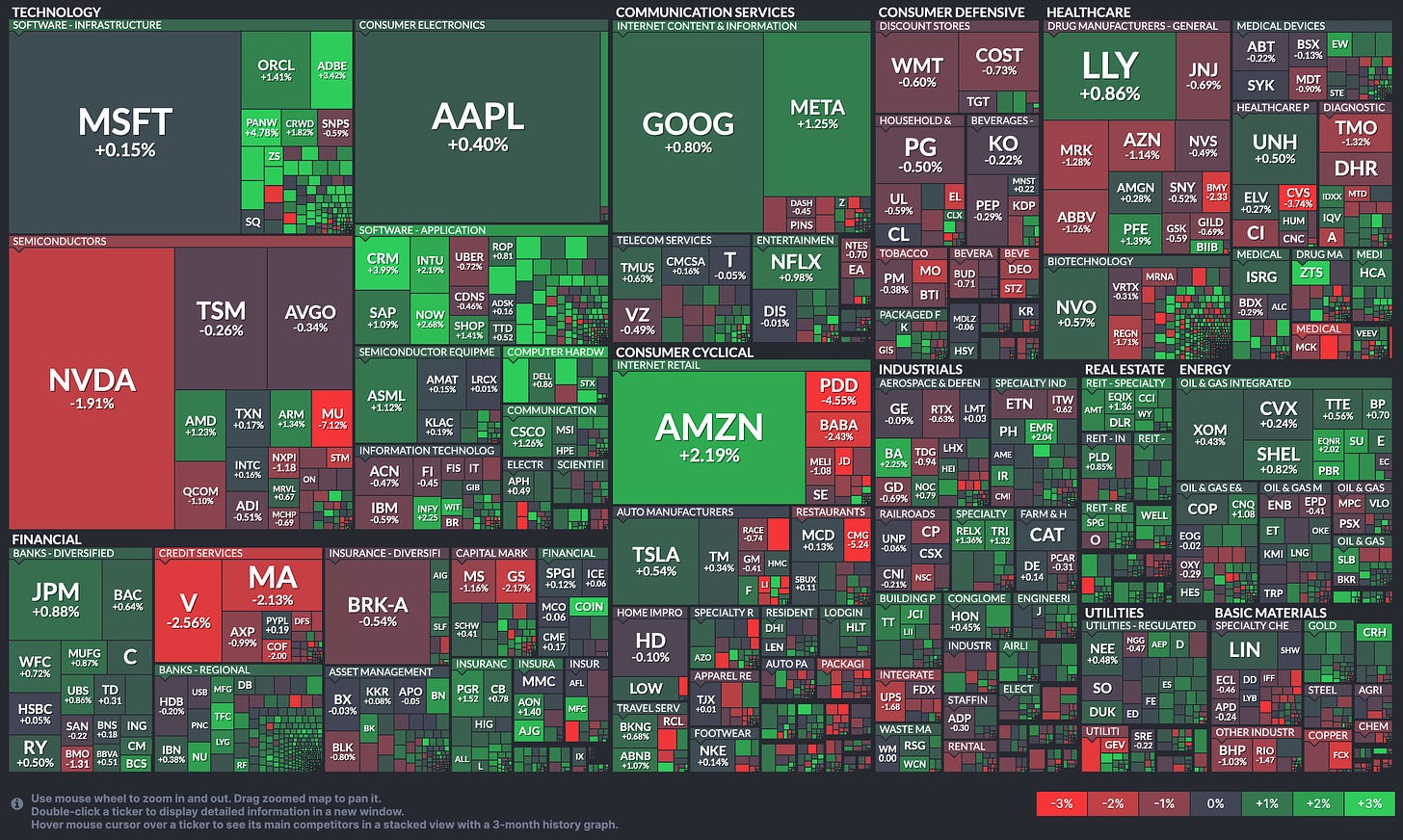

Most major sectors experienced modest changes, contributing to the overall lackluster market performance. Networking stocks showed significant strength, with the NYSE Arca Networking Index rising 1.3 percent. Computer hardware stocks also performed well, indicated by the NYSE Arca Computer Hardware Index's 1.3 percent gain. Airline, gold, and software stocks saw notable gains, while the semiconductor sector suffered due to a steep decline in Micron (MU) shares. Micron dropped 7.1 percent despite better-than-expected fiscal third-quarter results due to disappointing guidance.

In overseas trading, Asia-Pacific markets mostly declined on Thursday. Japan's Nikkei 225 Index and China's Shanghai Composite Index dropped by 0.8 percent and 0.9 percent, respectively, while Hong Kong's Hang Seng Index fell by 2.1 percent.

European markets had a mixed day. Germany's DAX Index increased by 0.3 percent, but the U.K.'s FTSE 100 Index decreased by 0.6 percent, and France's CAC 40 Index fell by 1.0 percent.

In the bond market, treasuries rebounded after Wednesday's decline. The yield on the benchmark ten-year note, which moves inversely to its price, decreased by 2.8 basis points to 4.288 percent.

Market Heatmap

Yesterday’s Watchlist

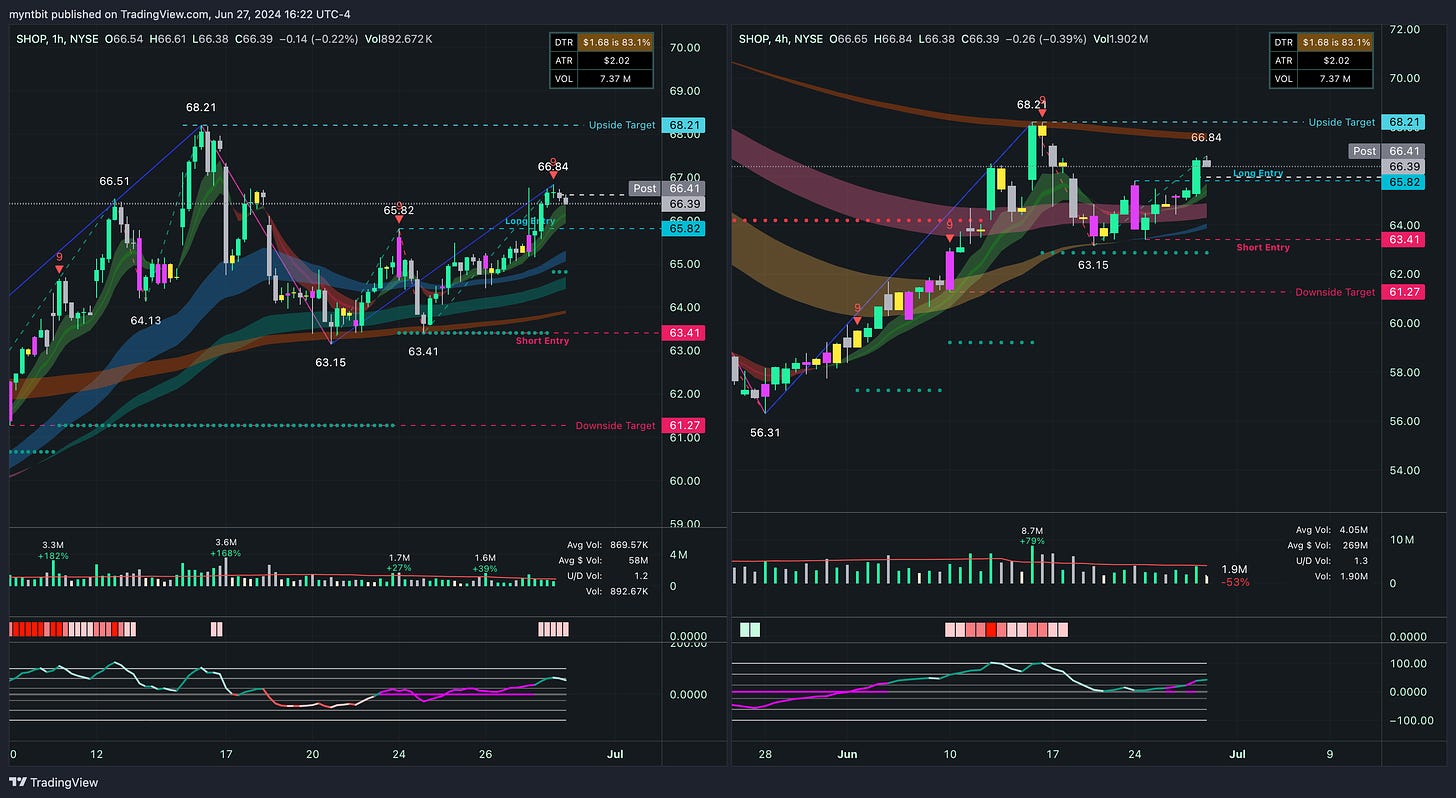

SHOP - Shopify Inc

SHOP broke above, looking for the upside target.

Bullish Case:

If the price breaks above the long entry point of 65.82 and sustains, there is potential for a move toward the upside target of 68.21.

A break and hold above 68.21 would indicate a possible trend reversal, paving the way for higher prices.

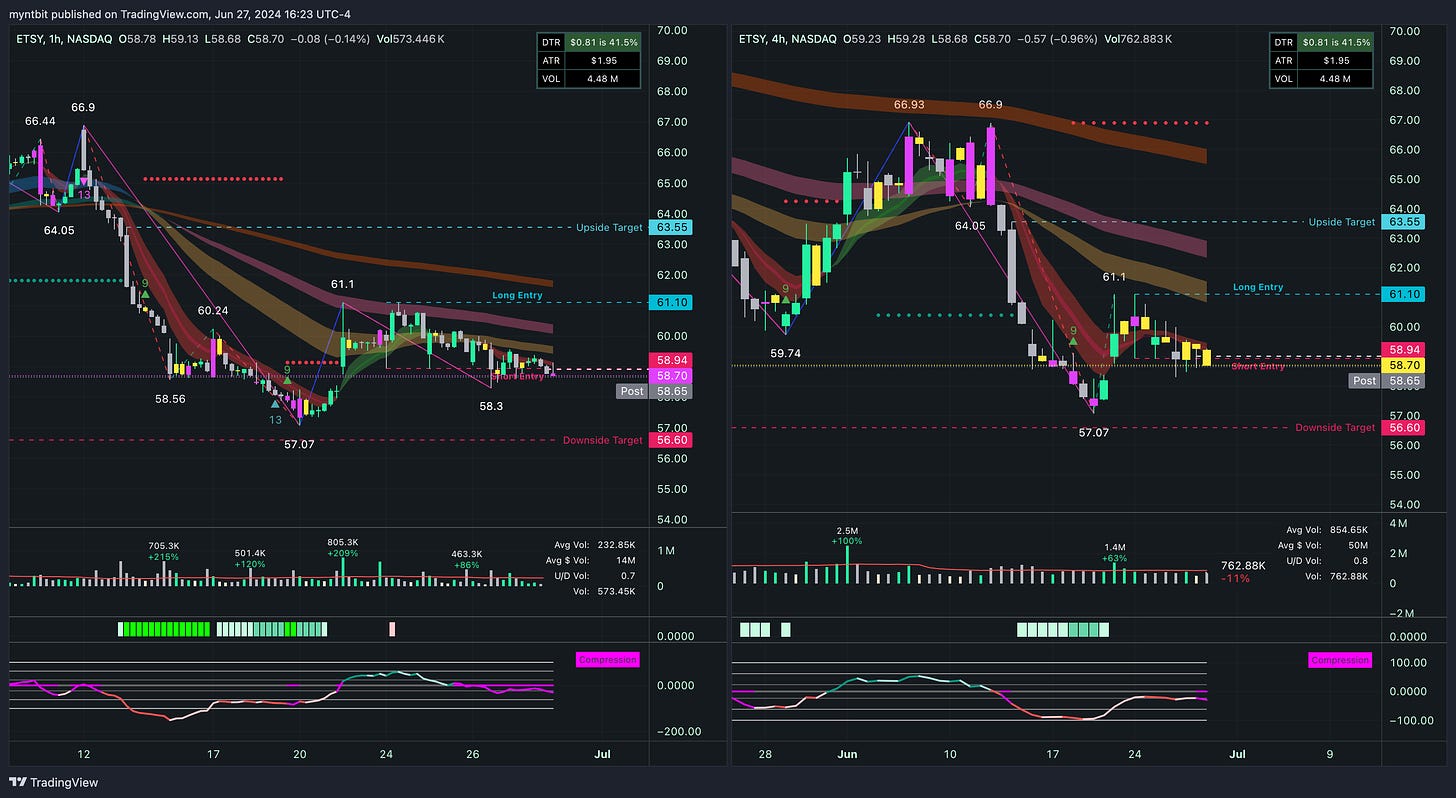

ETSY - Etsy Inc

ETSY broke below, looking for downside target

Bearish Case:

The prevailing trend is bearish, with the price trading below key moving averages and failing to sustain breaks above resistance levels.

The downside target remains at 56.60, with potential for further decline if support levels at 57.07 and 56.60 are breached.

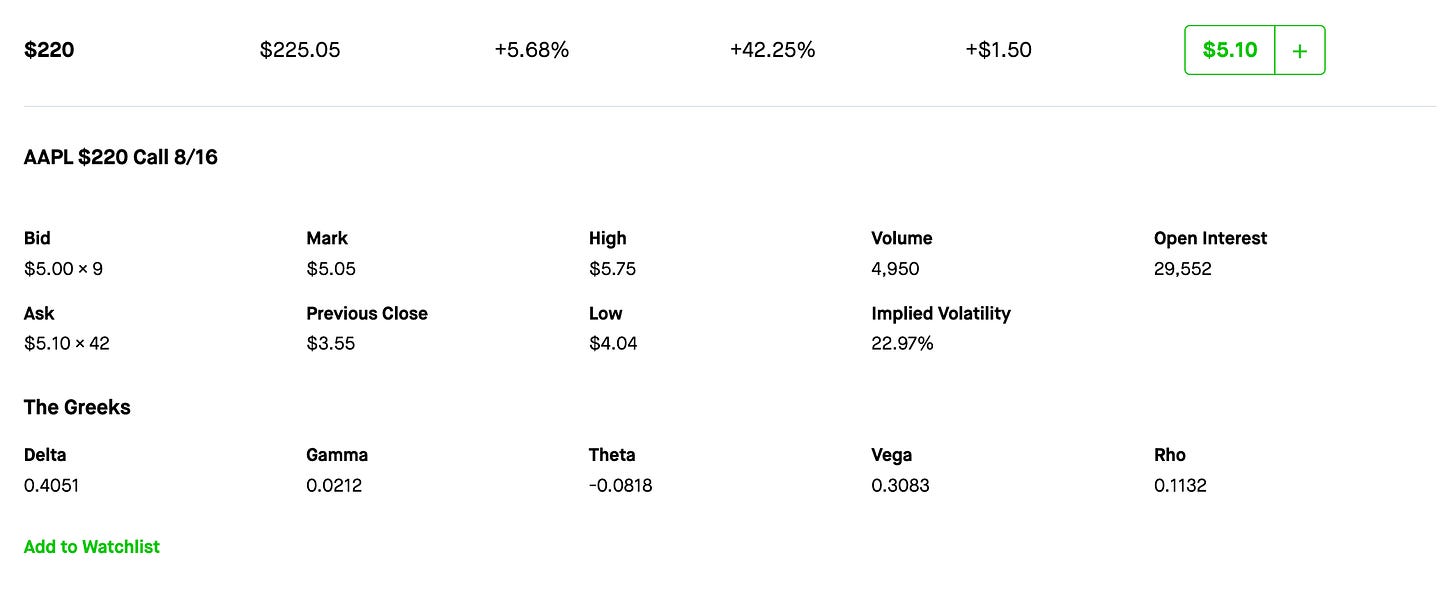

AAPL - Apple Inc

Long Entry hit, looking for Upside Target.

Bullish Case:

If the price breaks above the long entry point of 211.38 and sustains, there is potential for a move towards the upside target of 220.2.

A break and hold above 220.2 would indicate a possible trend reversal, paving the way for higher prices.

What’s in play?

Call Option: Alternatively, a call option with a strike price around 220.00, expiring in 1-2 months, could be considered if there are signs of a reversal above 211.38.

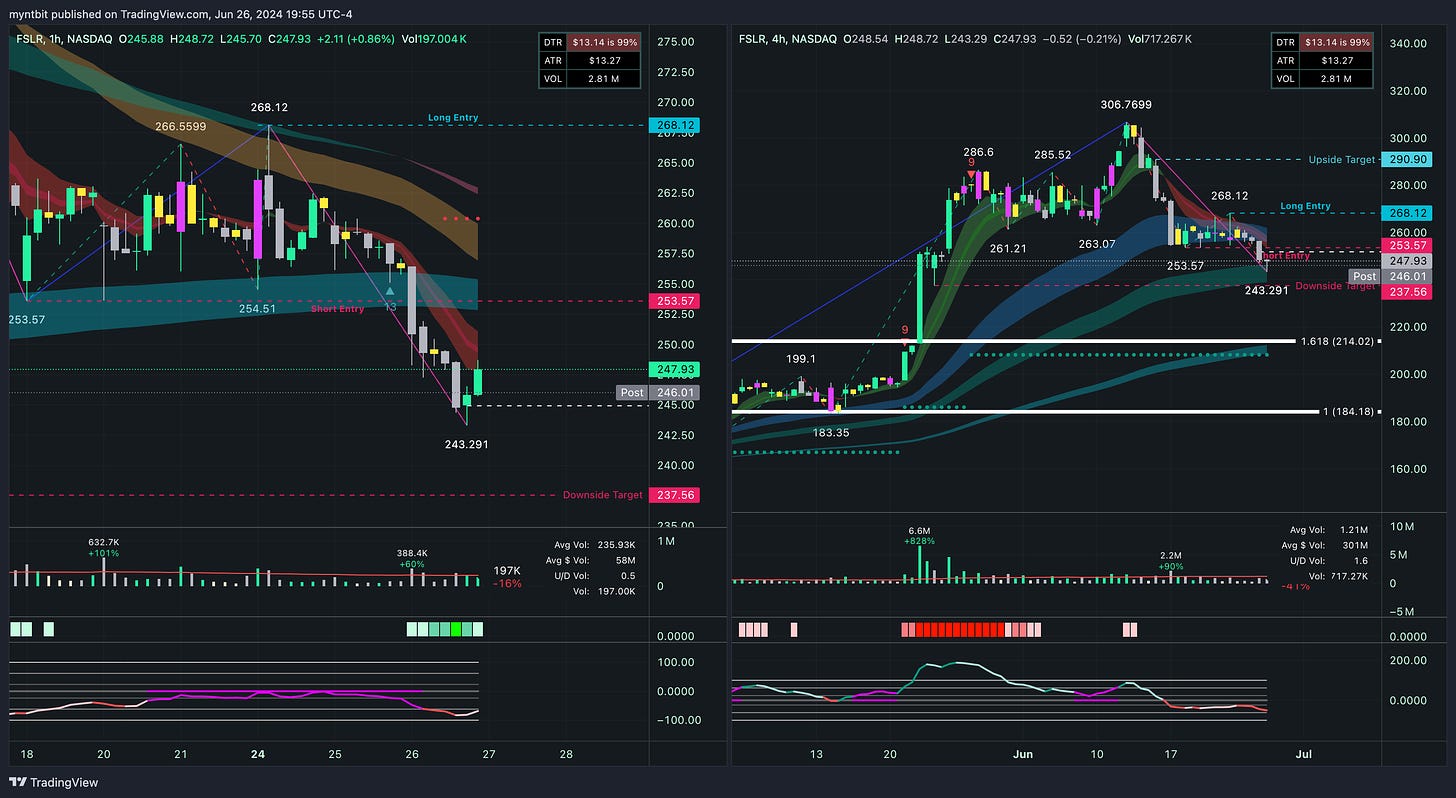

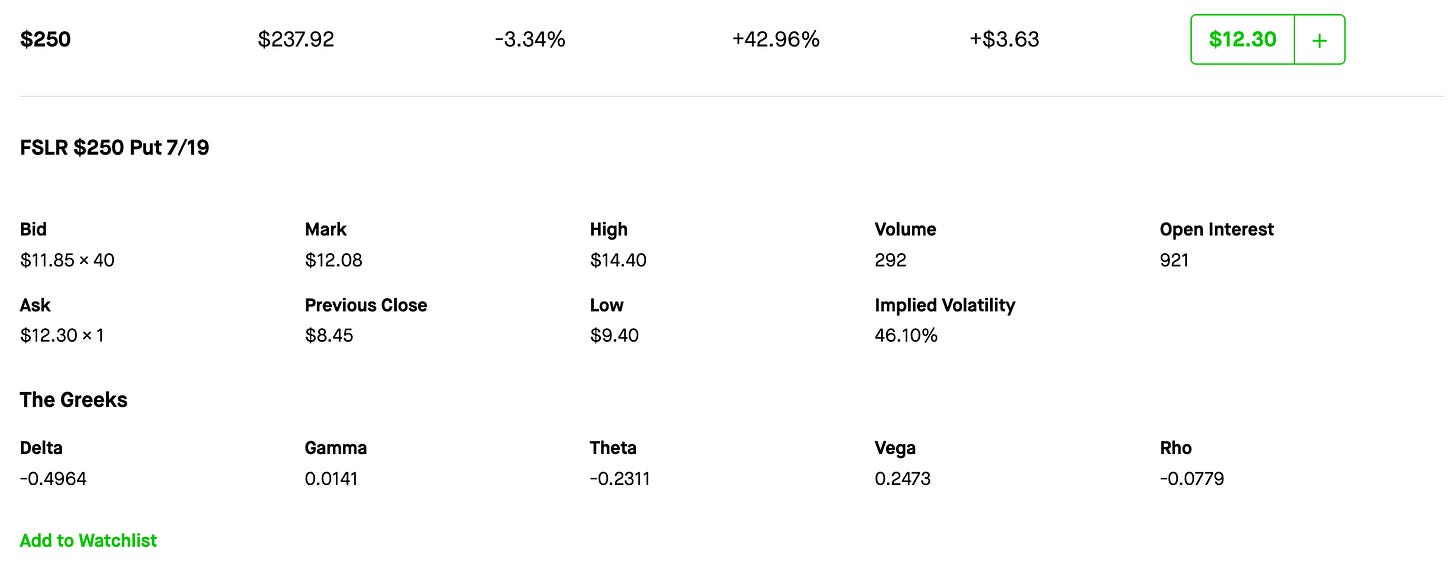

FSLR - First Solar Inc

Short Entry hit, looking for Downside Target.

Bearish Case:

The price is currently struggling to break above resistance levels, indicating potential weakness.

The downside target remains at 237.56, with potential for further decline if support levels at 253.57 and 237.56 are breached.

What’s in play?

Put Option: Consider buying a put option with a strike price around 250.00, expiring in the next 1-2 weeks, to capitalize on the potential short-term bearish trend.

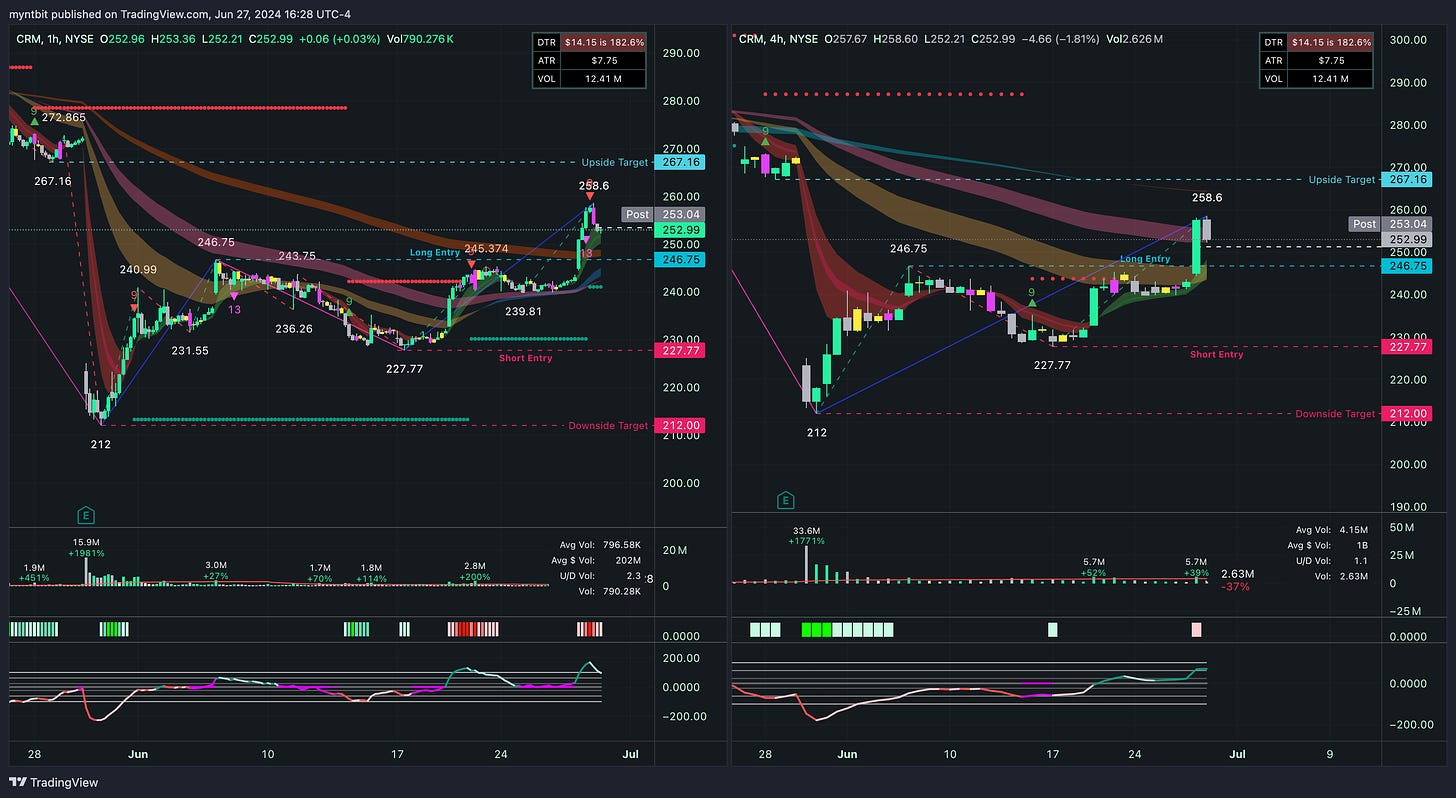

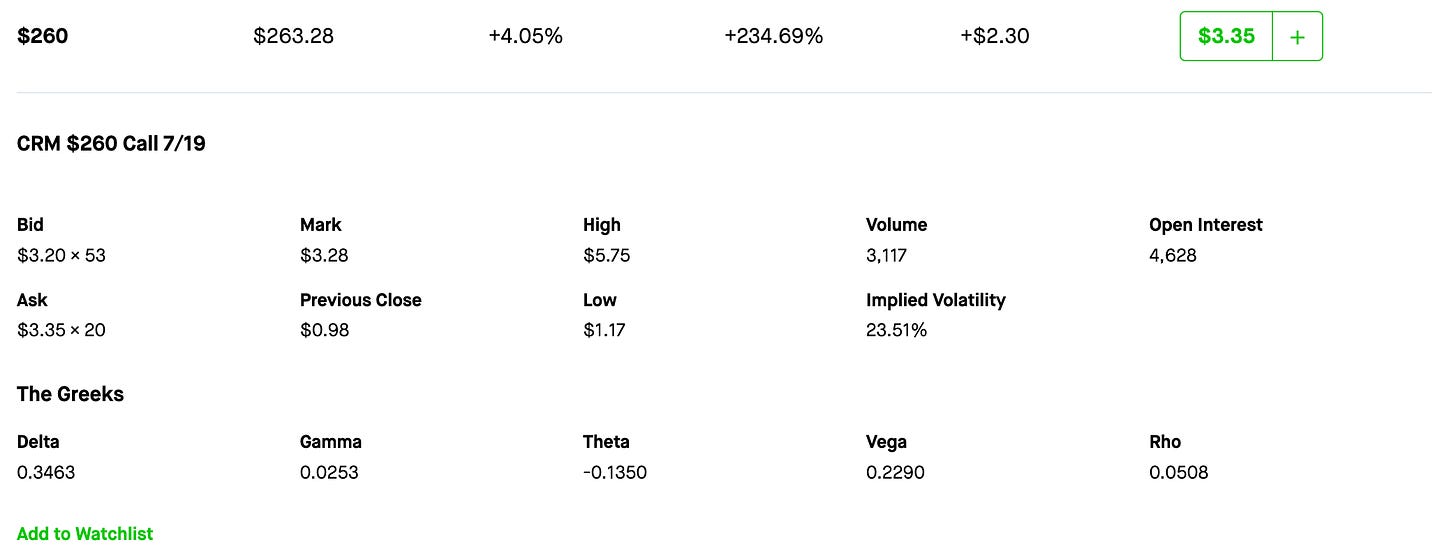

CRM - Salesforce Inc

Long Entry hit, looking for Upside Target.

Bullish Case:

If the price breaks above the long entry point of 246.75 and sustains, there is potential for a move towards the upside target of 267.16.

A break and hold above 267.16 would indicate a possible trend reversal, paving the way for higher prices.

What’s in play?

Call Option: Alternatively, a call option with a strike price around 260.00, expiring in 1-2 months, could be considered if there are signs of a continuation above 246.75.

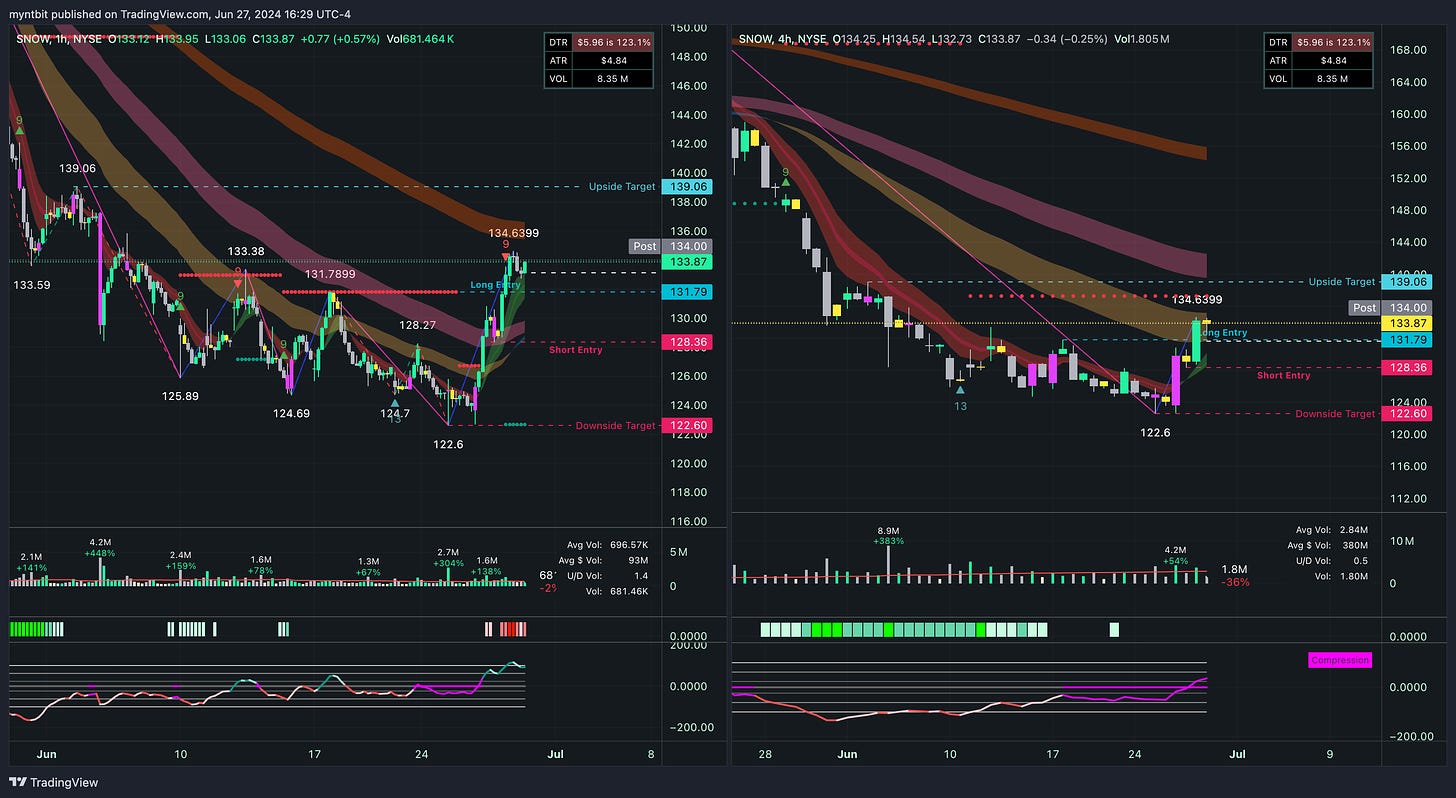

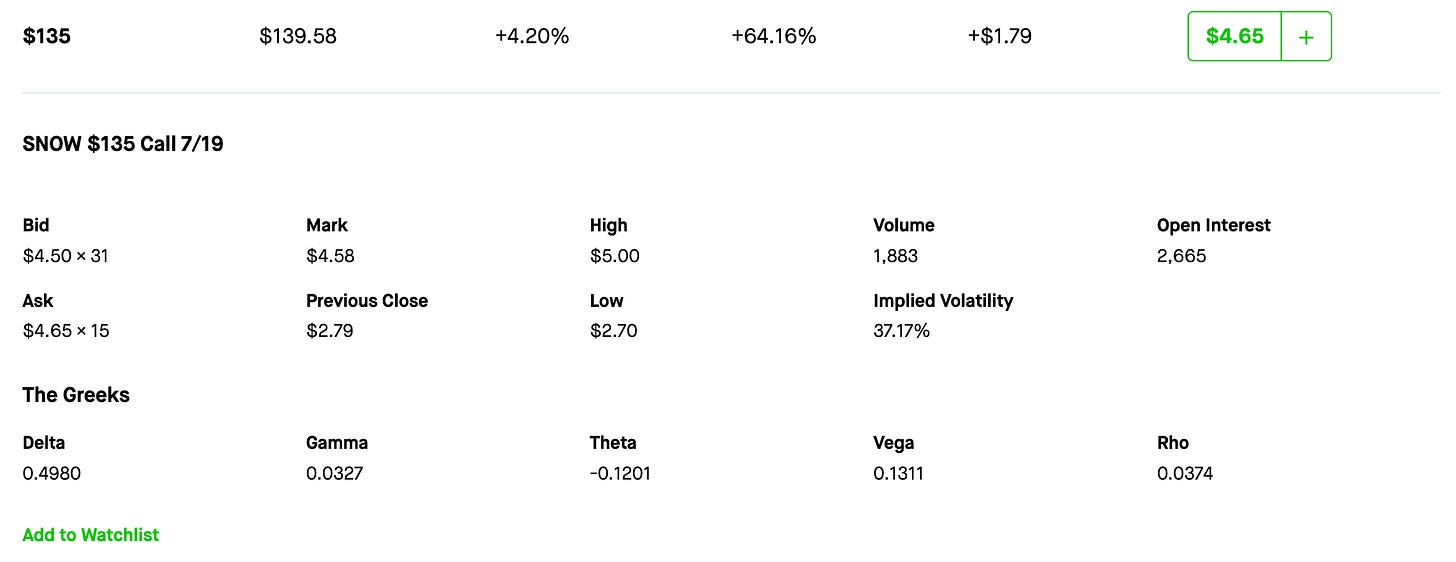

SNOW - Snowflake Inc

Long Entry hit, looking for Upside Target.

Bullish Case:

If the price breaks above the long entry point of 131.79 and sustains, there is potential for a move towards the upside target of 139.06.

A break and hold above 139.06 would indicate a possible trend reversal, paving the way for higher prices.

When to play?

Call Option: Alternatively, a call option with a strike price around 135.00, expiring in 1-2 months, could be considered if there are signs of a continuation above 131.79.

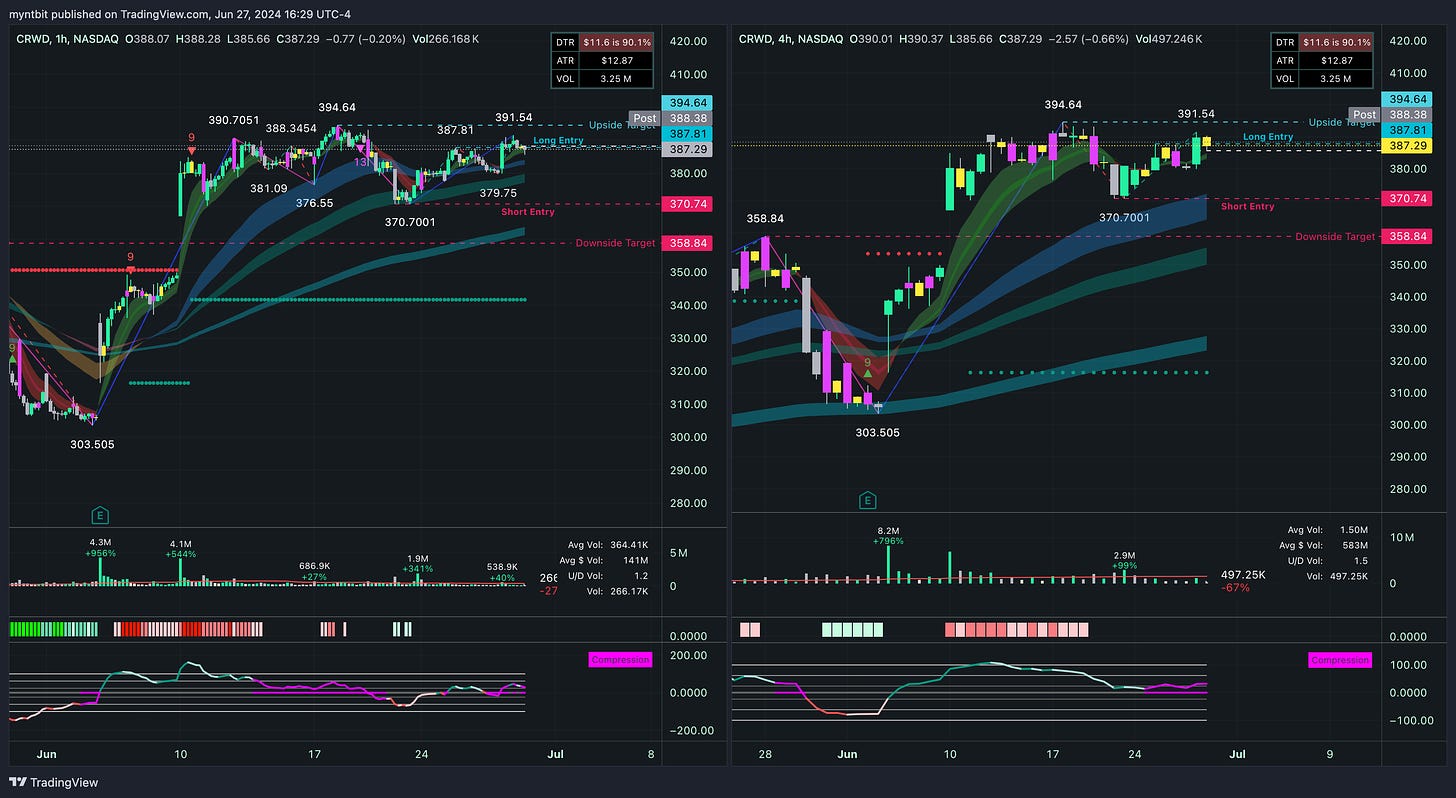

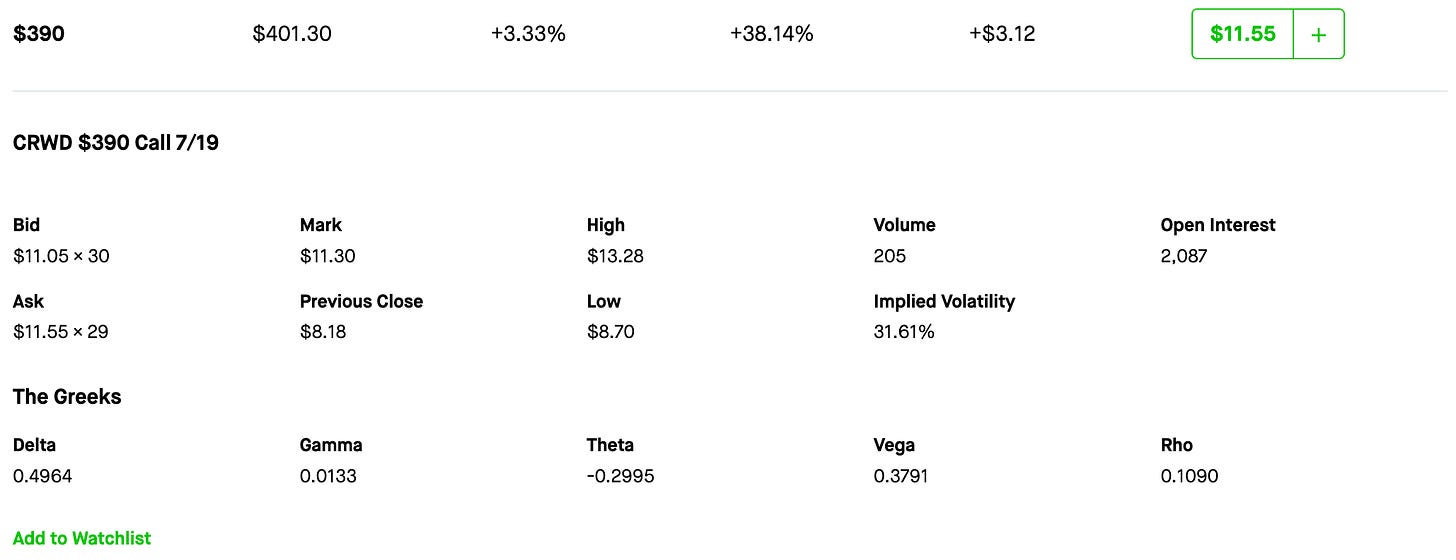

CRWD - Crowdstrike Holdings Inc

Long Entry hit, looking for Upside Target.

Bullish Case:

If the price breaks above the long entry point of 387.81 and sustains, there is potential for a move towards the upside target of 394.64.

A break and hold above 394.64 would indicate a possible trend continuation, paving the way for higher prices.

When to play?

Call Option: Alternatively, a call option with a strike price around 390.00, expiring in 1-2 months, could be considered if there are signs of a continuation above 387.81.

Tomorrow's Watchlist

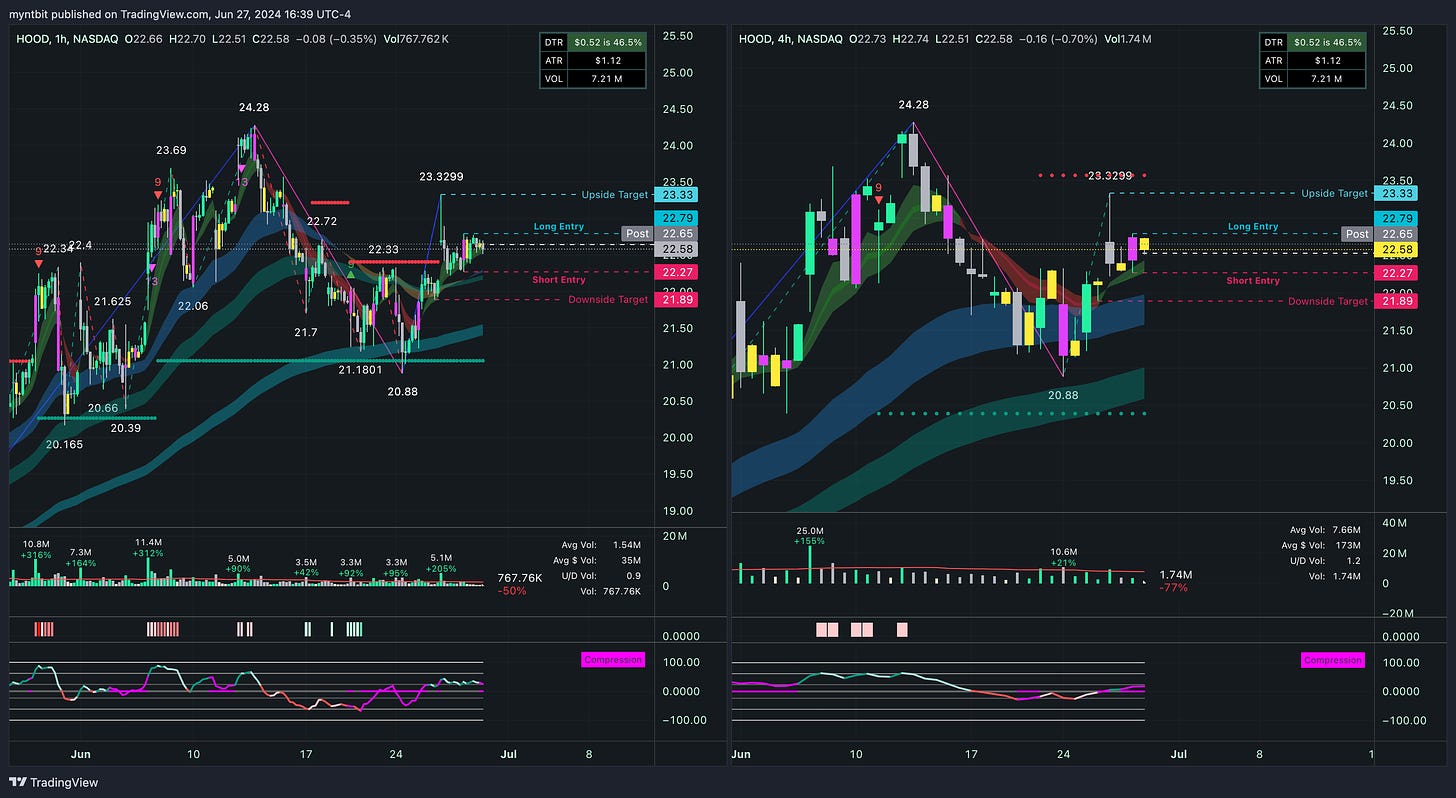

HOOD - Robinhood Markets Inc | Freebie

Bullish Case:

If the price breaks above the long entry point of 22.79 and sustains, there is potential for a move towards the upside target of 23.50.

A break and hold above 23.50 would indicate a possible trend continuation, paving the way for higher prices.

Bearish Case:

The price is currently struggling to break above resistance levels, indicating potential weakness.

The downside target remains at 21.89, with potential for further decline if support levels at 22.27 and 21.89 are breached.

When to play?

Put Option: Consider buying a put option with a strike price around 22.00, expiring in the next 1-2 weeks, to capitalize on potential short-term bearish movements if the price fails to break resistance.

Call Option: Alternatively, a call option with a strike price around 23.00, expiring in 1-2 months, could be considered if there are signs of a continuation above 22.79.