What is included in Today’s Daily Report?

Daily Review: In-depth analysis of significant market movements across equities, commodities, forex, and cryptocurrencies over the past 24 hours.

Looking Ahead: Forward-looking insights on key economic data, earnings reports, and geopolitical events likely to influence markets.

Stock Watchlist: Curated selection of stocks with potential for significant price action, including top picks, emerging opportunities, and specific buy and sell targets.

Today's Recap

U.S. stocks edged slightly higher on Wednesday after a somewhat sluggish session as investors made cautious moves ahead of the release of the personal consumption expenditures price index report, due on Friday.

Additional data on first-quarter GDP, May's durable goods orders, and the weekly jobless claims report are also anticipated this week.

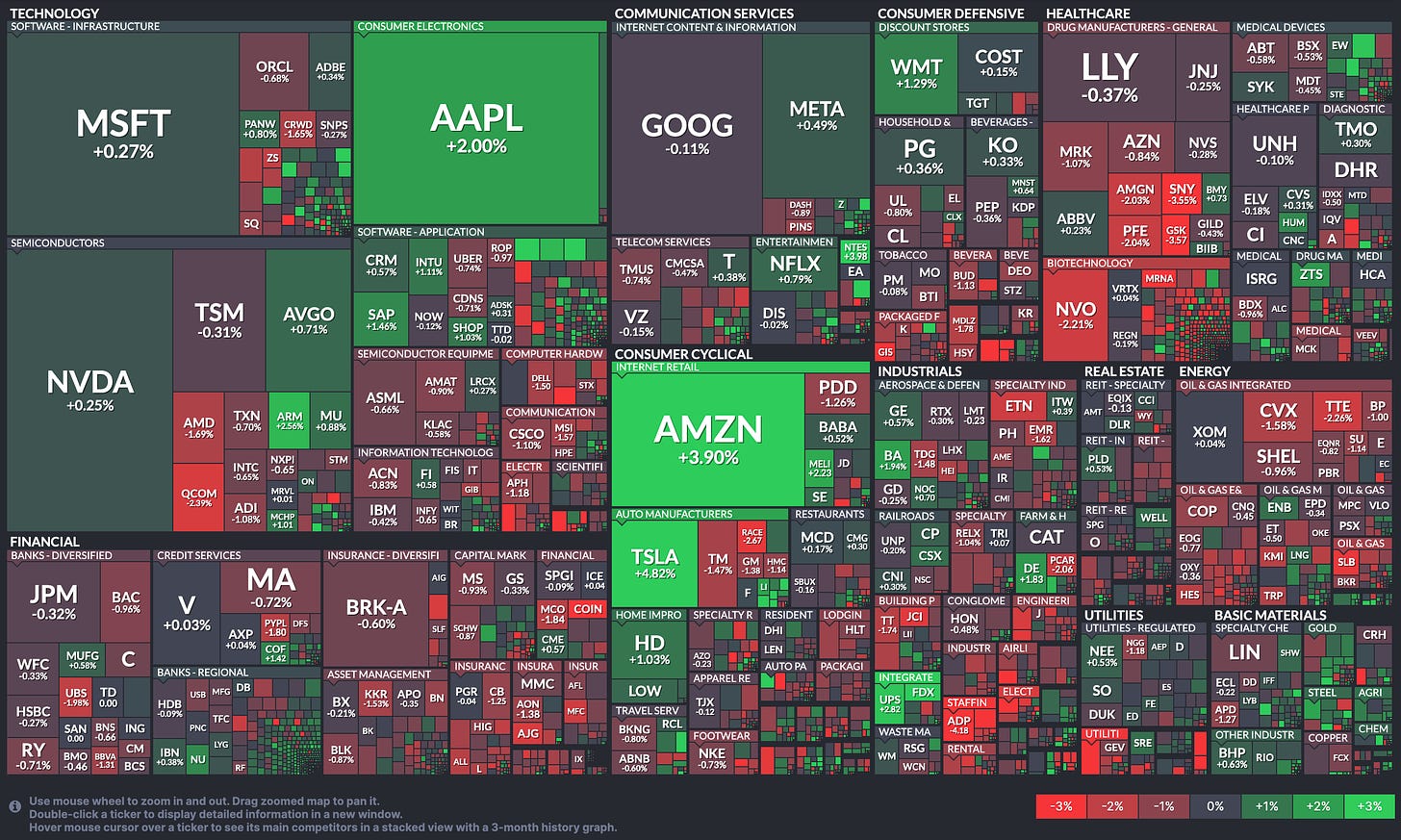

All major averages ended in positive territory. Technology stocks outperformed, lifting the Nasdaq by 87.50 points, or 0.49 percent, to 17,805.16. The Dow added 15.64 points, or 0.04 percent, closing at 39,127.80, while the S&P 500 gained 8.60 points, or 0.16 percent, to settle at 5,477.60.

Bank stocks were in focus ahead of the central bank's annual stress test, while shares of energy firms struggled due to sluggish oil prices.

Amazon surged about 4 percent, pushing its market cap past $2 trillion.

Apple Inc., Tesla Inc., Walmart, Home Depot, United Parcel Service, and Boeing gained between 1 and 4 percent.

Shares of Automatic Data Processing dropped more than 4 percent. Dell Technologies, Analog Devices, Pfizer, Morgan Stanley, Amgen, Cisco Systems, Qualcomm, Chevron, Advanced Micro Devices, and Merck fell between 1 and 3 percent.

Economically, a report from the Commerce Department showed that new home sales in the U.S. saw a substantial decrease in May, plunging by 11.3 percent to an annual rate of 619,000, following a 2.0 percent increase to a revised rate of 698,000 in April. Economists had expected new home sales to rise to an annual rate of 640,000 from the 634,000 originally reported for the previous month.

Meanwhile, U.S. building permits fell by 2.8 percent to a seasonally adjusted annual rate of 1.399 million in May, revised higher from a preliminary estimate of 1.386 million.

In overseas trading, Asian stocks ended mostly higher on Wednesday as a rebound in tech stocks helped offset hawkish comments from Federal Reserve officials. Amid uncertainty about the interest rate outlook, investors braced for the release of key U.S. inflation data later this week for directional cues.

European stocks failed to hold early gains and drifted lower on Wednesday as investors chose to lighten commitments ahead of crucial U.S. economic data, including a report on personal income and spending, amid uncertainty about the interest rate outlook.

Market Heatmap

Yesterday’s Watchlist

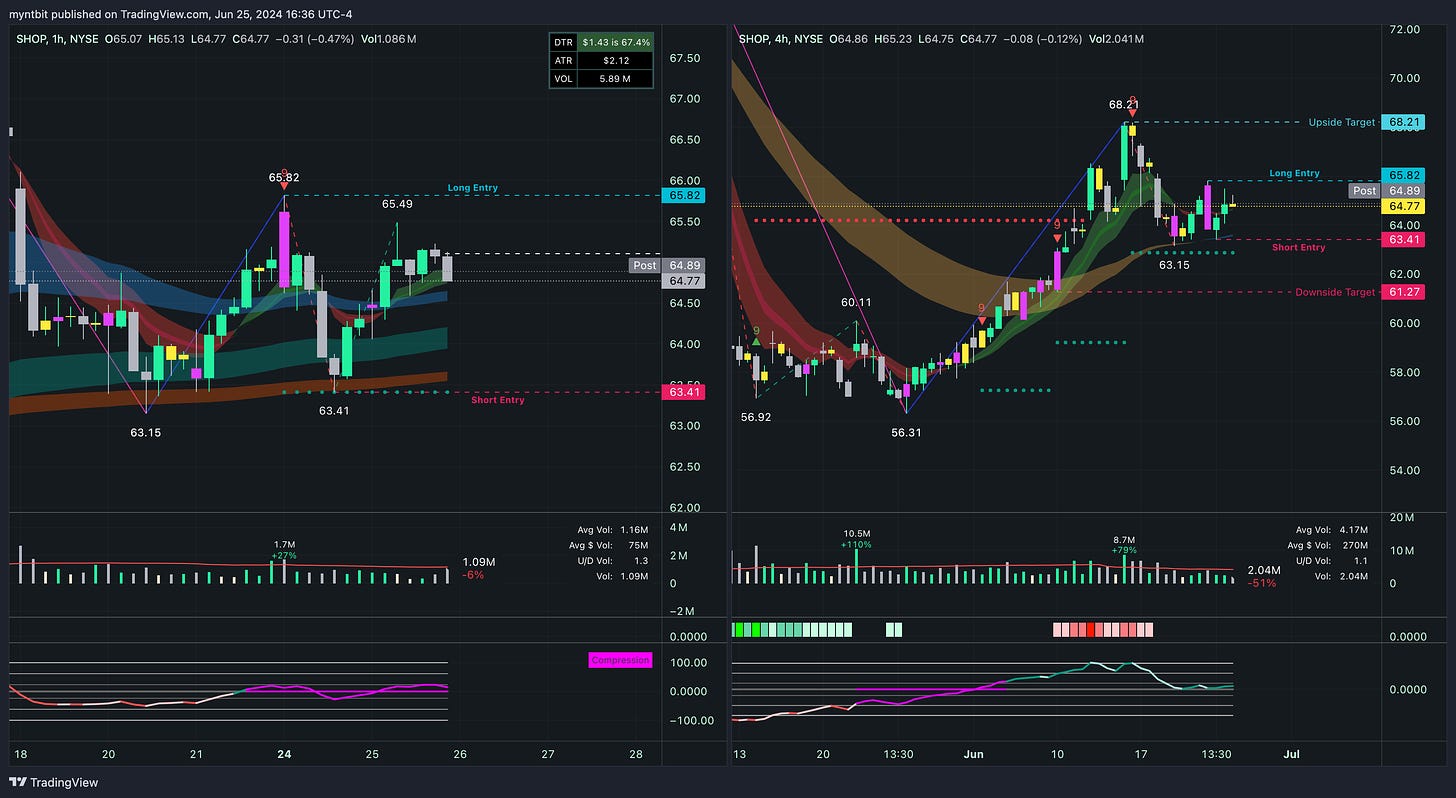

SHOP - Shopify Inc

Nothing has changed.

Bullish Case:

If the price breaks above the long entry point of 65.82 and sustains, there is potential for a move toward the upside target of 68.21.

A break and hold above 68.21 would indicate a possible trend reversal, paving the way for higher prices.

Bearish Case:

The prevailing trend is still bearish, with the price trading below key moving averages and failing to sustain breaks above resistance levels.

The downside target remains at 60.00, with the potential for further decline if support levels at 63.15 and 61.27 are breached.

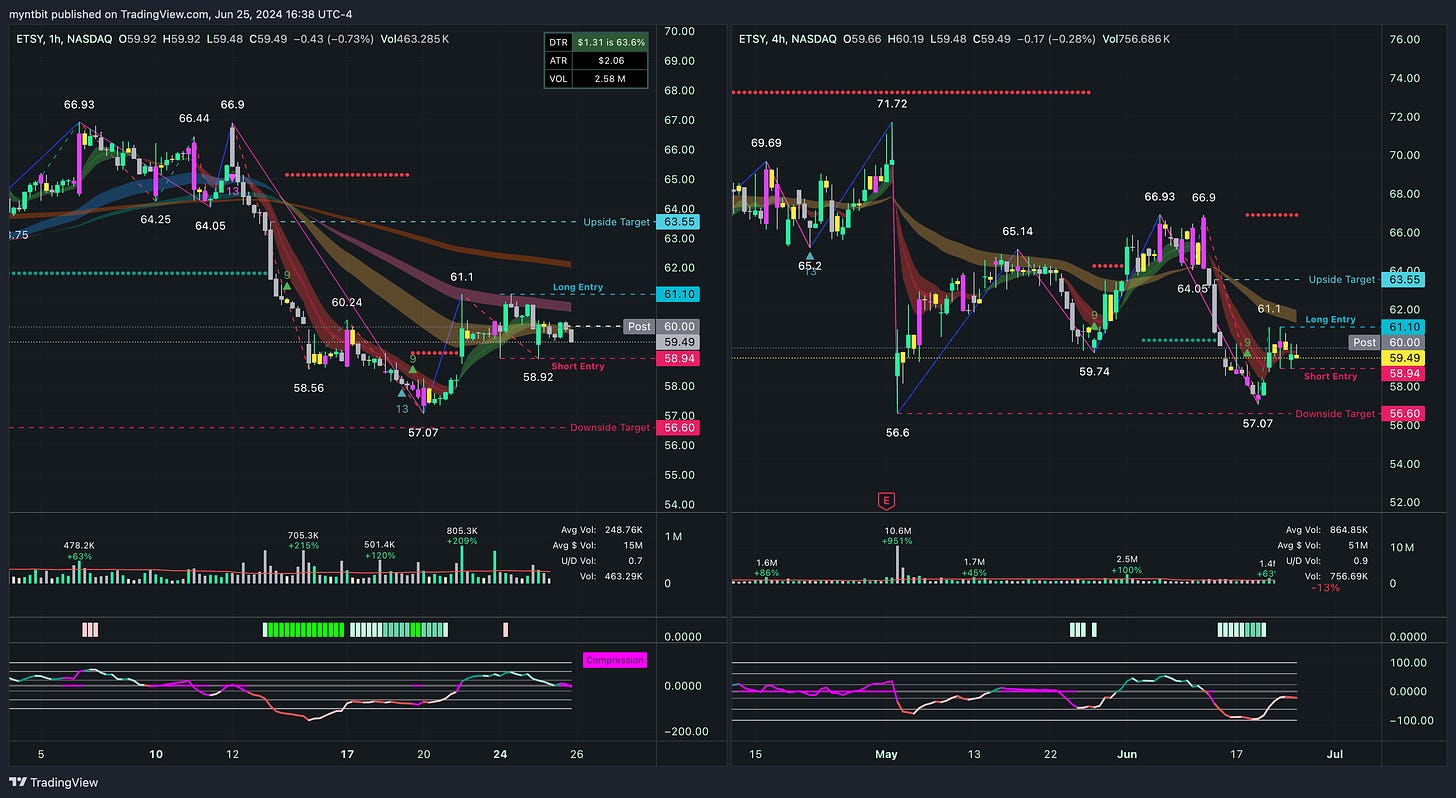

ETSY - Etsy Inc

ETSY broke below but consolidated, nothing changed from yesterday’s analysis.

Bullish Case:

If the price breaks above the long entry point of 61.10 and sustains, there is potential for a move towards the upside target of 63.55.

A break and hold above 63.55 would indicate a possible trend reversal, paving the way for higher prices.

Bearish Case:

The prevailing trend is bearish, with the price trading below key moving averages and failing to sustain breaks above resistance levels.

The downside target remains at 56.60, with potential for further decline if support levels at 57.07 and 56.60 are breached.

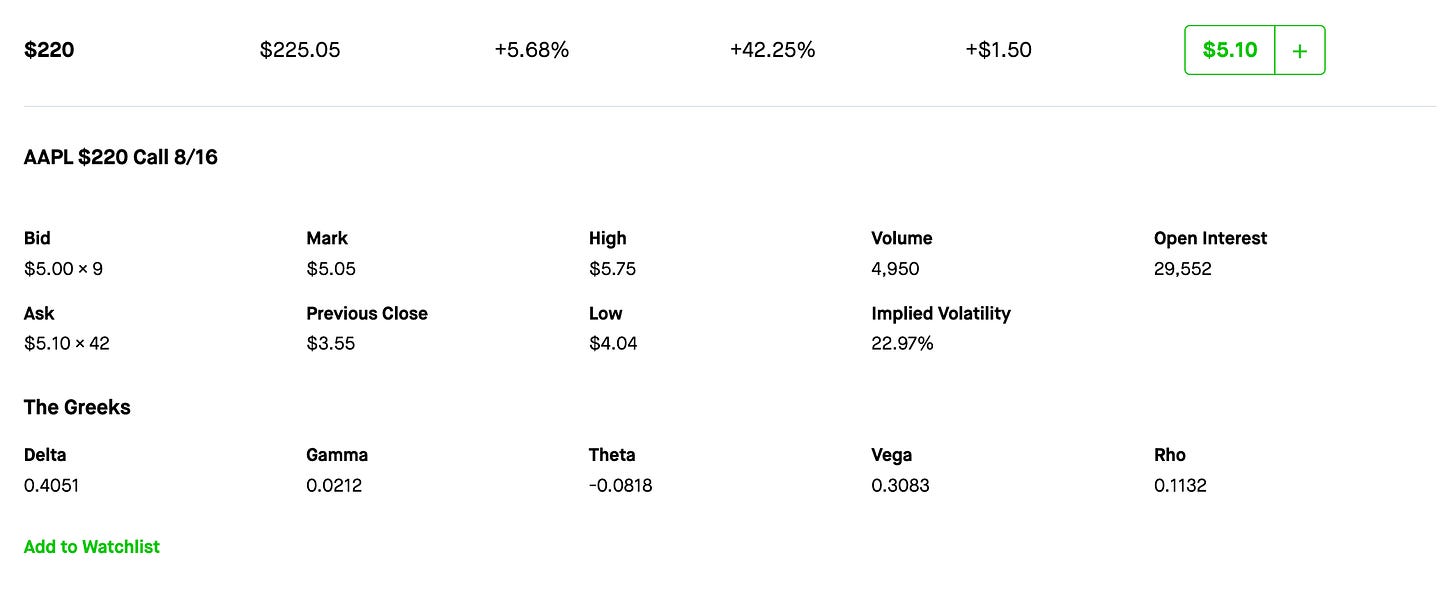

AAPL - Apple Inc

Long Entry hit, looking for Upside Target.

Bullish Case:

If the price breaks above the long entry point of 211.38 and sustains, there is potential for a move towards the upside target of 220.2.

A break and hold above 220.2 would indicate a possible trend reversal, paving the way for higher prices.

What’s in play?

Call Option: Alternatively, a call option with a strike price around 220.00, expiring in 1-2 months, could be considered if there are signs of a reversal above 211.38.

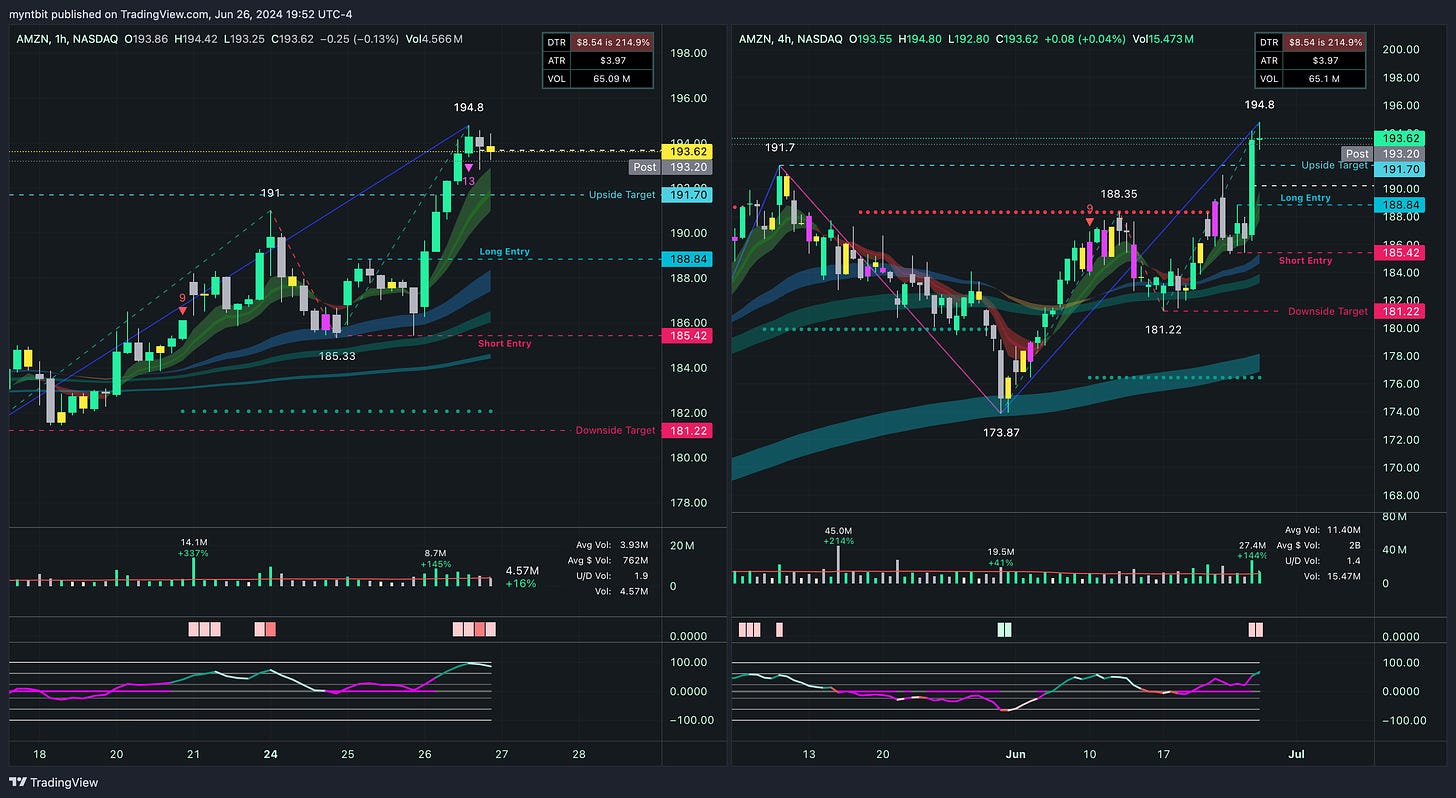

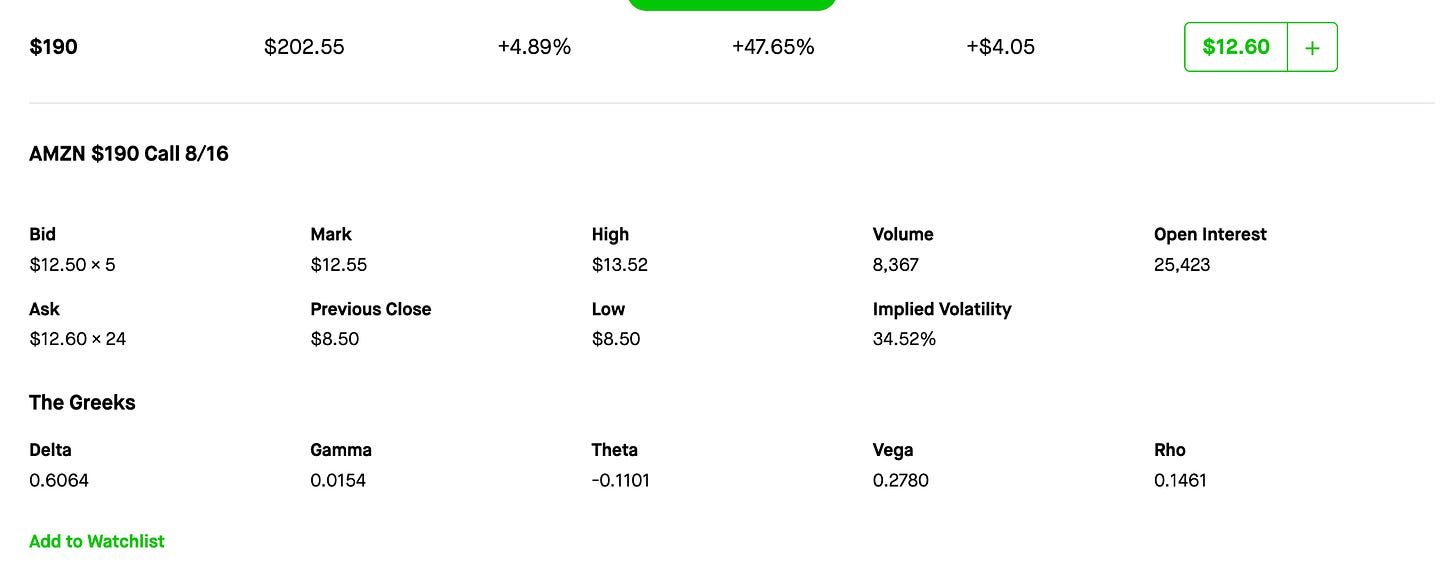

AMZN - Amazon.com Inc

Upside Target Hit. This will be removed from the list.

Bullish Case:

If the price breaks above the long entry point of 188.84 and sustains, there is potential for a move towards the upside target of 191.70.

A break and hold above 191.70 would indicate a possible trend continuation, paving the way for higher prices.

What is in play?

Call Option: Alternatively, a call option with a strike price around 190.00, expiring in 1-2 months, could be considered if there are signs of a continuation above 188.84.

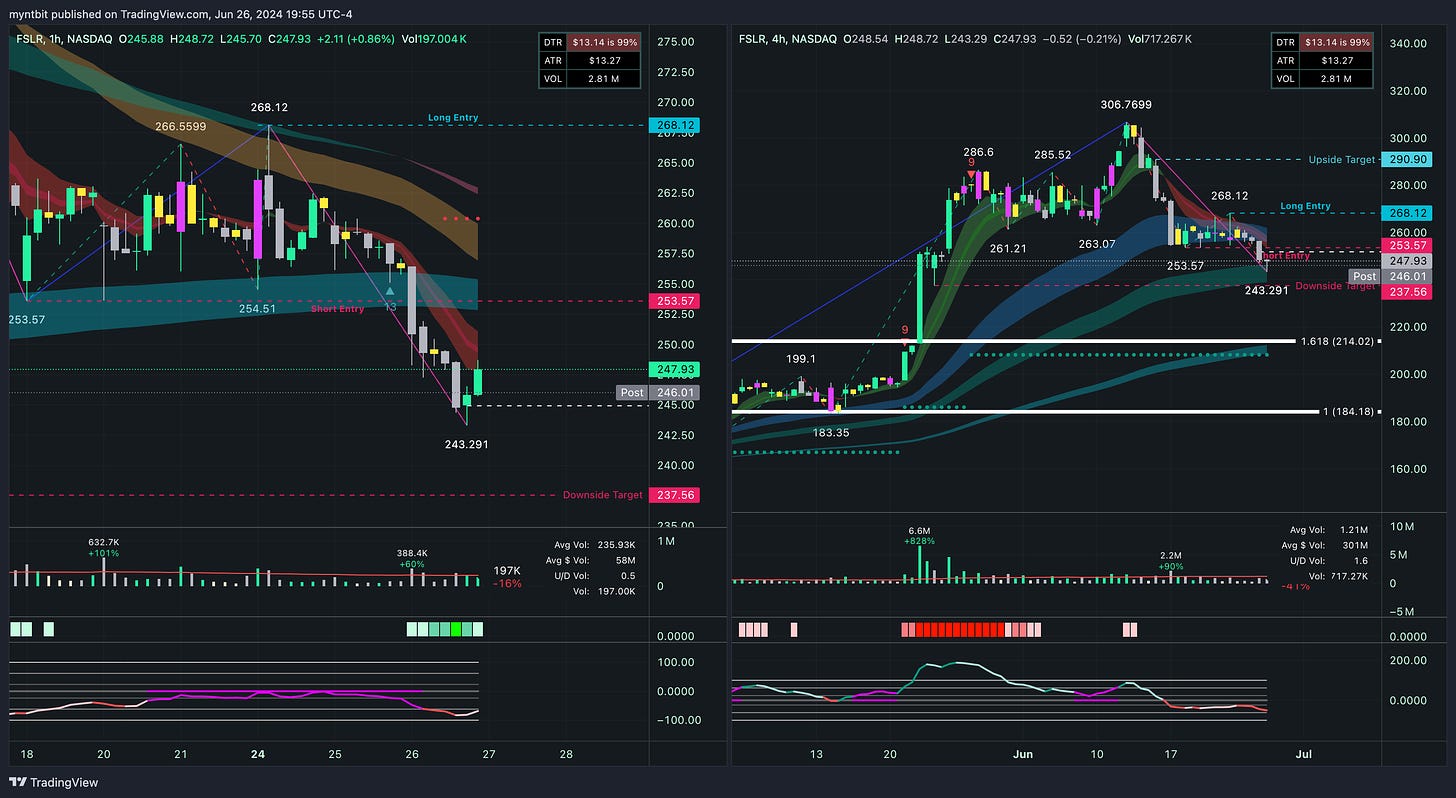

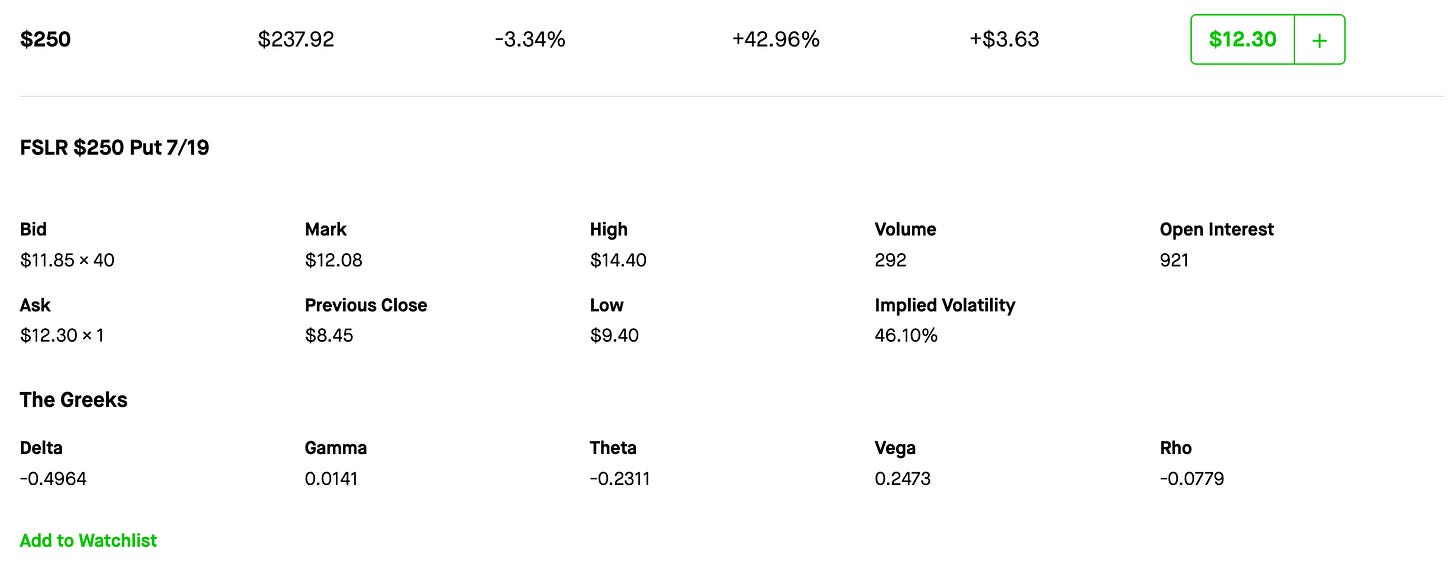

FSLR - First Solar Inc

Short Entry hit, looking for Downside Target.

Bearish Case:

The price is currently struggling to break above resistance levels, indicating potential weakness.

The downside target remains at 237.56, with potential for further decline if support levels at 253.57 and 237.56 are breached.

What is in play?

Put Option: Consider buying a put option with a strike price around 250.00, expiring in the next 1-2 weeks, to capitalize on the potential short-term bearish trend.

Tomorrow's Watchlist

CRM - Salesforce Inc | Freebie

Bullish Case:

If the price breaks above the long entry point of 246.75 and sustains, there is potential for a move towards the upside target of 267.16.

A break and hold above 267.16 would indicate a possible trend reversal, paving the way for higher prices.

Bearish Case:

The price is currently struggling to break above resistance levels, indicating potential weakness.

The downside target remains at 212, with potential for further decline if support levels at 227.77 and 212 are breached.

When to play?

Put Option: Consider buying a put option with a strike price around 230.00, expiring in the next 1-2 weeks, to capitalize on the potential short-term bearish trend.

Call Option: Alternatively, a call option with a strike price around 260.00, expiring in 1-2 months, could be considered if there are signs of a continuation above 246.75.