What is included in Today’s Daily Report?

Daily Review: In-depth analysis of significant market movements across equities, commodities, forex, and cryptocurrencies over the past 24 hours.

Looking Ahead: Forward-looking insights on key economic data, earnings reports, and geopolitical events likely to influence markets.

Stock Watchlist: Curated selection of stocks with potential for significant price action, including top picks, emerging opportunities, and specific buy and sell targets.

Today's Recap

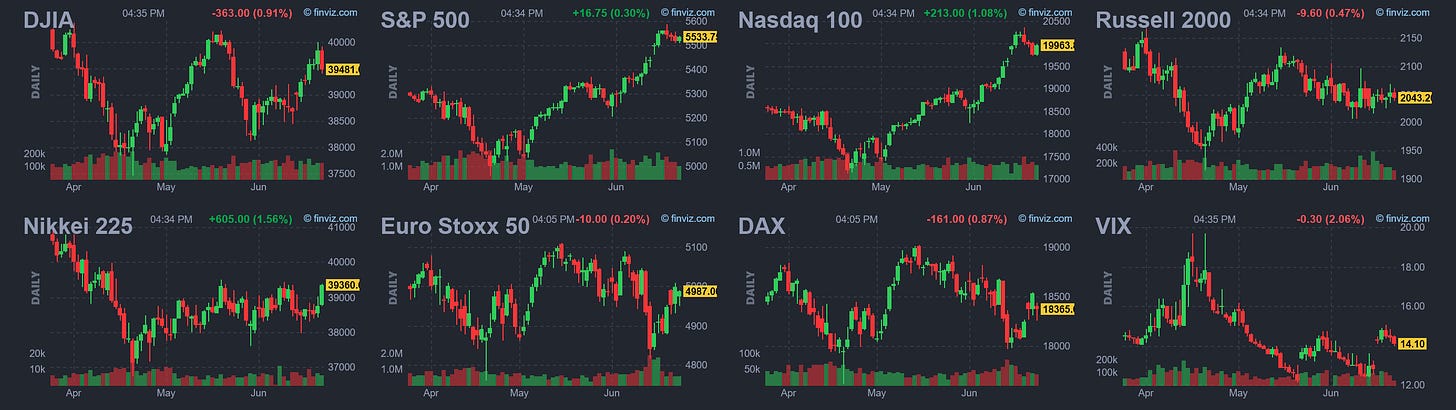

U.S. stocks closed mixed on Tuesday following a cautious session, as investors awaited crucial U.S. data, including a report on consumer income and spending, for insights into the Federal Reserve's interest rate outlook.

The Dow settled with a loss of 299.05 points, or 0.76 percent, at 39,112.16. The Nasdaq climbed 220.84 points, or 1.26 percent, to 17,717.65, while the S&P 500 rose by 21.43 points, or 0.39 percent, to 5,469.30.

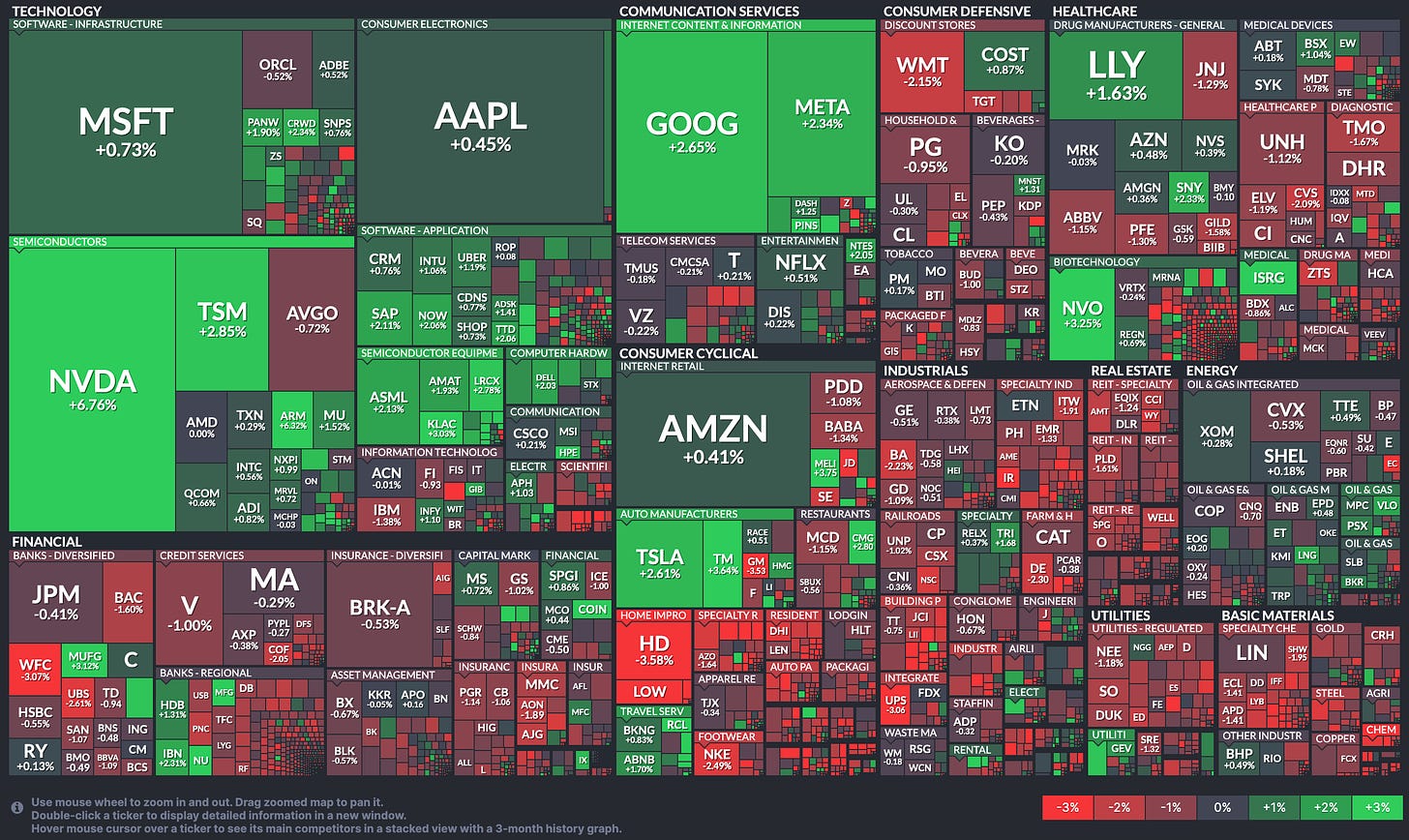

Nvidia rallied nearly 7 percent, rebounding from recent losses. Meta Platforms, Alphabet, Apple Inc., Eli Lilly, Micron Technology, Uber Technologies, Arista Networks, Palo Alto Networks, Dell, and Airbnb also posted strong gains.

Conversely, Boeing, Nike, Goldman Sachs, IBM, Pfizer, McDonald's Corporation, Wells Fargo, Bank of America, Home Depot, and Johnson & Johnson declined sharply. Walmart ended over 2 percent lower after its CFO described the second quarter as the "most challenging."

On the economic front, the Chicago Fed's measure of overall economic activity and related inflationary pressure rose in May for the first time in three months. The Chicago Fed National Activity Index (CFNAI) increased to +0.18 in May from -0.26 in April (revised from -0.23).

U.S. house prices rose less than expected in April after stagnating the previous month, according to the latest data from the Federal Housing Financing Agency. The seasonally adjusted house price index increased by 0.2 percent from the previous month, falling short of economists' forecast of a 0.3 percent gain. March's 0.1 percent increase was revised down to 0.0 percent. Year-on-year, house prices rose 6.3 percent in April, more than double the 3.1 percent gain recorded in the same month last year.

Survey data from the Conference Board indicated a slight decline in U.S. consumer confidence in June, with households' economic expectations eroding. The Conference Board Consumer Confidence Index fell to 100.4 from 101.3 in May, slightly below economists' expectations of 100. The Expectations Index, reflecting consumers' short-term outlook for income, business, and labor market conditions, decreased to 73.0 from 74.9 in May.

In overseas trading, Asian stocks ended mostly higher on Tuesday after China's Premier Li Qiang expressed confidence in achieving the country's full-year growth target of around 5 percent.

European stocks closed on a weak note as investors monitored the political scene, digested regional corporate news, and looked ahead to U.S. consumer income and spending data for clues about the Federal Reserve's monetary policy moves.

Market Heatmap

Yesterday’s Watchlist

VRT - Vertiv Holdings Co.

Upside target hit. This will be removed from the list.

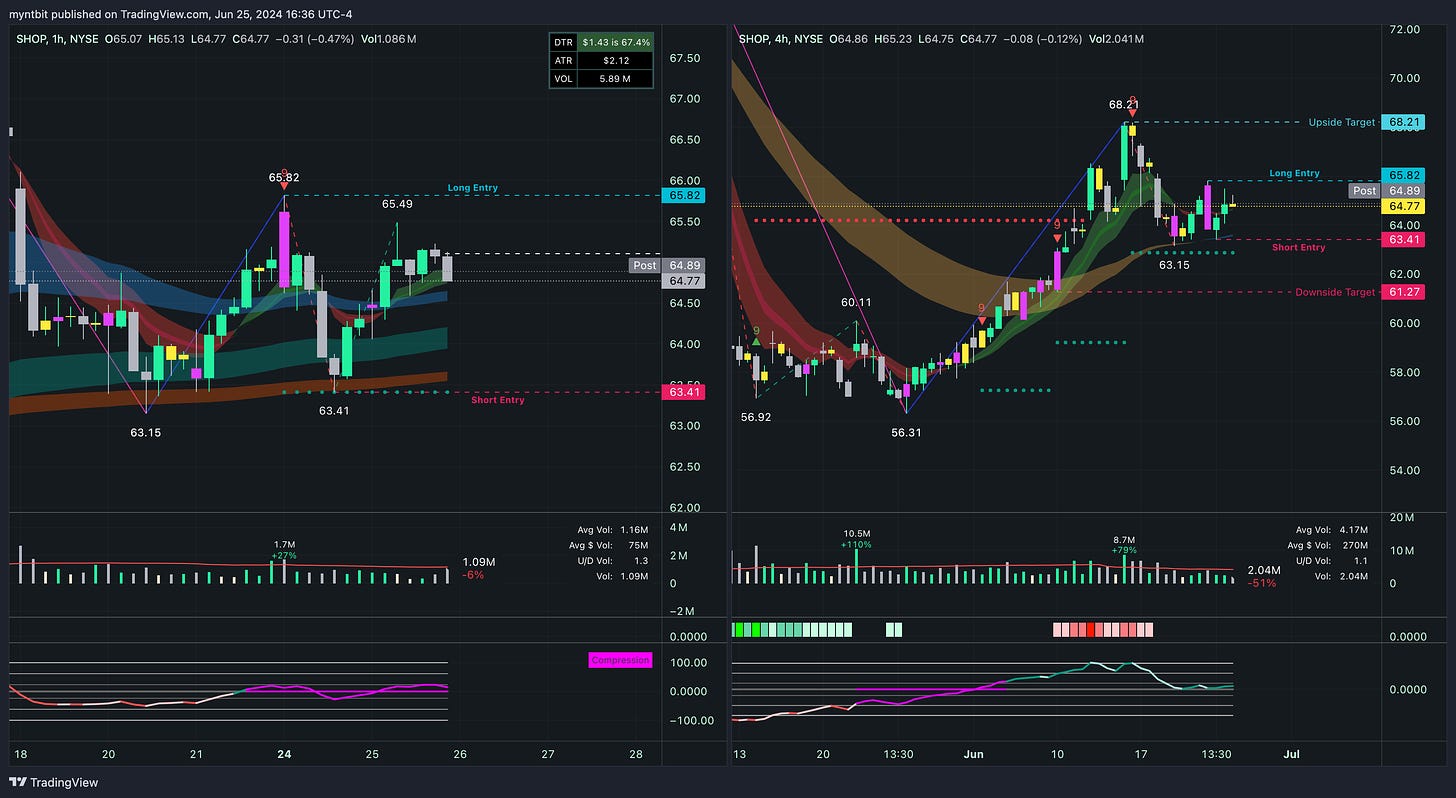

SHOP - Shopify Inc

Nothing has changed from yesterday’s analysis.

Bullish Case:

If the price breaks above the long entry point of 65.82 and sustains, there is potential for a move toward the upside target of 68.21.

A break and hold above 68.21 would indicate a possible trend reversal, paving the way for higher prices.

Bearish Case:

The prevailing trend is still bearish, with the price trading below key moving averages and failing to sustain breaks above resistance levels.

The downside target remains at 60.00, with the potential for further decline if support levels at 63.15 and 61.27 are breached.

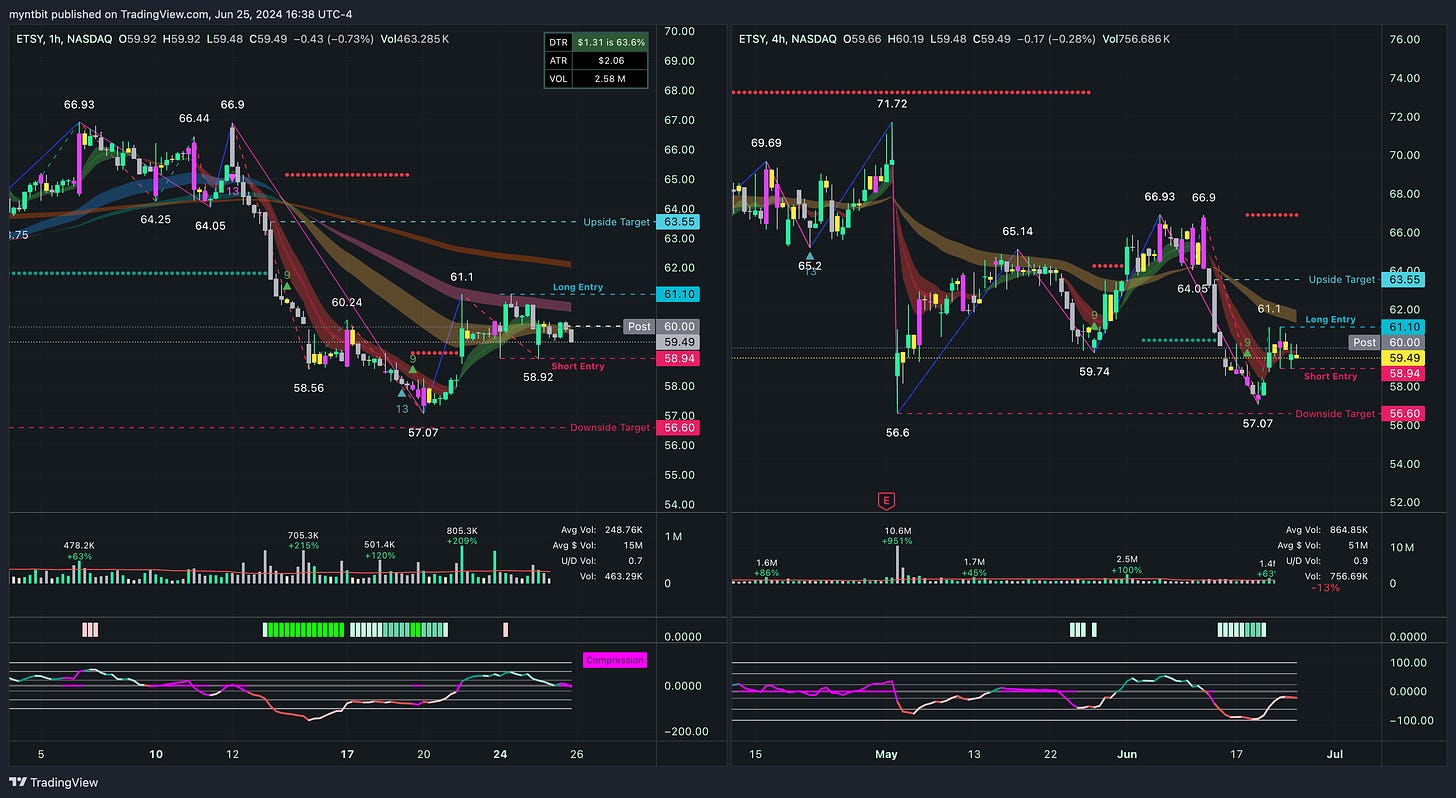

ETSY - Etsy Inc

ETSY broke below but consolidated, nothing changed from yesterday’s analysis.

Bullish Case:

If the price breaks above the long entry point of 61.10 and sustains, there is potential for a move towards the upside target of 63.55.

A break and hold above 63.55 would indicate a possible trend reversal, paving the way for higher prices.

Bearish Case:

The prevailing trend is bearish, with the price trading below key moving averages and failing to sustain breaks above resistance levels.

The downside target remains at 56.60, with potential for further decline if support levels at 57.07 and 56.60 are breached.

Tomorrow's Watchlist

AAPL - Apple Inc | Freebie

Bullish Case:

If the price breaks above the long entry point of 211.38 and sustains, there is potential for a move towards the upside target of 220.2.

A break and hold above 220.2 would indicate a possible trend reversal, paving the way for higher prices.

Bearish Case:

The prevailing trend is bearish, with the price trading below key moving averages and failing to sustain breaks above resistance levels.

The downside target remains at 204.44, with potential for further decline if support levels at 206.59 and 204.44 are breached.

When to play?

Put Option: Consider buying a put option with a strike price around 206.00, expiring in the next 1-2 weeks, to capitalize on the short-term bearish trend.

Call Option: Alternatively, a call option with a strike price around 220.00, expiring in 1-2 months, could be considered if there are signs of a reversal above 211.38.