What is included in Today’s Daily Report?

Daily Review: In-depth analysis of significant market movements across equities, commodities, forex, and cryptocurrencies over the past 24 hours.

Looking Ahead: Forward-looking insights on key economic data, earnings reports, and geopolitical events likely to influence markets.

Stock Watchlist: Curated selection of stocks with potential for significant price action, including top picks, emerging opportunities, and specific buy and sell targets.

Today's Recap

U.S. stocks ended mixed on Monday as investors remained cautious ahead of crucial economic data, including an upcoming report on personal income and spending.

The Dow rose for the fifth straight session, closing up 260.88 points or 0.67% at 39,411.21. The Nasdaq fell 192.54 points or 1.09% to 17,496.82, and the S&P 500 declined 16.75 points or 0.31% to 5,447.87.

Several companies, including Nike, Micron Technology, Carnival, and Walgreens Boots Alliance, are set to announce their quarterly results this week.

On Friday, the Commerce Department will release its report on personal income and spending for May, which includes the Federal Reserve's preferred inflation metrics. This report, expected to show a modest slowdown in the annual rate of consumer price growth, could significantly influence interest rate outlooks.

Other reports, such as those on new home sales, consumer confidence, durable goods orders, and pending home sales, will also draw attention this week. Additionally, investors are anticipating the presidential debate between Joe Biden and Donald Trump.

Shares of Nvidia Corporation dropped 6.7% due to profit-taking, while Dell Technologies and Qualcomm both fell by over 5%. Amazon, Broadcom, Oracle, Home Depot, Netflix, Adobe, Salesforce, and Intel saw declines of 1 to 3%.

Meanwhile, Berkshire Hathaway, JP Morgan Chase, Walmart, Exxon Mobil, UnitedHealth Group, Merck, Bank of America, Chevron, Coca-Cola, Wells Fargo, Verizon, IBM, Pfizer, Morgan Stanley, Goldman Sachs, and Boeing gained between 1 to 4%.

In overseas trading, Asian stocks retreated on Monday as investors awaited U.S. inflation data and Fed officials' comments for interest rate clues. European stocks closed firmly as bond yields fell and investors digested corporate news while looking ahead to new economic data, the U.S. Presidential debate, and France's snap parliamentary polls.

In commodities, West Texas Intermediate Crude oil futures rose $0.90 or 1.1% to $81.63 a barrel. Gold futures for June increased by $13.60 or 0.6% to $2,330.00 an ounce.

In currency trading, the dollar index fell to 105.37 before recovering slightly to 105.48, still down 0.3% from the previous close. The dollar declined to 1.0736 against the Euro and 159.61 yen against the Japanese currency.

Market Heatmap

Tomorrow's Watchlist

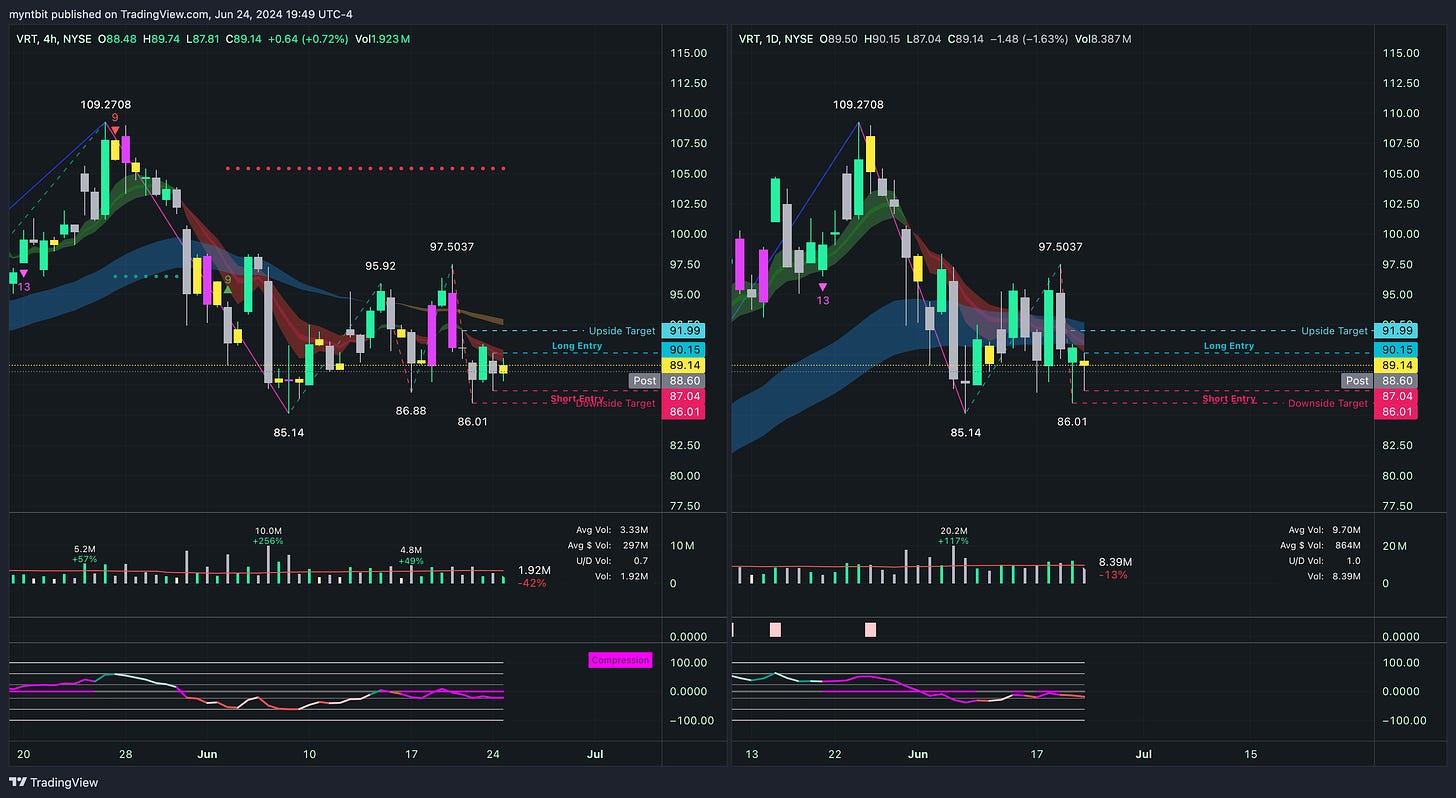

VRT - Vertiv Holdings Co. | Freebie

Bullish Case:

If the price breaks above the long entry point of 90.15 and sustains, there is potential for a move towards the upside target of 91.99.

A break and hold above 95.92 would indicate a possible trend reversal, paving the way for higher prices.

Bearish Case:

The prevailing trend is bearish, with the price trading below key moving averages and failing to sustain breaks above resistance levels.

The downside target remains at 86.01, with potential for further decline if this support level is breached.