Daily Report | Jul 03 2024 + Watchlist

What is included in Today’s Daily Report?

Daily Review: In-depth analysis of significant market movements across equities, commodities, forex, and cryptocurrencies over the past 24 hours.

Looking Ahead: Forward-looking insights on key economic data, earnings reports, and geopolitical events likely to influence markets.

Stock Watchlist: Curated selection of stocks with potential for significant price action, including top picks, emerging opportunities, and specific buy and sell targets.

Today's Recap

After a sluggish start, U.S. stocks rallied on Tuesday, ending the session on a strong note. Initially, concerns about interest rates kept investors cautious as they digested Federal Reserve Chair Jerome Powell's speech at the ECB Forum and the JOLTS report showing a slight increase in job openings. However, as bond yields drifted down, market sentiment improved, leading to gains across the major indices. The Dow rose by 162.33 points, or 0.41 percent, closing at 39,331.85. The S&P 500 added 33.92 points, or 0.62 percent, to 5,509.01, while the Nasdaq advanced 149.46 points, or 0.84 percent, to finish at 18,028.76.

Economic data played a significant role in the day's market movement. The Labor Department reported an increase in job openings to 8.140 million in May, up by 221,000 from the previous month. Additionally, Redbook Research indicated a 5.8 percent year-over-year increase in the Redbook Index for the week ending June 29. In his speech at a central banking forum in Sintra, Portugal, Jerome Powell expressed cautious optimism about inflation but emphasized the need for more evidence before considering interest rate cuts. His comments kept investors attentive to upcoming economic reports, particularly the closely watched monthly jobs report from the Labor Department, expected on Friday.

In the stock market, Tesla Inc. surged over 10 percent following a better-than-expected sales report for the April-June quarter. Other significant gainers included Advanced Micro Devices, Inc., Apple Inc., Alphabet, Amazon, and Meta Platforms, which rose between 1 and 2.5 percent. Conversely, Nike, Verizon Communications, Eli Lilly, and Nvidia ended the day with losses. Overseas, Asian markets were mixed as investors pondered the implications of the U.S. Supreme Court's decision granting immunity to former President Donald Trump for official actions taken while in office. European stocks closed lower, influenced by regional political developments and ECB officials' comments suggesting no imminent rate cuts, adding to the uncertainty about U.S. interest rates.

Market Heatmap

Yesterday’s Watchlist

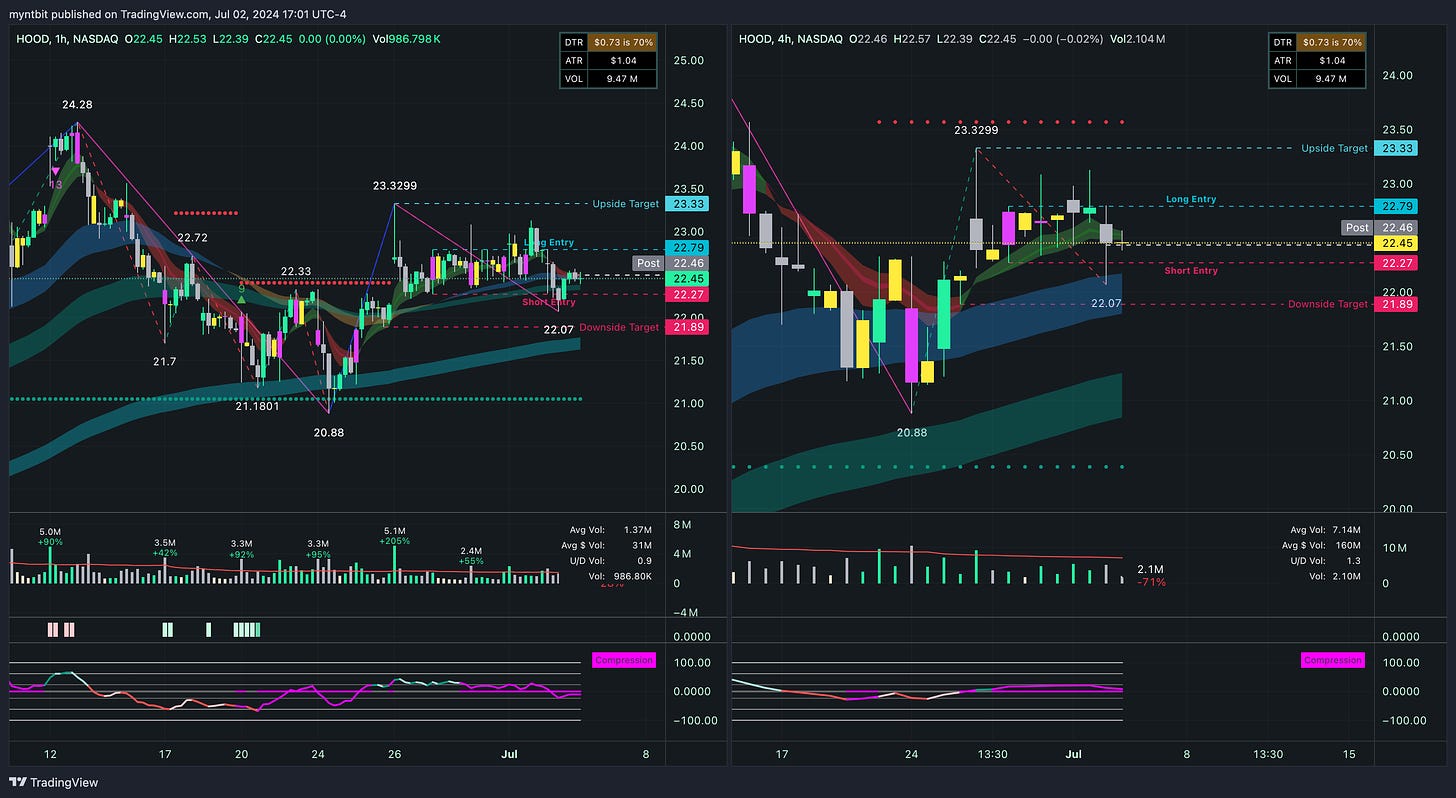

HOOD - Robinhood Markets Inc | Freebie

HOOD is still consolidating.

Bullish Case:

If the price breaks above the long entry point of 22.79 and sustains, there is potential for a move towards the upside target of 23.50.

A break and hold above 23.50 would indicate a possible trend continuation, paving the way for higher prices.

Bearish Case:

The price is currently struggling to break above resistance levels, indicating potential weakness.

The downside target remains at 21.89, with potential for further decline if support levels at 22.27 and 21.89 are breached.

When to play?

Put Option: Consider buying a put option with a strike price around 22.00, expiring in the next 1-2 weeks, to capitalize on potential short-term bearish movements if the price fails to break resistance.

Call Option: Alternatively, a call option with a strike price around 23.00, expiring in 1-2 months, could be considered if there are signs of a continuation above 22.79.

QCOM - Qualcomm Inc | Freebie

QCOM is still consolidating.

Bullish Case:

If the price breaks above the resistance level of 203.94, there is potential for a move towards 209.41 and higher.

A sustained move above 209.41 could indicate a more significant upward trend.

Bearish Case:

The price is currently near key moving averages, suggesting potential consolidation or slight bearish momentum.

The downside targets are at 196.08 and 190.00, which could be tested if the price fails to break above resistance levels.

When to play?

Put Option: Consider buying a put option with a strike price around 190.00, expiring in the next 1-2 weeks, to capitalize on potential short-term bearish movements.

Call Option: Alternatively, a call option with a strike price around 210.00, expiring in 1-2 months, could be considered if there are signs of a continuation above 203.94.

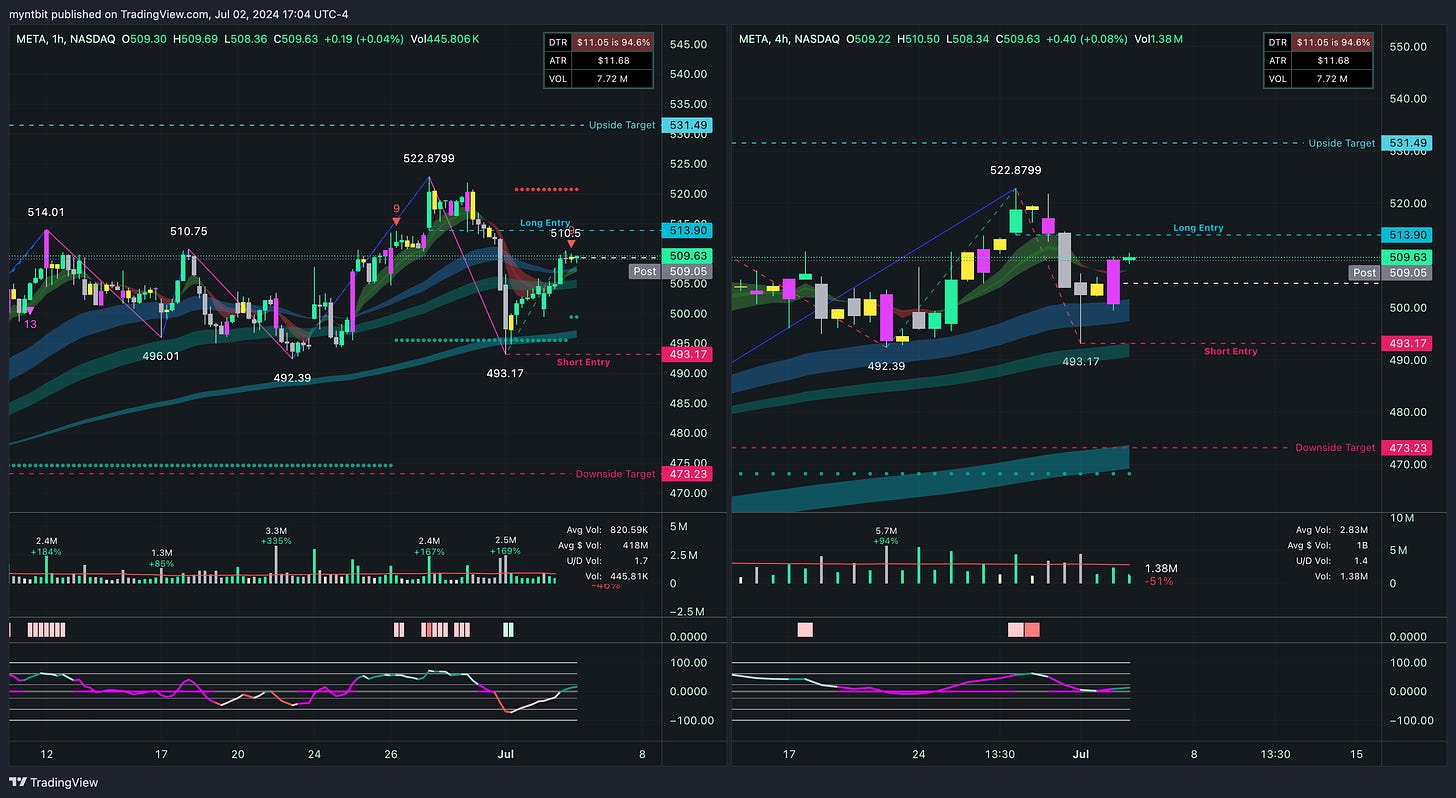

META - Meta Platforms Inc

META is still consolidating.

Bullish Case:

If the price breaks above the resistance level of 513.90 on the hourly chart, there is potential for a move towards 531.49 and higher.

A sustained move above 531.49 on the 4-hour chart could indicate a more significant upward trend.

Bearish Case:

The price is currently near key moving averages, suggesting potential consolidation or slight bearish momentum.

The downside targets are at 493.17 and 473.23, which could be tested if the price fails to break above resistance levels.

When to play?

Put Option: Consider buying a put option with a strike price around 490.00, expiring in the next 1-2 weeks, to capitalize on potential short-term bearish movements.

Call Option: Alternatively, a call option with a strike price around 520.00, expiring in 1-2 months, could be considered if there are signs of a continuation above 513.90.

BA - Boeing Co

BA is still consolidating.

Bullish Case:

If the price breaks above the resistance level of 189.47 on the hourly chart, there is potential for a move towards 196.18 and higher.

A sustained move above 196.18 on the 4-hour chart could indicate a more significant upward trend.

Bearish Case:

The price is currently near key resistance levels, suggesting potential consolidation or slight bearish momentum if it fails to break higher.

The downside targets are at 184.44 and 172.05, which could be tested if the price fails to break above resistance levels.

When to play?

Put Option: Consider buying a put option with a strike price around 180.00, expiring in the next 1-2 weeks, to capitalize on potential short-term bearish movements if the resistance fails.

Call Option: Alternatively, a call option with a strike price around 195.00, expiring in 1-2 months, could be considered if there are signs of a continuation above 189.47.

Tomorrow's Watchlist

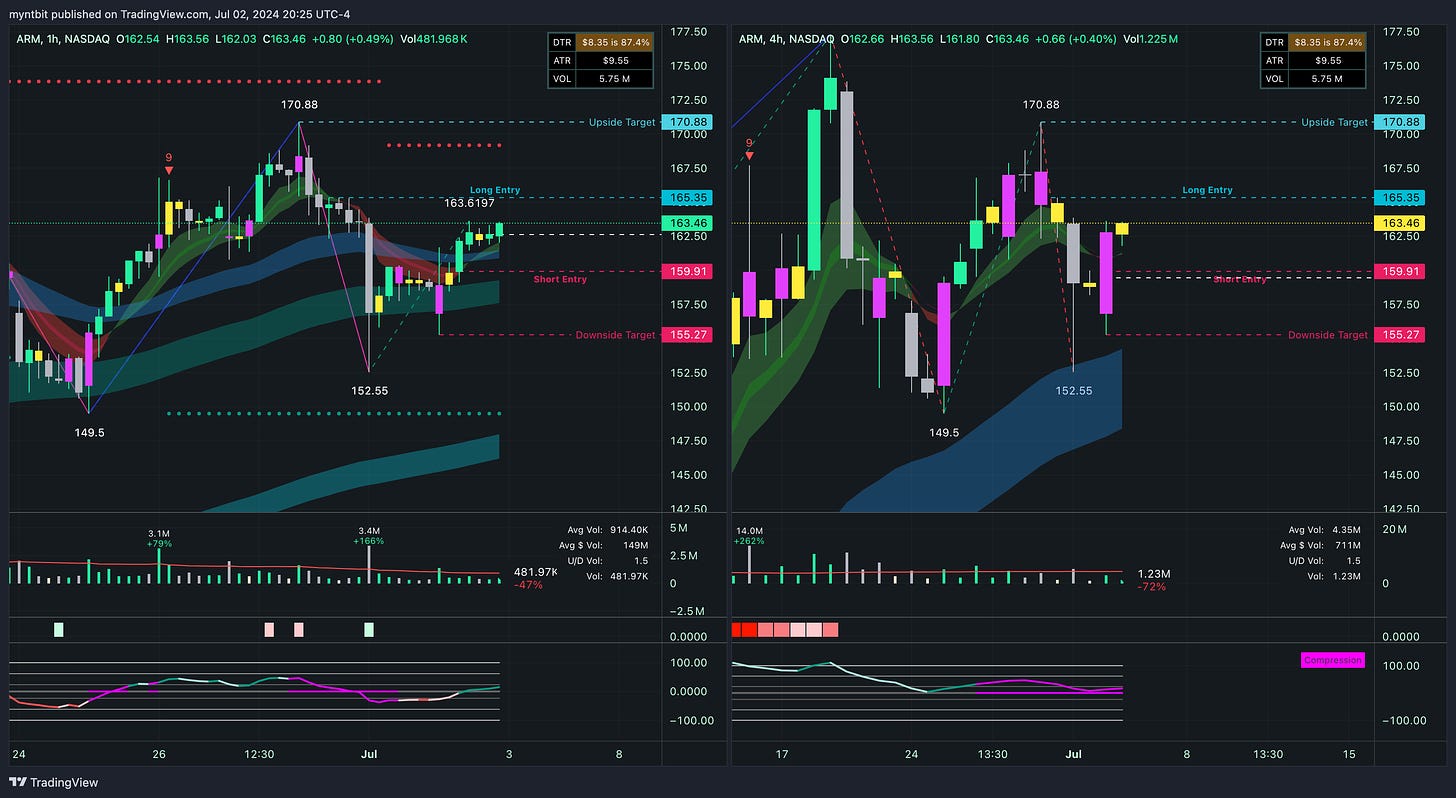

ARM - Arm Holdings Plc | Freebie

Bullish Case:

If the price breaks above the resistance level of 165.35 on the hourly chart, there is potential for a move towards 170.88 and higher.

A sustained move above 170.88 on the 4-hour chart could indicate a more significant upward trend.

Bearish Case:

The price is currently near key resistance levels, suggesting potential consolidation or slight bearish momentum if it fails to break higher.

The downside targets are at 159.91 and 155.27, which could be tested if the price fails to break above resistance levels.

When to play?

Put Option: Consider buying a put option with a strike price around 155.00, expiring in the next 1-2 weeks, to capitalize on potential short-term bearish movements if the resistance fails.

Call Option: Alternatively, a call option with a strike price around 170.00, expiring in 1-2 months, could be considered if there are signs of a continuation above 165.35.