Daily Report | Jul 02 2024 + Watchlist

What is included in Today’s Daily Report?

Daily Review: In-depth analysis of significant market movements across equities, commodities, forex, and cryptocurrencies over the past 24 hours.

Looking Ahead: Forward-looking insights on key economic data, earnings reports, and geopolitical events likely to influence markets.

Stock Watchlist: Curated selection of stocks with potential for significant price action, including top picks, emerging opportunities, and specific buy and sell targets.

Today's Recap

U.S. stocks closed higher on Monday, led by a strong performance in technology shares. Although the major indices started the day with a weak and lackluster trade, they gradually gained strength as the session progressed.

The Dow rose 50.66 points, or 0.13 percent, to 39,169.52. The S&P 500 advanced 14.61 points, or 0.27 percent, to 5,475.09, while the Nasdaq climbed 146.70 points, or 0.83 percent, to 17,879.30.

Investors are anticipating the Labor Department's monthly jobs report due on Friday, which is expected to show a slowdown in job growth for June and could influence interest rate projections.

On the economic front, the Institute for Supply Management reported that U.S. manufacturing activity unexpectedly contracted at a slightly faster rate in June. The manufacturing PMI edged down to 48.5 from 48.7 in May, with a reading below 50 indicating contraction. Economists had expected the index to rise to 49.1.

Additionally, the Commerce Department reported a slight, unexpected decrease in U.S. construction spending for May, which edged down by 0.1 percent to an annual rate of $2.140 trillion after a revised increase of 0.3 percent in April. Economists had anticipated a 0.1 percent increase in construction spending.

In the stock market, Microsoft Corporation shares gained about 2.2 percent, Apple Inc. climbed nearly 3 percent, Amazon surged 2 percent, and Nvidia and Alphabet posted modest gains. Tesla Inc. surged over 6 percent ahead of its second-quarter delivery numbers expected on Tuesday.

Other notable gainers included JP Morgan Chase, Eli Lilly, Oracle Corporation, Merck, Wells Fargo, T-Mobile, Verizon Communications, Morgan Stanley, IBM, Goldman Sachs, Nike, and Boeing, which rose between 1 to 3 percent.

Conversely, ADP, Analog Devices, Honeywell International, Blackstone, Uber Technologies, Comcast Corporation, Caterpillar, Walt Disney, Home Depot, Procter & Gamble, and Advanced Micro Devices ended notably lower.

In overseas trading, stock markets across the Asia-Pacific region mostly rose on Monday. Japan's Nikkei 225 Index inched up by 0.1 percent, while China's Shanghai Composite Index advanced by 0.9 percent.

The major European markets also moved higher, with the pan-European Stoxx 600 climbing 0.32 percent. Germany's DAX gained 0.3 percent, France's CAC 40 rose 1.09 percent, and the U.K.'s FTSE 100 edged up 0.03 percent.

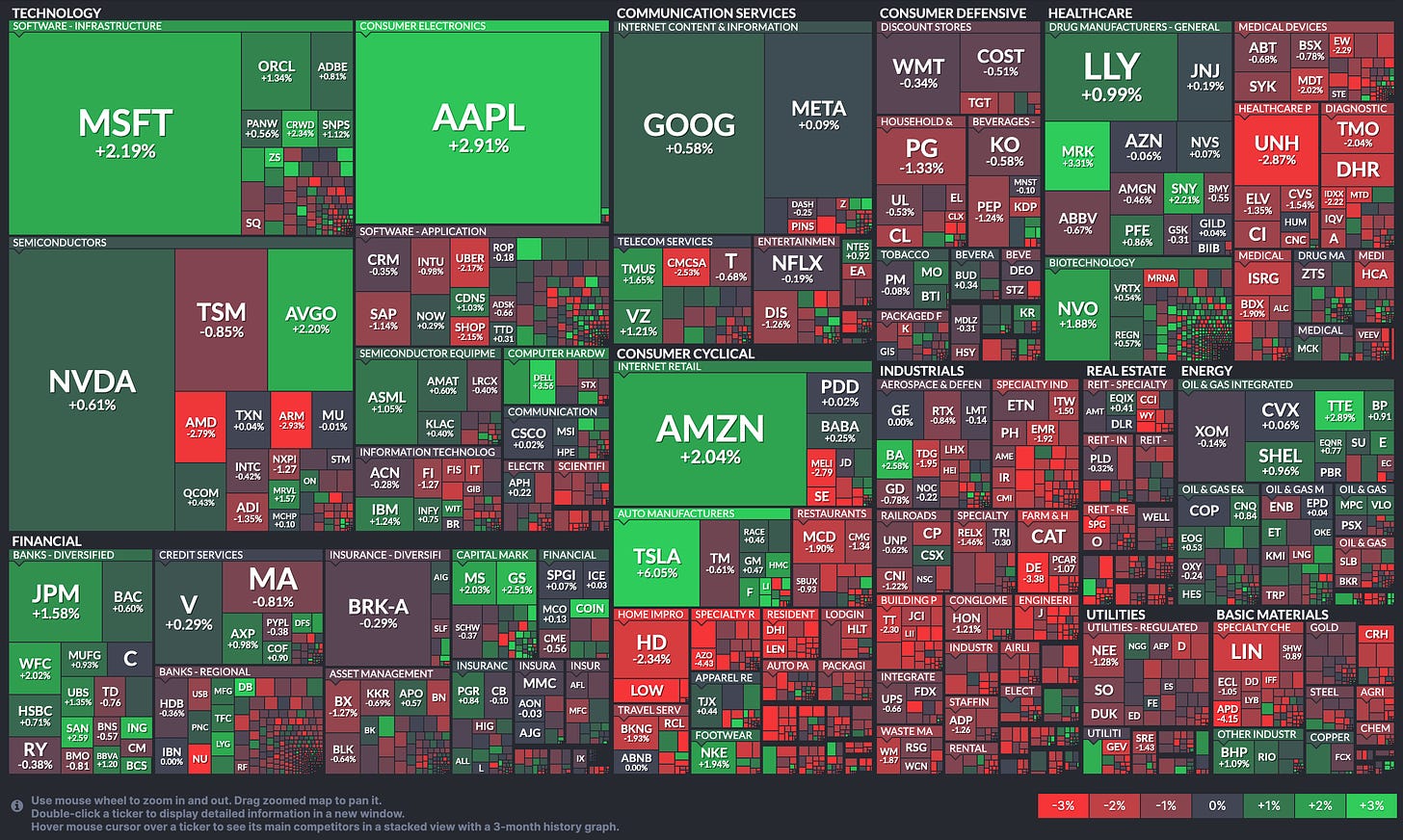

Market Heatmap

Yesterday’s Watchlist

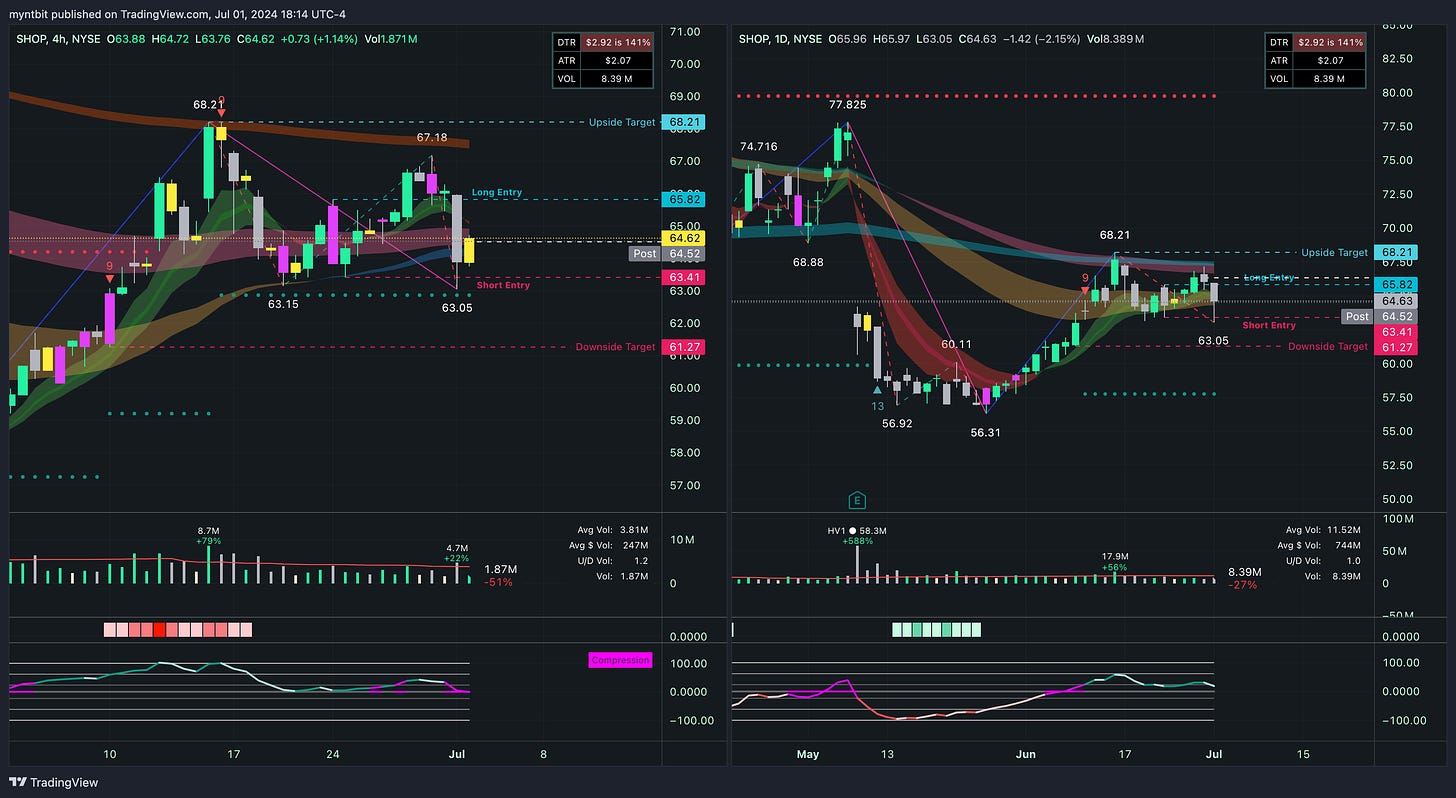

SHOP - Shopify Inc

SHOP hit stoploss. Will be removed from the list.

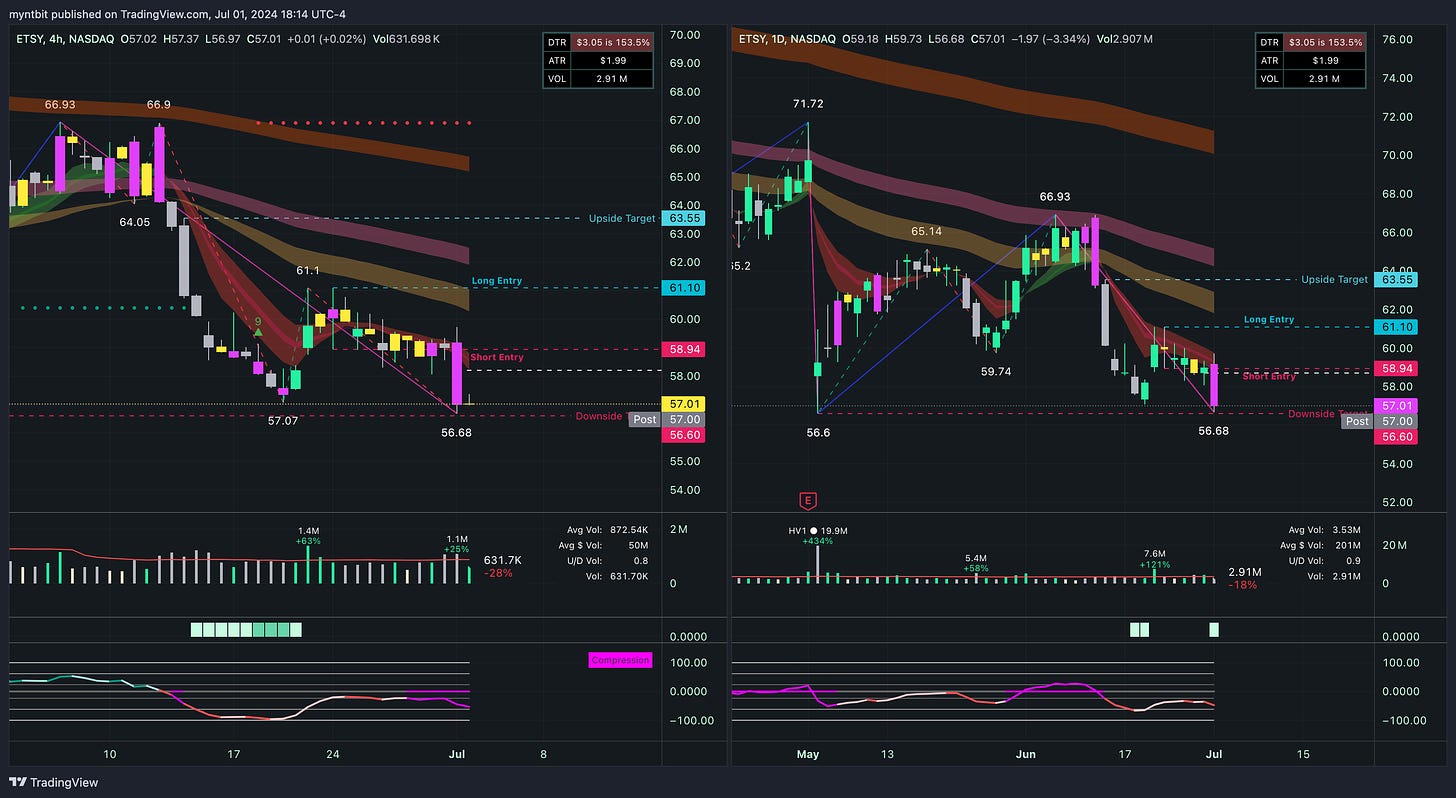

ETSY - Etsy Inc

ETSY close to hitting the downside target. Will be removed from the list.

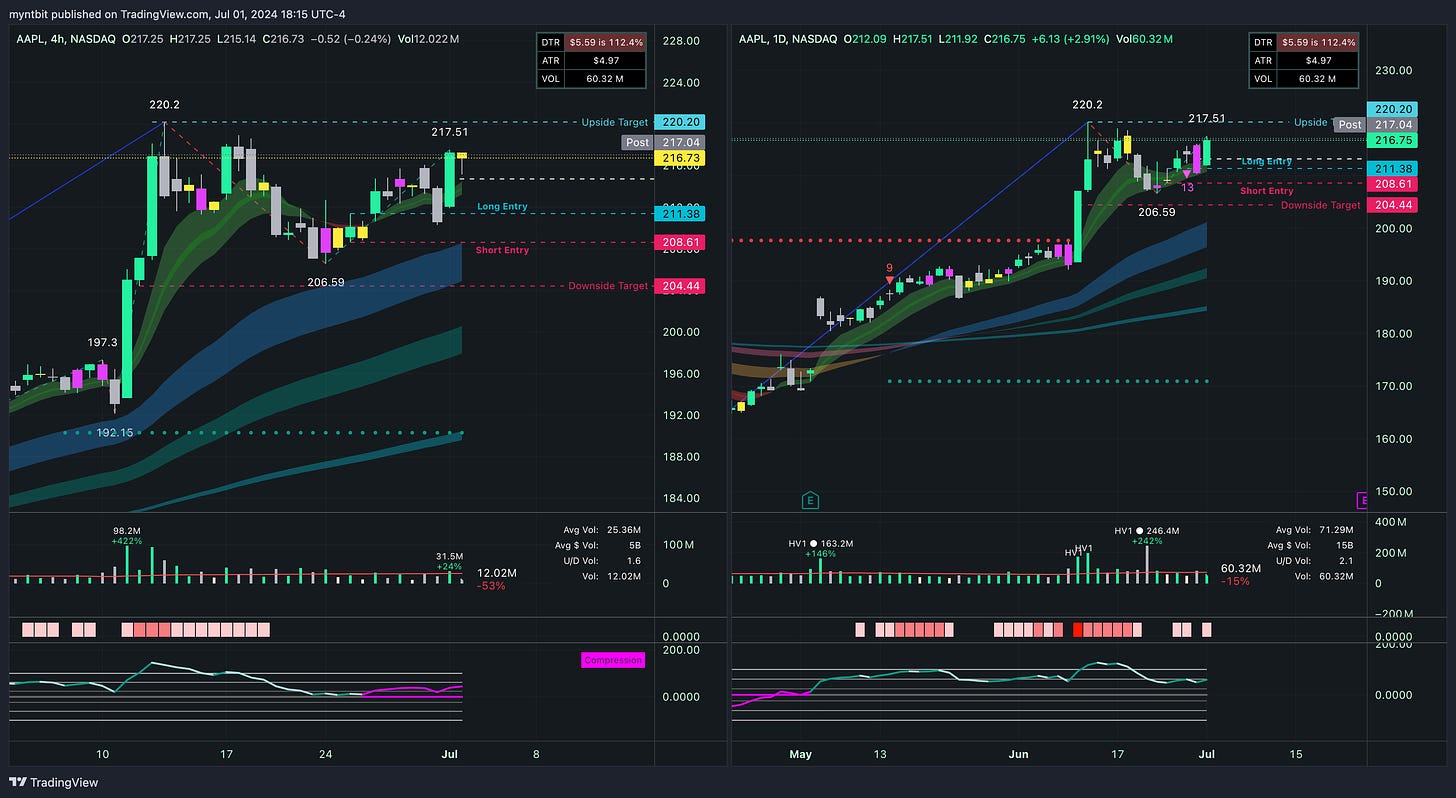

AAPL - Apple Inc

Long Entry hit, looking for Upside Target. Will be removed from the list

FSLR - First Solar Inc

Hit the downside target. Will be removed from the list

CRM - Salesforce Inc

Upside Target Hit. Will be removed from the list

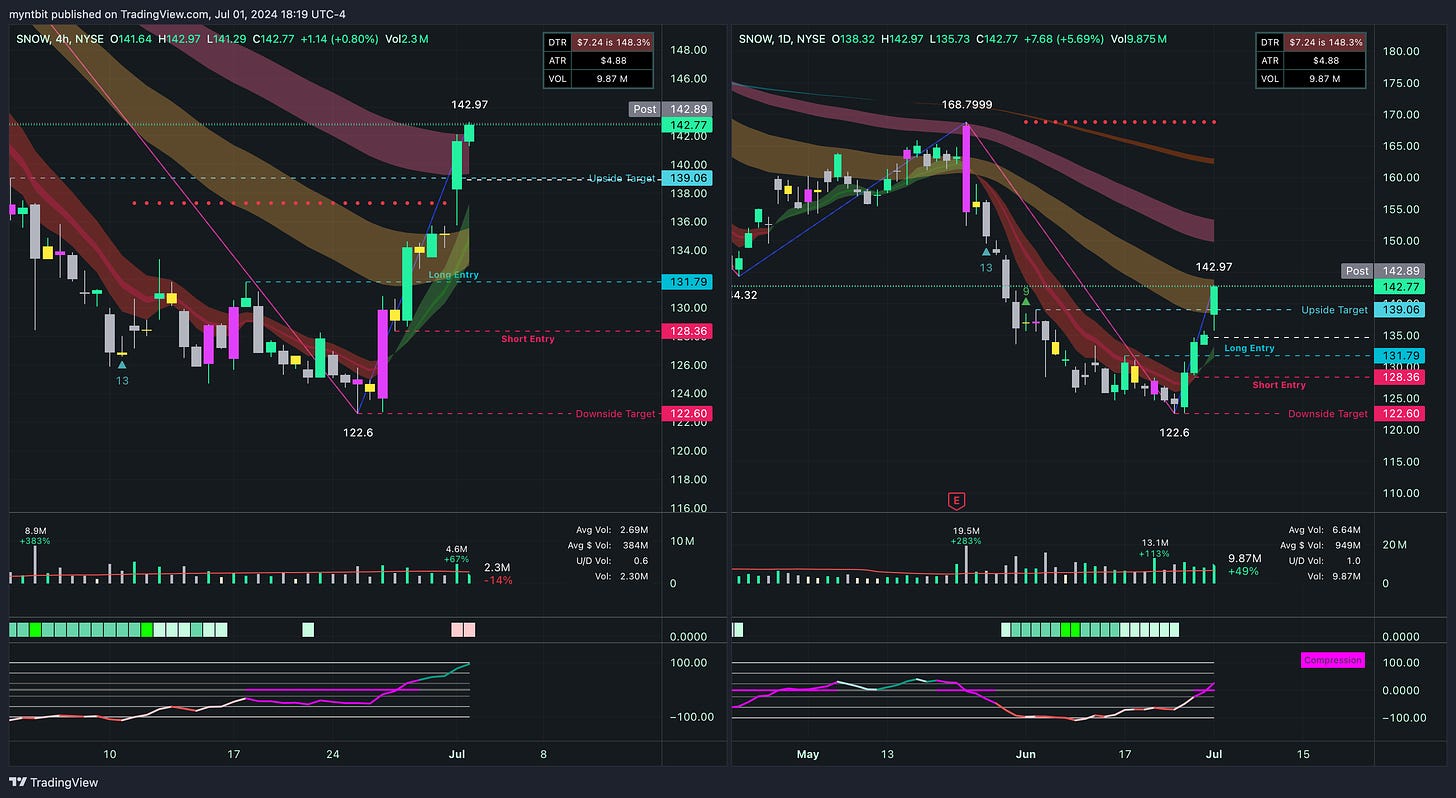

SNOW - Snowflake Inc

Upside Target Hit. Will be removed from the list

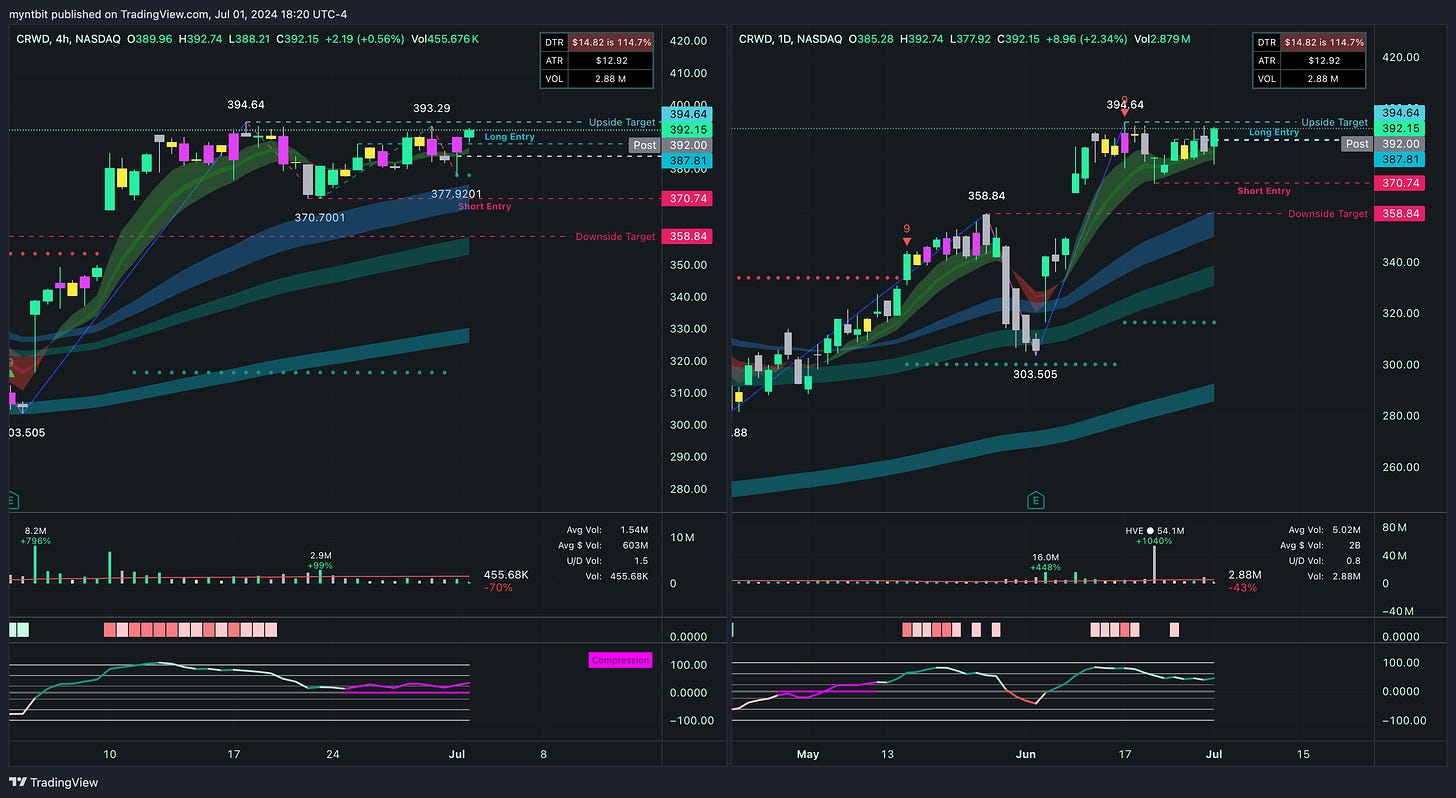

CRWD - Crowdstrike Holdings Inc

Upside Target Hit. Will be removed from the list

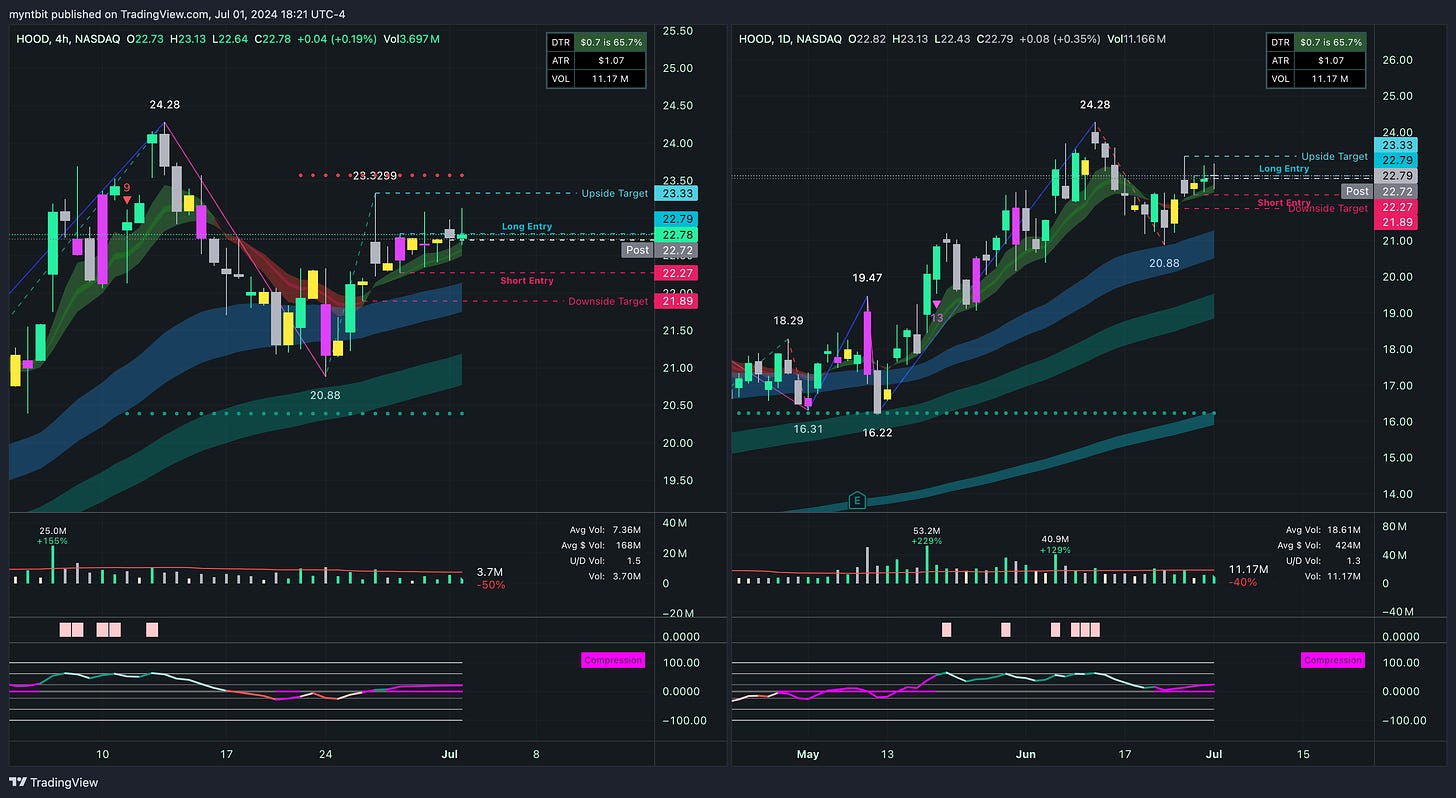

HOOD - Robinhood Markets Inc | Freebie

HOOD is still consolidating.

Bullish Case:

If the price breaks above the long entry point of 22.79 and sustains, there is potential for a move towards the upside target of 23.50.

A break and hold above 23.50 would indicate a possible trend continuation, paving the way for higher prices.

Bearish Case:

The price is currently struggling to break above resistance levels, indicating potential weakness.

The downside target remains at 21.89, with potential for further decline if support levels at 22.27 and 21.89 are breached.

When to play?

Put Option: Consider buying a put option with a strike price around 22.00, expiring in the next 1-2 weeks, to capitalize on potential short-term bearish movements if the price fails to break resistance.

Call Option: Alternatively, a call option with a strike price around 23.00, expiring in 1-2 months, could be considered if there are signs of a continuation above 22.79.

NVDA - NVIDIA Corp

NVDA broke below but quickly recovered, be careful. Will be removed from the list.

Tomorrow's Watchlist

QCOM - Qualcomm Inc | Freebie

Bullish Case:

If the price breaks above the resistance level of 203.94, there is potential for a move towards 209.41 and higher.

A sustained move above 209.41 could indicate a more significant upward trend.

Bearish Case:

The price is currently near key moving averages, suggesting potential consolidation or slight bearish momentum.

The downside targets are at 196.08 and 190.00, which could be tested if the price fails to break above resistance levels.

When to play?

Put Option: Consider buying a put option with a strike price around 190.00, expiring in the next 1-2 weeks, to capitalize on potential short-term bearish movements.

Call Option: Alternatively, a call option with a strike price around 210.00, expiring in 1-2 months, could be considered if there are signs of a continuation above 203.94.