Daily Plan 09.23.22

MyntBit's Daily Plan is dedicated to providing traders with today's recap and bringing setups to watch for stocks and futures for the next trading day.

What is included in tomorrow's game plan?

Daily Recap

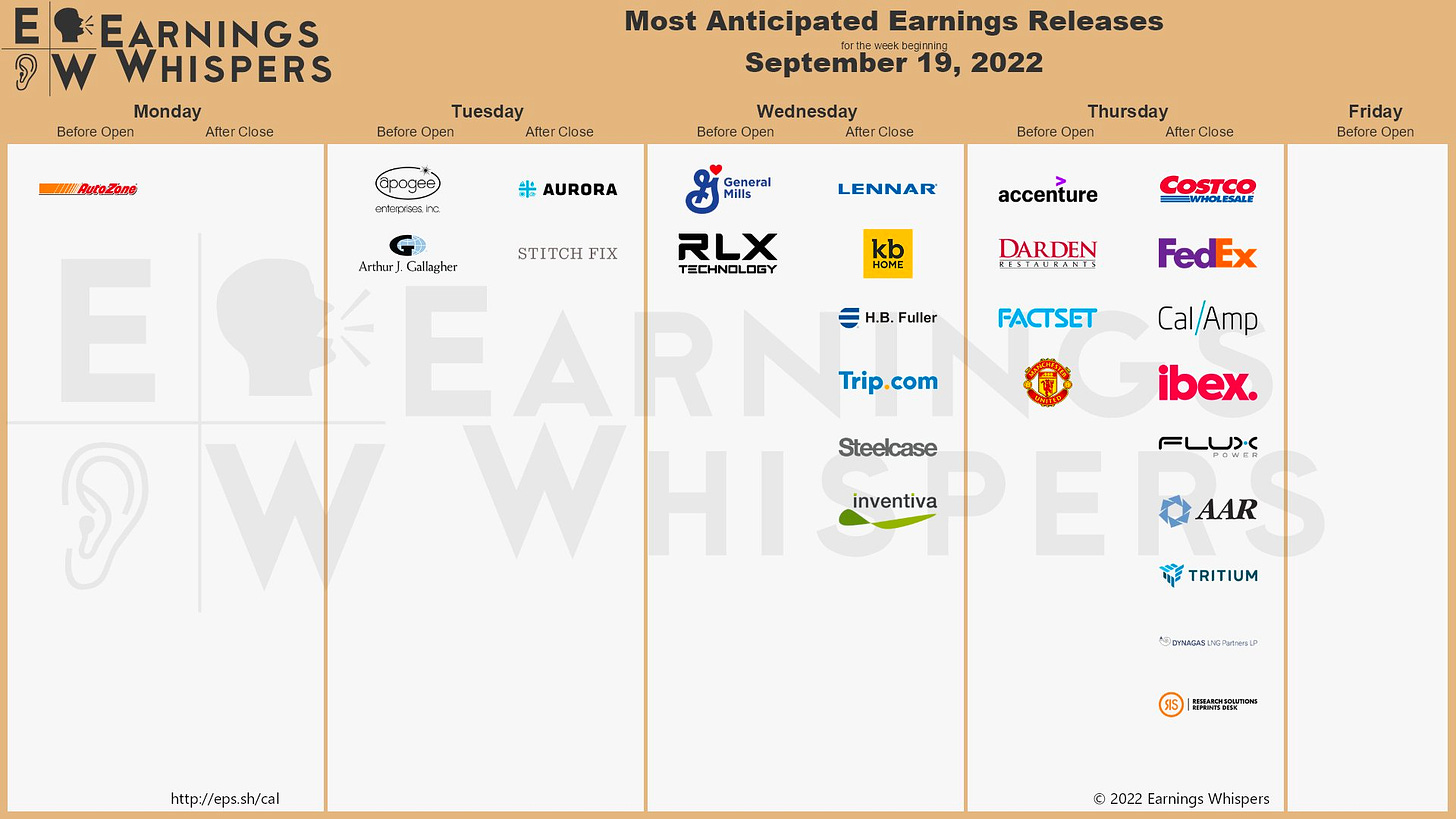

Look Ahead - Economic & Earnings Calendar

Key Futures Levels - S&P 500 (/ES) and NASDAQ (/NQ)

Day Trade Stock Ideas - will be provided in the discord.

Today's Recap

Market Snapshot

Market Heatmap

Briefing Market Update

The stock market had its issues today and they had mostly to do with interest rates. There were policy rate considerations on one side and market rate considerations on the other, yet the two were interconnected. The connection is that policy rates and market rates were rising (again) and that made it difficult for the stock market to stage a concerted rebound effort following the sharp losses that were registered Wednesday in the wake of the FOMC decision. The jump in rates also raised concerns about the economy suffering a hard landing.

The major indices started the session on a soft note, giving in to follow-through selling interest as the yield on the 10-yr note moved precipitously to 3.70%. The 2-yr note yield, and the rest of the curve, also shot higher, responding to the Fed's policy rate guidance yesterday and a series of aggressive rate hikes from other central banks today.

Briefly, the Bank of England raised its key policy rate by 50 basis points to 2.25%, the Norges Bank raised its key policy rate by 50 basis points to 2.25%, the Bank of Indonesia raised its key policy rate by 50 basis points to 4.25%, the Hong Kong Monetary Authority raised its key policy rate by 75 basis points to 3.50%, and the Swiss National Bank raised its key policy rate by 75 basis points to 0.50%, exiting its negative rate domain for the first time since 2015.

The Bank of Japan bucked the rate-hike trend, choosing instead to leave its key policy rate unchanged at -0.10%; moreover, Governor Kuroda said the bank won't be raising rates for some time. In related news, Japan's Ministry of Finance intervened to support the yen for the first time since 1998. USD/JPY was down 1.2% to 142.35, but the yen's strength faded during the day.

Notwithstanding the stronger yen, the U.S. Dollar Index still gained 0.5% to 111.21, as the dollar continued to benefit from the interest-rate differential trade.

Stocks, meanwhile, did not benefit much from a buy-the-dip trade.

There were some individual winners, like Microsoft (MSFT 240.98, +2.03, +0.9%), which is confident regulators will approve its acquisition of Activision (ATVI 77.03, +1.71, +2.3%), and Lennar Corp. (LEN 77.43, +1.51, +2.0%), which moved higher after its earnings report, and Eli Lilly (LLY 310.92, +14.44, +4.9%), which jumped on a UBS upgrade to Buy from Hold that followed the news of the FDA approving Retevmo. Salesforce, Inc. (CRM 150.15, +2.52, +1.7%) also outperformed after providing an upbeat long-term outlook at its Investor Day.

Overall, there wasn't any concerted buying interest on a broad level. That point was evident in an advance-decline line that favored decliners by a better than 4-to-1 margin at the NYSE and a better than 3-to-1 margin at the Nasdaq. It was also evident in the 1.4% loss registered by the Invesco S&P 500 Equal Weight ETF (RSP).

When the closing bell rang, there were just two sectors showing a gain: health care (+0.5%) and communication services (+0.1%). The consumer discretionary sector (-2.2%) led the losers, underperforming as worries about rate hikes and a slowdown in discretionary spending hit home. Other notable sector laggards included the financial (-1.7%), industrials (-1.5%), and materials (-1.2%) sectors.

Semiconductors were one of the weakest industry groups, which weighed heavily on the information technology sector (-1.0%). The Philadelphia Semiconductor Index fell 2.8%, paced by losses in key constituents Adv. Micro Devices (AMD 69.50, -4.98, -6.7%) and NVIDIA (NVDA 125.61, -7.00, -5.3%).

Notably, the stock market tried to stage a late comeback effort, having traded in a narrow range for most of the session. That comeback effort, however, got stopped out shortly before the close as there was a rush of selling interest in the final ten minutes of the session that left the indices near their worst levels of the day.

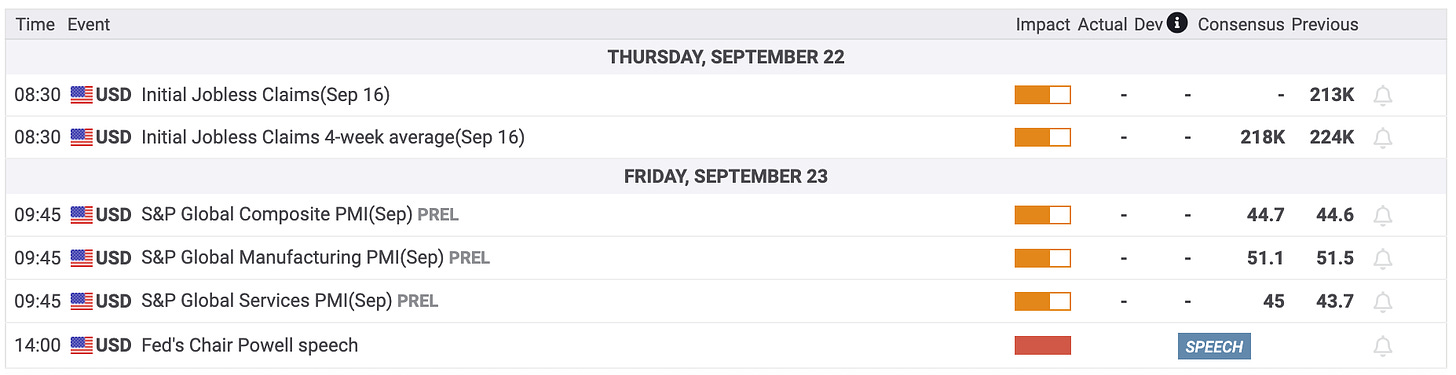

Looking ahead to Friday, the market will receive the preliminary September IHS Markit Manufacturing and Services PMI readings at 9:45 a.m. ET.

Reviewing today's economic data:

For the week ending September 17, initial claims increased by 5,000 to 213,000 (Briefing.com consensus 220,000). For the week ending September 10, continuing jobless claims decreased by 22,000 to 1.379 million.

The key takeaway from the report is that the low level of initial claims -- a leading indicator -- will register with the Fed as a basis to maintain an aggressive line with its rate hikes since it sees a softening in the labor market as a necessary ingredient for helping to bring inflation back down to its 2.0% target.

The Q2 Current Account Deficit improved to -$251.5 billion (Briefing.com consensus -$260.0 billion) from an upwardly revised -$282.5 billion (from -$291.4 billion) in the first quarter.

The August Leading Economic Index decreased 0.3% month-over-month following a downwardly revised 0.5% decline (from -0.4%) in July.

Dow Jones Industrial Average: -17.3% YTD

S&P Midcap 400: -19.5% YTD

S&P 500: -21.2% YTD

Russell 2000: -23.3% YTD

Nasdaq Composite: -29.3% YTD

source: briefing.com

Market Trader by MyntBit

Will the FED Crash The Markets? | Market Trader Edition No. 6