Daily Plan 09.22.22

MyntBit's Daily Plan is dedicated to providing traders with today's recap and bringing setups to watch for stocks and futures for the next trading day.

What is included in tomorrow's gameplan?

Daily Recap

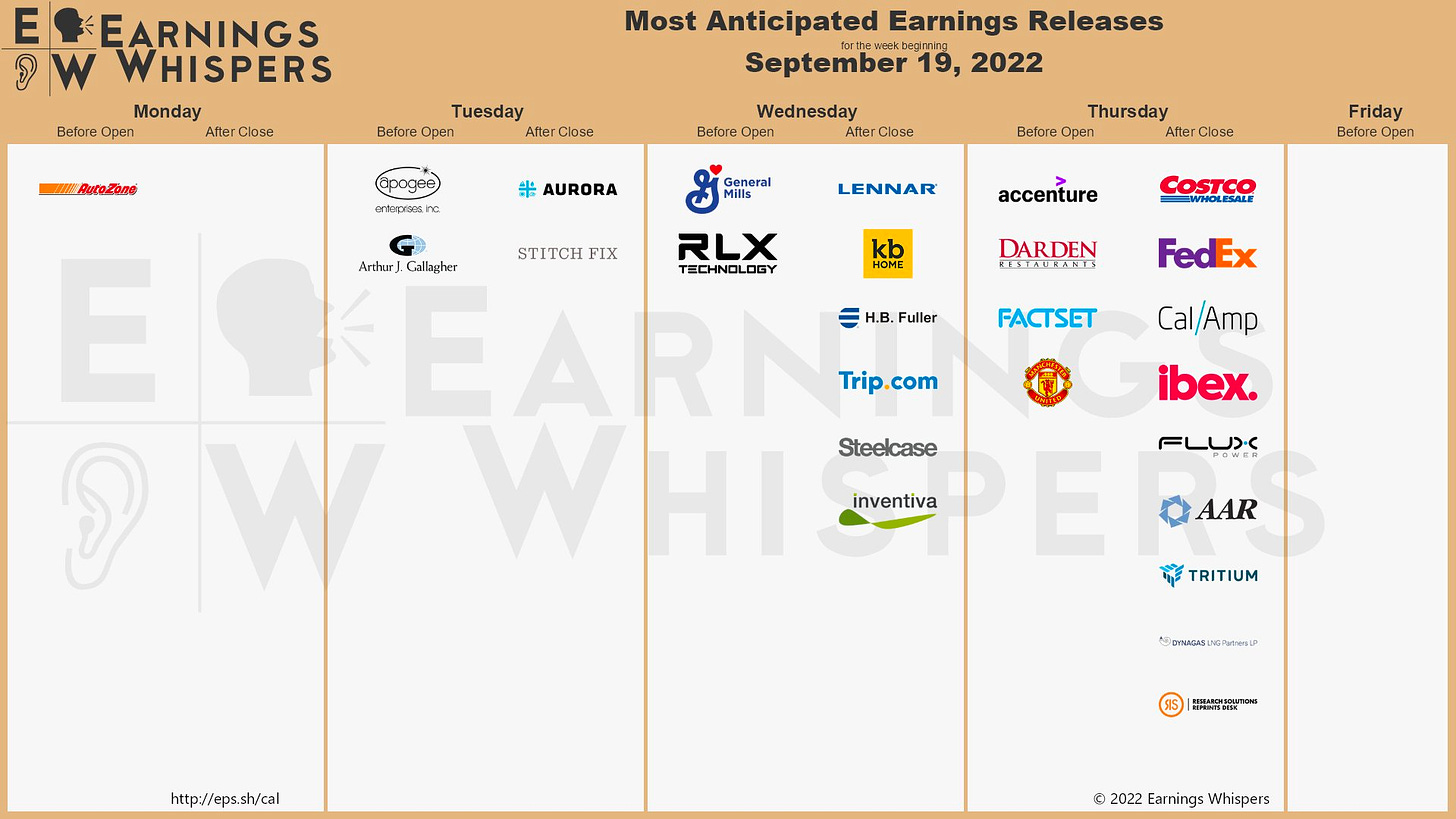

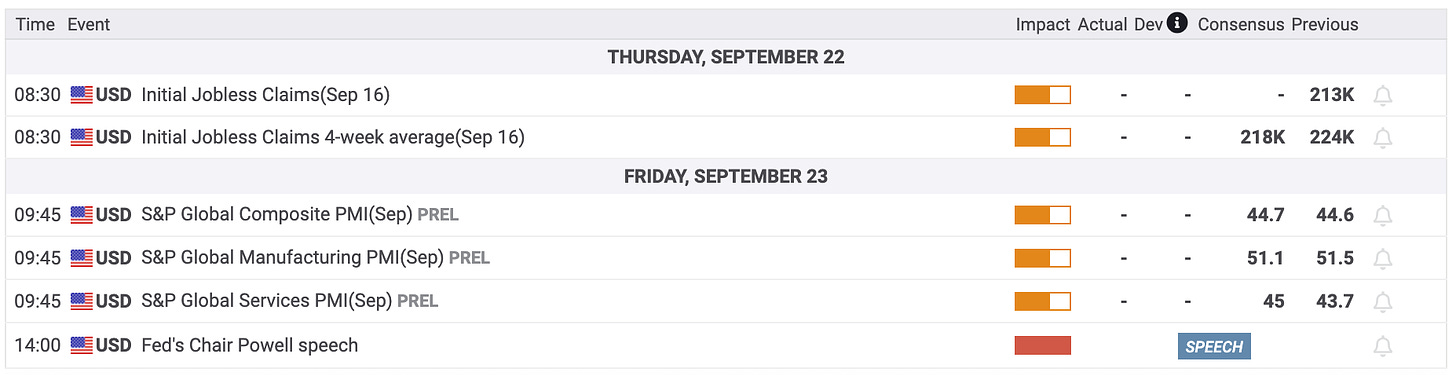

Look Ahead - Economic & Earnings Calendar

Key Futures Levels - S&P 500 (/ES) and NASDAQ (/NQ)

Day Trade Stock Ideas - will be provided in the discord.

Today's Recap

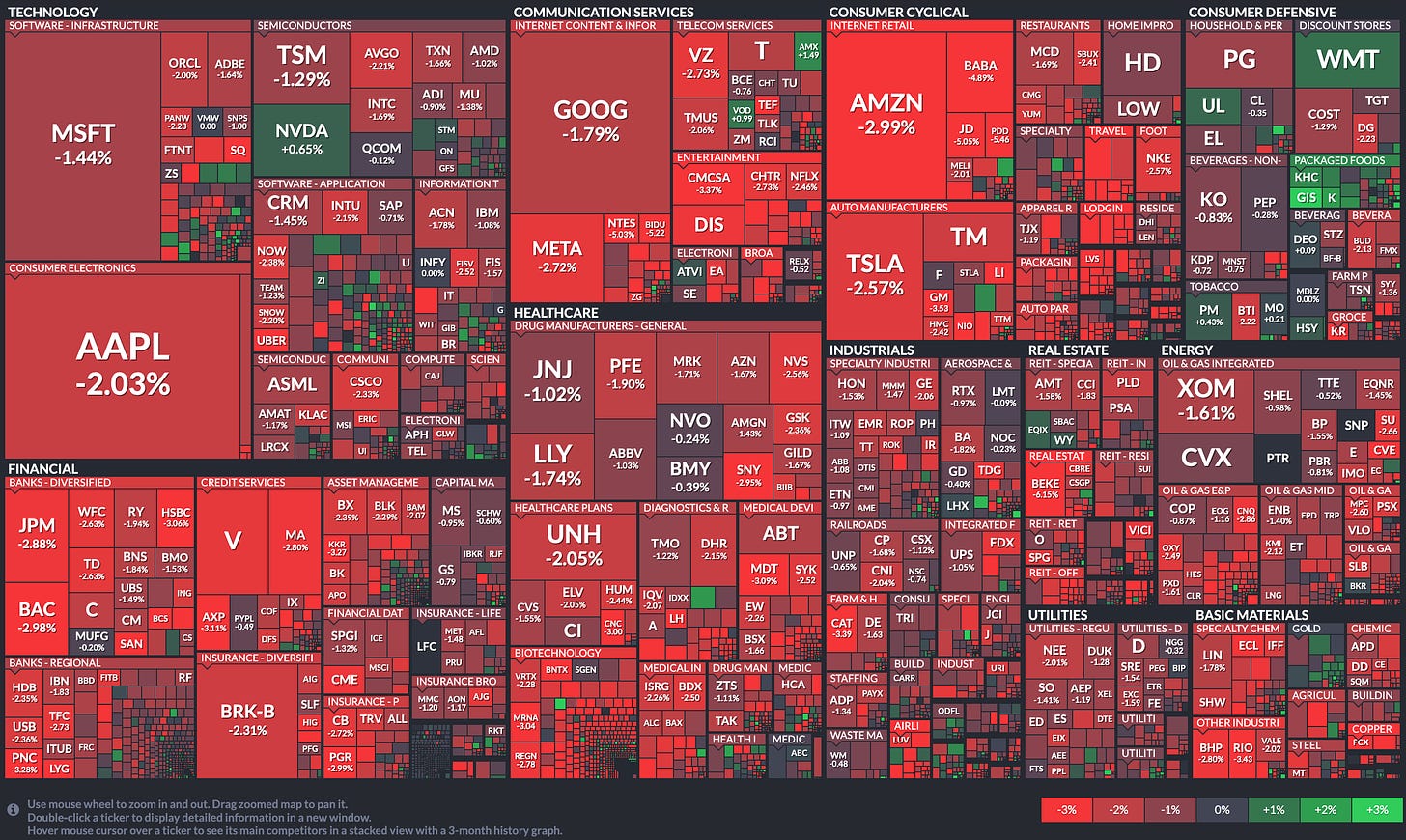

Market Snapshot

Market Heatmap

Briefing Market Update

The stock market was confined to a narrow trading range until the FOMC rate hike decision at 2:00 p.m. ET fueled whipsaw price action. The FOMC voted unanimously to raise the target range for the fed funds rate by 75 basis points, as expected, to 3.00-3.25% and suggested that further rate increases will be appropriate. The Summary of Economic Projections conveyed a higher terminal rate of 4.60%, versus 3.80% with the June projection.

The initial reaction was a heavy inclination to sell before a rebound effort, supported by falling Treasury yields, took the S&P 500 above the 3,900 level. The market ran into resistance there, however, and sold off sharply, finishing at its lows for the day.

The takeaway from today's rate hike decision, Summary of Economic Projections, and Fed Chair Powell's press conference was that the Fed will be raising rates further and will keep them at higher levels for longer. Fed Chair Powell conceded that there is apt to be another 100 or 125 basis points of tightening this year and that he thinks it is very likely the fed funds rate will certainly get to 4.60%, which is the Fed's median estimate for 2023 and presumably the new terminal rate.

The equity and bond markets both had volatile reactions. The action in the Treasury market will be interpreted as a belief that inflation will be quelled by the Fed's rate hikes and a material slowdown in economic activity. The 2-yr note yield dropped to 3.95% (from 4.10%) and settled at 3.98%. The 10-yr note yield went from 3.61% to 3.51%.

The moves in the Treasury market supported the rebound effort until it resonated for stock market participants that Fed Chair Powell's message has not changed at all from Jackson Hole where he said, "Restoring price stability will require maintaining a restrictive policy stance for some time. The historical record cautions strongly against prematurely loosening policy."

This is not a friendly statement for the economy or for the market. It is a statement that suggests multiple expansion is not going to be easy to achieve, because interest rates are header higher. The uncertainty about how much impact that will ultimately have on earnings prospects, along with the uncertainty as to how high the fed funds rate will go and how long it will stay there, is why investors will be reluctant to pay a premium for each dollar of earnings.

The late sell off that ensued was broad and indiscriminate. The three main indices all logged losses of at least 1.7%. The Vanguard Mega Cap Growth ETF (MGK) closed down 1.9% and the Invesco S&P 500 Equal Weight ETF (RSP) closed down 1.7%.

Every S&P 500 sector closed in negative territory with losses ranging from 0.3% (consumer staples) to 2.4% (consumer discretionary). The former was supported by General Mills (GIS 79.72, +4.31, +5.7%), which was able to buck the downtrend after reporting favorable quarterly results.

Energy complex futures settled mixed. WTI crude oil futures fell 0.3% to $83.84/bbl while natural gas futures rose 1.2% to $7.81/mmbtu.

Looking ahead to Thursday, market participants will receive the Q2 Current Account Balance report (Briefing.com consensus -$260.0 billion; prior -$291.4 billion) and weekly initial jobless claims (Briefing.com consensus 220,000; prior 213,000) and continuing claims (prior 1.403 million) at 8:30 a.m. ET, the August Leading Economic Index (Briefing.com consensus -0.1%; prior -0.4%) at 10:00 a.m. ET, and weekly EIA Natural Gas Inventories (prior +73 bcf) at 10:30 a.m. ET.

Reviewing today's economic data:

The weekly MBA Mortgage Applications Index showed a total increase of 3.8% versus last week's 1.2% decline.

Existing home sales decreased 0.4% month-over-month in August to a seasonally adjusted annual rate of 4.80 million (Briefing.com consensus 4.70 million) versus an upwardly revised 4.82 million (from 4.81 million) in July. That is the seventh straight month that existing home sales have fallen. Total sales in August were down 19.9% from a year ago.

The key takeaway from the report is that higher mortgage rates are taking a bite out of existing home sales, having created affordability pressures that have forced some sellers to lower asking prices, which in turn is leading to a moderation in the pace of growth in median selling prices.

The weekly EIA Crude Oil Inventories showed a build of 1.14 million barrels after last week's build of 2.44 million barrels.

Dow Jones Industrial Average: -16.9% YTD

S&P 400: -17.7% YTD

S&P 500: -20.5% YTD

Russell 2000: -21.5% YTD

Nasdaq Composite: -28.3% YTD

source: briefing.com

Market Trader by MyntBit

Will the FED Crash The Markets? | Market Trader Edition No. 6