Daily Plan 08.24.22 | Stocks Drop After PMI Data

MyntBit's Daily Market Update is dedicated to providing traders with a recap and bringing setups to watch for the next trading day.

Today's Recap

Market Snapshot

Market Heatmap

RTTNews Market Update

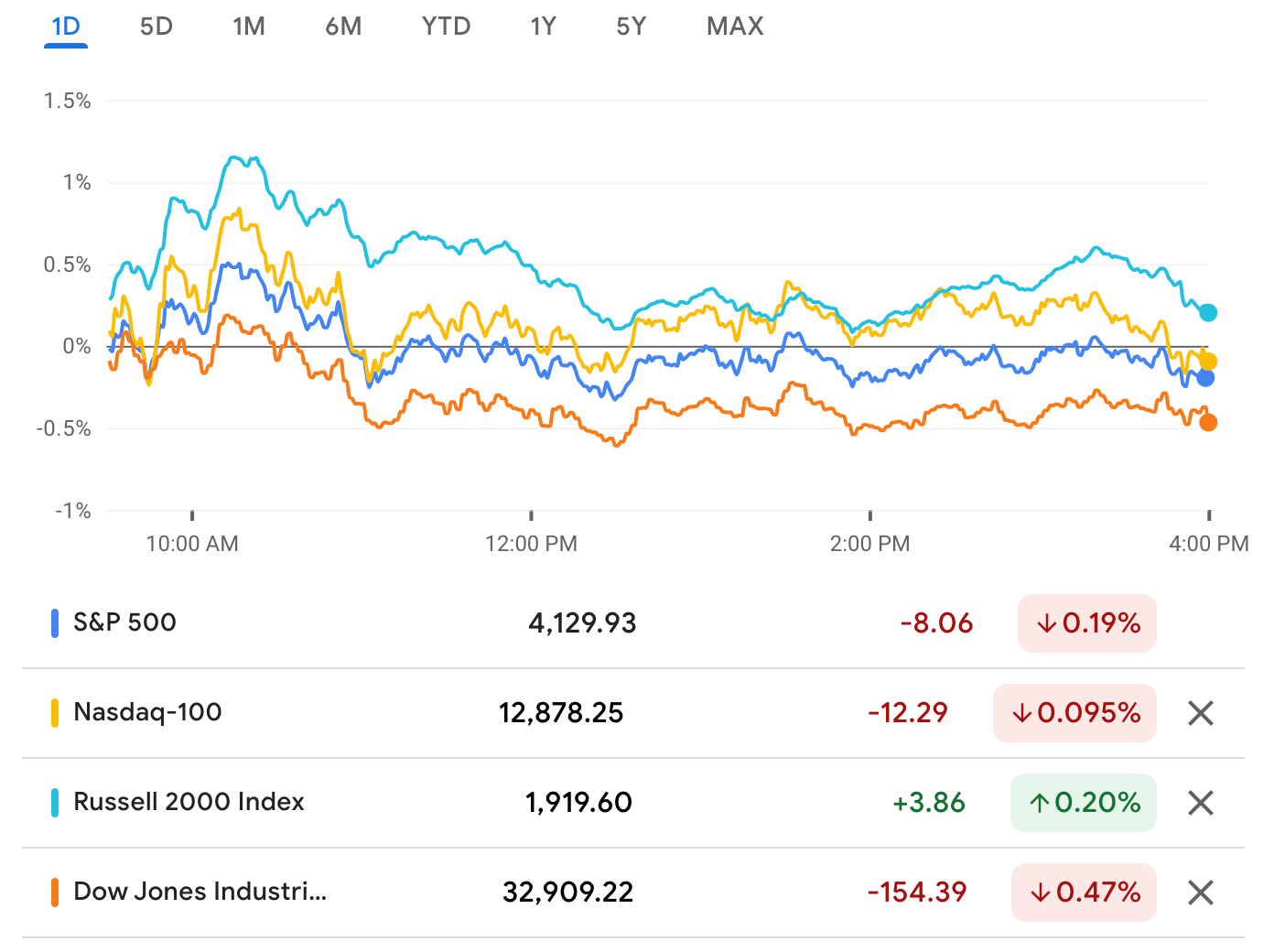

U.S. stocks closed lower on Tuesday, losing ground for a third straight session, as worries about economic slowdown and tighter monetary policy weighed on sentiment.

Data showing U.S. business activity dropping for a second straight month and at the fastest pace as well since May 2020 weighed.

Investors also ahead to Fed Chair Jerome Powell's speech at the central bank's annual Jackson Hole economic symposium later this week for clues about the bank's outlook for the economy and interest rates.

Among the major averages, the Dow ended down 154.02 points or 0.47 percent at 32,909.59 and the S&P 500 settled lower by 9.26 points or 0.22 percent at 4,128.73. The Nasdaq outperformed and ended flat at 12,381.30, less than 0.3 points down from the previous close.

Data from Markit Economics showed the S&P Global US Composite PMI came in with a score of 45 for August, down from a reading of 47.7 in July.

The Manufacturing PMI fell to 51.3 in August from 52.2 a month earlier, while the Services PMI dropped to 44.1 in the month from 47.3 in July.

Data from the Commerce Department showed new home sales in the U.S. dropped 12.6% month-over-month to a seasonally adjusted 511,000 in July, the lowest reading since January 2016.

According to a report from the Federal Reserve Bank of Richmond, the Richmond Fed composite manufacturing index fell to -8 in August from 0 in the previous month.

Meanwhile, Redbook Research Inc. said that the Redbook index increased by 13.5 percent in the week ending August 20, 2022 over the same week in the previous year.

P&G, Home Depot, United Health and Verizon shed 1.4 to 2 percent. Merck, Walt Disney, JP Morgan, Visa, J&J, Microsoft, Goldman Sachs and McDonalds also closed weak, albeit with less pronounced losses.

Chevron rallied more than 3 percent. Caterpillar surged nearly 3 percent.

Macy's surged more than 3 percent on strong second-quarter results.

Shares of Zoom Video plunged 16.5 percent after the company lowered its full-year forecast.

Twitter shares tumbled more than 7 percent, weighed down by news about filing of complaints against the company at the Securities Exchange Commission.

Shares of Palo Alto Networks soared more than 12 percent after the company reported stronger than expected fourth-quarter results thanks to a surge in billings amid growing cybersecurity demand.

In overseas trading, Asian stocks closed mostly lower on Tuesday to extend recent losses as investors waited for Fed Chair Jerome Powell's comments on inflation and the rate outlook at the upcoming annual Jackson Hole economic symposium.

The major European markets closed lower on Tuesday, extending losses to a third straight session, as concerns over monetary tightening by central banks and fears about economies falling into a recession continued to weigh on investor sentiment.

But, as of now, nothing has changed from our weekly perspective, check out our newsletter. This week's Market Trader by MyntBit

The END of the Bear-Market RALLY | Market Trader Edition No. 2

more info...

Market Trader Subscription

Robust weekly technical analysis is delivered straight to your inbox, every week.

Tickers That Will Be Covered

FUTURES - /ES & /NQ

STOCKS - $INTU | $CRM | $ULTA | $META | $TSLA