Daily Plan 08.23.22 | Stocks Down On Growth and Rate Outlook

MyntBit's Daily Market Update is dedicated to providing traders with a recap and bringing setups to watch for the next trading day.

Today's Recap

Market Snapshot

Market Heatmap

RTTNews Market Update

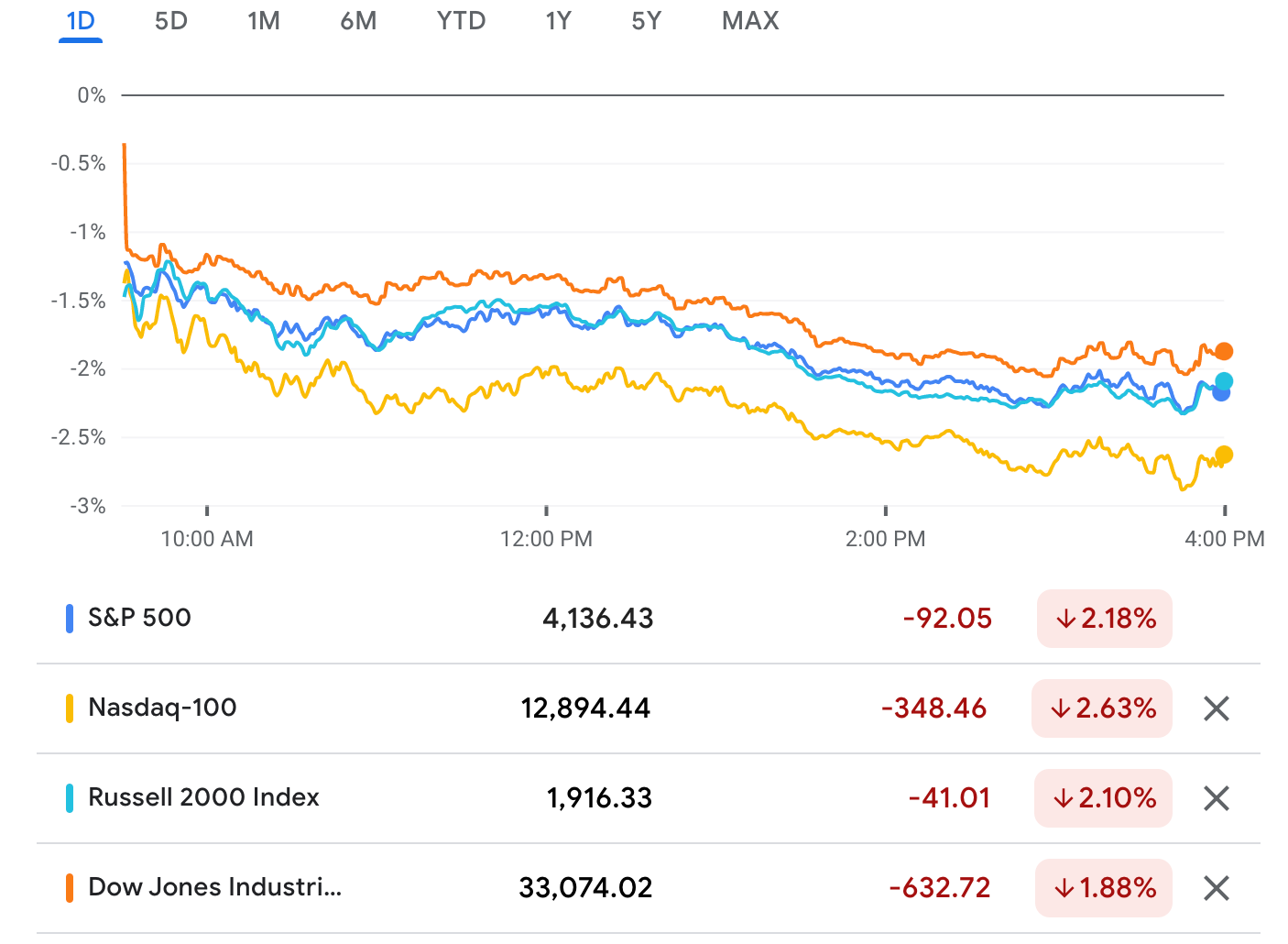

U.S. stocks tumbled right at the stroke of the opening bell on Monday and stayed weak right through the day's session, extending losses from the previous session.

The major averages all ended notably lower. The Dow ended down 643.13 points or 1.91 percent at 33,063.61. The S&P 500 drifted down 90.49 points or 2.14 percent to 4,137.99, while the Nasdaq settled with a loss of 323.64 points or 2.55 percent at 12,381.57.

The Dow and the S&P 500 suffered their worst session since mid June.

The market fell amid rising concerns about the outlook for interest rates.

Traders also looked ahead to the economic symposium in Jackson Hole, Wyoming this week.

In a research note, Chris Senyek, chief investment strategist at Wolfe Research, suggested Fed Chair Jerome Powell will sound a more hawkish tone in his comments at the conference.

"Fed Chair Powell is likely to sound meaningfully more hawkish during his Jackson Hole speech on Friday morning at 10am ET than he did at his July 27th press conference, when he said the fed funds rate is already back to neutral," Senyek said.

He added, "As we've previously discussed at length, we believe that Fed would have to hike the fed funds rate to 4.5%+ to set inflation on a sustainable path back toward the FOMC's long-term 2% target."

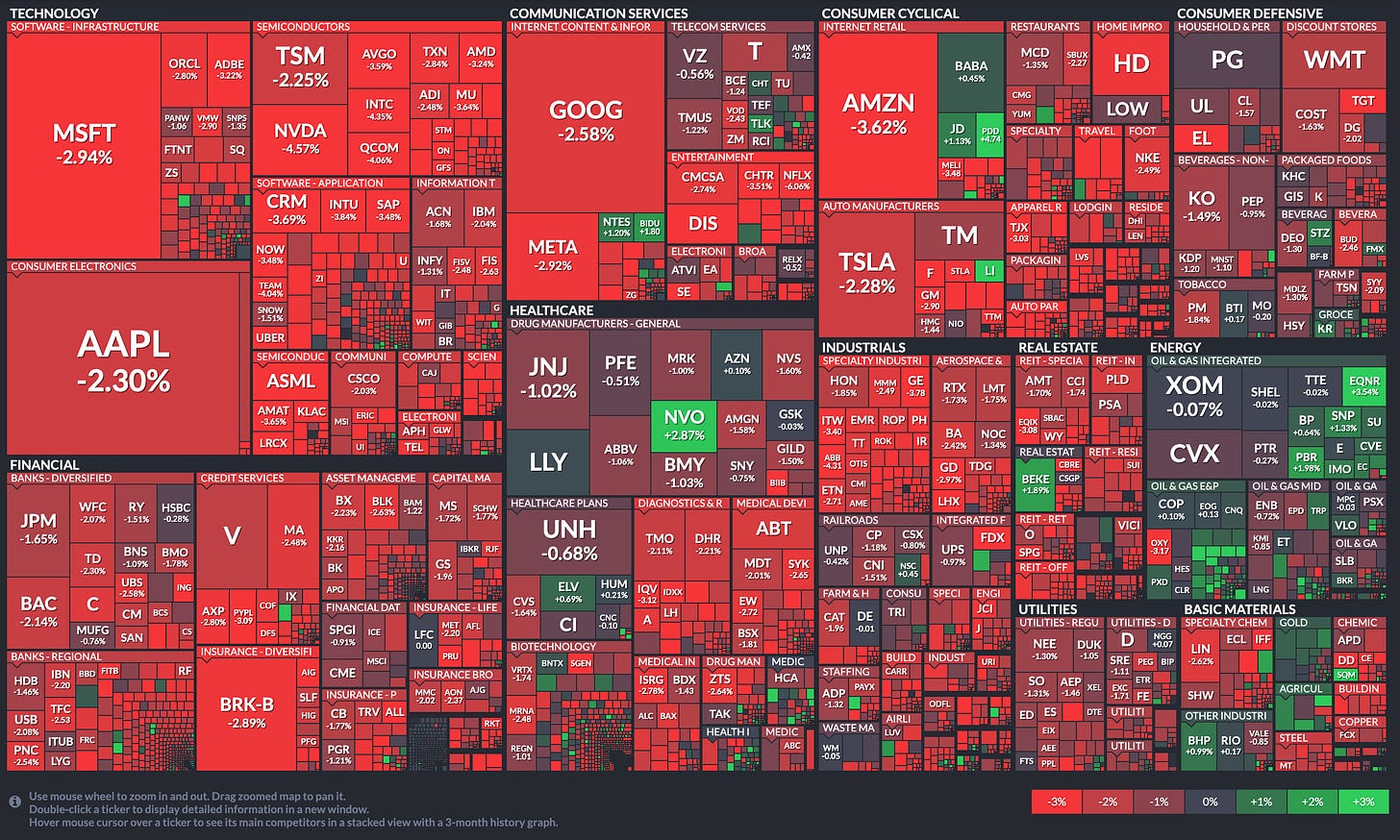

Shares from across several sectors reeled under severe selling pressure. Technology stocks as bond yields rose. Financial, airline and energy stocks were among the other prominent losers.

Netflix shares plunged more than 6 percent after CFRA downgraded the stock's rating, citing concerns about a likely drop in company's earnings inthe second half of the current financial year.

Microsoft, Meta Platforms, Alphabet, Intel, Apple, IBM and Cisco Systems declined sharply.

Ford shares plunged after the company said it will lay off 3,000 workers to fund its shift to electric vehicles.

Visa, Goldman Sachs, American Express, Home Depot, 3M, Caterpillar, JP Morgan Chase and Caterpillar also ended with sharp losses.

In overseas trading, stock markets across the Asia-Pacific region turned in a mixed performance during trading on Monday. Japan's Nikkei 225 Index fell by 0.5 percent, while China's Shanghai Composite Index rose by 0.6 percent.

The major European markets closed weak. The pan European Stoxx 600 drifted down 0.96 percent. The U.K.'s FTSE 100 ended 0.22 percent down, Germany's DAX dropped 2.32 percent, and France's CAC 40 declined 1.8 percent.

But, as of now, nothing has changed from our weekly perspective, check out our newsletter. This week's Market Trader by MyntBit

The END of the Bear-Market RALLY | Market Trader Edition No. 2

more info...

Market Trader Subscription

Robust weekly technical analysis is delivered straight to your inbox, every week.

Tickers That Will Be Covered

FUTURES - /ES & /NQ

STOCKS - TTD | COIN | TSLA