Daily Newsletter Oct 28 '22

What is included in tomorrow's game plan?

Daily Recap

Look Ahead - Economic & Earnings Calendar

Key Futures Levels - S&P 500 (/ES) and NASDAQ (/NQ)

Day Trade Stock Ideas - $RBLX | $TTD - Details will be provided in Discord

Today's Recap

Market Snapshot

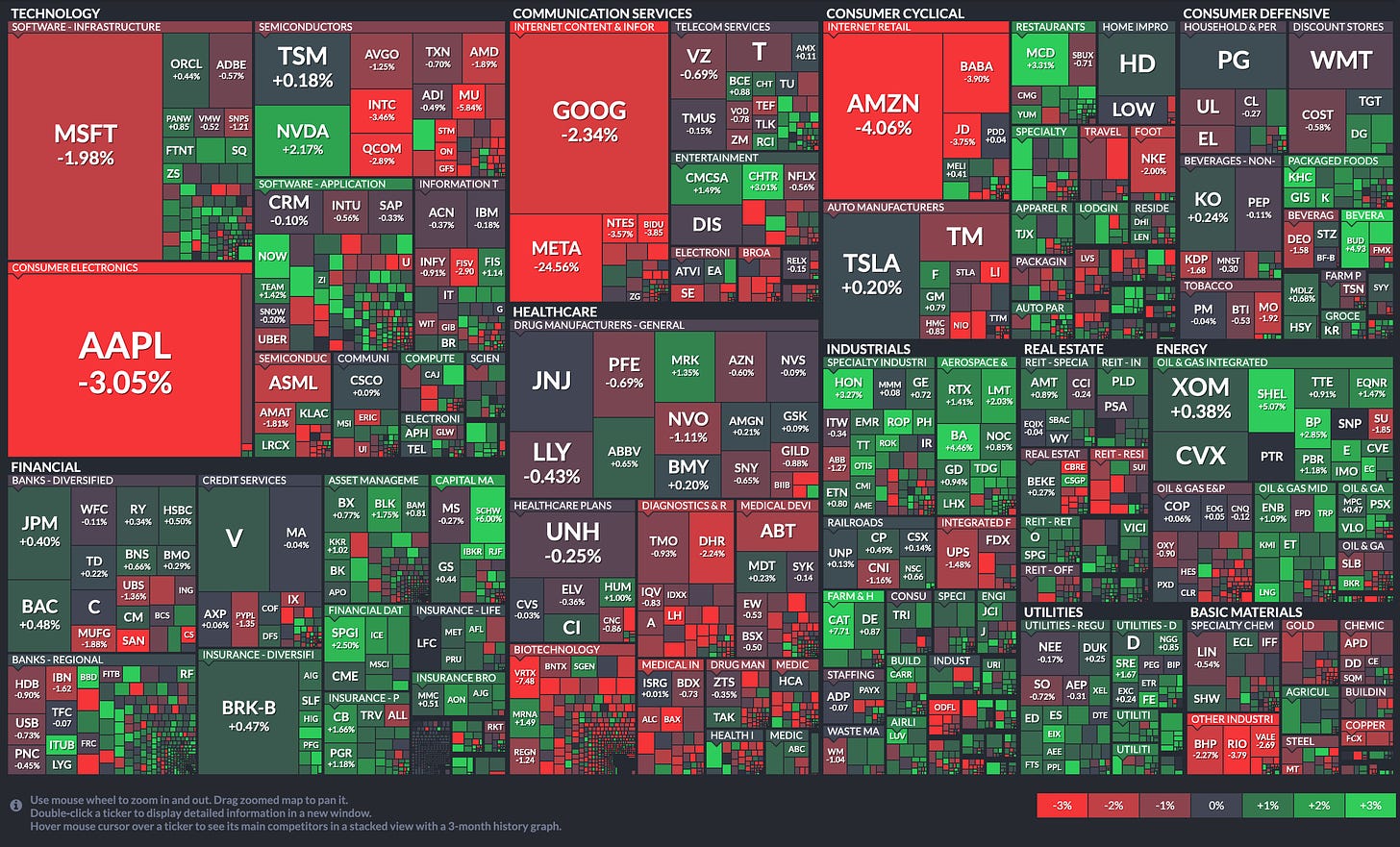

Market Heatmap

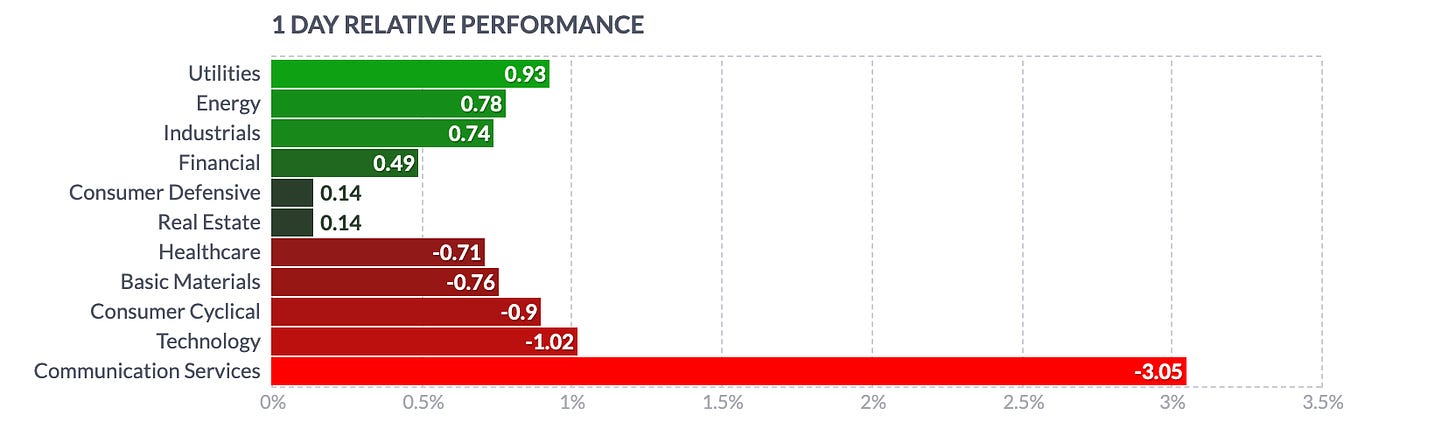

Sector Heatmap

Market Recap

Today's trade was mixed as market participants reacted to a slew of earnings reports since yesterday's close. The S&P 500 tested its 50-day moving average (3,850) early on, but couldn't break meaningfully above that level. Ultimately, the major indices all closed near session lows.

Aside from earnings news, other factors that moved the market today included a decision by the ECB to raise its key policy rates by 75 basis points each, an advance Q3 GDP report that showed the U.S. economy returning to expansion mode, and a 10-yr note yield that settled the session below 4.00%.

The 10-yr note yield fell eight basis points to 3.94% and the 2-yr note yield fell nine basis points to 4.33% as participants hold onto the notion that the Fed may take a less aggressive rate-hike approach coming out of its November 1-2 FOMC meeting.

Like the performance of the three main indices, the advance-decline line reflected a mixed market. Advancers led decliners by an 11-to-10 margin at the NYSE and decliners led advancers by roughly the same margin at the Nasdaq.

Meta Platforms (META 97.94, -31.88, -24.6%) suffered a huge loss following its disappointing earnings report. Other mega cap stocks exhibited similar weakness, namely Apple (AAPL 144.80, -4.55, -3.1%) and Amazon.com (AMZN 110.96, -4.70, -4.1%), which weighed on the S&P 500 (-0.6%) and Nasdaq Composite (-1.6%).

Meanwhile, the Dow Jones Industrial Average (+0.6%) was able to maintain a positive position thanks to earnings-driven gains in Caterpillar (CAT 212.14, +15.18, +7.7%), Honeywell (HON 196.49, +6.22, +3.3%), Merck (MRK 99.74, +1.33, +1.4%), and McDonald's (MCD 265.11, +8.50, +3.3%).

Roughly half of the S&P 500 sectors closed in the red. The poor performance from Meta Platforms drove the S&P 500 communication services sector (-4.1%) to last place today. The information technology (-1.3) and consumer discretionary sectors (-0.7) also struggled as their respective mega cap components, Apple and Amazon.com, weighed on sector performance.

Industrials (+1.1%), led by Honeywell and Caterpillar, sat atop the leaderboard for the 11 sectors.

Separately, the U.S. Dollar Index made a sizable move today, up 0.8% to 110.61 with EUR/USD -1.2% to 0.9962. This followed the ECB's decision, which stoked concerns of an economic slowdown.

Exxon Mobil (XOM), Chevron (CVX), AbbVie (ABBV), Colgate-Palmolive (CL), Booz Allen Hamilton (BAH), NextEra Energy (NEE), and Grainger (GWW) are set to report earnings ahead of Friday's open.

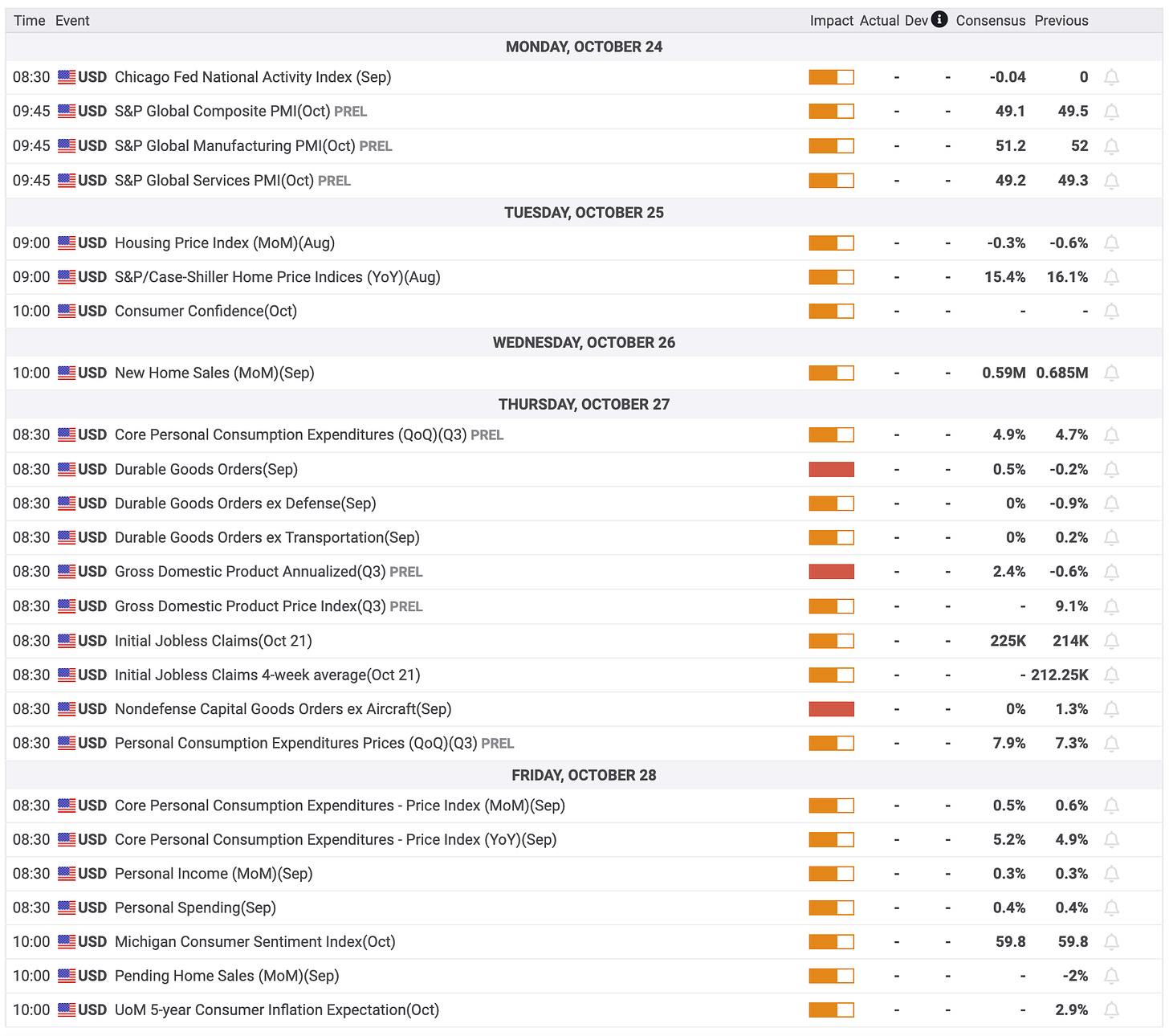

Looking ahead to Friday, market participants will receive the following economic data:

8:30 ET: September Personal Income (Briefing.com consensus 0.3%; prior 0.3%), Personal Spending (Briefing.com consensus 0.4%; prior 0.4%), PCE Prices (Briefing.com consensus 0.3%; prior 0.3%), Core PCE Prices (Briefing.com consensus 0.4%; prior 0.6%), and Q3 Employment Cost Index (Briefing.com consensus 1.2%; prior 1.3%)

10:00 ET: September Pending Home Sales (Briefing.com consensus -5.1%; prior -2.0%) and final October University of Michigan Consumer Sentiment survey (Briefing.com consensus 59.6; prior 59.8)

Reviewing today's economic data:

Q3 GDP-Adv. 2.6% (Briefing.com consensus 2.3%); Prior -0.6%; Q3 Chain Deflator-Adv. 4.1% (Briefing.com consensus 5.3%); Prior 9.0%

The key takeaway from the report is that it ends a two-quarter streak of negative GDP prints. It also suggests the economy held up well in the third quarter as it started to acclimate to rising interest rates. Real final sales of domestic product, which excludes the change in private inventories, increased a solid 3.3%.

Weekly Initial Claims 217K (Briefing.com consensus 220K); Prior was revised to 220K from 214K; Weekly Continuing Claims 1.438 mln; Prior was revised to 1.383 mln from 1.385 mln

The key takeaway from the report is that the initial claims data suggest the labor market continues to hold up well, which of course is something that will continue to draw the Fed's attention.

September Durable Orders 0.4% (Briefing.com consensus 0.6%); Prior was revised to 0.2% from -0.2%; September Durable Orders Ex-Transportation -0.5% (Briefing.com consensus 0.2%); Prior was revised to 0.0% from 0.2%

The key takeaway from the report is that it revealed some softening in business spending, which was evident in the 0.7% decline in nondefense capital goods orders excluding aircraft.

Dow Jones Industrial Average: -11.9% YTD

S&P Midcap 400: -15.9% YTD

S&P 500: -20.1% YTD

Russell 2000: -19.6% YTD

Nasdaq Composite: -31.0% YTD

source: briefing.com